Global Industrial Absorbents Market Size, Share, Trends & Growth Forecast Report – Segmented By Material Type (Organic & Inorganic, Synthetic), By Product (Pads, Rolls, Booms & Socks, And Others), Type (Universal, Oil-only, HAZMAT/Chemicals, And Others), End-use Industry (Oil & Gas, Chemical, Food Processing, And Others) and Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Industrial Absorbents Market Size (2024 to 2032)

The global industrial absorbents market is predicted to grow at a CAGR of 7.26% from 2024 to 2032 and the market size is expected to be valued at USD 11.47 billion by 2032 from USD 6.55 billion in 2024.

Current Scenario of the Global Industrial Absorbent Market

The Industrial absorbent market is majorly driven by its demand in many chemical industries. The various applicability of absorbents in land and water-based spills are also a reason for the boost of the industrial absorbent market globally. Industrial absorbents have varied applications in manufacturing units, warehouses, automotive, and laboratories. The absorbents are generally used for oil and petroleum-based spills that do not absorb water and float indefinitely. In today’s world, the need for the use of absorbents in industries is growing widely as the importance of protecting the environment by eliminating harmful gases is eventually creating scope for net zero emissions. The manufacturing process emphasizes adopting new technologies that are highly efficient in producing eco-friendly products. Government support for easy approvals for environment-friendly products is greatly influencing the growth rate of the industrial absorbent market.

MARKET DRIVERS

Oil and chemical spill regulations and growing environmental concerns are majorly propelling the growth of the global industrial absorbents market.

The growing concern for the environment and regulations related to oil and chemical spills in the environment, the increasing incidence of oil and water spills in water and on land, and rapid industrialization are some of the main factors driving the growth of the market during the period 2024 to 2032. However, the saturation and buoyancy of absorbent industrial products and the availability of profitable Industrial Absorbent substitutes are the main obstacles to the growth of the world Industrial Absorbent market.

The global industrial absorbents market is expected to experience substantial growth during the forecast period due to growing environmental concerns and growing regulations regarding global oil and chemical spills. The growing environmental concerns and regulations regarding oil and chemical spills in the environment, the increasing incidence of oil and water spills in water as well as on land, and rapid industrialization are also contributing to the global market expansion. Many companies are involved in launching innovative industrial absorbents. Industrial absorbents are a kind of material that is majorly employed for the withdrawal of chemicals or spilled liquids on different surfaces or floors. It is made up of chemicals and soaking composites mainly made for this type of spill that assists in the withdrawal procedure and is more effective than a normal absorbent. Industrial absorbents are inherently chemically inert, making them safe to use on any type of surface or chemical.

MARKET RESTRAINTS

However, the saturation and buoyancy of absorbent industrial products, as well as the availability of profitable substitutes for industrial absorbents hinder the world market of industrial absorbents. The ease of access to profitable substitutes for industrial absorbent products such as crushed clay and montmorillonite are further hampering the growth of the global market. Furthermore, congestion and lightness of industrial absorbent goods and the presence of price-effective substitutes for industrial absorbents are significant barriers to the expansion of the worldwide industrial absorbent market.

MARKET OPPORTUNITIES

The increasing cases of reusable industrial absorbents is the significant factor contributing to the growth of industrial absorbents market opportunities. Most of the industrial absorbents can be utilized until they reach saturation and lose their water-repelling capabilities. This acts as major opportunity for the market growth rate. The reusable variants find extensive applications especially in oil and gas, food processing industries which accelerate the market growth. The increased investments in the research and development activities for enhancing the quality and cost-efficient reusable absorbent products is augmenting their adoption across various industries is creating market growth opportunities. The surge in the technological advancements in the industry along with the rising focus on the workplace safety among the industry players is propelling the market growth opportunities. The enlarging focus on sustainability is another factor boosting the growth opportunity to the market.

MARKET CHALLENGES

The increasing costs of the products is the major challenge for the market players due to affordability in expanding the global market growth rate. The reduction in the oil spills is another factor restraining the market growth rate. The significant spills may occur due to various reasons such as collision, groundings, hull or equipment failures, fires, explosions and adverse weather conditions or human errors which are estimated to impede the market growth. The stringent regulations regarding the approvals and product launches may lead to delays and the high complexity in the procedures will act as challenge for the market players in expanding the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

7.26% |

|

Segments Covered |

By Product, Type, End-use, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

3M Company (US), Brady Corporation (US), Decorus Europe Ltd. (UK), Johnson Matthey Plc, Kimberly-Clark Professional, Meltblown Technologies Inc. (US), Monarch Green, Inc. (US), New Pig Corporation (US), and Oil-Dri Corporation of America (US), and Others. |

SEGMENTAL ANALYSIS

Global Industrial Absorbents Market Analysis By Product

The pads segment is leading with the dominant share of the market. Pads are available in different sizes according to industrial applications. The rising number of applications of pads to clean up diverse spills of oil and chemicals without causing any harm to the environment is ascribed to the leveling up of the growth rate of the segment. The rolls segment is ascribed to holding the highest CAGR by the end of 2032. Rolls industrial absorbents are cost-effective and can be used to absorb heavy leaks and spills, which are ideal for indoor or outdoor applications. Pillow segment is deemed to have huge growth opportunities in the coming years.

Global Industrial Absorbents Market Analysis By Type

The oil-only segment is gaining huge traction over the share of the industrial absorbent market. The need for the use of absorbents is very high in the oil and gas companies. Ongoing research and development activities to launch innovative technological products in favor of the public are accounted for in prompting the growth rate of the market. HAZMAT/Chemical segment is anticipated to have the fastest growth rate opportunities in the coming years.

