Latin America Telecom Market Size, Share, Trends and Growth Analysis Report, Segmented By Services And By Country (Brazil, Mexico, Argentina, Chile & Rest of Latin America), Industry Analysis From (2025 to 2033)

Latin America Telecom Market Size

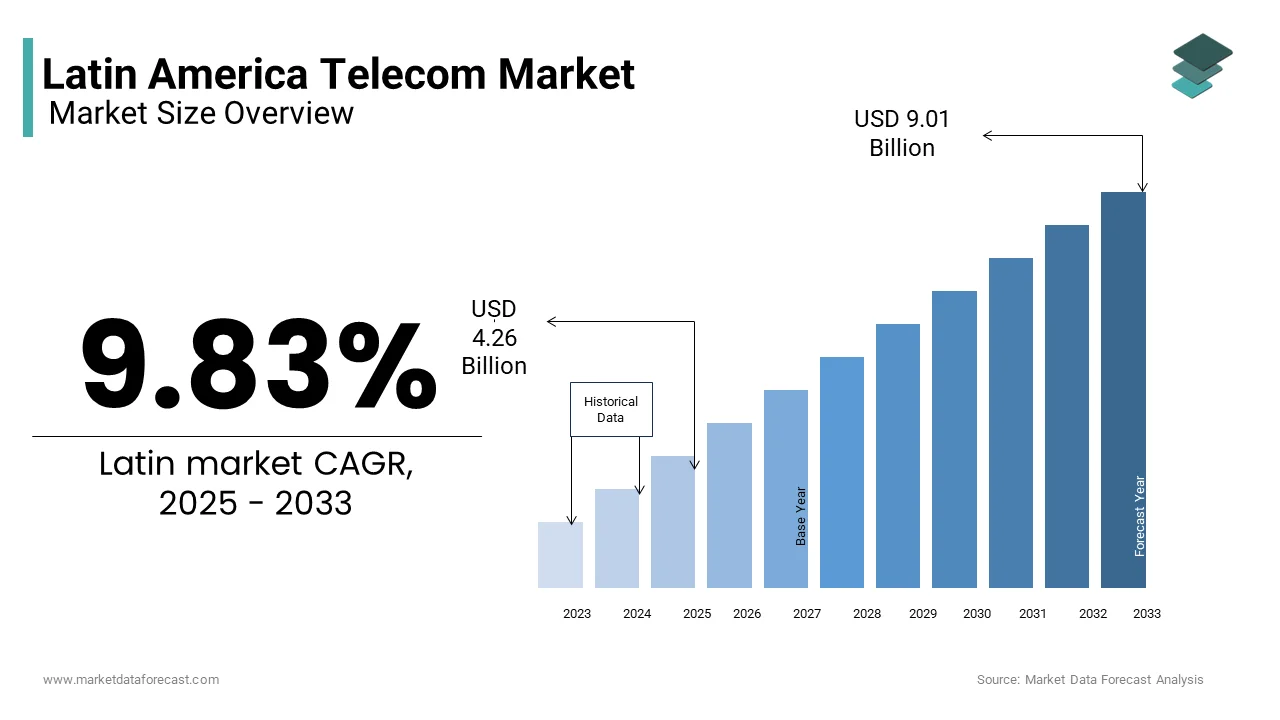

The Latin American telecom market was valued at USD 3.88 billion in 2024 and is anticipated to reach USD 4.26 billion in 2025 from USD 9.01 billion by 2033, growing at a CAGR of 9.83% during the forecast period from 2025 to 2033.

The Latin American telecom market includes fixed-line, mobile, broadband, and emerging 5G infrastructure. It serves as the backbone for digital transformation across industries such as finance, healthcare, education, and e-commerce. The sector is undergoing rapid modernization, driven by increased investment in fiber-optic networks, mobile expansion, and government-led digital inclusion initiatives.

Brazil is a key regional market due to its large population, high mobile penetration, and expanding broadband infrastructure. In addition, Chile has emerged as a leader in 5G deployment, supported by transparent spectrum allocation policies and public-private partnerships. Meanwhile, Argentina and Colombia are making strides in rural connectivity through national broadband programs.

