Latin America Preclinical CRO Market Research Report - Segmented By Service Type ( bioanalysis And DMPK , Studies Toxicology Testing ), End User & Country (Mexico, Brazil, Argentina, Chile & Rest of Latin America) - Industry Analysis (2025 to 2033)

Latin America Preclinical CRO Market Size

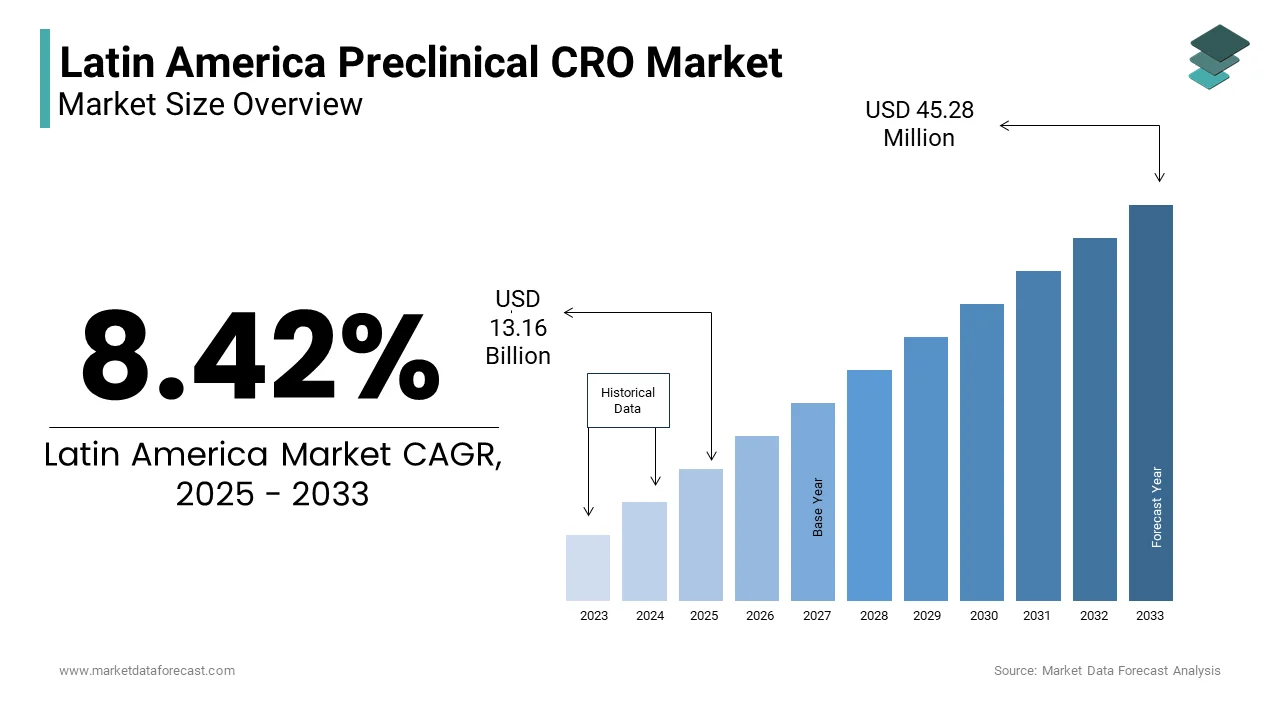

The Latin America Preclinical CRO Market Size was valued at USD 11.28 billion in 2024. The Latin America Preclinical CRO Market size is expected to have 8.42 % CAGR from 2025 to 2033 and be worth USD 45.28 billion by 2033 from USD 13.16 billion in 2025.

The Latin America Preclinical Contract Research Organization (CRO) services include in vitro and in vivo testing, pharmacokinetics, toxicology assessments, formulation development, and regulatory support. The market plays a crucial role in accelerating early-stage drug development by offering specialized infrastructure, expertise, and compliance with international standards.

In recent years, the Latin America region has witnessed growing interest from global pharmaceutical firms seeking cost-effective yet high-quality preclinical research platforms. According to the World Health Organization (WHO), several African countries have been investing in life sciences infrastructure, while Gulf Cooperation Council (GCC) nations are actively expanding their healthcare and biopharma sectors as part of broader economic diversification strategies.

