Global Steam Methane Reforming Market Size, Share, Trends & Growth Forecast Report – Segmented By Technology (Coal Gasification, Steam Methane Reforming), Systems (Merchant and Captive), Application (Methanol Production, Ammonia Production, Petroleum Refinery) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

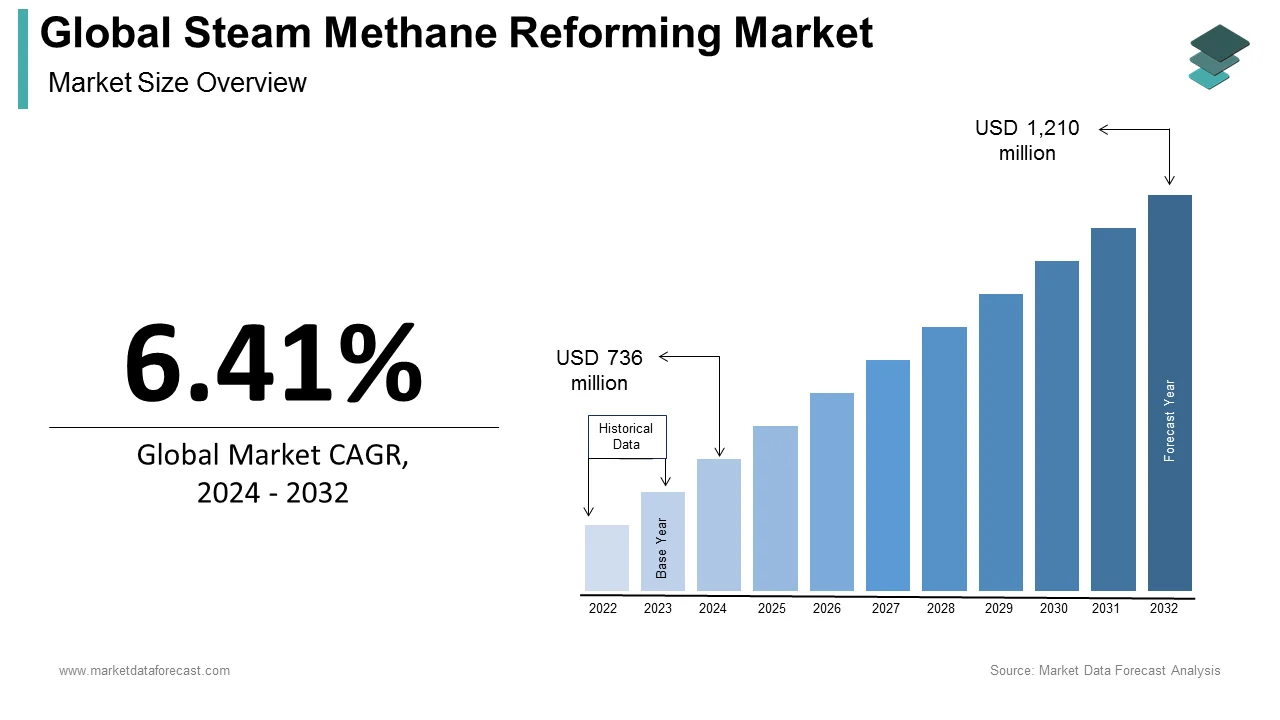

Global Steam Methane Reforming Market Size (2024 to 2032):

The size of the global steam methane reforming market was valued at USD 692 million in 2023. The global market is projected to reach USD 1,210 million by 2032 from USD 736 Million in 2024, growing at a CAGR of 6.41% from 2024 to 2032.

Current Scenario of the Global Steam Methane Reforming Market

The growing hydrogen production industry has become a key driver of the worldwide steam methane reformer market as steam methane reforming remains the most economical method of producing hydrogen. Steam reforming of methane mainly involves two reactions that are the water gas shift reaction and the reforming reaction. In the latter case, natural gas is generally steam-stripped and then heated to a very high temperature to extract hydrogen and carbon monoxide. Hydrogen is employed in a variety of applications ranging from chemical processing, fuel cells, oil recovery, and refining to metal production. Of these, hydrogen call is highest in the oil refinery and ammonia production segments. The transportation industry also promises enormous expansion opportunities for the market, as it is predicted to become one of the main consumers of hydrogen in the coming years.

MARET DRIVERS

The growing demand for clean energy fuels is one of the major factors propelling the growth of the steam methane reforming market.

