Global Orthopedic Orthotics Market Size, Share, Trends & Growth Analysis Report – Segmented By Products (Spine Orthotics, Upper-limb Orthotics, Lower-Limb Orthotics) By Application ( Fractures, Sports Injuries, Neuromuscular and musculoskeletal disorders),By Material (Plastic, Metal, Rubber, Carbon fibers) , Price And Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Orthopedic Orthotics Market Size

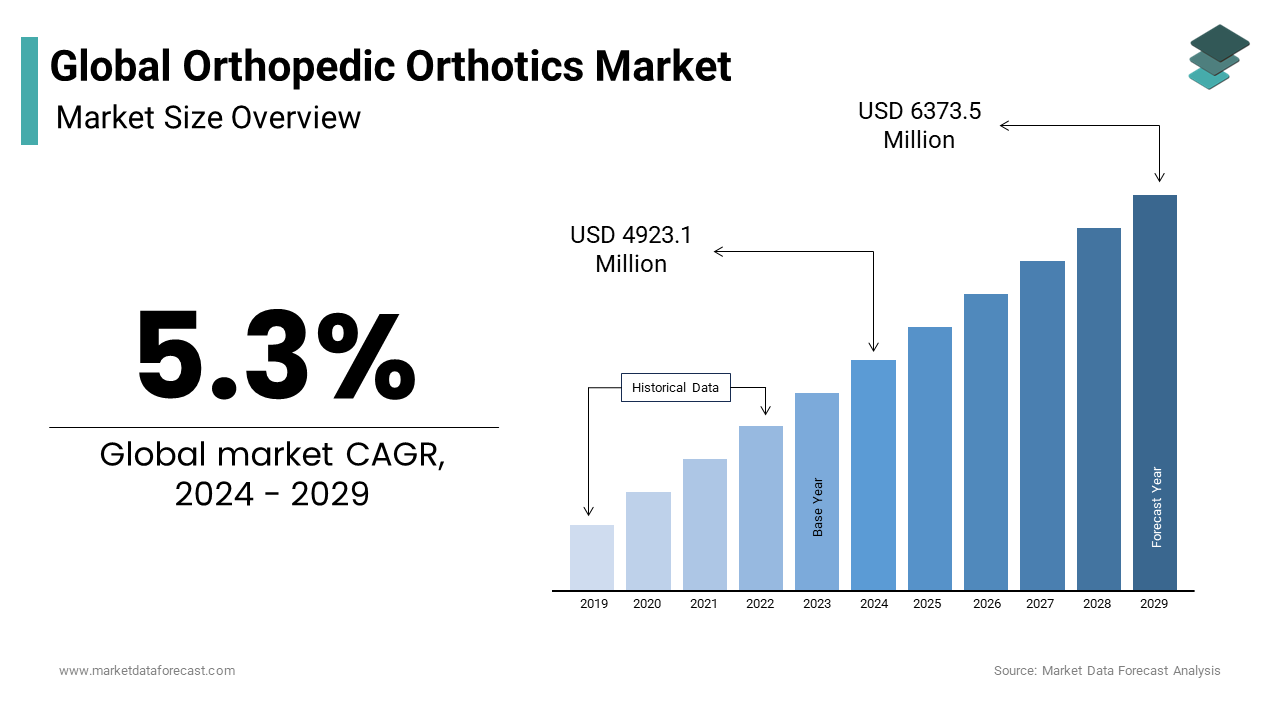

The global orthopedic orthotics market was valued at USD 4923.1 million in 2024. The global market is predicted to be worth USD 7837.13 Mn by 2033 from USD 5184.78 Mn in 2025, growing at a CAGR of 5.3% from 2025 to 2033.

MARKET DRIVERS

One of the major factors propelling the growth of the orthopedic orthotics market is the rising geriatric population worldwide requiring orthopedic assistance.

For example, according to a UN report, the senior population worldwide is expected to reach 1.6 billion by 2050. In addition, the number of people over 65 is expected to double in the next three decades. Therefore, the growing prevalence of orthopedic problems, especially among the older populations, supports the need for the market. According to the WHO stats, around 1.71 billion people worldwide suffer from musculoskeletal problems. Additionally, the growing cases of arthritis (Approximately 14 million cases in 2021), bunions, hammer toes, heel spurs, flat feet, back pain, etc., all of which need orthotic assistance, support the growth of the market. Furthermore, the growing cases of injuries and sports injuries and common mishaps leading to support from these devices support the market's rise.

