Global Molybdenum Market Size, Share, Trends, & Growth Forecast Report Segmented By End-user Industry (Oil and Gas, Chemicals and Petrochemicals, Automotive, Mechanical Engineering, Building and Construction, Power Generation, Aerospace and Defence, Electronics and Medical, Process Industry, and Other Industries), Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Molybdenum Market Size

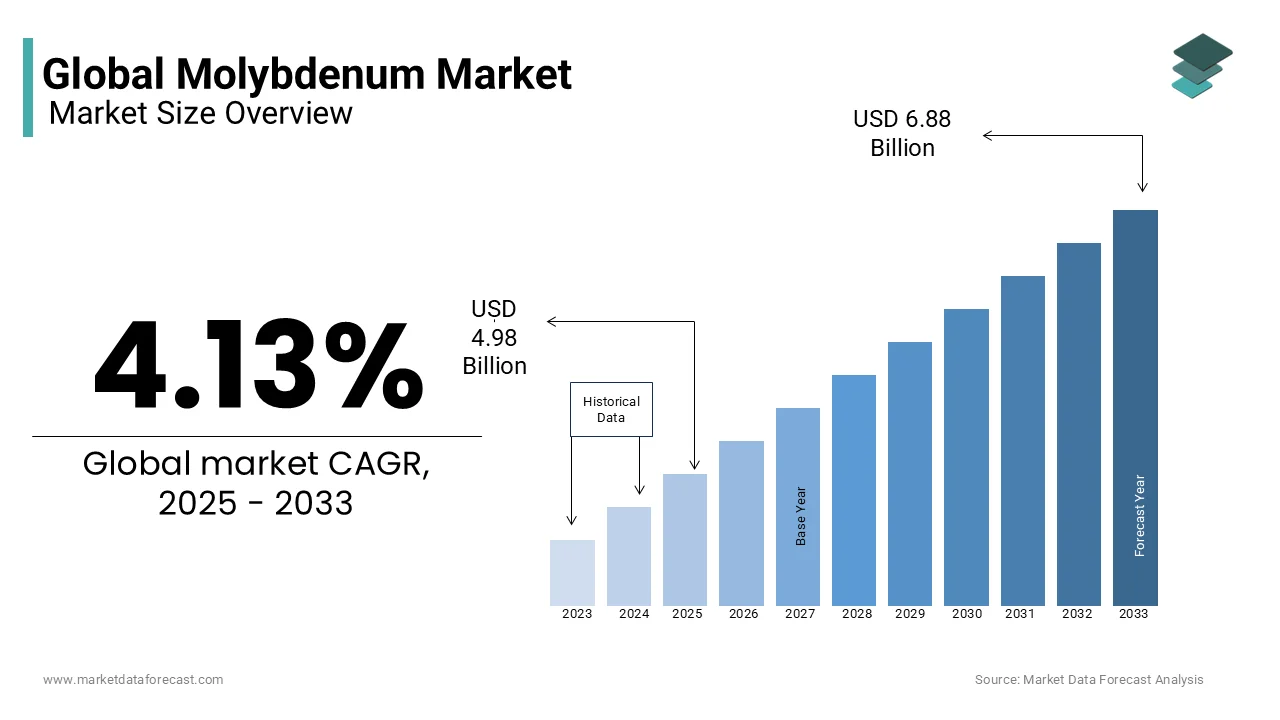

The global Molybdenum market size was valued at USD 4.78 billion in 2024 and is projected to grow from USD 4.98 billion in 2025 to USD 6.88 billion by 2033, the market is expected to grow at a CAGR of 4.13% during the forecast period.

Molybdenum is a refractory metal known for its remarkable strength, high melting point of 2,623°C (4,753°F), and exceptional resistance to corrosion and wear. These properties make it a crucial element in various industrial applications as an alloying agent to enhance the performance of steel and superalloys. Molybdenum improves the strength, hardness, and resistance of materials to extreme temperatures and corrosive environments to make it indispensable in sectors like aerospace, automotive, construction, and energy. Beyond metallurgy, molybdenum is vital in the chemical industry, where it functions as a catalyst in petroleum refining and in the production of lubricants and pigments. Biologically, molybdenum is an essential trace element for humans, animals, and plants. It plays a critical role in enzymatic processes for those involved in nitrogen fixation in plants and the metabolism of sulfur-containing amino acids in humans. The Recommended Dietary Allowance (RDA) for molybdenum in adults is 45 micrograms per day, according to the National Institutes of Health. Deficiencies, though rare, can lead to metabolic disorders.

