Global 3D Printing Market Size, Share, Trends & Growth Forecast Report By Component (Hardware, Software and Services), Technology (FDM, SLS, SLA, DMLS / SLM, Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CDLP, SDM and LOP), Application, End User & Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa), Industry Analysis From 2024 to 2033

Global 3D Printing Market Size

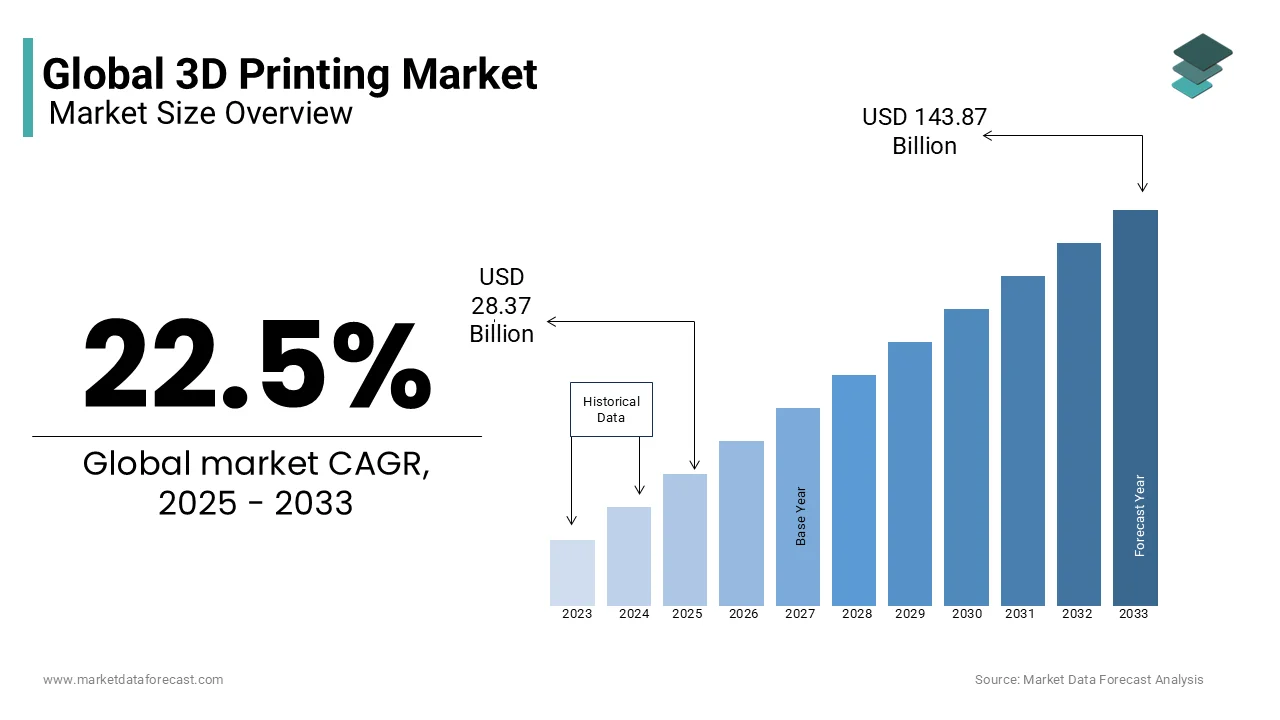

The global 3D printing market size was valued at USD 23.16 billion in 2024. The global market is expected to register a CAGR of 22.5% from 2025 to 2033 and be worth USD 143.87 billion by 2033, up from USD 28.37 billion in 2025.

Printing materials and techniques are expanding quickly, generating new opportunities for technology and enabling the production of difficult and personalized products. Additive manufacturing is shifting from prototyping to functional fabrication to meet FDA, ASTM, and ISO standards, new materials, shorter lead times, and creative finishes.

The use of 3D printing in the existing manufacturing landscape continues to grow regardless of the issues relating to the availability and the cost of additive materials. According to the global survey by Jabil, 97% of the respondents utilize 3D printing to make end-user or functional parts. Also, close to 3 quarters of participants printed a minimum of 10 thousand parts, while in 2022, as far as 100 thousand parts were printed by over a third. The data reveals rising trust from business leaders in this market. Moreover, companies have started working on text-to-3D model tools and leveraging the benefits of artificial intelligence. Gratefully, the issues with blockchain and additive manufacturing (AM) that previously existed were no longer there. In addition, supply chains were a key focus for AM specialists in 2023. The market saw it progressively being incorporated into manufacturing applications over several industries to reduce supply chain breakdowns. AM provides local production, decreasing external transport costs, supplier quantities, and ecological effects because of the reduction in carbon emissions.

