Global Green Hydrogen Market Research Report - Segmentation By Technology (Alkaline Electrolyzer, Polymer Electrolyte Membrane (PEM) Electrolyzer ), By Application (Power Generation, Transport, Others ), By End-User (Petrochemical, Food and Beverages, Medical, Chemical, Glass, Others ), By Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) – Industry Forecast 2024 to 2032.

Global Green Hydrogen Market Size (2024-2032):

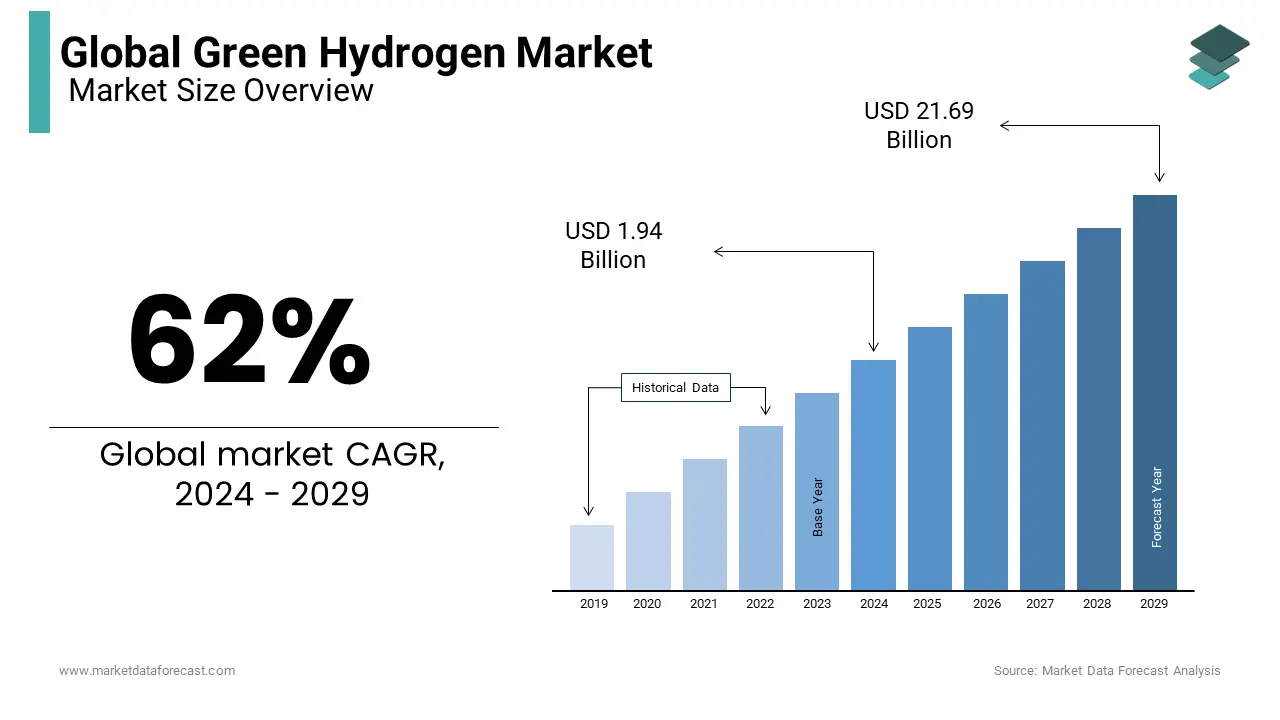

The Global Green Hydrogen Market was worth US$ 1.20 billion in 2023 and is anticipated to reach US$ 92.22 billion by 2032 from US$ 1.94 billion in 2024, registering a CAGR of 62% during the forecast period 2024-2032.

MARKET DRIVERS

The green hydrogen market is growing due to its popularity as an eco-friendly solution for various industries.

