North America Animal Feed Additives Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Livestock, product, Form, Source And By Country (The US, Canada, And Rest of North America), Industry Analysis From (2025 to 2033)

North America Animal Feed Additives Market Size

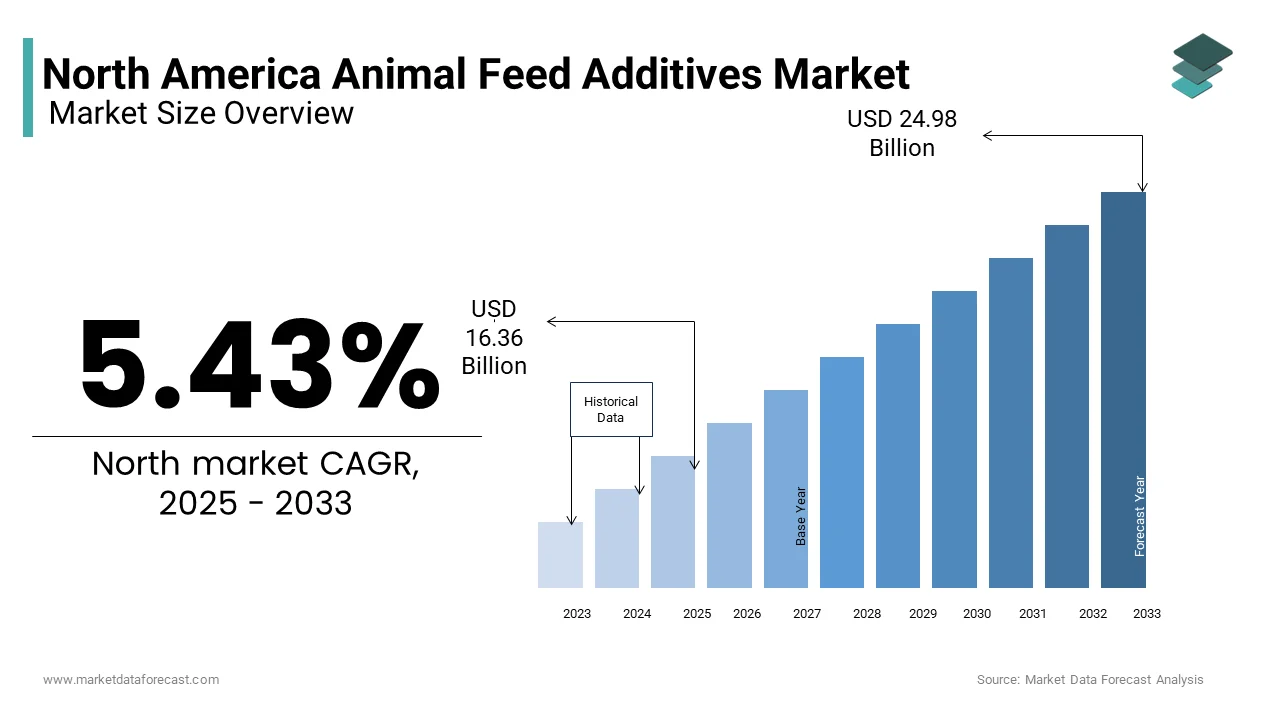

The North America animal feed additives market was valued at USD 15.52 billion in 2024 and is anticipated to reach USD 16.36 billion in 2025 from USD 24.98 billion by 2033, growing at a CAGR of 5.43% during the forecast period from 2025 to 2033.

The North American animal feed additives market covers a wide range of substances added to livestock, poultry, aquaculture, and companion animal feed to enhance nutritional value, improve digestion, promote growth, and ensure overall animal health. These additives include amino acids, enzymes, vitamins, minerals, probiotics, and antimicrobials.

Besides, increasing awareness about food safety and animal welfare has prompted feed manufacturers to adopt more sustainable and functional feed ingredients. The region's well-established regulatory framework, led by agencies like the FDA and CFIA, ensures that additives meet stringent safety and efficacy standards. Technological advancements in feed formulation and rising investments in biotech-based feed solutions further bolster market dynamics.

