North America Artificial Lift Systems Market Size, Share, Trends & Growth Forecast Report By Type (Progressive Cavity Pumps (PCP), Electric Submersible Pumps (ESP), Gas Lift Systems, Other Types), Area of Deployment (Onshore, Offshore), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Artificial Lift Systems Market Size

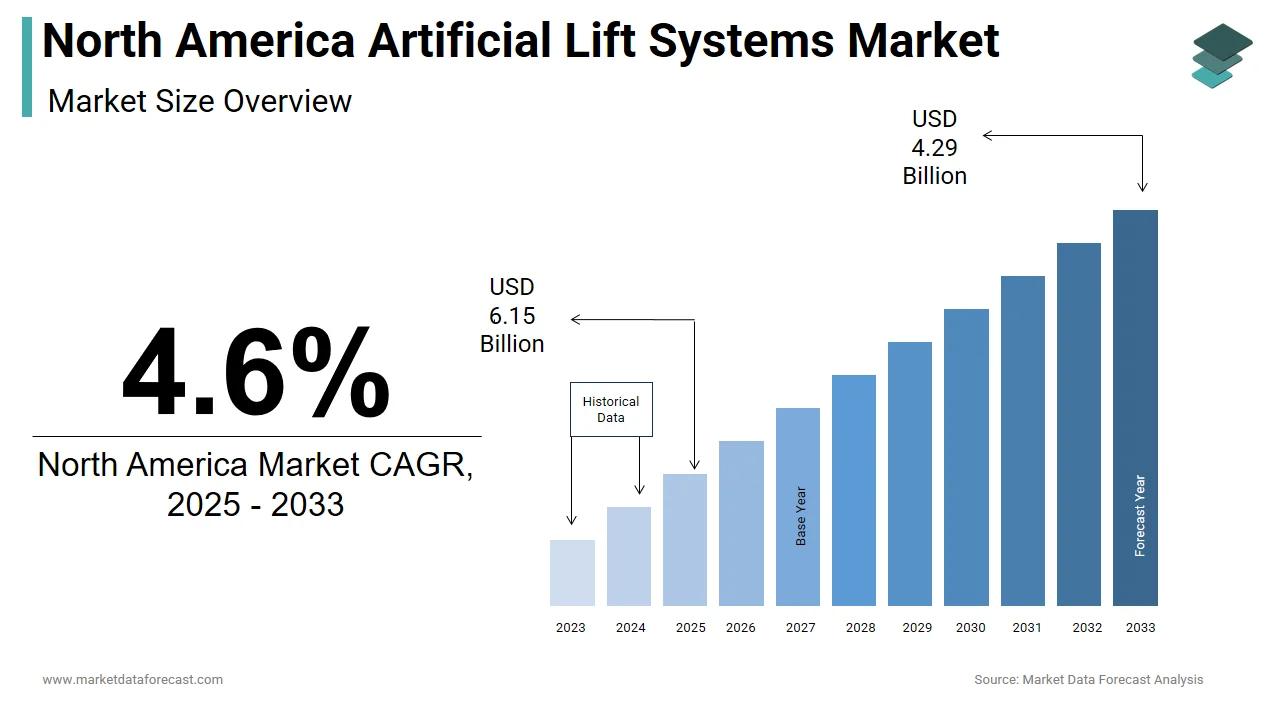

The size of the North America artificial lift systems market was worth USD 4.1 billion in 2024. The North America market is anticipated to grow at a CAGR of 4.6% from 2025 to 2033 and be worth USD 6.15 billion by 2033 from USD 4.29 billion in 2025.

Artificial lift systems are critical mechanisms employed in oil and gas wells to enhance production by supplementing natural reservoir pressure, especially as wells mature. In North America, a region historically marked by robust energy exploration and production activities, these systems have become indispensable for maintaining hydrocarbon output levels amid declining well pressures. The market encompasses a range of technologies such as rod pumps, electric submersible pumps (ESPs), gas lift systems, progressive cavity pumps (PCPs), and plunger lifts. As unconventional resources like shale oil and tight gas gain prominence, reliance on artificial lift methods has intensified across the U.S. and Canada.