Many sectors, including manufacturing, transportation, and chemicals, traditionally rely on fossil fuels. Green hydrogen offers a cleaner alternative, serving as a substitute or supplement in processes like steel production, ammonia synthesis, and fuel cell vehicles. This transition to green hydrogen plays a crucial role in decarbonizing these industries, significantly reducing their greenhouse gas emissions and environmental footprint. As companies seek sustainable practices and governments enforce stricter emission regulations, the green hydrogen market continues to flourish as a critical component in achieving decarbonization goals.

The green hydrogen market is driven by energy storage and grid stability. During times of abundant renewable energy production, such as sunny or windy days, surplus energy can be harnessed to generate green hydrogen through electrolysis. This stored green hydrogen is a versatile resource, capable of being reconverted into electricity or used across various applications when energy market demand is at its peak or renewable energy generation is insufficient. As a result, this inherent flexibility helps bolster grid reliability, diminish energy wastage, and enhance the dependability of renewable energy sources, propelling the growth of the green hydrogen market.

MARKET RESTRAINTS

The green hydrogen market faces significant restraints due to its cost compared to conventional hydrogen made from natural gas.

Producing green hydrogen, which relies on renewable energy sources, is currently more expensive. Also, scaling up the production of green hydrogen to meet increasing demand presents a challenge. These substantial costs can be a deterrent for many small businesses to adopt. As a result, it slows down the market growth of green hydrogen and hinders the overall adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

62% |

|

Segments Covered |

By Technology, Application, End User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens Energy, Air Liquide, Hydrogenics, McPhy Energy, Nel ASA, ITM Power, Ballard Power Systems, Plumgrid, Sinopec, ENGIE, and Others. |

SEGMENTAL ANALYSIS

Global Green Hydrogen Market Analysis By Technology

Based on technology, alkaline electrolysis holds the largest market share, at 65%, during the forecast period. It involves splitting water into hydrogen and oxygen using an alkaline solution as the electrolyte. This technology is valued for its cost-effectiveness and long history of use in industrial applications, especially in sectors like ammonia production and metal processing. Alkaline electrolyzers are typically employed for large-scale hydrogen production and are known for their efficiency, making them a significant player in the green hydrogen production landscape.

The PEM (Proton Exchange Membrane) electrolysis segment is expected to grow at a CAGR of 24% during the forecast period. It employs a solid polymer electrolyte membrane to facilitate the water-splitting process, generating hydrogen and oxygen. PEM electrolyzers are renowned for their efficiency, rapid response times, and compact design. They are gaining attention for various applications, including hydrogen fuel cell vehicles and distributed hydrogen generation, where quick startups, shutdowns, and operational adjustments are essential. This technology's versatility and responsiveness make it a significant player in the green hydrogen production landscape.

Global Green Hydrogen Market Analysis By Application

Based on Application, the transportation sector holds 42% of the market share during the forecast period. It serves as an eco-friendly fuel for different modes of transport, including fuel cell electric vehicles (FCEVs), hydrogen-powered buses, and trucks. Its adoption in transportation is driven by the imperative to curtail carbon emissions and combat air pollution. FCEVs offer zero-emission mobility, extended driving ranges, and shorter refuelling durations, making green hydrogen a compelling choice for a sustainable and environmentally conscious future of transportation.

The power generation sector holds the second biggest segment, and it is expected to generate a revenue of 180 million during the forecast period. Through electrolysis, surplus renewable electricity, like solar and wind power, is converted into green hydrogen. This stored hydrogen can be deployed during peak energy demand or when renewables are not generating Power. Green hydrogen enhances grid stability, bolsters the reliability of renewable sources, and substantially reduces greenhouse gas emissions in the energy industry. It stands as a pivotal solution for a more sustainable and resilient energy landscape.

