North America Biochar Market Size, Share, Trends & Growth Forecast Report, Segmented By Application, Technology, Manufacturing, Feedstock (Agricultural Waste, Forestry Waste, Animal Manure And Biomass Plantations) And By Country (The U.S, Canada, Mexico, and Brazil), Industry Analysis From 2025 to 2033

North America Biochar Market Size

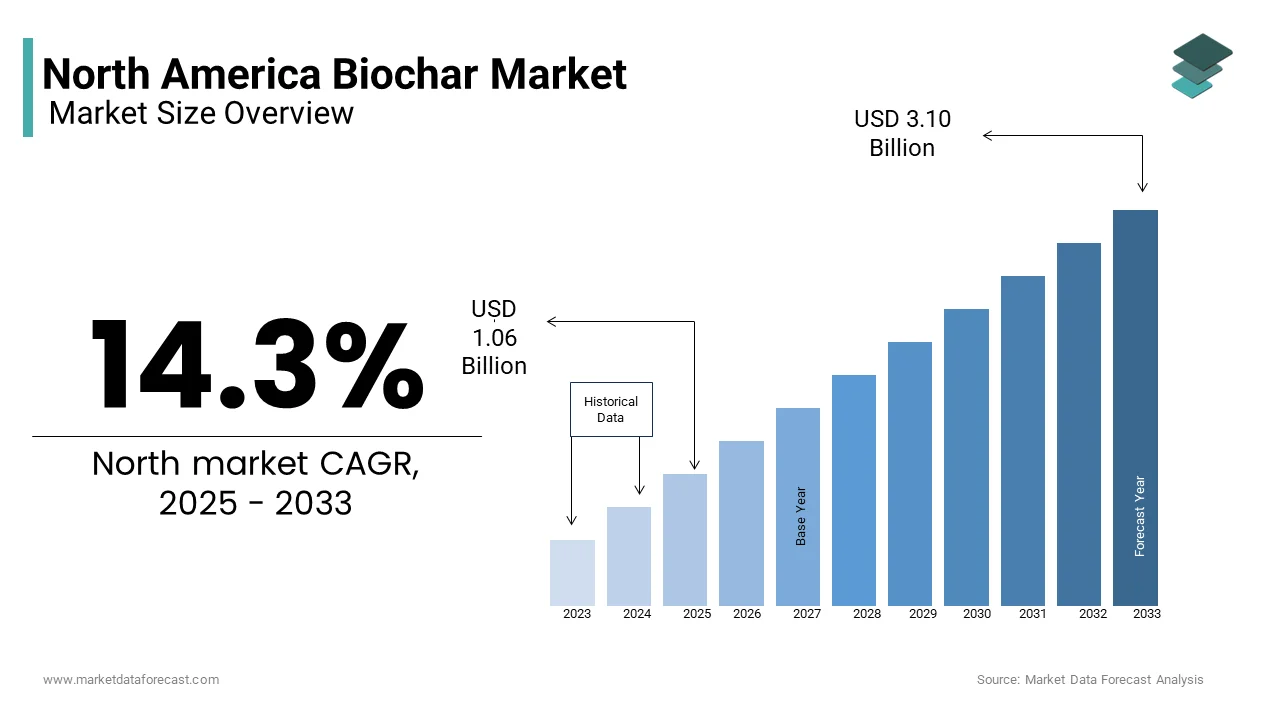

The North America biochar market was valued at USD 0.93 billion in 2024 and is anticipated to reach USD 1.06 billion in 2025 from USD 3.10 billion by 2033, growing at a CAGR of 14.3% during the forecast period from 2025 to 2033.

Current Scenario Of The North American Biochar Market

Biochar, a carbon-rich material derived from the pyrolysis of organic waste, has emerged as a pivotal solution for sustainable agriculture, soil health improvement, and carbon sequestration in North America. This market is driven by the region's growing emphasis on circular economy principles, climate change mitigation, and agricultural innovation. According to the United States Department of Agriculture (USDA), over 30% of the country’s agricultural land faces challenges related to soil degradation, underscoring the need for biochar as a soil amendment to enhance fertility and water retention. Additionally, as per the Environmental Protection Agency (EPA), organic waste contributes to approximately 15% of total municipal solid waste in the U.S., creating an abundant feedstock source for biochar production.

