Middle East and Africa Mushroom Cultivation Market Size, Share, Trends & Growth Forecast Report By Type (Oyster Mushroom, Button Mushroom, Shiitake Mushroom and Others) and Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan and Rest of Middle East and Africa), Industry Analysis From 2025 To 2033

Middle East and Africa Mushroom Cultivation Market Size

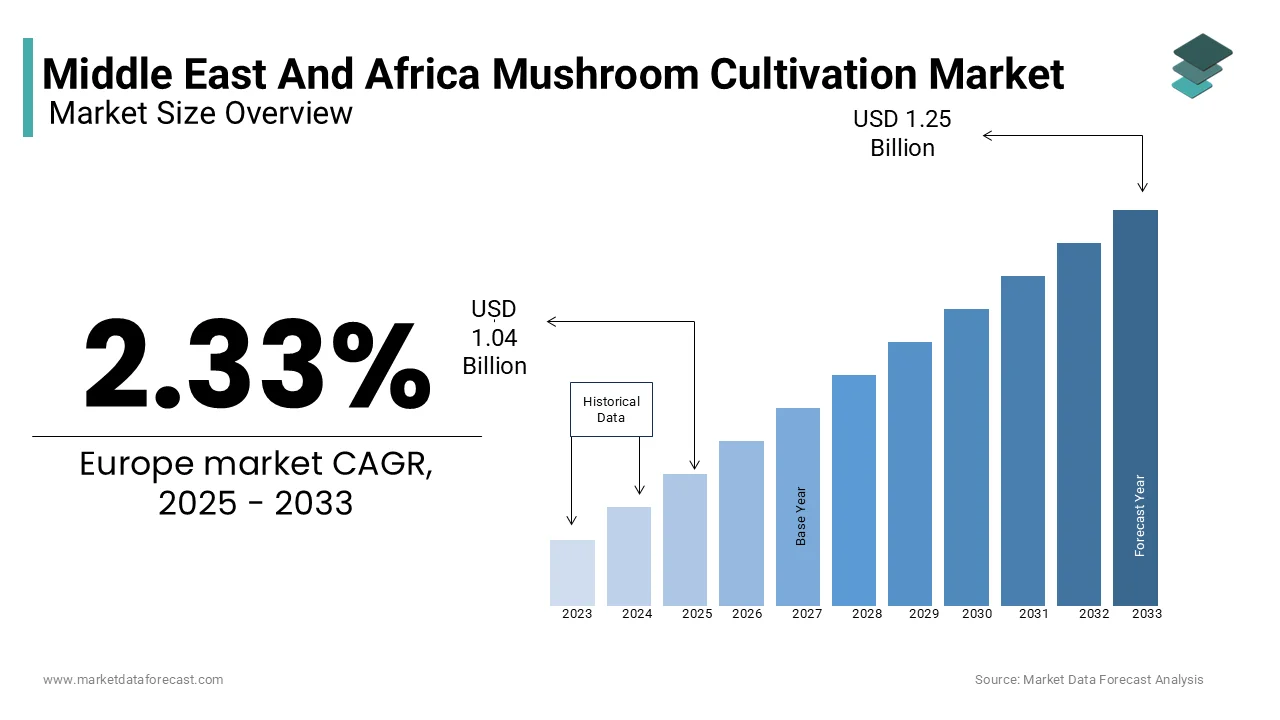

The mushroom cultivation market size in the Middle East and Africa was valued at USD 1.02 billion in 2024 and is anticipated to reach USD 1.04 billion in 2025 from USD 1.25 billion by 2033, growing at a CAGR of 2.33% during the forecast period from 2025 to 2033.

Mushrooms are rich in protein, vitamins, and minerals and this is making them a vital dietary component in regions grappling with food insecurity and malnutrition. According to the Food and Agriculture Organization (FAO), sub-Saharan Africa faces a protein deficiency rate of over 30%, underscoring the need for sustainable protein sources like mushrooms. The MEA mushroom cultivation market is also gaining traction due to its relatively low resource requirements compared to traditional agriculture. For instance, mushrooms can be grown on agricultural waste, such as straw and sawdust, reducing the strain on arable land and water resources.

The mushroom market in the Middle East and Africa is majorly driven by the growing urbanization, rising health consciousness, and increasing investments in agribusiness. South Africa, Egypt, and the UAE are leading adopters, leveraging advanced cultivation techniques to meet domestic and export demands. The International Trade Centre reports that the global mushroom market was valued at $50 billion in 2022, with the MEA region contributing approximately 5% to this figure. As climate change intensifies and arable land diminishes, mushroom cultivation offers a viable solution to food security challenges while fostering economic growth.

MARKET DRIVERS

Rising Demand for Nutritious and Sustainable Food Sources in Middle East and Africa

The escalating demand for nutritious and sustainable food sources is a primary driver propelling the MEA mushroom cultivation market. According to the World Health Organization, over 25% of the population in sub-Saharan Africa suffers from micronutrient deficiencies, creating an urgent need for nutrient-dense foods. Mushrooms, being rich in essential nutrients like vitamin D, selenium, and potassium, are increasingly recognized as a cost-effective solution. The African Development Bank highlights that mushroom consumption in urban areas has surged by 15% annually since 2018, driven by health-conscious consumers. Furthermore, mushrooms require significantly fewer resources than traditional crops; for example, they consume 90% less water than wheat production, as per the International Water Management Institute. This sustainability factor aligns with regional initiatives to combat water scarcity and desertification, particularly in arid nations like Saudi Arabia and Israel.