Furthermore, the healthcare industry exhibits strong acceptance of AM, particularly in making medical equipment and systems at the site of care. Surgical and medical centers are investing in 3D printing solutions for customized healthcare tools and devices.

MARKET DRIVERS

The growth of the 3D printing market is primarily driven by technological advancements, accessibility, increased customization, design freedom, environmental and sustainability. The capabilities of 3D printing, such as design flexibility and customization, are further contributing to the growth of the global market growth. 3D printing allows users to manufacture complex and practical products, and advancements in 3D design software are expanding the possibilities of additive manufacturing. Personalized goods and prototypes can be created by 3D printing, which encourages rapid production and reduces dependency on conventional production chains, leading to the development of new business models and consumer preferences. According to the study, over half of those surveyed, i.e., 55 percent, stated that their organization’s senior leadership identified additive manufacturing as a tactical capability.

The growing efforts from the governments of various countries in favor of 3D printing are boosting the market’s growth rate. Governments are launching programs with financing for universities, research facilities, and technological and scientific groups to study further the potential offered by 3D printing technology and promote its advancement. National initiatives were started by the US, UK, and Canada to support research on 3D printing at the university level, expand technological advancements, and support the growth of start-ups. Governments and business leaders worldwide are becoming interested in 3D printing as new technology uses arise. Like, GE Research was awarded 15 million dollars by the Department of Energy's Advanced Materials and Manufacturing Technologies Office for a project to develop and refine large-scale machinery manufacturing practices using 3D printing.

The 3D printing market is set to witness exponential growth in the coming decade. The healthcare industry, aerospace & defense, automotive, construction, and consumer goods are expected to expand the market further from the current level. Hospitals will directly integrate additive manufacturing, including surgical, dental, and orthopedic instruments. Furthermore, AI applications in 3D printing are expected to grow rapidly in the coming years, with ChatGPT, generative image software, and Nvidia's text-input 3D models showcasing their potential. The industry emphasizes accelerating additive manufacturing to produce production-grade parts quickly and effectively. Both hardware and software changes are necessary since Industry 4.0 integration will play a major role in organizing, tracking, maintenance, and quality assurance. The high prevalence of dental caries and other dental diseases further expands the 3D printing market. The increasing popularity of 3D dental prostheses as the primary restorative choice among dentists is expected to boost dental 3D printing.

MARKET RESTRAINTS

The gap in additive manufacturing material development, standardization, and qualification is a major restraint for the 3D printing market growth. Few materials can only reach the necessary quality standards; thus, more standardization is needed for market expansion. The lack of 3D printing software that supports this technology is another factor limiting the market growth rate. Customer-specific AM processes are largely manual, with IT solutions such as SAP ERP focusing on types of parts rather than individual parts, which hinders the conceptualization of replaceable parts. Furthermore, the lack of guidelines for 3D printed structures by regulatory bodies and building codes makes it difficult to obtain necessary approvals, delaying adoption. Equipment and technology costs are the primary factors hindering the growth of the 3D printing market. Due to high initial expenses, small companies and developing economies find it difficult to incorporate. Despite being expensive, additive manufacturing technologies continue to face issues with consistency, part quality, and process stability. AM technologies have low output speed, extra machine calibration time, and inline quality control, which is new and complicates synchronization with conventional manufacturing, presenting barriers for manufacturers to implement. As per the research, materials were recognized as the main cost or financial strain to accepting 3D printing by 79 percent of respondents, a rise from 18 percent just two years back in 2021.

MARKET CHALLENGES

Limited material selection is one of the key challenges for the growth of the 3D printing market. A considerable issue in additive manufacturing is the restricted range of materials available. Conventional production processes provide a wider choice of materials, consisting of several composites, plastics, and metals; in contrast, 3D printing has conventionally been restricted to a smaller array of materials. According to Jabil’s survey, 9 out of 10 claimed that the greatest challenge is the lack of required materials.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

22.5% |

|

Segments Covered |

By Component, Technology, Application, End User & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3D Systems Inc., Stratasys, ExOne, SLM Solutions, Voxeljet, Proto Labs, Nano Dimension Ltd., Renishaw Plc, Nanoscribe GmbH, Optomec Inc, and others. |

SEGMENTAL ANALYSIS

By Component Insights

The hardware segment captured 47.8% of the global market share in 2023 and is predicted to grow at a healthy CAGR during the forecast period, owing to the growing popularity of desktop and industrial printers in various industries. In November 2023, Nexa3D launched the xCURE Desktop cure system, which reduces post-processing time by up to 80%, alongside three new resins for its SLA 3D printing portfolio.