MARKET DRIVERS

Rising Demand for Organic and Natural Feed Ingredients

A significant driver shaping the North American animal feed additives market is the escalating consumer preference for organic and natural feed ingredients. This trend stems from heightened awareness regarding the impact of synthetic additives on animal health and food safety. This expansion has directly fueled demand for clean-label feed additives such as phytogenics, prebiotics, and natural antioxidants. Furthermore, major retailers and fast-food chains have pledged to source meat from animals raised without antibiotics or artificial growth promoters, prompting feed producers to reformulate their products accordingly. For instance, Tyson Foods announced in 2023 its commitment to sourcing 100% antibiotic-free chicken by 2025, a move that significantly impacts feed additive composition. Regulatory bodies such as the FDA have also tightened restrictions on certain synthetic additives, encouraging the adoption of plant-based alternatives. These factors collectively underline how shifting consumer preferences are steering the North American feed additives industry toward more sustainable and health-conscious formulations.

Expansion of the Livestock Industry and Increasing Meat Consumption

The expansion of the livestock industry, coupled with rising meat consumption, serves as another critical driver for the North American animal feed additives market. The U.S. remains one of the world’s largest producers and consumers of meat, with beef, pork, and poultry dominating dietary habits. As per USDA statistics, total red meat and poultry production in the U.S. reached approximately 56 million metric tons in 2023, reflecting a steady increase from 53 million metric tons recorded in 2020. This surge in production necessitates enhanced feed efficiency, disease prevention, and improved nutrient absorption—key functions fulfilled by feed additives. Moreover, Canada’s livestock sector has also experienced growth, particularly in the dairy and poultry segments. To support this growth, feed mills across North America are increasingly incorporating performance-enhancing additives such as enzymes, amino acids, and mycotoxin binders into feed formulations. The intensification of livestock farming has also led to a greater focus on biosecurity and gut health, further boosting demand for probiotics and acidifiers.

MARKET RESTRAINTS

Stringent Regulatory Frameworks and Compliance Burdens

One of the primary restraints impeding the growth of the North American animal feed additives market is the presence of stringent regulatory frameworks that govern the approval, usage, and labeling of feed ingredients. Both the U.S. Food and Drug Administration (FDA) and Health Canada impose rigorous compliance requirements on feed additive manufacturers, often resulting in prolonged product approval timelines and increased operational costs. For instance, under the FDA’s Current Good Manufacturing Practice (CGMP) regulations, feed additive producers must undergo extensive testing and documentation before bringing new products to market.

While these policies aim to curb antimicrobial resistance, they also limit the flexibility of feed formulators in addressing bacterial challenges within livestock populations. These regulatory complexities not only slow down innovation but also deter small- to mid-sized companies from entering the market, thereby limiting competition and stifling growth potential.

High Cost of Advanced Feed Additives and Limited ROI Perception

Another significant restraint affecting the NoAmericanrica animal feed additives market is the relatively high cost associated with advanced feed additives and the perception among some farmers that the return on investment (ROI) may not always justify the expense. Premium additives such as specialty enzymes, probiotics, and functional amino acids often come with elevated price tags due to complex manufacturing processes and research-intensive development.

Moreover, the lack of standardized tools for measuring the precise economic impact of specific additives complicates decision-making for many livestock producers. Consequently, even though advanced additives offer long-term benefits, their upfront costs and variable performance outcomes continue to hinder widespread adoption across certain segments of the North American livestock industry.

MARKET OPPORTUNITY

Growing Adoption of Precision Nutrition in Livestock Management

An emerging opportunity reshaping the North American animal feed additives market is the growing adoption of precision nutrition in livestock management. Precision nutrition involves tailoring feed formulations based on individual animal needs, genetic profiles, and environmental conditions to optimize productivity and health outcomes. This approach is gaining traction due to advancements in digital agriculture, data analytics, and genomic research, which allow for more accurate nutrient delivery and waste reduction.

In the U.S., the integration of Internet of Things (IoT)-enabled sensors and automated feeding systems has enabled real-time monitoring of livestock dietary intake, facilitating dynamic adjustments in feed additive usage. For example, companies like Alltech and DSM have introduced digital platforms that analyze farm-level data to recommend customized feed additive blends.

Also, academic institutions such as the University of Guelph in Canada are researching gene-specific diets for poultry and swine, further reinforcing the shift toward individualized nutrition strategies.

Increasing Use of Biotechnology and Fermentation-Derived Additives

Biotechnology and fermentation-derived feed additives represent a burgeoning opportunity within the North American animal feed additives market. Advances in microbial fermentation, synthetic biology, and enzyme engineering have enabled the development of next-generation additives that offer superior digestibility, immunity enhancement, and pathogen control.

Companies such as Novozymes and DuPont Danisco are investing heavily in fermentation-based production of carbohydrases, proteases, and phytases, which aid in breaking down complex feed components and improving nutrient uptake. In 2023, the U.S. Department of Energy awarded a grant of USD 12 million to a consortium of agricultural biotech firms focused on scaling up fermentation-derived feed proteins to reduce reliance on traditional soy and fishmeal sources.

