MEA Automotive Aftermarket Market Research Report – Segmented By Product, Distribution Channel, Application, And By Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, rest of MEA) - Industry Analysis Size, Share, Trends, COVID-19 Impact & Growth Forecast (2024 to 2032)

MEA Automotive Aftermarket Market Size (2024 to 2032)

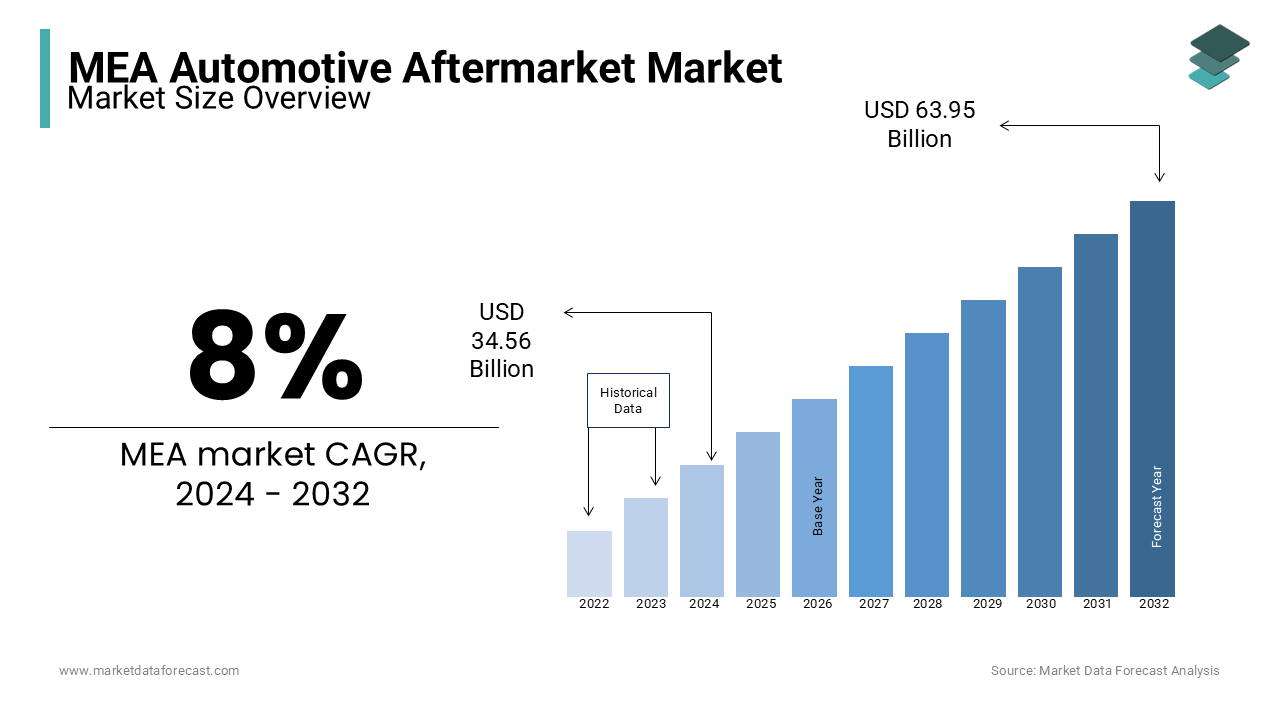

The Middle East and Africa (MEA) automotive aftermarket market was expected to be valued at USD 31.99 billion in 2023 and is anticipated to reach USD 34.56 billion in 2024 from USD 63.95 billion by 2032, growing at a CAGR of 8% during the forecast period from 2024 to 2032.

Demand for commercial vehicles is expected to increase throughout the region due to the recovery of economic conditions in the primary markets. The automotive aftermarket is one of the active, involved, and highly competitive markets that generally involve retail, manufacturing, remanufacturing, and distribution. In addition, the aftersales sector includes the installation of accessories, all vehicle parts, equipment, and chemicals after the OEM sells the product to the buyer. The automotive aftermarket is a diversified business that deals mainly with maintenance, repair, and after-sales service. There are several parts of different quality and prices for different vehicle models.

MARKET DRIVERS

The rise in demand for vehicles is among the main drivers of the MEA automotive aftermarket industry. Developments in the engineering of the vehicle, like options for customization, various paints and coatings, robust components, and engines, which are due to rapid advances in technology, are likely to fuel the regional market during the projection period. The high flexibility in the design of the vehicle is presumed to create immense opportunities for the market boom. Changes in consumer lifestyle coupled with the increase in disposable income are predicted to increase the production and sales of auto parts.

