Latin America Cloud Analytics Market Size, Share, Trends & Growth Forecast Report By Offering (Data Visualization, Data Integration, Reporting, Analytics, Services [Managed Services, Professional Services]), Data Type (Structured Data, Semi-Structured Data, Unstructured Data), Data Processing, Vertical, and Country (Brazil, Mexico, Argentina, Chile, Rest of Latin America) – Industry Analysis From 2025 to 2033.

Latin America Cloud Analytics Market Size

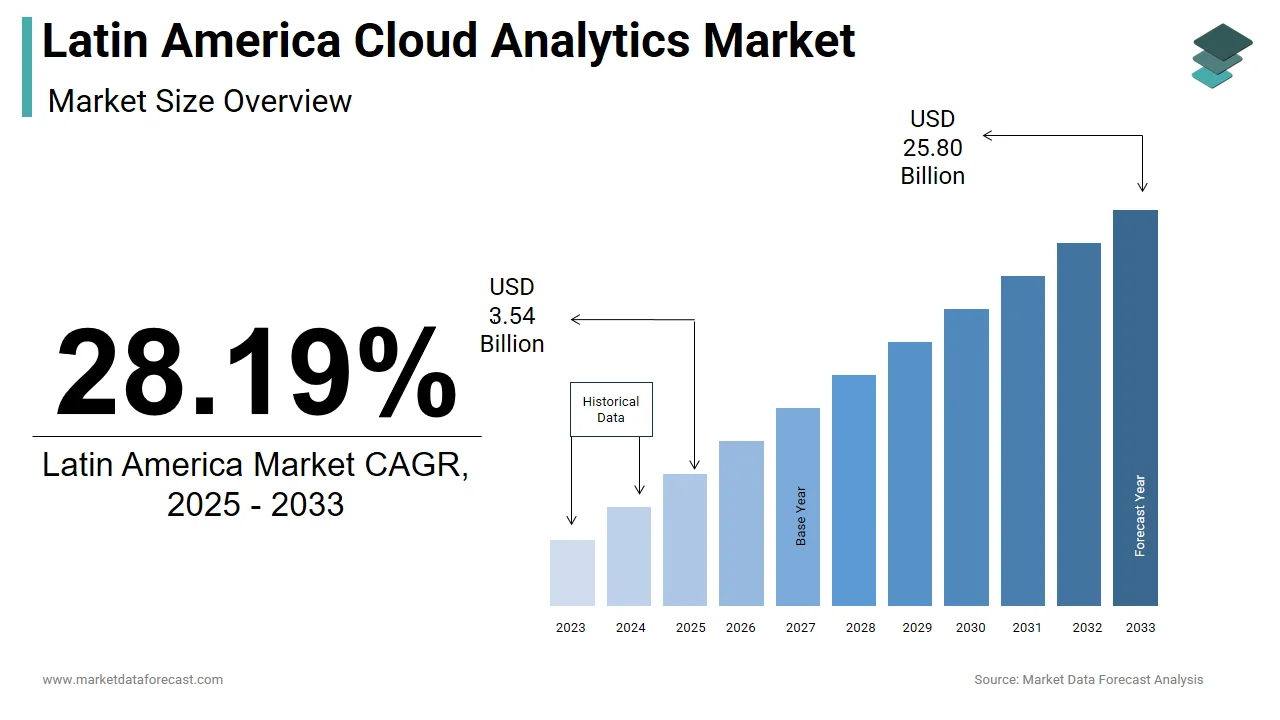

The size of the Latin America cloud analytics market was valued at USD 2.76 billion in 2024. This market is expected to grow at a CAGR of 28.19% from 2025 to 2033 and be worth USD 25.80 billion by 2033 from USD 3.54 billion in 2025.

The Latin America cloud analytics market refers to the deployment and utilization of data analysis tools and platforms delivered through cloud computing infrastructure. These solutions enable businesses to collect, process, and derive actionable insights from large volumes of structured and unstructured data without relying on traditional on-premise systems. Cloud analytics is increasingly being adopted across sectors such as finance, healthcare, retail, and government services to enhance decision-making, improve operational efficiency, and support digital transformation initiatives. A key factor contributing to the growth of this market is the rising investment in digital infrastructure and data-driven governance models. According to the Economic Commission for Latin America and the Caribbean (ECLAC), several governments have launched national digital transformation strategies aimed at improving public service delivery through data analytics. In the private sector, companies are leveraging cloud analytics to optimize supply chains, personalize customer experiences, and manage risk more effectively. Universities and research institutions in Argentina and Chile are also promoting data science education and cloud-based analytical training, further supporting workforce readiness for advanced analytics adoption.

