Global Non-Surgical Skin Tightening Market Size, Share, Trends & Growth Analysis Report - Segmented By Product (Laser-based Devices, RF Devices, Ultrasound Devices and Other Devices), End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033

Global Non-Surgical Skin Tightening Market Size

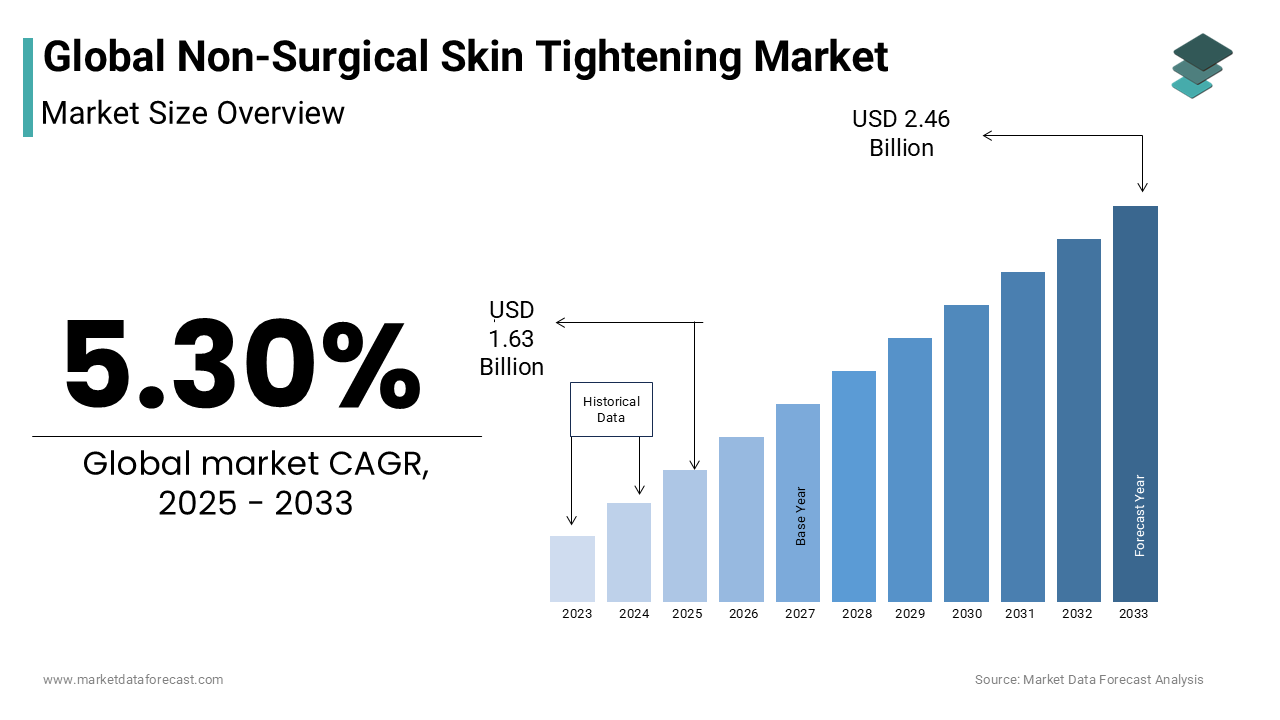

The global non-surgical skin tightening market size was valued at USD 1.55 billion in 2024. The global market is anticipated to grow at a CAGR of 5.30% from 2025 to 2033 and be worth USD 2.46 billion by 2033 from USD 1.63 billion in 2025.

Non-surgical skin treatment is recommended for people with gentle and average skin without undergoing any cosmetic surgeries. People are very conscious of their beauty, and medical aesthetics is increasing worldwide. This non-surgical skin tightening treatment is used by people whose skin tone and appearance are better than those of the previous skin utilizing this technology. This procedure is a non-invasive technique to help reduce fat and the signs of aging, like fine lines, wrinkles, and facial marks.

