Global Orthopedic Devices Market Size, Share, Trends and Growth Forecast Report – Segmented By Anatomical Location (Knee, Shoulder, Foot, Ankle, Hip, Spine, Elbow and Craniomaxillofacial), Consumable Type (Orthopedic Staples and Orthopedic Suture Anchors) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2025 to 2033)

Global Orthopedic Devices Market Size

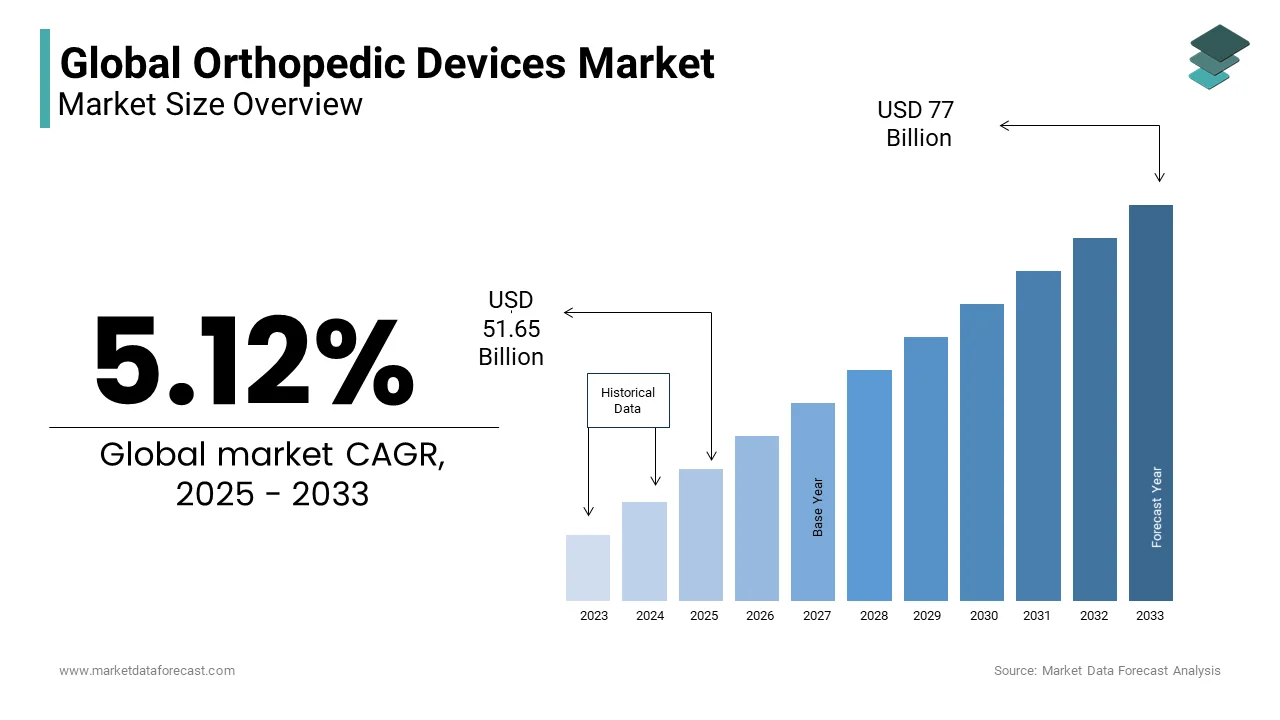

The global orthopedic devices market size was valued at USD 49.13 billion in 2024. The orthopedic devices market size is expected to have 5.12% CAGR from 2025 to 2033 and be worth USD 77 billion by 2033 from USD 51.65 billion in 2025.