Environmentally, the widespread industrial use of molybdenum raises concerns about its accumulation in soil and water, potentially affecting ecosystems. However, its relatively low toxicity compared to other heavy metals makes it less hazardous under typical exposure conditions. As industries increasingly prioritize sustainability, efforts are underway to optimize molybdenum recycling and minimize its environmental footprint.

MARKET DRIVERS

Rising Demand in the Energy Sector

The growing global focus on energy infrastructure, particularly in the oil, gas, and nuclear industries is a major driver of the molybdenum market. Molybdenum’s exceptional heat resistance and corrosion-proof properties make it indispensable in the production of pipelines, drilling equipment, and nuclear reactors. In nuclear power plants, molybdenum alloys are critical for withstanding extreme temperatures and radiation. According to the International Energy Agency, global nuclear energy capacity is expected to grow by 17% between 2020 and 2030 which is boosting demand for molybdenum-based materials. Additionally, with over 70% of molybdenum consumption linked to energy-related infrastructure as per the U.S. Geological Survey), any expansion in energy projects significantly impacts molybdenum demand.

Growth in the Aerospace and Defense Industries

Molybdenum’s unique properties, including high tensile strength and lightweight characteristics, have made it a key component in aerospace and defense applications. It is used in aircraft parts, missile components, and high-temperature-resistant coatings, where durability and performance are crucial. The Federal Aviation Administration reported a projected annual growth of 4.3% in global aerospace manufacturing through 2035 which is posing an increased demand for high-performance materials like molybdenum. Similarly, defense spending continues to rise globally, with the Stockholm International Peace Research Institute noting a 3.7% increase in global military expenditure in 2022 is further driving molybdenum demand in defense technologies.

MARKET RESTRAINTS

Volatility in Raw Material Prices

The molybdenum market is highly susceptible to fluctuations in raw material prices, driven by global economic conditions, mining output variations, and geopolitical factors. Since molybdenum is often produced as a byproduct of copper mining, shifts in copper production directly impact its supply and pricing. For example, disruptions in major mining regions like Chile, which accounted for approximately 20% of global molybdenum production according to the United States Geological Survey, can lead to sharp price volatility. In 2021, molybdenum prices surged by over 60% due to supply chain constraints and rising production costs which is affecting profitability for industries reliant on this metal. This unpredictability in pricing poses a significant restraint for long-term industrial planning and investment.

Environmental Regulations and Mining Restrictions

Stringent environmental regulations concerning mining activities and waste management are increasingly restricting molybdenum production. Governments are enforcing stricter controls on emissions, water usage, and land rehabilitation, especially in key producing countries. For instance, China, the largest molybdenum producer, has introduced rigorous environmental policies which is leading to temporary shutdowns of several mines. The Environmental Protection Agency in the U.S. has also tightened regulations on mining waste, which increases operational costs and complicates the approval process for new projects. These regulatory pressures can slow production growth, limit supply, and ultimately constrain market expansion.

MARKET OPPORTUNITIES

Expansion in Electric Vehicle (EV) Production

The rapid growth of the electric vehicle (EV) industry presents a significant opportunity for the molybdenum market. Molybdenum is used in the production of lightweight, high-strength steel for EV chassis and battery enclosures, improving vehicle efficiency and safety. Additionally, it enhances the performance of electrical contacts and components within battery systems. The International Energy Agency reported that global EV sales surpassed 10 million units in 2022 with 55% increase from the previous year, and projections indicate continued exponential growth. The demand for molybdenum-based components is expected to rise substantially by attributing metal as a key player in the sustainable transportation revolution.

Advancements in Medical and Healthcare Technologies

The increasing use of molybdenum in medical technologies, particularly in diagnostic imaging and radiology, is creating new market opportunities. Molybdenum is a key material in X-ray tube anodes and mammography equipment due to its ability to withstand high temperatures and generate precise imaging. The National Institutes of Health highlights the growing reliance on advanced diagnostic tools, driven by rising healthcare demands and aging populations. Furthermore, molybdenum isotopes are critical in nuclear medicine for cancer treatment and imaging procedures. As global healthcare expenditures are projected to grow by 5.4% annually, according to the World Health Organization, the molybdenum market is poised to benefit from increased investments in medical infrastructure and technologies.

MARKET CHALLENGES

Dependence on Byproduct Production

A significant challenge for the molybdenum market is its heavy reliance on byproduct production from copper mining. Since molybdenum is often extracted as a secondary product, fluctuations in copper demand and mining activities directly influence its availability. For instance, when copper prices fall, mining operations may slow down is leading to reduced molybdenum output regardless of its own market demand. The United States Geological Survey reports that approximately 60% of molybdenum is produced as a byproduct of copper mining. This dependence makes molybdenum supply vulnerable to external factors beyond its market control by causing potential shortages and contributing to price volatility, which complicates long-term planning for industries dependent on stable molybdenum supplies.

