North America Flexible Packaging Market Research Report - Segmented By Type, Material, Printing Technology, Application and Country (The U.S., Canada and Rest of North America) – Analysis on Market Size, Share, Trends, COVID-19 Impact & Growth Forecast From 2025 to 2033

North America Flexible Packaging Market Size

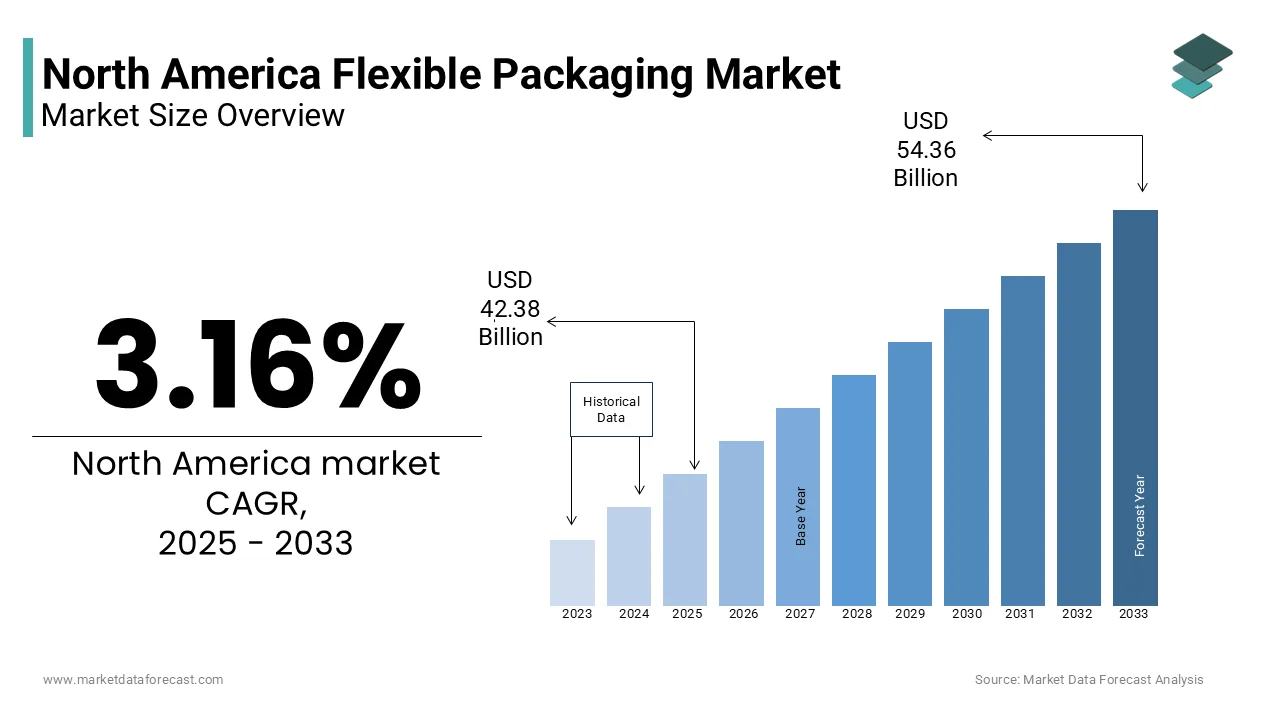

The North American flexible packaging market was assessed at USD 41.08 billion in 2024, and the regional market is predicted to grow at a CAGR of 3.16% from 2025 to 2033. The North American market size is expected to be worth USD 54.36 billion by 2033 from USD 42.38 billion in 2025.

The flexible packaging market in North America incorporates a wide array of lightweight, adaptable materials such as films, foils, and laminates used across various industries including food and beverage, healthcare, personal care, and consumer goods. Characterized by its ease of use, durability, and cost-effectiveness, flexible packaging has become a preferred alternative to rigid containers.