Furthermore, fermentation-based probiotics are gaining prominence as natural alternatives to antibiotic growth promoters.

MARKET CHALLENGES

Supply Chain Disruptions and Raw Material Price Volatility

A pressing challenge confronting the North American animal feed additives market is the persistent volatility in raw material prices and disruptions in the supply chain. Feed additive manufacturers rely heavily on commodities such as corn, soybean meal, and various minerals, all of which are subject to price fluctuations influenced by climatic conditions, geopolitical tensions, and trade policies.

According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for animal feed materials in the U.S. surged in 2022 compared to the previous year, largely due to extreme weather events impacting crop yields and rising energy costs affecting transportation and production.

Apart from these, the ongoing conflict in Ukraine has disrupted global grain supplies, leading to tighter availability and increased procurement costs for feed ingredient suppliers.

Moreover, logistics bottlenecks and labor shortages in the freight and shipping sectors have extended lead times for additive deliveries, hampering just-in-time production models adopted by many feed mills.

Diverging Consumer Perceptions and Misinformation Regarding Feed Additives

A growing challenge for the North American animal feed additives market is the divergence in consumer perceptions and the spread of misinformation regarding the safety and necessity of feed additives. Despite scientific consensus on the benefits of many approved additives, public skepticism persists, often fueled by misleading narratives propagated through social media and alternative health channels. A 2023 survey by the International Food Information Council (IFIC) revealed that 43% of U.S. consumers expressed concern over the presence of “chemical” additives in animal-derived foods, even when those additives are FDA-approved and essential for animal health. This apprehension is particularly pronounced among younger demographics. Such attitudes create marketing challenges for livestock producers and feed manufacturers, who must balance consumer expectations with scientifically backed feeding practices.

Besides, the proliferation of self-published content promoting unverified claims about feed additives has led to confusion and distrust. Addressing these misconceptions requires sustained educational efforts, transparent communication, and collaboration between regulators, scientists, and industry stakeholders to ensure that decisions are grounded in evidence rather than fear.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.43% |

|

Segments Covered |

By Livestock Product, Form, Source, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc (US), Evonik Industries AG (Germany), BASF (Germany), Ajinomoto Co. Inc (Japan), dsm-firmenich (Switzerland), Novonesis Group (Denmark), Adisseo (France), Jubilant Ingrevia Limited (India), Nutreco (Netherlands), BRF Global (Brazil), Volac International Ltd (England), Kemin Industries, Inc (US), Lallemand Inc (Canada), Bentoli (US), Alltech (US), Neospark Drugs and Chemicals Private Limited (India), Novus International, Inc (US), Global Nutrition International (France), Vitalac (France), Tex Biosciences (P) Ltd. (India), Centafarm SRL (Italy), NUQO Feed additives (France), Palital Feed Additives B. V. (Netherlands) |

SEGMENT ANALYSIS

By Livestock Insights

The poultry dominates the regional market, accounting for 35.8% of the total revenue share in 2024. This dominance is primarily driven by the robust growth of the poultry industry in the United States, which remains one of the largest producers and consumers of poultry meat globally. The high demand for cost-effective protein sources has fueled intensive poultry farming practices, necessitating the use of feed additives to enhance feed efficiency, disease resistance, and overall productivity.

One key driver is the increasing adoption of feed enzymes and probiotics to improve digestion and reduce antibiotic dependency. As per Rabobank, enzyme-based feed additive usage in U.S. poultry operations grew annually between 2020 and 2023. Additionally, regulatory support for reducing antimicrobial use in livestock feed, such as the FDA’s Veterinary Feed Directive, has further accelerated the shift toward alternative additives like acidifiers and phytogenics.

The fastest-growing segment in the North American animal feed additives market is probiotics, projected to expand at a CAGR of 6.8%. This rapid growth is attributed to rising awareness around gut health and microbial balance in livestock, particularly in response to consumer demand for antibiotic-free meat. Probiotics serve as natural alternatives to antibiotics by promoting digestive efficiency and enhancing immunity, making them increasingly favored across poultry, swine, and ruminant nutrition programs.

A significant driver is the expansion of organic and free-range livestock production, where synthetic additives are restricted. Besides, major agribusiness players such as Cargill and Novus International have launched targeted probiotic formulations tailored for precision feeding systems, further driving adoption. Regulatory bodies like the FDA have also recognized several probiotic strains under the Generally Recognized as Safe (GRAS) category, facilitating their integration into mainstream feed manufacturing.

