Industrial Coatings Market Research Report – Segmentation By Product Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others), By Technology (Solvent Borne, Water Borne, Powder Based, Others ), By End-User (General Industrial, Marine, Automotive & Vehicle Refinish, Electronics, Aerospace, Oil & Gas, Mining, Power Generation, Others ), and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East - Africa) – Industry Forecast 2024 to 2029.

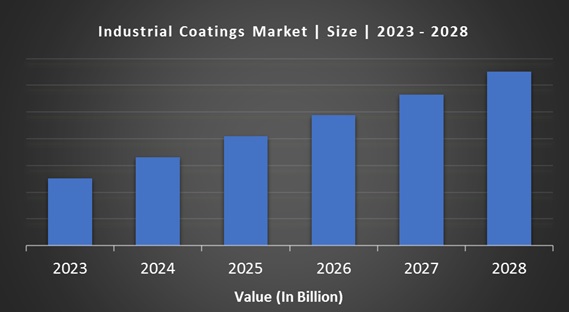

Industrial Coatings Market Size (2023-2028):

The Global Industrial Coatings Market was worth US$ 104.2 billion in 2022 and is anticipated to reach a valuation of US$ 121.8 billion by 2028 and is predicted to register a CAGR of 2.4% during 2023-2028.

Market Drivers:

The critical need for corrosion protection drives the growth of the industrial coatings market. These coatings act as a shield, protecting metal surfaces and structures from rust and decay. As industries expand and infrastructure grows, the growth for protective coatings to extend the lifespan of equipment and assets increases. This is particularly crucial in manufacturing, oil and gas, and construction, where equipment and infrastructure are exposed to harsh environmental conditions. The use of industrial coatings ensures the longevity and reliability of these assets, making them a fundamental component in preserving and maintaining vital industrial operations.

The Industrial Coatings Market growth is driven by aesthetic and functional enhancement. They improve the appearance of products and structures, making them attractive to consumers. Also, these coatings provide added functionalities like non-stick surfaces, heat resistance, or antimicrobial properties. These extra advantages fuel their use in the automotive, aerospace, and healthcare industries. Industrial coatings are about safeguarding and contributing to better looks and performance, making them a crucial aspect of various sectors. This dual role as protectors and enhancers drives the growth of the market.

Market Restraints:

The industrial coatings market value faces significant restraints due to the volatility of raw material prices. The market heavily depends on raw materials like resins, pigments, and solvents. These price variations can directly impact the cost of coatings, affecting product pricing and overall market stability. This inconsistency in raw material costs poses a challenge for manufacturers in planning and maintaining stable pricing for their industrial coatings, potentially influencing their profitability and consumers' affordability.

Market Recent Developments:

- In 2023, Axalta introduced industrial coatings specifically formulated for the agricultural and construction equipment sectors, emphasizing durability and aesthetics.

- In 2023, PPG introduced a range of environmentally friendly industrial coatings with reduced volatile organic compounds (VOCs) and enhanced durability.

- In 2023, AkzoNobel focused on developing coatings that offer advanced corrosion protection, particularly for industrial and offshore applications.

- In 2022, Sherwin-Williams expanded its high-performance industrial coatings designed to resist harsh environmental conditions, such as extreme temperatures and chemical exposure.

INDUSTRIAL COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2028 |

|

CAGR |

2.4% |

|

Segments Covered |

By Product Type, Technology, End-User Type, Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities. |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

PPG Industries, AkzoNobel, Sherwin-Williams, Axalta Coating Systems, Hempel, Jotun, RPM International Inc., Kansai Paint, Nippon Paint, BASF SE, and Others. |

Market Segmentation:

Industrial Coatings Market - By Product Type:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

Based on product, the acrylic coatings segment holds the largest market share, 36%, during the forecast period due to their adaptability and durability. Being water-based, they excel in architectural coatings, automotive refinishing, and industrial machinery applications. Acrylic coatings provide robust weather resistance and shield against UV damage, while their eco-friendly nature bolsters their appeal. The adaptability to diverse surfaces and dependable performance solidify their dominance in the market, making them a preferred choice for numerous protective and decorative coating needs.

The alkyd coatings segment held the second-biggest market share of 26% during the forecast period due to their remarkable adhesion, gloss retention, and corrosion resistance. These coatings excel in various applications, including metal fabrication, marine coatings, and machinery. Their enduring market dominance is grounded in their proven performance and cost-effectiveness. They remain a reliable choice for protective and decorative coatings in industries where durability and affordability are essential.

Industrial Coatings Market - By Technology:

- Solvent Borne

- Water Borne

- Powder Based

- Others

Based on Technology, the Solvent-borne coatings segment is dominating the market and holds the largest market share of 37% during the forecast period; due to their exceptional adhesion, durability, and resilience in harsh environmental conditions, these coatings serve diverse industries like automotive, aerospace, and heavy machinery. Their continued dominance can be attributed to their proven performance and versatility in demanding applications.