According to the U.S. Department of Commerce, the food and beverage sector alone accounted for nearly 75% of flexible packaging usage in 2024, with ready-to-eat meals, snacks, and single-serve formats leading the demand. Besides, advancements in barrier technologies have improved shelf life and product safety, enhancing adoption across pharmaceutical and medical sectors. While environmental concerns around plastic waste remain a challenge, industry players are increasingly investing in recyclable and compostable alternatives.

MARKET DRIVERS

Increasing Demand for Convenience and On-the-Go Food Consumption

One of the primary drivers fueling the growth of the flexible packaging market in North America is the rising consumer preference for convenience foods and on-the-go meal options. According to the International Food Information Council (IFIC), over 68% of American consumers in 2024 prioritized easy-to-carry and ready-to-consume food products, particularly among urban professionals and millennials. This shift in eating habits has significantly boosted demand for flexible pouches, stand-up bags, and vacuum-sealed wraps that offer portability without compromising freshness or hygiene. The U.S. Department of Agriculture (USDA) reported that sales of single-serve and pre-packaged meals grew year-over-year in 2023, directly contributing to increased flexible packaging adoption. Also, the rise of e-commerce grocery delivery platforms such as Instacart and Amazon Fresh has further amplified the need for durable yet lightweight packaging solutions capable of withstanding logistics stress while ensuring product integrity. Manufacturers have responded by introducing resealable zippers, moisture-resistant coatings, and tamper-evident seals to enhance usability and safety.

Technological Advancements in Sustainable and Smart Packaging Solutions

Technological innovation, particularly in sustainable and smart packaging, has emerged as a major catalyst for the expansion of the flexible packaging market in North America. Consumers and regulatory bodies alike are pushing for eco-friendly alternatives to traditional plastics, prompting manufacturers to invest heavily in biodegradable films, compostable substrates, and recyclable multilayer structures. As per data from the Environmental Protection Agency (EPA), only 8.7% of all plastic waste generated in the U.S. was recycled in 2023, highlighting the urgency for sustainable alternatives. In response, companies like Amcor and Sealed Air have launched fully recyclable mono-material films that maintain performance attributes while reducing environmental impact. Also, the integration of smart packaging features—such as oxygen scavengers, time-temperature indicators, and antimicrobial coatings—has enhanced product safety and extended shelf life. These innovations are particularly valuable in the perishables and pharmaceutical sectors, where spoilage reduction and traceability are critical. Furthermore, digital printing technologies have enabled brand customization and shorter production runs, making flexible packaging an attractive option for small and medium-sized enterprises.

MARKET RESTRAINTS

Regulatory Scrutiny and Compliance Challenges for Plastic-Based Materials

A significant restraint impacting the North America flexible packaging market is the growing regulatory scrutiny surrounding plastic-based materials and their environmental consequences. Governments at both federal and state levels have introduced stringent policies aimed at reducing single-use plastics, which form a substantial portion of flexible packaging. For instance, California, New York, and Washington have enacted laws banning certain types of plastic films and imposing higher recycling content requirements. According to the National Conference of State Legislatures (NCSL), more than 20 states had introduced plastic-related legislation in 2024, with several proposing extended producer responsibility (EPR) schemes that place financial obligations on packaging manufacturers. These regulations necessitate costly reformulations, material substitutions, and investment in recycling infrastructure, increasing operational complexity for industry players. Also, the U.S. Environmental Protection Agency (EPA) has been advocating for a circular economy model, urging companies to adopt reusable or fully recyclable packaging solutions. While these measures are environmentally beneficial, they pose immediate challenges for businesses reliant on conventional polyethylene and polypropylene films. Moreover, inconsistent compliance standards across regions create logistical hurdles, as manufacturers must adapt packaging specifications based on jurisdiction

