Global Hydrogen Energy Storage Market Size, Share, Trends & Growth Forecast Report – Segmented By State (Liquid, Gas and Solid), Storage Technology (Compression, Liquefaction and Material Based), End User (Industrial, Commercial and Utilities) and Region (North America, Europe, Asia Pacific, Latin America, Middle east and Africa) – Industry Analysis (2024 to 2032)

Global Hydrogen Energy Storage Market Size (2024 to 2032):

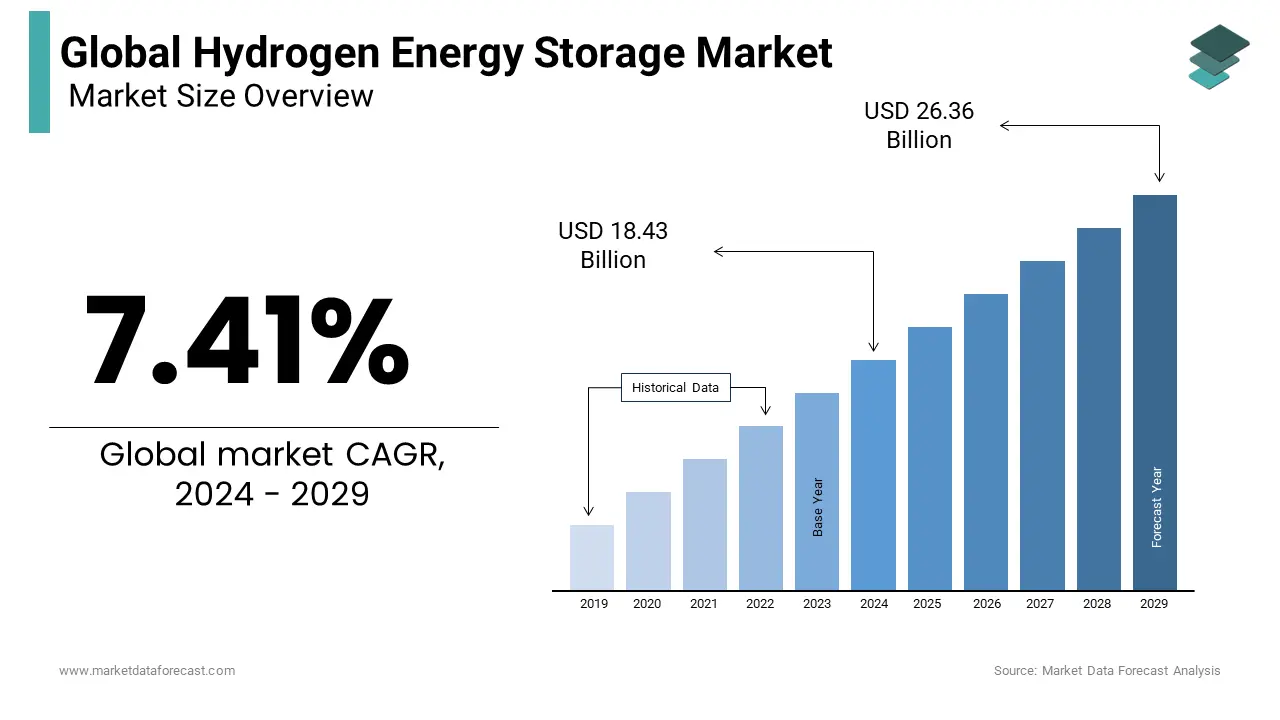

The Global Hydrogen Energy Storage Market was worth USD 17.16 billion in 2023 and is anticipated to reach a valuation of USD 32.65 billion by 2032 from USD 18.43 billion in 2024, and it is predicted to register a CAGR of 7.41% during the forecast period 2024-2032.

Current Scenario of the Global Hydrogen Energy Storage Market

The expansion is attributed to the increased use of stored hydrogen for stationary and standby power applications. In addition to this, the call for hydrogen is also generated by the chemical industry where hydrogen is employed in the ammonia and methanol production processes. Hydrogen energy storage systems are receiving increasing positive attention around the world. The technology is very promising, as hydrogen storage can store energy consumption much more efficiently. Perhaps that is why departments like the Office of Energy Efficiency and Renewable Energy in the United States have set specific goals to strengthen the technology. The department's goal was to create automotive hydrogen storage systems that would offer 300 miles and meet the requirements for safety, business viability, and performance. These goals have been largely achieved and today's electric cars are predicted to further enhance the hydrogen energy storage market.

MARKET DRIVERS

The worldwide hydrogen energy storage market is predicted to see tremendous expansion, driven by growing consumer interest in next-generation electric vehicles.

Tesla's rise to power and the subsequent announcement by major automakers to launch new vehicles is a boon for the hydrogen energy storage market. The low density of hydrogen remains a challenge. However, the current range and improved infrastructure supporting the expansion of electric vehicles are predicted to lead to a significant expansion in the hydrogen energy storage market. Factors such as the increasing call for hydrogen in the chemical industry and the increasing call for hydrogen in stationary and portable electrical applications are driving the expansion of the market. In addition to the automotive sector, the hydrogen energy storage market meets the needs of material handling equipment, portable electrical applications, and light onboard vehicles. The increasing investment in hydrogen storage and its promise as a renewable energy source is predicted to lead to a significant expansion in the hydrogen storage market in the near future.

