North America Veterinary Healthcare Market Research Report – Segmented By Animal Type (Livestock Animals, Companion Animals), Product and Country (the United States, Canada and Rest of North America) – Industry Analysis From 2025 to 2033

North America Veterinary Healthcare Market Size

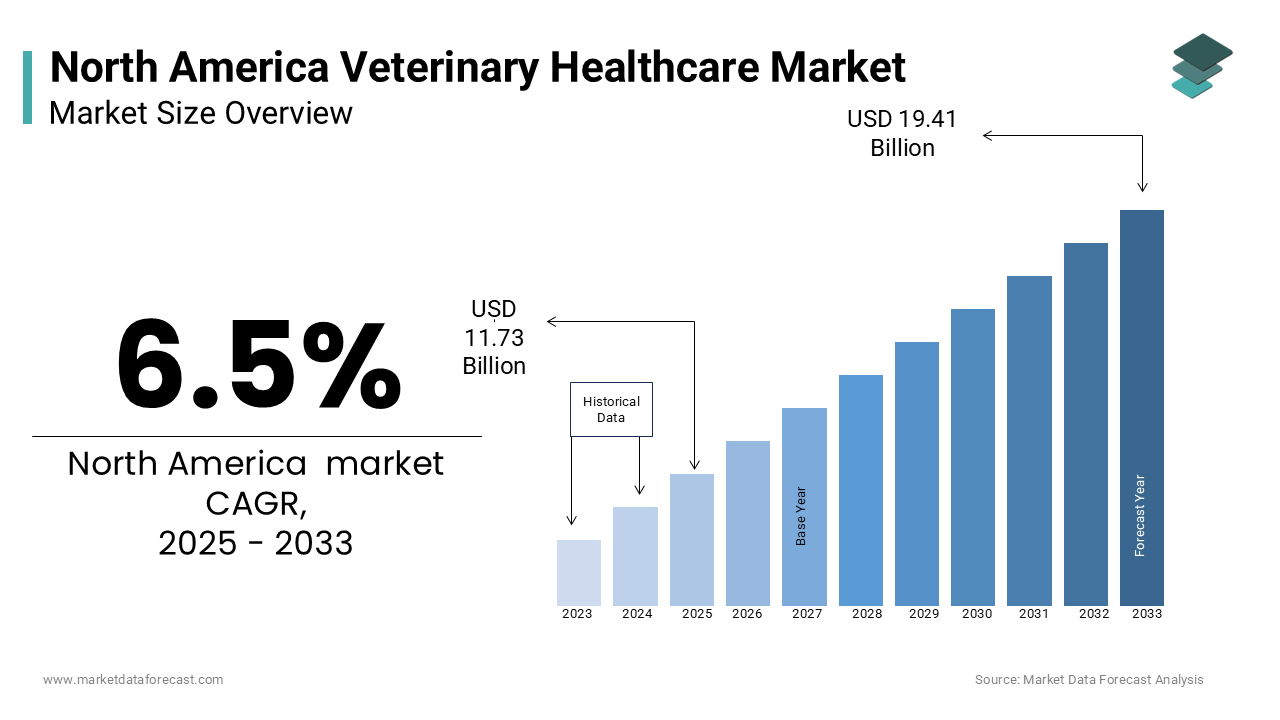

The North America veterinary healthcare market size was valued at USD 11.01 billion in 2024 and is estimated to reach USD 19.41 billion by 2033 from USD 11.73 billion in 2025, registering a CAGR of 6.5% from 2025 to 2033.

The North America Veterinary Healthcare market is experiencing robust growth and that is supported by increasing pet ownership and advancements in veterinary care. According to the American Pet Products Association (APPA), over 67% of U.S. households own a pet which signifies a surging emotional and financial investment in companion animals. This trend has spurred demand for high-quality healthcare products and services, with spending on veterinary care reaching $34 billion in 2023, as per the Bureau of Labor Statistics.

A notable factor influencing this development is the rise in understanding about animal health and wellness. The Canadian Veterinary Medical Association reports that 80% of pet owners now prioritize preventive care, such as vaccinations and regular check-ups, compared to just 50% a decade ago. Additionally, innovations in biologics and pharmaceuticals have improved treatment outcomes and are driving adoption among veterinarians and pet owners alike. For instance, Zoetis introduced a novel vaccine in 2023 that reduced the incidence of canine parvovirus by 30% indicates the role of R&D in market expansion.

Apart from these, the advancements in technology is also reshaping the landscape. Like, telemedicine platforms for pets gained traction during the pandemic, with McKinsey & Company estimating a 25% increase in virtual consultations since 2020.