Limited Recycling Infrastructure

Despite molybdenum's recyclability, the global recycling infrastructure for this metal remains underdeveloped, posing a challenge to sustainable supply chains. Molybdenum recycling rates are significantly lower compared to other industrial metals like aluminum or steel is limiting the potential to reduce reliance on primary extraction. The International Molybdenum Association notes that less than 25% of molybdenum used in industrial applications is recovered and reused. This gap is attributed to technological barriers in efficiently separating molybdenum from complex alloys and a lack of standardized recycling processes. The absence of robust recycling systems may hinder the industry's ability to meet future supply needs sustainably.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.13% |

|

Segments Covered |

By End-User Industry, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BHP Billiton Group, Jinduicheng Molybdenum Co., American CuMo Mining, Thompson Creek metals, Moly Metal LLP, ENF Ltd., Compania Minera Dona Ines De Collahuasi S.C.M., Freeport McMoran, and others. |

SEGMENT ANALYSIS

By End-user Industry Insights

The oil and gas industry held the prominent share of 30.1% global molybdenum market share in 2024. The superior resistance of molybdenum to corrosion and high temperatures makes it essential in drilling equipment, pipelines, and refining infrastructure. In offshore drilling and deep-water exploration, molybdenum-containing stainless steels are crucial for preventing corrosion under extreme conditions. As global energy demand continues to rise, with the International Energy Agency forecasting a 15% increase in oil and gas infrastructure investment by 2030, the reliance on molybdenum for maintaining the durability and efficiency of critical components reinforces its dominance in this sector.

The electronics and medical industry segment is anticipated to progress at a CAGR of 6.5% over the forecast period. In electronics, molybdenum is vital in the production of thin-film transistors, semiconductors, and solar cells due to its excellent conductivity and thermal stability. In the medical field, molybdenum is used in diagnostic imaging, X-ray tubes, and cancer treatments through its isotopes. The World Health Organization highlights an increase in global healthcare spending is expected to grow at 5.4% annually while the electronics sector is rapidly expanding with semiconductor demand projected to rise by 7% annually, as reported by the Semiconductor Industry Association. This dual growth drives molybdenum’s accelerated adoption in these advanced technologies.

By Application Insights

The stainless steel segment led the market and had 36.6% of global market share in 2024. Molybdenum enhances stainless steel’s strength, corrosion resistance, and ability to withstand extreme temperatures by making it essential for industries like construction, chemical processing, and marine engineering. The U.S. Geological Survey highlights that molybdenum-containing stainless steel is widely used in infrastructure projects due to its durability and low maintenance costs. The metal's role in increasing the longevity and performance of stainless steel products sustains its dominance in rapidly urbanizing regions where demand for high-performance construction materials is strong.

The catalysts segment is estimated to expand at the highest CAGR of 5.8% from 2025 to 2033. Molybdenum-based catalysts are critical in petroleum refining where they are used for hydrodesulfurization to remove sulfur from fuels, ensuring compliance with increasingly stringent environmental regulations. The U.S. Environmental Protection Agency reports that global sulfur limits for fuels have been drastically reduced to as low as 10 ppm in many regions, boosting the demand for efficient catalytic processes. Additionally, molybdenum catalysts play a growing role in chemical manufacturing and renewable energy applications which further accelerating growth in this segment.

REGIONAL ANALYSIS

Asia-Pacific held the largest share of 40.1% of the global market in 2024. The dominance of Asia-Pacific in the global market is primarily driven primarily by China, the world’s leading producer and consumer of molybdenum where rapid industrialization and robust steel production fuel demand. The International Molybdenum Association highlights that China alone contributes to more than 35% of global molybdenum production. Additionally, countries like Japan and South Korea, with their advanced automotive and electronics industries, significantly contribute to regional consumption. The growth in infrastructure, energy projects, and manufacturing sectors across emerging economies further cements Asia-Pacific’s leadership in the global molybdenum market.

The Middle East and Africa region is projected to register a CAGR of 6.2% from 2025 to 2033. The large-scale energy infrastructure projects, including oil and gas exploration that heavily rely on molybdenum for pipelines and drilling equipment due to its corrosion resistance is driving the market growth in this region. Additionally, significant investments in industrial diversification in Saudi Arabia's Vision 2030 initiative which are promoting non-oil sectors like construction and manufacturing, further increasing molybdenum demand. The expansion of mining activities in African countries, such as the Democratic Republic of Congo is also expected to bolster regional supply and stimulate market growth.