COUNTRY ANALYSIS

The United States had the largest market share in the North American animal feed additives market, accounting for approximately 78% of total regional revenue in 2024. As the global leader in livestock and poultry production, the U.S. maintains an expansive agricultural infrastructure that supports large-scale feed formulation and additive integration.

One major factor behind the U.S. market’s dominance is the widespread adoption of advanced feed technologies, including amino acids, enzymes, and probiotics, aimed at improving feed conversion ratios and ensuring food safety.

Also, the growing presence of multinational feed additive manufacturers such as ADM, BASF, and DSM has contributed to a well-developed supply chain and innovation ecosystem. Moreover, the implementation of the Veterinary Feed Directive has spurred interest in non-antibiotic growth promoters, further shaping market dynamics.

Canada is growing significantly in the market. The Canadian livestock industry is highly developed, particularly in the dairy, poultry, and pork sectors, all of which drive consistent demand for feed additives.

A key driver for the Canadian feed additives market is the increasing emphasis on sustainable and antibiotic-free livestock production. In line with federal initiatives such as the One Health Framework, Health Canada has implemented stricter guidelines on antimicrobial use in animal feed, prompting a shift toward alternatives like probiotics, prebiotics, and acidifiers. Furthermore, the expansion of organic farming and the rise of niche markets such as free-range poultry have bolstered demand for clean-label ingredients. With strong government backing for biosecurity measures.

KEY MARKET PLAYERS

Cargill, Incorporated (US), ADM (US), International Flavors & Fragrances Inc (US), Evonik Industries AG (Germany), BASF (Germany), Ajinomoto Co. Inc (Japan), dsm-firmenich (Switzerland), Novonesis Group (Denmark), Adisseo (France), Jubilant Ingrevia Limited (India), Nutreco (Netherlands), BRF Global (Brazil), Volac International Ltd (England), Kemin Industries, Inc (US), Lallemand Inc (Canada), Bentoli (US), Alltech (US), Neospark Drugs and Chemicals Private Limited (India), Novus International, Inc (US), Global Nutrition International (France), Vitalac (France), Tex Biosciences (P) Ltd. (India), Centafarm SRL (Italy), NUQO Feed additives (France), Palital Feed Additives B. V. (Netherlands). Are the market players that are dominating the North American animal feed additives market

Top Players In The Market

One of the leading players in the North American animal feed additives market is BASF SE. The company offers a broad portfolio of feed additives, including vitamins, amino acids, carotenoids, and enzymes. BASF plays a pivotal role in driving innovation through sustainable product development and strategic collaborations. Its strong research capabilities and global distribution network allow it to maintain a competitive edge.

Another key player is Cargill Incorporated, a major force in the agricultural and animal nutrition sector. Cargill provides customized feed additive solutions tailored to enhance livestock performance and health. With its extensive supply chain infrastructure and focus on integrated farming systems, the company supports large-scale livestock producers across North America.

ADM (Archer Daniels Midland Company) ranks among the top contributors to the market due to its emphasis on biotechnology-driven feed ingredients. ADM invests heavily in fermentation-based additives and natural alternatives to synthetic compounds. Its integration of advanced processing technologies with sustainability goals positions it strongly within the evolving feed additives landscape.

Top Strategies Used by Key Market Participants

Key players in the North American animal feed additives market employ several strategies to strengthen their positions. One major approach is product innovation and differentiation, where companies develop specialized additives that offer enhanced nutritional value, improved digestibility, and reduced environmental impact. This helps them cater to evolving consumer preferences and regulatory standards.

Another widely adopted strategy is strategic partnerships and collaborations, wherein companies engage with research institutions, livestock producers, and agri-tech firms to co-develop cutting-edge formulations and expand their market reach. These alliances also facilitate faster adoption of new technologies.

Lastly, expansion through mergers and acquisitions is a prominent tactic. Companies acquire smaller firms with niche expertise or regional presence to consolidate their portfolios, enter new market segments, and enhance their supply chain efficiency across North America.

COMPETITION OVERVIEW

The competition in the North American animal feed additives market is characterized by a mix of established multinational corporations and emerging regional players striving for technological differentiation and market expansion. As demand for high-performance, sustainable, and antibiotic-free feed solutions continues to rise, companies are intensifying efforts to innovate and diversify their product offerings. Strategic positioning through R&D investments, supply chain optimization, and customer-specific formulation services has become crucial in maintaining a strong foothold. The market is witnessing increased collaboration between industry leaders and academic institutions to accelerate the development of bio-based and functional additives. At the same time, regulatory pressures and shifting consumer expectations regarding transparency and clean labeling are compelling firms to reconfigure their strategies. This evolving competitive landscape fosters continuous improvement and adaptation, ensuring that only those companies capable of delivering both efficacy and sustainability will thrive in the long term.

