North America Commodity Chemicals Market Research Report – Segmented By Product Type (Commercial and Industrial Cleaners, Flavor & Fragrances ) Function and Country (The U.S., Canada and Rest of North America) - Industry Analysis, Size, Share, Growth, Trends, & Forecasts 2025 to 2033.

North America Commodity Chemicals Market Size

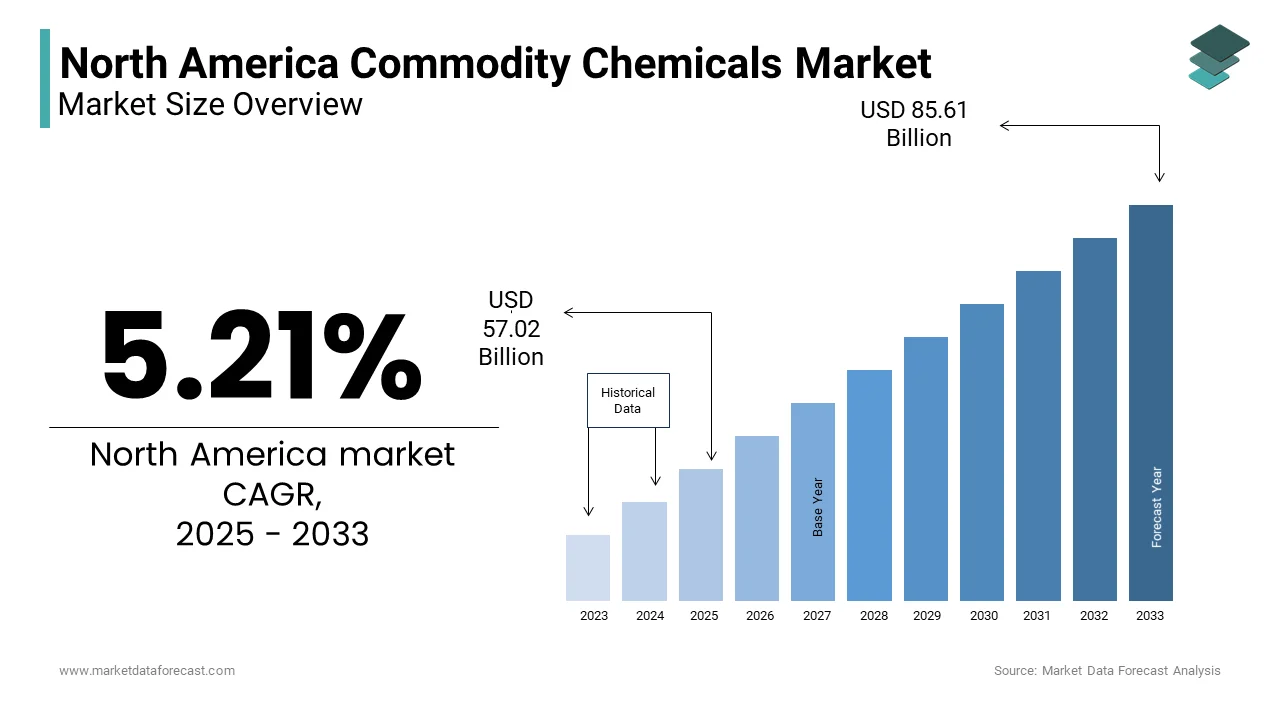

The North America Commodity Chemicals Market Size was valued at USD 54.2 billion in 2024. The North America Commodity Chemicals Market size is expected to have 5.21 % CAGR from 2025 to 2033 and be worth USD 85.61 billion by 2033 from USD 57.02 billion in 2025.

The North America commodity chemicals market is a cornerstone of the region's industrial ecosystem, serving as a critical input for various sectors such as agriculture, manufacturing, and consumer goods. As per data from the American Chemistry Council, the U.S. chemical industry alone contributes approximately $900 billion annually to the economy exhibiting its economic significance. The region benefits from abundant raw material availability, including natural gas and shale gas which has positioned it as a global leader in low-cost chemical production. Canada complements this with its robust petrochemical sector, driven by its oil sands and hydrocarbon reserves. Also, the market's growth is further fueled by rising demand from end-use industries like automotive, construction, and packaging.

