North America Data Center Cooling Market Size, Share, Trends & Growth Forecast Report By Type (Enterprise Data Center, Edge Data Center), Solutions, Service, Cooling Type, Organization Size and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Data Center Cooling Market Size

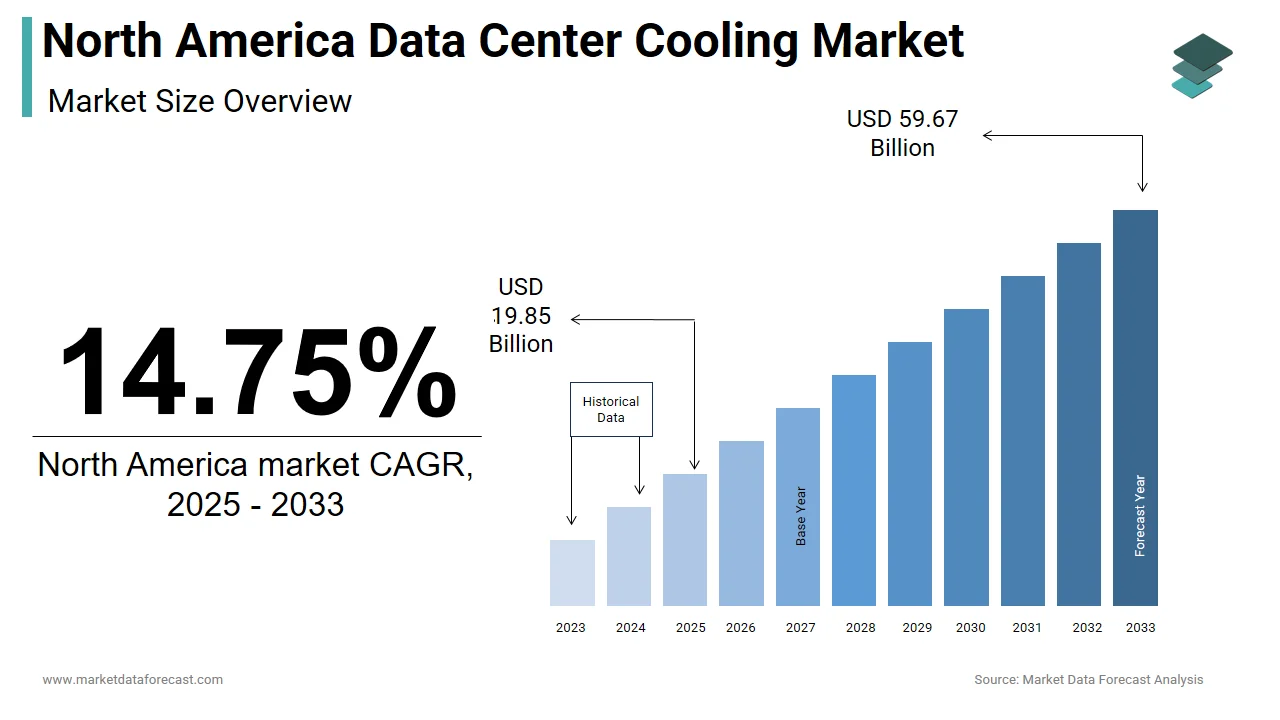

The North America data center cooling market was worth USD 17.30 billion in 2024. The North American market is estimated to grow at a CAGR of 14.75% from 2025 to 2033 and be valued at USD 59.67 billion by the end of 2033 from USD 19.85 billion in 2025.

The North America data center cooling market is a critical segment within the broader data center infrastructure ecosystem, which is driven by the escalating demand for efficient thermal management solutions to ensure optimal operating conditions for servers and IT equipment. The need for advanced cooling technologies has become indispensable as data centers are pivotal in supporting digital transformation, cloud computing, artificial intelligence, and big data analytics. Cooling systems account for approximately 30% to 40% of a data center's total energy consumption, according to the U.S. Department of Energy highlights their importance in achieving sustainability goals. The region's focus on reducing carbon footprints and improving Power Usage Effectiveness (PUE) has led to innovations such as liquid cooling, free cooling, and evaporative cooling systems.

North America is home to some of the largest hyperscale data centers globally, with Northern Virginia alone hosting over 1,500 megawatts of data center capacity as reported by Data Center Frontier. Moreover, rising temperatures due to climate change pose additional challenges. As per the National Oceanic and Atmospheric Administration (NOAA), 2022 was among the warmest years on record, which is emphasizing the urgency for resilient cooling strategies. The pressure on data centers to adopt sustainable practices continues to grow by making efficient cooling not just an operational necessity but also an environmental imperative.