MARKET DRIVERS

Rising Number of Aging Wells Requiring Production Enhancement

One of the most significant drivers of the North America artificial lift systems market is the increasing number of aging oil and gas wells that require enhanced recovery methods to sustain production. These older wells naturally experience a decline in reservoir pressure, making it increasingly difficult to extract hydrocarbons without mechanical assistance. Artificial lift systems offer a viable solution by enabling continued production from these mature assets.

The growing emphasis on cost-effective field life extension strategies has led operators to adopt advanced lifting technologies such as intelligent electric submersible pumps and variable speed drives, which improve efficiency while reducing downtime. This trend aligns with broader industry goals of optimizing capital expenditures and maximizing return on existing infrastructure, reinforcing the necessity of artificial lift systems in the North American landscape.

Expansion of Shale Oil Production and Unconventional Reserves Development

The rapid expansion of shale oil and unconventional gas production in North America has significantly boosted demand for artificial lift systems. According to the U.S. Energy Information Administration (EIA), the Permian Basin alone accounted for over 5 million barrels of oil equivalent per day in 2024, driven largely by horizontal drilling and hydraulic fracturing techniques. Unlike conventional wells, unconventional plays often exhibit steep initial production declines, necessitating early integration of artificial lift systems to maintain economic viability.

Given the complex geology and flow characteristics of these formations, artificial lift systems tailored for intermittent flow and high sand content are becoming increasingly prevalent. Companies such as Schlumberger and Baker Hughes have introduced specialized pump designs and real-time monitoring tools aimed at improving reliability in these challenging environments, further accelerating market growth.

MARKET RESTRAINTS

High Capital and Maintenance Costs Associated with Advanced Systems

Despite their operational benefits, the high capital investment and ongoing maintenance costs associated with advanced artificial lift systems pose a considerable restraint on market growth in North America.

Moreover, frequent system failures caused by sand ingress, corrosion, or electrical faults lead to costly workovers and unplanned downtime. Smaller independent producers, who constitute a significant portion of the market, often struggle to justify these costs, especially when oil prices remain volatile. Consequently, many companies delay adoption or opt for less expensive but less efficient alternatives such as beam pumping units, limiting the penetration of technologically superior lift systems in certain segments of the market.

Environmental Regulations and Operational Compliance Pressures

Stringent environmental regulations and increasing compliance requirements are also impeding the growth of the North America artificial lift systems market. Governments across the region are intensifying efforts to curb methane emissions and reduce the carbon footprint of oil and gas operations. As per the U.S. Environmental Protection Agency (EPA), the oil and gas sector was responsible for a notable share of total U.S. methane emissions in 2023, prompting new regulatory measures targeting upstream production practices. Several states, including Colorado and California, have enacted laws mandating leak detection and repair (LDAR) programs, which apply pressure on operators to minimize fugitive emissions from artificial lift components such as rod seals and gas lift valves.

Compliance with these standards often necessitates retrofitting existing lift systems or investing in low-emission alternatives, adding to operational complexity and expenditure

MARKET OPPORTUNITIES

Integration of Digital Technologies and Predictive Analytics in Artificial Lift Operations

A compelling opportunity emerging in the North America artificial lift systems market is the integration of digital technologies, including predictive analytics, IoT-enabled sensors, and machine learning algorithms, into lift system operations. These innovations enable real-time performance monitoring, condition-based maintenance, and dynamic optimization of lift efficiency. According to a 2024 report by PwC, the adoption of digital oilfield solutions has the potential to reduce artificial lift-related downtime and extend equipment life by 15–20%. Operators are increasingly deploying smart lift controllers equipped with remote diagnostics, allowing for faster troubleshooting and reduced field visits.