Fluctuating Raw Material Prices and Supply Chain Disruptions

Another critical constraint affecting the North America flexible packaging market is the volatility in raw material prices and ongoing supply chain disruptions. Flexible packaging relies heavily on petroleum-derived polymers such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), all of which are subject to price fluctuations influenced by crude oil markets and geopolitical tensions. According to the U.S. Energy Information Administration (EIA), crude oil prices saw a notable increase in 2023, directly impacting polymer costs and compressing profit margins for packaging producers. Companies such as Berry Global and Sonoco Products faced double-digit resin price hikes, forcing them to either absorb costs or pass them on to consumers, thereby affecting demand elasticity. Also, supply chain bottlenecks caused by labor shortages, transportation delays, and trade restrictions have led to extended lead times and inventory shortages. The Bureau of Transportation Statistics (BTS) noted that in 2024, average container dwell times at U.S. ports increased by 15% compared to the previous year, exacerbating production constraints. The semiconductor shortage also affected automated packaging equipment, delaying capital investments for many manufacturers. Furthermore, the transition toward bio-based and recyclable materials, though environmentally favorable, often involves higher input costs and limited availability, adding another layer of complexity.

MARKET OPPORTUNITIES

Expansion of E-commerce and Direct-to-Consumer Distribution Channels

The rapid expansion of e-commerce and direct-to-consumer (DTC) distribution channels presents a substantial opportunity for growth in the North America flexible packaging market. As online retail continues to gain prominence, brands are increasingly relying on packaging solutions that ensure product protection, visual appeal, and logistical efficiency. This surge in online shopping has heightened the demand for flexible packaging formats that are lightweight, space-efficient, and damage-resistant during transit. Unlike rigid containers, flexible packaging reduces shipping costs and carbon footprint, aligning with sustainability goals pursued by both retailers and consumers. Leading e-commerce players such as Amazon and Shopify have emphasized the importance of optimized packaging through initiatives like Frustration-Free Packaging and Shipt Zero, encouraging suppliers to adopt recyclable and minimalistic designs. Also, direct-to-consumer models in the food and wellness sectors—exemplified by subscription services like HelloFresh and Daily Harvest—have driven the need for innovative flexible pouches that preserve freshness while offering portion control and resealability. According to McKinsey & Company, more than 60% of consumers in North America now consider packaging sustainability before making a purchase, indicating a shift in buying behavior that favors flexible solutions incorporating post-consumer recycled (PCR) content.

Development of Barrier Films for Enhanced Shelf Life and Product Safety

Development of Barrier Films for Enhanced Shelf Life and Product Safety

The advancement of high-performance barrier films represents a significant growth avenue for the North America flexible packaging market, particularly in food preservation and pharmaceutical applications. These specialized films are designed to protect contents from moisture, oxygen, UV exposure, and microbial contamination, thereby extending shelf life and ensuring product integrity. According to the Institute of Food Technologists (IFT), approximately one-third of all food produced globally is wasted annually, largely due to inadequate packaging. In response, manufacturers have developed multilayer barrier films using materials such as ethylene-vinyl alcohol (EVOH), metallized polyester, and nanocomposites that offer superior protective properties. Companies like Dow Chemical and BASF have introduced oxygen scavenging films that actively absorb residual oxygen within sealed packages, preventing spoilage and maintaining freshness in perishable goods. In the healthcare sector, barrier films play a crucial role in sterile medical device packaging, ensuring compliance with FDA and ISO sterilization standards. Additionally, the rise of modified atmosphere packaging (MAP) techniques in fresh produce and meat packaging has further amplified the adoption of barrier-enhanced flexible films.

