Global Hostels Market Size, Share, Trends & Growth Forecast Report By Deployment (Hybrid, On-Premise, and Cloud), Solution (Channel Manager, Production Reports, Daily Activity Report, Room Management, Canteen Management, Invoice Management and Hostel Member Management), Enterprise (Small and Medium Enterprises and Large Enterprises) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis From (2025 to 2033).

Global Hostels Market Size

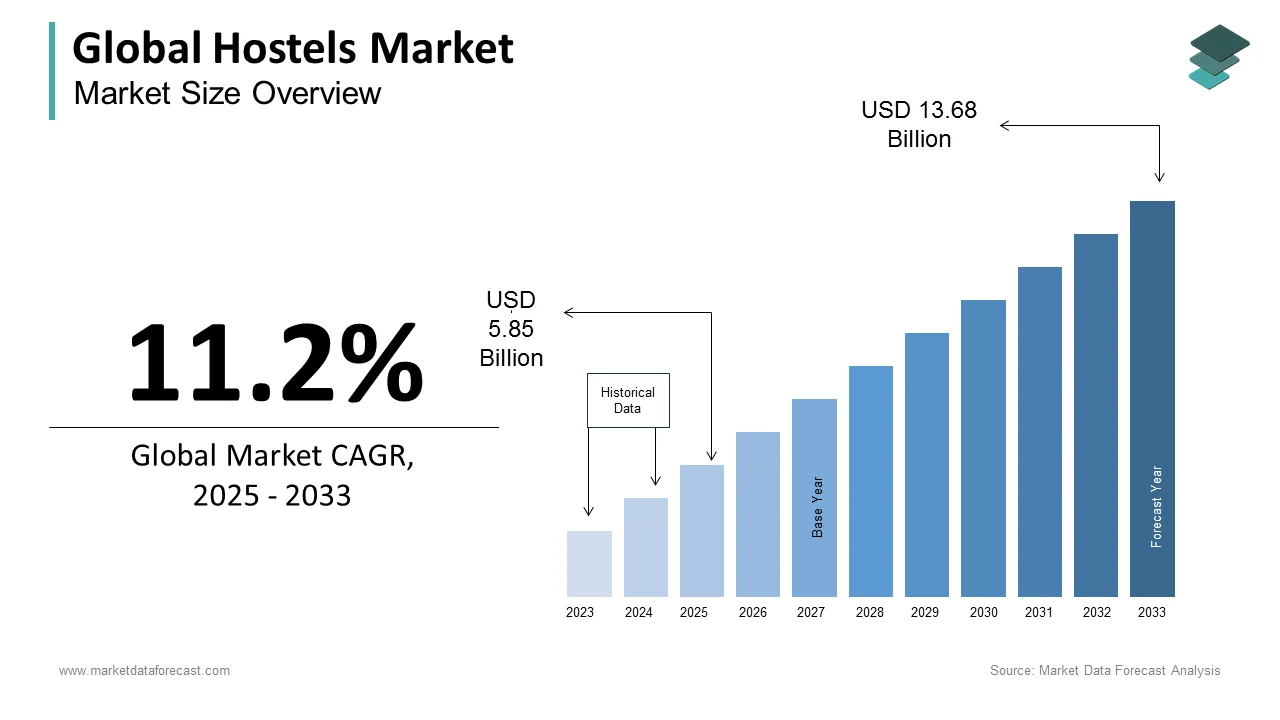

The size of the global hostels market was worth USD 5.26 billion in 2024. The global market is anticipated to grow at a CAGR of 11.2% from 2025 to 2033 and be worth USD 13.68 billion by 2033 from USD 5.85 billion in 2025.

The word "hostel" evokes the style of a one-bedroom, a small and inexpensive accommodation for people who want to adapt to a cheap stay. Hostels today include private rooms and all the hotel-like amenities. Travelers will indeed find accommodation elsewhere at cheaper prices, but this travel segment is also undergoing major changes to form its niche in the hotel industry and now meets the needs of travel enthusiasts around the world, replacing the dormitory hostel image of the past.

