North America A2 Milk Market Size, Share, Trends & Growth Forecast Report By Form (Powder and Liquid), Packaging, Distribution Channel, and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America A2 Milk Market Size

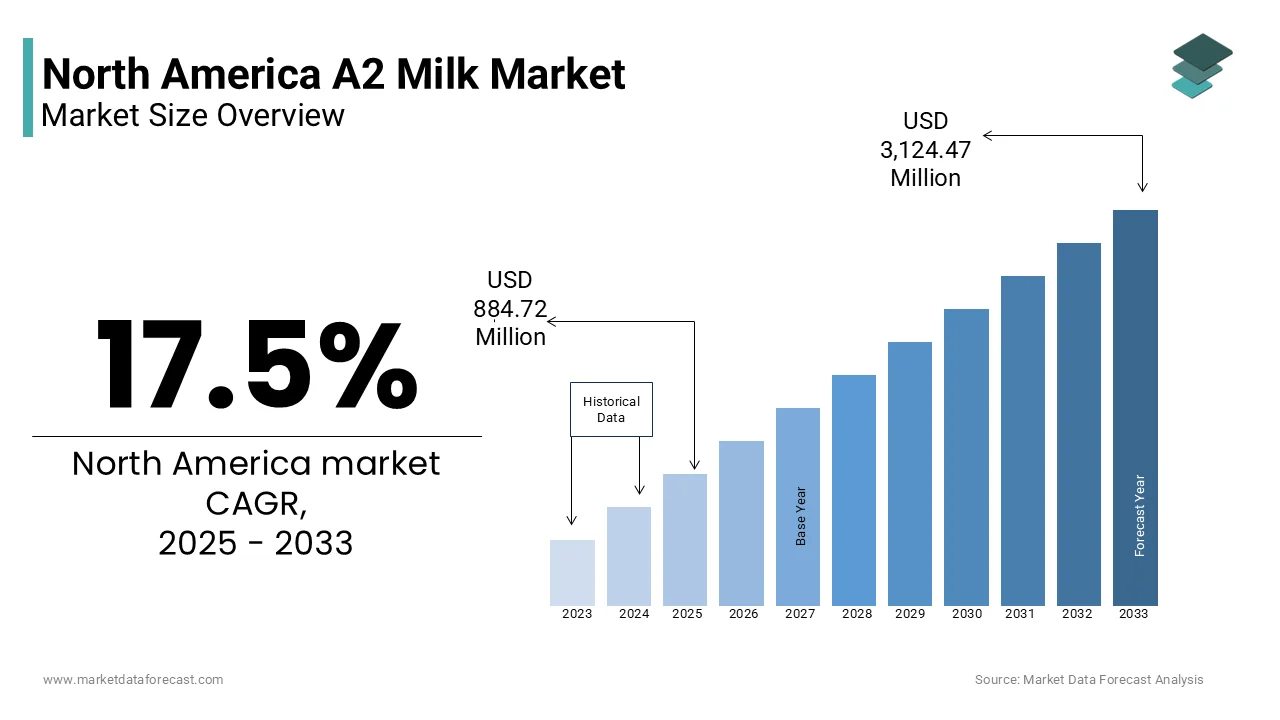

The A2 milk market size in North America was valued at USD 752.95 million in 2024 and is predicted to be worth USD 3,214.47 million by 2033 from USD 884.72 million in 2025 and grow at a CAGR of 17.5% from 2025 to 2033.

A2 milk refers to a type of cow’s milk that contains only the A2 variant of beta-casein protein, as opposed to conventional milk which often contains a mix of A1 and A2 proteins. Scientific research has suggested that the A1 protein may be associated with digestive discomfort and other health concerns in some individuals, prompting consumer interest in A2 milk as a potentially easier-to-digest alternative. The market has witnessed steady growth due to rising awareness around functional foods and increasing demand for clean-label, health-focused dairy products.

MARKET DRIVERS

Rising Consumer Awareness Around Digestive Wellness

One of the key drivers fueling the North America A2 milk market is the heightened consumer focus on digestive wellness and functional nutrition. This shift reflects broader trends where consumers prioritize food items offering perceived health benefits beyond basic nutrition. In the U.S., approximately 45 million people suffer from irritable bowel syndrome (IBS) or lactose intolerance, according to data published by the International Foundation for Gastrointestinal Disorders (IFFGD). This large demographic base represents a significant target audience for A2 milk marketers. Moreover, clinical studies such as those conducted by the University of Auckland have demonstrated reduced bloating and improved digestion among participants consuming A2 milk versus conventional milk.