MARKET CHALLENGES

Complexity in Recycling Multi-Layer Flexible Packaging

A foremost challenges confronting the North America flexible packaging market is the difficulty associated with recycling multi-layered and composite packaging structures. Traditional flexible packaging often consists of multiple layers of different materials—such as polyethylene (PE), aluminum foil, and ethylene-vinyl alcohol (EVOH)—bonded together to provide barrier protection, durability, and printability. However, this complexity makes separation and mechanical recycling extremely challenging, limiting the feasibility of closed-loop recycling systems. According to the Sustainable Packaging Coalition (SPC), less than 10% of flexible packaging in the U.S. was effectively recycled in 2024, compared to over 30% for rigid plastic containers. The lack of standardized recycling infrastructure tailored for flexible materials further compounds the issue. Municipal recycling programs typically exclude flexible films due to sorting inefficiencies and contamination risks, resulting in most of these materials ending up in landfills or incineration facilities. Major players such as Procter & Gamble and Unilever have acknowledged this limitation and are collaborating with industry coalitions like How2Recycle to improve labeling clarity and promote consumer education. Despite technological advancements in chemical recycling and depolymerization processes, scalability and cost-effectiveness remain barriers to widespread implementation.

Consumer Perception and Misconceptions About Plastic Usage

Consumer Perception and Misconceptions About Plastic Usage

Despite the functional and environmental benefits offered by modern flexible packaging, negative consumer perception surrounding plastic usage remains a significant challenge in North America. Years of media coverage highlighting plastic pollution, microplastics, and landfill accumulation have fostered a general distrust toward plastic-based packaging, even when it is recyclable or derived from sustainable sources. This perception gap creates difficulties for manufacturers seeking to promote flexible packaging as a resource-efficient alternative to glass, metal, or paper-based containers. While flexible films consume less energy and generate fewer emissions during production and transport, public sentiment often equates any plastic presence with environmental harm. The proliferation of misleading "eco-friendly" marketing claims has further confused consumers, making it harder for responsible brands to differentiate themselves. Besides, retailers and brand owners are under increasing pressure to eliminate all forms of plastic from product lines, sometimes without viable substitutes available. A 2024 report by the Ellen MacArthur Foundation highlighted that while alternatives like compostable films are gaining traction, they still represent a small fraction of overall flexible packaging output due to cost and performance limitations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.16% |

|

Segments Covered |

By Type, Material, Printing Technology, Application , and Region |

|

Various Analyses Covered |

Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Amcor Limited, Bemis Company Inc., Constantia Flexibles Group GmbH, Sealed Air Corporation, Huhtamäki Oyj, Coveris Holdings S.A., Sonoco Products Company, Berry Plastics Group Inc., Mondi Group, and Reynolds Group |

SEGMENTAL ANALYSIS

By Material Insights

Plastics constituted the largest segment in the North America flexible packaging market, capturing approximately 69% of total revenue in 2024. This dominance is primarily attributed to the widespread use of polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET) across food and beverage, personal care, and pharmaceutical applications. According to the American Chemistry Council (ACC), over 18 million tons of plastic resins were consumed in U.S. packaging applications in 2023, with flexible formats accounting for nearly half of that volume. The material’s popularity stems from its versatility, lightweight nature, moisture resistance, and cost-effectiveness compared to alternatives like aluminum foil or paper-based structures. Also, advancements in barrier technologies have enabled plastics to offer extended shelf life for perishable goods, making them indispensable in the food industry. Moreover, innovations such as resealable zippers, stand-up pouches, and recyclable mono-material films are enhancing consumer appeal and reinforcing plastic’s stronghold in the market.

On the other hand, paper and paperboard are emerging as the fastest-growing segment in the North America flexible packaging market, projected to expand at a CAGR of 6.8%. This growth is driven by increasing consumer demand for sustainable, biodegradable, and recyclable packaging solutions amid growing environmental awareness. Leading brands such as Nestlé and Unilever have committed to replacing plastic-based sachets and wraps with paper-based alternatives in their product lines, further accelerating adoption. Additionally, technological advancements—such as water-resistant coatings and compostable lamination layers—have improved functional performance, allowing paper-based flexible packaging to compete with traditional plastic formats.

