Global Green Ammonia Market Research Report - Segmentation By Technology (Proton exchange membrane (PEM), Alkaline water electrolysis (AWE) and Solid oxide electrolysis (SOE)), By End-User (Power Generation, Transportation, and Industrial feedstock); and By Region (North America, Europe, Asia Pacific, Latin America, & Middle East - Africa) – Industry Forecast 2024 to 2032.

Global Green Ammonia Market Size (2024-2032):

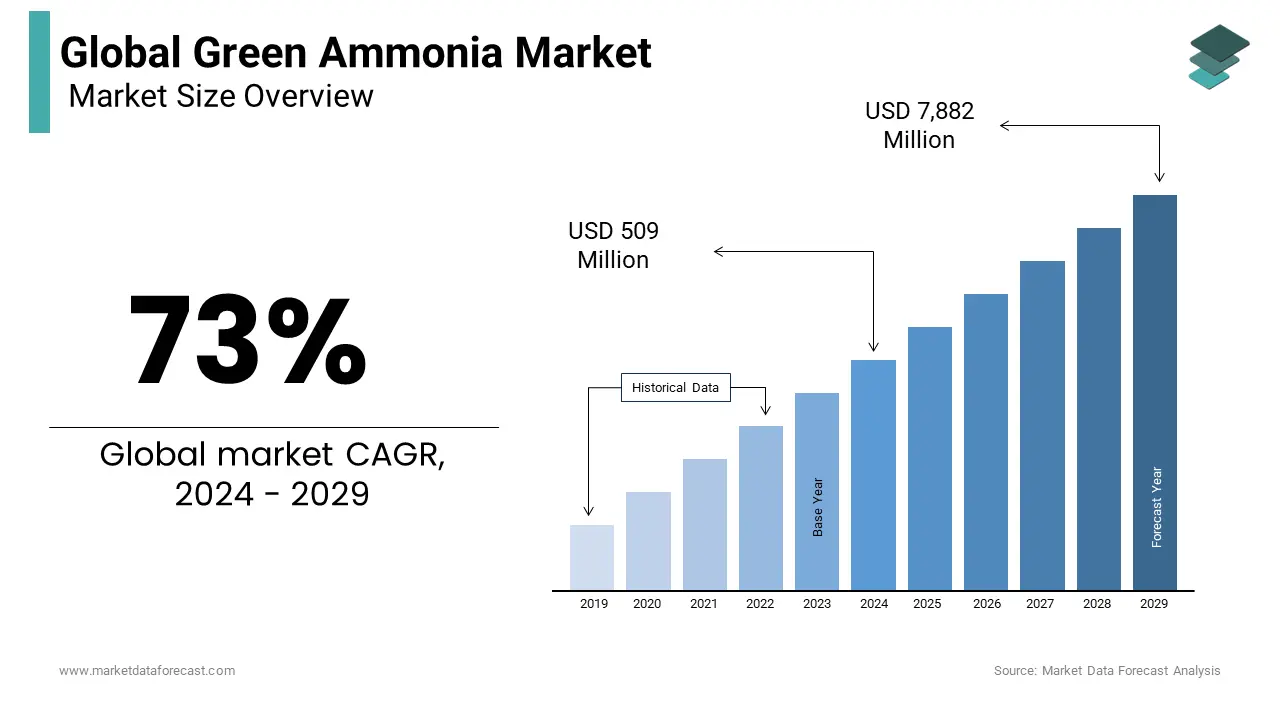

The Global Green Ammonia Market size was valued at US$ 294 million in 2023 and is anticipated to reach US$ 40,810 million by 2032 from US$ 509 million in 2024 and increase at a CAGR of 73% between 2024 and 2032.

Current Scenario of the Global Green Ammonia Market

Rising investments in green fuel and wide-scale plans for green energy are the main characteristics responsible for the growth of the global green ammonia market. Primarily, Ammonia is a nitrogen-hydrogen chemical with the formula NH3. Moreover, Ammonia is a colorless gas with a pungent odor. In addition, it is a stable binary hydride and the simplest pnictogen hydride. It is considered a frequent nitrogenous waste, especially among aquatic creatures. It contributes considerably to terrestrial organisms' nutritional needs by serving as a precursor to 45 percent of the world's food and fertilizers. Ammonia is also utilized in many commercial cleaning products and is a building block for producing many pharmaceutical medicines, directly or indirectly. It is gathered mainly by air and water displacement downward. The maximum utilization of hydrogen from water electrolysis and nitrogen extracted from the air is one of the primary methods of producing green Ammonia. These are then put into the Haber process, also termed the Haber-Bosch process, which is entirely powered by renewable energy. The Haber process produces Ammonia, NH3, by combining hydrogen and nitrogen at high temperatures and pressures.

MARKET DRIVERS

Ammonia is the world's second most-produced chemical used in various sectors, including fertilizer, polymers, explosives, textiles, insecticides, and dyes.

However, conventional ammonia production relies on fossil fuels, such as natural gas or coal, to obtain hydrogens. As a result, ammonia production accounts for more than 1% of world greenhouse gas emissions and 5% of global natural gas consumption. The steam reforming method produces around 72 percent of the total Ammonia generated worldwide. Therefore, there is a massive amount of carbon dioxide emissions. Green Ammonia is made with renewable energy rather than natural gas or coal. As a result, it is declared as an efficient method of lowering greenhouse gas emissions. The Haber-Bosch electrochemical process manufactures Ammonia without emitting any greenhouse gases. A lot of businesses throughout the world are transitioning to ecological operations to reduce greenhouse gas emissions. This change is driving the green ammonia market. The demand for green Ammonia has a bright future because of the growing use of green Ammonia as a maritime fuel. The shipping industry accounts for 3% of global greenhouse gas emissions, primarily due to ships' high diesel and sulfur fuel use.