Growing Demand for Enhanced Oil Recovery (EOR) Techniques in Mature Fields

Another key opportunity lies in the growing adoption of enhanced oil recovery (EOR) techniques in conjunction with artificial lift systems, particularly in mature fields across North America. EOR methods such as water flooding, CO₂ injection, and polymer flooding are being increasingly utilized to boost reservoir pressure and improve hydrocarbon mobility, which in turn enhances the effectiveness of artificial lift mechanisms.

In Texas and Oklahoma, where many fields have entered late-stage production, EOR applications have surged since 2021, according to data from the Oklahoma Corporation Commission. This trend is encouraging operators to integrate compatible artificial lift systems such as high-efficiency ESPs and progressing cavity pumps that can function optimally under altered fluid properties and higher injection pressures. As EOR becomes more economically viable due to improved technology and policy backing, the artificial lift systems market stands to benefit significantly from complementary deployment opportunities.

MARKET CHALLENGES

Supply Chain Disruptions and Equipment Lead Time Delays

A pressing challenge facing the North America artificial lift systems market is the persistent disruption in global supply chains, which has led to extended equipment lead times and procurement delays. The aftermath of the pandemic, geopolitical tensions, and semiconductor shortages have disrupted the manufacturing and delivery of critical components such as motors, control panels, and variable frequency drives used in artificial lift systems. This delay has had a cascading effect on field development timelines, particularly in fast-paced basins like the Eagle Ford and DJ Basin. Furthermore, logistics bottlenecks at key ports such as Houston and Long Beach have added weeks to equipment delivery schedules, hampering just-in-time inventory strategies. In response, some operators have resorted to stockpiling spare parts or opting for refurbished systems, which may compromise long-term reliability.

Workforce Shortages and Technical Skill Gaps in Field Operations

Another critical challenge confronting the North America artificial lift systems market is the shortage of skilled labor and technical expertise required for the installation, operation, and maintenance of advanced lift technologies. The aging workforce in the oil and gas sector, coupled with declining interest among younger generations, has created a talent gap that limits the effective deployment of sophisticated lift systems. As reported by the Petroleum Services Association of Canada (PSAC), the average age of field technicians in the energy sector rose to 52 years in 2024, with fewer replacements entering the pipeline. Compounding the issue, newer artificial lift systems incorporate digital controls, telemetry, and automation features that require specialized training to operate efficiently. Many small and mid-sized operators lack the internal capacity to train personnel on these evolving technologies, leading to reliance on external service providers, which increases both time and cost.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Area of Deployment, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

India, China, Japan, South Korea, Australia, New Zealand, Thailand, Malaysia, Vietnam, Philippines, Indonesia, Singapore, Rest of APAC |

|

Market Leaders Profiled |

JJ Tech, Halliburton Company, Baker Hughes Company, Schlumberger Limited, and DistributionNow. |

SEGMENTAL ANALYSIS

By Type Insights

Electric Submersible Pumps (ESPs) dominated the North America artificial lift systems market, accounting for a 42.4% of total market revenue in 2024. One key driver behind this dominance is their ability to handle large volumes of fluid with high efficiency, making them ideal for wells experiencing steep decline curves.

Additionally, advancements in ESP technology such as variable speed drives and sand-tolerant designs have significantly improved reliability and longevity. The growing integration of digital monitoring tools further enhances performance optimization, reducing unplanned downtime, according to analysis conducted by McKinsey & Company. These technological improvements, combined with rising demand for production optimization in mature and unconventional fields, solidify ESPs as the leading type segment in North America.

Gas Lift Systems are projected to be the fastest-growing segment in the North America artificial lift systems market, with a compound annual growth rate (CAGR) of 7.1%. This rapid expansion is primarily driven by their suitability for deep and offshore wells where other lifting methods may be less effective or economically viable.

Moreover, operators are increasingly adopting continuous flow gas lift systems in unconventional plays like the Bakken and Niobrara formations, where fluctuating gas-oil ratios necessitate flexible lifting solutions.