By Product Type Insights

Stand-up pouches represented the biggest product type segment in the North America flexible packaging market, holding an estimated 34.8% share in 2024. Their dominance is largely due to their functional advantages, including stability on retail shelves, resealability, portability, and space efficiency. These features make them ideal for packaging snacks, beverages, pet food, and household detergents. The rise of premium private-label brands in supermarkets and e-commerce platforms has further boosted demand for high-quality, branded pouches with enhanced visual appeal. Additionally, manufacturers have introduced multi-layer barrier films within these pouches to improve freshness retention, making them a preferred choice for perishables. Companies like Amcor and Constantia Flexibles have expanded their stand-up pouch portfolios with integrated sustainability features, such as recyclable mono-material constructions and plant-based inks.

Retort pouches and gusseted packs are witnessing the highest growth rate in the North America flexible packaging market, expanding at a CAGR of 7.3%. This rapid expansion is fueled by the rising demand for ready-to-eat meals, long-life food preservation, and portion-controlled packaging across both consumer and military applications. Retort pouches allow for thermal sterilization without compromising nutritional value or taste, making them essential in the foodservice and emergency preparedness sectors. In the commercial sector, companies like Hormel Foods and Conagra Brands have increasingly adopted retort technology for shelf-stable soups, stews, and baby food, capitalizing on consumer preferences for convenience and safety. Gusseted packs, with their expandable bottom and side panels, are widely used for bulkier items such as coffee, pet treats, and frozen vegetables.

By Application Insights

Food and beverage packaging constituted the biggest application segment in the North America flexible packaging market by commanding an estimated 61% share in 2024. This overwhelming dominance is primarily driven by the extensive use of flexible films, pouches, wraps, and bags across dairy, bakery, confectionery, snack, and beverage sectors. According to the U.S. Food and Drug Administration (FDA), over 75% of all packaged food products in the U.S. utilize some form of flexible packaging, owing to its ability to enhance shelf life, maintain freshness, and support portion control. Additionally, the rise of single-serve and on-the-go consumption trends, particularly among millennials and Gen Z consumers, has significantly boosted demand for convenient packaging solutions. Innovations such as modified atmosphere packaging (MAP), antimicrobial coatings, and barrier-enhanced laminates have further reinforced the role of flexible packaging in preserving food safety and reducing waste.

The pharmaceutical segment is coming up as the booming application area in the North America flexible packaging market, expanding at a CAGR of 8.1%. This progress is primarily attributed to the rising demand for sterile, tamper-evident, and child-resistant packaging solutions for prescription medications, over-the-counter drugs, and nutraceuticals. According to the U.S. Food and Drug Administration (FDA), more than 5.8 billion prescription medications were dispensed in the U.S. in 2023, necessitating advanced packaging systems that ensure product integrity and patient compliance. Blister packs, strip packs, and pouches made from high-barrier flexible films are increasingly used to protect tablets, capsules, and powders from moisture, light exposure, and microbial contamination. Besides, the rise of personalized medicine and unit-dose packaging has further accelerated the adoption of flexible solutions tailored for individual patient needs. Manufacturers such as Alcan Packaging and Gerresheimer have introduced anti-counterfeiting features like holographic labels and RFID tags embedded into flexible pharmaceutical packaging.

REGIONAL ANALYSIS

The United States had the dominant position in the North America flexible packaging market by capturing an overwhelming 86.1% market share in 2024. This prime status is underpinned by a robust manufacturing base, high consumer demand for packaged goods, and strong presence of global brand owners and packaging suppliers. The country benefits from a well-established supply chain network, cutting-edge R&D initiatives, and a thriving e-commerce ecosystem that favors lightweight, durable packaging. Furthermore, major players such as Amcor, Berry Global, and Sealed Air have headquarters or major production facilities in the U.S., reinforcing its influence on regional market dynamics. Regulatory bodies like the FDA also play a crucial role in shaping packaging standards, ensuring safety and innovation.

