Global 4D Printing in Healthcare Market Size, Share, Trends & Growth Forecast Report By Component, Technology, Application, End-user, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global 4D Printing in Healthcare Market Size

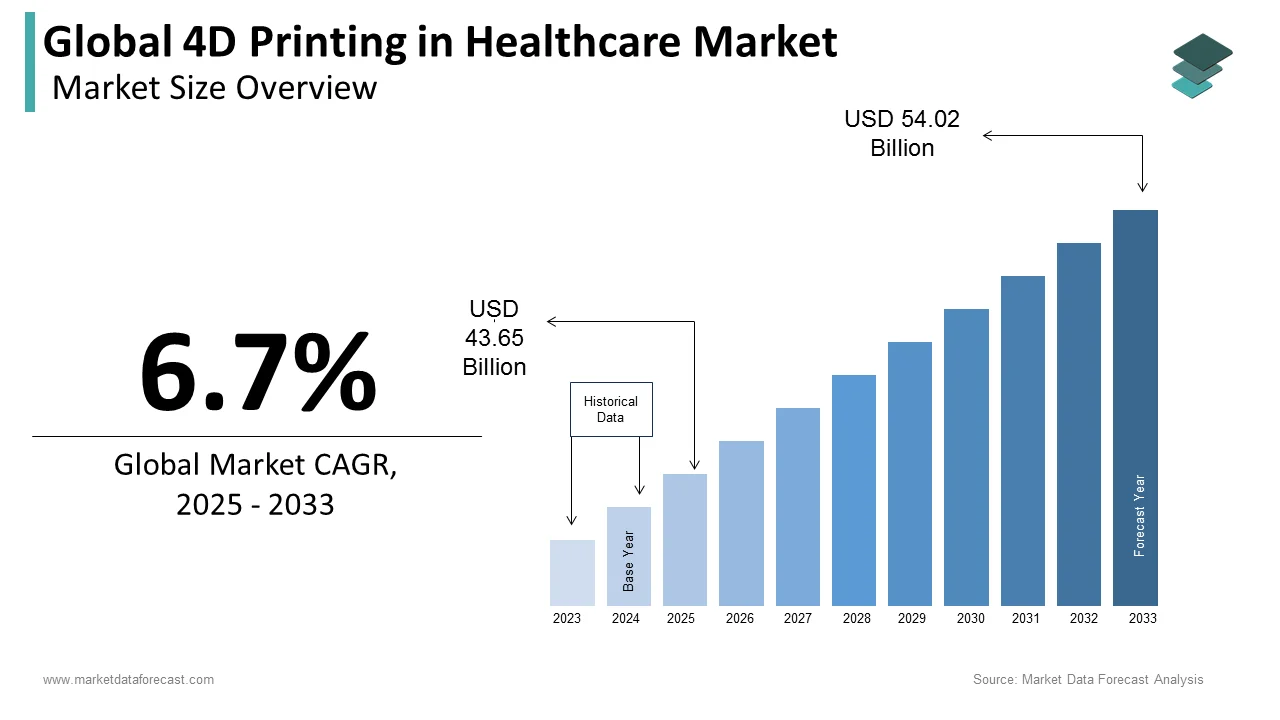

The size of the global 4D printing in healthcare market was worth USD 42.5 billion in 2024. The global market is anticipated to grow at a CAGR of 6.7% from 2025 to 2033 and be worth USD 54.02 billion by 2033 from USD 43.65 billion in 2025.

4D printing refers to 3D printed objects that can remodel, restructured, or self-assemble into another structure using heat, light, water, and other primary energy inputs. Since its introduction in 2013, 4D printing technology has gained considerable interest in the soft robotics, defense, and manufacturing sectors. 4D printing has also found widespread use in the healthcare field. According to a Frost and Sullivan analysis, 4D printing technology is expected to change the healthcare sector significantly. Using flexible and lightweight materials, 4D printing products may be used as medical devices. It has also found use in tissue engineering, chemotherapy, and self-assembling human-sized biomaterials. As a result of its ability to manufacture biomedical splints, stents, bioprinting, and orthodontic devices, 4D medical devices have changed how people think. These implants can also grow along with the human body. In addition, one of the most significant contributions of 4D is the ability to reduce surgical operations. Furthermore, 4D allows for the self-assembly of materials needed to create new products, reducing labor and speeding up the process. Numerous studies on 4D printing are underway to improve healthcare's poor areas.

MARKET DRIVERS

The rising need for innovations to cure diseases majorly drives the growth of 4D printing in healthcare market.