Expansion of Distribution Channels and Product Innovation

Another critical driver underpinning the North America A2 milk market is the expansion of distribution networks and ongoing product innovation. Initially confined to natural food stores and niche organic retailers, A2 milk has now penetrated mass merchandisers, club stores, and online platforms, significantly boosting accessibility. This rapid shelf-space expansion has been supported by strategic partnerships between dairy producers and major retailers like Walmart, Kroger, and Albertsons. Simultaneously, product diversification has played a pivotal role in sustaining growth. While fluid milk remains the dominant category, companies are increasingly launching A2-based yogurts, cheese, and plant-milk blends.

MARKET RESTRAINTS

Limited Consumer Understanding of A2 Protein Benefits

Despite growing traction, one major restraint impeding the full potential of the North America A2 milk market is the limited understanding among mainstream consumers regarding the specific health benefits of A2 milk. While early adopters and health-conscious shoppers are well-informed, broader consumer education remains inadequate. Moreover, confusion persists between A2 milk and lactose-free milk, with many consumers conflating the two despite their distinct attributes. Data from Mintel indicates that nearly 40% of consumers who purchased A2 milk mistakenly believed it was inherently lactose-free. This misconception leads to dissatisfaction when expectations aren’t met, which is negatively impacting brand loyalty and word-of-mouth promotion.

Marketing efforts by industry players have attempted to bridge this gap, but budget constraints and regulatory scrutiny limit the scope of messaging. For instance, the U.S. Food and Drug Administration (FDA) has issued caution letters to certain brands for overstating health claims without sufficient clinical backing. As a result, promotional campaigns remain cautious, further slowing consumer awareness. In Canada, the Canadian Food Inspection Agency (CFIA) has imposed similar restrictions, requiring clear disclaimers on packaging and advertising materials.

High Production and Certification Costs

Another significant barrier to the growth of the North America A2 milk market is the elevated cost associated with production and certification. Unlike conventional milk, A2 milk must come from cows genetically tested to produce only the A2 beta-casein protein. This requires selective breeding programs, DNA testing, and stringent supply chain management, all of which contribute to higher operational costs. These expenses are typically passed on to consumers, which is resulting in a price premium that can deter cost-sensitive buyers. In Canada, where dairy supply management systems already keep prices relatively high, the added premium further narrows the affordability window. Additionally, maintaining A2 certification involves continuous monitoring and compliance audits, adding administrative burdens for small-scale dairies.

MARKET OPPORTUNITIES

Integration into School and Institutional Feeding Programs

An emerging opportunity for the North America A2 milk market lies in its potential inclusion within school meal programs and institutional feeding systems. Given the rising concern over childhood digestive issues and food sensitivities, several districts and organizations are exploring alternatives to conventional milk. In 2023, pilot programs were launched in select schools across California and Oregon to assess student tolerance and acceptance of A2 milk. Similarly, in Canada, provinces like British Columbia and Ontario have shown interest in incorporating A2 milk into daycare and elder care facilities. Furthermore, universities and corporate cafeterias are recognizing the value proposition of A2 milk in promoting workplace wellness. Institutions such as Harvard University Dining Services and Google’s campus cafes have included A2 milk in their menus, citing employee feedback on improved digestion.

Strategic Partnerships with Health and Fitness Brands

A promising avenue for growth in the North America A2 milk market is the formation of strategic alliances with health, fitness, and wellness-oriented brands. As consumers increasingly seek clean-label, nutrient-rich beverages, A2 milk is gaining traction as a functional ingredient in smoothies, protein shakes, and post-workout recovery drinks. Several fitness influencers and nutritionists have endorsed A2 milk for its purported benefits in muscle recovery and digestive comfort. In response, companies like Beyond Raw and MusclePharm have begun experimenting with A2 milk-based formulations for ready-to-drink (RTD) protein products. Retail chains such as Goliath Performance Nutrition and Life Time Fitness have also introduced A2 milk in their branded supplement lines, catering to an active consumer base prioritizing gut health and performance nutrition.