On the other hand, the maritime industry must reduce emissions by switching to greener energy sources. Under the International Maritime Organization (IMO) 2020 regulations (mass by mass), the sulfur limit in transportation oil used on board ships has been cut to 0.5 percent m/m. This will shift toward higher-quality marine fuels, potentially expanding the green ammonia market.

MARKET RESTRAINTS

The costly capital nature of green ammonia plants is now the most significant factor impeding market expansion.

The average lifespan of a modern ammonia plant is 15 to 20 years. The typical CAPEX cost per tonne of Ammonia produced in a Greenfield project ranges between USD 1,300 and USD 2,000. On the other hand, Green Ammonia is 1.5 times more expensive than natural gas-based ammonia factories. According to a study, Natural gas or coal, which accounts for 75 percent of the plant's operating costs, is the principal operating cost in ammonia manufacturing. In addition, the expense of electrolyzers raises the price of operations in green ammonia production. Therefore, these are the primary factors responsible for the slowdown of the global green ammonia market growth during the forecast period.

Furthermore, the use of green Ammonia is still in its infancy. Electrochemical synthesis, photochemical synthesis, and chemical looping directly produce Ammonia from water and nitrogen. However, such methods are fraught with considerable technological difficulties that necessitate time and R&D expenditures. As a result, most ammonia producers continue to use traditional production techniques. The biggest issue with green Ammonia is a lack of knowledge among chemical manufacturers. As a result, the largest chemical companies in China, Japan, and Russia continue to use natural gas steam methanation technology for ammonia production.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

73% |

|

Segments Covered |

By Technology, End User, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens, MAN Energy Solutions, ITM Power, Nel Hydrogen Solutions, Yara International, Haldor Topsoe, CF Industries Holdings, Inc., ThyssenKrupp AG, Nanjing Kapsom Engineering Limited, Maire Tecnimont SpA, and Others. |

SEGMENTAL ANALYSIS

Global Green Ammonia Market Analysis By Technology

Based on technology, the solid oxide electrolysis segment holds the highest green ammonia market share during 2024-2032. Because of the growing need for hydrogen systems to reduce carbon emissions, solid oxide electrolysis technology has been identified as a new revenue stream for the green ammonia market. Green hydrogen is produced using the SOE process using extra power supplied from renewable sources. Using SOE technology, green hydrogen can be synthesized further in an ammonia synthesis plant to make green Ammonia. Furthermore, the process produces green hydrogen, which may be stored and utilized as a fuel cell and again shifted back to electricity when required. When output exceeds demand, this permits power to be stored. As a result, the growing demand for hydrogen fuel cells boos the global green ammonia market shortly.

Global Green Ammonia Market Analysis By End-User

Based on end-users, the power generation segment dominates the global green ammonia market and continues to propel the global green ammonia market growth during the forecast period. Surplus renewable energy generated in remote regions can make carbon-free Ammonia, which can be used as a sustainable fuel for power generation, utilizing the electrolysis process. Furthermore, the market for green Ammonia is growing due to the requirement for long-term storage of renewable energy supplied by isolated wind farms and solar panels.

REGIONAL ANALYSIS

During 2024 - 2032, Europe is anticipated to hold the most prominent global green ammonia market, owing to the rise of green hydrogen projects in Germany and the Netherlands. Furthermore, favourable government regulations and activities to manufacture green hydrogen are projected to boost green ammonia demand.

The Asia-Pacific green ammonia market is expected to rise at a substantial CAGR of 9.5% during the forecast period 2024-2032. The most prominent factor fuelling the growth of the market is the growing preference for sustainable energy sources for power generation and transportation fuel.

Green ammonia's widespread use as a replacement for GHG-emitting materials and consistent government regulations to promote green ammonia production are significant factors driving the market's expansion in the North American area.

KEY PLAYERS IN THE GLOBAL GREEN AMMONIA MARKET

Companies playing a prominent role in the global green ammonia market include Siemens, MAN Energy Solutions, ITM Power, Nel Hydrogen Solutions, Yara International, Haldor Topsoe, CF Industries Holdings, Inc., ThyssenKrupp AG, Nanjing Kapsom Engineering Limited, Maire Tecnimont SpA, and Others.

DETAILED SEGMENTATION OF THE GLOBAL GREEN AMMONIA MARKET INCLUDED IN THIS REPORT

This research report on the global green ammonia market has been segmented and sub-segmented based on technology, end-user, and region.

By Technology

- Proton exchange membrane (PEM)

- Alkaline water electrolysis (AWE)

- Solid oxide electrolysis (SOE)

By End-User

- Industrial feedstock

- Transportation

- Power Generation

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the Green Ammonia Market growth rate during the projection period?

The Global Green Ammonia Market is expected to grow with a CAGR of 73% between 2024-2032.

What can be the total Green Ammonia Market value?

The Global Green Ammonia Market size is expected to reach a revised size of US$ 40,810 million by 2032.

Name any three Green Ammonia Market key players?

Nel Hydrogen Solutions, Yara International, and Haldor Topsoe are the three Green Ammonia Market players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com