The North American biochar market is characterized by its alignment with sustainability goals and green technologies. For instance, Canada’s commitment to achieving net-zero emissions by 2050 has spurred investments in biochar projects that support carbon capture initiatives. Furthermore, the increasing prevalence of urban farming and vertical agriculture across cities like New York and Los Angeles highlights the versatility of biochar in diverse agricultural applications. Its ability to reduce greenhouse gas emissions while improving crop yields makes it a critical component of modern agroecological practices. The convergence of environmental policies, technological advancements, and agricultural demands positions biochar as a transformative solution within North America’s broader sustainability landscape.

MARKET DRIVERS

Rising Demand for Sustainable Agriculture

The demand for sustainable agricultural practices is a significant driver propelling the North American biochar market forward. As per the USDA, nearly 40% of U.S. farmers are adopting soil-enhancing techniques to combat declining soil fertility and erosion. Biochar’s unique properties, such as its ability to retain nutrients and water, make it an ideal solution for revitalizing degraded soils. For instance, studies conducted by Cornell University have demonstrated that incorporating biochar into soil can increase crop yields by up to 25% in nutrient-depleted regions. This has led to widespread adoption among farmers in states like California and Texas, where water scarcity is a pressing issue.

Furthermore, the growing interest in regenerative agriculture, which focuses on restoring soil health and reducing chemical inputs, has amplified biochar’s appeal. According to the Rodale Institute, regenerative farming practices could sequester over 1 billion tons of carbon annually if implemented globally, with biochar playing a crucial role in this transition. Government incentives, such as subsidies for organic farming and carbon credits for soil carbon sequestration, further encourage farmers to integrate biochar into their operations. This confluence of environmental benefits, economic incentives, and agricultural innovation underscores biochar’s growing prominence in North America’s agricultural sector.

Stringent Environmental Regulations

Stringent environmental regulations aimed at reducing greenhouse gas emissions and promoting waste management are another key driver for the North American biochar market. The EPA has identified organic waste as a significant contributor to methane emissions, a potent greenhouse gas. In response, several states, including California and Massachusetts, have implemented mandatory organic waste recycling laws, creating a robust supply chain for biochar feedstock. For example, California’s SB 1383 mandates a 75% reduction in organic waste disposal by 2025, encouraging industries to adopt biochar production as a viable waste management solution.

Additionally, federal initiatives like the Clean Air Act and the Biden administration’s commitment to cutting U.S. emissions by 50% by 2030 have spurred investment in carbon-negative technologies. Biochar’s ability to sequester carbon for centuries aligns perfectly with these objectives. According to research published in Nature Communications, biochar can offset up to 12% of global anthropogenic emissions if scaled effectively. This regulatory push, coupled with the increasing corporate focus on achieving carbon neutrality, has positioned biochar as a critical tool in North America’s efforts to combat climate change while managing organic waste sustainably.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints hindering the growth of the North American biochar market is the high cost associated with its production. The initial investment required for setting up biochar production facilities, including pyrolysis reactors and feedstock processing units, can be substantial. According to the International Biochar Initiative, the capital expenditure for establishing a mid-sized biochar plant ranges from 1millionto5 million, depending on capacity and technology. These costs act as a barrier, particularly for small-scale producers and startups attempting to enter the market.

Moreover, operational expenses, such as energy consumption during pyrolysis and transportation of feedstock, further escalate production costs. For instance, as per data shared by the U.S. Energy Information Administration, energy prices in certain regions, like the Northeast, are significantly higher than the national average, impacting the affordability of biochar production. While economies of scale can mitigate some costs, many producers struggle to achieve sufficient output due to limited feedstock availability or fragmented supply chains. This financial burden limits the accessibility of biochar to smaller agricultural operations, thereby impeding its widespread adoption across the region.