Canada is maintaining a steady growth trajectory driven by rising consumer demand for convenience-oriented products and increased emphasis on sustainable packaging. The Canadian Plastics Industry Association (CPIA) noted that flexible packaging represented nearly 25% of total plastic packaging consumption in Canada, with stand-up pouches and resealable bags leading adoption. Environmental concerns have prompted regulatory action, with provinces like British Columbia and Quebec implementing extended producer responsibility (EPR) schemes aimed at improving recycling rates. As per Environment and Climate Change Canada (ECCC), only 9% of plastic packaging was recycled nationwide in 2023, prompting industry stakeholders to invest in recyclable mono-material structures and compostable alternatives. Also, cross-border trade agreements and proximity to U.S. markets facilitate seamless integration of Canadian firms into broader North American supply chains.

The Rest of North America, comprising Mexico and smaller Caribbean territories, represents a modest share of the regional flexible packaging market in 2024. While relatively small compared to the U.S. and Canada, this segment is gradually gaining traction due to improving economic conditions, industrial modernization, and rising disposable incomes. Additionally, Mexico’s proximity to the U.S. allows for efficient logistics and sourcing, making it an attractive location for multinational packaging firms looking to reduce costs. However, inconsistent regulatory frameworks and limited recycling infrastructure pose challenges to widespread adoption. Despite these constraints, companies like Mondi and Tetra Pak have expanded operations in Mexico, recognizing its potential as a strategic hub for Latin American exports.

KEY MARKET PLAYERS

Companies such as Amcor Limited, Bemis Company Inc., Constantia Flexibles Group GmbH, Sealed Air Corporation, Huhtamäki Oyj, Coveris Holdings S.A., Sonoco Products Company, Berry Plastics Group Inc., Mondi Group, and Reynolds Group Holdings are playing a dominating role in the North American flexible packaging market.

The competition in the North America flexible packaging market is marked by a mix of established multinational corporations and agile regional players striving to capture market share through innovation, sustainability, and strategic expansion. Dominant firms leverage their extensive R&D capabilities, broad product portfolios, and strong supply chain networks to maintain leadership positions. However, increasing demand for eco-friendly packaging solutions is reshaping the competitive dynamics, compelling even large players to reconfigure their offerings and invest in alternative materials. Smaller, innovative companies are emerging as disruptors, introducing novel biodegradable films and digitally enhanced packaging formats that cater to niche markets and specialty applications. Additionally, vertical integration is becoming a common trend, with manufacturers acquiring upstream suppliers or downstream distributors to streamline operations and reduce dependency on external vendors. As consumer awareness and regulatory scrutiny intensify, companies are under growing pressure to demonstrate environmental stewardship while maintaining cost efficiency and functional superiority. In this evolving landscape, agility, adaptability, and forward-looking investments in sustainable technologies are key differentiators determining long-term success.

TOP PLAYERS IN THE MARKET

Amcor plc

Amcor is a global leader in responsible packaging solutions, with a strong presence in the North American flexible packaging market. The company offers a diverse portfolio of sustainable flexible films, pouches, and barrier packaging tailored for food, beverage, pharmaceutical, and healthcare applications. Amcor has been at the forefront of developing recyclable and lightweight packaging alternatives that align with evolving consumer preferences and environmental regulations. Its commitment to innovation and sustainability has positioned it as a key player influencing industry trends, particularly in reducing plastic waste and promoting circular economy principles.

Berry Global Group, Inc.

Berry Global is a major contributor to the North America flexible packaging landscape, known for its extensive product range and integrated manufacturing capabilities. The company serves a wide array of end-use sectors including food and beverage, personal care, and industrial goods. Berry Global emphasizes material science advancements and operational efficiency to deliver high-performance packaging solutions. With a focus on customer-centric innovation, the company plays a crucial role in shaping flexible packaging formats that balance functionality, aesthetics, and environmental responsibility across both retail and institutional markets.

