Global Hydrogen Purifiers Market Size, Share, Trends & Growth Forecast Report By Type (Type I & Type II), Application (Electronics, Industrial Gas Industry, Metal Industry, Power Plants, Chemicals Industry, & Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2024 to 2033

Global Hydrogen Purifiers Market Size

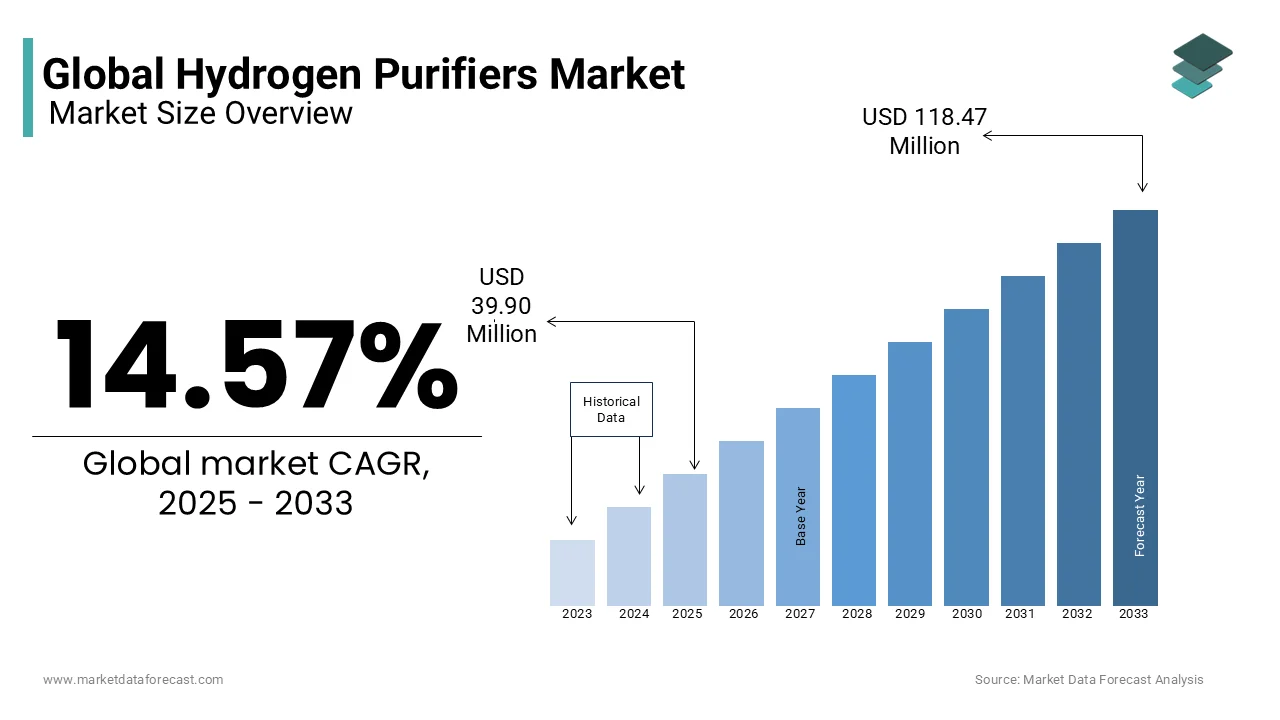

The global hydrogen purifiers market size was valued at USD 34.83 million in 2024. The global market is predicted to reach USD 118.47 million by 2033 from USD 39.90 million in 2025, at a compound annual growth rate (CAGR) of 14.57% from 2025 to 2033.

Hydrogen Purifier refers to the equipment employed to purify hydrogen, primarily if the product is derived from hydrocarbon sources. Hydrogen is employed in various industrial processes, mainly in the refining industry. It is an essential component of the gaseous effluents produced by various refining processes. Traditionally, gaseous effluents were employed as an energy resource employed for combustion. However, due to strict regulations and tight margins, the technologies employed for hydrogen recovery are receiving considerable and in-depth attention. Hydrogen purifiers are devices employed to clean hydrogen, especially if the consequence is a derivative of alkaline origin. Hydrogen is employed in various industrial processes, mainly in the purification industry. It is examined as a fundamental part of the exhaust gases produced by various disinfection procedures. Correctly, the gaseous effluents were employed as energetic assets employed for ignition. Hydrogen manufacturers are susceptible to the cost of devices to purify hydrogen because the cost they generally incur is that of hydrogen. The most important hydrogen purifiers are catalytic recombination or deoxygenation purifiers, pressure swing adsorption, dense and thin metal membrane hydrogen purifiers, and palladium membrane hydrogen purifiers.

MARKET DRIVERS

Hydrogen producers have extremely subtle prices for hydrogen refining equipment, as the price they normally charge is that of hydrogen. The most distinguished hydrogen disinfectants are deoxygenated refiners or pulse neutralization, oscillating force concentration, dense and narrow metal-lined membrane disinfectants,s and preventive layer hydrogen disinfectants. Among the many hydrogen disinfectants, the most learned method and accepted hydrogen cleaning procedure is the force change concentration method. This specific technology is based on the important imperative atomic process of gas to a substance that is solid adsorbent like zeolites, vitreous gel, and atomic carbon filters. It uses the element hydrogen to reduce differentiation and low magnetism pressure. Dense metal thin film hydrogen disinfectants are fairly inexpensive and can be employed. All these aspects play a pivotal role in the growth of the global hydrogen purifiers market.