Orthopedic devices include bandages, splints, prostheses, and special apparatus. Several types of orthopedic devices are distinguished. A fixing device is designed to restrict movements either wholly or partially in a joint; examples are hinged splints, which preserve a specific range of motion in a joint, and rigid braces. Relieving devices are used to relieve pressure on an ailing part by transferring support to functional components of an extremity; examples include the Thomas splint and the Voskoboinikova apparatus. These devices are used to correct a deformity gradually; these include corsets, splints, orthopedic footwear, insoles, and other devices to adjust abnormal foot positions. The innovations and modern diagnostic techniques have significantly reduced the need for complex orthopedic surgical procedures. Furthermore, as per the World Health Organization (WHO), in 2017, the prevalence of musculoskeletal conditions increased with age. Moreover, patterns and prevalence of orthopedic problems vary from region to region due to environmental, racial, and geographic differences.

MARKET DRIVERS

The rapid increase in the global aging population and rising patient count suffering from orthopedic diseases are majorly propelling the orthopedic devices market growth.

The growing geriatric population base is highly susceptible to the development of osteoporosis and osteoarthritis-related diseases. According to WHO, by 2050, the aging population worldwide is expected to hit 2 billion over 60 years. Increasing the elderly population generates significant demand for various orthopedic devices and implants. With growing age, people suffer from various orthopedic diseases. Due to this, the demand for orthopedic procedures and devices such as joint replacements, spinal implants, and trauma fixation devices is growing significantly. On the other hand, the number of people suffering from various orthopedic diseases such as osteoarthritis, osteoporosis, traumatic fractures, and rheumatoid arthritis is growing considerably worldwide. As per the data published by the Centers for Disease Prevention and Control (CDC), an estimated 32.5 million adults suffer from osteoarthritis in the United States. According to an article published by the National Centre for Biotechnology Information (NCBI) in 2016, an estimated 200 million people worldwide have osteoporosis. Let alone in the U.S.; an estimated 54 million people have osteoporosis. As per the information published by NCBI, an estimated 1.3 million adults in the United States suffer from rheumatoid arthritis. Likewise, the number of people suffering from orthopedic conditions is expected to promote the need for orthopedic devices and boost market growth.

The growing number of road accidents and sports injuries happening worldwide and increasing are further fuelling the growth rate of the orthopedic devices market.

Road accidents have been one of the significant causes of death among children and young adults worldwide, says WHO. An estimated 1.3 million people die yearly because of road accidents, and a considerable amount of the population. Per the data published by the MORTH India (Ministry of Road Transport & Highways), 412,432 accidents were recorded in 2021 in India, resulting in 153,972 deaths and 384,448 injuries. Road accidents damage several organs in the human body, including knee joints. The growing number of accidents is anticipated to demand more orthopedic devices and promote the market’s growth rate. On the other hand, the incidence of sports injuries is also increasing considerably with each year passing. An estimated 3.5 million injuries happen yearly among children due to their participation in sports and recreational activities in the United States.

The growing preference for minimally invasive surgical procedures stimulates global orthopedic devices market growth.

Owing to the advantages associated with minimally invasive surgeries, such as smaller incisions, reduced scarring, less blood loss, and faster recovery times, the adoption of these surgeries is growing significantly over traditional surgeries. As a result, the usage of orthopedic devices in minimally invasive surgeries has recently seen a spike as these devices are compatible with this type of surgery. In addition, with minimally invasive surgeries, patients can quickly be discharged from the hospitals and have less possibility for post-operative complications. Due to this, the adoption of minimally invasive surgeries for orthopedic diseases is growing and resulting in the orthopedic devices market growth.

In addition, emerging economies offer lucrative opportunities to develop the orthopedic devices market shortly. In addition, the early onset of musculoskeletal conditions triggered by obesity and a sedentary lifestyle are expected to boost the orthopedic devices market growth. Growing diabetes and obesity prevalence, lack of physical activity, low dietary intake, and rising smoking and alcohol consumption patterns would fuel market demand over the forecast years. In addition, new osteology technologies will promote the production of cost-effective instruments. Advancements in technology in 3D printing, robot-assisted surgical procedures, and intelligent implants will reflect driving factors of high impact on global market size. Furthermore, the rising occurrence of road accidents and sports injuries and stimulating demand for minimally invasive surgical processes should stimulate the growth of the global orthopedic devices market. In addition, the availability of medical interventions with innovative materials and biodegradable implants will increase demand.