The rising demand for hydrogen production from electrolysis utilizing a high amount of renewable energy is predicted to drive the the global market growth in the future years. The growing applications of hydrogen in various industries are predicted to further drive market expansion. For example, hydrogen generated by electrolysis can be employed for power generation, to reduce carbon intensity in pipelines, in stationary fuel cells, as fuel in fuel cell vehicles, and stored as a cryogenic liquid, compressed gas, or chemicals.

The increasing need for energy conservation and the reduction in the use of traditional petroleum fuel further boosts the hydrogen energy storage market growth.

Furthermore, hydrogen is an essential part of the range, as it is employed as a fuel for fuel cell vehicles. The fuel cell vehicle market has grown well in recent years. Recently, light commercial vehicles will meet the market call for hydrogen energy storage as it is employed as fuel for fuel cell vehicles. Fuel cell vehicles are featured by key players such as Toyota, Hyundai, and Honda. According to the California Energy Board, another sustainable vehicle and fuel technology is planned, and the US government has modernized its authority on zero-release vehicles. Hydrogen energy storage is predicted to increase at an average rate in the coming years. Technological advances in integrating the development of fuel cells will undoubtedly activate the hydrogen energy storage market.

MARKET RESTRAINTS

High investment costs may hamper the expansion of the hydrogen energy storage market during the foreseen period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.41% |

|

Segments Covered |

By State, Storage Technology, End User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Air Liquide (France), Linde (UK), Air Products and Chemicals (US), ITM Power (UK), Hydrogenics (Canada), Worthington Industries (US), Chart Industries (US), Hexagon Composites (Norway), FuelCell Energy (US), Nel Hydrogen (Norway), Plug Power (US) and Others. |

SEGMENTAL ANALYSIS

Global Hydrogen Energy Storage Market Analysis By State

The gas segment is predicted to have the largest market share in 2023. Storing hydrogen as a compression gas is the simplest and most cost-effective method compared to the liquefaction of hydrogen, which explains its strong call in the worldwide hydrogen energy storage market.

Global Hydrogen Energy Storage Market Analysis By Storage Technology

The liquid hydrogen segment dominates the market due to the need for clean and productive energy sources. Technological advances linked to the growing call for fuel will drive the hydrogen energy storage market. The commercial development of Power Gas technology is the major change in the hydrogen energy storage market. The market should develop next year. Increased spending on research and development in fuel cell technology will open an opportunity for the hydrogen energy storage market. South American companies have declared the start of the H2-based hybrid automotive fuel cell system, operating the Clean Feet facility, thus executing the call for a hydrogen energy storage system.

Global Hydrogen Energy Storage Market Analysis By End User

Utilities are predicted to see the fastest expansion, as the call for power generation using renewable energy sources is likely to drive the need for hydrogen energy storage in the utility segment.

REGIONAL ANALYSIS

North America is predicted to be the largest regional segment in the global market during the forecast period.

Increasing fuel cell applications, stringent emission control regulations, and the use of cleaner fuels are the main expansion drivers of the storage market of hydrogen energy. North America is predicted to be the dominant region in the hydrogen power systems market. Due to the increase in fuel cell deployments, strict rules to control emissions and the use of cleaner fuels are the key drivers of the market. The United States is North America's largest market for hydrogen energy storage systems as the need for hydrogen increases in the petroleum storage and chemical industries.

The increased distribution of electricity, combined with a focus on the reliability of foreign oil reserves in China and the United States, will take advantage of the hydrogen storage market. In China, the reduction in the cost of oil has led private oil manufacturers to cut their expenses and thus increase calls from other sources. Asia-Pacific accounted for the largest share of revenue at 35.0% in 2023. Falling costs for renewable electricity and electrolyzers led to rapid green hydrogen production. Increased hydrogen production has led to a growing call for its storage in the residential, industrial, and commercial sectors. The North American market is predicted to grow at a significant rate due to stringent regulations regarding emissions controls, the use of greener fuels, and the increase in fuel cell applications. The United States occupies the largest market share in the region due to the growing call for hydrogen in the chemical industries and oil refineries throughout the country.

KEY PLAYERS IN THE GLOBAL HYDROGEN ENERGY STORAGE MARKET

Companies playing a prominent role in the global hydrogen energy storage market include Air Liquide (France), Linde (UK), Air Products and Chemicals (US), ITM Power (UK), Hydrogenics (Canada), Worthington Industries (US), Chart Industries (US), Hexagon Composites (Norway), FuelCell Energy (US), Nel Hydrogen (Norway), Plug Power (US) and Others.

RECENT HAPPENINGS IN THE GLOBAL HYDROGEN ENERGY STORAGE MARKET

- Metal-hydrogen batteries landed on Earth with the launch of EnerVenue. EnerVenue seeks to adapt hydrogen-metal technologies similar to those employed in the nickel-hydrogen batteries on the International Space Station.

- The Japanese introduced the world's biggest hydrogen production industry. A Japanese consortium has introduced the 10 MW class hydrogen production unit powered by renewable energy which is the biggest in the world.

DETAILED SEGMENTATION OF THE HYDROGEN ENERGY STORAGE MARKET INCLUDED IN THIS REPORT

This global hydrogen energy storage market research report has been segmented and sub-segmented based on state, storage technology, end user, and region.

By State

- Liquid

- Gas

- Solid

By Storage Technology

- Compression

- Liquefaction

- Material based

By End User

- Industrial

- Commercial

- Utilities

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com