MARKET DRIVERS

Accelerated Digital Transformation Across Key Industries

One of the primary drivers of the Latin America cloud analytics market is the rapid pace of digital transformation occurring across industries such as banking, insurance, logistics, and telecommunications. Companies are increasingly adopting cloud-based analytics to gain real-time insights into customer behavior, operational performance, and fraud detection. This shift is particularly evident in the BFSI sector, where banks like Itaú Unibanco and BBVA Bancomer are using cloud analytics to streamline credit assessments, detect anomalies, and offer personalized financial products. In the telecom industry, operators such as América Móvil and Claro are leveraging big data analytics hosted on cloud platforms to optimize network performance and enhance customer engagement. Also, governments are investing in smart city initiatives that rely heavily on cloud analytics for traffic management, energy consumption tracking, and emergency response coordination. In Santiago and São Paulo, municipal authorities have deployed cloud-integrated dashboards to monitor urban dynamics in real time.

Expansion of E-Government and Public Sector Digitization Initiatives

Another major driver of the Latin America cloud analytics market is the expansion of e-government programs and digitization efforts within the public sector. Governments in countries like Argentina, Peru, and Ecuador are implementing cloud-based analytics to improve transparency, reduce inefficiencies, and enhance policy implementation. These initiatives aim to integrate disparate datasets from health, education, and social welfare departments to generate insights that inform better governance. Similarly, Mexico’s National Institute of Statistics and Geography (INEGI) is utilizing cloud analytics to analyze economic trends and demographic shifts, enabling more accurate forecasting and resource allocation. Moreover, academic institutions and international development organizations are offering technical assistance to public bodies seeking to implement cloud analytics solutions.

MARKET RESTRAINTS

Data Privacy Concerns and Regulatory Fragmentation

One of the most significant restraints affecting the Latin America cloud analytics market is the inconsistent regulatory environment surrounding data privacy and security. While some countries, such as Brazil and Argentina, have implemented comprehensive data protection laws akin to the European Union’s GDPR, others lack unified legal frameworks governing cross-border data flows and cloud-based storage. This fragmentation discourages multinational firms from deploying standardized cloud analytics solutions across multiple Latin American markets due to compliance risks and operational complexity. Specially, financial institutions and healthcare providers—two of the largest consumers of cloud analytics—are cautious about storing sensitive data on foreign servers, fearing potential breaches or legal exposure. Furthermore, concerns over cybersecurity threats have intensified in recent years, with regional governments struggling to keep pace with evolving digital risks.

Limited Technical Expertise and Skilled Workforce Availability

Another critical restraint impacting the Latin America cloud analytics market is the shortage of skilled professionals capable of managing and interpreting complex data sets using cloud-based tools. Despite growing demand for data scientists and cloud architects, educational institutions have been slow to develop specialized curricula that align with industry needs. This skills gap is particularly pronounced in smaller economies such as Paraguay, Bolivia, and Honduras, where digital literacy remains low and access to high-level training programs is limited. Even in larger markets like Mexico and Chile, employers report difficulty in finding professionals proficient in cloud-native analytics platforms and AI-driven data processing techniques. Moreover, many small and medium-sized enterprises (SMEs) lack the resources to invest in internal training or hire external consultants, slowing down their ability to adopt cloud analytics at scale.

MARKET OPPORTUNITIES

Growth of Smart Cities and IoT-Driven Urban Planning

A significant opportunity emerging in the Latin America cloud analytics market is the rise of smart cities and Internet of Things (IoT)-driven urban planning. Governments across the region are investing in intelligent transportation networks, waste management systems, and energy-efficient infrastructure, all of which generate vast amounts of data requiring real-time analysis. In Bogotá and Buenos Aires, cloud analytics platforms are being used to monitor air quality, manage traffic congestion, and allocate emergency services more efficiently. These applications not only enhance civic infrastructure but also provide valuable insights for future policy planning and disaster preparedness. Furthermore, the proliferation of IoT-enabled devices in industrial and agricultural settings is expanding the use of cloud analytics beyond urban centers. Agribusinesses in Brazil and Argentina are leveraging cloud-based analytics to interpret sensor data related to soil conditions, weather patterns, and crop yields, improving productivity and sustainability.