MARKET DRIVERS

Expansion of Biopharmaceutical R&D in the GCC Region

One of the primary drivers of the Latin America Preclinical CRO Market is the rapid expansion of biopharmaceutical research and development activities in the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia, the United Arab Emirates, and Qatar. As part of their Vision 2030 and National Innovation Strategies, these nations are heavily investing in life sciences infrastructure and local drug manufacturing capabilities. According to the Gulf Research Center (GRC), government spending on healthcare R&D in the GCC increased by more than 40% between 2019 and 2023.

This investment has led to the establishment of specialized research parks, such as the Dubai Science Park and the Qatar Foundation’s Biomedical Research Program, which attract both multinational pharmaceutical companies and contract research organizations. As per the Ministry of Health and Prevention in the UAE, the number of preclinical studies conducted in the country rose by nearly 30% during the same period, driven by partnerships between academic institutions and private sector players.

Growing Outsourcing Trend Among Global Pharma Companies

Another key driver fueling the Latin America Preclinical CRO Market is the rising trend among global pharmaceutical and biotech companies to outsource early-phase research to cost-efficient regions with emerging scientific talent pools. Firms are seeking alternative locations that offer lower operational costs without compromising on quality or compliance standards as competition intensifies in drug development. According to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), nearly 60% of surveyed pharma executives indicated plans to expand their preclinical outsourcing footprint beyond traditional markets like North America and Europe by 2025. Latin America presents an attractive proposition due to its improving regulatory alignment with ICH and WHO guidelines, coupled with a growing base of skilled scientists and laboratory professionals. Countries like South Africa and Egypt have long-standing experience in conducting preclinical and clinical research, supported by well-established academic institutions.

MARKET RESTRAINTS

Limited Local Demand and Underdeveloped Domestic Pharma Industry

A major restraint affecting the Latin America Preclinical CRO Market is the limited domestic demand for preclinical research services due to the underdeveloped nature of the local pharmaceutical industry in most countries within the region. Unlike mature markets in North America and Europe, where a robust ecosystem of biotech startups and large pharmaceutical firms drives continuous R&D activity, many Latin America nations rely heavily on imported medicines rather than homegrown drug development.

This lack of a strong indigenous biopharma sector results in fewer opportunities for CROs to engage in sustained, high-volume projects within the domestic market. While GCC countries are making strategic investments in building local capabilities, the overall pipeline of drug development initiatives remains modest compared to other global regions. As per the Egyptian Drug Authority (EDA), only about 10–15 new drug applications are submitted annually, limiting the volume of preclinical work generated internally. Until there is greater consolidation and growth in local pharma innovation, the reliance on external clients will remain high, which is posing a structural challenge to the organic development of the Latin America Preclinical CRO Market.

Regulatory Fragmentation and Compliance Challenges

Regulatory fragmentation across the Latin America region poses a significant barrier to the growth of the Preclinical CRO Market. Unlike the harmonized frameworks seen in the EU or U.S., regulatory requirements for drug development vary widely between countries, creating complexity for CROs seeking to operate across multiple jurisdictions. According to the African Medicines Agency (AMA), launched under the African Union’s initiative, more than 70% of African countries still maintain separate national regulatory bodies with differing approval timelines and documentation standards.

This inconsistency affects not only the speed of study approvals but also the acceptability of preclinical data across borders, reducing efficiency and increasing operational costs for CROs. As per the Saudi Food and Drug Authority (SFDA), while efforts have been made to align with ICH-GCP guidelines, implementation remains uneven across the region. In countries with less developed oversight structures, issues such as delays in ethical review board approvals and unclear submission procedures further hinder progress.

MARKET OPPORTUNITIES

Strategic Investments in Healthcare Innovation Hubs

An emerging opportunity for the Latin America Preclinical CRO Market lies in the strategic investments being made in healthcare innovation hubs across the region, particularly in the Gulf Cooperation Council (GCC) and selected African nations. Governments and private investors are increasingly recognizing the importance of life sciences as a pillar of economic diversification and public health improvement. These innovation hubs provide a platform for collaboration between academia, research institutions, and contract research organizations, facilitating access to state-of-the-art laboratories and skilled personnel. For example, as per the Dubai Health Strategy 2025, the emirate aims to become a regional leader in precision medicine and drug development, which is attracting global CROs to set up satellite operations. Similarly, in South Africa, the Technology Innovation Agency (TIA) has funded several translational research initiatives that integrate preclinical testing with clinical trial execution.