Steam reforming of methane is the most economical method for hydrogen production. The call for clean green fuel is predicted to increase exponentially in the coming years, with escalating levels of pollution coupled with escalating government regulations to control and reduce the sulfur content of fuels. This factor should stimulate the market. The United States is among the world's early adopters of clean energy solutions for industries such as power generation, manufacturing, and transportation. The US Department of Energy (DOE) and the Department of Transportation (DOT) submitted a hydrogen posture plan in December 2006. The purpose of this plan was to improve R&D and validate technologies that can be used. Employed to establish a hydrogen infrastructure. In addition, this plan provided for the deliverables established by the federal government to support the development of the hydrogen infrastructure in the country. The plan has been developed in accordance with the National Hydrogen Energy Vision and Roadmap. Hydrogen producers in the United States are looking to expand their geographic reach and target countries such as Vietnam, Indonesia, South Africa, and other developing countries to increase their income. US-based market players such as Praxair Inc. and Air Liquide are looking to expand their businesses in countries where hydrogen call is escalating as part of their strategic expansion plans. The North American market for hydrogen production has been growing for several years at a sustained rate thanks to the contributions of each application and technology. The application of hydrogen in the production of methanol and the production of ammonia is developing at a high rate in the area.

Taking into account the expansion observed in these segments and the industrialization in emerging countries, the future of the world steam methane reform market looks very positive. In addition, the use of fuel cells has increased dramatically in recent years, accelerating sales opportunities in the steam methane reforming market. As industries turn to smaller portable products, the call for steam methane reformers is predicted to increase even further in the future.

The rising application of hydrogen in various industries is likely to be another driving factor for the growth of the steam methane reforming market. Hydrogen is produced using many resources such as natural gas, biomass, coal, and various other renewable and non-renewable energy sources. Currently, natural gas is the main source of hydrogen production, and steam methane reformers using natural gas are employed primarily for production. However, in recent years, the adoption of more recent technologies, such as electrolysis and pyrolysis production, has been encouraged.

MARKET RESTRAINTS

The high initial capital investment required for steam methane reforming is primarily limiting the growth of the global market.

In addition, factors such as environmental concerns related to carbon emissions, limited availability of natural gas feedstocks and competition from alternative hydrogen production methods are inhibiting the growth of the global market. Challenges in carbon capture and storage, regulatory hurdles and permitting requirements, technological limitations in efficiency improvements and volatility in natural gas prices are imposing negative impact on the global market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.41% |

|

Segments Covered |

By Technology, Systems, Application and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

CB&I Company, Linde AG, Chevron Lummus Global LLC, Axens, Foster Wheeler, DuPont, KBR Inc, Haldor Topsoe, GTC Technology, Shell Global Solutions, Flour Corporation, Exxon Mobil, and Others. |

SEGMENTAL ANALYSIS

Global Steam Methane Reforming Market Analysis By Technology

The steam methane reforming segment had the major share of the global market in 2023 and the lead of the segment is expected to continue throughout the forecast period. Steam methane reforming is a method of producing hydrogen, along with other gases, including carbon monoxide and carbon dioxide. It is a mature and advanced technology in hydrogen production. Growing call around the world is a determining factor for the segment, as steam reforming of methane is the most economical method for hydrogen production.

Global Steam Methane Reforming Market Analysis By Systems

The merchants segment had the leading share of the global steam methane reforming market in 2023. Merchants emerged as the dominant segment in terms of revenue in 2023. On the other hand, the Captive Systems segment is predicted to grow at the highest CAGR in terms of revenue over the outlook period. Socio-economic developing regions, particularly North America and Europe, have large-scale penetration of this technology given the ease of adoption. Captive hydrogen generation is defined as on-site generation that eliminates various problems associated with hydrogen transportation and distribution. Therefore, the market is supposed to experience substantial expansion. For small industries, on-site hydrogen production has gained popularity with new technologies that are offered at reasonable costs compared to the distribution channels provided.

Global Steam Methane Reforming Market Analysis By Application

The methanol production segment led the market in 2023 and is predicted to be the most dominating segment in the worldwide market throughout the forecast period. Methanol is recognized as a useful chemical and a promising component for the production of more complex chemical compounds such as methyl tert-butyl ether, acetic acid, dimethyl ether, methylamine, and others. Methanol is the simplest alcohol and appears as a transparent liquid with a distinctive odor.

