Global Hydrogen Fueling Station Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type (Small Station, Medium Station, Large Station), Product (Retail, Non-Retail and Mobile hydrogen Stations), End User (Hydrogen Tube Trailers, Tanker Trucks, Pipeline Delivery, Railcars and Barges) & Region - Industry Forecast From 2024 to 2032

Global Hydrogen Fueling Station Market Size (2024 to 2032)

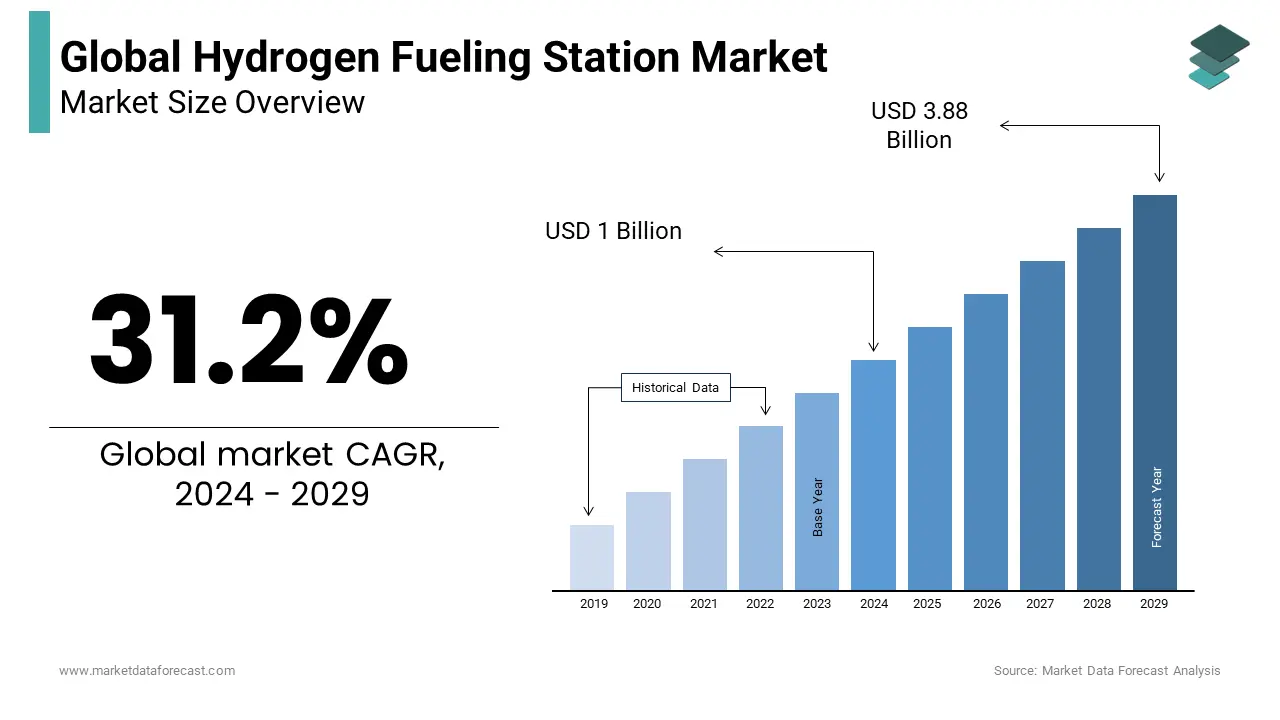

The Global Hydrogen Fueling Station Market was valued at USD 0.76 billion in 2023 and is projected to reach a valuation of USD 8.78 billion by 2032 from USD 1 billion in 2024 and is predicted to register a CAGR of 31.2% between 2024 and 2032.

MARKET SCENARIO

A hydrogen fuelling station is a storage and filling station for hydrogen gas or liquid. The components are liquid storage tanks, compressors, super compressors, and dispensers. Firstly, hydrogen is brought to the filling station in a truck. It can also be supplied with the help of pipelines to the station, as it exists in many countries. The next component is compressors, where the liquid form of hydrogen is converted into gas form by passing it through vaporizer towers, where the hydrogen liquid is heated at high temperatures until the gas form is achieved. Then it is passed to the next component, super compressors, where the hydrogen gas is compressed at high pressure. This can be done according to the two standards, H35 half pressure and H70 full pressure.

After that, it is stored in storage tanks at the fueling stations. The storage tanks are above the ground as compared to the gasoline tanks, which are below the ground. The last component is the dispenser, where before passing through the pumps, the gas should be cooled down through heat exchangers to prevent the cars from overheating and maintain the energy density of the hydrogen gas.