The waterborne coatings segment had a substantial share and is expected to rise at a notable CAGR during the forecast period. By utilizing water as the primary solvent, they effectively reduce VOC emissions and environmental impact. These coatings deliver exceptional adhesion and protection against corrosion and UV exposure, making them suitable for various automotive, architectural, and general industrial applications.

Industrial Coatings Market - By End-User Type:

- General Industrial

- Marine

- Automotive & Vehicle Refinish

- Electronics

- Aerospace

- Oil & Gas

- Mining

- Power Generation

- Others

Based on end-user type, the general industrial sector dominates the market and holds the highest market share of 44% during the forecast period. These coatings improve the aesthetics, longevity, and safeguarding of these items. The sector's dominance arises from its sheer scale and the diverse products necessitating coatings. With global manufacturing and production rising, the general industrial segment continues to drive the industrial coatings market.

The automotive and vehicle refinish sector significantly contributes to the industrial coatings market and is estimated to showcase a notable CAGR during the forecast period. These coatings play a vital role in enhancing the aesthetics of vehicles, shielding them from corrosion, and offering resilience against environmental elements. With the automotive industry's continuous expansion and technological advancements, the need for high-performance coatings remains robust. Furthermore, vehicle refinishing, encompassing activities like repainting and restoration, continues stimulating growth within this segment.

Market Regional Analysis:

- North America

- Europe

- Asia-pacific

- Middle East and Africa

- Latin America

Based on Region, The Asia-Pacific region is dominating the market with a CAGR of 43%, and it holds the 45% market share during the forecast period, driven by its vital industrial and manufacturing sectors. Nations such as China, India, and Japan boast thriving automotive, construction, and electronics industries, all fuel substantial demand for coatings. Rapid urbanization, infrastructure development, and a surge in automotive production are primary growth drivers. Additionally, the rising middle class with increased disposable income in the Asia-Pacific region contributes to higher production of automobiles and consumer goods, further propelling the industrial coatings market.

Europe holds the second biggest market share during the forecast period, primarily due to its thriving automotive and construction industries. European countries have imposed strict regulations on volatile organic compounds (VOCs) in coatings, driving the adoption of low-VOC and waterborne coatings. Sustainability and reduced environmental impact are paramount in the region, resulting in a transition to eco-friendly coating technologies. As Europe aligns with more sustainable manufacturing practices, the demand for environmentally responsible industrial coatings continues to surge.

North America had a significant share in the industrial coatings market. The region's strong manufacturing foundation and diverse industries, encompassing automotive, aerospace, and general industrial sectors, maintain a continuous need for industrial coatings. Stringent environmental regulations in North America have prompted the development of eco-friendly coatings, which are increasingly favoured.

Key industries, including oil and gas, mining, and construction drive the Middle East and Africa's industrial coatings market. The region's extensive infrastructure projects and oil-related activities necessitate protective coatings to ensure longevity and resilience against challenging environmental conditions.

Latin America is predicted to witness notable growth during the forecast period. It has a diverse industrial base, including agriculture, manufacturing, and automotive sectors, all contributing to the demand for industrial coatings.

Impact of COVID-19 on the Industrial Coatings Market:

The COVID-19 pandemic had a significant impact on the Industrial Coatings Market value. Initially, as economic activity slowed down and manufacturing industries faced disruptions, there was a temporary decline in demand for industrial coatings. Many construction and industrial projects were postponed, and supply chains experienced delays. However, the pandemic also highlighted the importance of industrial coatings in various sectors. The healthcare industry, for instance, requires coatings for hospital equipment and surfaces to maintain cleanliness and hygiene.

The need for coatings to produce personal protective equipment (PPE) surged, further demonstrating the market's growth. Overall, the Industrial Coatings Market growth is expected to rebound and evolve. The focus on sustainability, corrosion resistance, and safety will drive innovation, emphasizing eco-friendly and functional coatings. As industries recover and adapt to changing global dynamics, industrial coatings will remain vital in safeguarding equipment, structures, and surfaces across multiple sectors.

Market Key Players:

- PPG Industries

- AkzoNobel

- Sherwin-Williams

- Axalta Coating Systems

- Hempel

- Jotun

- RPM International Inc.

- Kansai Paint

- Nippon Paint

- BASF SE

Frequently Asked Questions

1. What is the CAGR of the Industrial Coatings Market from 2023-2028?

The Industrial Coatings Market is expected to grow with a CAGR of 2.4% during the forecast period.

2. Which is the dominating region for the Industrial Coatings Market share?

Asia-Pacific is currently dominating the Industrial Coatings Market share by region.

3. Which end-user type dominates the industrial coatings market?

The "general industrial" segment dominates the Industrial Coatings Market by End-User type.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1800

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]