Additionally, the integration of smart gas lift valves and real-time telemetry has enhanced system responsiveness and reduced operational costs. With ongoing offshore exploration projects and increasing reliance on gas reinjection techniques, gas lift systems are poised for sustained high-growth momentum in the region.

By Area of Deployment Insights

Onshore deployment remained the top performing application for artificial lift systems in North America in 2024. This overwhelming dominance is due to the region’s vast network of onshore oil and gas fields, particularly in the United States, where unconventional drilling activities have surged over the past decade.

The Permian Basin alone contributed nearly 5.5 million barrels of oil equivalent per day in 2024, most of which required artificial lift intervention within the first year of production. Furthermore, Canada’s Western Canada Sedimentary Basin (WCSB) continues to be a major hub for onshore development, hosting over 400,000 active and inactive wells as reported by the Alberta Energy Regulator in early 2024. Operators in these regions increasingly rely on progressive cavity pumps and electric submersible pumps tailored for harsh downhole conditions. The combination of aging well infrastructure, high drilling activity, and favorable regulatory support ensures continued leadership of the onshore segment.

Offshore deployment of artificial lift systems is emerging as the fastest-growing segment in the North America market, recording a CAGR of 6.8%. This accelerated growth trajectory is primarily fueled by renewed investment in deepwater exploration projects in the Gulf of Mexico, where reservoir characteristics often necessitate advanced lift mechanisms. As per the U.S. Bureau of Ocean Energy Management (BOEM), offshore oil production in federal waters reached an average of 1.8 million barrels per day in 2024, with over 70% of these wells utilizing gas lift or submersible pumping systems.

In addition, the recent discovery of new reserves in ultra-deepwater zones such as the Keathley Canyon and Walker Ridge blocks has spurred demand for high-efficiency, compact lift systems capable of operating under extreme pressures and temperatures. Moreover, the resurgence of offshore drilling permits over 150 new leases were approved in 2023 alone has created a conducive environment for expanded deployment of artificial lift systems. Companies have introduced specialized offshore-rated ESPs and gas lift mandrels designed for remote operation and minimal maintenance.

COUNTRY WISE ANALYSIS

The United States had the dominant position in the North America artificial lift systems market by commanding a 65.6% of total regional revenue in 2024. This is primarily attributable to the country’s extensive onshore oil and gas production, particularly in unconventional basins such as the Permian, Eagle Ford, and Bakken. According to the U.S. Energy Information Administration (EIA), the U.S. produced an average of 12.9 million barrels of crude oil per day in 2023, much of which came from mature and newly developed wells requiring mechanical lift support.

A key growth driver is the proliferation of horizontal drilling and multi-stage hydraulic fracturing, which often result in rapid production declines necessitating early adoption of artificial lift systems.

Additionally, the aging well population where over two-thirds of active wells are more than 20 years old, as reported by Rystad Energy continues to drive demand for cost-effective lift solutions. The integration of digital monitoring systems and predictive analytics, supported by initiatives from firms like Schlumberger and Baker Hughes, further enhances the efficiency of lift operations.

Canada is positioning it as the second-largest contributor in the region. The country's mature oil and gas infrastructure, particularly in western provinces like Alberta and Saskatchewan, necessitates widespread use of artificial lift technologies to sustain production levels. One of the primary drivers of artificial lift adoption in Canada is the expansion of unconventional resource development in the Montney and Duvernay formations. To counter declining reservoir pressure, operators increasingly deploy progressive cavity pumps and electric submersible pumps tailored for high-sand-content environments.

Additionally, the country’s commitment to carbon capture and enhanced oil recovery (EOR) techniques has spurred interest in compatible lift solutions. With supportive policy frameworks and rising investments in digital field management, Canada’s artificial lift systems market continues to expand steadily.

