Global 3D Printing Medical Devices Market Size, Share, Trends, Growth Forecast Report - Segmented By Product Type (Medical Implants, Prosthetics, Tissue Engineering, Surgical Instruments, Surgical Guides and Hearing & Audibility Aid), Material Type (Plastics, Biomaterials, Metal & Metal Alloys, Ceramics, Nylon and Wax), Technology and Region - Industry Analysis (2024 to 2032)

Global 3D Printing Medical Devices Market Size

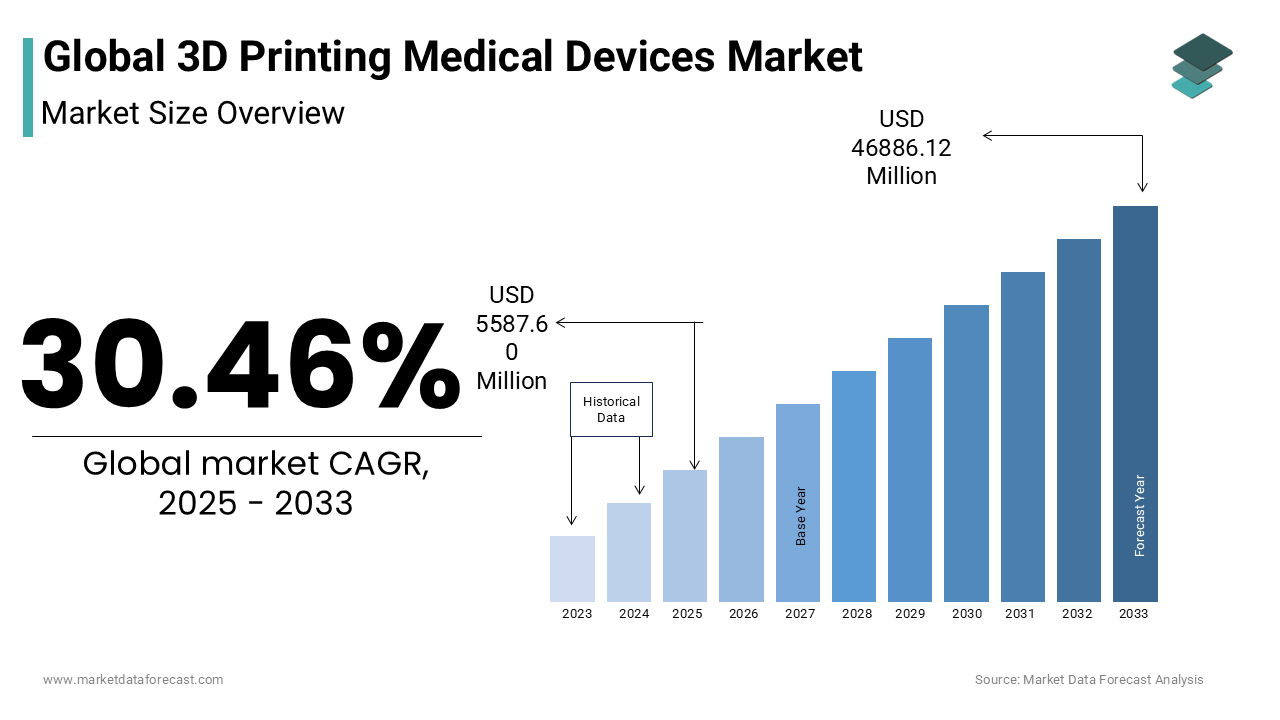

The global 3D printing medical devices market size was valued at USD 4283.00 million in 2024. The market is forecasted to grow to USD 46,886.12 Mn by 2033 from USD 5587.60 Mn in 2025. This market is expected to progress at a robust CAGR of 30.46% during the forecast period.

MARKET DRIVERS

The growing number of advancements in 3D printing technology in the medical devices industry is one of the major factors propelling the market growth.

The usage of 3D printing technology has increased significantly in recent years in the medical device industry, especially in developing precise and efficient 3D printers that can create complex medical devices with greater accuracy and speed. For instance, researchers and healthcare providers have created patient-specific prosthetics and implants in recent years using 3D printing technology that fit the anatomy of the patient. Using 3D printing technology, the creation of complex surgical guides and instruments is also possible to improve surgical precision and limit the risk of complications. 3D printing technology has further been used in recent years to manufacture drug delivery systems, surgical models for training, and other innovative medical devices. In the coming years, the ongoing advancements of 3D printing technology are expected to play a vital role in the healthcare industry and contribute to market growth.

The cost savings associated with the usage of 3D printing to manufacture medical devices further fuel the growth rate of the market.

