Latin America Online Grocery Market Size, Share, Trends, COVID-19 Impact & Growth Analysis Report – Segmented By Product Type (Vegetables and Fruits, Dairy Products, Staples and Cooking Essentials, Snacks Meat and Seafood, Others), Business model, Platform Based, Purchase Type & Region (North America, Europe, Asia – Pacific, Latin America and Middle East & Africa) – Industry Analysis From 2025 to 2033

Latin America Online Grocery Market Size

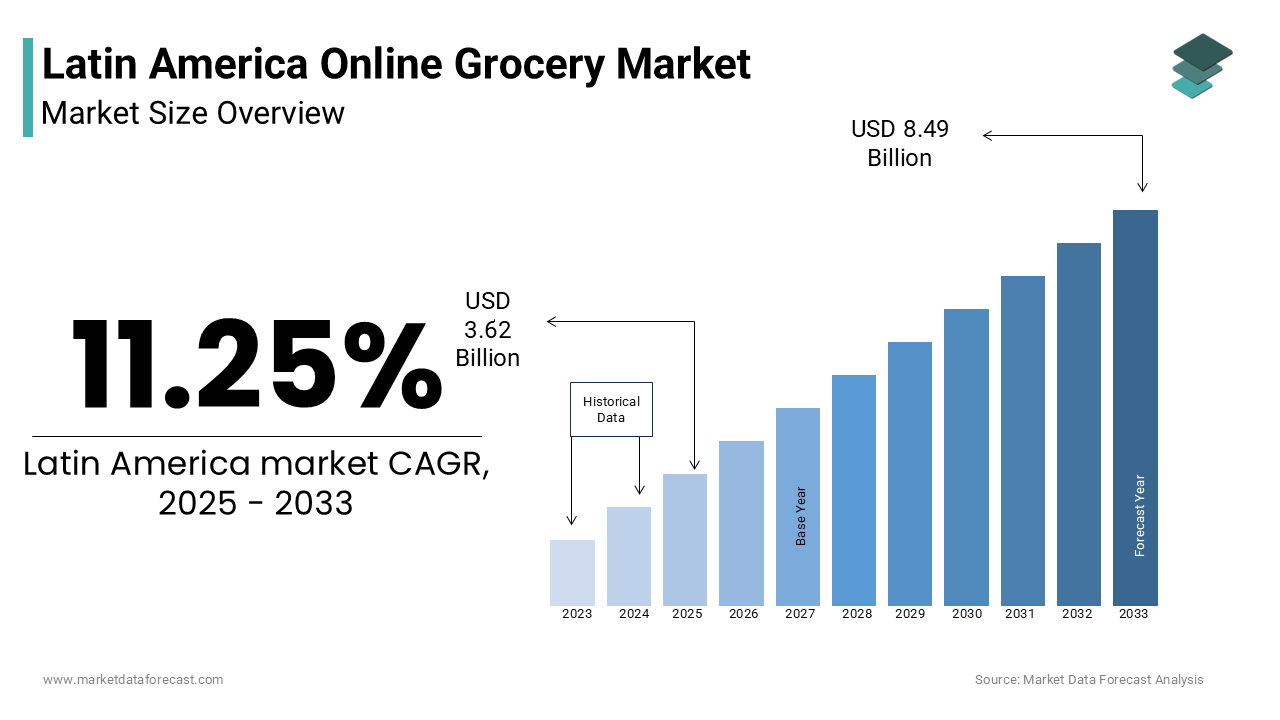

The Latin America Online Grocery Market was worth USD 3.25 billion in 2024. The Latin American market is expected to reach USD 8.49 billion by 2033 from USD 3.62 billion in 2025, rising at a CAGR of 11.25% from 2025 to 2033.