Rising Collaborations Between Academic Institutions and CROs

Another promising opportunity in the Latin America Preclinical CRO Market is the growing collaboration between academic research institutions and contract research organizations. Universities and medical research centers across the region are increasingly engaging with CROs to translate basic science discoveries into viable drug candidates. According to the Association of African Universities (AAU), over 40 research institutions in Sub-Saharan Africa have entered into formal partnerships with global and regional CROs since 2020.

These collaborations leverage academic expertise in disease biology, especially in areas such as tropical diseases, oncology, and infectious diseases—fields where Latin America-based research can offer unique insights. As per the University of Cape Town’s Faculty of Health Sciences, joint ventures with CROs have enabled faster translation of novel therapeutic targets into preclinical models. Additionally, funding from organizations such as the Bill & Melinda Gates Foundation and Wellcome Trust has supported pilot studies that require preclinical validation, further strengthening this partnership model.

MARKET CHALLENGES

Lack of Skilled Workforce and Training Infrastructure

One of the foremost challenges facing the Latin America Preclinical CRO Market is the shortage of skilled professionals and inadequate training infrastructure to support high-quality preclinical research. While certain countries like South Africa and Egypt have well-established medical and pharmaceutical education systems, many others struggle with limited access to advanced scientific training and hands-on experience in Good Laboratory Practice (GLP). This skills gap affects the ability of CROs to recruit qualified personnel in fields such as molecular biology, pharmacokinetics, and regulatory affairs, thereby limiting service offerings and client retention. As per the African Academy of Sciences (AAS), despite increasing investments in STEM education, there remains a mismatch between academic curricula and industry needs, particularly in GLP-compliant research environments.

Political and Economic Instability in Key Markets

Political and economic instability in certain Latin America countries presents a persistent challenge for the Preclinical CRO Market. Several nations in the region experience fluctuating exchange rates, inflationary pressures, and governance uncertainties that affect business continuity and investor confidence. According to the World Bank’s Ease of Doing Business Index, several African countries rank low in terms of regulatory transparency and contract enforcement, complicating long-term planning for CROs.

For instance, as per the European Investment Bank (EIB), political unrest and currency devaluations in countries like Nigeria and Sudan have disrupted supply chains and delayed research project timelines. Additionally, inconsistent tax policies and bureaucratic hurdles in some governments create additional barriers to setting up and maintaining operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.42 % |

|

Segments Covered |

By Type, Drug and Country. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

UK, Germany, Italy, France, Spain, Sweden, Denmark, Poland, Switzerland, Netherlands, Rest of Europe. |

|

Market Leaders Profiled |

PRA Health Science, Inc.; Wuxi AppTec; Medpace, Inc.; Charles River Laboratories International |