Sealed Air Corporation

Sealed Air is a prominent name in the flexible packaging sector, recognized for its expertise in protective and food packaging solutions. The company's innovations in vacuum-seal technology and modified atmosphere packaging have significantly influenced food safety and shelf-life extension practices across North America. Sealed Air integrates sustainability into its core strategy, developing flexible packaging systems that reduce material usage and support recycling initiatives. Its robust R&D framework ensures continuous improvement in performance-driven packaging, making it a trusted partner for major food processors and retailers seeking reliable and eco-conscious packaging solutions.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

One of the most significant strategies adopted by leading players in the North America flexible packaging market is investing in sustainable packaging innovation . Companies are prioritizing the development of recyclable, compostable, and bio-based materials to meet regulatory requirements and shifting consumer expectations toward environmentally responsible products. This shift not only enhances brand image but also ensures long-term compliance with evolving policies.

Another key approach is expanding through strategic acquisitions and partnerships , allowing firms to diversify their offerings, enhance technological capabilities, and strengthen regional footholds. By acquiring niche players or forming alliances with material innovators, companies can accelerate time-to-market for new packaging solutions while gaining access to specialized expertise and distribution networks.

Lastly, leveraging digital technologies and smart packaging integration has become essential for differentiation. Major players are incorporating digital printing, RFID tagging, and intelligent packaging features that provide traceability, freshness indicators, and interactive consumer engagement. These advancements help brands enhance product visibility and ensure supply chain transparency, reinforcing competitive positioning in a rapidly evolving market landscape.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Amcor introduced a new line of fully recyclable mono-material stand-up pouches designed specifically for dry food applications, enhancing its portfolio of sustainable packaging solutions and reinforcing its commitment to circular economy principles.

- In March 2024, Berry Global launched an advanced digital printing facility in Georgia, aimed at providing high-quality, customizable flexible packaging options that enable brands to differentiate themselves on store shelves while reducing lead times and production waste.

- In June 2024, Sealed Air announced a strategic partnership with a renewable materials startup to develop next-generation compostable films for use in fresh food packaging, supporting its vision of reducing single-use plastics and offering scalable eco-friendly alternatives.

- In September 2024, Sonoco invested in expanding its flexible packaging plant in Illinois, focusing on increasing capacity for high-barrier flexible structures used in pharmaceutical and medical device packaging to meet rising demand for sterile and durable packaging solutions.

- In November 2024, Constantia Flexibles unveiled a new research and development center in California dedicated to advancing smart packaging technologies, including active and intelligent packaging features that improve product traceability, freshness monitoring, and consumer engagement.

MARKET SEGMENTATION

This research report on the North American flexible packaging market has been segmented and sub-segmented into the following categories.

By Material

-

Plastics

- Polyethylene

- Polypropylene

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Polystyrene

- Ethylene-Vinyl Alcohol

- Aluminum Foil

- Paper and Paperboard

By Product Type

- Stand-Up Pouches

- Vacuum Pouches and Bags

- Retort Pouches and Gusseted Packs

- Wicketed Bags

- Others

By Printing Technology

- Flexography

- Rotogravure

- Digital

- Others

By Application

- Food And Beverage Packaging

- Personal Care Products

- Pharmaceutical Products

- Tobacco Products

- Agricultural Products

- Others

- Sporting Goods

- Agricultural Products

By Country

- The U.S.

- Canada

- Rest of North America

Frequently Asked Questions

Which countries contribute the most to the flexible packaging market in North America?

The United States and Canada are the primary contributors to the North American flexible packaging market.

Which industries are driving the demand for flexible packaging in North America?

The food and beverage industry, followed by healthcare and personal care, are the major drivers of flexible packaging demand in North America.

How does the North America flexible packaging market compare to other regions globally?

North America holds a significant share in the global flexible packaging market, ranking among the top regions in terms of market size.

What are the key challenges faced by the North America flexible packaging industry?

Regulatory compliance, fluctuating raw material prices, and concerns related to plastic waste management are some of the challenges faced by the industry.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com