MARKET DRIVERS

Expansion of Mobile Broadband and Increasing Smartphone Penetration

One of the most influential drivers shaping the Latin American telecom market is the widespread adoption of smartphones and the expansion of mobile broadband networks. According to the World Bank, a significant share of the population in Latin America now owns a mobile phone, with smartphone ownership rising steadily across both urban and rural areas. This shift is fueling demand for high-speed data services, prompting telecom operators to invest heavily in network upgrades and spectrum acquisitions. In Brazil, mobile data traffic grew by more than 25% year-over-year in 2023, according to Cisco’s Global Mobile Data Traffic Forecast. To meet this surge, major carriers like Claro, TIM, and Vivo have expanded their 4G LTE coverage and initiated 5G rollouts in major cities such as São Paulo and Rio de Janeiro. Mexico is also witnessing similar trends, with the National Institute of Statistics and Geography (INEGI) reporting that more than 80% of Mexican households had access to mobile internet in 203, up from 60% in 2020. Carriers are leveraging these trends to introduce bundled service packages and expand their customer base.

Government-Led Digital Inclusion and Broadband Expansion Initiatives

A key factor driving the Latin American telecom market is the implementation of national broadband expansion programs aimed at improving digital inclusion and reducing the digital divide. Governments across the region are prioritizing connectivity as a fundamental component of economic development, leading to substantial investments in fiber optic networks, satellite-based internet, and rural telecommunications infrastructure. Brazil’s “Brasil Conectado” initiative, launched by the Ministry of Science, Technology, and Communications, aims to provide nationwide broadband access, particularly in remote Amazonian regions. As per the Brazilian Internet Steering Committee (CGI.br), over USD 2 billion was allocated to rural broadband expansion between 2021 and 2023, significantly boosting internet availability in underserved areas. Similarly, in Colombia, the government’s “Vive Digital” program has led to a notable increase in internet penetration, especially in rural municipalities where mobile broadband is being deployed via satellite and LTE technologies. According to ProColombia, foreign direct investment in Colombia’s digital infrastructure surpassed USD 1.2 billion in 2023, largely driven by telecom projects.

MARKET RESTRAINTS

Regulatory Complexity and Spectrum Allocation Delays

One of the primary restraints affecting the Latin American telecom market is the inconsistent regulatory environment and prolonged delays in spectrum allocation across several countries. While some nations have adopted progressive policies to encourage investment, others face bureaucratic inefficiencies and legal disputes that hinder the timely deployment of next-generation networks. Also, the lack of a clear 5G rollout timeline has delayed infrastructure investments by major operators, limiting consumer access to advanced mobile services. In Peru, spectrum licensing procedures remain cumbersome, with multiple agencies involved in approval processes, causing project delays for telecom companies.

Infrastructure Gaps and Limited Rural Connectivity

Despite progress in urban centers, the Latin American telecom market continues to be constrained by significant infrastructure gaps, particularly in rural and remote regions. According to the International Telecommunication Union (ITU), as of 2023, only 45% of rural households in Latin America had access to fixed broadband, compared to over 75% in urban areas. In countries like Bolivia and Ecuador, rugged terrain and limited road infrastructure make it difficult to deploy fiber optics and cellular towers efficiently. The World Bank estimates that Latin America invests less than 2% of its GDP annually on infrastructure, well below the global average of 3.5%, contributing to persistent connectivity disparities. Additionally, the absence of redundant fiber routes in certain regions increases vulnerability to service disruptions. For example, in parts of Paraguay and northern Argentina, a single fiber cut can cause outages lasting several days.

MARKET OPPORTUNITY

Growth of 5G Networks and Industrial Digitization

The rollout of 5G networks presents a transformative opportunity for the Latin American telecom market, enabling faster data speeds, lower latency, and enhanced connectivity for industries such as manufacturing, logistics, and healthcare. According to Ericsson, 5G subscriptions in Latin America are expected to reach 130 million by 2027, signaling a major shift in network capabilities and consumer demand. Chile has taken a leadership role in this transition, having completed its first 5G spectrum auction in early 2023, followed by commercial launches in Santiago and Valparaíso. It was reported that Chilean telecom operators invested over USD 500 million in 5G infrastructure in 2023 alone, reflecting strong momentum in the sector. In Brazil, major telecom firms such as TIM Brasil and Claro have partnered with equipment vendors to launch 5 G-enabled smart factory pilots in São Paulo and Campinas, supporting Industry 4.0 applications such as real-time monitoring and automation.

