North America Chocolate Market Size, Share, Trends & Growth Forecast Report By Confectionery Variant (Dark Chocolate, Milk and White Chocolate), Distribution Channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Chocolate Market Size

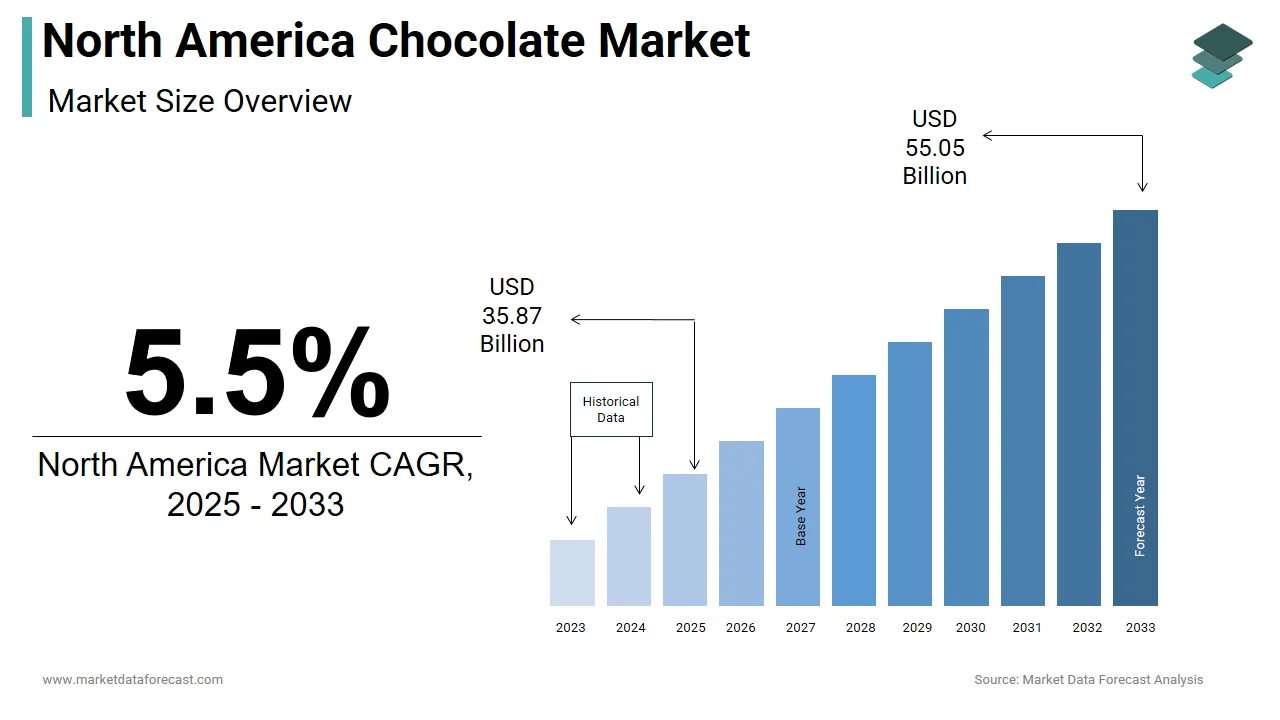

The size of the North America chocolate market was worth USD 34 billion in 2024. The North America market is anticipated to grow at a CAGR of 5.5% from 2025 to 2033 and be worth USD 55.05 billion by 2033 from USD 35.87 billion in 2025.

The chocolate encompasses a wide range of products from mass-produced candy bars to premium, bean-to-bar artisanal chocolates. This market is shaped by evolving consumer preferences, including a growing emphasis on health-conscious consumption, sustainability, and indulgence with purpose. As per the National Confectioners Association (NCA), chocolate remains a staple in American households, with over two-thirds of consumers purchasing chocolate at least once a month, which is often driven by seasonal promotions and gifting occasions. In Canada, chocolate consumption has been influenced by increasing demand for ethically sourced and organic products. According to Agriculture and Agri-Food Canada, there has been a notable rise in imports of fair-trade-certified cocoa, reflecting shifting consumer values and regulatory support for sustainable sourcing practices. The country also hosts a growing number of boutique chocolatiers who cater to niche markets with handcrafted and locally sourced offerings. Meanwhile, Mexico contributes to the regional chocolate landscape through both traditional and modern consumption patterns. The Mexican government has supported local cocoa production initiatives in southern states like Chiapas and Tabasco, which is reinforcing domestic supply chains while maintaining strong export ties with the U.S. and Europe.

