Global Iced Tea Market Size, Share, Trends, & Growth Forecast Report - Segmented By Flavours (Lemon Tea, Black Tea, Green Tea, Herbal Tea, Others), Packaging, By Distribution channels, Demographics, and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America - Industry Analysis From 2025 to 2033.

Global Iced Tea Market Size

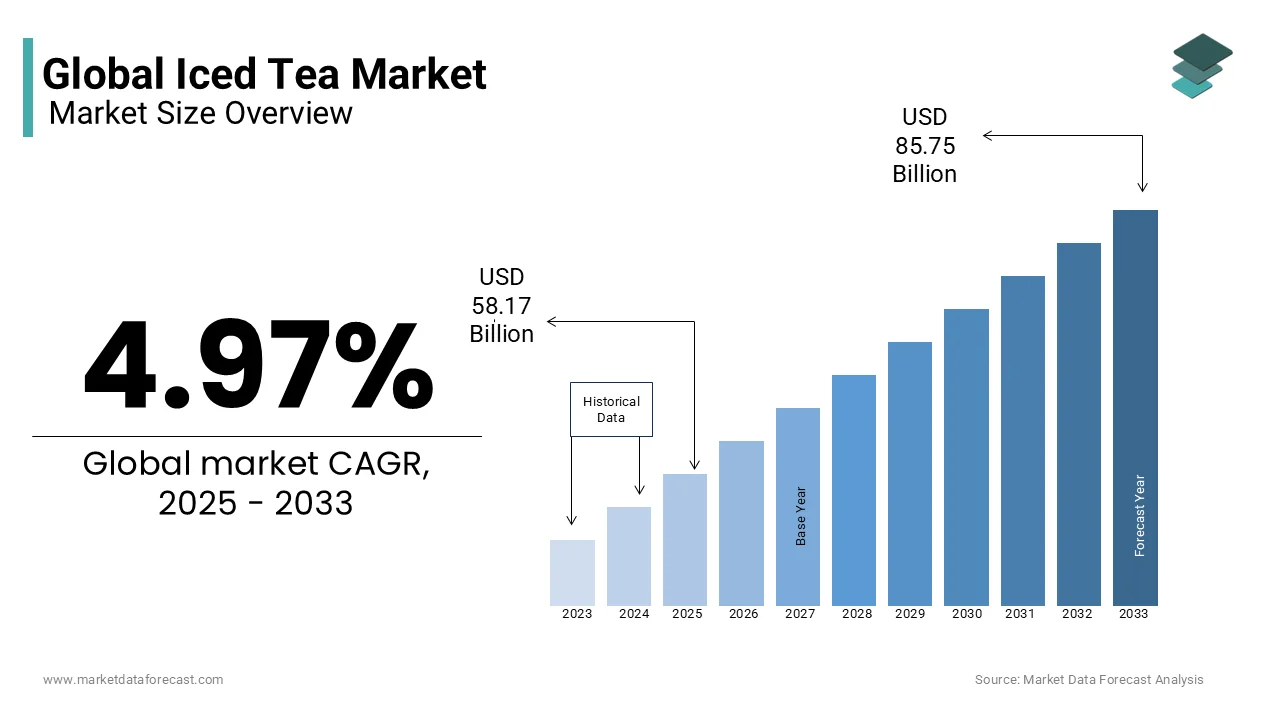

The Global Iced tea market size was valued at USD 55.42 billion in 2024, and the global market size is expected to reach USD 85.75 billion by 2033, from 58.17 billion in 2025, expanding at a compound annual growth rate (CAGR) of 4.97%

The demand for convenient and healthful beverages is driving the rapid growth of the worldwide iced tea market. Iced tea is a delightful beverage made from cooled tea and served over ice. It can be made with a variety of teas, including black tea, green tea, or herbal tea, and can be chosen to have sweetened or unsweetened. A common summertime beverage, iced tea is frequently flavored with lemon, mint, or other ingredients. Additionally, it comes in a variety of flavors, including peach, raspberry, and mango. The global Iced tea market is a dynamic business that is expanding at a quick rate. This expansion is being driven by shifting consumer preferences as well as an increasing desire for healthier beverage options over other options in the market. Because it is believed that drinking iced tea regularly may even reduce the risk of developing cancer, more and more people are gravitating towards using iced tea as a beverage for their day-to-day needs. Additionally, in comparison to carbonated and aerated beverages, it is regarded as a more beneficial choice for one's health. Powdered mixes bottled and canned iced teas, and ready-to-drink (RTD) iced teas are all types of items that are available on the market.