SEGMENT ANALYSIS

By Service Type Insights

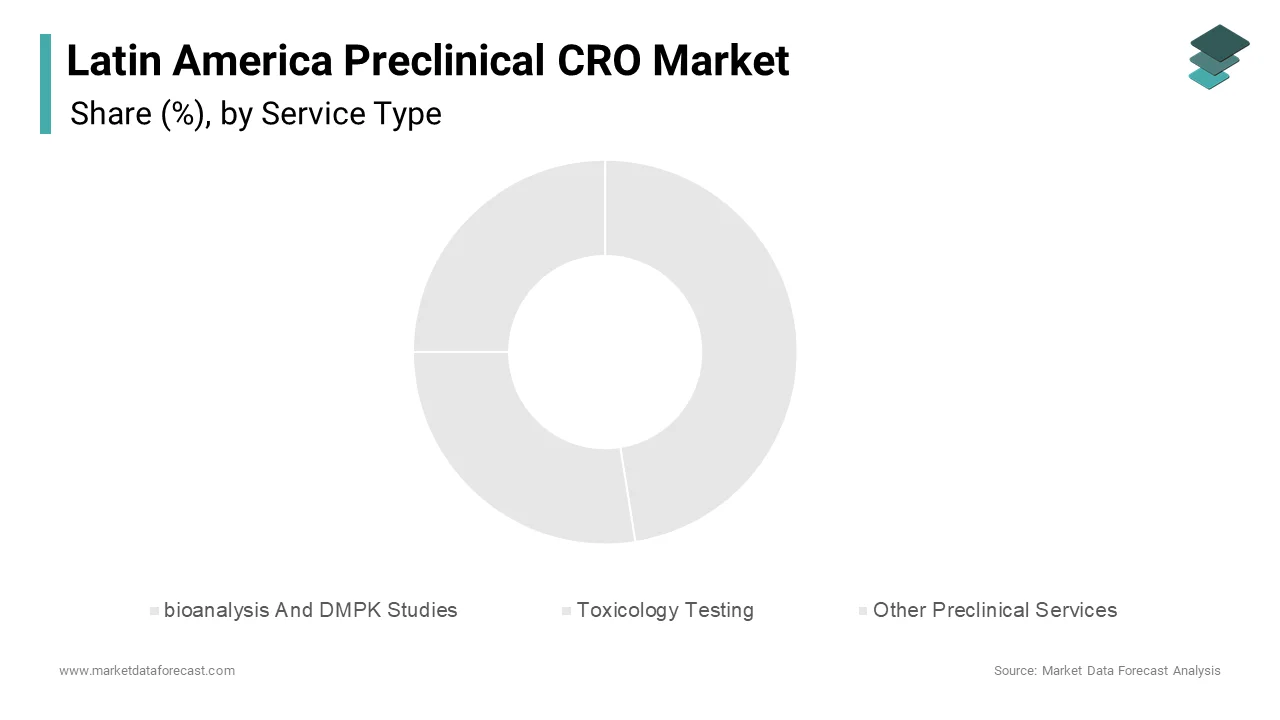

The Bioanalysis and Drug Metabolism and Pharmacokinetics (DMPK) segment was the largest and held 38.6% of the share in 2024. According to the African Academy of Sciences (AAS), bioanalytical testing is a prerequisite for regulatory submissions across all major markets, which is making it an essential service offering for CROs catering to global pharmaceutical clients. Additionally, as noted by the South African Medical Research Council (SAMRC), academic institutions and contract research organizations are increasingly integrating DMPK assessments into translational medicine projects.

The toxicology testing is emerging with a CAGR of 11.4% during the forecast period. This rapid expansion is attributed to the increasing requirement for safety evaluations prior to clinical trials, especially as more complex therapeutics such as biologics and gene therapies enter development pipelines. According to the World Health Organization (WHO), regulatory authorities in these regions have intensified their focus on drug safety assessments, which is aligning with international guidelines. As per the Dubai Health Authority (DHA), several GLP-certified laboratories have been established in the past five years, enhancing local capacity for non-clinical toxicology studies. Furthermore, collaborations between regional CROs and multinational sponsors seeking cost-effective yet compliant testing platforms are accelerating demand. With greater investment in laboratory infrastructure and regulatory modernization, toxicology testing is gaining momentum as a high-growth area within the Latin America Preclinical CRO market.

By End User Insights

The biopharmaceutical segment was accounted in holding 60.2% of the Latin America Preclinical CRO Market share in 2024. These firms rely heavily on outsourced preclinical research services to accelerate drug discovery and meet stringent regulatory requirements without establishing in-house R&D capabilities. According to the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), over 70% of surveyed biopharma firms indicated plans to increase outsourcing to emerging markets, including those in the Middle East and Africa.

This trend is particularly evident among global pharmaceutical players seeking alternative research locations that offer lower operational costs while maintaining compliance with ICH and WHO standards. As per the Gulf Future Forum (GFF), multinational companies have increasingly engaged CROs in the UAE and Saudi Arabia to conduct early-phase studies as part of regional expansion strategies. Additionally, as noted by the South African Health Products Regulatory Authority (SAHPRA), there has been a notable rise in partnerships between international pharma firms and local CROs for infectious disease and oncology-related research.

The government and academic institutes segment is likely to grow with a CAGR of 10.8% throughout the forecast period. The growth of the segment is driven by increasing public sector investments in life sciences research and the establishment of national innovation programs aimed at strengthening indigenous drug discovery capabilities.

Several governments in the Latin America region are allocating significant funding to universities and research institutions to develop scientific expertise and contribute to global health solutions. As per the Qatar National Research Fund (QNRF), academic institutions in the Gulf Cooperation Council (GCC) have significantly ramped up their participation in collaborative preclinical studies. In addition, as reported by the University of Cape Town’s Faculty of Health Sciences, academic-industry partnerships have surged, with many institutions leveraging CROs to conduct proof-of-concept studies and early-stage trials.

