Global Joint Replacement Market Size, Share, Trends & Growth Forecast Report By Product, Procedure, End-user and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Joint Replacement Market Size

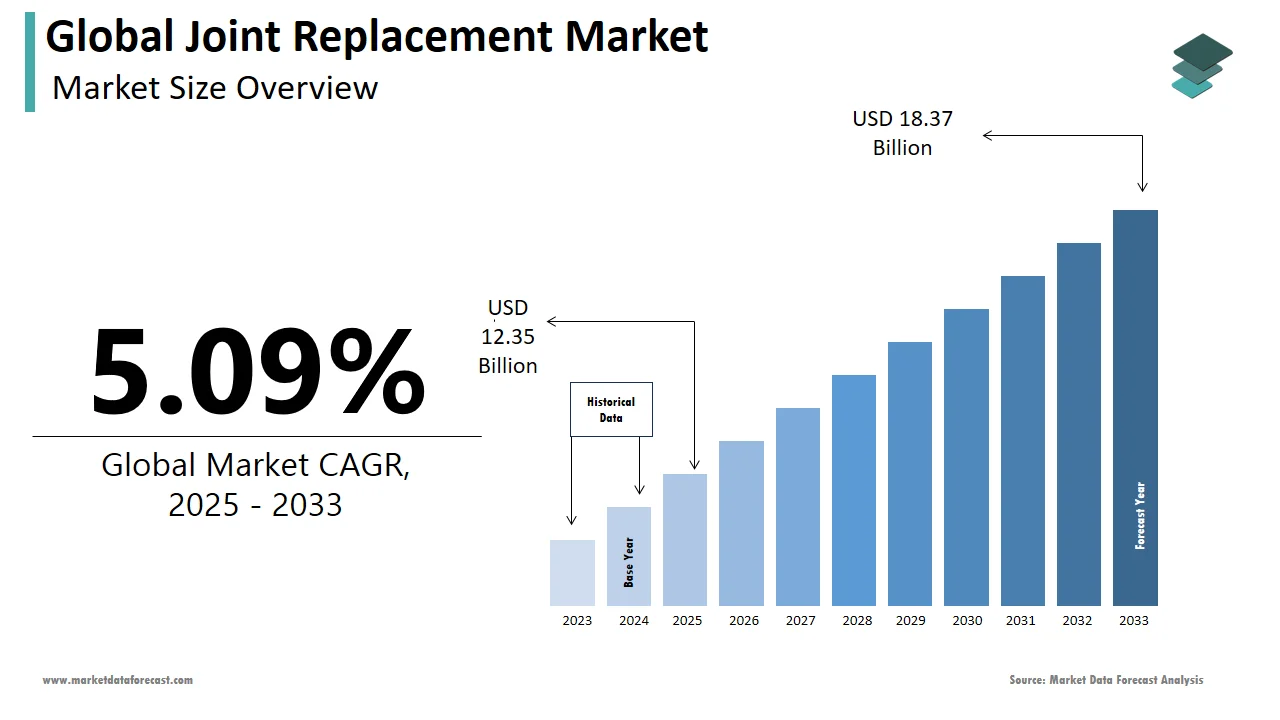

The size of the global joint replacement market was worth USD 11.75 billion in 2024. The global market is anticipated to grow at a CAGR of 5.09% from 2025 to 2033 and be worth USD 18.37 billion by 2033 from USD 12.35 billion in 2025.

Joint replacement is surgery to replace affected parts of the joint to relieve pain and disability. The procedure involves replacing the femur, tibia, and patella by cutting out the damaged bone and cartilage and replacing them with an artificial joint. It can help relieve pain and restore function to severely diseased joints. Joint replacement surgery is most frequently performed to relieve excruciating pain brought on by osteoarthritis. Joint replacement surgery is considered when the joint and cartilage are damaged and interrupt a person's mobility. The surgery is also carried out in cases of hemophilia, gout, arthritis, bone disorder, knee damage, and others. Artificial implants will replace the damaged knee during the surgery. Joint implants are composed of ceramic, metal alloys, and plastic and have three components: tibial, femoral, and patellar. The tibial component consists of a metal (attached above the resurfaced shin bone) and a plastic part (incorporated into the tibia). The femoral component encompasses metal and a curved part (fixed to the resurfaced thigh bone); consequently, the dome-shaped part of the patellar component replaces the affected knee cap. According to the anatomy of the patient's knee, weight, gender, age, etc., the surgeon chooses the appropriate type of implant for the patient's surgery.