The online grocery offers a wide range of offerings such as fresh produce, packaged foods, dairy products, and non-perishable goods delivered directly to consumers' doorsteps. Over the past few years, this sector has evolved rapidly due to changing consumer behaviors, improved internet penetration, and rising smartphone adoption across countries like Brazil, Mexico, Colombia, and Chile. As of 2024, Latin America recorded an internet penetration rate of approximately 75%, with Brazil alone accounting for over 160 million internet users, according to Statista. In parallel, mobile device usage for online shopping has surged, with more than 60% of all e-commerce transactions in the region being conducted through smartphones. The region also benefits from a young, digitally native population that is increasingly comfortable with adopting digital payment methods, which stood at around 45% of total retail payments in 2023, as per the International Monetary Fund (IMF)

MARKET DRIVERS

A key driver of the Latin America Online Grocery Market is the rapid expansion of digital payment infrastructure, which has significantly enhanced transaction convenience and trust among consumers. As of 2023, nearly 45% of retail payments in Latin America were made through digital channels, up from just 28% in 2020, as reported by the International Monetary Fund (IMF). This rise can be attributed to the proliferation of fintech startups, government-backed financial inclusion initiatives, and partnerships between traditional banks and e-commerce platforms. Countries like Brazil and Mexico have led this transformation, with local payment solutions such as PIX in Brazil processing over 14 billion transactions monthly by mid-2024, according to Banco Central do Brasil.

Moreover, major players in the online grocery space have integrated multiple payment gateways, including digital wallets, buy-now-pay-later options, and even cryptocurrency, to cater to diverse consumer preferences. This evolution in payment mechanisms not only lowers barriers to entry for new customers but also enhances scalability for service providers, which is making digital payments a cornerstone of sustained market growth.

Another critical driver of the Latin america online Grocery Market is the rising urbanization and dual-income households, which have reshaped consumer lifestyles and purchasing habits. According to the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), over 80% of the population in Latin America resides in urban areas as of 2023, one of the highest urbanization rates globally. This shift has concentrated demand in metropolitan regions where time scarcity and fast-paced lifestyles are prevalent, which is prompting consumers to seek convenient alternatives to traditional grocery shopping.

In tandem, the growing prevalence of dual-income households has further amplified the need for time-saving solutions. As per data released by the International Labour Organization (ILO) in 2024, female labor force participation in Latin America has risen steadily, reaching nearly 47% compared to 42% in 2015. This change has contributed to increased disposable income while simultaneously reducing the time available for routine tasks such as grocery shopping. Consequently, online grocery platforms offer an efficient solution by enabling consumers to shop anytime and from any location.

MARKET RESTRAINTS

One of the primary restraints affecting the Middle East and Africa Galacto-Oligosaccharide (GOS) Market is the limited awareness and understanding of prebiotic ingredients among consumers and manufacturers in certain parts of the region. Despite growing global recognition of GOS for its digestive health benefits, many markets in the Middle East and Africa remain underdeveloped in terms of consumer education and product formulation knowledge. According to a 2023 report by Frost & Sullivan, less than 30% of surveyed consumers in Saudi Arabia and Egypt could identify prebiotics or their role in gut health.

This lack of awareness hampers the integration of GOS into local product portfolios and limits marketing efforts aimed at promoting its benefits. Additionally, regulatory frameworks in some countries lag behind international standards, creating confusion and hesitation among producers looking to introduce GOS-enriched products. For example, as per the Gulf Standardization Organization’s 2022 review, several GCC countries lacked specific guidelines for labeling prebiotic content on food packaging, leading to inconsistent messaging.

Another significant restraint influencing the Middle East and Africa Galacto-Oligosaccharide (GOS) Market is the high production costs and limited local manufacturing capabilities, which restrict supply chain efficiency and price competitiveness. GOS is primarily derived from lactose through enzymatic synthesis, a process that requires advanced biotechnological infrastructure and high-purity raw materials. However, most countries in the Middle East and Africa lack domestic production facilities capable of meeting industrial-scale demands. Moreover, logistics challenges, including inadequate cold-chain storage and inconsistent customs procedures, further inflate operational expenses. For instance, in Egypt and Morocco, where dairy industries are still developing, only 5% of milk production is processed into value-added derivatives, as per FAO data from 2023.