Lack of Standardization and Awareness

Another significant restraint is the lack of standardization and awareness regarding biochar’s applications and benefits. Despite its potential, there remains considerable ambiguity about optimal usage practices and quality benchmarks. For instance, as per the National Organic Program, inconsistencies in biochar composition and production methods can lead to variability in its performance, making it challenging for farmers and regulators to establish trust in its efficacy. This lack of uniformity hinders its integration into mainstream agricultural practices.

Additionally, limited public awareness about biochar’s environmental and economic benefits acts as a barrier to market expansion. According to a survey conducted by the Soil Science Society of America, only 20% of farmers in the Midwest were familiar with biochar as a soil amendment. Educational gaps and insufficient outreach programs further exacerbate this issue, particularly among rural communities. Without clear guidelines and increased advocacy, overcoming skepticism and fostering widespread acceptance of biochar remains a formidable challenge in North America.

MARKET OPPORTUNITIES

Urban Waste Management Integration

The integration of biochar into urban waste management systems presents a transformative opportunity for the North American biochar market. As per the EPA, urban areas generate over 260 million tons of municipal solid waste annually, with organic waste accounting for nearly 30%. Cities like New York and San Francisco are increasingly prioritizing zero-waste initiatives, creating a fertile ground for biochar production. By converting organic waste into biochar, municipalities can simultaneously address waste management challenges and produce a valuable product for agricultural and industrial use.

This synergy between waste management and biochar production aligns with broader sustainability goals. For instance, Toronto’s Green Bin Program, which processes over 100,000 tons of organic waste annually, could expand its scope by incorporating biochar facilities. Additionally, as per the World Bank, urban populations in North America are projected to grow by 10% over the next decade, increasing the volume of organic waste available for biochar production. By leveraging this untapped resource, stakeholders can unlock new revenue streams while advancing circular economy principles.

Carbon Credit and Climate Investment Schemes

The emergence of carbon credit markets and climate-focused investment schemes offers another significant opportunity for the North American biochar market. As per the Climate Action Reserve, biochar projects qualify for carbon credits due to their ability to sequester carbon dioxide for hundreds of years. This has attracted interest from corporations seeking to offset their carbon footprints, creating a lucrative market for biochar producers. For example, companies like Microsoft and Amazon have committed to purchasing millions of carbon credits annually, driving demand for verified biochar projects.

Furthermore, government-backed initiatives, such as the U.S. Department of Agriculture’s Conservation Stewardship Program, incentivize farmers to adopt carbon-sequestering practices, including biochar application. According to the Nature Conservancy, carbon pricing mechanisms could generate over $50 billion in annual investments by 2030, benefiting biochar producers who align with these frameworks. By capitalizing on these opportunities, the biochar market can position itself as a cornerstone of North America’s climate action strategies while generating substantial economic value.

MARKET CHALLENGES

Limited Scalability of Feedstock Supply Chains

A significant challenge facing the North American biochar market is the limited scalability of feedstock supply chains. While organic waste is abundant, logistical inefficiencies and regional disparities hinder its consistent availability for biochar production. For instance, as per the USDA, rural areas often lack the infrastructure needed to collect and transport agricultural residues efficiently, leading to underutilization of potential feedstock. Similarly, urban centers face challenges in segregating organic waste from other municipal waste streams, complicating procurement efforts.

Seasonal variations further compound this issue. According to the Agricultural Research Service, crop residues like corn stover and wheat straw are primarily available post-harvest, creating periods of feedstock scarcity during other times of the year. These fluctuations disrupt production schedules and increase operational costs. To overcome this challenge, stakeholders must invest in decentralized biochar facilities and develop robust partnerships with waste management entities. However, achieving this level of coordination requires significant time and resources, posing a persistent obstacle to market growth.

Competition from Alternative Soil Amendments

Competition from alternative soil amendments represents another major challenge for the biochar market in North America. Traditional products like compost, manure, and synthetic fertilizers dominate the market due to their established reputation and lower costs. As per the Fertilizer Institute, the U.S. fertilizer industry generates over $150 billion in annual revenue, making it a formidable competitor for biochar producers. Farmers, particularly those operating on tight budgets, may opt for cheaper alternatives despite biochar’s long-term benefits.