MARKET DRIVERS

The increasing incidence of traffic mishaps resulting in accidents and amputations is expected to drive market growth over the forecast period. In addition, road accidents are one of the leading causes of death among young adults aged 5 to 29 and children, according to data published by the World Health Organization in June 2024. Therefore, these factors are expected to increase the demand for joint replacement surgery.

The growing aging population is expected to drive the joint replacement market growth.

As the aging population increases, the number of patients with arthritis also increases. Arthritis is a joint disease that causes swelling, joint pain, stiffness, and others. There are several types of arthritis, but osteoarthritis (cartilage that surrounds the joint of the bone degenerates) and rheumatoid arthritis (joints that are affected by the immune system) are the common types of arthritis. Symptoms may be mild or severe, restricting a person's mobility. Severe symptoms often lead to joint replacement surgery. As far as the research of the Global RA Network is concerned, above 350 million people are globally affected by arthritis.

Moreover, the WHO analyzed that the senior population was more significant than the population of children under five (in 2020) and will double in the succeeding decades. Osteoarthritis is shared among the senior population and mainly affects the knee joints of the patient. Twenty-seven million adults have osteoarthritis in the USA. The aging population increases the risk of arthritis and the performance of surgeries; thus, the demand for joint replacement implants elevates the revenue of its market. Furthermore, according to research by CDC (Centers for Disease Control and Prevention), 1.35 million people die in a year globally due to road accidents. One of the common surgeries performed in the case of an accident is joint replacement surgery; severe cases require total joint replacement surgery. Hence, the demand for joint replacement implants is higher, increasing the market's growth rate.

The rising prevalence of knee osteoarthritis drives the joint replacement market.

One of the major factors likely to drive the demand for bone surgeries is the rising prevalence of knee osteoarthritis globally. The increasing rate of diagnosis of knee arthritis in the adult population is expected to increase the demand for knee implants. Rheumatoid arthritis affects the joints of the body and causes muscle pain. Thus, the increase in the incidence of these chronic diseases leads to high demand for surgical procedures, which drives the market's growth. In addition, the continuously rising populations of geriatric people worldwide and the rising number of obesity cases are expected to boost the market growth. As the medical industry advances, disease diagnosis rates also increase. Due to the increasing rates, the adult population suffering from these diseases is more aware of their problems and has started opting for these alternative surgeries. This helps in the growth of the market.In addition, an increase in the number of product launches is also fuelling the growth of the joint replacement market. For instance, robotic-assisted surgeries promote high efficiency and precision and thus reduce the failure rates of surgery. Furthermore, the increase in imagination in the healthcare field, encouraging more vivid and innovative treatment procedures and advanced configured instruments, is anticipated to drive the market's growth.

MARKET RESTRAINTS

The joint replacement market growth is primarily hindered by the rising costs of joint implant surgical procedures and the lack of proper renumerating policies for patients undergoing surgery.

The cost of joint replacement surgery might be expensive. There are two types of joint replacement surgeries: total joint replacement surgery (the entire knee is replaced with artificial implants) and partial joint replacement surgery (a part of the knee is replaced by artificial implants). Total joint replacement surgery costs more than partial knee surgery. The surgery involves admission fees, equipment costs, and surgeon fees, and it also depends on the type of surgery, age, and whether it is done to one or both knees and others. Therefore, the cost of the surgery comes to around 5,00,000 INR (including both knees). According to the doctor's expertise and the country, the cost varies. Thus, the expenditure on surgery can be a hindrance to the market's growth.Furthermore, the growing number of FDA disapprovals and callbacks of joint replacement implants due to the incompetency of products, lack of standardization, or lack of proper safety and hygiene testing may hamper the market's growth. Additionally, joint replacement procedures are performed using precious metal implants and advanced technology, which makes these products more expensive. As a result, these products are expected to be limited in developing regions with limited healthcare expenditures and in regions with a shortage of skilled surgeons.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.09% |

|

Segments Covered |

By Product, Fixation Procedure, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Johnson & Johnson Services, Inc. (DePuy Synthes), Stryker, Zimmer Biomet, Smith+Nephew, DJO, LLC., Arthrex, Inc., Exactech, Inc., Conformis, and MicroPort Orthopedics, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the knee segment had the largest share of the worldwide joint replacement market in 2024 and the domination of the segment is likely to continue during the forecast period. The segment's growth is primarily driven by the growing aging population suffering from knee-related disorders.On the other hand, the extremities segment is anticipated to witness the fastest CAGR during the forecast period.