Currently, available trauma management techniques cannot successfully restore body parts due to the lack of efficient surgical tools. As a result, manufacturers invest significantly in Research and Development (R&D) to develop innovative and capable devices. Increased R&D activities are anticipated to ensure high orthopedic device market growth shortly. Furthermore, growing awareness regarding the availability of innovative products pushes hospitals to upgrade their devices and services continually. Besides, reimbursement coverage of orthopedic treatments has fuelled the adoption of orthopedic surgeries. Hence, this factor led to the implementation and monitoring of many hospitals.

MARKET RESTRAINTS

The high costs associated with orthopedic devices and implants are estimated to limit the expansion of the global market growth. Expensive joint reconstructions and implant products will further restrict the adoption among the people. The high costs will restrict access for the people in the low-income regions, which hampers the market size growth. Another primary factor is the risks and complications associated with surgical procedures, such as post-operative infections, neuroparalysis, and loss of free movement, which will hinder the market growth opportunities due to limited adoption among people. Periprosthetic fractures are other complications that result in hip and knee replacement surgeries, further restraining the market growth. The orthopedic devices must meet strict regulatory requirements to ensure high safety, quality, and effectiveness standards, which are challenging to manufacturers when expanding their market revenue worldwide. The increased cases of product recalls by the U.S. F.D.A. will limit the market growth rate. The availability of limited reimbursement policies in specific regions and the presence of minimally skilled professionals in low and underdeveloped regions are estimated to impede the global orthopedic devices market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Anatomical Location, Consumable Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Medtronic, Stryker, Zimmer Inc., DePuy Synthes, Smith & Nephew, and Biomed |

SEGMENTAL ANALYSIS

By Anatomical Location Insights

Based on the anatomical location, the knee and hips segments are the most lucrative segments and accounted for the largest share of the global orthopedic devices market in 2024. Therefore, it is also anticipated that these segments will hold the major share of the worldwide market during the forecast period. The growing prevalence of arthritis and other orthopedic diseases majorly drives the growth of the segments. In addition, factors such as the growing aging population and rapid adoption of technological developments are propelling segmental growth.On the other hand, segments such as spine and craniomaxillofacial are anticipated to witness a promising CAGR during the forecast period. The growing demand for minimally invasive surgical procedures is one of the major factors driving the segment's growth rate.

By Type of Consumables Insights

Based on the consumable type, the orthopedic suture anchors segment dominates the market under this segment with a global share of around 75%. Increasing demand for these devices in orthopedic surgeries is one of the major factors driving the segment's growth rate. Owing to the advantages of resorbable and metallic suture anchors and the increasing usage of these consumables in orthopedic surgeries, the segment is expected to see promising growth during the forecast period.

REGIONAL ANALYSIS

The North American orthopedic devices market had the largest worldwide market share in 2024 and is anticipated to continue the region’s dominance during the forecast period. The growing aging population suffering from various orthopedic diseases is a major factor in regional market growth. In addition, the rapid adoption of technological developments in orthopedic surgeries is further expected to boost the regional market’s growth rate. The U.S. market had the major share of the North American market, followed by Canada in 2021. Factors such as increasing healthcare spending and the presence of key market participants in the U.S. primarily drive the U.S. orthopedic devices market.