The Rest of North America, comprising Mexico and Central American territories, represents a smaller but rapidly evolving segment of the artificial lift systems market in 2024. While historically overshadowed by the U.S. and Canada, this segment is witnessing increased adoption of artificial lift systems due to renewed exploration activities and infrastructure modernization efforts.

A key factor driving growth in this region is the Mexican government’s push to attract foreign investment in upstream operations following energy reforms initiated in 2014. Although progress has been slower than anticipated, companies such as BP and Chevron have recently re-entered the market, bringing with them advanced artificial lift technologies suited for deep and high-water-cut wells. Also, offshore developments in the Gulf of Mexico’s shallow waters are gaining traction, with gas lift systems becoming increasingly prevalent.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America artificial lift systems market profiled in this report are JJ Tech, Halliburton Company, Baker Hughes Company, Schlumberger Limited, and DistributionNow.

TOP LEADING PLAYERS IN THE NORTH AMERICA ARTIFICIAL LIFT SYSTEMS MARKET

Schlumberger Limited

Schlumberger is a global leader in oilfield services and plays a dominant role in the North America artificial lift systems market. The company offers a comprehensive portfolio of lifting technologies, including electric submersible pumps, gas lift systems, and progressive cavity pumps. Schlumberger’s focus on digital integration and automation has enabled it to provide intelligent lift solutions that enhance production efficiency and reduce downtime. With strong R&D capabilities and a vast service network across the U.S. and Canada, Schlumberger continues to influence market trends through innovation and strategic partnerships with major upstream operators.

Baker Hughes Company

Baker Hughes is a key player known for its advanced artificial lift technologies tailored for both conventional and unconventional wells. The company provides a wide range of lift solutions, from rod pumps to high-performance ESPs and gas lift systems. Baker Hughes emphasizes digital monitoring and predictive analytics to optimize well performance and extend equipment life. Its customer-centric approach and continuous product development have strengthened its presence in major North American basins. The company also collaborates with energy firms to integrate sustainability into lift operations, aligning with evolving industry demands.

Weatherford International plc

Weatherford has established itself as a significant contributor to the North America artificial lift systems market through its innovative and reliable lifting solutions. The company offers customized artificial lift products and services, focusing on operational efficiency and adaptability across diverse well conditions. Weatherford’s commitment to digital transformation and real-time data analytics has enhanced its competitive edge. By continuously improving system durability and performance, Weatherford supports operators in maximizing hydrocarbon recovery while reducing maintenance costs, making it a trusted partner in the region’s evolving oil and gas landscape.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by leading companies in the North America artificial lift systems market is product innovation and technological advancement. Firms are investing heavily in research and development to design more efficient, durable, and digitally integrated lift systems that cater to the complex needs of unconventional wells. These innovations include smart pumps, remote monitoring tools, and adaptive control systems that improve reliability and reduce downtime.

Another crucial strategy is strategic partnerships and collaborations with upstream operators, technology providers, and digital solution developers. These alliances enable artificial lift system manufacturers to offer tailored solutions that align with field-specific challenges and production goals. Collaborations also facilitate knowledge exchange and faster deployment of new technologies across key basins.

Lastly, expansion of service networks and localized support infrastructure plays a vital role in strengthening market position. Companies are enhancing their regional presence through service centers, field technicians, and supply chain optimization to ensure rapid response times and consistent after-sales support, which is critical in maintaining long-term client relationships and ensuring operational continuity.

COMPETITION OVERVIEW

The competition in the North America artificial lift systems market is characterized by a mix of established multinational corporations and agile regional players striving to capture market share through innovation, service excellence, and strategic positioning. Major firms leverage their global expertise and extensive resource bases to deliver advanced, integrated solutions tailored to the evolving demands of oil and gas producers. The market sees intense rivalry not only in terms of product offerings but also in after-sales support, customization, and digital integration capabilities. Smaller companies often differentiate themselves by focusing on niche applications or offering cost-effective alternatives that appeal to independent operators. As demand for efficient, durable, and intelligent lifting solutions grows driven by aging wells and expanding unconventional drilling companies are increasingly emphasizing differentiation through technological superiority, local presence, and responsiveness. This dynamic environment fosters continuous improvement and adaptation, pushing competitors to refine their offerings and expand their service portfolios to maintain relevance in a highly specialized and technically demanding sector.