MARKET OPPORTUNITIES

An emerging opportunity within the Middle East and Africa Galacto-Oligosaccharide (GOS) Market lies in the growing emphasis on infant nutrition and maternal health, driven by increasing healthcare awareness and rising birth rates. Several countries in the region, particularly in Sub-Saharan Africa, continue to experience high fertility rates, with the United Nations projecting that the population of children under five in Nigeria alone will surpass 30 million by 2030. This demographic trend has spurred demand for fortified infant formulas and nutritional supplements containing prebiotics like GOS, which are known to support immune system development and digestive health. Furthermore, governments in countries such as Saudi Arabia and South Africa have introduced policies promoting early-life nutrition, including fortification mandates for essential micronutrients and prebiotics.

Another significant opportunity shaping the Middle East and Africa Galacto-Oligosaccharide (GOS) Market is the expanding functional food and beverage industry, supported by rising health consciousness and a growing middle class. Consumers in both urban and semi-urban areas are becoming increasingly aware of diet-related health issues such as obesity, diabetes, and digestive disorders, which is prompting a shift toward nutrient-dense and gut-friendly food products. Additionally, multinational food companies are entering strategic partnerships with regional manufacturers to localize production and meet evolving dietary preferences.

MARKET CHALLENGES

A major challenge facing the Middle East and Africa Galacto-Oligosaccharide (GOS) Market is the inconsistent regulatory landscape, which complicates product approvals, labeling, and market access across different countries. Unlike the European Union or the United States, where standardized frameworks govern the use of prebiotics in food and supplements, the Middle East and Africa exhibit fragmented regulatory systems. According to the Gulf Standardization Organization (GSO), while some Gulf Cooperation Council (GCC) countries have adopted harmonized food safety standards, others maintain separate requirements, causing delays in product registration and compliance verification. This inconsistency increases the administrative burden and costs for manufacturers seeking to enter multiple markets. It also creates confusion among consumers regarding product efficacy and safety. Additionally, the lack of unified scientific validation protocols for GOS-related health claims discourages investment in product development and marketing. Addressing these disparities through regional cooperation and policy alignment remains crucial for unlocking the full potential of the GOS market in the region.

A persistent challenge impacting the Middle East and Africa Galacto-Oligosaccharide (GOS) Market is the logistical and infrastructural limitations, which hinder the efficient distribution and storage of temperature-sensitive ingredients. GOS, typically supplied in liquid or powder form, requires controlled storage conditions to maintain stability and prevent microbial contamination. Furthermore, customs clearance processes in several Middle Eastern and African ports remain slow and bureaucratic, contributing to extended lead times and increased spoilage risks. In addition, the lack of specialized storage facilities at the distributor and retailer levels compromises product integrity, discouraging manufacturers from scaling operations.

SEGMENTAL ANALYSIS

By Product Type Insights

The vegetables and fruits segment was the largest and held 32.1% of the Latin America Online Grocery Market share in 2024. One key driver behind this trend is the increasing awareness around nutrition and wellness, with over 58% of Latin American consumers prioritizing fresh produce in their diets. Additionally, online platforms have significantly improved cold-chain logistics and last-mile delivery efficiency, ensuring that perishable items reach customers in optimal condition.

The Meat and Seafood segment is likely to grow with a CAGR of 19.7% from 2025 to 2033. This rapid growth stems from rising disposable incomes, changing dietary habits, and increased trust in digital platforms to handle temperature-sensitive products. A primary factor fueling this expansion is the growing demand for premium protein sources, especially in urban centers where time constraints and hygiene concerns are influencing purchasing behavior. According to a 2024 study by Mintel, over 63% of Mexican consumers preferred buying meat online due to perceived convenience and freshness guarantees. Moreover, e-grocery players such as Rappi (Colombia) and Mercado Livre (Brazil) have invested heavily in refrigerated storage and real-time tracking systems by ensuring product integrity during transit.