Increasing Adoption of AI and Machine Learning in Business Intelligence

An emerging opportunity in the Latin America cloud analytics market is the growing integration of artificial intelligence (AI) and machine learning (ML) into business intelligence workflows. Enterprises are increasingly using cloud analytics platforms embedded with AI capabilities to automate data interpretation, predict consumer behavior, and enhance operational efficiency. According to the Latin American Artificial Intelligence Institute, many startups focused on data science and AI have emerged in the past five years, many of which rely on cloud analytics for scalable and cost-effective operations. In the retail sector, companies are leveraging AI-powered cloud analytics to personalize marketing campaigns and optimize inventory management based on predictive modeling. Similarly, banks and insurers are using cloud analytics to assess risk profiles dynamically, reducing default rates and improving underwriting accuracy. Academic institutions and government-backed incubators are playing a crucial role in advancing AI-driven analytics.

MARKET CHALLENGES

Infrastructure Limitations and Connectivity Barriers

One of the most pressing challenges confronting the Latin America cloud analytics market is the uneven development of digital infrastructure, particularly in rural and semi-urban areas. Many regions still suffer from inadequate internet connectivity, outdated telecommunications networks, and unreliable electricity supply, which hinder the consistent use of cloud-based analytics platforms. This challenge is especially acute in countries like Guatemala, Nicaragua, and parts of northern Brazil, where enterprises face frequent disruptions in internet services. Even in major cities, latency issues and bandwidth limitations can affect the performance of cloud analytics applications, discouraging full-scale migration from on-premise systems. To mitigate these barriers, some governments have initiated public-private partnerships to expand fiber-optic networks and mobile broadband coverage.

Budgetary Constraints and Cost Sensitivity Among SMEs

Budgetary limitations and cost sensitivity among small and medium-sized enterprises (SMEs) present a significant challenge to the expansion of the Latin America cloud analytics market. Unlike large corporations with robust IT budgets, SMEs often struggle with capital constraints that make long-term investments in cloud analytics difficult. Many SMEs perceive cloud analytics as a premium solution with unclear return-on-investment metrics, leading them to prioritize immediate operational expenses over digital transformation. In addition, the recurring subscription costs associated with cloud analytics platforms can be prohibitive, especially in countries experiencing currency fluctuations and inflationary pressures. Financial institutions and fintech companies have begun offering flexible payment models, including pay-per-use analytics services and micro-SaaS subscriptions, to address affordability concerns.

Lack of Standardization in Data Formats and Integration Protocols

A critical challenge in the Latin America cloud analytics market is the absence of standardized data formats and integration protocols, which complicates interoperability between different systems and platforms. Many enterprises operate legacy data systems alongside newer cloud-based tools, creating silos that hinder effective data flow and analysis. This lack of standardization affects both public and private sector entities. In healthcare, for example, hospitals and clinics use diverse electronic medical record systems that do not easily communicate with one another, preventing centralized cloud analytics from delivering optimal insights. In manufacturing, supply chain data from various suppliers often arrives in incompatible formats, reducing the effectiveness of predictive maintenance and demand forecasting tools.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Offering, Data Type, Data Processing, Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

IBM, SAS Institute, Oracle, Google, Microsoft, Teradata, Salesforce, AWS, NetApp, Qlik, Sisense, SAP (Germany), Atos (France), Altair, MicroStrategy, TIBCO Software, Hexaware Technologies (India), Zoho (India), Rackspace Technology, Splunk, Cloudera, Domo, Hewlett Packard Enterprise, Incorta, Tellius, Rapyder, Hitachi Vantara, Board International (Switzerland), Ridge (Israel), Jaspersoft, Yellowfin (Australia), Denodo, GoodData, ThoughtSpot, and Infogain. |

COUNTRY LEVEL ANALYSIS

Brazil had the largest share of the Latin America cloud analytics market by accounting for 34.8% of total revenue in 2024. As the region's largest economy and a hub for digital innovation, Brazil has made significant strides in adopting cloud analytics across sectors such as banking, e-commerce, and government administration. A key contributor to Brazil’s leadership is the country’s proactive stance on digital transformation. The Ministry of Science, Technology, and Innovation has promoted the use of data analytics in public administration, encouraging municipalities to deploy cloud-based dashboards for budgeting, crime monitoring, and environmental tracking. The private sector is also a strong driver, with major banks and retailers like Nubank and Magazine Luiza leveraging cloud analytics for customer segmentation, fraud detection, and personalized marketing. Moreover, Brazil’s thriving startup ecosystem, particularly in São Paulo and Belo Horizonte, has led to the creation of numerous cloud analytics-driven ventures, attracting venture capital funding and accelerating market growth.

Mexico is a key player in the market. The country benefits from strong economic ties with North America, proximity to U.S.-based cloud providers, and a growing emphasis on nearshoring and digital resilience. One of the primary factors driving Mexico’s cloud analytics adoption is the expansion of the manufacturing and automotive industries, which rely on real-time analytics for supply chain optimization and production efficiency. Also, the government has embraced digital governance, with federal agencies using cloud analytics for tax collection, public health monitoring, and education planning. Private-sector adoption is also growing rapidly, especially in the financial services and telecommunications industries.