MARKET DRIVERS

Rising Pet Ownership and Humanization of Pets

The expanding trend of pet humanization is a primary driver propelling the North America Veterinary Healthcare market forward. The American Pet Products Association states that pet ownership surged by 12% between 2019 and 2023, with millennials and Gen Z leading the charge. This demographic shift has fostered a culture where pets are treated as family members by prompting increased spending on healthcare. Pet owners are investing heavily in premium healthcare services. The Bureau of Labor Statistics draws attention to the fact that spending on veterinary care reached $34 billion in 2023, with diagnostics and treatments accounting for the largest share. Companion animals, particularly dogs and cats, benefit from advanced treatments such as orthopedic surgeries and cancer therapies which were once exclusive to human medicine. This wave is further amplified by urbanization. The U.S. Census Bureau reports that over 83% of Americans live in urban areas, where small apartments and busy lifestyles necessitate preventive healthcare to ensure pets remain healthy and active. These factors collectively drive demand for innovative Veterinary Healthcare solutions.

Advancements in Veterinary Biologics and Pharmaceuticals

Technological breakthroughs in veterinary biologics and pharmaceuticals are another key driver shaping the market. In accordance with the U.S. Food and Drug Administration (FDA), more than 200 new veterinary drugs were approved in the past five years to address conditions ranging from chronic pain to infectious diseases. Biologics like vaccines and immunotherapies are gaining prominence due to their efficacy and safety profiles. For instance, Zoetis launched a novel vaccine in 2023 that reduced the incidence of canine parvovirus by 30%, as reported by the American Veterinary Medical Association. Similarly, monoclonal antibodies are being used to treat conditions like atopic dermatitis, achieving a 40% improvement in symptoms . Also, government support further accelerates innovation. The National Institutes of Health allocated $50 million to veterinary research in 2023, fostering collaboration between academia and industry. These advancements not only improve animal health but also expand the market’s reach.

MARKET RESTRAINTS

High Costs of Advanced Treatments

A key challenge hindering the growth of the North America Veterinary Healthcare market is the exorbitant cost of advanced treatments which limits accessibility for many pet owners. As stated by the American Veterinary Medical Association, specialized procedures such as orthopedic surgeries or cancer treatments can cost upwards of $5,000 is creating financial barriers for low-income households. This issue is exacerbated in rural areas, where access to veterinary clinics is limited. The Rural Health Information Hub brings to light that 20% of rural residents lack access to specialized veterinary care is forcing them to travel long distances for treatment. Even when services are available, the affordability of advanced diagnostics and therapies remains a concern. Besides, pet insurance adoption is still relatively low. The North American Pet Health Insurance Association estimates that only 3% of pets in the U.S. are insured, leaving many owners to bear the full cost of treatments. These financial constraints create significant obstacles to equitable market growth.

Regulatory Hurdles and Approval Delays

An added restraint that is equally critical is the strict regulatory environment governing veterinary drug approvals. This slows the introduction of innovative treatments. As mentioned by the FDA, the average time required to bring a new veterinary drug to market exceeds 7 years, with associated costs surpassing $100 million. These barriers disproportionately affect smaller companies are limiting their ability to innovate and compete. For example, the approval process for biologics is particularly complex, requiring extensive clinical trials to demonstrate safety and efficacy. The National Institutes of Health spotlights that 40% of veterinary drug candidates fail during clinical trials further delaying market entry. These legal hurdles create a challenging environment for manufacturers, slowing the pace of innovation and impeding market expansion.

MARKET OPPORTUNITIES

Expansion of Preventive Care Solutions

The surging emphasis on preventive care presents a great opportunity for the North America Veterinary Healthcare market. According to the Canadian Veterinary Medical Association, 80% of pet owners now prioritize preventive measures, such as vaccinations, dental care, and nutritional supplements, to avoid costly treatments later. Vaccines and diagnostics are leading this trend. The American Veterinary Medical Association stresses that the use of preventive vaccines reduced the incidence of common diseases like rabies and distemper by 25% over the past decade. Similarly, diagnostic tools such as imaging and blood tests enable early detection of conditions like diabetes and kidney disease are improving treatment outcomes. Innovative products are also gaining traction. For example, wearable health monitors introduced in 2023 track vital signs in real-time, allowing pet owners to monitor their animals’ health proactively. Bloomberg Healthcare Analytics estimates that the global market for pet wearables will reach $5 billion by 2025 is displaying the industry’s focus on innovation. These developments position preventive care as a lucrative avenue for market expansion.