By Business Model Insights

The Pure Marketplace model held 41.2% of the Latin America Online Grocery Market share in 2024. One major factor contributing to its dominance is the scalability of the Pure Marketplace approach, allowing platforms to onboard local vendors and large retailers without significant capital investment in inventory or infrastructure. According to Statista, over 75% of e-commerce businesses in Latin America operate under third-party seller models, driven by low entry barriers and high operational flexibility. Another key driver is the growing acceptance of multi-vendor platforms among consumers who seek variety and convenience. NielsenIQ’s 2023 survey indicated that 61% of online shoppers in Latin America prefer using platforms that aggregate offerings from multiple suppliers, enhancing user experience through personalized recommendations and localized assortments.

The Hybrid Marketplace model is swiftly emerging with a CAGR of 21.3% during the forecast period. A core reason behind its accelerated growth is the need for consistency in product availability and delivery speed, which has become a critical differentiator in competitive markets. Companies like Rappi and Día Digital in Argentina have adopted this model to offer guaranteed stock levels and faster fulfilment for high-frequency items. Additionally, the Hybrid Marketplace allows operators to optimize pricing strategies by balancing direct sales with commission-based listings.

By Platform Insights

The App-Based platform dominated the Latin America Online Grocery Market with a dominant share in 2024. Countries like Brazil and Mexico lead in mobile commerce usage, where over 60% of all online grocery transactions occur via apps. This trend is further reinforced by the integration of AI-driven personalization, push notifications, and seamless payment options within mobile apps, enhancing user engagement and loyalty. Moreover, app-based platforms offer superior real-time tracking, instant promotions, and voice-assisted shopping features, improving overall customer experience. As app developers continue to refine interfaces and introduce new functionalities, the App-Based segment is expected to maintain its stronghold in shaping the future of online grocery shopping in Latin America.

The Web-Based platform segment is estimated to grow with a CAGR of 18.4% in the next coming years. While app-based platforms dominate, web-based solutions are gaining traction among older demographics and first-time internet users who prefer desktop browsing over mobile applications.

One major driver of this growth is the rising use of shared devices in lower-income households, where smartphones may not be accessible to all family members. Web-based platforms provide a familiar interface for these users, eliminating the need for app downloads and updates. Additionally, enterprise-level B2B grocery platforms are increasingly adopting web-based interfaces to streamline bulk ordering and supply chain coordination. A study by Frost & Sullivan in 2023 found that small retailers and wholesalers in Argentina and Chile were shifting to web portals for easier integration with existing ERP systems.

By Purchase Type Insights

The one-time purchase type remains the dominant segment in the Latin America Online Grocery Market, representing around 72% of total transaction volume in 2023, as per Euromonitor International. This preference reflects the region’s evolving but still cautious consumer behavior toward online grocery services, where users tend to make spontaneous purchases based on immediate needs rather than committing to long-term subscriptions. One of the key drivers behind this dominance is the flexibility it offers in markets where income fluctuation and seasonal spending patterns are common. According to the International Labour Organization (ILO), nearly 45% of Latin america workers earn variable incomes, making them hesitant to lock into recurring payments. Additionally, limited awareness and trust in subscription-based models continue to hinder their adoption. A 2023 survey by NielsenIQ revealed that only 18% of online grocery users in the region had ever subscribed to a regular delivery service, which is citing concerns over hidden costs and inflexibility.

The Subscription Purchase type segment is likely to grow with a CAGR of 23.1% during the forecast period. This surge is primarily fueled by the increasing adoption of subscription-based services across other digital sectors, including streaming, fintech, and meal kits, which have conditioned consumers to expect recurring benefits and cost savings. A key driver is the introduction of value-added membership programs by leading e-grocery platforms, offering perks such as free delivery, exclusive discounts, and early access to flash sales. Similarly, Rappi introduced tiered subscription plans in Mexico and Colombia, resulting in a 34% increase in average order frequency among subscribers, according to internal company data released in 2024. Moreover, corporate partnerships and bundled offerings with telecom providers and banks have expanded accessibility. These strategic moves are accelerating the shift toward recurring purchase models, positioning subscriptions as a high-potential growth avenue in the Latin america online grocery sector.