MARKET DRIVERS

People are becoming increasingly health conscious, and as a result, they are looking for beverage options that are healthy for them. Iced tea is preferred by a large number of customers over other beverages, such as carbonated drinks, due to the perception that iced tea is a healthier option than carbonated soft drinks due to its reduced sugar content. Additionally, the perceived health benefits connected with the drinking of iced tea have influenced a huge number of consumers to prefer iced tea over other beverages. The shop is selling iced tea leaves, which, when consumed daily, help the body rid itself of toxins. The combination of this element and the evolving preference of customers for novel and forward-thinking food and beverage items has been a driving factor in the iced tea market growth. In addition to this, breweries are actively selling iced tea as a healthy alternative for customers who consume tea as a beverage. Flavonoids and other components found in iced tea can bind cholesterol and other harmful blood fats, removing them from circulation and lowering blood cholesterol levels. Additionally, iced tea is loaded with vitamins, minerals, and antioxidants; therefore, just one glass of iced tea daily can supply all the nutrients that are required for the daily intake of tea is consumed daily. Therefore, the demand in the international market is being driven by the fact that iced teas are associated with a significant number of health benefits.

The growing desire for beverages that are both healthier and more functional is one of the most significant prospects for the iced tea industry. Consumers are becoming increasingly health conscious and are looking for beverages that give additional health benefits in addition to simply providing water for the body. The decreased amount of sugar in iced tea and the purported health benefits of drinking it have led many people to believe that it is a healthier option than carbonated soft beverages. Furthermore, there is an opportunity for organizations in the iced tea industry to develop new products that cater to specific consumer segments. Examples of such products include iced teas that are organic and natural, iced teas that are low in calories and sugar-free, and iced teas that are infused with functional ingredients such as vitamins, antioxidants, and probiotics. These products have the potential to meet the rising demand for beverages that are both healthier and more sustainable in the long run, and they could also assist businesses in setting themselves apart from their rivals. In addition, the considerable growth potential for the business is presented by the rising level of discretionary money in developing nations as well as the rising popularity of iced tea in these markets. Demand for premium iced tea products may be pushed higher by big populations and expanding middle classes in developing economies such as India and China, which both have large total populations. The increased desire for healthier and more functional beverages, the creation of new products that appeal to certain consumer categories, and the growth potential in developing economies all create significant opportunities for the iced tea market

MARKET RESTRAINTS

The tremendous competition from various types of non-alcoholic beverages is one of the primary market challenges that the iced tea market must contend with. The industry is confronted with intense competition from a wide variety of products, including carbonated soft drinks, sports drinks, bottled water, coffee, tea, and fruit juices, amongst others. Because there is such a large variety of other beverages available, it is difficult for businesses that sell iced tea to win and keep the loyalty of their customers and increase their market share. A further factor that could hinder the expansion of the iced tea market is the shifting tastes of customers towards various other beverages. Because of this, companies that make iced tea are continuously coming up with new ideas and inventing new goods to maintain their competitive edge and satisfy the ever evolving wants of customers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.97% |

|

Segments Covered |

By Flavours, Packaging, Distribution Channel, Demographics, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Coca-Cola Company, PepsiCo, Nestlé S.A., Arizona Beverage Company, The Republic of Tea, Unilever(Lipton), Pure Leaf, Snapple, Teavana, Tradewinds Beverage Co. |

SEGMENTAL ANALYSIS

By Flavours Insights

Lemon tea is leading with the dominant shares of the market. With its tart and pleasant flavour, lemon-flavored iced tea is a classic and popular flavour. It is a versatile flavour that may be combined with other fruit Flavors like peach or raspberry, as well as herbs and spices like mint or ginger. Because of its adaptability, popularity, and ability to appeal to a wide spectrum of consumers, lemon is a major category in the iced tea market. Health-conscious consumers like green tea and herbal Flavors. Customers that prefer more unique flavors choose raspberry and other fruit flavors.

By Packaging Insights

The bottles segment is gaining traction over the shares of the iced tea market. Bottled iced tea is popular, with several brands offering varying sizes and shapes to suit consumer tastes. Bottles are portable and easy to store. Recyclability is an increasing concern among consumers seeking environmentally friendly packaging. Iced tea brands can easily brand and label bottles to reach consumers. Due to its ease, portability, and branding potential, bottled iced tea dominates the industry. Consumers that prefer to enjoy their beverages on the go choose cans. Cartons and pouches are popular among people that value sustainability and environmental friendliness.