MARKET CHALLENGES

Regulatory Hurdles and Labeling Restrictions

A major challenge confronting the North America A2 milk market is navigating the complex web of regulatory requirements and labeling limitations imposed by food safety authorities. Both the U.S. Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA) have taken a cautious stance on health-related claims made by A2 milk producers, restricting the ability of brands to highlight specific digestive benefits unless backed by robust clinical evidence. For instance, in 2023, the FDA issued formal guidance advising manufacturers against using statements such as “easier to digest” unless they could substantiate such claims with peer-reviewed research. This led to a repositioning of marketing strategies by several A2 milk brands, including a2 Milk® and Maple Hill Creamery, which had previously leveraged these messages in their branding. These restrictions limit differentiation in a crowded dairy market where consumers often rely on front-of-pack claims to make purchasing decisions. Furthermore, compliance with these evolving regulations increases administrative and legal costs for manufacturers, especially smaller players lacking dedicated regulatory teams.

Supply Chain Complexity and Farmer Adoption Barriers

Another pressing challenge for the North America A2 milk market is the logistical complexity and resistance from dairy farmers in transitioning to A2-certified herds. Producing A2 milk requires identifying and selectively breeding cows that naturally carry the A2 gene, a process that demands time, investment, and technical expertise. This transition poses economic risks for farmers accustomed to traditional dairy operations. Many small and mid-sized farms lack the financial cushion to undertake such investments without subsidies or guaranteed premium pricing.

Additionally, the logistics of transporting and processing A2 milk separately from conventional milk add another layer of complexity. Milk processors must maintain strict traceability and avoid cross-contamination, which often requires separate storage tanks and transportation routes. According to the National Milk Producers Federation (NMPF), this has resulted in increased handling costs and reduced efficiency in existing dairy infrastructure.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.5% |

|

Segments Covered |

By Form, Packaging, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Saputo, Groupe Lactalis, Nestlé S.A, Westland Milk Products, Fonterra, Friesland Campina, Groupe Lactalis, Arla Foods, and Danone S.A, and others |

SEGMENTAL ANALYSIS

By Form Insights

The liquid form segment dominated the North America A2 milk market with prominent share in 2024. One of the key drivers behind this segment’s dominance is its alignment with traditional milk consumption habits. The presence of established brands like a2 Milk® and Horizon Organic has further reinforced consumer trust and accessibility. Additionally, the integration of liquid A2 milk into school nutrition programs and institutional catering has expanded its reach beyond home consumers. Moreover, product innovation such as flavored and fortified versions has broadened appeal among younger demographics.

The powdered A2 milk is lucratively growing with a CAGR of 9.4% during the forecast period. A primary driver of this growth is the increasing use of A2 milk powder in infant formula and nutritional supplements. According to the U.S. Centers for Disease Control and Prevention (CDC), approximately 2.5 million infants in the U.S. consume formula regularly, prompting manufacturers to explore cleaner, more digestible dairy bases. Brands like Bellamy’s Organic have begun incorporating A2 milk protein into their premium formulas, capitalizing on parental concerns about digestion and gut health. In addition, powdered A2 milk is gaining traction among fitness enthusiasts and older adults seeking high-protein, easy-to-mix beverages. Retail expansion also plays a role. Amazon and Walmart have significantly increased listings for A2 milk powder variants, boosting online visibility and accessibility.

By Packaging Insights

The carton packaging was the largest and held a prominent share of the North America A2 milk market in 2024. According to the Food Marketing Institute (FMI), over 70% of U.S. consumers prefer carton-packaged milk for its ease of storage, recyclability, and extended shelf life without refrigeration until opened. These attributes align well with the growing emphasis on eco-conscious consumption. Another contributing factor is the strong presence of A2 milk in school meal programs, where cartons are the standard format. The National School Lunch Program (NSLP) serves milk exclusively in cartons to reduce spillage and improve portion control. Moreover, leading brands such as a2 Milk® and Maple Hill Creamery have prioritized carton packaging for their mainstream retail lines, leveraging partnerships with major grocers like Kroger and Albertsons.