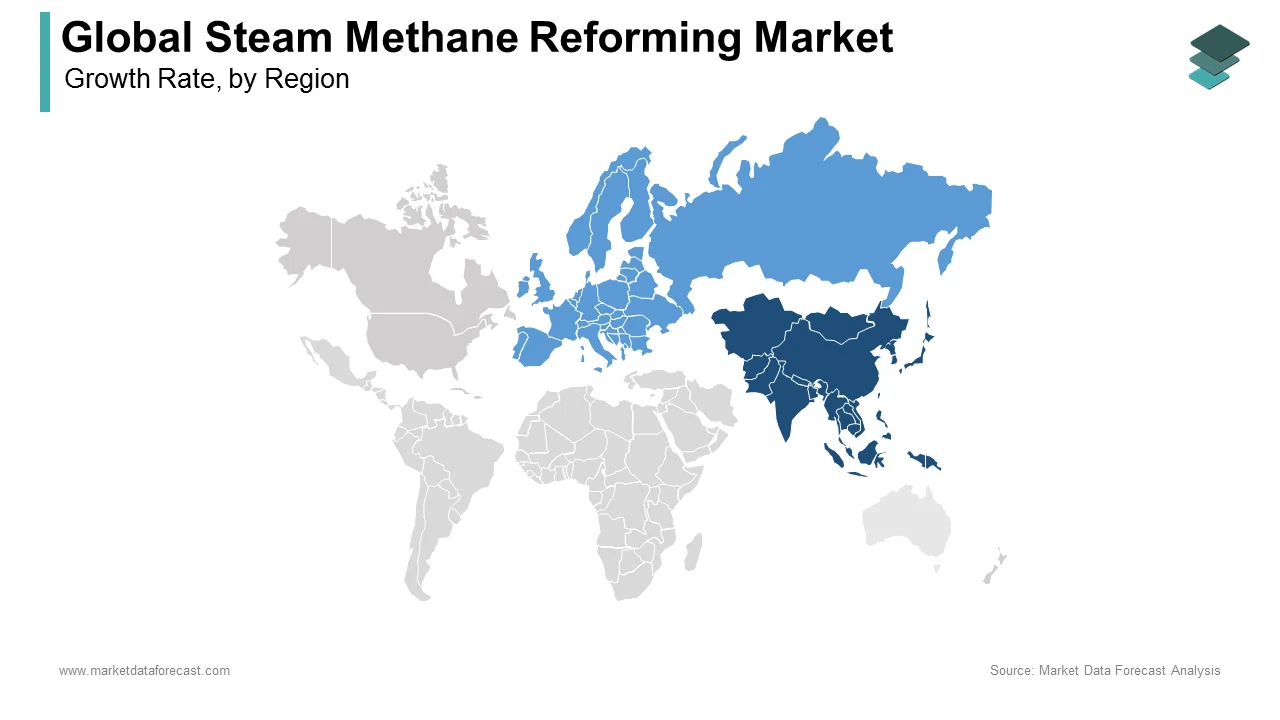

REGIONAL ANALYSIS

Asia-Pacific currently holds the majority share of the worldwide steam methane reforming market. With the escalating number of petrochemical complexes and refineries in the region, the steam methane reforming market is predicted to accelerate in Asia-Pacific in the coming years. In addition, the large populations of the major economies in Asia and the Pacific also support the call for hydrogen and, thus, methane reformers in various sectors.

In the coming years, Europe is expected to become a lucrative market for steam methane reformers. However, experts find that the call profiles in the Eurasian countries and in Europe are very different from each other. Although Russia has a huge petrochemical capacity and large refineries, the refinery industry in Europe is slowly declining. On the other hand, in Europe, the transport sector should continue to be a large consumer of hydrogen and, therefore, of steam methane reforming. Because the market is almost mature in North America, it is projected to show slower expansion in the region.

KEY PLAYERS IN THE GLOBAL STEAM METHANE REFORMING MARKET

Companies playing a significant role in the global steam methane reforming market include CB&I Company, Linde AG, Chevron Lummus Global LLC, Axens, Foster Wheeler, DuPont, KBR Inc., Haldor Topsoe, GTC Technology, Shell Global Solutions, Flour Corporation, Exxon Mobil and UOP.

RECENT HAPPENINGS IN THE GLOBAL STEAM METHANE REFORMING MARKET

- Shell introduces "blue" hydrogen technology. SHELL Catalysts & Technologies licenses technologies and brings the capacity to the industry, has introduced the Shell Blue Hydrogen Process.

DETAILED SEGMENTATION OF THE GLOBAL STEAM METHANE REFORMING MARKET INCLUDED IN THIS REPORT

This research report on the global steam methane reforming market has been segmented and sub-segmented based on technology, systems, application, and region.

By Technology

- Coal Gasification

- Steam Methane Reforming

By Systems

- Merchant

- Captive

By Application

- Methanol Production

- Ammonia Production

- Petroleum Refinery

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the Steam Methane Reforming Market growth rate during the projection period?

The Global Steam Methane Reforming Market is expected to grow with a CAGR of 6.41% between 2024-2032.

2. What can be the total Steam Methane Reforming Market value?

The Global Steam Methane Reforming Market size is expected to reach a revised size of US$ 1,210 billion by 2032.

3. Name any three Steam Methane Reforming Market key players?

Axens, Foster Wheeler, and DuPont are the three Steam Methane Reforming Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com