Integration of Digital Health Platforms

Digital health platforms represent additional promising opportunity for the market, particularly in enhancing accessibility and convenience. Telemedicine enables pet owners to consult veterinarians remotely, reducing travel time and costs. The American Telemedicine Association exhibits that 40% of pet owners now use online platforms for routine consultations, citing convenience as a key advantage. Also, AI-driven tools are also transforming diagnostics. For instance, machine learning algorithms introduced in 2023 analyze medical records and imaging data to predict disease risks, achieving a 30% higher accuracy rate compared to traditional methods. These innovations are reshaping the market is offering scalable solutions for diverse populations.

MARKET CHALLENGES

Addressing Disparities in Access to Veterinary Care

A grave challenge derailing the expansion of North America Veterinary Healthcare market is addressing disparities in access to veterinary services, particularly among underserved populations. As per the U.S. Department of Agriculture, 25% of rural households lack access to veterinary clinics are creating gaps in care for both companion and production animals. Economic barriers aggravate this issue, with uninsured pets accounting for 97% of the total pet population, as per the North American Pet Health Insurance Association. This leaves many owners unable to afford advanced treatments, even when services are available. Geographic disparities also persist, particularly in remote areas where transportation infrastructure is limited. The Rural Health Information Hub shows that 30% of rural residents travel over 50 miles for veterinary care, further complicating efforts to meet diverse needs effectively. These inequities create significant obstacles to equitable market growth.

Managing Antibiotic Resistance in Livestock

An extra difficulty is the growing concern over antibiotic resistance in livestock, which threatens food security and public health. The Centers for Disease Control and Prevention (CDC) emphasizes that antibiotic-resistant infections cause over 35,000 deaths annually in the U.S., with livestock being a significant contributor. The overuse of antibiotics in production animals exacerbates this issue. The World Health Organization reports that 70% of antibiotics sold globally are used in livestock, often for growth promotion rather than treating infections. This practice fosters the emergence of resistant strains, complicating disease management. Regulatory measures are being implemented to address this challenge. For instance, the FDA banned the use of medically important antibiotics for growth promotion in 2017, but enforcement remains inconsistent.

SEGMENTAL ANALYSIS

By Product Insights

The Pharmaceuticals segment spearheaded the North America Veterinary Healthcare market by possessing a 60.3% of the total revenue in 2024. This is because of their widespread use in treating chronic and acute conditions across companion and production animals. As per the American Veterinary Medical Association, 70% of veterinary prescriptions are for pharmaceuticals, showcasing their critical role in Veterinary Healthcare. A key factor driving this dominance is the versatility of pharmaceuticals. The FDA highlights that these products address a wide range of conditions, from pain management to infectious diseases, making them indispensable for veterinarians. Additionally, advancements in formulations, such as extended-release tablets and topical gels, enhance patient compliance and satisfaction. Government initiatives further bolster adoption. For instance, the USDA launched campaigns promoting the use of antibiotics for therapeutic purposes, aligning with broader efforts to combat antibiotic resistance. These factors solidify the position of pharmaceuticals as the backbone of the market.

On the other hand, the Biologics segment is predicted to expand at a CAGR of 15.2% in the future owing to their efficacy and safety profiles. According to the National Institutes of Health, biologics accounted for 25% of new veterinary drug approvals in 2023, reflecting their growing importance in the market. A major propellent is their application in preventive care. The Canadian Veterinary Medical Association states that vaccines and immunotherapies reduce the incidence of common diseases by 30% , making them a preferred choice for pet owners and livestock producers alike. Technological progress are also accelerating adoption. For example, monoclonal antibodies introduced in 2023 achieved a 40% improvement in symptoms for conditions like atopic dermatitis. These innovations position biologics as a transformative force in the Veterinary Healthcare market.

By Animal Type Insights

The Companion animals segment was at the forefront of the North America Veterinary Healthcare market by having a substantial portion of the total revenue in 2024. This leadership is driven by the growing trend of pet humanization and the increasing prevalence of chronic conditions among dogs and cats. The American Pet Products Association found that over 67% of U.S. households own a pet, creating substantial demand for healthcare products and services. A key factor supporter of this dominance is the emotional and financial investment in pets. The Bureau of Labor Statistics spotlights that spending on veterinary care reached $34 billion in 2023, with companion animals accounting for the largest share. Additionally, advancements in diagnostics and treatments have improved outcomes for conditions like arthritis and cancer, further boosting adoption. Urbanization also plays a role. The U.S. Census Bureau stresses that 83% of Americans live in urban areas, where small apartments and busy lifestyles necessitate preventive healthcare to ensure pets remain healthy and active. These factors solidify the position of companion animals as the largest segment.