The bottle packaging segment is swiftly growing with a CAGR of 8.9% throughout the forecast period. One of the main factors driving this shift is the increasing popularity of single-serve milk bottles in gyms, cafes, and convenience stores. Furthermore, bottled A2 milk is becoming a preferred option in specialty coffee shops and smoothie bars, where presentation and freshness matter. Companies like Starbucks and Jamba Juice have started using bottled A2 milk in select locations, citing customer feedback on improved taste and texture when steamed or blended. Retailers like Whole Foods and Wegmans have allocated dedicated shelf space for premium bottled A2 milk, further stimulating demand among affluent shoppers who prioritize aesthetics and functionality alongside nutrition.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was the largest and held 58.3% of the North America A2 milk market share in 2024. According to NielsenIQ, over 80% of A2 milk purchases in the U.S. occur in mass-market grocery chains such as Walmart, Kroger, and Safeway. These retailers have played a pivotal role in normalizing A2 milk by allocating prime shelf space and integrating it into regular dairy promotions. In Canada, Loblaw Companies Limited and Sobeys have similarly embraced A2 milk, featuring it prominently in weekly flyers and loyalty programs. Moreover, private label development by retailers has helped reduce price sensitivity. For example, Safeway Select A2 milk retails at $0.50 less per gallon than branded equivalents, enabling wider affordability. Additionally, in-store sampling and signage campaigns have contributed to consumer education by reducing confusion around A2 milk’s unique benefits compared to lactose-free or organic varieties.

The online retail segment is likely to register a CAGR of 11.2% during the forecast period. This rapid growth is primarily driven by the convenience of doorstep delivery, subscription models, and the ability to target niche health-conscious consumers who actively seek functional food products. Amazon Fresh and Instacart have been instrumental in accelerating online A2 milk sales, particularly in urban centers where time constraints and digital adoption converge. In Canada, Shopify-powered local grocery platforms and regional delivery services have expanded A2 milk availability beyond metropolitan hubs. Loblaw’s PC Express service reported a 25% increase in A2 milk orders in early 2024, indicating strong suburban uptake. Moreover, direct-to-consumer (DTC) models employed by smaller A2 milk producers have flourished online, allowing them to bypass traditional retail gatekeepers and engage directly with health-focused buyers.

REGIONAL ANALYSIS

The United States led the North America A2 milk market with 76.4% of share in 2024. According to the International Dairy Foods Association (IDFA), A2 milk was available in over 90% of U.S. supermarkets by mid-2024, with national brands like a2 Milk® and Horizon Organic spearheading product launches. This widespread availability has enabled greater trial and repeat purchase behavior among health-conscious consumers seeking alternatives to conventional milk. Additionally, clinical research conducted by institutions such as Stanford University and the University of California has supported claims of improved digestion with A2 milk, bolstering consumer confidence. The U.S. Department of Agriculture (USDA) also reports that domestic dairy farms have increasingly adopted genetic testing and selective breeding programs to supply A2-certified milk by ensuring stable production capacity.

Canada was positioned second in the North America A2 milk market by capturing 19.3% of share in 2024. This growth trajectory is closely linked to rising health consciousness and an increasing number of Canadians identifying as lactose intolerant or sensitive to conventional dairy proteins. Health Canada has played a crucial role in shaping market dynamics by updating labeling guidelines to accommodate A2 milk claims while maintaining scientific rigor. Major retailers including Loblaws, Metro, and Sobeys have introduced private-label A2 milk options, which is improving affordability and accessibility.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Saputo, Groupe Lactalis, Nestlé S.A, Westland Milk Products, Fonterra, Friesland Campina, Groupe Lactalis, Arla Foods, and Danone S.A. are playing dominating role in the North America A2 milk market.

The competition in the North America A2 milk market is marked by strategic differentiation and growing interest from both established dairy giants and emerging niche players. While early entrants like the a2 Milk Company and Horizon Organic have laid the foundation for consumer awareness, traditional dairy processors are now actively entering or expanding within the category to capitalize on shifting dietary preferences. This influx has intensified rivalry, prompting brands to emphasize scientific validation, clean-label appeal, and digestive wellness messaging in their marketing communications.

Retail partnerships play a critical role in determining competitive advantage, with leading firms focusing on securing premium shelf space and exclusivity deals to strengthen brand positioning. Simultaneously, private-label developments by major grocery chains have introduced price-competitive alternatives, adding pressure on branded players to justify premium pricing through added value and superior consumer experience.

Beyond product offerings, competition extends into digital engagement and direct-to-consumer outreach, especially through e-commerce platforms where shopper education and convenience drive purchasing decisions.

TOP PLAYERS IN THE MARKET

a2 Milk Company

One of the leading companies in the North America A2 milk market is the a2 Milk Company. Originating from New Zealand, this company has been instrumental in globalizing A2 milk and played a pivotal role in introducing the product to North American consumers. The a2 Milk Company has established itself as a front-runner in positioning A2 milk as a premium health-conscious dairy option across the U.S. and Canada.