The growing cases of prosthetic care in orthopedics due to the rising number of amputees, accidents, and congenital disabilities also lead to growth in the orthopedic orthotics market.

As orthoses help people with prosthetics to stabilize and function adequately with prosthetics, they are two inseparable branches of orthopedics. Prosthetic care may often require the assistance of alignment, pain relief, and pressure relief in the areas of treatment leading to the need for orthotics. Additionally, orthotics come in different forms according to the patient's requirement, providing a wide range of options leading to more demand for the market. These devices are either premade or custom-made for patients on prescription. Orthotics provides patients with custom-fabricated products (precise and individualized), semi-finished products (last-minute supply for recurrent problems), and finished products (short-term bandages for a limited time).

Orthoses come in four different specificities lower extremities, upper extremities, trunk orthotics, and head orthotics. Therefore, they cover a wide range of orthopedic problems. Nevertheless, these foot and heel inserts are recommended by the orthotist as a last result when regular exercise and common physiotherapies fail to provide relief to the patient. Therefore, they are the most effective treatment regime with promising results leading to market growth. Additionally, orthotics are a non-invasive procedure without any surgery or incision on the body leading to more favor for the patients and doctors. Foot deformities are a pervasive problem that can occur due to multiple reasons like tight shoes, too much stress on the foot, being overweight, and even due to genetic reasons. Therefore, there is a widespread need for these markets. Furthermore, technological advancements in producing new and advanced orthoses support market growth. Increasing flexibility and versatility in products due to the use of materials like modern plastics, foam, carbon graphite, etc., and deep customizability support the market expansion.

MARKET RESTRAINTS

Customizable orthotic products can be expensive and are only affordable to some economic classes, which can pose a drawback to the market. Additionally, the reimbursement policies for orthotics are limited as the insurance policies will cover the procedure only if deemed medically essential. Additionally, limited knowledge in the field and a lack of trained professionals may lead to restraint for the market. Finally, the several side effects associated with using orthoses may also lead to a drawback for the market. For example, orthotics may cause nerve pain, numbness, pain in the knees, extreme sweating, etc. Additionally, orthotics do not require prescriptions, so it is essential to do thorough research before opting for this treatment.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Products, Application, Material, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Key Market Players |

Bauerfeind AG, Breg, Inc., BSN Medical, DeRoyal Industries, Inc., DJO Global, Ossur, Ottobock, Truelife, Hanger, Inc., and Fillauer LLC. |

SEGMENTAL ANALYSIS

By Product Insights

The lower-limb Orthotics segment is expected to dominate the market during the forecast period due to the growing rates of deformities and lower limb problems being more common than upper-limb issues. These devices help support the fit and realign it to remove pain and discomfort while working. They can also be used to reduce motion and stop the progression of deformities in the body.

The spine orthotics segment is expected to grow due to the rapid technological advancements in the segment. Additionally, the growing cases of spinal cord dislocations and problems like slipped disks and spinal cord injuries support the segment's growth during the forecast period. According to the WHO, between 250,000 and 500,000 people suffer from a spinal cord injury every year. Therefore, the need for orthotics to support the spinal cord supports the growth of the market.

By Application Insights

The neuromuscular and musculoskeletal disorders segment is expected to dominate the market during the forecast period due to the rising cases of these problems. According to the WHO, musculoskeletal cases have risen to 1.71 billion. Therefore, the rising need for assistance with these problems leads to growth for the segment.

The fractures segment is also expected to have moderate growth in the market. The growing geriatric population and road accidents resulting in fractures support the growth of the market. Globally, it was recorded that there were 178 million bone fractures in 2019, and the number is expected to grow during the forecast period.

By Material Insights

The plastics segment is expected to dominate the market during the forecast period (propylene) as it is the most common Material used in making these customized orthoses. Additionally, the growth of modern plastics derived from natural gas and petroleum with advanced abilities also supports the rise of the segment. Furthermore, new industrial varieties of plastics are being made from renewable resources like cotton and corn, leading to more markets for the segment.

