North America Industrial Coatings Market Research Report – Segmented Based on Resin (Epoxy, Acrylic, Polyester, Alkyd), Application, End-use, Country (The United States, Canada and Rest of North America) - Analysis on Size, Share, Trends, Growth Forecast from 2025 to 2033

North America Industrial Coatings Market Size

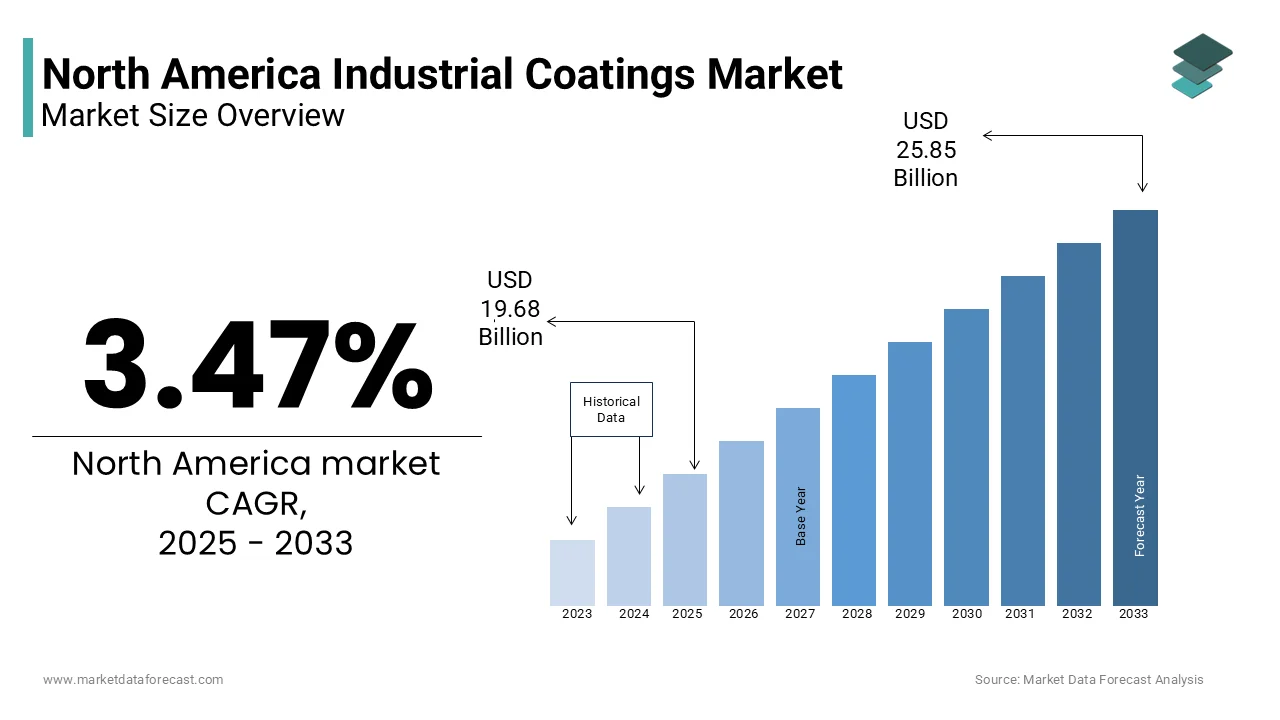

The North America industrial coatings market size was worth USD 19.02 billion in 2024 and is anticipated to reach USD 25.85 billion by 2033 from USD 19.68 billion in 2025, with a CAGR of 3.47% during the forecast period 2025 to 2033.

North American industrial coatings refer to a wide range of protective coatings used across industries for surfaces like metals, concrete, or other materials. These coatings, prevalent in manufacturing, automotive, aerospace, and construction sectors, shield surfaces from corrosion, wear, and environmental damage. They include various types like epoxy, polyurethane, and acrylic coatings, tailored for specific applications and environments. North American industrial coatings adhere to strict quality standards, offering durable protection while enhancing aesthetics and prolonging the lifespan of machinery, infrastructure, and products.

MARKET DRIVERS

The rising concern over the growing manufacturing sector is increasing the demand in the market. These coatings, indispensable for safeguarding surfaces from corrosion, environmental factors, and wear, find heightened relevance in an expanding industrial landscape. Not merely confined to protection, the coatings cater to aesthetic preferences, further elevating their demand. The robust growth in manufacturing not only necessitates enhanced protective measures but also fuels the quest for coatings offering advanced functionalities. This dynamic interplay between manufacturing and the industrial coatings market underscores a pivotal synergy, defining the market's trajectory in North America. As industrial activities evolve and diversify, the demand for innovative and sustainable coatings solutions remains a linchpin, propelling the market forward in tandem with the region's industrial vibrancy.

However, the North America Industrial Coatings Market is also experiencing another transformative surge propelled by cutting-edge technological advancements. Remarkable strides in coating technologies are steering the market toward unprecedented growth. The development of high-performance coatings, characterized by enhanced durability and multifaceted functionalities, stands out as a key driver. Innovations in nanotechnology are facilitating precision at the molecular level, revolutionizing coating properties. Additionally, the advent of self-healing coatings and other advanced formulations is reshaping industry standards, offering unparalleled resilience and longevity. This technological evolution not only addresses conventional challenges in surface protection but also introduces novel features, catering to diverse industrial needs. As the North American market embraces these advancements, the industrial coatings sector finds itself at the forefront of innovation, poised for continued expansion as it meets the demands of a rapidly evolving industrial landscape.