The growing patient population of chronic diseases contributes to the growth of the 3D printing medical devices market. People who are suffering from chronic diseases such as cancer, CVDs, diabetes, orthopedic diseases, and others require continuous health monitoring and disease management and patients need customized medical devices for effective management of the diseases. 3D printing technology can potentially help to manufacture patient-specific medical devices such as implants, prosthetics, and surgical instruments that can match the exact requirements of the patients. Using 3D printing technology, researchers and healthcare providers have been manufacturing customized medical devices that can offer improved patient outcomes by ensuring correct fit, function and comfort, which is essential for chronic disease patients who require long-term use of medical devices.

The growing demand for patient-specific orthopedics and maxillofacial surgery products, growing awareness among healthcare professionals regarding the possibilities of 3D printing technology in the healthcare industry, diversity of materials that range from polymers to living tissue, supportive policies, and increasing funding by the governments of several countries in favor of 3D printing medical devices, fuel the market growth. 3D printing is a computer-aided design approach for creating three-dimensional medical items. For Instance, orthopedic implants and cranial implants, surgical equipment, dental restorations such as crowns, and external prostheses are 3D-printed medical devices. In addition, it has various advantages over traditional reconstructive operations, including reducing operational risks during complex operations, infection susceptibility, and aesthetic exposure time. Due to this, patients would be able to heal faster and spend less time in the hospital. Furthermore, 3D printing technology allows surgeons to enhance their results, which is expected to boost the global market growth.

Furthermore, factors such as shortages of organs for transplant, increasing number of approvals for 3D printing medical devices by regulatory bodies such as USFDA, increasing number of partnership activities between the manufacturers of 3D printing medical devices to boost the innovation and R&D further, rising awareness among people regarding the potential benefits of 3D printing in healthcare drive the global market growth. Increasing usage of 3D printing in the development of personalized medicine, growing awareness among healthcare providers regarding the surgical benefits of 3D printed medical devices such as improved surgical outcomes and reduced surgical time, rising adoption of 3D printing in military healthcare and dental healthcare and growing adoption of telemedicine are predicted to accelerate the growth of the 3D printing medical devices market during the forecast period.

MARKET RESTRAINTS

The high costs associated with 3D printing medical devices and the lack of skilled people handling 3D printing operations are hindering the market growth.

In addition, 3D printing can be a slow and time-consuming process that can limit the production capacity of 3D printing medical devices, which is expected to hamper the market growth during the forecast period. Limited awareness and acceptance of 3D printing medical devices by healthcare providers and patients is another major attribute impeding market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product, Material, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

3D Systems Corporation (U.S.), Stratasys Ltd., Renishaw plc (U.K.), EOS GmbH Electro Optical Systems (Germany), EnvisionTEC GmbH (Germany), Materialize NV (Belgium), Arcam AB (Sweden), 3T RPD, Ltd. (U.K.), Prodways (France) and Concept Laser GmbH (Germany) |

SEGMENTAL ANALYSIS

Global 3D Printing Medical Devices Market Analysis By Product

The surgical instruments segment is expected to grow at the fastest CAGR during the forecast period. The growing demand for minimally invasive surgeries that require specialized surgical instruments majorly drives segmental growth. Researchers have been able to manufacture surgical instruments with complex geometries and enhanced precision using 3D printing technology. This has significantly boosted the use of 3D printing to manufacture surgical instruments and resulted in segmental growth.

On the other hand, the surgical guides segment is anticipated to hold a considerable share of the worldwide market during the forecast period.

The tissue engineering segment is also anticipated to account for a substantial share of the market due to its wide application with the combination of elements of medicine and biology, belonging to a group of relatively new fields of human activity. Therefore, tissue-engineered (TE) scaffolds are of enormous importance with the fundamental goal of promoting the development of methods for regenerating damaged complex tissues and organs, especially non-regenerative ones, in a reproducible and precise manner.

During the forecast period, the medical implants segment is predicted to progress at a healthy CAGR. Factors such as increasing patient count of chronic diseases such as osteoporosis, arthritis, and dental problems and the growing aging population worldwide are driving the segmental growth. Under the sub-segments, the orthopedic implants segment is expected to register a promising CAGR during the forecast period owing to the growing number of accidents and injuries happening worldwide.

Global 3D Printing Medical Devices Market Analysis By Material

The plastics segment is estimated to account for a major share of the global market during the forecast period. The growing number of R&D activities and growing acceptance from patients primarily boost the growth of the segment. Some commonly used printing filaments are Polycarbonate, PLA, Lactic acid-based polymers, and Polyvinyl Alcohol, which is a biocompatible and biodegradable form of plastics and, therefore, widely used in pharmaceutical applications. The benefits associated with plastic materials such as cost-effectiveness, versatility, durability, flexibility and biocompatibility further contribute to segmental growth.

