Latin America Schizophrenia Drugs Market Size, Share, Trends & Growth Forecast Report By Therapeutic Class, Treatment & Country (Brazil, Argentina, Chile, Mexico and Rest of Latin America) – Industry Size, Share, Trends & Growth Forecast (2025 to 2033)

Latin America Schizophrenia Drugs Market Size

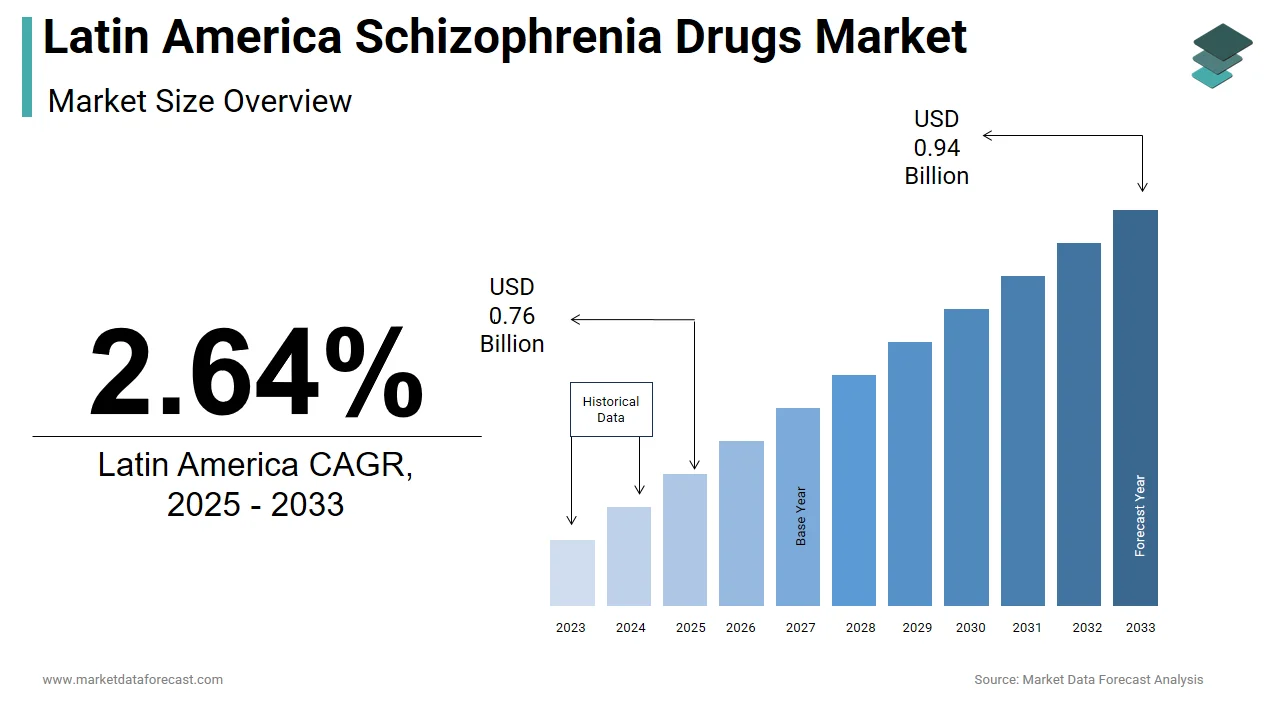

The size of the Latin America schizophrenia drugs market was valued at USD 0.74 billion in 2024. This market is expected to grow at a CAGR of 2.64% from 2025 to 2033 and be worth USD 0.94 billion by 2033 from USD 0.76 billion in 2025.