RECENT MARKET DEVELOPMENTS

- In February 2024, Schlumberger launched an advanced digital lift optimization platform designed specifically for unconventional shale wells. This initiative enhances real-time decision-making and improves production efficiency, reinforcing Schlumberger’s leadership in intelligent artificial lift solutions.

- In May 2024, Baker Hughes announced a strategic collaboration with a leading data analytics firm to integrate AI-driven diagnostics into its electric submersible pump systems. This partnership aims to improve system longevity and reduce unplanned downtime, strengthening Baker Hughes’ value proposition in the North American market.

- In July 2024, Weatherford expanded its service footprint by opening a new regional support center in Texas, focused exclusively on artificial lift system maintenance and rapid-response field support. This move enhances the company's ability to serve Permian Basin operators with greater efficiency and speed.

- In September 2024, NOV introduced a next-generation compact electric submersible pump tailored for horizontal wells with limited space and high sand content. This product innovation addresses specific operational challenges in North American unconventional plays, giving NOV a stronger foothold in key producing regions.

- In November 2024, Dover Corporation acquired a small but innovative artificial lift startup specializing in plunger lift automation. This acquisition allows Dover to expand its digital capabilities and offer more adaptive lift solutions to independent producers seeking cost-effective, high-efficiency systems.

MARKET SEGMENTATION

This research report on the North America artificial lift systems market is segmented and sub-segmented into the following categories.

By Type

- Progressive Cavity Pumps (PCP)

- Electric Submersible Pumps (ESP)

- Gas Lift Systems

- Other Types

By Area of Deployment

- Onshore

- Offshore

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main drivers fueling the North America Artificial Lift Systems Market?

Growth is driven by rising unconventional oil production, depletion of conventional reserves, enhanced oil recovery (EOR) initiatives, and technological advancements in automation and monitoring

2. How are digital technologies and automation transforming the North America Artificial Lift Systems Market?

Integration of IoT sensors, real-time data analytics, and automation enables remote monitoring, predictive maintenance, and operational optimization, reducing downtime and costs

3. Which countries dominate the North America Artificial Lift Systems Market?

The United States leads the market, driven by extensive shale oil and gas production, followed by Canada and Mexico, which are also expanding their oilfield operations

4. What role do electric submersible pumps (ESPs) play in the North America Artificial Lift Systems Market?

ESPs are favored for their high efficiency and ability to handle large production volumes, especially in deep and unconventional wells, and are expected to dominate market share

5. What are the major components of artificial lift systems in North America?

Artificial lift systems typically include pumps, motors, cable systems, controllers, and monitoring devices, each contributing to system reliability and efficiency

6. What are the key challenges facing the North America Artificial Lift Systems Market?

Challenges include high capital and operational costs, technical complexity, regulatory compliance, and the need for skilled personnel to manage advanced systems

7. What trends are shaping the future of the North America Artificial Lift Systems Market?

Key trends include adoption of AI and predictive analytics, wireless monitoring, advanced materials for durability, and a shift toward greener, more energy-efficient solutions

8. How are artificial lift systems contributing to enhanced oil recovery (EOR) in North America?

These systems are critical for maximizing output from aging and depleted wells, supporting EOR strategies that unlock additional reserves and extend field life

9. Who are the leading players in the North America Artificial Lift Systems Market?

Major companies include Schlumberger, Halliburton, Baker Hughes, Weatherford, NOV Inc., Dover Corporation, and several specialized technology providers

10. What opportunities exist for new entrants or investors in the North America Artificial Lift Systems Market?

Opportunities lie in developing advanced automation, digital solutions, and energy-efficient systems to address the evolving needs of the oil and gas sector

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com