The Production animals segment is anticipated to rise at a CAGR of 12.8% from 2025 to 2033 and is propelled by the increasing demand for safe and sustainable food products. As stated by the USDA, the U.S. livestock industry generates over $200 billion annually, underscoring its economic significance. A major backing factor is the focus on disease prevention. The World Health Organization reports that vaccines and immunotherapies reduce the incidence of infectious diseases by 25% , ensuring healthier livestock and higher yields. Technological advancements are also accelerating adoption. For example, AI-driven tools introduced in 2023 analyze herd health data to predict disease outbreaks, improving farm management. These innovations position production animals as a key growth driver in the Veterinary Healthcare market.

By Distribution Channel Insights

The Retail pharmacies commanded the North America Veterinary Healthcare market by holding a market share of 45.5% in 2024. This is driven by their widespread accessibility and convenience, particularly for purchasing over-the-counter medications and nutritional supplements. According to the National Association of Chain Drug Stores, there are over 40,000 retail pharmacies in the U.S., making them the most convenient option for pet owners. A key factor behind this dominance is consumer trust. A survey conducted by the American Pharmacists Association reveals that 70% of pet owners prefer purchasing medications from retail pharmacies due to personalized service and ease of access. Additionally, retail chains like PetSmart and Chewy offer a wide range of products, from prescription drugs to dietary supplements, catering to diverse needs. Promotions and discounts further amplify demand. For instance, loyalty programs introduced by retailers in 2023 increased repeat purchases by 20%, solidifying retail pharmacies' position as the largest distribution channel.

In contrary, the E-commerce segment is expected to advance at a CAGR of 18.5% in the future is fueled by the increasing adoption of online shopping and digital health solutions. In line with the Bloomberg Healthcare Analytics, online sales accounted for 15% of total Veterinary Healthcare revenue in 2023, with projections indicating significant growth as platforms become more integrated into consumer lifestyles. A major driver is convenience. McKinsey & Company states that 40% of pet owners now use online platforms for medication refills, citing time savings and home delivery as key advantages. Additionally, the COVID-19 pandemic accelerated this trend, with online sales increasing by 30% since 2020. Technological developments are also propelling growth. For example, AI-driven platforms introduced in 2023 enable personalized recommendations and real-time inventory tracking, improving customer satisfaction. These innovations position e-commerce as a transformative force in the Veterinary Healthcare market.

By End-Use Insights

The Veterinary hospitals and clinics segment dominated the North America Veterinary Healthcare market by capturing 51.4% of the total revenue in 2024. This is due to their role as the primary point of care for both companion and production animals, offering a wide range of services, including diagnostics, surgeries, and emergency treatments. According to the American Veterinary Medical Association (AVMA), there are over 15,000 veterinary clinics across the U.S., serving millions of pets annually. A key factor driving this dominance is the increasing prevalence of chronic diseases among companion animals. The AVMA brings to light that conditions like arthritis, diabetes, and cancer affect 40% of dogs and 30% of cats, necessitating frequent visits to veterinary hospitals. Additionally, advancements in medical equipment, such as MRI machines and ultrasound devices, have improved diagnostic accuracy, attracting more pet owners to seek professional care. Urbanization further amplifies demand. The U.S. Census Bureau exhibits that 83% of Americans live in urban areas, where access to veterinary hospitals is convenient. Loyalty programs and telemedicine consultations offered by clinics also enhance customer retention, solidifying their position as the largest end-use segment.

On the other hand, The Point-of-care testing (POCT) and in-house testing are projected to grow at a CAGR of 16.8% from 2025 to 2033 which is driven by the need for rapid and accurate diagnostics in veterinary settings. As per the Bloomberg Healthcare Analytics, POCT accounted for 20% of diagnostic procedures in 2023, with projections indicating significant growth due to technological advancements. A major driver is the increasing adoption of portable diagnostic tools. The Canadian Veterinary Medical Association reports that handheld analyzers reduce diagnosis time by 50%, enabling veterinarians to provide immediate treatment plans. For instance, glucose meters and blood gas analyzers introduced in 2023 achieved a 30% higher accuracy rate compared to traditional lab tests. Technological integration is also propelling growth. AI-driven platforms introduced in 2023 analyze test results in real-time, improving efficiency and patient outcomes. These innovations position POCT as a transformative force in the Veterinary Healthcare market.