CURRENT SCENARIO

The global non-surgical skin tightening market has accounted for significant growth opportunities from the recent period and is projected to have prominent market growth during the forecast period. Non-surgical skin tightening is a minimally invasive procedure that enhances skin tone and texture. The accelerating demand for minimally invasive procedures and increasing demand for non-surgical procedures among dermatologists is raising the global market revenue. The escalating technological advancements in non-surgical procedures and the introduction of various laser treatment procedures for the skin tightening process are estimated to enhance the market growth opportunities during the forecast period. The rising innovations in the cosmetic industry positively impact market expansion due to continuous innovative product launches. Skin tightening procedure is ranked sixth among the most popular non-surgical procedures in the United States. The FDA's recent development has enhanced the approval of various skin-tightening procedures and devices, which fuels market growth.

MARKET DRIVERS

Factors include people knowing the non-surgical skin tightening treatment procedures, growing disposable income, lifestyle changes, and choosing cosmetic processes of all age groups to propel the global non-surgical skin tightening market growth. The market players play a crucial role in increasing awareness regarding medical aesthetics by conducting campaigns and programs related to skin problems. This will help in improving its production values in the market. Increasing fashion encompassing surgical techniques that will lessen the healing time will accelerate the global non-surgical skin tightening market. Also, the growing awareness of beauty, according to medicine, is boosting the market. Advanced technologies related to the skin tightening market are also fuelling the demand for this market.

The several uses of non-surgical skin tightening technologies to augment the market growth. This technology is used to develop heat into the deep layers present on the skin. These medical aesthetics and clinical treatments obtain support from many people within a brief period. For example, Thermage from Bausch Health is a protective and not harmful skin tightening process that makes the skin smooth, tight, and bound up the skin for a natural look and youthful look skin. These non-surgical skin tightening devices are anticipated to bring out the increase in growth in the market successfully. In addition, these devices help doctors safely entrust treatment to medical staff.

The growing demand for non-invasive and minimally invasive procedures across the population positively impacts the expansion of the market. The American Society of Plastic Surgeons estimated an increase of 9% in non-invasive skin tightening procedures in the U.S and an estimated 19% increase in non-surgical cellulite treatments using lasers to eliminate fat. These ongoing trends and the rising number of non-surgical procedures are expected to contribute to substantial growth of the market.

MARKET RESTRAINTS

The increased exposure to radiation during laser procedures and the high costs of skin procedures are expected to hamper the global market expansion. The presence of adverse effects associated with skin-tightening procedures, such as skin discoloration, acne breakouts, and others, are estimated to limit the adoption of these procedures, leading to restricted market growth. The post-treatment side effects will limit the people to adopt these treatment methods. The presence of stringent regulatory requirements and late approvals are expected to slow down product launches and the introduction of new technological procedures, which act as challenges to the market players in the process of market expansion. The need for awareness among the underdeveloped regions and the shortage of skilled professionals with knowledge is hindering market growth opportunities.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Analysed |

By Product, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC; PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

|

Market Leaders Profiled |

Cutera Inc., Cynosure Inc., Solta Medical Inc., Lynton Lasers Ltd., Venus Concept Canada Corp., Fotona d.d., Lutronic Corporation, Strata Skin Sciences Inc., Lumenis Ltd., EL.En. S.p.A., Sciton, Inc., Alma Lasers Ltd, and |

SEGMENTAL ANALYSIS

By Product Insights

The laser-based devices segment is to be sought-after among non-surgical skin tightening procedures products, with revenues poised to account for over half the share of the global market during the forecast period. Laser-based treatment has several advantages; you can eliminate fine lines, dark spots, and other cosmetic flaws while tightening up slack skin. Most individuals who use laser treatments seem 5–10 years younger. The results are long-lasting; you can enhance them by returning for additional therapy sessions.

The RF devices segment is projected to emerge as the fastest-expanding product in the market. The ultrasound devices segment held the largest share of this market segment. The RF devices segment is growing due to its advantages: eliminating wrinkles and fine lines, improving skin tone and texture, firm, loose, sagging skin, age-defying skin, flexibility for various body parts and skin types, and swift and straightforward treatment.

By End User Insights

The dermatology clinics segment held the largest share of the global market in 2024. Dermatology clinics are the most trusted treatment spaces and promise the best results. Dermatology clinics are set up by professional and experienced dermatologists and, therefore, have a high success rate, leading to the segment's dominance.

However, sales in beauty clinics will exhibit a comparatively higher CAGR. This is due to the rising popularity of multi-faceted beauty stores which provide multiple services. In addition, the merger of salon benefits and other aesthetic services is trending, helping the segment's growth.

