Global Hydrogen Generation Market Size, Share, Trends, & Growth Forecast Report – Segmented By Application (Petroleum Refinery, Ammonia & Methanol production, Transportation and Power Generation) Generation & Delivery Mode (Captive and Merchant), Source (Blue Hydrogen, Green Hydrogen and Grey Hydrogen) & Region - Industry Forecast From 2024 to 2032

Global Hydrogen Generation Market Size (2024 to 2032)

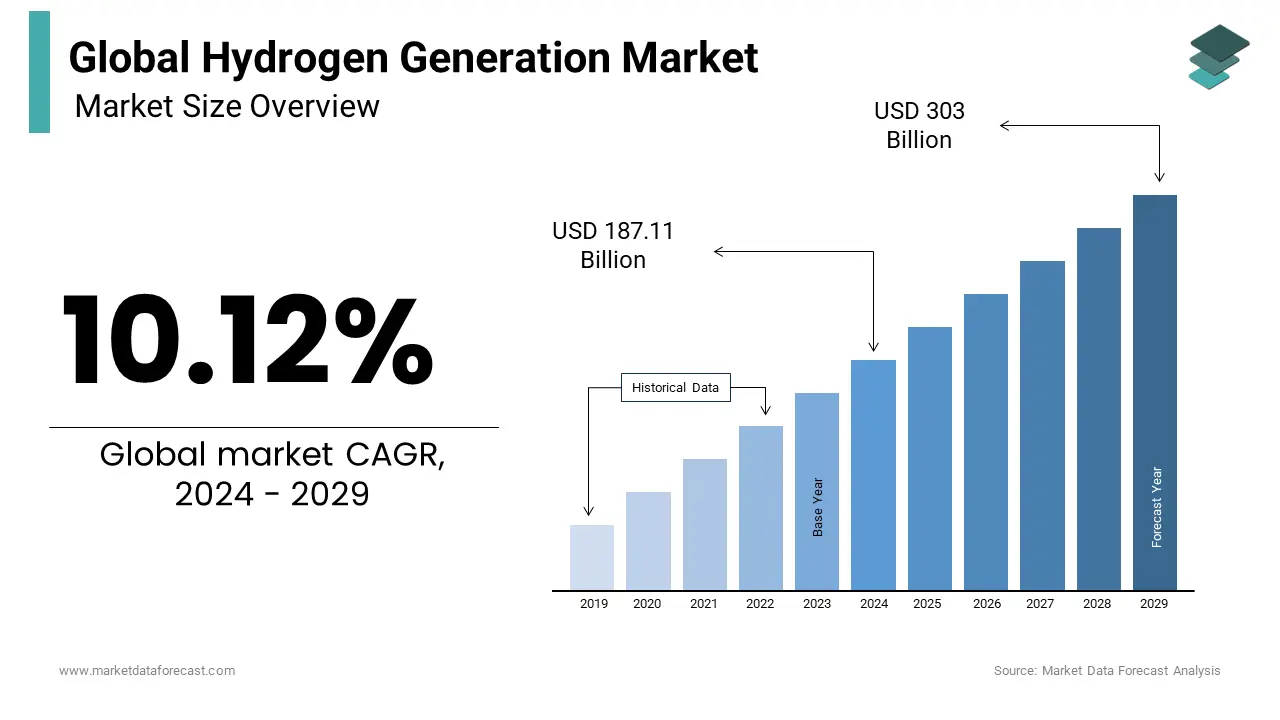

The Hydrogen Generation Market was worth USD 170 billion in 2023 and is projected to reach a valuation of USD 404.60 billion by 2032 from USD 187.11 billion in 2024 and is predicted to register a CAGR of 10.12% from 2024 to 2032.

MARKET SCENARIO

Hydrogen may be produced utilizing a variety of procedures and resources. For example, the thermochemical method requires the use of fossil fuels to release hydrogen, whereas other systems use electrolysis or solar energy to split water into hydrogen and oxygen. At the moment, new technologies based on bacteria and algae are being presented, which are likewise cost-effective, efficient, and environmentally benign. The demand for hydrogen generation is now increasing in the refining of petroleum, the treatment of metals, the production of fertilizers, and the processing of food goods. Aside from that, it's gaining popularity as a fuel in electric cars (EVs) all around the world.