REGIONAL ANALYSIS

The United States dominated the North America Veterinary Healthcare market by commanding a market share of 72.5% in 2024 . This leadership is attributed to its large population of companion animals, advanced veterinary infrastructure, and high spending on pet care. As stated by the American Pet Products Association (APPA), over 67% of U.S. households own a pet, creating substantial demand for healthcare products and services. A key factor driving this dominance is the growing trend of pet humanization. The Bureau of Labor Statistics shows that spending on veterinary care reached $34 billion in 2023 , with diagnostics and treatments accounting for the largest share. Urbanization further amplifies demand, as 83% of Americans live in cities, where small apartments and busy lifestyles necessitate preventive healthcare for pets. Innovations in biologics and pharmaceuticals also bolster growth. For instance, Zoetis launched a novel vaccine in 2023 that reduced the incidence of canine parvovirus by 30% , underscoring the role of R&D in market expansion.

Canada is expanding steadily in this market and is anticipated to have fastest CAGR of 6.2% during the forecast period. The country’s universal healthcare system and emphasis on animal welfare drive demand for affordable and effective healthcare solutions. As per the Canadian Veterinary Medical Association, 80% of pet owners prioritize preventive care , reflecting a growing awareness of animal health. A major propellent is government support for livestock health. The Canadian Food Inspection Agency allocated $50 million to combat infectious diseases in production animals, ensuring food safety and sustainability. Additionally, telemedicine platforms gained traction during the pandemic, with virtual consultations increasing by 25% since 2020 , as reported by McKinsey & Company. These factors make Canada a vital contributor to the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Zoetis is a global leader in the Veterinary Healthcare market, contributing significantly to innovation and accessibility. The company’s flagship products, such as vaccines and anti-parasitics. Zoetis’s focus on R&D has resulted in groundbreaking solutions, including a novel vaccine introduced in 2023 that reduced the incidence of canine parvovirus by 30%.

Merck specializes in biologics and pharmaceuticals, offering treatments for both companion and production animals. The company is supported by its commitment to sustainability and disease prevention. Its acquisition of emerging biotech firms has further strengthened its portfolio.

Elanco focuses on innovative solutions for livestock and companion animals. The company leverages partnerships with farmers and veterinarians to address unmet needs, particularly in rural areas.

The North America Veterinary Healthcare market is highly competitive, characterized by innovation and a focus on meeting diverse needs. Zoetis, Merck Animal Health, and Elanco lead the market, leveraging advanced technologies and strategic alliances to meet growing demand. Smaller players focus on niche segments, such as rare diseases or alternative therapies, intensifying competition.

Top Strategies Used by Key Players

Key players in the North America Veterinary Healthcare market employ strategies such as mergers and acquisitions, strategic partnerships, and product diversification to strengthen their positions. For instance, Zoetis acquired a biotech startup in 2023 to expand its vaccine portfolio. Merck partnered with digital health startups to integrate AI-driven diagnostics, while Elanco focused on expanding its reach in underserved regions through collaborations with agricultural cooperatives.

RECENT MARKET DEVELOPMENTS

- In June 2024, Merck Animal Health announced the launch of NOBIVAC® NXT Rabies, a vaccine leveraging RNA-particle technology to protect cats and dogs from rabies.

- In July 2024, Elanco released its 2023 Environmental, Social, and Governance Report, highlighting initiatives to advance animal health, people, the planet, and enterprise.

- In February 2025, the U.S. Department of Agriculture (USDA) granted conditional approval to Zoetis for its avian influenza vaccine for poultry. This approval allows for emergency use in special circumstances to help control outbreaks affecting both commercial and wild bird populations.

- In March 2025, VMX 2025, the world’s largest annual veterinary meeting and expo, showcased groundbreaking advances in veterinary medicine aimed at improving the health and quality of life for animals, from pets to wildlife species.

- In March 2025, Loyal, a San Francisco biotech startup, continued development of a daily pill designed to extend the healthy lifespan of dogs by at least a year. The U.S. Food and Drug Administration (FDA) has granted approval for this initiative, with long-term trials underway.

MARKET SEGMENTATION

This research report on the North American veterinary healthcare market has been segmented and sub-segmented into the following categories

By Animal Type

- Livestock Animals

- Companion Animals

By Product

- Pharmaceuticals

- Feed Additives

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

Which countries contribute the most to the North American veterinary healthcare market?

The United States and Canada are the primary contributors, with the U.S. holding the largest market share.

What factors are driving the growth of the veterinary healthcare market in North America?

Factors such as increasing pet ownership, rising awareness of pet health, and advancements in veterinary technology are driving market growth.

What are the notable trends in the North American veterinary healthcare market?

Telemedicine for pets, personalized pet nutrition, and a shift towards preventive veterinary care are some of the noteworthy trends.

Are there any regulatory challenges affecting the veterinary healthcare market in North America?

Compliance with changing regulations, especially regarding veterinary drugs and biologics, poses a challenge for market players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com