Global Industrial Absorbents Market Analysis By End User

The oil and gas segment is accounted for leading the significant share of the industrial absorbents market. The rising number of oil and gas companies, especially in emerging countries like India and China, is the major factor for the market's growth. Government support through funds and investments is evolving to adopt the new trends in the industries that eventually create growth opportunities for the industrial absorbents market. The healthcare segment is likely to have the highest growth rate throughout the forecast period.

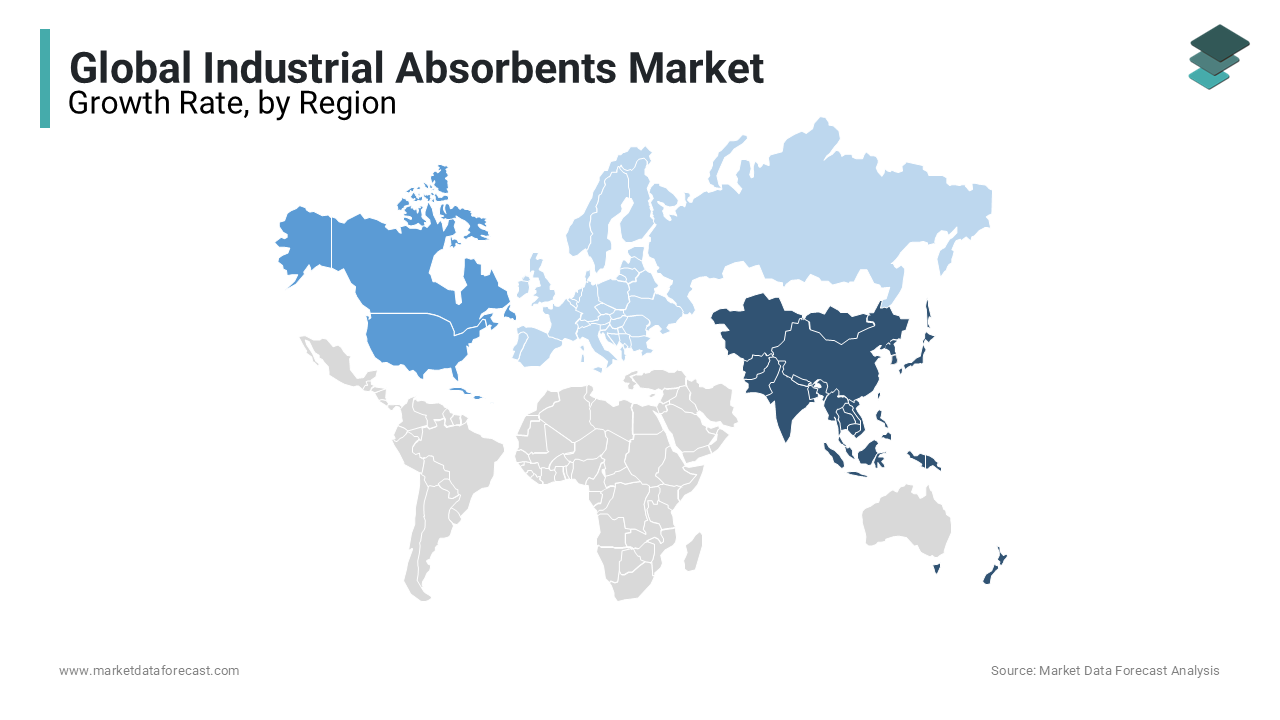

REGIONAL ANALYSIS

The Asia Pacific regional segment is predicted to experience the quickest expansion rate throughout the foreseen period.

This is due to escalating awareness and pressure to increasingly strict environmental rules for the response and control of spills and pollution from end-use businesses. The Industrial Absorbents industry in Asia-Pacific is augmented by calls from nations like China, Japan, India, and South Korea, owing to quick industrialization and the increase in the number of small liquid spills in end-use businesses. In addition to that, regions like Europe and North America have strict spill and chemical response standards. All of these reasons are driving Industrial Absorbents' expansion in the end-use chemical industry.

The North American region is projected to record significant growth during the forecast period. The rapid industrialization, expanding manufacturing activities across various industries and the increasing cases of spills and accidents are escalating the requirement of industrial adsorbents leading to substantial market growth. The presence of favorable regulations across the region fuels the regional market growth rate.

KEY PLAYERS IN THE GLOBAL INDUSTRIAL ABSORBENTS MARKET

Companies playing a major role in the global industrial absorbents market include 3M Company (US), Brady Corporation (US), Decorus Europe Ltd. (UK), Johnson Matthey Plc, Kimberly-Clark Professional, Meltblown Technologies Inc. (US), Monarch Green, Inc. (US), New Pig Corporation (US) and Oil-Dri Corporation of America (US).

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Finite Fiber, a prominent and leading authority in fibers and precision cut fiber technology, announced the launch of PurAbsorb Industrial Super Absorbent. This product is utilized in spill cleanup processes in various industries. It is estimated to offer instant and overall absorption by contact with liquids, which ensures swift and thorough cleanup with no residual moisture.

- In January 2024, Novipax, a manufacturer in U.S. which specializes in high-quality absorbent pads which opened a strategic partnership with Front1 Health Partners, a trailblazer in healthcare solutions.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL ABSORBENTS MARKET INCLUDED IN THIS REPORT

This research report on the global industrial absorbents market has been segmented and sub-segmented based on product, type, end-user, and region.

By Product

- Pads

- Rolls

- Pillows

- Granules

- Booms and Socks

- Sheets and Mats

- Others

By Type

- Universal

- Oil-only

- HAZMAT/Chemical

By End-use

- Oil And Gas

- Chemical

- Food Processing

- Healthcare

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]