MARKET DRIVERS

Rising Demand for Premium and Artisanal Chocolate Varieties

One of the primary drivers fueling growth in the North America chocolate market is the increasing preference for premium and artisanal chocolate varieties among discerning consumers. This trend is particularly pronounced among millennials and Gen Z, who prioritize transparency, craftsmanship, and storytelling when selecting food products. Artisanal chocolatiers have capitalized on this movement by offering small-batch, single-origin, and bean-to-bar products that emphasize traceability, unique flavor profiles, and ethical sourcing. These brands often collaborate with independent retailers, fine dining establishments, and specialty cafes to create immersive tasting experiences that elevate chocolate beyond its traditional role as a snack item. Additionally, online platforms have expanded access to niche chocolate producers, allowing consumers to explore international flavors and limited-edition releases from around the world.

Increasing Health Consciousness and Functional Chocolate Consumption

Another significant driver shaping the North America chocolate market is the rising interest in health-conscious and functional chocolate consumption. According to the International Food Information Council (IFIC), over 60% of U.S. consumers actively seek healthier snack alternatives, which is prompting manufacturers to develop low-sugar, high-cocoa, and nutrient-enhanced chocolate options tailored to wellness-oriented lifestyles. Dark chocolate has gained popularity due to its perceived health benefits, including antioxidant properties and potential cardiovascular advantages. In response to this demand, major chocolate brands and startups alike have introduced products infused with adaptogens, nootropics, plant-based proteins, and CBD to appeal to consumers seeking both indulgence and wellness. The Good Food Institute noted a surge in plant-based chocolate launches, with more than 200 new vegan chocolate products entering the U.S. market in 2023 alone. Furthermore, clean-label movements have led to reformulations that eliminate artificial preservatives, hydrogenated oils, and excessive sugar content.

MARKET RESTRAINTS

Growing Obesity Rates and Regulatory Pressure on Sugar Content

A major restraint affecting the North America chocolate market is the growing public health concern surrounding obesity and excessive sugar intake. This trend has prompted increased scrutiny of sugary snacks, including chocolate confections, which are often associated with high calorie density and added sweeteners. Government agencies and health organizations have responded with initiatives aimed at reducing sugar consumption, such as front-of-package warning labels in Canada and proposed sugar taxes in several U.S. states. Health Canada reported that consumers are now reading nutrition labels more carefully, leading to a decline in impulse purchases of conventional chocolate products. Additionally, parents and caregivers are becoming more selective about children's snacking choices, favoring alternatives like fruit-based treats, protein bars, and low-sugar dairy desserts. The American Academy of Pediatrics emphasized the need for reduced sugar intake among children, further influencing purchasing behavior. These health-related concerns have forced chocolate manufacturers to reformulate products and promote portion-controlled packaging.

Volatility in Cocoa Prices and Supply Chain Disruptions

Another critical restraint impacting the North America chocolate market is the volatility in global cocoa prices and ongoing supply chain disruptions. According to the International Cocoa Organization (ICCO), cocoa bean prices surged by over 50% in early 2024 , driven by poor harvests in West Africa, which accounts for nearly 70% of global production. These price fluctuations have directly affected manufacturing costs for chocolate producers, leading to higher retail prices and reduced profit margins. Smaller chocolate manufacturers and independent chocolatiers have been disproportionately affected by these cost pressures, limiting their ability to compete with large-scale producers who can absorb input price increases through economies of scale.

MARKET OPPORTUNITIES

Expansion of Plant-Based and Vegan Chocolate Options

An emerging opportunity in the North America chocolate market is the rapid expansion of plant-based and vegan chocolate alternatives. According to the Plant Based Foods Association, the plant-based confectionery segment grew by over 18% in 2024, with chocolate-based products accounting for a significant share of this increase. This growth is fueled by the expanding adoption of vegan and flexitarian diets, particularly among younger consumers who seek indulgent yet health-aligned food choices. The Good Food Institute reported that plant-based chocolate product launches doubled between 2022 and 2024, with oat-based, almond-based, and coconut-based formulations gaining widespread acceptance. Manufacturers are responding by introducing innovative blends that replace dairy with plant-derived ingredients while maintaining texture and meltability. Brands such as Dang Brothers, Hu Kitchen, and Alter Eco have successfully positioned themselves in this space, which is leveraging clean-label positioning and eco-friendly packaging to attract conscious consumers. Moreover, mainstream chocolate companies have entered the category through acquisitions and internal product development. For instance, Mars Inc. launched a line of certified vegan chocolate bars in early 2024, signaling a strategic pivot toward inclusive and alternative ingredient-based offerings.