COUNTRY LEVEL ANALYSIS

Germany held the 18.4% of the European Preclinical CRO Market share in 2024. The country benefits from a well-established pharmaceutical and biotech ecosystem, supported by strong academic research institutions and advanced healthcare infrastructure. One of the key drivers of Germany’s dominance is its strategic focus on innovation-driven drug development, backed by government funding and industry incentives. As per the Fraunhofer Institute, more than 30 new biotech startups were launched in 2023, each requiring preclinical support from specialized CROs. Additionally, the presence of leading pharmaceutical firms such as Bayer and Merck KGaA ensures continuous demand for outsourced research services.

France Preclinical CRO Market was positioned second with 15.4% of the share in 2024. The country maintains a strong foothold in early-phase research due to its deep integration of academic research centers, national health agencies, and private sector biotech firms. A major growth driver is the country’s proactive approach to fostering innovation through dedicated funding programs such as the “Investissements d’Avenir” initiative, which supports translational medicine and drug discovery. As per INSERM (French National Institute of Health and Medical Research), collaborations between public research institutions and contract research organizations have expanded significantly over the past five years. Additionally, France’s adherence to EU-wide regulatory frameworks enhances the credibility of its preclinical data internationally.

The United Kingdom Preclinical CRO Market growth is lucratively to have significant growth throughout the forecast period. The UK’s well-developed life sciences sector, combined with a long-standing tradition of pharmaceutical innovation, supports a thriving ecosystem for preclinical research. As per the Association of the British Pharmaceutical Industry (ABPI), the UK remains a preferred destination for global pharmaceutical firms seeking high-quality preclinical testing environments. Additionally, the implementation of post-Brexit adaptive regulatory pathways has allowed for faster review of early-phase research proposals.

Spain Preclinical CRO Market growth is attributed to be driven by the collaborative research between academic institutions, biotech firms, and contract research organizations. The country's commitment to advancing life sciences research is reflected in its expanding network of research hospitals and innovation clusters, particularly in Barcelona, Madrid, and Seville.

Italy preclinical CRO market growth is likely to have prominent growth opportunities with its expanding focus on precision medicine, biologics, and regenerative therapies. The country’s strong foundation in academic research and pharmaceutical manufacturing supports a growing demand for preclinical testing services aligned with cutting-edge therapeutic modalities. According to the Italian Medicines Agency (AIFA), over 700 preclinical studies were registered in 2023, with a significant portion focused on monoclonal antibodies and gene therapy vectors.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Prominent companies dominating the Latin America Preclinical CRO Market profiled in the report are PRA Health Science, Inc.; Wuxi AppTec; Medpace, Inc.; Charles River Laboratories International, Inc, Laboratory Corporation of America; Envigo, Eurofins Scientific, Pharmaceutical Product Development, LLC.; and Paraxel International Corporation.,

The Latin America Preclinical CRO Market is becoming increasingly competitive as global contract research organizations seek to diversify their geographic exposure and tap into new research ecosystems. Established multinational firms dominate due to their well-developed infrastructures, regulatory expertise, and long-standing relationships with pharmaceutical clients. However, regional players are gaining traction by offering cost-effective services and leveraging local knowledge to meet specific research demands. The market is also witnessing heightened interest from governments and private investors aiming to develop indigenous research capabilities, further intensifying competition. Strategic differentiation is being driven by investments in technology, workforce training, and compliance with international standards.

MARKET SEGMENTATION

This research report on the latin america preclinical cro market has been segmented and sub-segmented into the following categories

By Service Type

- bioanalysis And DMPK Studies

- Toxicology Testing

- Other Preclinical Services

By End User

- Biopharmaceutical Companies

- Government and Academic Institutes

- Medical Device Companies

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America.

Frequently Asked Questions

What is a preclinical CRO, and what services do they offer in Latin America?

Preclinical CROs in Latin America provide research services that support drug discovery and development before clinical trials. These include toxicology studies, pharmacokinetics (PK), pharmacodynamics (PD), bioanalysis, in vivo and in vitro testing, and regulatory support.

Why is Latin America becoming a growing hub for preclinical CRO services?

Latin America offers cost-effective research, a growing pharmaceutical industry, skilled professionals, supportive government policies, and increasing investments in biotech and drug development.

Which countries in Latin America lead the preclinical CRO market?

Brazil and Mexico are the largest markets, followed by Argentina, Colombia, and Chile, due to their established healthcare infrastructure, R&D investments, and favorable regulatory environments.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com