Schizophrenia is a severe chronic mental disorder characterized by distorted thinking, impaired emotional responses, and disorganized speech or behavior. According to the World Health Organization (WHO), neuropsychiatric disorders account for a significant proportion of the global disease burden, with schizophrenia affecting approximately 1% of the world’s population. In Latin America, epidemiological studies suggest that the prevalence of schizophrenia remains consistent with global figures, though underdiagnosis and inadequate access to care persist in many areas. Moreover, societal stigma and fragmented healthcare systems continue to hinder early diagnosis and sustained treatment. However, increasing government initiatives aimed at integrating mental health into primary healthcare have started making an impact. According to the Inter-American Development Bank (IDB), several countries are investing in digital health platforms to improve access to psychiatric medications.

MARKET DRIVERS

Rising Awareness and Mental Health Policy Reforms

One of the primary drivers of the Latin America schizophrenia drugs market is the growing awareness around mental health issues and the implementation of policy reforms aimed at integrating mental health services into mainstream healthcare. According to the Pan American Health Organization (PAHO), nearly all Latin American countries have updated their national mental health policies since 2015, emphasizing community-based care models and medication availability. For example, Brazil’s "National Mental Health Policy" has significantly expanded public access to antipsychotic medications through its Unified Health System (SUS). Additionally, non-governmental organizations and advocacy groups have played a crucial role in promoting early diagnosis and treatment adherence. As per the World Health Organization (WHO), mental health literacy campaigns have led to a 25% increase in diagnosed schizophrenia cases in Mexico over the past five years.

Expansion of Public and Private Healthcare Infrastructure

Another key driver of the Latin America schizophrenia drugs market is the expansion of healthcare infrastructure, both public and private, which has improved access to psychiatric medications. According to the Inter-American Development Bank (IDB), healthcare spending in Latin America has increased by an average of 5% annually over the past decade, with significant portions allocated to mental health services. In Colombia, for instance, the government has implemented a universal health coverage system that includes access to essential psychiatric medications, including antipsychotics used in schizophrenia treatment. In addition, private pharmaceutical companies are increasingly partnering with local distributors to ensure broader availability of branded and generic schizophrenia medications.

MARKET RESTRAINTS

High Cost of Second-Generation Antipsychotics

A major restraint affecting the Latin America schizophrenia drugs market is the high cost of second-generation antipsychotics (SGAs), which limits affordability and access for large segments of the population. While SGAs are generally more effective and cause fewer side effects compared to first-generation antipsychotics (FGAs), their higher price point restricts widespread usage among low-income patients. As per the Mexican Institute of Social Security (IMSS), the monthly cost of branded SGAs such as risperidone or olanzapine can be up to ten times higher than that of older antipsychotics like haloperidol.

Additionally, as per a report by the Pan American Health Organization (PAHO), only 15% of patients in rural Bolivia receive consistent treatment due to financial barriers. In Ecuador, despite government efforts to provide subsidized medications, shortages of newer-generation drugs are frequently reported. These economic constraints significantly impede the adoption of advanced schizophrenia therapies, which is limiting market growth in lower-income regions.

Limited Availability of Psychiatric Specialists and Treatment Facilities

Another critical restraint on the Latin America schizophrenia drugs market is the limited availability of psychiatric specialists and treatment facilities in rural and underserved areas. According to the World Health Organization (WHO), Latin America has one of the lowest psychiatrist-to-population ratios globally, with some countries reporting fewer than two psychiatrists per 100,000 people. Furthermore, as per the Pan American Health Organization (PAHO), less than 20% of individuals suffering from schizophrenia in Guatemala receive formal psychiatric treatment. In Honduras and Nicaragua, mental health facilities are often concentrated in urban centers, leaving vast rural populations without proper care.

MARKET OPPORTUNITIES

Integration of Digital Health and Telepsychiatry Services

A promising opportunity for the Latin America schizophrenia drugs market lies in the integration of digital health and telepsychiatry services, which are rapidly transforming mental healthcare delivery. The adoption of mobile health applications, virtual consultations, and remote monitoring tools has enhanced access to psychiatric care in regions with limited specialist availability. In Argentina, the Ministry of Health launched a nationwide telepsychiatry initiative in 2022, which is allowing patients in remote provinces to consult with specialists and receive medication prescriptions online. In Chile, a pilot program conducted by the University of Santiago demonstrated a 30% improvement in treatment compliance among patients using digital reminders. These innovations present a scalable solution to overcome geographical and logistical barriers, which is driving greater demand for schizophrenia medications across the region.