Government Support and Investment in Agribusiness

Government support and investment in agribusiness are further contributing to the growth of mushroom cultivation across the MEA region. The United Arab Emirates’ Ministry of Climate Change and Environment has allocated over $100 million to promote sustainable agriculture, including mushroom farming. Similarly, Ethiopia’s Agricultural Transformation Agency reports that small-scale mushroom farms have received subsidies and training programs, enabling rural communities to generate income while addressing food shortages. According to the African Union’s Comprehensive Africa Agriculture Development Programme, mushroom cultivation projects have created over 100,000 jobs in East Africa alone. These initiatives not only enhance food security but also empower marginalized groups, such as women and youth, by providing accessible livelihood opportunities.

MARKET RESTRAINTS

Limited Awareness and Technical Expertise

Limited awareness and technical expertise among farmers are a major restraint to the expansion of mushroom cultivation in the MEA region. A survey conducted by the African Farmers’ Association reveals that only 20% of smallholder farmers in rural areas are familiar with modern mushroom farming techniques. This knowledge gap often results in poor yields and contamination risks, discouraging potential investors. For instance, improper sterilization of substrates can lead to fungal infections, reducing crop viability by up to 40%, according to the International Society for Mushroom Science. Additionally, the lack of formal education and training programs exacerbates the problem, particularly in remote areas where access to agricultural extension services is limited. The United Nations Development Programme notes that bridging this awareness deficit requires substantial investment in capacity-building initiatives, which remains a challenge in underfunded regions.

High Initial Capital Requirements

High initial capital requirements for establishing mushroom farms act as a deterrent to market entry, especially for small-scale producers. The African Agricultural Technology Foundation estimates that setting up a medium-sized mushroom farm costs between $20,000 and $50,000, excluding ongoing operational expenses. This financial burden is compounded by the need for specialized equipment, such as climate-controlled growing rooms and automated irrigation systems. In countries like Sudan and Kenya, where access to affordable credit is limited, aspiring entrepreneurs struggle to secure funding. According to the World Bank, less than 10% of agricultural businesses in sub-Saharan Africa receive formal loans, stifling innovation and scalability. While government grants and international aid programs aim to alleviate these challenges, their reach remains insufficient to meet the growing demand for mushroom cultivation infrastructure.

MARKET OPPORTUNITIES

Growing Export Potential to Global Markets

The growing export potential to global markets is a lucrative opportunity for the MEA mushroom cultivation market. As per the European Commission, Europe imports over 60% of its fresh mushrooms, creating a significant demand for high-quality produce from regions like South Africa and Egypt. According to the International Trade Centre, South Africa exported $15 million worth of mushrooms in 2022, with key markets including the UK, Germany, and France. Similarly, Egypt’s strategic location as a gateway to Europe and the Middle East positions it as a competitive exporter. Advances in cold chain logistics and packaging technologies have further enhanced the shelf life and quality of exported mushrooms, boosting profitability. By tapping into these international markets, MEA producers can diversify revenue streams and establish themselves as key players in the global mushroom trade.

Adoption of Vertical Farming Technologies

The adoption of vertical farming technologies offers immense potential to revolutionize mushroom cultivation in the MEA region. Vertical farming allows for year-round production in controlled environments, mitigating the impacts of climate variability and land scarcity. The International Food Policy Research Institute states that vertical farms can increase yield per square meter by up to 300% compared to traditional methods. Countries like the UAE and Israel are pioneering this approach, with Dubai-based startups investing over $50 million in vertical mushroom farms. According to the Middle East Green Building Council, these systems reduce water usage by 70% and energy consumption by 40%, aligning with regional sustainability goals. As urban populations grow, vertical farming not only meets local demand but also reduces reliance on imports, fostering self-sufficiency.

MARKET CHALLENGES

Climate-Related Risks and Resource Scarcity

Climate-related risks and resource scarcity is a major challenge to mushroom cultivation in the MEA region. The Intergovernmental Panel on Climate Change warns that rising temperatures and erratic rainfall patterns could reduce agricultural productivity by 20% over the next decade. Mushrooms, though resilient, require specific humidity and temperature conditions, making them vulnerable to extreme weather events. For instance, prolonged droughts in Ethiopia have disrupted substrate availability, forcing farmers to rely on imported materials at higher costs. The African Climate Policy Centre reports that over 60% of mushroom farms in arid regions face seasonal closures due to water shortages. Additionally, limited access to renewable energy sources hinders the adoption of climate-controlled systems, exacerbating operational inefficiencies. Addressing these challenges requires innovative solutions and cross-sector collaboration.