However, the market faces challenges such as fluctuating crude oil prices, which directly impact feedstock costs, and stringent environmental regulations that necessitate sustainable practices. According to a report by the Environmental Protection Agency, the industry is increasingly adopting green chemistry principles to mitigate environmental impacts. With over 13,000 chemical facilities across the U.S. and Canada, the market remains highly competitive characterized by innovation-driven strategies and evolving consumer preferences.

MARKET DRIVERS

Rising Demand from End-Use Industries

The North America commodity chemicals market is heavily influenced by the burgeoning demand from key end-use industries such as automotive, construction, and agriculture. The automotive sector, for instance, relies on chemicals for producing lightweight materials and coatings, which enhance fuel efficiency and durability. According to the National Association of Manufacturers, the U.S. automotive industry generates over 1 trillion in annual revenue, with a significant portion attributed to chemical inputs. Similarly, the construction sector, which accounts for nearly 4800 billion in 2023 reflecting robust growth. The agricultural sector also plays a pivotal role, with fertilizers and pesticides driving demand. As per the Food and Agriculture Organization, North America accounts for approximately 15% of global fertilizer consumption, underscoring its reliance on chemical inputs. These interconnected industries create a steady demand pipeline propelling the commodity chemicals market forward.

Abundant Availability of Feedstock

A fellow key driver is the region's abundant availability of low-cost feedstock, particularly natural gas and shale gas. The shale gas boom has transformed North America into a hub for cost-effective chemical production. Based on the findings by the U.S. Energy Information Administration, natural gas production in the U.S. exceeded 100 billion cubic feet per day in 2023 providing a reliable and affordable feedstock source. This advantage has enabled North American chemical manufacturers to produce ethylene and other base chemicals at globally competitive prices. Canada’s oil sands further augment this supply chain ensuring sustained production capabilities. Also, government policies promoting energy independence have bolstered investments in exploration and extraction technologies. As per the International Energy Agency, the U.S. is projected to account for nearly 60% of global ethylene capacity additions by 2025. This strategic advantage not only strengthens domestic production but also enhances export opportunities, solidifying the region's dominance in the global commodity chemicals landscape.

MARKET RESTRAINTS

Volatility in Crude Oil Prices

A primary restraints impacting the North America commodity chemicals market is the volatility in crude oil prices, which directly affects feedstock costs. Since many commodity chemicals are derived from petroleum-based raw materials, fluctuations in oil prices can lead to significant cost variations. For instance, the World Bank stresses that crude oil prices surged by over 60% in 2022 due to geopolitical tensions creating uncertainty for chemical manufacturers. This price instability disrupts production planning and profit margins, especially for small and medium-sized enterprises. Moreover, downstream industries reliant on stable chemical pricing face increased operational risks. The ripple effects are evident in sectors like plastics and packaging, where cost-sensitive applications amplify the pressure. While shale gas offers some relief, its limited availability for certain chemical derivatives means that crude oil remains a critical factor. This dependency underscores the need for diversification and alternative feedstock development to mitigate risks associated with oil price volatility.

Stringent Environmental Regulations

Stringent environmental regulations pose another significant restraint for the North America commodity chemicals market. Governments across the region have implemented rigorous policies to curb emissions and promote sustainable practices compelling manufacturers to invest in cleaner technologies. For example, the Environmental Protection Agency mandates compliance with the Toxic Substances Control Act, which regulates the use of hazardous chemicals. Non-compliance can result in hefty fines, with penalties exceeding $37,000 per violation per day, as per agency guidelines. To add to this, Canada’s Carbon Pricing Act imposes levies on greenhouse gas emissions, further increasing operational costs. These regulatory frameworks necessitate substantial capital expenditures for retrofitting plants and adopting eco-friendly processes. A study by McKinsey & Company estimates that compliance-related costs could account for up to 10% of total production expenses. While these measures align with global sustainability goals, they strain profitability and slow down market expansion. Balancing regulatory adherence with economic viability remains a persistent challenge for industry players.

MARKET OPPORTUNITIES

Expansion of Biobased Chemicals

The growing emphasis on sustainability has opened significant opportunities for biobased chemicals in the North America commodity chemicals market. Biobased alternatives, derived from renewable resources such as corn, sugarcane, and vegetable oils, are gaining traction as environmentally friendly substitutes for petrochemicals. In line with the U.S. Department of Agriculture, the biobased products industry contributes over $470 billion annually to the U.S. economy exhibiting its economic potential. In conjunction with, consumer awareness and corporate sustainability commitments are driving demand for greener solutions. For instance, major retailers like Walmart have pledged to reduce their carbon footprint by sourcing biobased packaging materials. Technological advancements have also improved the cost competitiveness of biobased chemicals, with production costs declining by nearly 20% over the past decade, as per BloombergNEF. Government incentives, such as tax credits under the Inflation Reduction Act, further encourage investment in this segment.