Global Green Hydrogen Market Analysis By End-User

Based on End-User, the petrochemical industry holds the largest revenue of 105 million during the forecast period; it encompasses refining and chemical production and has long relied on hydrogen, often produced from fossil fuels. The emergence of green hydrogen, generated using renewable energy sources, offers a sustainable alternative. Hydrogen is vital in various petrochemical processes, such as hydrocracking and hydrotreating. Shifting to green hydrogen in this sector is pivotal for curtailing carbon emissions and advancing sustainability objectives, aligning with the industry's transition towards cleaner and more eco-friendly practices.

The food and beverage industry is estimated to showcase a notable CAGR during the forecast period, including the hydrogenation of edible oils and fats, generating hydrogenated water, and serving as a reducing agent in food processing. The increasing demand for green hydrogen in this sector reflects a commitment to environmentally friendly and sustainable production methods. By transitioning to green hydrogen, the food and beverage industry aligns with eco-conscious practices, promoting cleaner and greener processes while meeting the needs of consumers who value sustainability and responsible production.

REGIONAL ANALYSIS

Europe holds the largest market share at 55%, with a CAGR of 8% during the forecast period, demonstrating a firm dedication to carbon neutrality and advancing green hydrogen production. The European Union's ambitious Green Deal and Hydrogen Strategy underscore the significance of green hydrogen in the region's decarbonization endeavours. Nations like Germany, Spain, and the Netherlands are making substantial investments in green hydrogen projects and infrastructure, positioning Europe as a frontrunner in the global green hydrogen market.

North America leads the second biggest market with a revenue of 123 million during the forecast period, with a strong emphasis on clean energy and sustainability, and is heavily investing in green hydrogen production. Supportive government policies, technological advancements, and a rising demand for renewable energy sources have established North America as a frontrunner in the green hydrogen sector. The region's dedication to reducing carbon emissions and championing hydrogen as a clean energy solution is propelling substantial growth in this industry.

The Asia-Pacific region is expected to grow fastest during the forecast period due to the rise in industrialization and urbanization, and the demand for clean energy is propelling the need for green hydrogen. Governments in the region are increasingly acknowledging hydrogen's potential as a clean energy source and are introducing favourable policies and incentives.

Latin America, and Middle East & Africa are predicted to grow with a healthy CAGR during the forecast period.

KEY PLAYERS IN THE GLOBAL GREEN HYDROGEN MARKET

Companies playing a prominent role in the global green hydrogen market include Siemens Energy, Air Liquide, Hydrogenics, McPhy Energy, Nel ASA, ITM Power, Ballard Power Systems, Plumgrid, Sinopec, ENGIE, and Others.

RECENT HAPPENINGS IN THE GLOBAL GREEN HYDROGEN MARKET

- In 2023, Siemens Energy expanded its green hydrogen production capacity by developing advanced electrolysis systems that use renewable energy sources.

- In 2023, Air Liquide invested in the construction of large-scale green hydrogen production facilities, aiming to meet the rising demand from various sectors, including industry and transportation.

- In 2023, Plug Power made strategic investments to expand its green hydrogen production capacity, focusing on fuel cells and electrolyzers.

- In 2022, McPhy Energy introduced compact electrolyzer solutions for on-site hydrogen production, catering to industries seeking reliable and sustainable hydrogen sources.

DETAILED SEGMENTATION OF THE GLOBAL GREEN HYDROGEN MARKET INCLUDED IN THIS REPORT

This research report on the global green hydrogen market has been segmented and sub-segmented based on technology, application, end-user and region.

By Technology

- Alkaline Electrolyzer

- Polymer Electrolyte Membrane (PEM) Electrolyzer

By Application

- Power Generation

- Transport

- Others

By End-User

- Petrochemical

- Food and Beverages

- Medical

- Chemical Glass

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the CAGR of the Green Hydrogen Market from 2024-2032?

The green hydrogen market is expected to grow with a CAGR of 62% during the forecast period.

2. Which is the dominating region for the Green Hydrogen Market share?

Europe is currently dominating the green hydrogen market share by region.

3. Which application type dominates the market for the green hydrogen market?

The "transportation" segment dominates the green hydrogen market by Application type.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]