With changing trends and easy customization, customers can use their aftermarket products to replace the original equipment. The need for new and advanced vehicles is increasing the demand for auto parts. The reduction of the costs of the components of the aftermarket is one of the main drivers of market growth. Also, population growth and the increasing use of light cars positively affect the market.

MARKET RESTRAINTS

In contrast, the main limiting factor in the market is legal problems. Besides, as the opening of the automated market increases, market growth is steep.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8% |

|

Segments Covered |

By Product, Distribution Channel, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Denso Corporation, Robert Bosch GmbH, Mitsubishi Electric Corporation, Delphi Automotive Plc, ACDelco, Akebono Brake Industry Co., Ltd, Magna Internation Inc., WABCO, Continental AG, Cooper Tire & Rubber Company, and Others. |

This research report on the MEA automotive aftermarket is segmented and sub-segmented into the following categories.

MEA Automotive Aftermarket Market Analysis By Product

- Wear-and-Tear Parts

- Crash-Relevant Parts

- Accessories

- Diagnostic Products

Of these, the accessories segment held the leading share and is likely to continue the same in the prediction period.

MEA Automotive Aftermarket Market Analysis By Distribution Channel

- Offline

- Online

The offline segment registered the highest part in the local market, owing to the rise in the number of traders, automotive dealerships, garage and service stations, commercial logistics, and retail outlets. However, online sales are also destined to contribute a significant percentage in the coming years.

MEA Automotive Aftermarket Market Analysis By Application

- Commercial Vehicles

- Consumer Vehicles

Both divisions are contributing in a similar manner to the local industry and will continue the same in the envisioned years.

COUNTRY ANALYSIS

- KSA

- UAE

- Israel

- Rest of the GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

MEA Automotive Aftermarket Market business is geographically classified in countries like Saudi Arabia, Iran, United Arab Emirates, and Oman, and customers want to modify and improve the performance of their vehicles by customizing and enhancing the appearance of the cars. In recent years, many vehicle modifications have been requested, especially among young people in the region. This trend is supposed to continue in the foreseen years, augmenting the demand for auto parts in the Middle East and Africa.

KEY PLAYERS IN THE MEA AUTOMOTIVE AFTERMARKET MARKET

Denso Corporation, Robert Bosch GmbH, Mitsubishi Electric Corporation, Delphi Automotive Plc, ACDelco, Akebono Brake Industry Co., Ltd, Magna Internation Inc., WABCO, Continental AG, Cooper Tire & Rubber Company. These are the market players that dominate the global MEA automotive aftermarket.

MARKET RESEARCH METHODOLOGY

Secondary Research The first phase of the research process is extensive secondary research and identification of the related intelligence. Secondary data is compiled from various sources. Extensive secondary research helps in generating hypotheses and identifying critical areas of interest that are investigated through primary research.

Primary Research This entails conducting hundreds of primary interviews with industry participants and commentators in order to validate the data points obtained from secondary research and to fill the data gaps. A primary interview provides first-hand information on the market size, market trends, growth trends, competitive landscape, future outlook, etc. It also helps in deciding the scope and deliverables of the study in terms of the requirements of the market. Primary research involves e-mail interactions, telephonic interviews as well and face-to-face interviews for each market, category, segment, and sub-segment across geographies.

MARKET REPORT HIGHLIGHTS

- Evaluation of the current stage of the market and future implications of the market based on the detailed observation of recent key developments.

- Address the matter by better understanding the market size estimates through CAGR analysis to forecast the future market.

- Comprehensive segmentation of the market, the detailed evaluation of the market by further sub-segments.

- Address Market Drivers and restraints and provide insights for gaining market share.

- Porter’s Five Forces are used to analyze the factors responsible for the shaping of the industry as it is a result of a competitive environment.

RECENT HAPPENINGS IN THE MEA AUTOMOTIVE AFTERMARKET

- November 2018: GAA (Gulf Advantage Automobiles), which imported Renault cars from Saudi Arabia, launched a new Renault Duster SUV on the market.

- July 2018: Toyota distributor in Saudi Arabia, Abdul Latif Jameel Motors, launches a new Toyota Rush.

- In 2017, the government of Qatar established a $ 44 million tire recycling plant to recycle tires and other rubber materials into new products.

- Karwa Motors plans to produce Oman's first assembled buses in 2020, and the company plans to build 1,000 buses each year when Phase 1 operations begin.

- In May 2018, Saudi Arabian National Tire Company (NTC) announced plans to build a tire manufacturing plant in Jubail by 2020, which will be able to produce 20 million tires per year.

- November 2018: Tata Motors has launched two models, Tata NEXON and Tata HEXA in Tanzania through the distributor Tata Africa Holdings (Tanzania) Limited.

- June 2018: Ford presents the new sedan peak model in the South African market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com