The biomaterials segment is predicted to account for a notable share of the market during the forecast period owing to the high use of Bio inks, loaded with cells and other biological materials, used for 3D printing for the deposition of small cell units, allowing the work to be done with minimal process-induced cell damage and precision.

Global 3D Printing Medical Devices Market Analysis By Technology

The electron beam melting (EBM) segment is estimated to register the highest share of the global market during the forecast period. The growing number of dental institutes and rising demand for dental crowns and bridges accelerate segmental growth. The EBM process is particularly suitable for small batch production of complex orthopedic implants through an electron beam, which is several times more potent than a laser, for producing perfectly dense and exact layer-by-layer melting of powder to produce parts, ultimately leading to faster print speeds.

The laser beam melting (LBM) segment is anticipated to hold a substantial share of the global market during the forecast period. Laser beam melting is an additive manufacturing process for digitally cutting 3D components into 2D layers. Due to its high-performance laser, it becomes Ideal for producing solid functional parts with complex geometries, exposing surfaces of the 2D layers. Saving printing and post-processing time without the requirement of support is the reason behind its high adoption.

REGIONAL ANALYSIS

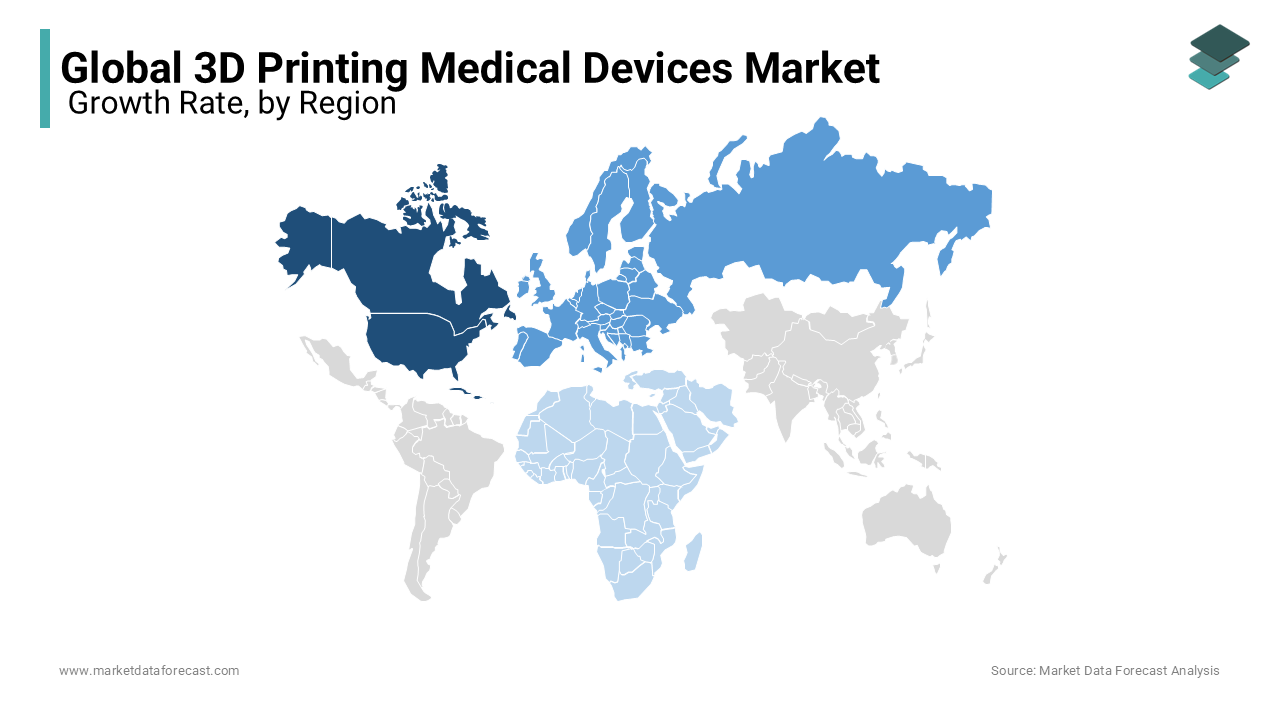

The North American region held the largest share of the worldwide market in 2023 and is estimated to continue its dominance throughout the forecast period. The domination of the North American market can be attributed to the rapid adoption of 3D printing technology in the healthcare industry, the presence of numerous 3D printing companies in North American countries, and the increasing number of product launches of various devices in favor of the end-users. For Instance, North America is the leading consumer of 3D printing technology in the healthcare industry. The growing prevalence of chronic diseases and rising demand for personalized medical devices in North American countries further boost regional market growth. In 2023, the U.S. was the largest regional market for 3D printing medical devices in North America.