Rise of IoT and Smart City Initiatives

The proliferation of Internet of Things (IoT) applications and smart city projects is creating a significant opportunity for the Latin American telecom market. With governments and private enterprises increasingly adopting connected technologies for transportation, energy management, and public safety, there is a growing need for reliable and scalable telecom infrastructure to support these deployments. Brazil launched a national initiative in 2023 to integrate IoT-enabled sensors into urban infrastructure, requiring extensive telecom support for real-time data transmission. In Mexico, cities such as Monterrey and Guadalajara are implementing smart mobility solutions, including intelligent traffic lights and GPS-based public transport tracking systems. These require continuous connectivity and low-latency networks, which telecom providers are beginning to deliver through 5G and fiber expansions. Furthermore, telecom operators are partnering with municipal authorities to develop smart lighting and surveillance systems, opening new revenue channels beyond traditional voice and data services.

MARKET CHALLENGES

Cybersecurity Threats and Network Vulnerabilities

Cybersecurity threats pose a growing challenge to the Latin American telecom market, as the expansion of digital infrastructure exposes networks to increasing cyberattacks. According to Kaspersky Lab, Latin America experienced a 37% increase in ransomware attacks in 2023, many of which targeted telecom operators and mobile service providers. These incidents disrupt service delivery, compromise user data, and raise operational costs for network security upgrades. Compounding this issue is the shortage of skilled cybersecurity professionals capable of managing advanced threat detection and response systems. The Latin American Cybersecurity Forum reported in 2023 that there is a deficit of over 150,000 trained specialists in the field, leaving telecom companies vulnerable to sophisticated breaches. Moreover, outdated legacy infrastructure in some parts of the region further complicates the implementation of robust security measures.

High Cost of Deployment and Operational Constraints

The high cost of telecom infrastructure deployment remains a significant challenge in the Latin American telecom market, particularly in rural and remote areas. Expanding fiber networks, erecting cell towers, and maintaining last-mile connectivity require substantial capital investment, which many operators find difficult to justify in low-income or sparsely populated regions. According to the World Bank, approximately 20% of Latin American businesses experience frequent power outages, increasing reliance on backup generators and raising operational expenses for telecom firms. Countries like Venezuela and Nicaragua face disruptions exceeding 40 hours per month, further straining network reliability and profitability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.83% |

|

Segments Covered |

By Services, And Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Argentina, Chile, Mexico, Rest of Latin America |

|

Market Leaders Profiled |

Reliance Jio Infocomm, Bharti Airtel, Vodafone Idea Limited, Bharat Sanchar Nigam Limited (BSNL), Mahanagar Telephone Nigam Ltd (MTNL). |

SEGMENTAL ANALYSIS

By Services Insights

The Wireless Voice Services segment holds the largest share of the Latin America telecom market by capturing a 68.9% in 2024. It is also growing at the fastest CAGR of 5.2% from 2025 to 2033. This dominance is primarily driven by the widespread adoption of mobile telephony over traditional fixed-line services, especially in emerging economies where mobile networks offer more accessible and cost-effective communication solutions. A main aspect behind this trend is the high mobile penetration rates across major countries such as Brazil, Mexico, and Colombia. According to the International Telecommunication Union (ITU), mobile cellular subscriptions in Latin America were high among inhabitants in 2023, indicating a strong preference for wireless communication over landline-based voice services. Telecom operators have also enhanced service quality through network modernization and VoLTE support, improving call clarity and reliability.

This swift growth is fueled by continued improvements in network infrastructure and the increasing reliance on mobile voice communications in both urban and rural areas. A primary driver is the expansion of 4G and early-stage 5G networks that support advanced voice services such as VoLTE and VoNR (Voice over New Radio). Moreover, telecom providers are bundling voice minutes with data packages to retain customers and encourage consistent usage. In Mexico, for instance, Telcel and AT&T have introduced hybrid plans that combine unlimited voice with high-speed internet, contributing to increased user retention and service adoption.