In terms of specific applications, such as the semiconductor industry, there is no alternative to palladium membrane hydrogen purifiers. Most of the hydrogen supplied to developing countries like India and China has a variable consistency. This also results in peaks of contamination in the feed employed by the technologies that work with absorbed H2. The cost of replacing contaminated epithelial wafers caused by required downtime and impurities for cleaning tools is prohibitive for producers. The market has not yet seen steady expansion due to the escalating use of heavy oils in refining and the growing call for extremely pure hydrogen, coupled with environmental restrictions and low profit margins. However, the future looks promising for the hydrogen purifiers market due to the rising awareness.

MARKET RESTRAINTS

The level of clarity of the hydrogen being removed is not suitable for various proprietary applications. When it comes to niche implementations like electronics manufacturing, there's no option for palladium-layered hydrogen sanitizers. Most of the hydrogen that is taken to emerging countries such as China and India has variable stability, affecting the sales in the hydrogen purifiers market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.57% |

|

Segments Covered |

By Types, Applications, and Regions. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ally Hi-Tech, Chart Industries, Air Products, SchmackCarbotech GmbH, SAES Pure Gas Inc., Petronas, Xebec, Advanced Extraction Technologies Inc., Yangtze Energy Technologies Inc., Honeywell UOP, and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The Type I segment is a method of producing hydrogen with additional gases, including CO (carbon monoxide) and CO2. It is a developed and advanced automation in the creation of hydrogen. The growing need in the world is a critical operating factor for the segment, as development-enhancing hydrogen purifiers include functional advantages such as surge planning related to hydrogen purifier upgrade procedures. Coal carbonation automation recorded the second-highest market revenue in 2020 and is predicted to increase with excessive CAGR in the hydrogen purifiers market. The carbonation of coal, which uses carbon as an organic material to give hydrogen, has been applied for almost two centuries. Also, it is accepted as a developed technology, such as hydrogen purifier automation. The cost of renewing contaminated semiconductors that are generated by essential intermediate and degradation is excessive for manufacturers. On the other hand, the hydrogen purifiers market has yet to see stable development due to the escalating use of heavy oils in cleaning and low-profit margins.

REGIONAL ANALYSIS

Regionally, the countries likely to witness a massive increase in the use of hydrogen purification technologies are India, Canada, Japan, Russia, China, and the United States. The Asia Pacific hydrogen purifiers market is likely to experience expansion due to the massive use of hydrogen in industries. The slow expansion of the refining industry in Western Europe is likely to stall the hydrogen purifier market in this region for some time. Asia-Pacific is predicted to be the dominant region in the hydrogen purifier business. Asia-Pacific was ranked the highest in terms of revenue, recording a 33% market share. The movement is supposed to continue throughout the projected period. Strong and lucrative performance, as well as substantial R&D spending in countries such as India, Australia, South Korea, and Japan, is believed to be the burden of development.

China is undergoing major changes in the energy and crude oil industry to control various ultimatums, including deterioration and profitable incoherence between people in rural and urban areas. Factors such as increased air pollution and increased sulfur gratification in habitat also act as ultimatums for the country. Furthermore, the existence of an excessive number of oil refineries in major countries such as India and China is believed to take advantage of the application of hydrogen creation. The governments of some countries, such as Australia and Japan, are believed to be exploiting the application of hydrogen creation and believe in cleaner and greener automation, which is supposed to ensure the development of the hydrogen purifiers market.

KEY MARKET PLAYERS

Companies playing a prominent role in the global hydrogen purifiers market include Ally Hi-Tech, Chart Industries, Air Products, SchmackCarbotech GmbH, SAES Pure Gas Inc., Petronas, Xebec, Advanced Extraction Technologies Inc., Yangtze Energy Technologies Inc., Honeywell UOP, and Others.

RECENT HAPPENINGS IN THE GLOBAL MARKET

-

Hy9 launches a range of hydrogen purifiers. Massachusetts-based Hy9 Corporation manufactures hydrogen generators and purifiers and introduces its new HPS family of palladium multi-membrane hydrogen purifiers.

-

Air Products will introduce 30 tons per day of liquid hydrogen industries in China in 2022.

MARKET SEGMENTATION

This research report on the global hydrogen purifiers market has been segmented and sub-segmented based on types, application, and region.

By Types

- Type I

- Type II

By Application

- Electronics

- Industrial Gas Industry

- Metal Industry

- Power plants

- Chemicals Industry

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the primary technologies used in hydrogen purification?

The main technologies include Pressure Swing Adsorption (PSA), membrane separation, and catalytic conversion. PSA utilizes adsorbent materials to selectively remove impurities. Membrane separation employs selective permeability to filter out contaminants. Catalytic conversion uses catalysts to transform impurities into harmless substances.

Which industries are the largest consumers of hydrogen purifiers?

Key industries include energy, electronics, chemicals, and transportation. In energy, purifiers ensure hydrogen quality for fuel cells. Electronics manufacturing requires ultra-pure hydrogen for semiconductor production. The chemical sector uses purified hydrogen in various synthesis processes.

What factors are driving the growth of the hydrogen purifiers market?

Increasing demand for clean energy, technological advancements in purification methods, and supportive government policies are major growth drivers. The push for sustainability and reduction of carbon emissions also contribute significantly. Additionally, expanding applications of hydrogen across various sectors boost market demand.

What future trends are expected in the hydrogen purifiers market?

Future trends include the development of more energy-efficient and low-carbon purification technologies. The market is also likely to see increased integration of renewable energy sources and advancements in automation. Additionally, expanding hydrogen applications across various industries will drive further innovation and growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]