On the other hand, the software segment is expected to grow at a higher CAGR during the forecast period because workflows for 3D printing design, optimization, and post-processing are becoming increasingly significant.

By Technology Insights

The SLS segment is anticipated to grow rapidly during the forecast period due to the broad range of materials that are compatible with SLS printing, such as metals, polymers, ceramics, and composites. This enables producers to create extremely intricate, long-lasting parts with superior mechanical qualities. In November 203, Formlabs introduced the Fuse Blast system, an automated part cleaning and polishing solution that speeds up post-processing and lowers labor costs for selective laser sintering. For instance, SLS 3D printers assisted JawsTec in maximizing the application rates of recycled powder. With the improved packaging density pace of the QLS series printers, the organization was capable of using 100 percent of their powders, and their previous systems could not achieve that by operating a 50 percent addition powder refresh rate.

By Application Insights

The prototyping segment is anticipated to hold a significant share of the global 3D printing market during the forecast period, owing to its broad application in various industries. Businesses can attain more accuracy and consistently deliver finished products by using prototyping. This technology makes three-dimensional computer-aided design models and prototypes possible. Furthermore, according to NASA Marshall Space Flight Centre, the aerospace sector uses fast prototyping and rapid printing models to improve research apparatus and construct supersonic speed models. As per the survey by Jabil in 2023, prototyping continues to be the leading application of additive manufacturing for most of the survey respondents, i.e., 96 percent of participants succeeded by design at 52 percent and small-scale production at 27 percent.

By End User

The healthcare segment is expected to propel at the highest CAGR in the coming years. The demand for individualized and cost-effective medical solutions in developing economies drives healthcare 3D printing. Along with supporting education and local industry, it also tackles the difficulties associated with rural healthcare. According to Statista, 94 percent of surgeons in the United States who have utilized 3D printing models stated the model was a highly useful instrument for presurgical planning. According to an article published in Stellaris, 97 percent of healthcare additive manufacturing experts are convinced that 3D printing technology will keep growing in this industry.