COUNTRY-LEVEL ANALYSIS

Brazil maintained the biggest share of the Latin American telecom market by contributing 33.2% in 2024. Positioned as the region’s largest economy and most populous nation, Brazil drives telecom demand through high mobile penetration, expanding broadband coverage, and government-led digital inclusion programs. Digital transformation initiatives are a key enabler of market growth, with Brazilian enterprises increasingly adopting cloud-based communication systems and mobile workforce solutions. As per the Central Bank of Brazil, digital banking transactions surged substantially in 2023, necessitating stable and secure telecom infrastructure to support financial services. Furthermore, the Ministry of Communications has accelerated spectrum auctions to promote 5G deployment. Major carriers like Vivo, TIM Brasil, and Claro have launched commercial 5G services in São Paulo, Rio de Janeiro, and Brasília, signaling a new phase of connectivity-driven economic activity.

Mexico is placed as a strategic bridge between North and Latin America, benefits from strong trade linkages, increasing foreign investment, and a growing domestic demand for mobile and broadband services. A key growth driver is the country’s rapid industrial digitization, particularly in manufacturing and logistics, which rely heavily on real-time communication networks. In addition, Mexico has made significant progress in 5G rollout, supported by transparent spectrum policies and public-private collaboration. The Federal Institute of Telecommunications (IFT) auctioned additional mid-band spectrum in late 2023, enabling operators to improve network performance and support IoT-enabled applications. Major players such as América Móvil, AT&T México, and Telefonica Movistar continue to invest in network upgrades and bundled service offerings.

Argentina, despite economic volatility, remains a notable participant due to its well-established IT workforce, strong academic institutions, and growing digital engagement. A major progress factor is the increasing use of mobile devices for voice and data services. The Argentine National Communications Entity (ENACOM) reported that mobile connections surpassed 52 million in 202, exceeding the country's population and highlighting high multi-SIM card usage and mobile dependency. Regulatory reforms have also played a role in improving investor confidence. Argentina passed a revised data privacy law in 2023 that aligns more closely with international standards, facilitating cross-border data flows and encouraging multinational telecom firms to increase their presence. Buenos Aires is becoming a regional fintech and tech innovation hub, attracting venture capital and prompting startups to adopt mobile-first communication strategies.

Chile is known for its political stability, transparent regulatory framework, and abundant renewable energy. Chile has emerged as a preferred destination for next-generation telecom investments. One main driver is Chile’s leadership in 5G deployment. Additionally, Chile serves as a connectivity hub for South America due to its extensive subsea cable networks linking it to the U.S., Asia, and Europe. These factors contribute to Chile’s sustained presence in the Latin American telecom market, positioning the country as a leader in digital connectivity and network modernization.

Rest of Latin America (RoLA) countries, such as Colombia, Peru, Ecuador, and Costa Rica, each experience varying degrees of telecom development based on economic conditions and policy environments. Colombia is emerging as a focal point within RoLA, supported by government-backed initiatives like “Vive Digital,” which aims to expand broadband access and promote digital entrepreneurship. Peru is also witnessing growth due to improved regulatory clarity and increased foreign direct investment.

KEY MARKET PLAYERS

Reliance Jio Infocomm, Bharti Airtel, Vodafone Idea Limited, Bharat Sanchar Nigam Limited (BSNL), Mahanagar Telephone Nigam Ltd (MTNL). Are the market players that are dominating the Latin American telecom market?

Top Players in the Market

Telefónica S.A. is a leading multinational telecommunications company with a strong presence across Latin America, particularly in Brazil, Argentina, Colombia, and Peru. The company operates under the Movistar brand and offers a comprehensive portfolio of mobile, fixed-line, broadband, and digital services. Telefónica has been instrumental in driving fiber expansion, 5G deployments, and digital transformation initiatives in the region. Its global expertise combined with localized service offerings makes it a key player in shaping telecom infrastructure and innovation across Latin America.

América Móvil is one of the largest telecommunications companies in Latin America, operating under brands such as Claro, Embratel, and NET. Headquartered in Mexico, América Móvil has built an extensive network spanning multiple countries, offering integrated telecom solutions including voice, data, and cloud services. The company plays a crucial role in expanding connectivity to underserved areas while investing heavily in next-generation networks. Its influence extends beyond national borders, contributing significantly to the evolution of regional telecom ecosystems and setting industry benchmarks for service quality and coverage.

Vivo (Telefónica Brasil) is the largest mobile operator in Brazil and a dominant force in the Latin American telecom landscape. As part of Telefónica’s global network, Vivo has led the way in deploying advanced technologies such as 5G, IoT-enabled networks, and enterprise-grade communication solutions. The company's strategic investments in fiber infrastructure and customer-centric digital services have reinforced its leadership position in Brazil and influenced broader market trends in the region. Vivo continues to set the pace for innovation, regulatory compliance, and scalable telecom growth across Latin America.