Competition from Imported Mushrooms

Competition from imported mushrooms threatens the growth of local cultivation efforts in the MEA region. The International Monetary Fund states that imported mushrooms account for nearly 40% of the total market share in countries like Kenya and Nigeria. Chinese and European suppliers dominate these imports, offering lower prices due to economies of scale and advanced production techniques. According to the African Economic Outlook, local producers struggle to compete, with profit margins shrinking by 25% in the past five years. This competition undermines investments in domestic infrastructure and discourages new entrants. To counteract this trend, governments must implement protective tariffs and promote “buy local” campaigns to bolster indigenous industries.

SEGMENTAL ANALYSIS

By Type

The button mushrooms segment accounted for the 46.4% of the Middle East and African market share in 2024. The versatility in culinary applications and widespread consumer acceptance of button mushrooms is majorly driving the lead of the segment in this regional market. According to the South Africa’s Department of Agriculture, button mushroom production has grown by 12% annually since 2019, driven by urbanization and changing dietary habits. These mushrooms are cultivated using cost-effective techniques, such as compost-based substrates, which reduce production costs by 30%. Additionally, their short cultivation cycle of 4-6 weeks ensures rapid returns on investment, attracting both smallholders and commercial growers.

The oyster mushrooms segment is another major segment and is anticipated to register a promising CAGR over the forecast period. The adaptability of oyster mushrooms to diverse climates and substrates, such as maize stalks and sugarcane bagasse is majorly boosting the expansion of the segment in this regional market. Kenya’s Ministry of Agriculture highlights that oyster mushroom farms have expanded by 25% annually in rural areas, creating employment opportunities for women and youth. Their high protein content and medicinal properties, including immune-boosting compounds, have increased consumer interest. The International Centre for Tropical Agriculture reports that oyster mushrooms fetch premium prices in urban markets, driving profitability. As awareness of their health benefits spreads, oyster mushrooms are poised to become a cornerstone of sustainable agriculture in the MEA region.

REGIONAL ANALYSIS

Saudi Arabia is a frontrunner in the Middle East and Africa mushroom activation market, holding the leading share of the regional market. The country's growing interest in diversifying its economy beyond oil has led to increased investments in agriculture, including mushroom cultivation. According to the Saudi Ministry of Environment, Water, and Agriculture, the government aims to enhance food security and promote sustainable agricultural practices, which includes the cultivation of mushrooms as a nutritious food source. The rising health consciousness among consumers has also contributed to the demand for mushrooms, known for their nutritional benefits. Furthermore, the establishment of modern farming techniques and facilities has made mushroom production more efficient, positioning KSA as a leader in the region's mushroom activation market.

The UAE accounts for a substantial share of the mushroom activation market in the Middle East and Africa. The country's strategic location as a trade hub and its diverse population have fostered a growing demand for various food products, including mushrooms. The UAE's Ministry of Climate Change and Environment has reported a significant increase in local agricultural production, with mushrooms being a key focus due to their health benefits and culinary versatility. The rise of urban farming initiatives and vertical farming technologies has further enhanced mushroom cultivation in the region. Additionally, the UAE's commitment to food security and sustainability, particularly in light of the COVID-19 pandemic, has led to increased investments in local food production, making it a vital player in the mushroom activation market.

South Africa is expected to account for a considerable share of the Middle East and Africa mushroom cultivation market over the forecast period due to its well-established agricultural industry. The country is known for its diverse agricultural practices, including mushroom farming, which has gained popularity due to the increasing demand for healthy food options. According to the South African Department of Agriculture, Forestry and Fisheries, the mushroom industry has seen consistent growth, with production reaching over 20,000 tons annually. The rising health awareness among consumers and the growing trend of plant-based diets have further fueled the demand for mushrooms. Additionally, South Africa's favorable climate conditions and availability of agricultural land support the expansion of mushroom cultivation, positioning it as a key player in the regional market.

Egypt holds a notable position in the mushroom activation market in the Middle East and Africa, with a growing interest in mushroom cultivation as a sustainable food source. The Egyptian Ministry of Agriculture has reported an increase in local mushroom production, driven by rising consumer awareness of the health benefits associated with mushrooms. The country's agricultural sector is vital to its economy, contributing approximately 11% to the GDP, and mushrooms are increasingly recognized for their potential to enhance food security. The government has also initiated programs to promote modern farming techniques, which include mushroom cultivation. The combination of a large population and a growing middle class seeking diverse food options positions Egypt as an emerging player in the mushroom activation market.

KEY MARKET PLAYERS

Some of the key players in the mushroom cultivation market are Smithy Mushrooms Ltd., Italspwan, Mushroom SAS, Monaghan Mushrooms, Rheinische Pilz Zentrale GmbH, Mycelia, Walsh Mushrooms Group, South Mill Mushrooms Sales, Hirano Mushroom LLC, and Fujishukin Co. Ltd.

MARKET SEGMENTATION

This research report on the Middle East and Africa mushroom cultivation market is segmented and sub-segmented into the following categories.

By Type

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Other Types

- Nameko

- Maitake

- Enoki

- Mane

- Straw

- Shimji

By Country

- KSA

- UAE

- Israel

- Rest of the GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com