The European orthopedic devices market is another promising regional market globally and is anticipated to grow at a notable CAGR during the forecast period. The growing patient count suffering from orthopedic diseases and the presence of advanced healthcare facilities are driving the regional market growth. Germany, France and the UK are estimated to hold the major share of the European market during the forecast period. In addition, the growing R&D activities by the key market participants in the European region are further contributing to the growth of the European market.gr

The APAC orthopedic devices market is predicted to register the fastest CAGR during the forecast period. Factors such as growing disposable income among the APAC countries and the availability of affordable healthcare are promoting the APAC orthopedic devices market growth. In addition, emerging economies in the APAC region are another major factor propelling regional market growth. During the forecast period, countries such as India, China and Japan are anticipated to hold the major share of the APAC market. China had the largest share of the APAC market in 2024 owing to its large population and increasing patient population.

The Latin American orthopedic devices market is forecasted to register a steady CAGR during the forecast period. The growing aging population, increasing number of people suffering osteoarthritis, and rising incidence of sports injuries are major contributors to the growth of the orthopedic devices market in Latin America. Companies such as Johnson & Johnson, Stryker, Zimmer Biomed, and Medtronic have a strong foothold in the Latin American market. They provide a wide range of orthopedic devices, including joint replacement products, spine surgery products, trauma and extremity products, and other products such as craniomaxillofacial and thoracic products. Brazil, followed by Mexico, accounted for the leading share of the Latin American market in 2024.

The orthopedic devices market in MEA is estimated to grow at a CAGR of 4.59% during the forecast period.

KEY MARKET PLAYERS

Notable companies leading the global orthopedic devices market profiled in the report are Medtronic, Stryker, Zimmer Inc., DePuy Synthes, Smith & Nephew, and Biomed. In addition, the market is categorized by diversified international and national companies, where the global players lead the market and are predicted to grow exponentially by securing regional or local companies.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Smith and Nephew finalized the acquisition of CartiHeal, a sports medicine technology designed for knee cartilage regeneration.

- In August 2024, Medtronic plc secured Conformite Europeenne (C.E.) Mark approval for its Inceptiv closed-loop rechargeable spinal cord stimulator.

- In October 2024, Smith and Nephew introduced the REGENETEN Bioinductive Implant in Japan, providing access to thousands of patients. Since its introduction in the U.S. and Europe, over 100,000 procedures have been conducted worldwide.

- In April 2024, Stryker partnered with Project C.U.R.E. to provide medical equipment to underserved regions. Project C.U.R.E. is acknowledged as the primary distributor worldwide of donated medical devices and supplies to communities with limited resources in more than 135 countries.

- In April 2024, Enovis Corporation acquired Novastep, an Amplitude Surgical subsidiary. Novastep develops clinically proven foot and ankle solutions and has a portfolio of CE-marked forefoot and midfoot implants. These are expected to enhance the company's global position.

- In January 2024, Orthofix Medical Inc., a spine orthopedics company, launched its Mariner Deformity Pedicle Screw System. The Mariner Deformity Pedicle Screw system incorporates the strength of Mariner's modular technology to provide a comprehensive implant offering.

- In October 2024, Enovis, a US-based medical technology company focused on orthopedics, acquired Italian orthopedic player Limacorporate. This Italian company specializes in manufacturing implants used in shoulder, knee, elbow, and hip surgeries.

MARKET SEGMENTATION

This research report on the global orthopedic devices market has been segmented and sub-segmented into anatomical location, consumable type, and region.

By Anatomical Location

- Knee

- Shoulder

- Foot

- Ankle

- Hip

- Spine

- Elbow

- Craniomaxillofacial

By Type of Consumables

- Orthopedic Staples

- Orthopedic Suture Anchors

- Resorbable Suture Anchors

- Metallic Suture Anchors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global orthopedic devices market going to be worth by 2033?

As per our research report, the global orthopedic devices market size is forecasted to grow to USD 77 billion by 2033.

What is the growth rate of the global orthopedic devices market?

The global orthopedic devices market is estimated to grow at a CAGR of 5.12% during the forecast period.

Which are the key players operating in the orthopedic devices market?

Medtronic, Stryker, Zimmer Inc., DePuy Synthes, Smith & Nephew, and Biome are some of the noteworthy players in the global orthopedic devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com