Growth of Generic Drug Manufacturing and Pricing Initiatives

The expansion of generic drug manufacturing and supportive pricing initiatives presents a significant opportunity for the Latin America schizophrenia drugs market. Governments and regulatory bodies across the region are increasingly promoting the use of cost-effective generic alternatives to enhance affordability and treatment continuity. Similarly, as per the Mexican Federal Commission for the Protection against Sanitary Risk (COFEPRIS), the approval process for generic antipsychotics has been streamlined, reducing time-to-market and increasing competition. In Peru, recent legislation mandates that all public hospitals prioritize generic prescribing for chronic conditions, including schizophrenia.

MARKET CHALLENGES

Regulatory Complexity and Approval Delays

A major challenge confronting the Latin America schizophrenia drugs market is the complexity and inconsistency of regulatory frameworks across different countries. According to the Pan American Health Organization (PAHO), only eight out of twenty Latin American countries have fully functional regulatory agencies capable of efficiently evaluating psychiatric medications. In countries like Venezuela and Bolivia, outdated regulatory processes and bureaucratic inefficiencies further delay patient access to innovative therapies. Additionally, as per the Brazilian Health Regulatory Agency (ANVISA), inconsistencies in classification criteria lead to confusion regarding whether certain formulations qualify as essential medicines. These regulatory hurdles create operational inefficiencies and discourage multinational pharmaceutical companies from entering or expanding within the Latin American market.

Stigma and Low Patient Engagement in Long-Term Treatment

Another pressing challenge in the Latin America schizophrenia drugs market is the persistent social stigma surrounding mental illness and the resulting low patient engagement in long-term treatment. According to the World Health Organization (WHO), less than 40% of schizophrenia patients in Latin America receive consistent treatment, largely due to fear of discrimination and lack of family support. Moreover, as per the Argentine Society of Psychiatry, cultural beliefs in rural communities often lead to reliance on traditional healers rather than licensed psychiatrists. In Guatemala and Paraguay, religious and familial influences play a dominant role in treatment decisions, further complicating medication adherence. Addressing these deep-rooted behavioral and social barriers requires comprehensive education campaigns, community engagement, and stronger patient support systems an ongoing challenge for market stakeholders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Therapeutic Class, Treatment, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

Brazil, Mexico, Argentina, Chile, Rest of Latin America |

|

Market Leaders Profiled |

Johnson & Johnson, Sumitomo Dainippon, Eli Lilly, Bristol-Myers Squibb/ Otsuka Pharma, AstraZeneca, Alkermes, Vanda Pharma, Allergan, and Pfizer. |