The carbon fibers segment is also expected to grow due to its several advantages like durability, stress resistance, being lightweight, and also resistance to corrosion. In addition, carbon fibers are also more flexible, leading to more customizability.

By Distribution Channel Insights

The footwear retailer segment is expected to dominate the market during the forecast period. Orthoses do not need a prescription from a doctor and can be bought and ordered from customs centers. These medical shoes are often directly bought by consumers from foot retailers without any involvement in medical procedures leading to the growth of the segment.

The hospital and online pharmacy segments are also expected to grow due to the growing concerns about the severity of foot deformities and the need for proper consultation and treatment for the problems. Additionally, the growing modernizing society and the shift toward the internet are expected to support the online segment.

REGIONAL ANALYSIS

The North American region is expected to dominate the market during the forecast period due to the rising geriatric population and advancements in the healthcare industry. Additionally, the increasing pain relief and management in orthopedic cases support the market rise in the region. Furthermore, growing musculoskeletal disorders in the region support the market's growth. For example, an estimated 126.6 million adults have musculoskeletal disorders, and every 1 in 2 adults suffers from these problems. Furthermore, the presence of key market players in the region also leads to growth for the market. The high revenue from the market in the region also supports the interest of the investors. For example, orthotic services in the US can cost anywhere from $200 to $800, leading to significant industry growth. Therefore, the market in countries like the US and Canada supports the market growth.

The market in Asia-Pacific is also expected to grow due to the rising need for better healthcare systems and disposable incomes. In addition, the highly populated regions in the Asia-Pacific, like India, China, Japan, South Korea, etc., all have a densely populated geriatric group leading to more demand in the region. Additionally, the rising awareness regarding the need for good foot health supports the market's rise in the region.

KEY MARKET PLAYERS

Bauerfeind AG, Breg, Inc., BSN Medical, DeRoyal Industries, Inc., DJO Global, Ossur, Ottobock, Truelife, Hanger, Inc., and Fillauer LLC are some of the major companies in the global orthopedic orthotics market.

RECENT MARKET HAPPENINGS

- In April 2022, 3D Ortho Pro launched 'Piro,' a new ankle foot and spinal mobility orthosis. The company claimed that this new variety is more comfortable and easier to handle, along with being an extremely good fit and providing stability to the body. It is an advanced 3D-printed technology set to provide promising results in children with Tetraplegia or Cerebral Palsy.

- In September 2022, Tynor Orthotics launched a brand campaign called "'STOP. NEVER" in partnership with the advertising agency "Rediffusion." The campaign and the ad focus on the never-ending spirit of sportspeople in all sports, like cycling, swimming, volleyball, etc., and how these athletes need to keep healthy.

MARKET SEGMENTATION

The global orthopedic orthotics market research report has been segmented and sub-segmented based on the products, application, material, distribution channel and region.

By Products

- Spine Orthotics

- Upper-limb orthotics

- Wrist Orthotics

- Hand, Elbow

- Others

- Lower-Limb Orthotics

- Foot and ankle Orthotics

- Knee Orthotics

- Others

- Others

By Application

- Fractures

- Sports Injuries

- Neuromuscular and musculoskeletal disorders

- Others

By Material

- Plastic

- Metal

- Rubber

- Carbon fibers

- Others

By Distribution Channel

- Online Pharmacies

- Footwear Retailer

- Hospital Pharmacies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- MEA

Frequently Asked Questions

who are the key players of the global orthopedic orthotics market?

Bauerfeind AG, Breg, Inc., BSN Medical, DeRoyal Industries, Inc., DJO Global, Ossur, Ottobock, Truelife, Hanger, Inc., and Fillauer LLC. are some of the key market players in the orthopedic orthotics market.

Which Region holds the largest revenue share during the forecast period in the global orthopedic orthotics market ?

The North American orthopedic orthotics market is expected to grow significantly and hold the largest revenue share during the forecast period.

what is the compound annual growth rate (CAGR%) of the global orthopedic orthotics market during the forecast period?

The global orthopedic orthotics market is expected to grow at a CAGR of 5.3% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com