Europe was the second largest regional market for 3D printing medical devices globally in 2023 and is expected to grow enormously during the forecast period. The strong R&D environment, solid technological advancements, and a high level of innovation primarily propel the European market growth. In addition, the growing aging population, increasing healthcare expenditure and the presence of sophisticated healthcare infrastructure propel the European market growth. Germany, France, and the United Kingdom accounted for the largest share of the European market in 2023 and the same trend is expected to repeat during the forecast period.

The APAC market is expected to grow at a promising CAGR during the forecast period. The presence of a large population, rising demand for technologically well-advanced medical devices and the growing number of healthcare facilities in the countries of the APAC region primarily drive the 3D printing medical devices market in the Asia-Pacific region. The growing prevalence of chronic diseases such as cancer, cardiovascular diseases and diabetes and increasing demand for advanced medical devices further boost the growth rate of the APAC market. Countries such as India, China, and Japan have contributed significantly to the APAC in 2023 and the 3D printing adoption in these countries is brisk.

Latin America is anticipated to hold a considerable share of the worldwide market during the forecast period. Favorable government initiatives and investments in research and development majorly promote market growth in Latin America. Mexico and Brazil are predicted to capture the major share of the Latin American market during the forecast period.

MEA is estimated to grow at a moderate CAGR during the forecast period.

KEY PLAYERS IN THE GLOBAL 3D PRINTING MEDICAL DEVICES MARKET

Companies such as 3D Systems Corporation (U.S.), Stratasys Ltd., Renishaw plc (U.K.), EOS GmbH Electro Optical Systems (Germany), EnvisionTEC GmbH (Germany), Materialize NV (Belgium), Arcam AB (Sweden), 3T RPD, Ltd. (U.K.), Prodways (France) and Concept Laser GmbH (Germany) are currently leading the global 3D printing medical devices market.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, D Systems partnered with We Matter to affordably expand 3D Systems' Selective Laser Sintering (SLS) portfolio in Europe, the Middle East, and Africa (EMEA).

- In November 2022, Chromatic 3D Materials announced a new range of 3D printers, RX-Flow, for low-volume industrial production and development work more durably and flexibly.

- In November 2022, Velo3D, Inc. ordered two new Sapphire XC printers to reduce manufacturing cycles and enable faster product development times significantly.

- In October 2022, 3D LifePrints received FDA clearance for the EmbedMed personalized surgery platform, allowing faster and personalized digitization of surgical planning to patient-specific devices.

- In February 2020, Stratasys Ltd announced the J826 3D printer launch. This J826 is designed to develop advanced medical equipment with exceptional print quality and improve patient care.

- In April 2019, Renishaw integrated with Yorkshire Dental Laboratory to digitize the design and production of removable partial dentures to achieve RPDSs more quickly and with good quality.

- In June 2017, the United States-based leading manufacturer of 3D printing platforms, EnvisionTEC, announced the M-Type disposable material tray for a different range of desktop machines to strengthen their position in the market.

DETAILED SEGMENTATION OF THE GLOBAL 3D PRINTING MEDICAL DEVICES MARKET INCLUDED IN THIS REPORT

This research report on the global 3d printing medical devices market has been segmented & sub-segmented based on the product, material, technology, and Region.

By Product

- Medical Implants

- Orthopedic Implants

- Dental Implants

- Craniomaxillofacial Implants

- Prosthetics

- Tissue Engineering

- Surgical Instruments

- Surgical Guides

- Hearing & Audibility Aid

By Material

- Plastics

- Biomaterials

- Metal & Metal Alloys

- Ceramics

- Nylon

- Wax

By Technology

- Laser Beam Melting (LBM)

- Electron Beam Melting (EBM)

- Droplet Deposition

- Photopolymerization

- Wax deposition Modelling

- Bio Printing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global 3D printing medical devices market worth in 2023?

As per our report, the global 3D printing medical devices market was worth USD 3283 million in 2023.

Does this report include the impact of COVID-19 on the 3D medical devices market?

Yes, a detailed analysis on how COVID-19 has impacted the 3D printing medical devices market included in this report.

Which segment by product accounted for the major share of the 3D printing medical devices market?

Based on the product, the 3D printing surgical instruments segment was the most lucrative segment among all in the global 3D printing medical devices market in 2023.

Who are the dominating players in the 3D printing medical devices market?

Companies playing a key role in the 3d printing medical devices market are 3D Systems Corporation (U.S.), Stratasys Ltd., Renishaw plc (U.K.), EOS GmbH Electro Optical Systems (Germany), EnvisionTEC GmbH (Germany), Materialize NV (Belgium), Arcam AB (Sweden), 3T RPD, Ltd. (U.K.), Prodways (France) and Concept Laser GmbH (Germany).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com