REGIONAL ANALYSIS

North America led the market in 2024 and is expected to account for the largest share of the global non-surgical skin tightening market over the forecast period. Moreover, the North American market will witness the fastest expansion. Due to the rising prevalence of skin disorders, the high presence of major industrial players operating in the aesthetics industry, the rising geriatric population, the increased awareness of the aesthetic appeal, the availability of board-certified and skilled cosmetic surgeons, the high expenditure on cosmetics, the rise in the number of skin tightening procedures, and the high adoption of technologically advanced treatment,

Europe is also expected to show growth due to the increasing use of cosmetic surgery and minimally invasive medicine, the rise in popularity of non-invasive procedures, the rising use of social media, and the spread of aesthetic beauty trends through them. In Europe, people with increasing disposable incomes are spending more on improving their appearance, increasingly becoming aware of skin rejuvenation & resurfacing procedures. As a result, Europe will be the second most lucrative market for non-surgical skin tightening.

Asia-Pacific is predicted to continue to be the second-fastest expanding market for the market. The awareness about sophisticated personal care systems is increasing along with the rising number of new public health systems & healthcare institutions and improvements in healthcare infrastructure. Local vendors in the Asia Pacific will manufacture products at low costs, attracting customers from various other regions.

KEY MARKET PARTICIPANTS

Some of the noteworthy companies leading the global non-surgical skin tightening market profiled in this report are Cutera Inc., Cynosure Inc., Solta Medical Inc., Lynton Lasers Ltd., Venus Concept Canada Corp., Fotona d.d., Lutronic Corporation, Strata Skin Sciences Inc., Lumenis Ltd., EL.En. S.p.A., Sciton, Inc. and Alma Lasers Ltd.

RECENT MARKET DEVELOPMENTS

- In October 2022, The FDA approved Endymed Ltd, currently listed on the Tel Aviv Stock Exchange, to market and sell the new hair removal device Pure Laser in the US. The Pure Laser, which used laser technology and was created in the Company's labs by its subsidiary Endymed Medical Ltd., is intended to treat hair removal on all skin types. The Company carried out numerous clinical tests to assess the device's efficacy and safety to get approval. The clinical trials were completed in the Company's R&D facility, and the results were encouraging.

- In October 2022, Since its beginning, Carissa Aesthetics has earned a reputation for locating and promoting cutting-edge non-invasive aesthetic technologies. Working directly with the top manufacturers worldwide, Caressa seeks medical equipment in the most in-demand treatment areas that genuinely benefit patients and healthcare professionals. LipoAI, the most recent addition to its portfolio, represents its entry into the minimally invasive market.

- In November 2022, the ultimate anti-aging micro facelift will be coming to Ireland from Kerry Hanaphy (without going under the knife). Kerry Hanaphy's clinics aim not to produce a sea of uniform, "Instagram-perfect" looks but rather to enhance and enhance the innate beauty that everyone already possesses using the most up-to-date technologies.

- In March 2020, Lumenis Ltd introduced a new and creative Stellar M22. It is used to improve skin care and also offers treatments like hair removal and skin texture. This is one of the innovative products that allows the user to experience various applications on one platform. The launch of this product may expand the Company's product folio.

- In November 2018, Sciton, a critical manufacturer of high-quality laser and light systems, announced ALLURA's release. It is a laser treatment for the reduction of fat and skin contraction.

MARKET SEGMENTATION

This research report on the global non-surgical skin tightening market has been segmented and sub-segmented into the following categories.

By Product

- Laser-based Devices

- RF Devices

- Ultrasound Devices

- Other Devices

By End User

- Dermatology Clinics

- Beauty Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

who are the key players of the global non-surgical skin tightening market ?

Cutera Inc., Cynosure Inc., Solta Medical Inc., Lynton Lasers Ltd., Venus Concept Canada Corp., and Fotona d.d., are some of the key marketv players in the non-surgical skin tightening market.

which region accounted for the largest share in the global non-surgical skin tightening market ?

The non-surgical skin tightening market in North America is expected to grow significantly and hold the largest share of revenue during the forecast period.

what is the compound annual growth rate (CAGR%) of the non-surgical skin tightening market during the forecast period?

The global non-surgical skin tightening market is expected to grow at a CAGR of 5.30% during the forecast period.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com