Increasing Export Potential

Further potential opportunity lies in the region's increasing export potential, driven by its cost advantages and strategic trade agreements. North America's abundant shale gas reserves have enabled the production of chemicals at globally competitive prices, making it an attractive supplier for international markets. As indicated by the U.S. Department of Commerce, chemical exports from the U.S. reached 180 billion in 2023, accounting for approximately 1030 billion worth of chemicals annually from North America. As per the International Trade Administration, Mexico and Canada remain top destinations collectively accounting for 40% of U.S. chemical exports. Investments in port infrastructure and logistics networks further bolster export capabilities. By leveraging these factors, North American chemical manufacturers can expand their global footprint, driving revenue growth and reinforcing their leadership in the international market.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant challenge for the North America commodity chemicals market, exacerbated by global events such as pandemics and geopolitical conflicts. The COVID-19 pandemic, for instance, caused unprecedented delays in raw material shipments and labor shortages, leading to production bottlenecks. The Institute for Supply Management notes that delivery times for chemical inputs increased by 25% in 2021 severely impacting manufacturing schedules. Geopolitical tensions particularly between the U.S. and China have further strained supply chains by imposing tariffs and export restrictions. A report by Deloitte reveals that over 60% of chemical companies experienced disruptions in 2022, resulting in revenue losses exceeding $10 billion. Along with, the reliance on overseas suppliers for critical components such as catalysts and additives, heightens vulnerability to external shocks. To mitigate these risks, companies are exploring nearshoring and digitalization strategies. However, transitioning to resilient supply chains requires substantial investment and time, posing a persistent challenge for the industry.

Intense Competition from Low-Cost Producers

Intense competition from low-cost producers in regions like the Middle East and Asia presents another formidable challenge for the North America commodity chemicals market. Countries such as Saudi Arabia and China benefit from lower labor costs and government subsidies enabling them to offer chemicals at significantly reduced prices. According to the International Energy Agency, Middle Eastern producers enjoy a cost advantage of up to 30% in ethylene production due to abundant and inexpensive natural gas resources. This price disparity puts pressure on North American manufacturers to either reduce costs or innovate to differentiate their offerings. Furthermore, China’s rapid industrialization has led to overcapacity in certain chemical segments flooding global markets with competitively priced products. A study by PwC reveals that Chinese chemical exports grew by 15% annually over the past five years, intensifying competition. While North America’s focus on high-value specialty chemicals provides some insulation, the commoditization of certain products limits profitability. Navigating this competitive landscape requires strategic investments in R&D and customer-centric solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.21 % |

|

Segments Covered |

By Product Type, Function and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

BASF,Bayer,The Dow Chemical,Mitsubishi Chemical Holdings,PPG Industries |

SEGMENTAL ANALYSIS

By Product Type Insights

The commercial and industrial cleaners segment prevailed in the North America commodity chemicals market by capturing 40.5% of the total market share in 2024. This segment's prominence is driven by the widespread adoption of cleaning agents across diverse industries, including healthcare, hospitality, and food processing. For instance, hospitals and clinics rely heavily on industrial-grade disinfectants to maintain hygiene standards, with the healthcare sector accounting for nearly 25% of the segment's demand. As an additional point, the rise of e-commerce has spurred demand for warehouse cleaning solutions, as per the Council of Supply Chain Management Professionals. The segment's growth is further supported by technological advancements, such as the development of bio-based and non-toxic cleaners, which align with sustainability trends. Regulatory mandates, including OSHA guidelines for workplace safety, also mandate the use of specialized cleaning products. With urbanization and industrialization accelerating across North America, the demand for commercial and industrial cleaners is expected to grow at a steady pace reinforcing its leadership position in the market.