North America is expected to witness steady growth, supported by strong demand in aerospace, defense, and energy sectors. The U.S. Geological Survey notes that the United States is one of the top molybdenum producers with a focus on high-performance alloys for advanced technologies. Europe, with its stringent environmental regulations and focus on sustainable energy, will see moderate growth as molybdenum catalysts are increasingly used in refining and renewable energy applications. Latin America, led by Chile is one of the largest molybdenum producers will continue to benefit from mining activities though market growth may be tempered by political and environmental challenges affecting the mining sector.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

BHP Billiton Group, Jinduicheng Molybdenum Co., American CuMo Mining, Thompson Creek metals, Moly Metal LLP, ENF Ltd., Compania Minera Dona Ines De Collahuasi S.C.M., Freeport McMoran are playing a dominating role in the global molybdenum market.

The global molybdenum market is characterized by moderate to high competition, driven by the presence of both diversified mining conglomerates and specialized molybdenum producers. Major players such as BHP Billiton Group, Jinduicheng Molybdenum Co., and Freeport-McMoRan Inc. dominate the market due to their extensive resource bases, integrated operations, and technological advancements. These companies leverage vertical integration, securing control over mining, refining, and distribution, which enhances operational efficiency and supply chain resilience.

Competition intensifies as firms strive to expand their market share through strategic mergers, acquisitions, and geographic diversification, particularly targeting emerging markets in Asia-Pacific and Africa. Companies are also focusing on sustainability initiatives, incorporating environmentally friendly mining practices to align with stricter global regulations and appeal to environmentally conscious consumers.

Smaller and regional players, such as American CuMo Mining and Moly Metal LLP, compete by specializing in niche markets, offering customized molybdenum products for specific applications in industries like catalysts, superalloys, and electronics.

STRATEGIES USED BY THE MARKET PLAYERS

Vertical Integration and Diversification of Operations

Leading companies such as Jinduicheng Molybdenum Co. and Freeport-McMoRan Inc. have adopted vertical integration strategies to control the entire molybdenum value chain—from mining to processing and distribution. This approach enhances operational efficiency, reduces reliance on third-party suppliers, and ensures consistent quality and supply. Diversification into related minerals, like copper and rare earth elements, also buffers these companies against molybdenum price volatility, ensuring financial stability and sustained growth.

Strategic Mergers and Acquisitions

Key players are leveraging mergers and acquisitions to expand their market footprint and resource base. For instance, BHP Billiton Group has a history of acquiring mining assets to diversify its portfolio and increase molybdenum byproduct production from its copper mining operations. Acquisitions enable companies to access new reserves, reduce competition, and achieve economies of scale, strengthening their global market position.

Technological Innovation and Sustainability Initiatives

Companies like Freeport-McMoRan are investing heavily in advanced mining technologies and sustainable practices to optimize extraction processes, reduce environmental impact, and comply with tightening global regulations. Automation, digitization, and efficient resource management are key focus areas. These innovations not only improve operational efficiency but also align with global sustainability trends, enhancing brand reputation and long-term viability.

Expansion into Emerging Markets

Key players are increasingly targeting emerging markets, particularly in Asia-Pacific and Africa, to tap into growing industrial and infrastructure development. By establishing partnerships and joint ventures with local firms, companies like Jinduicheng Molybdenum Co. are expanding their customer base and securing new revenue streams. This geographic diversification helps mitigate risks associated with regional economic fluctuations.

Long-term Supply Contracts and Strategic Partnerships

To ensure stable revenue streams, companies are entering into long-term supply agreements with major end-users in the steel, aerospace, and energy sectors. These partnerships help secure consistent demand and foster collaborative product development, particularly for high-performance alloys and specialized molybdenum applications. This strategy also helps in mitigating risks from short-term market fluctuations and building strong client relationships.

TOP 3 PLAYERS IN THE MARKET

BHP Billiton Group

BHP Billiton Group, one of the world’s largest mining companies, plays a significant role in the global molybdenum market. While primarily known for its diversified portfolio in iron ore, copper, and coal, BHP’s copper mining operations, particularly at the Escondida mine in Chile—the world’s largest copper mine—produce substantial molybdenum as a byproduct. According to the company’s annual reports, BHP contributes significantly to global molybdenum supply through these operations. Its large-scale, technologically advanced mining techniques and commitment to sustainable practices position BHP as a major player influencing molybdenum production and pricing trends worldwide.