Additionally, misconceptions about biochar’s immediate impact on crop yields deter adoption. According to a study by the University of California, Davis, while biochar enhances soil health over time, its effects are not always immediately visible, leading some growers to favor faster-acting solutions. This perception gap, combined with the entrenched market presence of conventional amendments, creates a challenging environment for biochar manufacturers. Bridging this gap requires targeted education campaigns and demonstrations of biochar’s cumulative advantages, which remain an uphill battle in the current competitive landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.3% |

|

Segments Covered |

By Application, Technology, Manufacturing, Feedstock, and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The U.S, Mexico, Brazil, Rest of North America |

|

Market Leaders Profiled |

Biochar Products Inc., Diacarbon Energy Inc., Agri-Tech Producers LLC, Genesis Industries, Green Charcoal International, Vega Biofuels Inc., The Biochar Company, Cool Planet Energy Systems Inc., Full Circle Biochar, and Pacific Pyrolysis Pty Ltd. |

SEGMENTAL ANALYSIS

By Application Insights

The agriculture segment dominates the North American biochar market, accounting for approximately 45% of the total market share, as per data from the United States Department of Agriculture (USDA). This dominance is driven by biochar’s ability to enhance soil fertility, water retention, and carbon sequestration, making it indispensable for sustainable farming practices. For instance, studies conducted at Cornell University reveal that incorporating biochar into agricultural soils can increase crop yields by up to 25% in nutrient-depleted regions.

A key driving factor is the growing adoption of regenerative agriculture. According to the Rodale Institute, regenerative farming practices could sequester over 1 billion tons of carbon annually if implemented globally, with biochar playing a pivotal role in this transition. Additionally, government incentives such as subsidies for organic farming and carbon credits for soil carbon sequestration further encourage farmers to adopt biochar. For example, California’s Healthy Soils Program allocates $28 million annually to support carbon-sequestering practices, including biochar application. These factors collectively fortify agriculture as the largest application segment in the biochar market.

The gardening segment is the fastest-growing application area in the North American biochar market, with a projected CAGR of 12.8% through 203, according to research by the National Gardening Association. This growth is fueled by the increasing popularity of urban gardening and backyard farming, particularly among millennials and Gen Z consumers who prioritize sustainability.

A significant driver is the rising demand for organic produce. As per the Organic Trade Association, sales of organic products in the U.S. reached $61.9 billion in 2022, reflecting a growing consumer preference for chemical-free gardening practices. Biochar’s ability to improve soil structure and reduce the need for synthetic fertilizers aligns perfectly with this trend. Additionally, initiatives like New York City’s GreenThumb program, which supports community gardens, have spurred the use of biochar in urban settings. With over 550 community gardens across the city, biochar has become a go-to solution for enhancing soil health and productivity.

By Technology Insights

Continuous pyrolysis holds the largest market share in the North American biochar market, capturing approximately 35% of the market, as stated by the International Renewable Energy Agency (IRENA). This technology is favored for its efficiency and scalability, enabling large-scale production of high-quality biochar. The ability to process diverse feedstocks, such as agricultural residues and forestry waste, makes continuous pyrolysis ideal for meeting the region’s growing biochar demand.

A primary driving factor is the focus on reducing greenhouse gas emissions. According to IRENA, continuous pyrolysis systems achieve carbon sequestration rates of up to 50%, significantly higher than other methods. Additionally, advancements in automation and energy recovery have reduced operational costs by 20%, making the technology more accessible. For instance, Canada’s Clean Fuel Standard mandates the adoption of low-carbon technologies, encouraging industries to invest in continuous pyrolysis systems. These factors solidify continuous pyrolysis as the dominant technology in the North American biochar market.