The rising need for 4D printing to develop new therapeutics for various diseases drives the healthcare 4D printing market. Rising incidences of cancer, orthopedics, cardiovascular disease, and other diseases necessitate the development of novel remedies throughout time. Some solutions have been developed, while others are still in the pipeline. However, 4D printing alters one's perspective of the world. For example, UNSW Sydney and The University of Auckland recently revealed that cancer medications and tissue engineering could be given more efficiently when combined with the 4D printing process. The use of 4D printing has also resulted in the development of cancer-fighting nanorobots, transforming them into molecular "delivery trucks" capable of transporting medicines to cells in the body. With the power to reshape, 4D printing has vast possibilities in orthopedics.

Smart orthopedic implants treat spinal abnormalities, fracture fixation, joint and knee replacement, and other orthopedic applications. Furthermore, researchers have spent significant effort developing a solution for CVDs (the leading cause of mortality worldwide). For these cardiovascular treatments, 4D printing technology is a game-changer. For example, 4D printing may readily create stents for heart valves, which can be extended with heat in the patient's body. In the case of pediatrics, 4D-printed structures might grow and alter as children mature, obviating the need for subsequent surgeries to replace tissues or scaffolds that fail to do so. The discoveries and hidden advancements that have yet to be discovered boost the need for 4D printing in healthcare.

Growing demand for artificial organs to promote 4D printing in the healthcare market growth.

The growing demand for artificial organs also drives the expansion of healthcare 4D printing. The scarcity of organ donors necessitated the development of artificial intelligence technologies. According to the United States Government Information on Organ Donation and Transplantation, more than 114,000 men, women, and children are on the national transplant waiting list. Unfortunately, 22 individuals die each day while waiting for a transplant. As a result, 4D printing may be used to make bones, ears, exoskeletons, windpipes, jawbones, eyeglasses, cell cultures, stern cells, blood arteries, vascular networks, tissues, and organs, as well as novel dosage forms and medication delivery systems. The capacity of 4D printing to expand in line with human growth raises demand for artificial organs, accelerating the growth of 4D printing in the healthcare market.

Organization and government support will create new opportunities for 4D printing in the healthcare market.

Initiatives by organizations and governments will create an opportunity for 4D printing in the healthcare market. Many advances have resulted from 4D technology, yet there are still many questions that it can address. Therefore, companies and governments should concentrate on 4D technology research and development. With increased research and development, the healthcare sector may look forward to seeing the light at the end of the tunnel for many disorders. The Singapore University of Technology and Design (SUTD) and its research colleagues, for example, have successfully achieved four-dimensional (4D) printing of shape memory polymers at submicron dimensions like visible light wavelengths in January 2021. This revolutionary advancement has now enabled researchers to investigate new applications in the field of nanophotonics.

MARKET RESTRAINTS

Lack of expertise and low adoption rate may hamper 4D printing in the healthcare market.

However, a lack of experienced specialists and a low adoption rate in low-income nations are projected to impede the expansion of 4D printing in the healthcare business. 4D printing is still a developing technique. There are a limited number of experts that are well-versed in this technology. In addition, the complexity and scarcity of materials used in 4D printing in low- and middle-income nations reduce adoption. As a result, the market for 4D printing in healthcare is growing slowly.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Component, Technology, Application, End-user, & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3D Systems, Organovo Holdings Inc., Stratasys Ltd., Dassault Systèmes, Materialise, EOS GmbH Electro Optical Systems, EnvisionTEC, Poietis, Fit3D, Lantos Technologies, Biomodex, CertaScan, Monogram, Open Bionics, ShapeScale, Tractus3D, axial3D and Medical 3D Printing Experts Ltd. |