By Distribution Channels Insights

Supermarkets and hypermarkets dominate the iced tea market shares. These stores offer a variety of iced tea brands so customers may compare and choose the best one. Consumers can buy all their groceries, including iced tea, at supermarkets and hypermarkets. These retailers also provide iced tea discounts and promotions, making them appealing to budget-conscious shoppers. Supermarkets and hypermarkets in residential neighbourhoods are easily accessible by public transit. Due to its variety, convenience, and accessibility, supermarkets and hypermarkets dominate the iced tea market. Convenience stores are popular with customers looking for a quick and convenient beverage alternative. Customers who wish to buy iced tea from the convenience of their own homes prefer online businesses.

By Demographics Insights

Iced tea consumers are mostly 18-34-year-olds. Iced tea matches this age group's need for healthful, refreshing drinks. Young individuals are more willing to try new iced tea flavors and brands with unique flavors. Iced tea businesses with eco-friendly packaging target young folks since they are more socially and environmentally conscientious. Due to their interest in refreshing and healthful beverages, young adults dominate the iced tea market demographics.Families with children are a prominent demographic group, as parents may prefer iced tea to sugary drinks for their children. Individuals who are health-conscious and athletes are a prominent demographic group, as they may value the health benefits of iced tea.

REGIONAL ANALYSIS

North America has been the leading region in the iced tea market. Iced tea consumption is strongly embedded in American culture, which is propelling the demand of the market. Iced tea is also a popular beverage in Canada, particularly during the summer months. Iced tea has grown in popularity in Mexico and other Latin American countries in recent years. After North America, Europe has the potential revenue shares during the forecast period.

Iced tea has grown in popularity in Europe in recent years, with customers in the United Kingdom, Germany, and France preferring the beverage. The introduction of new flavors and packaging options, as well as increased interest in healthier beverage options, have spurred the expansion of the Europe iced tea market. Aside from these huge multinationals, many local brands offer unique iced tea flavors and styles, such as green tea-based iced teas in Japan and India.

Iced tea consumption is growing in the Middle East and Africa, with Saudi Arabia and South Africa being key markets for the beverage. Iced tea is popular in many areas as a refreshing alternative to hot tea, especially during the hot summer months. The iced tea market is still in its early stages.

KEY MARKET PLAYERS

key players of global iced tea market are Coca-Cola Company, PepsiCo, Nestlé S.A., Arizona Beverage Company, The Republic of Tea, Unilever (Lipton), Pure Leaf, Snapple, Teavana, Tradewinds Beverage Co.

RECENT HAPPENINGS IN THE MARKET:

-

In April 2022, Jade Forest, a significant participant in the beverage business, debuted a line of iced teas in three different flavors. These iced teas were produced in collaboration with flavor specialists headquartered in Denmark.

- Beverage Partners International (BPI), in conjunction with Teabrary and Berjaya Group, introduced Dilmah iced tea to the market in Malaysia in the month of July 2022.

- In March 2021, Lipton, an industry-leading brand of iced tea, announced that it would be launching a new product line known as "Lipton Infused," which will contain a variety of herbal iced teas.

- A new variety of organic iced teas was presented to consumers in the United States by Pure Leaf, an additional well-known brand of iced tea, in the month of May 2021.

- Arizona, a well-known brand of iced tea, announced that it would be launching its "Arizona Hard" line of alcoholic iced teas in June of 2021. These iced teas are created with real brewed tea and contain alcohol.

- In July 2021, Snapple, a brand of iced tea and juice drinks, announced the launching of its new product line named "Snap2O," which comprises iced teas manufactured with natural flavors that have no calories and are flavored with natural ingredients.

MARKET SEGMENTATION

This research report on the global iced tea market has been segmented and sub-segmented based on flavours, packaging, distribution channels, demographics and region.

By Flavours

- Lemon Tea

- Black tea

- Green tea

- Herbal tea

- Others

By Packaging

- Bottles

- Cans

- Cartons

- Sachets

By Distribution Channels

- Supermarkets

- Convenience stores

- Online retailers

- Cafes

By Demographics

- Age

- Gender

- Income

- Education

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Frequently Asked Questions

1. What is the expected growth rate of the market from 2025 to 2033?

The market is anticipated to grow at a CAGR of 4.97% during this period

2. What factors are driving the growth of the Global Iced Tea Market?

Growth drivers include increasing consumer preference for healthier, low-calorie beverages, rising demand for organic and functional iced teas, and innovations in flavors and sustainable packaging.

3. Who are some key players in the Global Iced Tea Market?

Prominent companies include Nestle SA, Coca-Cola Company, PepsiCo Inc., Unilever, and Beyond Water.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com