MARKET DRIVERS

Growth is primarily driven by resuming business and adapting to the new normal while recovering from the impact of COVID-19, which previously led to restrictive containment measures involving social distancing, remote work, and business closures which resulted in operational challenges.

Increasing spending by millennials (ages 18-35) on travel is a key factor in the growth of the hostel market. Due to low cost, value for money, experience-based accommodation, convenient locations, and opportunities to meet millennials, other travelers opt for hostels. More than 70% of hostel travelers are millennials, 15% of whom have spent the last 12 months in a hostel. In the United States, 85% of travelers to millennial hostels have taken a trip abroad in the past 12 months, compared to just 33% of all leisure travelers in the US. The hostel industry has seen strong growth driven by millennial travelers (ages 18-35) looking to spend more money on longer trips and see the world as much as possible. Online channels are the main growth engine in the hospitality Market.

MARKET RESTRAINTS

Leaving behind their old notion that they previously only provided bunk beds, hostels today offer private rooms with lively cocktail bars, yoga classes, and luxurious interiors.

Popular misconceptions are the biggest limiting factor in the youth hostel market. There are many misconceptions about hostels around the world that often lead people to create a negative opinion of them. In general, people assume that shelters are only for young people, and some feel that the shelters are not hygienic or unsafe. Also, people who had a bad experience in a shelter generalized the notion to all shelters and refrained from using them. Such misconceptions limit the growth of the youth hostel market. However, inadequate awareness and misconceptions are the main obstacles likely to hamper the growth of the hostel market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.2% |

|

Segments Covered |

By Implementation, By Solution, By Company Size, By Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

eZee Frontdesk, Hostelworld, Safestay plc, RoomMaster, Rezlynx PMS, Frontdesk Anywhere, MSI CloudPM, Maestro PMS, Hotelogix PMS, OPERA Property Management System (PMS), A&O Hotels and Hostels, Cloudbeds, WOKSEN, Canada Hostels, Newquay Backpackers, London Backpackers, Green Tortoise Hostel, and Hostelling International, and Others. |