SEGMENTAL ANALYSIS

By Therapeutic Class Insights

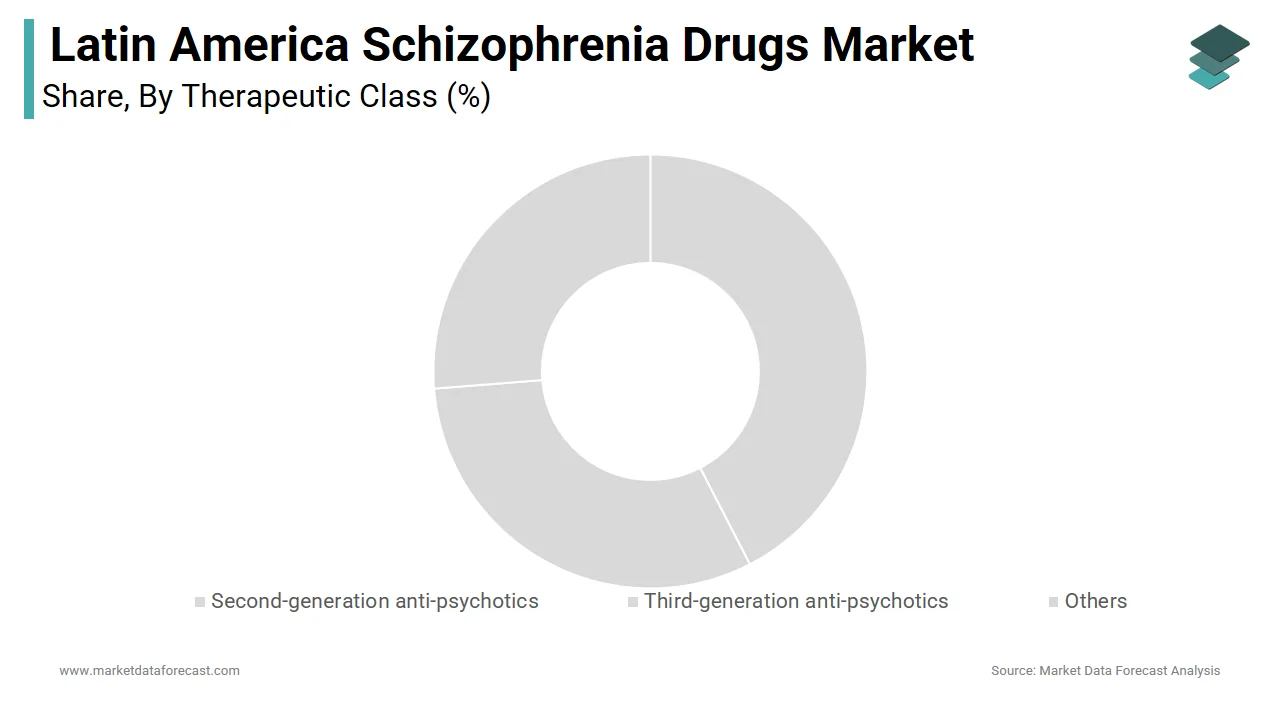

The Second-generation antipsychotics (SGAs) segment was accounted in holding a prominent share of share in 2024. According to the Pan American Health Organization (PAHO), SGAs such as risperidone, olanzapine, quetiapine, and aripiprazole are the most commonly prescribed medications for schizophrenia in Latin America. As per the Brazilian Psychiatric Association, over 75% of psychiatric prescriptions for schizophrenia in Brazil include SGAs due to their improved tolerability and lower risk of extrapyramidal symptoms. Moreover, government initiatives promoting mental health integration into primary care have led to increased access to these medications through public health programs. In Mexico, the National Institute of Psychiatry reports that SGAs are now included in essential medicine lists, ensuring availability in public hospitals.

The Third-generation antipsychotics (TGAs) segment is projected to grow with a CAGR of 9.2% during the forecast period. A key driver behind this growth is the growing awareness among clinicians about the limitations of second-generation antipsychotics, particularly concerning weight gain, diabetes, and cardiovascular risks. Additionally, as per the Mexican Institute of Social Security (IMSS), cariprazine prescriptions have risen by over 35% since its inclusion in select hospital formularies in 2022. In Brazil, private healthcare providers are increasingly incorporating third-generation options into treatment guidelines for resistant schizophrenia cases.

By Treatment Insights

The oral antipsychotics segment was accounted constitute the largest segment in the Latin America schizophrenia drugs market share in 2024. According to the World Health Organization (WHO), over 90% of schizophrenia patients in Latin America receive oral medication as the primary mode of treatment. In Brazil, as per the Ministry of Health’s National Mental Health Policy, oral antipsychotics are widely distributed through the Unified Health System (SUS), ensuring broad access even in remote areas. Moreover, as per the Mexican Institute of Social Security (IMSS), oral formulations account for more than 85% of all psychiatric prescriptions in the country. The preference for daily or once-weekly dosing regimens, combined with minimal infrastructure requirements, makes oral drugs the preferred choice in both acute and maintenance phases of schizophrenia treatment.