SEGMENTAL ANALYSIS

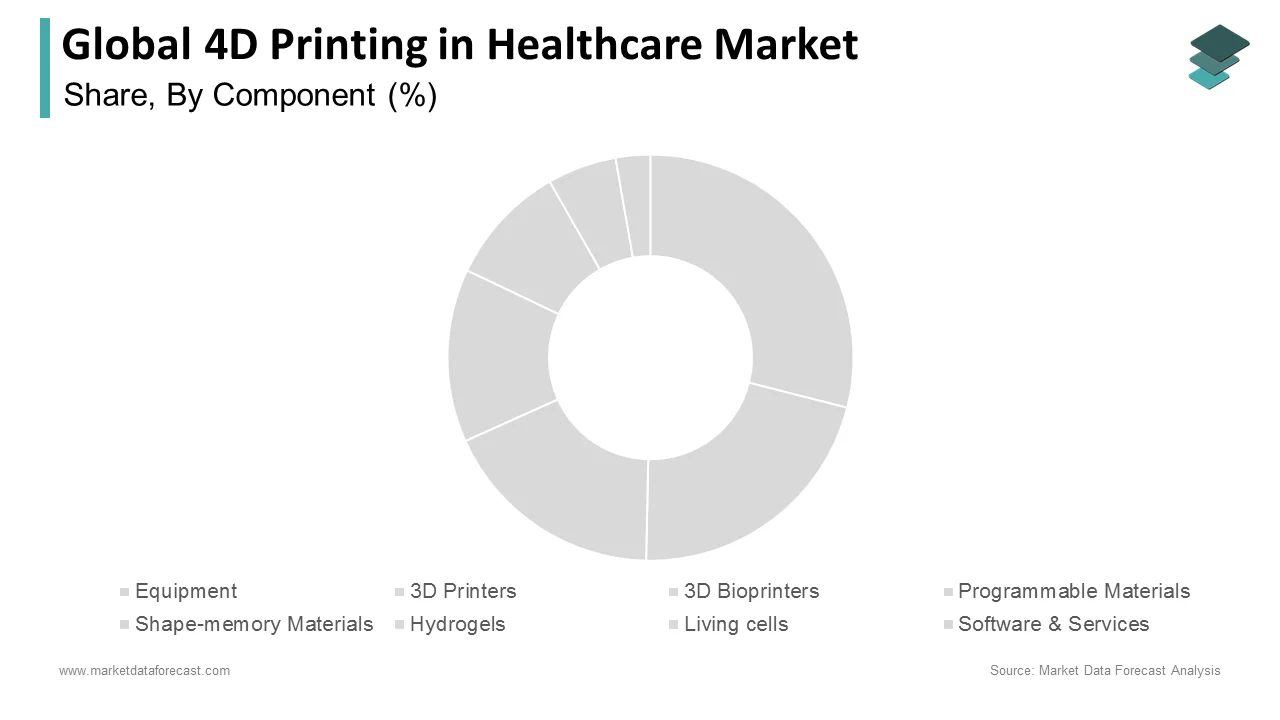

By Component Insights

Based on components, the software & services segment is predicted to lead the market and grow faster during the forecast period. In additive manufacturing, the software offers a wide range of uses. For example, 3D printing software is used to create, design, and assemble models in the healthcare industry. In addition, this software also inspects prototypes for compliance with the needed requirements.

The file preparation program creates STL and SLC files to build the product design. Therefore, the software required for 4D printing should be capable of fully supporting the process. However, because 4D printing technology is still in its infancy, research into 4D printing software is restricted.

By Technology Insights

Based on technology, the PolyJet segment is predicted to grow at the highest growth rate during the forecast period. Complex forms with complex features and delicate characteristics may be created with this technique. In addition, it combines a variety of colors and materials into a single product. The possibility of employing numerous materials and colors and decreased material waste due to greater deposition precision are two main advantages of this technology driving its demand.

The most suited extrusion based on AM methods for 4D printing is FDM or Fused Deposition Modeling. The thermoplastic filament is used in this kind. This is used to heat the melting point and remove the layers one at a time. The healing process may be utilized to demonstrate a shape-shifting phenomenon.

By Application Insights

Based on the application, the Medical Models segment is predicted to have the most significant market share. These models may be customized based on the patient's pathology, providing more efficient patient care. The ability of 4D printing technology to create smart medical models will significantly impact the medical industry and drive this segment's growth throughout the forecast period.

By End-user Insights

Based on the end-user, due to the growing number of hospitals and surgical centers, the Hospitals &clinics segment held the largest market share. In dental clinics and laboratories, 4D printing reduces the complexity of existing operations. Dental laboratories utilize 4D printing technology to improve their competitiveness and productivity, resulting in the segment's rise.