Integration of Functional Ingredients into Chocolate Products

Another transformative opportunity in the North America chocolate market is the integration of functional ingredients such as adaptogens, nootropics, and CBD-infused chocolate products. This trend is being driven by a convergence of the wellness and indulgence markets, where consumers seek products that provide both sensory satisfaction and health benefits. Companies are capitalizing on this shift by developing chocolate bars infused with ingredients such as ashwagandha, L-theanine, magnesium, and MCT oil to support stress relief, focus, and energy management. Brands like Chocolat Moderne and HigherDOSE have introduced high-end, functional chocolate lines that blend gourmet appeal with holistic wellness benefits. Moreover, the legal cannabis market has spurred CBD and THC-infused chocolate edibles, particularly in states where recreational use is permitted.

MARKET CHALLENGES

Ethical Sourcing and Sustainability Pressures

An ongoing challenge in the North America chocolate market is the increasing pressure to ensure ethical sourcing and environmental sustainability throughout the supply chain. According to the World Cocoa Foundation, over 90% of global cocoa production comes from smallholder farms, many of which face issues related to deforestation, child labor, and inadequate farmer compensation. North American consumers, particularly millennials and Gen Z, are demanding greater transparency in sourcing practices. The Natural Marketing Institute (NMI) found that more than 65% of U.S. consumers consider ethical sourcing before making a chocolate purchase, which is pushing companies to adopt Fair Trade, Rainforest Alliance, and Direct Trade certifications. However, implementing sustainable sourcing models requires significant investment and logistical coordination. Moreover, climate change and environmental degradation are threatening cocoa yields, further complicating long-term sourcing strategies.

Regulatory Scrutiny Over Marketing to Children

A pressing challenge facing the North America chocolate market is the increasing regulatory scrutiny surrounding the marketing of chocolate products to children. According to the Federal Trade Commission (FTC), several major chocolate brands faced inquiries in 2024 regarding digital advertising strategies targeting younger audiences on social media and mobile gaming platforms. Health advocacy groups and consumer watchdog organizations have raised concerns about the influence of branded characters, cartoon imagery, and interactive digital campaigns that may encourage frequent consumption of sugar-laden chocolate products. The Center for Science in the Public Interest (CSPI) petitioned the FTC to impose restrictions similar to those applied to breakfast cereals, which is citing evidence linking childhood exposure to confectionery marketing with unhealthy eating habits. In response, some chocolate manufacturers have voluntarily revised packaging designs and promotional strategies, removing child-oriented branding from certain product lines and launching educational campaigns on responsible consumption. However, compliance with evolving advertising regulations remains complex, particularly as digital engagement channels become more sophisticated. This heightened scrutiny not only affects brand perception but also necessitates additional investment in compliance measures and rebranding efforts.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Confectionery Variant, Distribution Channel, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Ferrero International SA, Mars Incorporated, Mondelez International Inc., Nestle SA, and The Hershey Company. |

SEGMENTAL ANALYSIS

By Confectionery Variant Insights

The milk and white chocolate segment held 58.1% of the North America chocolate market share in 2024. One of the key drivers behind the dominance of this segment is its deep-rooted presence in mainstream confectionery offerings. According to the National Confectioners Association (NCA), over 65% of all chocolate candy bars sold in the U.S. contain milk or white chocolate, which makes them integral to seasonal promotions, gifting trends, and impulse purchases at retail outlets. Additionally, milk chocolate remains a staple ingredient in popular snack formats such as trail mixes, cookies, and ice creams, reinforcing its widespread usage beyond standalone confections. Furthermore, white chocolate has seen growing use in premium and novelty product lines, especially during holidays like Valentine’s Day and Easter.

The dark chocolate segment is likely to grow with an expected CAGR of 9.4% in the coming years, owing to the shifting consumer preferences toward healthier indulgences and increased awareness of dark chocolate’s potential health benefits. According to Mintel, sales of dark chocolate products in the U.S. grew by over 11% in 2023, which is outpacing other chocolate categories. This surge is largely attributed to the perception of dark chocolate as a functional food rich in antioxidants, flavonoids, and lower sugar content compared to milk and white variants. Moreover, specialty retailers and online platforms have played a role in increasing accessibility to premium dark chocolate from global origins, including Ecuador, Venezuela, and Madagascar.

