North America Consumer Healthcare Market Size, Share, Trends & Growth Forecast Report By Product, Distribution Network and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Consumer Healthcare Market Size

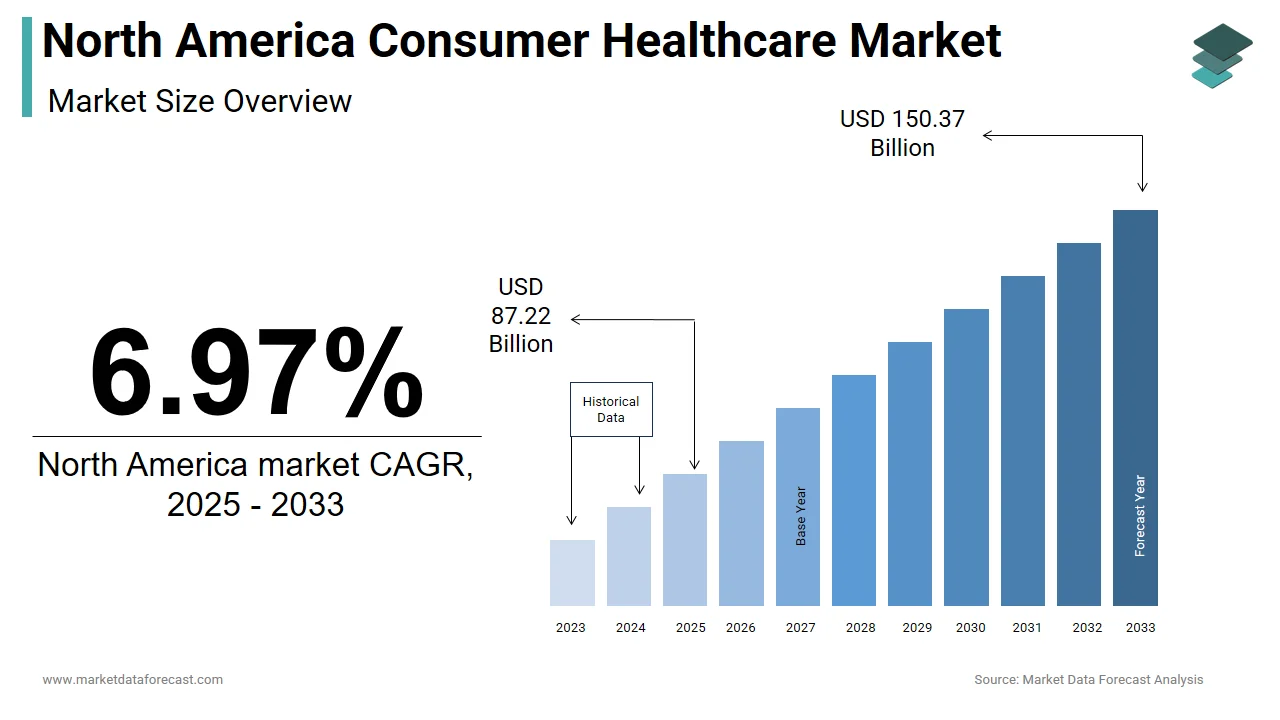

The size of the North America consumer healthcare market was worth USD 82 billion in 2024. The North america market is anticipated to grow at a CAGR of 6.97% from 2025 to 2033 and be worth USD 150.37 billion by 2033 from USD 87.22 billion in 2025.

MARKET DRIVERS

Shift Toward Self-Medication and OTC Products

The shift in demand towards self-medication and over-the-counter products mainly explains the growth of the market. Another factor supporting the growth of the North American consumer healthcare market is the growing geriatric population which is more susceptible to disease.

Many consumer health products often do not require a written prescription from healthcare professionals and can be purchased directly from pharmacies. For example, according to the Consumer Healthcare Products Association, on average, American households spend about $ 355 per year on over-the-counter products. Another factor supporting the growth of the North American consumer healthcare market is the increase in the geriatric population which is more susceptible to disease, especially for pain medications. In addition, the growing popularity of over-the-counter products among the elderly further supports the market's growth.

Rising Healthcare Costs Driving Shift to Cheaper Alternatives

Rising healthcare costs are crucial elements that can provide a lucrative growth opportunity for the mainstream healthcare market, as consumers are urged to avoid prescription treatments for cheaper alternatives. In addition, shifting trends from traditional to online shopping platforms can provide an attractive growth opportunity for market players operating in the consumer healthcare market. Online websites platforms such as healthkart, vitacost, MedlinePlus, PharmEasy, and vivavitamins offer a wider variety of healthcare products, protein shakes, and supplements online; this will support the growth of the North American consumer healthcare market.

MARKET RESTRAINTS

Presence of Counterfeit Products

The growth of the North American consumer healthcare market is expected to be hampered due to the presence of counterfeit products which do not have any active pharmaceutical ingredient (API) or incorrect amount of API, low-grade API, or a contaminant in them.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Distribution Network, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe. |

|

Market Leaders Profiled |

Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals, and Teva Pharmaceuticals |

GEOGRAPHICAL ANALYSIS

Geographically, North America has emerged as the number one region in the global consumer healthcare market, followed by Europe and Asia-Pacific. In the United States, an estimated 105,500 over-the-counter drugs are marketed and sold through various outlets, such as pharmacies and convenience stores. The United States is one of the most favorable national environments globally for the marketing of pharmaceuticals with minimal trade barriers and an intellectual property system. In addition, Canada is one of the largest exporters of pharmaceuticals in the world.

North America had the largest over-the-counter consumer health products. The United States dominates the over-the-counter consumer health product market, accounting for 35% of the entire industry at $ 389 billion in 2018. In Canada, 75% of adults use over-the-counter drugs in the first place response to minor health problems, and nearly 65% of parents give their children over-the-counter medications to treat an immediate medical symptom. After the United States, Canada is the second-largest market in North America.

The major pharmaceutical giants in the region have gained a competitive advantage for efficient distribution channels of consumer health products throughout the North American region. Pharmaceutical companies turn to offer consumer health products because of the lengthy and difficult regulatory approval processes for prescription drugs. The growing demand for alternative medicines with natural ingredients due to their excellent benefits drives the demand for consumer health products across the U.S. In addition, the growing aging of the region's population is expected to shift a large portion of the population towards health care supplements and over-the-counter preventative products.

KEY MARKET PLAYERS

Johnson & Johnson, Boehringer Ingelheim GmbH, GlaxoSmithKline plc, Amway, Bayer AG, Pfizer Inc., Abbott Laboratories, Sanofi, BASF SE, DSM, American Health, Herbalife, The Himalaya Drug Company, Kellogg, Takeda Pharmaceuticals, and Teva Pharmaceuticals are some of the notable companies in the North American consumer healthcare market.

MARKET SEGMENTATION

This research report on the North America consumer healthcare market is segmented and sub-segmented into the following categories.

By Product

- OTC Pharmaceuticals

- Dietary Supplements

By Distribution Network

- Departmental Stores

- Independent Retailers

- Pharmacies or Drugstores

- Specialist Retailers

- Supermarkets or Hypermarkets

By Country

- United States

- Canada

- Mexico

- Rest of North America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]