The injectable antipsychotics segment is likely to grow with a CAGR of 10.5% during the forecast period. One of the main reasons for this shift is the high incidence of non-adherence to oral therapies, which remains a persistent challenge in the region. According to the Pan American Health Organization (PAHO), nearly 50% of schizophrenia patients in Latin America discontinue oral medication within the first year of diagnosis. LAI formulations, such as paliperidone palmitate and risperidone microspheres, offer monthly or bi-monthly dosing, significantly improving compliance. In Brazil, as per the São Paulo School of Medicine, injectable antipsychotics have been integrated into public mental health clinics, especially for patients with recurrent hospitalizations. Additionally, as per Frost & Sullivan, pharmaceutical companies are launching educational campaigns targeting psychiatrists and caregivers to promote the benefits of LAIs. In Mexico, the National Institute of Psychiatry has included LAIs in revised treatment guidelines, further supporting their uptake.

COUNTRY-WISE ANALYSIS

Brazil Schizophrenia Drugs Market Insights

Brazil was the largest contributor of the largest share of the Latin America schizophrenia drugs market with 36.3% of share in 2024. According to the Brazilian Ministry of Health, schizophrenia affects over 2.5 million people nationwide, making it one of the leading contributors to disability-adjusted life years (DALYs). As part of the "National Mental Health Policy," the Unified Health System (SUS) provides free or subsidized access to essential antipsychotic medications, including second-generation and long-acting injectable formulations. Furthermore, as per the Brazilian Psychiatric Association, the number of mental health consultations has increased by over 25% since 2020, reflecting improved access to care. Private pharmaceutical companies such as Novartis and Janssen have strengthened their presence in Brazil through partnerships with local distributors.

Mexico Schizophrenia Drugs Market Insights

Mexico ranked second in the Latin America schizophrenia drugs market by holding 25.3% of share in 2024. The country benefits from a growing patient pool, increasing healthcare expenditure, and government efforts to expand access to psychiatric medications under national health insurance schemes. According to the Mexican Institute of Social Security (IMSS), over 1.8 million individuals suffer from schizophrenia or related psychotic disorders. As per the National Institute of Psychiatry Ramón de la Fuente Muñiz, mental health conditions contribute to nearly 12% of total disability-adjusted life years lost in the country. Pharmaceutical companies are leveraging digital health platforms to support treatment adherence and patient monitoring.

Argentina Schizophrenia Drugs Market Insights

Argentina schizophrenia drugs market growth is likely to have dominant growth opportunities in the next coming years. According to the Argentine Society of Psychiatry, schizophrenia affects over 500,000 individuals in the country, with only 40% receiving consistent treatment. Additionally, as per the University of Buenos Aires Medical School, adherence to second-generation antipsychotics has improved by over 20% since 2021 due to better patient education and follow-up programs. Private pharmaceutical players have also intensified their presence in Argentina. In 2023, Roche Argentina launched an initiative to provide free medication samples to low-income patients suffering from treatment-resistant schizophrenia. Moreover, collaborations between academic institutions and global manufacturers are driving clinical research into novel antipsychotics.

Chile Schizophrenia Drugs Market Insights

Chile schizophrenia drugs market growth is distinguished by its proactive approach to mental health policy and integration of digital tools into psychiatric care. The country maintains one of the highest healthcare expenditures per capita in the region, which is supporting the adoption of modern treatment modalities. In recent years, Chile has become a hub for clinical research related to schizophrenia. As per the University of Chile, several studies have explored the efficacy of third-generation antipsychotics in managing cognitive and negative symptoms. Additionally, as per Frost & Sullivan, Chile has experienced a surge in the adoption of long-acting injectables, supported by favorable reimbursement policies.