The flavor and fragrances segment is the fastest-growing category within the North America commodity chemicals market, with a projected CAGR of 8.5% through 2033. This growth is fueled by changing consumer preferences, particularly the rising demand for natural and organic products. Millennials and Gen Z consumers, who prioritize health and wellness, are driving the shift toward plant-based flavors and eco-friendly fragrances. The food and beverage industry, which accounts for over 60% of segment revenue, is a key contributor. For instance, as per the National Restaurant Association, the U.S. organic food market grew by 12% in 2023, boosting demand for natural flavor enhancers. Also, the personal care sector, valued at $90 billion in North America relies heavily on innovative fragrances to differentiate products. Technological advancements, such as encapsulation techniques for controlled fragrance release further propel growth. With increasing disposable incomes and urbanization, the flavor and fragrances segment is poised to outpace other categories, solidifying its status as a growth engine for the market.

By Function Insights

The surfactants represented the largest functional segment in the North America commodity chemicals market by commanding a market share of 35.7% in 2024. This dominance is because of their extensive application across industries including detergents, cosmetics, and agrochemicals. In the household cleaning sector alone, surfactants account for over 50% of ingredient formulations, as per the American Cleaning Institute. Their ability to reduce surface tension makes them indispensable in cleaning agents, emulsifiers, and wetting agents. The agricultural sector also contributes significantly, with surfactants used as adjuvants in pesticides to enhance efficacy. Also, regulatory support further bolsters demand; for instance, the EPA promotes the use of biodegradable surfactants to minimize environmental impact. To build on this, innovations such as biosurfactants, derived from microbial sources, are gaining traction due to their eco-friendly properties. With increasing urbanization and hygiene awareness, surfactant demand is expected to remain robust, sustaining its leadership position in the market.

The antioxidants are the rapidly rising functional segment, with a calculated CAGR of 9.2% owing to the expanding use of antioxidants in food preservation, polymer stabilization, and pharmaceuticals. The food and beverage industry, which accounts for nearly 45% of segment revenue, relies on antioxidants to extend shelf life and prevent oxidation. For instance, as per the Grocery Manufacturers Association, the U.S. processed food market grew by 8% in 2023 fueling antioxidant demand. In the polymer industry, antioxidants are essential for preventing degradation during processing and product usage with the plastics sector alone consuming over 3 million tons annually, as per PlasticsEurope. Technological advancements, including nano-antioxidants, further enhance efficacy and application scope. With growing health consciousness and industrial innovation, antioxidants are set to lead functional segment growth.

COUNTRY LEVEL ANALYSIS

The United States remains the undisputed heavyweight in North America's commodity chemicals space. It accounted for nearly four-fifths i.e. 78.6% of regional market share in 2024. Its authority is strengthened by a robust industrial base, advanced infrastructure, and abundant natural resources. Also, the country’s chemical industry benefits from favorable policies such as tax incentives under the Inflation Reduction Act, which encourage investments in green technologies. According to the American Chemistry Council, the U.S. chemical production index grew by 4% in 2023, driven by strong demand from end-use sectors like automotive and construction. Texas and Louisiana, home to major petrochemical hubs, contribute significantly to national output. The shale gas revolution has further cemented the U.S.'s position as a low-cost producer, with ethylene production costs estimated to be 30% lower than in Europe. Innovations in biobased chemicals and digitalization are also propelling growth, positioning the U.S. as a global leader in sustainable chemical manufacturing.

The growth pace of Canada isn’t explosive but it’s persistent in the North America commodity chemicals market. The nation’s vast oil sands and hydrocarbon reserves provide a reliable feedstock source, supporting its petrochemical sector. Alberta is the epicenter of Canada’s chemical industry accounts for over 60% of national production, as per Statistics Canada. The government’s focus on sustainability exemplified by the Carbon Pricing Act has spurred investments in eco-friendly technologies. Beyond this, Canada’s proximity to the U.S. facilitates seamless trade, with bilateral chemical exports exceeding $30 billion annually, according to the Canadian Chemical Producers' Association. The agricultural sector also drives demand, particularly for fertilizers and pesticides, with Canada being one of the world’s largest potash producers. Despite challenges such as stringent environmental regulations, Canada’s strategic initiatives ensure steady growth reinforcing its regional importance.

In the Rest of North America, it’s momentum is not maturity and is having a projected CAGR of 6.4%. Mexico’s chemical industry is closely tied to its manufacturing sector, particularly automotive and electronics, which together generate over $200 billion in annual revenue, as per the Mexican Chemical Industry Association. The USMCA agreement has strengthened trade ties enabling Mexico to serve as a key supplier to North American markets. The country’s low labor costs and strategic location make it an attractive destination for foreign investments. Additionally, government initiatives to modernize infrastructure and promote industrial corridors are boosting chemical production. However, challenges such as limited access to advanced technologies and reliance on imports for certain raw materials hinder growth. Despite these constraints, Mexico’s expanding industrial base and trade partnerships position it as a vital player in the regional market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the North America Commodity Chemicals Market are BASF,Bayer,The Dow Chemical,Mitsubishi Chemical Holdings,PPG Industries,Linde,Akzo Nobel,LyondellBasell Industries,Asahi Kasei.