Top Strategies Used by Key Market Participants

One of the most prevalent strategies among leading telecom players in Latin America is expanding 5G and fiber optic infrastructure to meet growing demand for high-speed connectivity and support digital transformation across industries. Companies are investing heavily in spectrum acquisitions, network modernization, and infrastructure sharing agreements to accelerate deployment and reduce costs.

Another key strategy involves offering bundled services that integrate mobile, broadband, TV, and digital content, allowing operators to enhance customer retention and increase average revenue per user. This convergence approach enables telecom providers to compete more effectively with Over-The-Top (OTT) platforms and other emerging digital service providers.

Lastly, there is a growing emphasis on strategic partnerships and mergers to strengthen market positions and expand reach. Operators are forming alliances with technology firms, cloud providers, and local governments to deploy smart city solutions, rural connectivity projects, and enterprise-grade telecom services tailored to evolving consumer and business needs.

COMPETITION OVERVIEW

The Latin American telecom market is highly competitive, featuring a mix of global giants, regional leaders, and emerging challengers vying for market share in a rapidly evolving digital ecosystem. Established players such as Telefónica, América Móvil, and Vivo dominate due to their vast network coverage, financial strength, and long-standing relationships with regulators and consumers. These companies leverage economies of scale to invest in next-generation infrastructure and introduce innovative service models that cater to both individual users and enterprises.

At the same time, smaller operators and new entrants are leveraging niche offerings, cost-effective plans, and agile digital strategies to carve out space in the market. Regulatory shifts aimed at increasing competition and reducing monopolistic tendencies have further intensified rivalry, prompting companies to differentiate through service quality, pricing, and technological advancements.

Additionally, the rise of Over-The-Top (OTT) communication platforms has disrupted traditional voice and messaging revenues, forcing telecom providers to diversify into value-added services such as cloud-based solutions, cybersecurity, and IoT applications. In this dynamic environment, success depends on adaptability, investment in innovation, and the ability to align with regional economic and policy landscapes.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Telefónica expanded its fiber-to-the-home (FTTH) footprint in Chile, launching high-speed residential internet packages designed to capture market share from cable and satellite providers.

- In March 2024, América Móvil acquired a regional wireless infrastructure provider in Colombia, aiming to enhance network performance and improve service reliability in underserved markets.

- In June 2024, Vivo launched a nationwide 5G standalone pilot program in Brazil, positioning itself at the forefront of next-generation telecom innovation and paving the way for industrial IoT adoption.

- In August 2024, Telefónica partnered with a leading cloud services firm to develop hybrid telecom-cloud solutions tailored for Latin American enterprises seeking digital transformation support.

- In October 2024, América Móvil introduced a new AI-powered customer engagement platform across several Latin American markets, enhancing user experience and improving churn management for mobile and broadband services.

MARKET SEGMENTATION

This research report on the Latin American telecom market is segmented and sub-segmented into the following categories.

By Services

- Wired

- Wireless

By Country

- Brazil

- Argentina

- Chile

- Mexico

- Colombia

Frequently Asked Questions

What’s driving telecom growth in Latin America?

Rising mobile and internet penetration, especially in rural and underserved areas, combined with 5G infrastructure rollouts in Brazil, Mexico, and Chile, are fueling the market’s expansion.

How is 5G deployment progressing across Latin America?

Brazil and Chile lead the region in 5G rollouts, with Colombia and Mexico accelerating spectrum auctions. However, full-scale deployment is challenged by infrastructure gaps and investment hurdles.

What are the main challenges facing telecom providers in the region?

Key issues include high regulatory costs, fragmented rural coverage, spectrum allocation delays, and currency volatility, which impact CAPEX planning and long-term service delivery.

How are telecom operators addressing digital inclusion?

Operators are investing in low-cost smartphones, prepaid data plans, and rural connectivity partnerships, especially through fiber-optic expansions and satellite-based broadband in remote areas.

What role is fintech playing in the telecom sector?

Telcos are increasingly offering mobile wallets, microloans, and payment services—with Claro Pay and Movistar Money gaining traction—as telecom-fintech convergence becomes a major regional trend.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com