MARKET RESTRAINTS

Heightened environmental concerns have spurred a wave in the market growth particularly focusing on curbing the use of specific chemicals and volatile organic compounds (VOCs) in coatings. As regulatory frameworks tighten, manufacturers face a demanding landscape that requires meticulous compliance. The formulation of industrial coatings undergoes scrutiny, compelling the industry to innovate and transition towards eco-friendly alternatives. While this shift aligns with sustainability goals, it introduces complexities in manufacturing processes, potentially impacting costs and product performance. Navigating this regulatory maze becomes pivotal for market players, as the quest for environmentally responsible coatings converges with the imperative to maintain competitiveness in the evolving North American Industrial Coatings Market.

Also, the unpredictable undulations in raw material prices act as a reason for the downfall of the North America Industrial Coatings Market. Relying on diverse raw materials, the industry is susceptible to the inherent volatility in their costs. Fluctuations in these essential inputs introduce a layer of uncertainty, impacting the overall production costs for coatings manufacturers. The ripple effect extends to end-users, who may experience increased prices for industrial coatings. As the market contends with this intricate pricing dynamic, manufacturers must employ strategic measures to mitigate cost pressures without compromising product quality. The ability to navigate and absorb these raw material price fluctuations becomes integral for sustaining competitiveness in the North America Industrial Coatings Market, emphasizing the industry's resilience in the face of economic and market-driven uncertainties.

SEGMENTAL ANALYSIS

By Resin Insights

Epoxy resins are widely used in industrial coatings and are most dominating in the North America Industrial Coatings Market growth as it is known for their exceptional adhesion, chemical resistance, and durability. As, it provide excellent protection against corrosion and abrasion, making them a dominant choice in demanding environments.

Acrylic resins are valued for their versatility, offering good UV resistance, weatherability, and color retention. They find applications in various industrial coatings, including architectural coatings, automotive topcoats, and industrial maintenance coatings. The demand for acrylic resins is often driven by their balance of performance and cost-effectiveness.

By Application Insights

Solvent-borne coatings have historically been widely used in the North America Industrial Coatings Market due to their excellent performance characteristics, including good adhesion, durability, and versatility. They are commonly employed in applications such as automotive coatings, industrial maintenance, and metal finishing. However, their dominance has faced challenges due to environmental concerns related to volatile organic compounds (VOCs) emissions.

Water-borne coatings have gained second prominence, driven by environmental regulations restricting VOC emissions. They are increasingly dominant in applications such as architectural coatings, automotive coatings, and general industrial coatings. Water-borne coatings offer advantages like low toxicity, reduced odor, and easy cleanup. The push for eco-friendly solutions has led to a significant shift toward water-borne formulations across various industries.

By End-User Insights

Architectural coatings hold the largest market share in the era of 2022-2023 and are utilized for residential, commercial, and institutional buildings. They include interior and exterior paints, primers, and protective coatings. Architectural coatings represent a substantial portion of the market due to the extensive construction activities and ongoing maintenance and renovation projects in North America.

Wooden coatings are employed to protect and enhance the aesthetics of wood surfaces in furniture, flooring, and other applications. The demand for wooden coatings is in second lead in the market growth and is influenced by the construction and furniture industries.

REGIONAL ANALYSIS

The United States is often a dominant force in the North America Industrial Coatings Market due to its large and diverse industrial base. The country has a well-established manufacturing sector, including automotive, aerospace, construction, and electronics, all of which are major consumers of industrial coatings.

Canada, which act as a second significant player in the industrial coatings market growth, due to differences in the scale of industrial activities between the two countries. Canada's industrial coatings market is influenced by sectors such as mining, forestry, and energy, and it may experience variations in demand based on global commodity prices.

KEY MARKET PLAYERS

PPG Industries, Inc., Axalta Coating Systems Ltd., Sherwin-Williams Company, RPM International Inc., Akzo Nobel N.V., Nippon Paint Holdings Co., Ltd., BASF SE, Hempel A/S, Kansai Paint Co., Ltd., Berger Paints India Limited, Jotun A/S, Sika AG, Tikkurila Oyj, Dunn-Edwards Corporation, The Valspar Corporation (part of Sherwin-Williams), Benjamin Moore & Co. (part of Berkshire Hathaway), Dunn-Edwards Corporation, Masco Corporation, Rust-Oleum Corporation (part of RPM International Inc.) are some of the notable companies in the North America Industrial Coatings Market.

MARKET SEGMENTATION

This research report on the North America industrial coatings market has been segmented and sub-segmented based on the following categories.

By Resin

- Epoxy

- Acrylic

- Polyester

- Alkyd

By Application

- Solvent-borne

- Water-borne

- UV-cured coatings

- Powder coatings

By End-User

- Architectural

- Wooden

- Automotive

- Marine

- Aerospace

- Packaging

By Country

- US

- Canada

Frequently Asked Questions

1. What is the North America Industrial Coatings Market growth rate during the projection period?

The North America Industrial Coatings Market is expected to grow with a CAGR of 4% between 2024-2029.

2. What can be the total North America Industrial Coatings Market value?

The North America Industrial Coatings Market size is expected to reach a revised size of US$ 19.74 billion by 2029.

3. Name any three North America Industrial Coatings Market key players?

BASF SE, Hempel A/S, and Kansai Paint Co., Ltd. are the three North America Industrial Coatings Market key players.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com