Colombia Schizophrenia Drugs Market Insights

Colombia schizophrenia drugs market growth is driven by expanding healthcare access and rising government emphasis on psychiatric care. The country has made notable strides in improving mental health services under its universal health coverage initiative, particularly in urban centers. Private sector participation has also grown, with companies like Grupo Gamma and Janssen expanding their schizophrenia drug portfolios in the country. As per Frost & Sullivan, Colombia’s homecare pharmacy services have played a crucial role in improving medication adherence. Government-backed insurance schemes and increasing awareness about mental health are expected to drive continued growth in Colombia’s schizophrenia drugs market.

KEY MARKET PLAYERS

Some of the major companies dominating the market by their products and services include Johnson & Johnson, Sumitomo Dainippon, Eli Lilly, Bristol-Myers Squibb/ Otsuka Pharma, AstraZeneca, Alkermes, Vanda Pharma, Allergan, and Pfizer.

TOP LEADING PLAYERS IN THE MARKET

Janssen Pharmaceuticals (Johnson & Johnson)

Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson, is a leading global player in psychiatric medications and holds a strong presence in the Latin America schizophrenia drugs market. The company offers a comprehensive portfolio of antipsychotics, including long-acting injectables such as paliperidone palmitate, which are widely used for managing chronic schizophrenia. In Latin America, Janssen has established partnerships with local healthcare providers and governments to enhance patient access to advanced treatments. Its commitment to research and development ensures continuous innovation in schizophrenia therapy.

Otsuka Pharmaceutical Co., Ltd.

Otsuka Pharmaceutical plays a significant role in the Latin America schizophrenia drugs market through its flagship product, Abilify (aripiprazole), a widely prescribed second-generation antipsychotic. The company is known for its focus on neuroscience and long-term treatment solutions for psychiatric disorders. In Latin America, Otsuka has been actively expanding its distribution network and engaging in awareness campaigns to promote early diagnosis and sustained medication adherence. Its collaboration with academic institutions and mental health advocacy groups helps improve clinical outcomes.

Lundbeck Latin America Inc.

Lundbeck Latin America Inc., a subsidiary of H. Lundbeck A/S, specializes in central nervous system (CNS) disorders and maintains a strong foothold in the schizophrenia drugs market. The company’s portfolio includes key long-acting injectable antipsychotics that cater to patients requiring consistent, supervised treatment.

The company focuses on improving mental health care through scientific education and strategic partnerships with public health systems. In countries like Brazil and Mexico, Lundbeck has launched initiatives aimed at training healthcare professionals in schizophrenia management. These efforts have strengthened its regional presence and reinforced its reputation as a dedicated CNS pharmaceutical leader.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS IN THE MARKET

One major strategy employed by key players in the Latin America dicamba herbicide market is formulation innovation to enhance crop safety and reduce volatility by ensuring compliance with environmental regulations while maintaining effective weed control properties. Companies are investing in low-volatility formulations that minimize off-target movement and align with sustainable agricultural practices. Another critical approach is collaboration with biotech seed companies to develop integrated weed management systems, particularly those involving dicamba-tolerant genetically modified crops. These partnerships ensure compatibility between herbicides and crop varieties, enhancing adoption among large-scale farmers seeking efficient and reliable solutions.

The localized agronomic support and farmer engagement initiatives are being leveraged to strengthen market positions. Companies are conducting field trials, training sessions, and direct outreach programs to build trust, improve product understanding, and drive sustainable usage tailored to regional farming conditions and regulatory landscapes.

COMPETITION OVERVIEW

The Latin America dicamba herbicide market is characterized by intense competition driven by the dominance of multinational agrochemical firms and the rising influence of domestic players. Market participants compete not only on product formulation and pricing but also through technological differentiation and regulatory compliance. The demand for effective post-emergence herbicides, particularly in soybean and cotton cultivation, has intensified rivalry as companies strive to secure contracts with large-scale agribusinesses and cooperatives.