SEGMENT ANALYSIS

By Implementation Insights

REGIONAL ANALYSIS

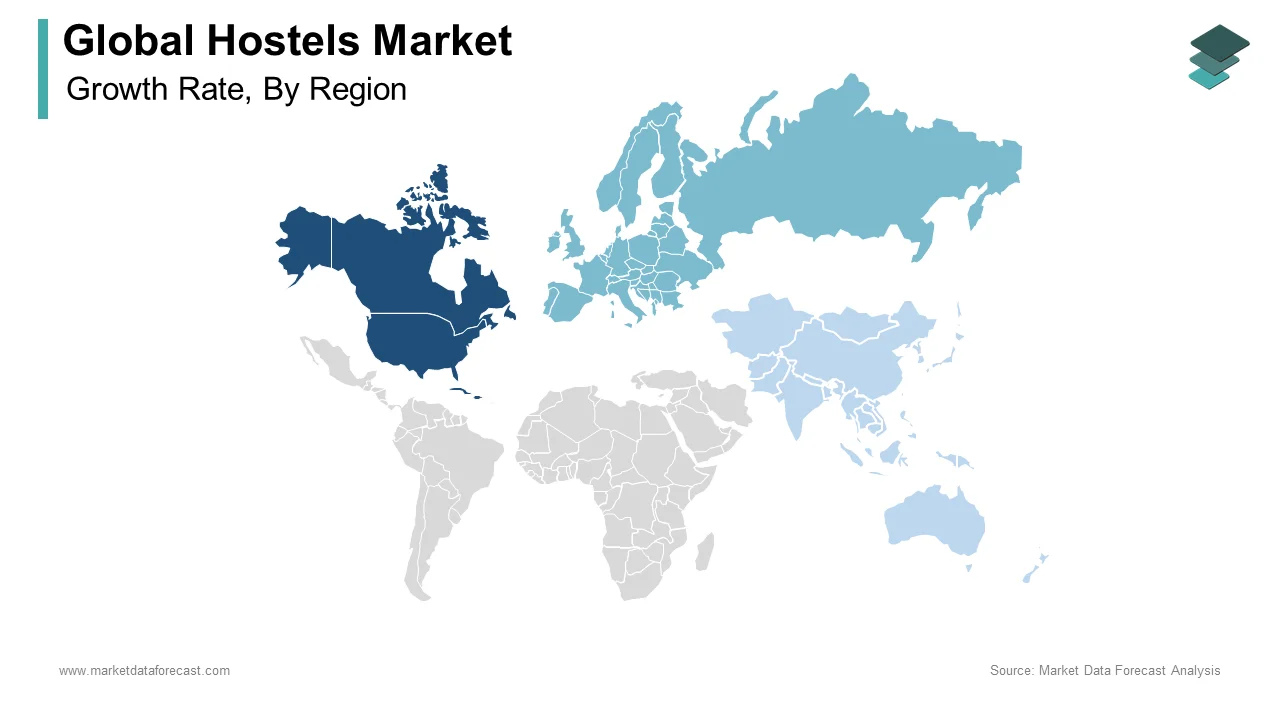

The North American hostel market is expected to grow at a substantial rate during the forecast period. This is due to the strong adoption of the hostel due to its features such as powerful and efficient management of student accommodation, automated hostel attendance records, and multi-site user support. Asia-Pacific is expected to be a lucrative region of the hostel market during the outlook period. The adoption of hostels in the region is likely to be high as the software is easy to use and efficient and offers many useful features. The software offers innovative solutions for hostel, school, dorm, and university businesses.

KEY MARKET PLAYERS

Companies playing a noteworthy role in the global hostels market include eZee Frontdesk, Hostelworld, Safestay PLC, RoomMaster, Rezlynx PMS, Frontdesk Anywhere, MSI CloudPM, Maestro PMS, Hotelogix PMS, OPERA Property Management System (PMS), A&O Hotels and Hostels, Cloudbeds, WOKSEN, Canada Hostels, Newquay Backpackers, London Backpackers, Green Tortoise Hostel and Hostelling International.

RECENT MARKET HAPPENINGS

- A unit of Goldman Sachs has purchased student accommodation at a private university in northern India for an enterprise value of ₹ 900 crores (about $ 120 million), two people familiar with the development said. Good Host Spaces, a majority-owned student accommodation company from Goldman Sachs, recently took over the Sonipat-based OP Jindal Global University (JGU) hostel's land and facilities in Haryana.

- The Bhopal District Administration acquired the shelter from the Maulana Azad National Institute of Technology (MANIT) to transform it into a quarantine centre. After the acquisition, the administration began the process of evicting the shelters. Arrangements are being made for the stay of several people due to COVID-19 cases in the area. However, MANIT students and faculty opposed the move, saying it would affect internships on campus.

- The European hostel chain Clink Hostels recently purchased the successful Ecomama and Cocomama boutique concept hostels located in the heart of the city of Amsterdam. Clink is excited about this opportunity, given his innovative approach to hostels and the similarities to Clink's Vision, wanting to make a difference by igniting the imaginations of those who love to travel and participate in new experiences.

MARKET SEGMENTATION

This research report on the global hostels market has been segmented and sub-segmented based on implementation, solution, and region.

By Implementation

- Cloud

- On-Premises

- Hybrid

By Solution

- Youth Hostel Member Management

- Bill Management

- Canteen Management

- Room Management

- Daily Activity Report

- Production Reporting

- Channel Manager

By Company Size

- Small And Medium-Sized Companies

- Large Companies.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Hostels Market growth rate during the projection period?

The Global Hostels Market is expected to grow with a CAGR of 11.20% between 2025-2033.

2. What can be the total Hostels Market value?

The Global Hostels Market size is expected to reach a revised size of US$ 13.68 billion by 2033.

3. Name any three Hostels Market key players?

Hostelworld, Safestay plc, and RoomMaster are the three Hostels Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com