REGIONAL ANALYSIS

Brazil was the top performer in the Latin america online Grocery Market with 38.3% of share in 2024. A major growth driver in Brazil is the rapid expansion of digital payment adoption, with over 47% of all retail transactions conducted digitally in 2023, as per the Central Bank of Brazil. Additionally, platforms like Mercado Livre and Carrefour have scaled their omnichannel operations, integrating dark stores and micro-fulfillment centers to enhance delivery speed. Statista reported that same-day delivery services in São Paulo and Rio de Janeiro accounted for over 60% of all online grocery orders in 2023, reinforcing consumer trust in digital platforms.

Mexico was positioned second by holding 25.3% of the share in 2024. One of the key contributors to Mexico’s strong performance is the expansion of digital banking and mobile payment solutions, with over 65 million active digital wallet users recorded in 2023, as per a report by Banxico, the country’s central bank. Major players like Amazon, Walmart de México, and Rappi have capitalized on this trend by introducing flexible payment options, including buy-now-pay-later schemes and cashback incentives, thereby attracting a broader consumer base.

Moreover, urbanization and dual-income households are reshaping purchasing behaviors, with over 60% of Mexican consumers preferring online grocery services due to time constraints and convenience, according to NielsenIQ’s 2023 E-Commerce Insights Report. The presence of well-established retail chains integrating online platforms has also boosted market penetration.

Argentina was positioned second in the Latin America Online Grocery Market by capturing 12.3% of share in 2024. A significant growth driver in Argentina is the strong presence of tech-savvy youth and a highly urbanized population, with over 93% of residents living in cities, according to the World Bank’s 2023 Urban Development Review. Additionally, hyperinflation and currency instability have encouraged consumers to adopt digital payment methods, reducing reliance on cash transactions. Furthermore, cold-chain logistics improvements have enabled better handling of perishable goods, enhancing customer satisfaction. The

Chile Online Grocery Market is lucratively growing with the advanced digital infrastructure, high internet penetration, and stable economy contributing to its strong foothold in the online grocery sector. One of the key drivers of Chile’s market growth is its well-developed logistics network, which supports efficient last-mile delivery and ensures product freshness. Additionally, e-commerce-friendly regulations and strong consumer protection laws have fostered trust in online transactions, encouraging more users to switch from traditional retail formats. Leading players such as Jumbo (part of Cencosud) and Falabella have integrated mobile apps with AI-powered recommendation engines by enhancing user engagement and increasing basket sizes.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Walmart Inc., Carrefour S.A., Amazon.com, Inc., Cencosud S.A., Grupo Éxito, Cornershop by Uber, and Mercadoni are some of the key market players in the Latin America Online Grocery Market.

The competition in the Latin america online Grocery Market is intensifying as both global giants and regional startups aggressively expand their digital footprints. The market is characterized by rapid innovation, evolving consumer expectations, and a fragmented retail environment that presents both opportunities and challenges. Established players like Mercado Livre, Amazon, and Rappi are continuously refining their service models to capture greater market share, often leveraging their existing e-commerce and logistics infrastructures to scale operations efficiently. Meanwhile, emerging homegrown platforms are focusing on niche segments such as organic produce, subscription-based models, and ultra-fast delivery to differentiate themselves. Strategic partnerships, acquisitions, and localized marketing campaigns have become common tactics to build brand loyalty and gain traction in new cities.

Top Players in the Latin America Online Grocery Market

Mercado Livre is a dominant force in the Latin america e-commerce landscape and plays a crucial role in shaping the online grocery market. The company has expanded its offerings through Mercado Livre Super, integrating grocery fulfillment with its existing logistics network. Its contribution lies in setting benchmarks for digital payment integration, last-mile delivery efficiency, and multi-vendor marketplace scalability, influencing how consumers across Brazil and other regional markets engage with online grocery services.