Jinduicheng Molybdenum Co., Ltd.

Jinduicheng Molybdenum Co., based in China, is the largest molybdenum producer globally, controlling a significant portion of the market. The company operates extensive mining, processing, and refining facilities and supplies molybdenum products for use in steel manufacturing, chemicals, and electronics. According to the International Molybdenum Association, Jinduicheng accounts for a substantial share of China’s molybdenum output, which represents more than 35% of global production. The company's vertical integration and dominance in both domestic and international markets make it a pivotal force in setting global molybdenum supply dynamics and pricing structures.

Freeport-McMoRan Inc.

Freeport-McMoRan Inc., a leading U.S.-based mining company, is a major contributor to the global molybdenum market through its operations at the Climax and Henderson mines in Colorado, two of the largest primary molybdenum mines in the world. The U.S. Geological Survey ranks Freeport-McMoRan among the top producers globally, with the company supplying molybdenum for applications ranging from aerospace to energy. Its focus on sustainable mining practices, coupled with substantial investments in technological innovation, enables Freeport-McMoRan to maintain a strong market presence and contribute significantly to the stability of global molybdenum supply chains.

RECENT HAPPENINGS IN THE MARKET

- In November 2024, BHP Billiton Group announced plans to invest up to $14 billion in expanding its Chilean copper operations, particularly at the Escondida mine. This investment aims to boost annual copper output by 430,000 to 540,000 tonnes, with molybdenum production increasing as a byproduct. The expansion will help offset declining ore grades and strengthen BHP's position in the global molybdenum market.

- In July 2023, Jinduicheng Molybdenum Group Co., Ltd. expanded its operations by launching advanced processing and metallurgical facilities in Shaanxi Province, China. These facilities, now the largest in Asia, aim to enhance production efficiency and meet growing global demand. With this expansion, Jinduicheng solidified its position as a leading player in the global molybdenum market, capturing 8% of the world’s molybdenum share and strengthening partnerships with Fortune 500 companies.

- In September 2022, Freeport-McMoRan implemented sustainability initiatives at its Climax Mine in Colorado, introducing advanced water recycling technologies. This move was designed to reduce environmental impact and promote sustainable molybdenum extraction.

- In April 2023, ENF Ltd. invested in renewable energy applications, focusing on R&D for molybdenum use in solar technologies. This initiative aimed to position ENF Ltd. in the rapidly growing renewable energy sector.

- In December 2020, Freeport-McMoRan acquired the Kisanfu Project in the Democratic Republic of Congo. This acquisition secured access to molybdenum-rich resources, diversifying the company’s mining portfolio and strengthening its market position.

- In May 2022, Jinduicheng Molybdenum Co. formed a strategic alliance with Baosteel, one of China’s largest steel producers. This partnership aimed to secure long-term molybdenum supply agreements and foster collaborative development of high-performance alloys.

MARKET SEGMENTATION

This research report on the global molybdenum market has been segmented and sub-segmented based on end product, end-user industry, and region.

By End-user Industry

- Oil and Gas

- Chemicals and Petrochemicals

- Automotive

- Mechanical Engineering

- Building and Construction

- Power Generation

- Aerospace and Defence

- Electronics and Medical

- Process Industry

- Other Industries

By Application

- Full Alloy

- Stainless Steel

- HSLA

- Tools

- Carbon

- Cast Iron

- Catalysts

- MO Metal Alloy

- Super alloy

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the primary applications driving the demand for molybdenum?

Molybdenum is widely used in the steel industry for strengthening alloys, in the aerospace and automotive sectors for high-performance components, and in the chemical industry for catalysts, lubricants, and electronics manufacturing.

2. Which regions dominate the global molybdenum market?

China, North America, and Europe lead the molybdenum market due to significant mining operations, high steel production, and increasing demand from industrial sectors. China, in particular, is the largest producer and consumer.

3. What are the key challenges affecting molybdenum production and supply?

Challenges include fluctuating raw material prices, environmental regulations on mining activities, geopolitical tensions affecting supply chains, and the need for sustainable extraction methods.

4. How is molybdenum contributing to advancements in energy and sustainability?

Molybdenum is essential in clean energy technologies such as wind turbines, solar panels, and nuclear reactors. It is also used in catalytic converters for reducing emissions and in advanced batteries for energy storage.

5. What are the emerging trends in the molybdenum market?

Key trends include the growing demand for molybdenum in 3D printing, increasing use in medical implants, rising adoption in electric vehicle (EV) components, and advancements in recycling technologies to reduce dependency on mining.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com