The North America commodity chemicals market is characterized by intense competition, driven by the presence of multinational corporations and regional players. Companies strive to differentiate themselves through innovation, cost efficiency, and sustainability. Strategic collaborations, such as joint ventures and licensing agreements, are common to leverage complementary strengths. The market’s fragmented nature necessitates continuous investments in R&D and process optimization. Regulatory compliance and shifting consumer demands further intensify competition, compelling players to adopt agile strategies.

Top Players in the Market

Dow Inc.

Dow Inc. is a global leader in the commodity chemicals market, renowned for its innovative solutions and extensive product portfolio. Headquartered in Michigan, the company operates in over 160 countries, serving diverse industries such as packaging, infrastructure, and consumer care. Dow’s strengths lie in its cutting-edge R&D capabilities and commitment to sustainability, exemplified by its goal to achieve carbon neutrality by 2050. The company’s integration across the value chain, from feedstock to finished products, ensures operational efficiency and cost competitiveness.

BASF Corporation

BASF Corporation, a subsidiary of Germany-based BASF SE, is a dominant player in the North America commodity chemicals market. The company excels in producing high-performance chemicals, including surfactants, antioxidants, and biocides. Its market position is bolstered by strategic investments in digitalization and circular economy initiatives. BASF’s collaborative approach with customers and partners fosters innovation enabling it to deliver tailored solutions that meet evolving market demands.

LyondellBasell Industries

LyondellBasell Industries is a key contributor to the North America commodity chemicals landscape, specializing in polymers, olefins, and advanced plastics. The company’s state-of-the-art manufacturing facilities and focus on operational excellence drive its success. LyondellBasell’s leadership in developing sustainable products, such as recyclable plastics, aligns with global environmental goals. Its strong distribution network and customer-centric strategies further enhance its market presence.

Top strategies used by the key market participants

Key players in the North America commodity chemicals market employ strategies such as mergers and acquisitions, R&D investments, and sustainability initiatives to strengthen their positions. Mergers and acquisitions enable companies to expand their product portfolios and geographic reach. For instance, Dow Inc. acquired Rohm and Haas to enhance its specialty chemicals division. R&D investments focus on developing innovative solutions, such as BASF’s advancements in biodegradable surfactants. Sustainability initiatives, including LyondellBasell’s circular economy programs, address regulatory requirements and consumer preferences. Partnerships with technology firms also drive digital transformation, optimizing supply chains and production processes.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Dow Inc. partnered with Shell to develop advanced recycling technologies, aiming to convert plastic waste into valuable chemical feedstocks.

- In June 2023, BASF launched a new biobased surfactant line, targeting the growing demand for sustainable cleaning agents.

- In March 2023, LyondellBasell acquired A. Schulman Inc., expanding its specialty polymers portfolio and enhancing market reach.

- In January 2023, Chevron Phillips Chemical invested $6 billion in a Gulf Coast petrochemical facility to boost ethylene production.

- In November 2022, ExxonMobil initiated a carbon capture project in Louisiana, aligning with its net-zero emissions goal by 2050.

MARKET SEGMENTATION

This research report on the north america commodity chemicals market has been segmented and sub-segmented into the following.

By Product Type

- Commercial and Industrial Cleaners

- Flavor & Fragrances

By Function

- Surfactants

- Antioxidants

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are commodity chemicals, and how do they differ from specialty chemicals in north america commodity chemicals market ?

Commodity chemicals are bulk-produced, standardized chemicals used as raw materials in various industries, unlike specialty chemicals, which are tailored for specific applications.

What are the major types of commodity chemicals in North America Commodity Chemicals Market?

The key types include petrochemicals, polymers, fertilizers, industrial gases, synthetic rubber, and basic inorganics like acids, bases, and salts.

What are the main factors driving the growth of the North America commodity chemicals market?

Factors include increasing demand from industries like automotive, construction, agriculture, and consumer goods, along with technological advancements and regulatory support.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com