By Fixation Insights

Based on fixation, the cemented segment captured almost half of the global market share in 2024 and is anticipated to grow at a promising CAGR during the forecast period.

By Procedure Insights

Based on the procedure, the total replacement segment was the leader in the worldwide joint replacement market in 2024. In total knee arthroplasty, knee joint articular surfaces are replaced with metal and polyethylene plastic. Osteoarthritis affects 6% of every adult; therefore, the incidence of osteoarthritis increases when the aging population increases. Osteoarthritic is the degeneration of tissue which can limit the movement of patients. Therefore, total joint replacement surgery will help them avoid pain and permit the knee to move and rotate. Moreover, in partial joint replacement surgery, the affected tissues are treated, and artificial implants are used to replace only a part of the knee; therefore, it is done when arthritis affects a part of the knee joint or in case of accidents.

By End-User Insights

Based on the end-user, the hospital segment is anticipated to hold a significant share of the worldwide joint replacement market during the forecast period. Several outpatient centers and clinics have evolved to share the service of hospitals; however, patients reach out to hospitals for treatment. Ambulatory surgical centers offer immediate surgery but do not provide overnight stays for outpatients who come for surgery. It advises patients with complicated issues to carry out the surgery in hospitals. Besides, Medical clinics diagnose and provide treatment for outpatients but are visited only for minor medical issues. On the other hand, hospitals have intensive and non-intensive care units to care for patients and provide them with every facility they would need. Hence, hospitals dominate the joint replacement market since surgeries are implemented there.