REGIONAL ANALYSIS

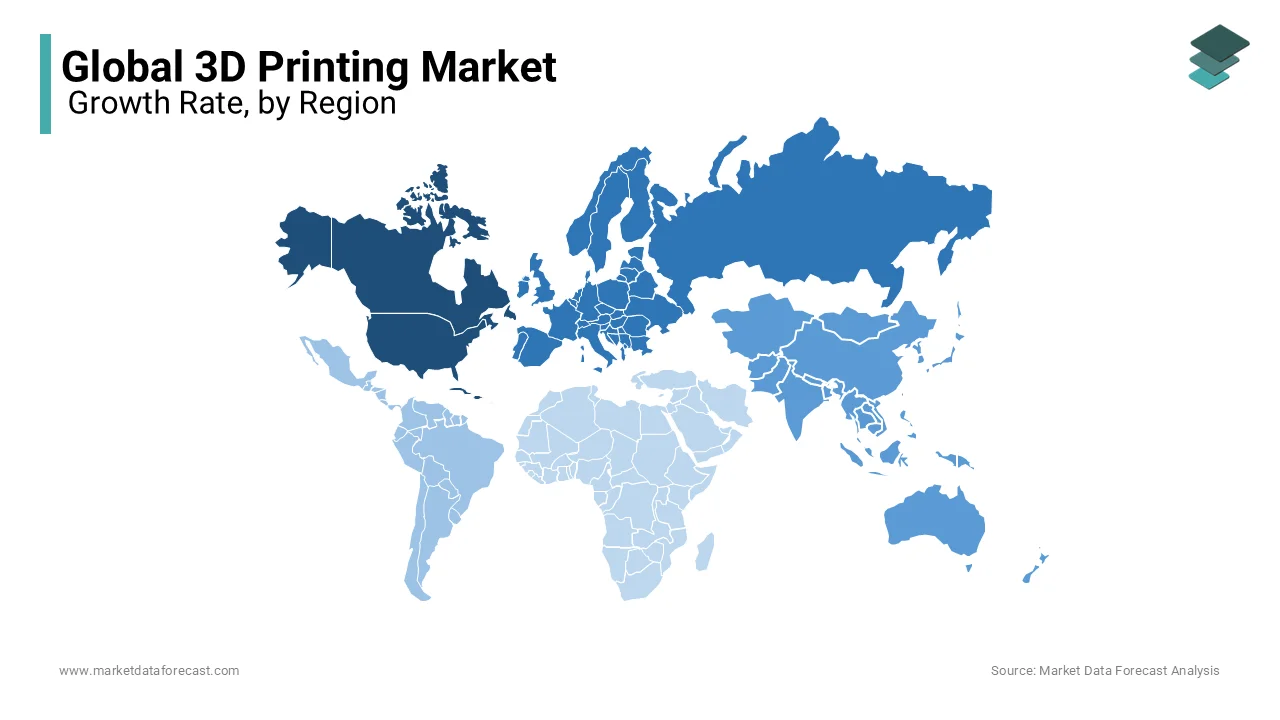

North America led the market and accounted for 36.8% of the worldwide market share in 2023, which is anticipated to grow promisingly during the forecast period. The investments made by the United States and Canada in cutting-edge manufacturing technologies have driven the regional market forward. For instance, two sets of projects of 45 million dollars were announced by the US Department of Energy to improve manufacturing processes for wind and water energy technologies, which are expected to remain in high demand due to their critical roles in the USA's clean energy shift. To achieve its clean energy targets, the need for large wind and water turbine components will increase by at least five times over the next ten years.

The European market is estimated to grow significantly during the forecast period. This growth is driven by the need for fast, dependable, and reasonably priced prototypes for production. Moreover, the adoption of this technology in the semiconductor and manufacturing industries is anticipated to rise significantly in the local market. In the aircraft industry, 3D printing drives the design and testing stages, allowing for unparalleled customization and inventive prototypes.

Asia Pacific is anticipated to grow fastest in the forecast period. The demand for prototyping and modern manufacturing using 3D printing has increased significantly in the last few years. Government efforts, large-scale R&D capabilities, and foreign direct investment also propel the growth. China's technological advances are yet another factor in expanding the market. It is a prominent global producer of automobiles and consumer electronics. Recently, the Philippines has implemented initiatives such as the Manufacturing Resurgence Programme to fortify the sophisticated manufacturing sector.

The Latin American region is expected to grow steadily in the coming years. A major factor propelling the growth is the increasing incidence of surgical procedures, which results from multiple reasons. Industrial 3D printing technologies are gaining popularity for high-volume production in low to medium-volume manufacturing. Opportunities for high-volume additive manufacturing are expected to rise in Latin America.

The Middle East and Africa are estimated to propel with a considerable market share during the forecast period. The market is growing due to increased adoption in the healthcare, aerospace, defense, and automotive industries, government initiatives, and personalized products. Future trends that are further boosting the share include metal 3D printing adoption, medical sector demand, and advancements in advanced materials. Therefore, the market is expected to continue growing.

KEY MARKET PLAYERS

Companies playing a significant role in the global 3D printing market include 3D Systems Inc., Stratasys, ExOne, SLM Solutions, Voxeljet, Proto Labs, Nano Dimension Ltd., Renishaw Plc, Nanoscribe GmbH, and Optomec Inc.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, HeyGears introduced a novel, accurate, and fast UltraCraft Reflex RS 3D Printer.

- In September 2024, Trincle reported software upgrades for Fixturemate 2.2 3D printer fixture design.

MARKET SEGMENTATION

This research report on the global 3D printing market has been segmented and sub-segmented based on component, technology, application, end-user, and region.

By Component

- Hardware

- Software

- Services

By Technology

- FDM

- SLS

- SLA

- DMLS / SLM

- Polyjet

- Multi Jet Fusion

- DLP

- Binder Jetting

- EBM

- CDLP

- SDM

- LOP

By Application

- Prototyping

- Production

- Proof of Concept

- Others

By End User

- Automotive

- Aerospace &Defense

- Healthcare

- Architecture & Construction

- Consumer Products

- Education

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the 3D printing market?

The key factors driving growth include advancements in 3D printing technology, the increasing demand for customized products, the growing adoption of 3D printing in various industries, and the reduction in manufacturing costs.

Which industries are the largest adopters of 3D printing technology?

The largest adopters of 3D printing technology are the automotive, aerospace, healthcare, and consumer electronics industries. These industries utilize 3D printing for prototyping, tooling, and production of end-use parts.

How is the 3D printing market expected to evolve in the next decade?

The 3D printing market is expected to witness significant advancements in materials, printing speeds, and accuracy. There will be greater integration of AI and machine learning, increased adoption in end-use production, and the expansion of applications in new industries such as construction and fashion.

What are the latest trends in the 3D printing market?

Latest trends include the development of multi-material and multi-color printing capabilities, the rise of metal 3D printing, the use of 3D printing for mass customization, and the increasing focus on sustainable and eco-friendly printing materials.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]