Rappi has emerged as a leading player by leveraging its on-demand delivery infrastructure to offer fast and reliable grocery services. Operating across multiple Latin america countries, Rappi's strength lies in its app-based platform that connects users with local stores and dark stores. It contributes significantly to the global market by pioneering hyperlocal delivery models and expanding the reach of instant commerce, thereby redefining convenience-driven shopping habits in emerging markets.

Amazon continues to strengthen its presence in the Latin america online Grocery Market through localized strategies and strategic partnerships. By adapting its global expertise in supply chain management and customer-centric technology, Amazon has been able to penetrate key markets like Brazil and Mexico. Its contributions include introducing curated grocery selections, investing in cold storage infrastructure, and enhancing user experience through AI-driven personalization, which is reinforcing its influence in the evolving regional online grocery ecosystem.

Top Strategies Used by Key Market Participants

One major strategy employed by key players in the Latin america online Grocery Market is expanding hyperlocal fulfillment networks, including the deployment of dark stores and micro-warehouses. This allows companies to reduce delivery times and improve inventory responsiveness, catering to the growing demand for same-day and next-day deliveries in urban centers.

Another critical approach is the integration of digital payment ecosystems by enabling seamless transactions and increasing consumer trust. Companies are partnering with fintech firms and local banks to introduce flexible payment options such as buy-now-pay-later, mobile wallets, and cashback incentives, which enhance accessibility and encourage repeat purchases.

Leveraging data analytics and artificial intelligence has become a cornerstone strategy. Firms are utilizing AI-powered recommendation engines, personalized promotions, and predictive demand modeling to enhance customer engagement, optimize product assortments, and improve operational efficiency across their platforms.

RECENT MARKET DEVELOPMENTS

- In January 2024, Mercado Livre launched an expanded grocery delivery service under Mercado Livre Super, integrating dark stores in São Paulo and Bogotá to enable faster order fulfillment and enhance customer satisfaction.

- In March 2024, Rappi announced a partnership with Carrefour in Argentina to integrate the retailer’s full product catalog into the Rappi app, which is improving access to fresh groceries and strengthening its omnichannel presence.

- In May 2024, Amazon introduced a localized grocery subscription plan in Mexico, offering unlimited same-day deliveries on select items to Prime members, aiming to boost retention and increase basket size.

- In July 2024, Día Digital expanded its fleet of refrigerated delivery vehicles in Buenos Aires, improving cold-chain logistics to ensure product freshness and reliability for perishable goods.

- In September 2024, Cornershop (owned by Uber) rolled out a new AI-powered personalization feature across Chile and Colombia by enhancing user recommendations based on purchase history and browsing behavior to drive higher engagement.

MARKET SEGMENTATION

This research report on the Latin America online grocery market is segmented and sub-segmented into the following categories.

By Product Type

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

By Business model

- Pure Marketplace

- Hybrid Marketplace

- Others

By Platform Based

- Web-Based

- App-Based

By Purchase Type

- One-Time

- Subscription

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What is the current market size of the Latin America online grocery market?

The market is growing steadily, driven by increasing internet penetration, smartphone usage, and consumer preference for convenience in grocery shopping.

What are the key factors driving growth in this market?

Key drivers include changing consumer lifestyles, advancements in delivery logistics, growth of mobile commerce, and the rise of digital payment options.

What are the challenges faced by online grocery platforms in the region?

Major challenges include last-mile delivery logistics, cold chain management, internet connectivity in rural areas, and limited digital literacy among certain populations.

What types of products are commonly purchased online in this market?

Consumers often buy fresh produce, packaged foods, dairy products, snacks, beverages, and household essentials through online platforms.

What is the future outlook of the Latin America online grocery market?

The market is expected to continue growing robustly, with increasing investments in tech infrastructure, improved logistics, and greater consumer trust in online transactions.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com