A significant battleground is the development of low-volatility dicamba formulations that reduce off-target movement and meet stringent environmental standards. Companies are increasingly integrating these products with herbicide-tolerant crop systems to offer comprehensive weed management solutions. Strategic alliances with biotech seed producers have become essential for ensuring compatibility and maximizing adoption. Additionally, localized distribution networks and agronomic support services are being leveraged to strengthen customer relationships and improve product accessibility in rural areas.

RECENT MARKET DEVELOPMENTS

- In March 2023, Janssen Pharmaceuticals launched an expanded patient assistance program in Brazil, offering subsidized access to long-acting injectable antipsychotics for low-income individuals. This initiative was designed to improve treatment adherence and reduce hospitalization rates among schizophrenia patients.

- In October 2023, Otsuka Pharmaceutical partnered with a Mexican telemedicine platform to integrate digital monitoring tools into schizophrenia treatment plans by allowing physicians to track medication adherence and symptom progression in real time.

- In May 2024, Lundbeck Latin America Inc. introduced a new medical education campaign targeting psychiatrists and primary care physicians in Argentina, which is focusing on best practices for using long-acting injectable antipsychotics in chronic schizophrenia management.

- In December 2024, Novartis Argentina expanded its mental health portfolio by introducing a locally manufactured generic version of aripiprazole, aiming to increase affordability and availability of essential schizophrenia medications in public hospitals.

- In February 2025, Roche Colombia collaborated with the Ministry of Health to launch a pilot program distributing free samples of third-generation antipsychotics to patients in underserved regions by supporting improved access and early intervention strategies for schizophrenia.

MARKET SEGMENTATION

This Latin America schizophrenia drugs market research report is segmented and sub-segmented into the following categories.

By Therapeutic Class

- Second-generation anti-psychotics

- Risperdal

- Invega

- Zyprexa

- Geodon

- Seroquel

- Latuda

- Aristada

- Fanapt

- Saphris

- Vraylar

- Third-generation anti-psychotics

- Others

By Treatment

- Oral anti-psychotics

- Injectable anti-psychotics

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What are the main drivers of growth in the Latin America Schizophrenia Drugs Market?

Growth is driven by rising mental health awareness, expanding government healthcare initiatives, and improved access to diagnosis and treatment

Which drug classes dominate the Latin America Schizophrenia Drugs Market?

Second-generation antipsychotics hold the largest market share, followed by third-generation antipsychotics and a smaller segment for first-generation drugs

How are government policies impacting the Latin America Schizophrenia Drugs Market?

Policies supporting mental health integration into primary care, public sector funding, and incentives for biosimilars are enhancing market access and affordability

What is the role of biosimilar antipsychotics in the Latin America Schizophrenia Drugs Market?

Biosimilars are increasingly favored by regulators and public health systems for their cost-effectiveness and ability to expand treatment access

How is the reduction of mental health stigma affecting the Latin America Schizophrenia Drugs Market?

Declining stigma is encouraging more individuals to seek diagnosis and treatment, boosting demand for antipsychotic medications

What are the most common routes of administration for schizophrenia drugs in Latin America?

Both oral and injectable formulations are widely used, with a growing trend toward long-acting injectable therapies for better adherence

What are the major challenges facing the Latin America Schizophrenia Drugs Market?

Challenges include limited mental health resources, uneven access in rural areas, medication side effects, and adherence issues

How are pharmaceutical companies innovating in the Latin America Schizophrenia Drugs Market?

Companies are developing next-generation antipsychotics, focusing on reduced side effects, alternative mechanisms, and digital health integration

Which distribution channels are most important in the Latin America Schizophrenia Drugs Market?

Hospital pharmacies dominate, followed by retail and online pharmacies, reflecting the need for professional oversight in schizophrenia treatment

What role do digital health tools play in the Latin America Schizophrenia Drugs Market?

Digital tools and telepsychiatry are emerging to support medication management, adherence, and continuous patient care

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com