Microwave pyrolysis is the fastest-growing segment in the North American biochar market, with a CAGR of 14.5%, as per a study by the American Society of Agricultural and Biological Engineers. This growth is attributed to its ability to produce high-purity biochar with minimal environmental impact. For example, microwave pyrolysis reduces energy consumption by 30% compared to traditional methods, making it an attractive option for eco-conscious producers.

A key driver is technological innovation. According to the study, recent advancements in microwave technology have improved processing efficiency, enabling faster conversion of feedstock into biochar. Additionally, state-level policies, such as Massachusetts’ Zero Waste Plan, incentivize the adoption of energy-efficient technologies. Private sector investments are also accelerating growth; companies like BioChar Supreme have committed over $50 million to develop microwave pyrolysis solutions. The emphasis on sustainability and resource efficiency further amplifies the adoption of microwave pyrolysis in the region

By Manufacturing Insights

Pyrolysis accounts for the largest share of the North American biochar market, with approximately 40% market share, as reported by the Global Biochar Initiative. This method is widely used due to its versatility in converting various feedstocks, including agricultural and forestry waste, into biochar. The scalability of pyrolysis systems makes them suitable for both small-scale and industrial applications, particularly in countries like the U.S. and Canada.

A major driving factor is the abundance of feedstock. According to the USDA, North America generates over 500 million tons of agricultural residues annually, providing a reliable input for pyrolysis processes. Another factor is cost-effectiveness; pyrolysis systems achieve thermal efficiencies of up to 85%, significantly higher than alternative methods. This aligns with regional policies aimed at reducing greenhouse gas emissions. For instance, Canada’s Net-Zero Emissions by 2050 plan prioritizes investments in clean energy technologies, spurring the adoption of pyrolysis for biochar production.

Gasification is the fastest-growing manufacturing segment in the North American biochar market, with a CAGR of 13.7%, as per the International Energy Agency (IEA). This growth is driven by its ability to produce syngas alongside biochar, creating dual revenue streams for manufacturers. For example, gasification-derived syngas is increasingly used in power generation, while biochar serves as a valuable soil amendment.

A key driver is the emphasis on circular economy principles. According to the IEA, gasification systems reduce waste disposal costs by 40%, making them an attractive option for municipalities and industries. Government support plays a crucial role as well. For instance, the U.S. Department of Energy’s Bioenergy Technologies Office has allocated over $100 million to fund gasification projects, fostering innovation in this space. The push for decarbonization further amplifies growth, as industries seek alternatives to fossil fuel-based energy sources.

By Feedstock Insights

Agricultural waste constitutes the largest feedstock segment in the North American biochar market, commanding approximately 38% of the market share according to the USDA. This prominence stems from the region’s vast agricultural output, with states like Iowa and Illinois generating over 100 million tons of crop residues annually.

A primary driving factor is the availability and affordability of agricultural waste. As per the USDA, utilizing crop residues for biochar production reduces dependency on imported raw materials, lowering costs by 20%. Another factor is government support for waste-to-energy projects. For instance, the U.S. Farm Bill offers grants of up to $500,000 for bioenergy initiatives, incentivizing farmers to participate. Additionally, advancements in conversion technologies enable higher yields, with some systems achieving biochar recovery rates of 80%.

Forestry waste is the fastest-growing feedstock segment, with a CAGR of 15.2%, as stated by the Forest Products Laboratory. This growth is fueled by the increasing availability of logging residues and wood chips, particularly in forest-rich regions like the Pacific Northwest. Forestry waste serves as a rich source of lignin, which enhances biochar’s structural integrity and carbon sequestration potential.

A key driver is the emphasis on sustainable forest management. According to the Forest Products Laboratory, utilizing forestry waste for biochar production reduces wildfire risks by 30%, mitigating environmental hazards. Government policies also play a crucial role; Canada’s Forest Carbon Initiative allocates $1 billion to promote innovative uses of forestry resources, spurring the adoption of biochar. Furthermore, rural electrification programs in states like Oregon and Washington are integrating biochar systems, creating new opportunities for feedstock utilization.