REGIONAL ANALYSIS

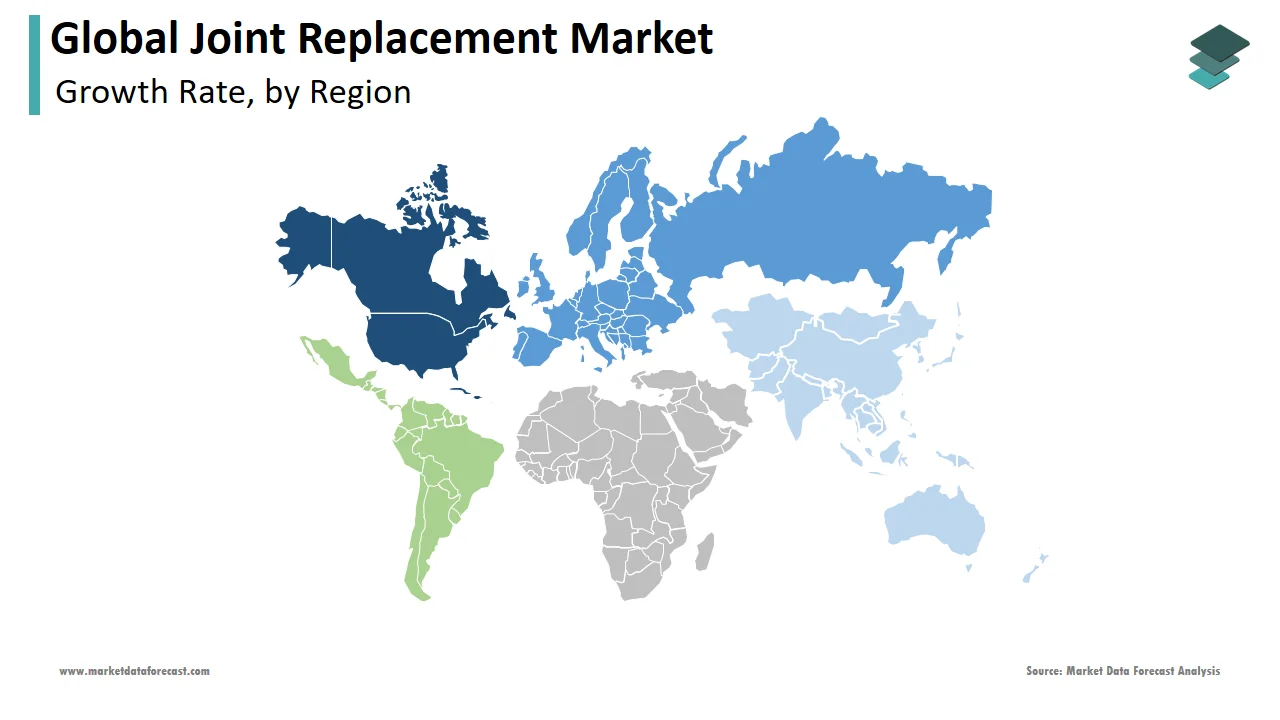

Geographically, North America dominated the market for joint replacement worldwide in 2024. The region's dominance can be attributed to the rising cases of bone diseases like arthritis in the region, along with the growing imaginative and innovative technologies for surgical development in the field of orthopedics. Furthermore, key product launches, high concentration of market players or the presence of manufacturers and acquisitions and partnerships are some factors favoring the market in North America. In addition, the increasing penetration of computer-aided implant designs, robot-assisted surgeries, the prevalence of osteoarthritis, the geriatric population, the availability of insurance coverage, and several trauma and accident cases are also expected to drive demand for joint replacements in the North American region.

Europe is likely to have the second largest share of the global market after North America during the forecast period owing to the increase in chronic diseases such as diabetes leading to an increase in the prevalence of bone disorders. Out of the surgeries performed, about 85% of them last for 20 years. According to the Eurostat in 2020, more than one-fifth of the European Union Population is above 65. As age increases, the prevalence of orthopedic ailments increases; thus, the share in the market increases.

In the region of Asia-Pacific, an increase in the prevalence of osteoporosis and its awareness is presumed to drive market growth and hold a significant share.

Latin America, the Middle East, and Africa will likely experience slow market growth due to a lack of orthopedic surgeons and low revenue growth. However, an increasing number of orthopedic injuries and diseases and an increase in the adoption of replacement procedures are expected to drive growth.

KEY MARKET PLAYERS

Johnson & Johnson Services, Inc. (DePuy Synthes), Stryker, Zimmer Biomet, Smith+Nephew, DJO, LLC., Arthrex, Inc., Exactech, Inc., Conformis, and MicroPort Orthopedics are a few of the noteworthy companies operating in the global joint replacement market profiled in this report.

RECENT MARKET DEVELOPMENTS

- In September 2022, the CORI Surgical System from Smith+Nephew, a leading medical technology provider, was the first to replace a knee with intelligent non-image mapping, doing away with the necessity for preoperative CT/MRI scans. Instead, surgeons can model the joint in 3D using information specific to the patient. In addition, RI.KNEE ROBOTICS can precisely cut components for final placement, balance the gap in real-time, and register flaws following implant removal.

- In 2022, Smith+Nephew performed its first revision procedure using robotic assistance in total replacement surgeries done using its core surgical system. In addition, Smith+Nephew taps robot assistants for joint replacement revisions.

- In October 2022, A 62-year-old woman with severe knee deformity and difficulty walking recently underwent total joint replacement surgery at Victor Hospital. Fewer incisions, less discomfort and scarring, a quicker recovery, and less strain on the surrounding muscles are all benefits of minimally invasive joint replacement surgeries.

MARKET SEGMENTATION

This report on the global joint replacement market has been segmented and sub-segmented into the product, fixation, procedure, end-user, and region.

By Product

- Knees

- Hips

- Extremities

- Upper

- Lower

By Fixation

- Cemented

- Cementless

- Hybrid

- Reverse Hybrid

By Procedure

- Total Replacement

- Partial Replacement

By End-User

- Hospitals

- Orthopedic Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global joint replacement market worth in 2024?

Geographically, the North American region is anticipated to play the leading role in the worldwide joint replacement market during the forecast period.

What are the companies in the joint replacement market?

Yes, we have studied and included the COVID-19 impact on the global joint replacement market in this report.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com