MARKET DRIVERS

Over the forecast period, the hydrogen fueling station market is expanding rapidly as a result of the rising demand for hydrogen-powered vehicles.

Hydrogen is considered a clean and flexible energy source to support zero-carbon energy emissions. The vehicles are more powerful and energy efficient than gasoline-driven ones, and the declining cost of hydrogen fuel is driving the hydrogen fueling station market. Different automobile manufacturers are planning to launch new FCEVs and support the government's zero-emission strategies. The use of green hydrogen in many sectors, like automobiles, aerospace, and manufacturing industries, is also expanding the market.

MARKET RESTRAINTS

The construction cost of a hydrogen fuelling station is very high as it requires building various components of inflammable hydrogen fuel, which is a significant barrier to the market's expansion. If hydrogen gas escapes from its containment, it can affect safety issues, which is also a factor limiting growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

31.2% |

|

Segments Covered |

By Type, Product, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fuel Cell Energy Inc., Air Products, Cummins Inc., Ballard, ITM Power, Air Liquide, Hydrogenics, Linde Group, Black and Veatch Holding Company, Praxair, and Others. |

SEGMENTAL ANALYSIS

Global Hydrogen Fueling Station Market Analysis By Type

The small station segment is predicted to grow at a high rate because of the increase in the number of hydrogen-powered passenger vehicles. Many customers are adapting to zero-emission vehicles, and various countries' governments are supporting the move.

Global Hydrogen Fueling Station Market Analysis By Product

The mobile hydrogen refueling station is growing during the forecasted period because of its various benefits, such as a high level of flexibility and the ability to be modified according to customer needs. These can also be moved from one place to another in comparison to the retail and non-retail hydrogen fueling stations, which are fixed structures.

Global Hydrogen Fueling Station Market Analysis By End-User

At present, the Pipeline Delivery segment occupies the largest share of the market and is projected to grow. The most energy-efficient and cost-effective method of delivering hydrogen is through a pipeline. The pipeline is expected to witness the highest adoption rate for large-scale hydrogen transportation in the future as the hydrogen energy industry develops.

REGIONAL ANALYSIS

The Asia-Pacific region is estimated to hold the highest position in the hydrogen fueling station market. China, Japan, and Korea are among the leading countries that are moving towards zero emissions and introducing various policies. The government is providing funding for the hydrogen-based fuelling station facilities, which is a key factor in this region's growth.

KEY PLAYERS IN THE GLOBAL HYDROGEN FUELING STATION MARKET

Companies playing a prominent role in the global hydrogen fueling station market include Fuel Cell Energy Inc., Air Products, Cummins Inc., Ballard, ITM Power, Air Liquide, Hydrogenics, Linde Group, Black and Veatch Holding Company, Praxair, and Others.

RECENT HAPPENINGS IN THE GLOBAL HYDROGEN FUELING STATION MARKET

- In December 2021, Air Products announced the opening of its first hydrogen fuelling station in Shandong Province in a joint effort with the local government to support China's "Hydrogen into Ten Thousand Homes" initiative to fuel buses and trucks for environmentally friendly transportation.

- In July 2020, Linde announced that work on the world's first hydrogen refueling station for passenger trains will begin in Bremervorde, Germany.

- In March 2021, Air Products and Baker Hughes announced a collaboration for Global Hydrogen Projects in which they will develop next-generation hydrogen compression to lower production costs and increase the use of hydrogen fuel to achieve zero carbon emissions.

DETAILED SEGMENTATION OF THE GLOBAL HYDROGEN FUELING STATION MARKET INCLUDED IN THIS REPORT

This research report on the global hydrogen fueling station market has been segmented and sub-segmented based on type, product, end-user, and region.

By Type

- Small Station

- Medium Station

- Large Station

By Product

- Retail

- Non-Retail

- Mobile hydrogen Stations

By End-User

- Hydrogen Tube Trailers

- Tanker Trucks

- Pipeline Delivery

- Railcars and Barges

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. Which countries are leading the market in the Asia-Pacific region?

The leading countries in the Asia-Pacific region are China, Japan, and Korea.

2. What is the projected CAGR for the market during the forecast period 2024-2032?

The market is expected to grow at a high rate of 31.2 % during the projected period 2024-2032.

3. In 2021, which region had the largest market share?

Asia Pacific is leading the market in terms of share in 2023.

4. Who are the main players in the hydrogen fuelling station market?

Some of the main players are: Air Products, Linde Group and Air Liquide

5. Who is leading the Product segment of the hydrogen fueling station market?

Mobile hydrogen refueling station is because of its high flexibility and modifications according the customer benefits.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com