COUNTRY ANALYSIS

Top Leading Countries in the Market

The U.S. leads the North American biochar market, holding a 50% market share as per the USDA. The country’s dominance is underpinned by its robust agricultural sector, with over 2 million farms requiring sustainable soil management solutions. A driving factor is federal initiatives like the Conservation Stewardship Program, which incentivizes farmers to adopt carbon-sequestering practices, including biochar application. Additionally, the prevalence of urban gardening and vertical farming in cities like New York and Los Angeles drives demand for biochar as a soil amendment.

Canada ranks second, with a 25% market share, according to Natural Resources Canada. The country’s leadership is fueled by its commitment to achieving net-zero emissions by 2050, spurring investments in biochar projects. The abundance of forestry waste, estimated at over 50 million tons annually, provides a reliable feedstock for biochar production. Moreover, provincial policies, such as British Columbia’s Carbon Tax, encourage industries to adopt low-carbon technologies.

Mexico holds a 15% market share as per the Mexican Ministry of Agriculture. The country’s growth is driven by the rising demand for sustainable agricultural practices, particularly among small-scale farmers. Government programs like PROAGRO allocate $100 million annually to support organic farming, fostering biochar adoption. Additionally, Mexico’s tropical climate creates ideal conditions for biochar-enhanced soil fertility.

Brazil accounts for 5% of the market, according to the Brazilian Agricultural Research Corporation. The nation’s dominance in tropical agriculture, with over 70 million hectares under cultivation, drives demand for biochar as a soil conditioner. Initiatives like the ABC Plan, which promotes low-carbon agriculture, further bolster biochar adoption. Additionally, Brazil’s vast forestry resources provide abundant feedstock for biochar production.

The remaining countries hold a 5% market share as per regional trade associations. These nations leverage biochar to address localized challenges, such as soil degradation and organic waste management. For instance, Caribbean islands like Jamaica are adopting biochar to combat drought-induced agricultural losses. Government partnerships and international funding further support market growth in these regions.

KEY MARKET PLAYERS

Some of the major companies dominating the North American biochar market are Biochar Products Inc., Diacarbon Energy Inc., Agri-Tech Producers LLC, Genesis Industries, Green Charcoal International, Vega Biofuels Inc., The Biochar Company, Cool Planet Energy Systems Inc., Full Circle Biochar, and Pacific Pyrolysis Pty Ltd.

Top Players in the Market

Cool Planet

Cool Planet is a leading innovator in the biochar market, renowned for its advanced pyrolysis technology and sustainable solutions. The company’s contribution to the global market lies in its ability to produce high-quality biochar while simultaneously generating renewable energy. Cool Planet’s focus on carbon-negative technologies aligns with international climate goals, making it a trusted partner for industries seeking to reduce their carbon footprint. By leveraging its proprietary systems, Cool Planet has positioned itself as a pioneer in transforming organic waste into valuable resources, supporting both agricultural and environmental applications worldwide.

BioChar Supreme

BioChar Supreme specializes in producing premium-grade biochar tailored for diverse applications, including agriculture, gardening, and soil remediation. The company’s commitment to quality ensures that its biochar meets stringent environmental standards, enhancing its appeal in North America and beyond. BioChar Supreme actively collaborates with farmers, researchers, and policymakers to promote the adoption of biochar as a sustainable solution. Its emphasis on education and advocacy has strengthened its global reputation, positioning it as a key player driving the transition to regenerative practices.

Pacific Pyrolysis

Pacific Pyrolysis is a prominent player known for its scalable pyrolysis systems designed to convert organic waste into biochar and syngas. The company’s innovative approach addresses both waste management challenges and the growing demand for carbon sequestration solutions. By offering modular and customizable systems, Pacific Pyrolysis caters to a wide range of industries, from agriculture to municipal waste management. Its contributions to the global market include advancing circular economy principles and fostering sustainable development through cutting-edge biochar technologies.