RECENT HAPPENINGS IN THE MARKET

- In February 2024, BASF launched a new line of phytogenic feed additives designed specifically for poultry operations. This product line aims to improve gut health and nutrient absorption without the use of antibiotics, aligning with growing consumer demand for cleaner meat production methods.

- In May 2024, Cargill announced a partnership with a leading U.S.-based biotech firm to develop enzyme-based feed solutions that enhance protein digestibility in swine diets. This collaboration strengthens Cargill’s ability to provide science-backed nutritional products tailored for intensive livestock farming.

- In July 2024, ADM expanded its fermentation facility in Illinois to increase production capacity for probiotics and specialty amino acids. This move allows ADM to better serve the rising demand for natural feed additives in North America while improving supply chain resilience.

- In September 2024, Novozymes introduced a digital feed additive management platform targeted at precision livestock farmers. The tool enables real-time monitoring of feed efficiency and additive performance, reinforcing Novozymes’ position as an innovator in smart agricultural solutions.

- In November 2024, DSM-Firmenich completed the acquisition of a U.S.-based startup specializing in microbial feed enhancers. This strategic move enhances DSM-Firmenich’s portfolio of sustainable feed additives and strengthens its foothold in the fast-growing probiotics segment.

MARKET SEGMENTATION

This research report on the North America Animal Feed Additives market is segmented and sub-segmented into the following categories.

By Livestock

- Ruminants

- Poultry

- Swine

- Aquatic Animal

By Product

- Vitamins

- Antibiotics

- Feed Enzymes

- Acidifiers

- Aminoacids

- Antioxidants

By Form

- Dry

- Liquid

By Source

- Natural

- Synthetics

By Country

- The United States

- Canada

- Mexico

Frequently Asked Questions

What is the projected CAGR of the North America Animal Feed Additives Market from 2025 to 2033?

The North America animal feed additives market is expected to grow at a CAGR of 5.43% from 2024 to 2030 , driven by rising demand for functional feed ingredients that enhance animal health, improve feed efficiency, and meet clean-label consumer preferences.

Which country leads in feed additive innovation within North America?

The U.S. accounts for over 80% of feed additive R&D investments , with major hubs in Iowa, Nebraska, and Minnesota, where large-scale livestock operations drive demand for performance-enhancing feed solutions.

How many metric tons of feed additives were used in North American livestock diets in 2023?

Over 2.7 million metric tons of feed additives — including amino acids, enzymes, probiotics, and mycotoxin binders — were consumed across the U.S. and Canada in 2023, according to USDA estimates.

Which type of feed additive is experiencing the fastest growth in North America?

Probiotics and prebiotics are growing at the fastest rate, with a CAGR of 7.9% , due to increased focus on gut health, antibiotic reduction programs, and natural livestock management practices.

What percentage of poultry feed in the U.S. contains enzyme-based additives?

Approximately 68% of commercial poultry feed formulations now include enzymes like phytase and xylanase, helping improve nutrient absorption and reduce phosphorus excretion, as reported by the U.S. Poultry & Egg Association.

How has the FDA’s Guidance 213 impacted antibiotic growth promoter use in feed?

Following the full implementation of FDA Guidance 213 in 2024 , sales of medically important antimicrobials for livestock dropped by 41% since 2016 , accelerating the shift toward alternative additives like organic acids and phytogenics.

Which states in the U.S. have the highest demand for feed additives?

Iowa, Texas, and North Carolina lead in feed additive consumption due to their large livestock populations, especially swine, poultry, and cattle, and presence of major integrators and feed manufacturers.

How much do feed additives contribute to reducing methane emissions from ruminants?

Additives like 3-nitrooxypropanol (3-NOP) and seaweed-based supplements have shown potential to reduce enteric methane emissions by up to 30% , prompting interest from dairy and beef producers aiming to meet sustainability targets.

What role do feed additives play in improving carcass quality in pork production?

Feed additives such as chromium propionate and betaine are increasingly used in swine diets to improve lean meat yield and marbling, contributing to a 12–15% increase in premium cut value in major pork processing plants.

How is e-commerce influencing the distribution of feed additives in North America?

Online B2B platforms for feed additives saw a 35% rise in transaction volume in 2023 , particularly among smaller farms and organic livestock producers seeking direct access to niche products and technical support.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com