By Distribution Channel Insights

The supermarkets and hypermarkets segment was accounted in holding 43.1% of the North America chocolate market share in 2024.One of the leading factors driving the dominance of this segment is the convenience and variety offered by large retail chains such as Walmart, Kroger, and Costco. According to NielsenIQ, more than 80% of chocolate purchases in the U.S. occur at mass merchandisers and grocery stores, where consumers can access both everyday favorites and seasonal promotional bundles. In Canada, the Canadian Federation of Independent Grocers (CFIG) reported that supermarkets remained the top choice for chocolate buyers, with over 75% of surveyed consumers preferring these locations for bulk purchases and family-friendly options. Additionally, in-store displays, endcap promotions, and loyalty programs enhance consumer engagement, reinforcing repeat buying behaviors. Another contributing factor is the role of private label brands, which offer cost-effective alternatives to name-brand chocolates. Retailers are increasingly investing in exclusive formulations and packaging customization to differentiate their offerings while maintaining affordability, further strengthening the supermarket/hypermarket channel's influence in the regional chocolate market.

The online retail segment is likely to register a CAGR of 12.8% in the next coming years. According to eMarketer, online chocolate sales in the U.S. grew by over 14% in 2023, driven by digital-first brands leveraging social media, influencer marketing, and personalized gifting options to attract millennial and Gen Z consumers. Platforms such as Amazon, Etsy, and Chocosphere have expanded access to international and small-batch chocolate producers, allowing consumers to explore niche and ethically sourced products. Subscription-based services like Cocoa & Co. and Gold Box Club have also gained traction, offering curated monthly selections tailored to individual taste preferences.

COUNTRY LEVEL ANALYSIS

United States Chocolate Market Insights

The United States was the top performer in the North America chocolate market by accounting for 79.1% of the share in 2024. One of the key factors driving this dominance is the country's deep-rooted cultural association with chocolate consumption, particularly during holidays such as Halloween, Valentine’s Day, and Easter. Additionally, the rise of health-conscious consumers has led to a surge in demand for dark chocolate, organic variants, and functional chocolate products enriched with superfoods or adaptogens.

Canada Chocolate Market Insights

Canada was positioned second with 16.1% of share in the North America chocolate market. One of the primary contributors to this growth is the increasing demand for Fair Trade and Rainforest Alliance-certified chocolates. According to Statistics Canada, over 55% of Canadian consumers prefer chocolate products with sustainability claims, a significantly higher proportion than the global average. Moreover, Canada’s multicultural population has contributed to a diverse chocolate market, with growing demand for ethnic and premium European-style chocolates. The Canadian Specialty Chocolate Association reported that artisanal chocolate makers in Quebec and British Columbia saw a 15% increase in sales in 2023, which indicates strong local engagement with high-quality chocolate experiences. Additionally, government-led initiatives promoting sustainable agriculture and traceable sourcing have encouraged domestic chocolate producers to differentiate themselves through transparency and ethical practices.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America chocolate market profiled in this report are Ferrero International SA, Mars Incorporated, Mondelez International Inc., Nestle SA, and The Hershey Company.

TOP LEADING PLAYERS IN THE MARKET

The Hershey Company

Hershey is a dominant force in the North America chocolate market and one of the most recognized confectionery brands globally. Known for its extensive portfolio that includes Hershey’s, Reese’s, and Kisses, the company plays a central role in shaping consumer preferences and seasonal gifting trends. Hershey’s influence extends beyond traditional confections with increasing focus on premium, organic, and plant-based offerings to align with evolving dietary habits.

Mondelez International (U.S. Operations)

Mondelez is a key player in the North American chocolate landscape, managing global brands such as Cadbury and Toblerone in the region. The company emphasizes innovation and brand consistency while adapting to local tastes. Mondelez has been instrumental in advancing sustainable sourcing initiatives and digital engagement strategies, which is reinforcing its dominant position in both mass-market and specialty segments.

Lindt & Sprüngli (North America Division)

Lindt has established itself as a leader in premium chocolate consumption across North America. Renowned for its high-quality Swiss chocolate, Lindt has successfully expanded its retail presence and introduced flagship stores in major cities. The company’s focus on luxury positioning, experiential retail, and limited-edition releases has strengthened its appeal among affluent and health-conscious consumers.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies adopted by leading players in the North America chocolate market is product innovation through flavor diversification and functional ingredient integration, where companies introduce new taste profiles, textures, and wellness-focused formulations to capture evolving consumer preferences.