Top Strategies Used by Key Market Participants

Strategic Partnerships with Agricultural Stakeholders

Key players in the North American biochar market frequently collaborate with farmers, agricultural cooperatives, and research institutions to promote biochar adoption. These partnerships enable companies to demonstrate the tangible benefits of biochar in improving soil health and crop yields. For instance, joint initiatives with universities allow firms to conduct field trials, providing scientific validation of biochar’s efficacy. Such collaborations not only enhance credibility but also create a network of advocates who drive grassroots adoption.

Investment in R&D for Technological Advancements

Innovation remains a cornerstone for maintaining competitiveness in the biochar market. Leading companies are investing heavily in research and development to improve production efficiency and product quality. By focusing on advancements such as microwave pyrolysis and gasification, these firms can differentiate themselves while addressing emerging trends like carbon credits and urban waste management. This emphasis on technological leadership ensures they stay ahead of regulatory requirements and consumer expectations.

Expansion into Emerging Applications

To diversify their revenue streams, key players are exploring new applications for biochar beyond agriculture. For example, biochar is increasingly being used in water filtration, construction materials, and even cosmetics. By targeting these emerging markets, companies can tap into untapped opportunities and reduce reliance on traditional sectors. This strategy not only broadens their customer base but also reinforces biochar’s versatility as a sustainable material.

COMPETITION OVERVIEW

The North American biochar market is characterized by intense competition, driven by the presence of established players and emerging startups striving to capture market share. Leading companies leverage their expertise in technology and innovation to offer superior products that comply with stringent environmental standards. The competitive landscape is further shaped by the increasing demand for sustainable solutions, prompting firms to adopt strategies such as mergers, acquisitions, and partnerships. Additionally, the push for decarbonization and waste management has intensified rivalry, as companies vie to integrate advanced technologies into their offerings. Smaller players, on the other hand, focus on niche markets, targeting specific applications like urban gardening or water treatment. This dynamic interplay between innovation, sustainability, and strategic initiatives underscores the complexity of the market, ensuring robust growth and continuous evolution.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Cool Planet partnered with a major U.S. agricultural cooperative to launch a nationwide initiative promoting biochar as a soil amendment. This collaboration aims to educate farmers about the long-term benefits of biochar while facilitating access to carbon credit programs.

- In June 2023, BioChar Supreme introduced a new line of biochar-based fertilizers specifically designed for organic farming. This product expansion aligns with the growing demand for chemical-free agricultural inputs and strengthens the company’s position in the organic market.

- In February 2024, Pacific Pyrolysis acquired a regional waste management firm in Canada to expand its feedstock sourcing capabilities. This acquisition enhances the company’s supply chain resilience and supports its goal of scaling biochar production.

- In September 2023, Cool Planet signed an agreement with a renewable energy developer to integrate biochar production systems into existing biomass plants. This move positions the company as a leader in combining biochar production with renewable energy generation.

- In November 2023, BioChar Supreme launched a pilot program in California to demonstrate the use of biochar in urban gardening projects. The initiative targets environmentally conscious consumers and highlights biochar’s role in sustainable urban ecosystems.

MARKET SEGMENTATION

This research report on the North American Biochar market is segmented and sub-segmented into the following categories.

By Application

- Agriculture

- Gardening

- Households

- Others

By Technology

- Microwave pyrolysis

- Continuous pyrolysis

- Batch pyrolysis kiln

- Gratifier

- hydrothermal

- Cookstove

- Others

By Manufacturing

- Gasification

- Pyrolysis

- Others

By Feedstock

- Agricultural waste

- Forestry waste

- Animal manure

- Biomass plantations

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is driving the growth of the biochar market in North America?

The demand is rising due to sustainable agriculture practices, soil enhancement benefits, and carbon sequestration efforts.

Which industries are the main users of biochar in North America?

Agriculture, forestry, waste management, and energy sectors are the key consumers.

What are the leading production technologies for biochar in the region?

Pyrolysis (slow and fast) and gasification are the most widely used technologies.

Which countries in North America are dominating the biochar market?

The United States leads the market, followed by Canada, due to strong R&D and government support.

What challenges does the North American biochar market face?

Lack of awareness, high initial production costs, and inconsistent product standards.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]