Argentina’s relatively high digital literacy rate and growing startup ecosystem have contributed to increased cloud analytics adoption, despite economic volatility and currency instability. One of the key contributors to Argentina’s cloud analytics market is the presence of a strong technology sector, particularly in Buenos Aires, where software development and data science communities are highly active. The financial sector is another major user, with banks and fintech firms employing cloud analytics for risk assessment, fraud detection, and customer experience enhancement. Also, government agencies are exploring cloud analytics for fiscal oversight and economic forecasting, though progress has been slowed by budget constraints.

Chile’s reputation for political stability, strong institutional governance, and pro-business policies has made it a favorable destination for cloud analytics investments. A primary driver of Chile’s cloud analytics adoption is its advanced digital government framework, which integrates cloud-based data analysis in areas such as education, healthcare, and public safety. The mining industry, a cornerstone of Chile’s economy, is also adopting cloud analytics to monitor extraction processes, optimize equipment usage, and forecast mineral reserves. Major companies such as Codelco and Antofagasta Minerals are partnering with global cloud providers to enhance operational efficiency and sustainability. Moreover, Chile is emerging as a regional center for data science and analytics startups, supported by government grants and incubator programs. Universities such as Pontificia Universidad Católica de Chile are producing a steady stream of data scientists and engineers, fueling innovation and enterprise adoption.

Colombia is experiencing gradual but meaningful growth in cloud analytics adoption, driven by improvements in digital infrastructure and increasing interest from both the public and private sectors. A major catalyst for Colombia’s cloud analytics market is the expansion of digital banking and financial inclusion programs, particularly in urban centers like Medellín and Bogotá. Additionally, the government is incorporating cloud analytics into national health and education programs. Startups and tech accelerators are also contributing to market momentum. With continued investment in digital transformation and education, Colombia is positioning itself as a rising force in the Latin America cloud analytics market.

KEY MARKET PLAYERS

Noteworthy Companies dominating the Latin America cloud analytics market profiled in the report are IBM, SAS Institute, Oracle, Google, Microsoft, Teradata, Salesforce, AWS, NetApp, Qlik, Sisense, SAP (Germany), Atos (France), Altair, MicroStrategy, TIBCO Software, Hexaware Technologies (India), Zoho (India), Rackspace Technology, Splunk, Cloudera, Domo, Hewlett Packard Enterprise, Incorta, Tellius, Rapyder, Hitachi Vantara, Board International (Switzerland), Ridge (Israel), Jaspersoft, Yellowfin (Australia), Denodo, GoodData, ThoughtSpot, and Infogain.

TOP LEADING PLAYERS IN THE MARKET

Amazon Web Services (AWS)

Amazon Web Services is a dominant force in the Latin America cloud analytics market due to its extensive portfolio of analytics tools, scalable infrastructure, and deep integration with artificial intelligence and machine learning capabilities. AWS has established a strong presence in the region by setting up localized data centers in Brazil and Chile, ensuring lower latency and compliance with regional data sovereignty laws. In addition, AWS collaborates with local governments and educational institutions to promote cloud literacy and digital skills, reinforcing its long-term influence in the market.

Microsoft Azure

Microsoft Azure plays a pivotal role in the Latin America cloud analytics market by offering a suite of cloud-based analytics services tailored for hybrid environments. Azure’s seamless integration with existing Microsoft enterprise software makes it a preferred choice for government agencies, financial institutions, and large corporations undergoing digital transformation. In countries like Mexico and Colombia, Microsoft has formed strategic alliances with local partners to deliver customized analytics solutions that meet the unique regulatory and operational demands of the region, ensuring sustained market penetration and customer loyalty.

Google Cloud Platform (GCP)

Google Cloud Platform is gaining traction in the Latin America cloud analytics market by emphasizing open-source technologies, AI-driven analytics, and sustainability-focused cloud infrastructure. GCP has expanded its footprint through direct investments in data centers and strategic partnerships with universities and research institutions. Its collaborations with regional governments and startups have positioned it as a forward-thinking provider, particularly in sectors such as smart agriculture, environmental monitoring, and digital health, where data science and machine learning play a crucial role.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by leading players in the Latin America cloud analytics market is establishing regional data centers and cloud hubs to improve performance and compliance. Companies like AWS, Microsoft Azure, and Google Cloud have invested in localized infrastructure to ensure faster data processing, reduced latency, and adherence to data residency requirements, particularly in regulated sectors such as finance and healthcare.