One of the key elements driving the demand for sustainable energy sources like hydrogen is increased energy demand, which coincides with growing environmental concerns. Furthermore, governments in a number of nations are enacting strict rules to limit carbon emissions in the automobile sector, which is driving up EV sales around the world. This, together with the widespread use of hydrogen as a coolant in power plant generators, is fuelling market expansion. Aside from that, various projects are being supported to reduce the costs of hydrogen production technologies as well as their environmental implications. For example, hydrogen production via nuclear energy is viewed as a cost-effective way to reduce carbon emissions and address the important global climate crisis. As a result, demand for hydrogen generation in glass purification, fertilizer production, and semiconductor manufacturing is expected to increase around the world.

MARKET GROWTH

The market for hydrogen generation is predicted to be driven by an exponential increase in demand for clean and green fuel due to rising pollution levels, as well as expanding government laws to control and restrict sulfur content in fuels.

MARKET DRIVERS

The demand for fuel cell electric vehicles (FCEVs) such as passenger cars, buses, lorries, and other heavy-duty vehicles is expected to grow rapidly.

FCEVs are equipped with a fuel cell device that allows them to function without emitting harmful emissions by using hydrogen as a primary fuel. Furthermore, various governments' massive FCEV deployment targets have resulted in a large increase in the number of FCEVs on the road.

As a result of continuous industrial and urban expansion, countries have been forced to adopt various power generation systems in order to meet demand. In addition, rapid population growth and development activities in the Asia Pacific, the Middle East, and Africa. Concerns about the use of sustainable energy to minimize reliance on fossil fuels such as crude oil and natural gas are growing in importance in the worldwide market.

MARKET RESTRAINTS

H2 fuel is commercially manufactured using various technologies that require a large amount of cash to set up and manage, slowing down the worldwide market.

Furthermore, the significant energy consumption required to create hydrogen via technologies such as water electrolysis is exceedingly expensive, as additional electricity is required to break water molecules into hydrogen and oxygen.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.12% |

|

Segments Covered |

By Application, Generation & Delivery Mode, Source, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Praxair, Air Liquide S.A, Air Products and Chemicals, INOX Air Products Ltd., Airgas, Inc., Hydrogenics Corporation, Messer Group GmbH, CLAIND srl, Starfire Energy, Enapter, and Others. |

SEGMENTAL ANALYSIS

Global Hydrogen Generation Market Analysis By Application

The market is segmented into Petroleum Refinery, Ammonia and Methanol Production, Transportation, and Power Generation based on application. During the projected period, the transportation category is expected to increase at the fastest rate. In the future years, the market for hydrogen generation is projected to be driven by the rapid rise in demand for Fuel Cell Electric Vehicles (FCEV) in the Asia Pacific. Hydrogen is used in a variety of types of transportation, including buses, trains, and fuel cell electric vehicles (FCEV) (including marine, aeroplane, and drones). Hydrogen is used to power FCEVs. They are more fuel efficient than traditional internal combustion engines and release no tailpipe pollutants, merely water vapour and warm air.

Global Hydrogen Generation Market Analysis By Generation and Delivery Mode

The market is divided into Captive and Merchant segments based on generation and delivery mode. The merchant market is likely to be driven by increased large-scale hydrogen production via water electrolysis and natural gas processes. Both water electrolysis and natural gas methods can yield merchant hydrogen. This strategy eliminates the demand for fuel transportation and, as a result, the need for new hydrogen-producing infrastructure to be built. However, compared to captive hydrogen generation, its low production capacity results in higher hydrogen costs.

Global Hydrogen Generation Market Analysis By Source

The market is divided into three categories, according to Source: blue hydrogen, green hydrogen, and grey hydrogen. From 2024 to 2029, the blue hydrogen segment is expected to increase at a faster rate. Steam methane reforming is used to create blue hydrogen from natural gas (SMR). SMR combines natural gas with extremely hot steam using a catalyst, which results in hydrogen and carbon monoxide. After water is added to the mix, the carbon monoxide is converted to carbon dioxide, and more hydrogen is produced. CO2 emissions are absorbed and stored underground using carbon capture, utilization, and storage (CCUS) technology, leaving practically pure hydrogen in the process. The cost of producing blue hydrogen is rather inexpensive.