Dean Foods

Another major player is Dean Foods (now part of Dairy Farmers of America). As a legacy dairy processor in North America, Dean Foods contributed significantly to scaling the production and distribution of A2 milk through its extensive supply chain and national brand partnerships. The company’s ability to integrate A2-certified milk into mainstream retail channels helped increase consumer access and acceptance by making it a key enabler of market growth before its acquisition.

Horizon Organic

Horizon Organic is a subsidiary of Danone North America, is another prominent contributor to the A2 milk market. Known for its organic dairy portfolio, Horizon Organic expanded into the A2 segment by leveraging its existing consumer trust in clean-label products. The brand has strengthened awareness and trial among health-oriented shoppers, which is reinforcing A2 milk’s positioning as a digestively gentle alternative within the premium dairy space.

TOP STRATEGIES USED BY KEY PLAYERS

One of the primary strategies employed by key players in the North America A2 milk market is strategic branding and consumer education campaigns. Companies invest heavily in marketing initiatives that highlight the perceived digestive benefits of A2 milk, often citing clinical research to support their claims. These efforts are designed to differentiate A2 milk from conventional dairy and position it as a wellness-driven lifestyle product rather than just another milk variant.

Another crucial strategy involves expanding distribution networks and securing prime retail placements. Leading brands collaborate with major supermarket chains, club stores, and online retailers to ensure broad availability and visibility.

A third key approach is product diversification and innovation. Market leaders are continuously developing new formats such as flavored A2 milk, organic variants, and plant-based blends to cater to evolving consumer preferences. Introducing complementary products allows brands to capture a broader audience and maintain relevance in an increasingly competitive functional food landscape.

RECENT HAPPENINGS IN THE MARKET

- In May 2023, The a2 Milk Company launched a nationwide educational campaign in collaboration with registered dietitians and gastroenterologists to raise awareness about the potential digestive benefits of A2 milk. The initiative included digital content, in-store promotions, and webinars aimed at improving consumer understanding and encouraging trial adoption.

- In July 2023, Horizon Organic expanded its A2 milk line by introducing an organic A2 chocolate-flavored variant, targeting younger consumers and families seeking both taste and nutritional benefits. This move was part of a broader effort to diversify its portfolio and attract households looking for indulgent yet functional dairy options.

- In February 2024, a major U.S. retailer partnered with a regional dairy cooperative to launch a private-label A2 milk brand, making the product more accessible to budget-conscious consumers while maintaining quality standards. This initiative enabled greater affordability and wider store coverage.

- In June 2024, The a2 Milk Company entered into a co-packing agreement with a leading U.S. beverage manufacturer to explore the use of A2 milk in ready-to-drink protein shakes and smoothies. This expansion into adjacent categories was intended to tap into the growing sports nutrition and wellness beverage sectors.

- In October 2024, a Canadian dairy processor announced a long-term sourcing partnership with select farms committed to producing A2-certified milk. This vertical integration strategy aimed at ensuring supply consistency and reinforcing product integrity, which is supporting sustained market presence and future growth planning.

MARKET SEGMENTATION

This research report on the North America A2 milk market has been segmented and sub-segmented based on the following categories.

By Form

- Liquid

- Powder

By Packaging

- Bottle

- Carton

By Distribution Channel

- Supermarket & Hypermarket

- Online Retail

- Grocery & Convenience Stores

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the key drivers behind the growing demand for A2 milk in North America?

The rising awareness about the health benefits of A2 milk, increasing lactose intolerance among the population, and a growing preference for organic and natural dairy products are the main drivers behind the demand for A2 milk in North America.

How does A2 milk differ from regular milk in terms of nutritional content?

A2 milk contains only the A2 beta-casein protein, which is easier to digest for many people. Regular milk contains both A1 and A2 beta-casein proteins, and the A1 protein has been linked to digestive discomfort in some individuals.

How are retailers and supermarkets contributing to the growth of A2 milk sales in North America?

Major retailers and supermarkets like Walmart, Whole Foods, and Kroger are contributing to the growth by offering a broader range of A2 milk products, creating wider consumer access and visibility.

What is the outlook for the North American A2 milk market in terms of innovation and new product development?

The outlook for the North American A2 milk market is positive, with companies expected to introduce more value-added products such as flavored A2 milk, A2 milk-based yogurts, and A2 milk infant formula, further driving market growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com