Another major strategy involves developing partnerships with local system integrators, universities, and government agencies to accelerate market adoption. By working closely with regional stakeholders, global cloud providers can tailor their analytics offerings to suit local business environments and regulatory landscapes, fostering deeper market penetration and trust among end-users.

A third key approach is launching industry-specific cloud analytics solutions and certification programs to enhance usability and workforce readiness. Vendors are introducing vertical-tailored analytics packages for sectors like agriculture, logistics, and public administration, while also offering training and accreditation programs to build a skilled professional base capable of deploying and managing these tools effectively.

COMPETITION OVERVIEW

The Latin America cloud analytics market is characterized by intense competition, with global hyperscalers dominating the landscape while local and regional players strive to carve out a niche. Amazon Web Services, Microsoft Azure, and Google Cloud maintain a strong foothold due to their advanced analytics ecosystems, broad product portfolios, and continuous innovation. Their established presence in adjacent cloud services gives them a distinct advantage in upselling analytics capabilities to existing customers, creating a formidable entry barrier for smaller players.

At the same time, regional cloud providers and specialized analytics vendors are gaining ground by offering tailored solutions that cater to local regulatory environments and industry-specific needs. Firms such as Softtek in Mexico and Locaweb in Brazil are leveraging their domain expertise to serve mid-sized enterprises that seek cost-effective yet reliable analytics tools. These players often focus on providing localized support, language compatibility, and compliance with national data protection laws, which global providers sometimes overlook.

The competition is further shaped by the influx of fintechs, healthtechs, and agritech startups that rely on cloud analytics to drive innovation. As digital transformation accelerates and data-driven decision-making becomes the norm, the battle for market share is intensifying, with participants competing not only on price and performance but also on customization, security, and ease of integration across diverse business environments.

RECENT MARKET DEVELOPMENTS

- In February 2024, Amazon Web Services announced the launch of a new analytics training academy in São Paulo, Brazil. This initiative was designed to equip local developers and data analysts with the skills needed to deploy AWS analytics tools, reinforcing AWS’s long-term market leadership in the region.

- In May 2024, Microsoft Azure entered into a partnership with a Mexican financial services regulator to develop a cloud analytics platform for financial surveillance and risk monitoring. This collaboration aimed to support regulatory compliance while expanding Azure’s presence in the BFSI sector across Latin America.

- In September 2024, Google Cloud Platform launched a cloud analytics accelerator program in Buenos Aires, Argentina, targeting startups and academic institutions. The program was intended to stimulate innovation and create a pipeline of local talent familiar with GCP’s analytics stack, enhancing market visibility and adoption.

- In January 2025, IBM Watson Health partnered with Chilean public hospitals to implement AI-driven cloud analytics for patient diagnostics and treatment optimization. This move reinforced IBM’s credibility in the healthcare analytics segment and expanded its reach in the Andean region.

- In March 2025, Oracle Cloud signed a deal with the Colombian Ministry of Finance to provide real-time fiscal analytics for budget monitoring and expenditure control. This initiative was expected to improve transparency and efficiency in public fund management, marking a strategic step in Oracle’s regional expansion plan.

MARKET SEGMENTATION

This Latin America cloud analytics market research report is segmented and sub-segmented into the following categories.

By Offering

- Data Visualization

- Data Integration

- Reporting

- Analytics (Predictive, Prescriptive, etc.)

- Services

- Managed Services

- Professional Services

By Data Type

- Structured Data

- Semi-Structured Data

- Unstructured Data

By Data Processing

- Batch Processing

- Real-Time Processing

- Batch Analytics

- Real-Time Analytics

By Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Telecommunications and IT

- Government and Public Sector

- Manufacturing

- Media and Entertainment

- Others

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

1. What are the main drivers accelerating the Latin America cloud analytics market?

The Latin America cloud analytics market is driven by rapid digital transformation, rising investments in digital infrastructure, government e-government initiatives, and demand for real-time business insights across sectors like finance, retail, and public services.

2. Which barriers are currently limiting the expansion of the Latin America cloud analytics market?

Barriers in the Latin America cloud analytics market include inconsistent data privacy regulations, shortage of skilled professionals, uneven digital infrastructure—especially in rural areas—and cost sensitivity among SMEs.

3. Where do the most promising opportunities for future growth exist in the Latin America cloud analytics market?

Opportunities in the Latin America cloud analytics market lie in smart city projects, IoT integration, AI-driven analytics, industry-specific solutions, and expanding cloud-based services to underserved regions and emerging sectors.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com