Another key approach is leveraging sustainability narratives and ethical sourcing claims , allowing brands to differentiate themselves in a competitive marketplace and align with the values of environmentally conscious and socially responsible buyers who prioritize transparency in cocoa procurement.

Firms are increasingly investing in digital transformation and direct-to-consumer platforms by enhancing brand visibility through e-commerce, personalized subscriptions, and immersive storytelling that strengthens customer engagement and builds long-term loyalty beyond traditional retail channels.

COMPETITION OVERVIEW

The competition in the North America chocolate market is highly dynamic, featuring a mix of global confectionery giants, regional manufacturers, and a growing number of artisanal and specialty brands. Established players such as Hershey, Mondelez, and Nestlé maintain strong footholds through broad distribution networks, brand recognition, and continuous product development tailored to mainstream and niche markets alike.

Simultaneously, boutique chocolatiers and clean-label startups are gaining traction by focusing on bean-to-bar craftsmanship, fair-trade certifications, and innovative formats such as vegan and functional chocolates. These smaller players leverage social media, direct-to-consumer sales, and curated retail placements to carve out distinct identities and challenge industry leaders.

Retailers and private label brands also exert influence by offering competitively priced alternatives that mirror the taste and quality of national brands. This intensifies the race for shelf space and consumer loyalty across supermarkets, convenience stores, and online platforms. Innovation, brand storytelling, and supply chain ethics have become critical differentiators in this fiercely contested market.

RECENT MARKET DEVELOPMENTS

- In February 2024, Hershey announced the launch of a new line of plant-based chocolate bars made with oat milk and free from artificial additives, which is targeting health-conscious consumers and expanding its portfolio beyond traditional confections.

- In April 2024, Mondelez acquired a stake in a clean-label chocolate startup specializing in low-sugar and functional chocolate bars by aiming to enhance its wellness-oriented product offerings and attract younger demographics.

- In July 2024, Lindt & Sprüngli opened a flagship chocolate café in Chicago by combining retail and experiential elements to strengthen brand engagement and showcase its premium product range to a wider audience.

- In September 2023, Nestlé launched a blockchain-enabled traceability program for its chocolate supply chain by allowing consumers to verify the origins of cocoa used in its U.S. and Canadian product lines, reinforcing transparency and ethical sourcing.

- In November 2023, Guittard Chocolate Company expanded its B2B partnerships with independent bakeries and ice cream makers, which is supplying high-quality bulk chocolate to support the growth of premium dessert and confectionery businesses across North America.

MARKET SEGMENTATION

This research report on the North America chocolate market is segmented and sub-segmented into the following categories.

By Confectionery Variant

- Dark Chocolate

- Milk and White Chocolate

By Distribution Channel

- Convenience Store

- Online Retail Store

- Supermarket/Hypermarket

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What are the main drivers fueling growth in the North America Chocolate Market?

Growth is driven by impulse buying, rising demand for premium and artisanal chocolates, health-conscious consumer trends, and strong gifting culture

Which chocolate types dominate the North America Chocolate Market?

Milk chocolate leads the market, accounting for over 61% of revenue, followed by dark and white chocolate, with dark chocolate gaining popularity for its health benefits

How is the premium chocolate segment performing in the North America Chocolate Market?

Premium and artisanal chocolates are experiencing strong growth due to consumer interest in high-quality, unique flavors, and ethical sourcing

What impact did COVID-19 have on the North America Chocolate Market?

The pandemic initially disrupted supply chains and reduced premium chocolate sales, but demand rebounded with the easing of restrictions and festive season purchases

How are health and wellness trends affecting the North America Chocolate Market?

There is rising demand for dark, organic, low-sugar, and sugar-free chocolates as consumers seek healthier alternatives and functional benefits

Which distribution channels are most significant in the North America Chocolate Market?

Offline retail, including supermarkets and specialty stores, dominates, but online sales are growing rapidly due to convenience and variety

Who are the leading companies in the North America Chocolate Market?

Major players include Mars, Hershey’s, Nestle, Lindt, Ferrero, Godiva, and Ghirardelli, along with emerging artisanal brands

How does ethical and sustainable sourcing influence the North America Chocolate Market?

Consumers increasingly value chocolates made with ethically sourced cocoa and sustainable packaging, prompting brands to adapt

How are regulations and quality standards shaping the North America Chocolate Market?

FDA regulations and quality standards ensure product safety and influence the development of healthier and cleaner-label chocolates

What challenges does the North America Chocolate Market face?

Challenges include volatile cocoa prices, health concerns over sugar, and the need for constant product innovation to meet evolving consumer preferences

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com