REGIONAL ANALYSIS

The Asia Pacific contributed over 35.0% of sales in 2021, and this trend is likely to continue through 2029. China, Japan, South Korea, India, and Australia are all part of the Asia Pacific Market growth is expected to be boosted by strong economic performance and large-scale R&D investments in Asia Pacific developing countries. China is making major reforms to its petroleum and gasoline industries in order to address a variety of problems. Furthermore, governments in Asia Pacific countries such as Japan and Australia are considering greener and cleaner hydrogen-producing technologies, which are projected to enhance regional market growth.

The government is utilizing hydrogen's potential to meet the regional population's fuel requirements. The metal and chemical industries are two additional key applications that can provide significant growth potential for the hydrogen-generating market in North America.

Due to the existence of several industrial units around the country, the hydrogen-generating business in Canada has been steadily growing over the last few years.

Because of the implementation of numerous energy efficiency regulations, the hydrogen generation business in the United Kingdom will continue to grow at a stable rate in the future. Many end-users in the region are seeing a significant increase in demand for zero-carbon fuels. All of this is being done in accordance with the United Nations' Sustainable Development Goals (SDGs) and the Paris Climate Agreement. The country's main goal is to totally phase out the usage of fossil fuels and attain zero carbon emissions by implementing eco-friendly measures and adhering to EU rules. These factors will help the hydrogen-generating market in the United Kingdom grow.

The Middle East and Africa Hydrogen Generation Markets are expected to expand at a fixed rate, with growth rates varying depending on the degree of natural resources available in each nation and access to energy at cheap rates. The need for power and energy has been increasing in the region, with some countries seeing particularly high demand due to their high levels of economic growth.

KEY PLAYERS IN THE GLOBAL HYDROGEN GENERATION MARKET

Companies playing a prominent role in the global hydrogen generation market include Praxair, Air Liquide S.A, Air Products and Chemicals, INOX Air Products Ltd., Airgas, Inc., Hydrogenics Corporation, Messer Group GmbH, CLAIND srl, Starfire Energy, Enapter, and Others.

RECENT HAPPENINGS IN THE GLOBAL HYDROGEN GENERATION MARKET

- Atawey, a leader in hydrogen refueling stations in France, is introducing a new mobile hydrogen station. It eliminates the constraints associated with hydrogen refuelling and project setup by being able to supply multiple heavy goods vehicles and being ready to function in about half a day, the fastest on the market.

DETAILED SEGMENTATION OF THE GLOBAL HYDROGEN GENERATION MARKET INCLUDED IN THIS REPORT

This research report on the global hydrogen generation market has been segmented and sub-segmented based on application, generation and delivery mode, source, and region.

By Application

- Petroleum Refinery

- Ammonia and Methanol production

- Transportation

- Power Generation

By Generation and Delivery Mode

- Captive

- Merchant

By Source

- Blue Hydrogen

- Green Hydrogen

- Grey Hydrogen

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the size of the hydrogen-generation market?

The global hydrogen generating market is predicted to reach USD 404.60 billion by 2032, up from USD 170 billion in 2023.

Which segment had the biggest share of the hydrogen generation market?

In 2023, North America held the largest share of the hydrogen generation market. This is due to a rise in healthcare knowledge, as well as the acceptance of cloud-based technology and ongoing research and development projects.

What are the driving factors for hydrogen generation market?

The hydrogen generating market is being driven by increased government attempts to minimise carbon emissions and rising demand for green energy in industrialised countries.

Who are the major players in the Hydrogen Generation Industry?

Praxair, Inc., Air Liquide S.A., Air Products and Chemicals, INOX Air Products Ltd., Airgas, Inc., Iwatani Corporation, Hydrogenics Corporation, and Messer Group GmbH are among the leading firms in the Hydrogen Generation Market.

What categories does the Hydrogen Generation Market cover?

Application, Generation & Delivery Mode, Source, and Geography are the segments that make up the Global Hydrogen Generation Market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com