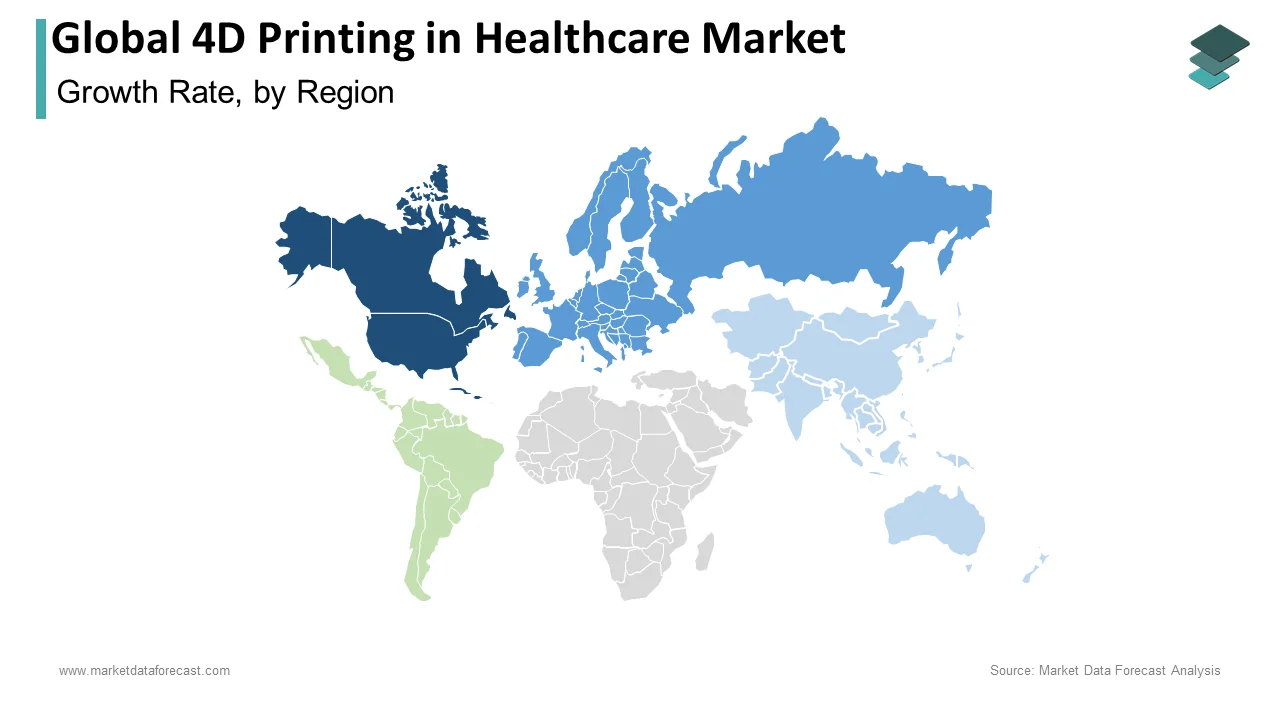

REGIONAL ANALYSIS

Based on region, the largest regional market for 4D printing in healthcare is expected to be North America. This is due to the region's well-developed healthcare infrastructure, ongoing technical advancements, rising demand for organ donation, and initiatives to study and develop 4D printing technologies in the healthcare industry. The Americas led the market in 2020 and are expected to continue to do so during the forecast period. This is due to many medical device businesses and prominent businesses manufacturing 4D printing equipment and software.

Due to the use of 3D and 4D printing in healthcare, European 4D printing in the Healthcare market has the second-largest stake. Healthcare providers are adopting innovative printing technologies for medical devices made of custom materials.

Asia-Pacific region's fastest growth rate can be attributed to increased investment by government agencies and private and public corporations.

KEY MARKET PARTICIPANTS

Notable players operating in the 4D printing in the healthcare market profiled in this report are 3D Systems, Organovo Holdings Inc., Stratasys Ltd., Dassault Systèmes, Materialise, EOS GmbH Electro Optical Systems, EnvisionTEC, Poietis, Fit3D, Lantos Technologies, Biomodex, CertaScan, Monogram, Open Bionics, ShapeScale, Tractus3D, axial3D and Medical 3D Printing Experts Ltd.

These players have used new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market.

RECENT MARKET DEVELOPMENTS

In May 2021, ROKIT Healthcare announced the opening of a high-end anti-aging wellness facility in Hungary. ROKIT Healthcare hopes to integrate 4D bioprinting, single-cell RNA sequencing, artificial intelligence-based anti-aging goods, and individualized regenerative medicine services in this facility.

MARKET SEGMENTATION

This market research report on the global 4D printing in healthcare market has been segmented and sub-segmented into the following categories and analyzed market size and forecast until 2033.

By Component

- Equipment

- 3D Printers

- 3D Bioprinters

- Programmable Materials

- Shape-memory Materials

- Hydrogels

- Living cells

- Software & Services

By Technology

- FDM

- PolyJet

- Stereolithography

- SLS

By Application

- Medical Models

- Surgical Guides

- Patient-specific Implants

By End-user

- Hospitals & Clinics

- Dental Laboratories

- Other End-Users

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region will lead the 4d printing in healthcare market in the future?

Geographically, the North American regional market dominated the 4D printing in healthcare market in 2024.

Who are the major companies in the 4d printing in healthcare market?

3D Systems, Organovo Holdings Inc., Stratasys Ltd., Dassault Systèmes, Materialise, EOS GmbH Electro Optical Systems, EnvisionTEC, Poietis, Fit3D, Lantos Technologies, Biomodex, CertaScan, Monogram, Open Bionics, ShapeScale, Tractus3D, axial3D and Medical 3D Printing Experts Ltd are some of the noteworthy companies in the 4D printing in healthcare market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]