MARKET DRIVERS

Increasing Energy Efficiency Regulations

The trend towards energy efficiency in data centers is a significant driver of the North America data center cooling market. Regulatory frameworks, like those implemented by the U.S. Environmental Protection Agency (EPA) will mandate stringent energy consumption standards to reduce greenhouse gas emissions. Data centers consume about 2% of total U.S. electricity, as stated by the Lawrence Berkeley National Laboratory by making them a focal point for sustainability initiatives. The EPA's ENERGY STAR program encourages adopting advanced cooling technologies like liquid immersion and economizers, which can reduce cooling energy usage by up to 40%. Additionally, incentives for renewable energy integration further propel the adoption of energy-efficient cooling systems. As per the U.S. Department of Energy, the Biden administration targeting a carbon-free power sector by 2035, where data centers are under increasing pressure to adopt innovative cooling solutions that align with national climate goals.

Growing Demand for Hyperscale Data Centers

The rapid expansion of hyperscale data centers across North America is another key driver fueling the demand for advanced cooling solutions. According to the International Energy Agency (IEA), hyperscale facilities accounted for over 70% of global data center traffic in 2022, with North America leading this growth. These facilities require robust cooling systems due to their high-density server environments, which generate substantial heat. According to the U.S. Census Bureau, internet usage surged by 40% during the pandemic that accelerates cloud adoption and necessitating scalable infrastructure. According to the General Services Administration, federal agencies increasingly rely on cloud services, which further boosts demand for efficient cooling. The need for cutting-edge cooling technologies, such as direct-to-chip liquid cooling, becomes critical to maintaining operational reliability and meeting performance benchmarks.

MARKET RESTRAINTS

High Initial Investment and Operational Costs

One significant restraint in the North America data center cooling market is the high initial investment and operational costs associated with advanced cooling technologies. Implementing state-of-the-art cooling systems can require substantial capital, often exceeding millions of dollars for large facilities. For instance, a report from the U.S. Department of Energy indicates that energy costs can account for up to 30% of a data center's total operating expenses. This financial burden can deter smaller companies from investing in necessary cooling solutions by limiting market growth and innovation.

Increasing Regulatory Pressure

Another major constraint is the increasing regulatory pressure regarding energy efficiency and environmental sustainability. Government agencies, such as the Environmental Protection Agency (EPA), have set stringent guidelines to reduce energy consumption in data centers. According to the EPA, data centers in the U.S. consumed about 70 billion kilowatt-hours of electricity in 2014 by contributing to significant greenhouse gas emissions. Compliance with these regulations often necessitates additional investments in energy-efficient cooling technologies, which can be a barrier for many operators.

MARKET OPPORTUNITIES

Growing Demand for Cloud Services

A key opportunity in the North America data center cooling market is the increasing demand for cloud services. The need for efficient data center operations, including effective cooling systems is rising as businesses increasingly migrate to cloud-based solutions. This surge in cloud adoption necessitates advanced cooling technologies to manage the heat generated by densely packed servers by presenting a lucrative opportunity for cooling solution providers to innovate and expand their offerings.

Advancements in Cooling Technologies

Another promising opportunity lies in the advancements in cooling technologies in liquid cooling and free cooling systems. These innovative solutions are becoming increasingly popular due to their efficiency and lower environmental impact. According to the U.S. Department of Energy, liquid cooling can reduce energy consumption by up to 30% compared to traditional air cooling methods. The adoption of these advanced cooling technologies is expected to grow as data centers strive to enhance energy efficiency and reduce operational costs. This trend not only opens new markets for cooling equipment manufacturers but also aligns with sustainability goals by making it a win-win for both businesses and the environment.

MARKET CHALLENGES

Increasing Energy Costs

A major challenge for the North America data center cooling market is the rising energy costs. The financial burden of energy consumption becomes more pronounced as data centers expand and demand for cooling increases. According to the U.S. Energy Information Administration (EIA), electricity prices in the U.S. have increased by about 15.1% over the past decade. This trend poses a significant challenge for data center operators, as cooling systems can account for nearly 40% of a data center's total energy usage. The escalating costs can strain budgets and compel operators to seek more energy-efficient cooling solutions, which may require additional investment and time to implement.

Limited Availability of Water Resources

Another critical challenge is the limited availability of water resources for cooling systems that rely on water for heat dissipation. Many data centers utilize water-cooled systems, which can be problematic in regions experiencing drought or water scarcity. According to the U.S. Geological Survey (USGS), approximately 40% of the U.S. population lives in areas that are experiencing water shortages. This scarcity can lead to increased operational costs and regulatory restrictions on water usage by forcing data centers to reconsider their cooling strategies. The operators may need to invest in alternative cooling technologies, which can complicate existing infrastructure and increase capital expenditures.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Solutions, Service, Cooling Type, Organization Size, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, and the Rest of North America. |

|

Market Leaders Profiled |

Vertiv Group Corp. (U.S.), Eaton (U.S.), Daikin Applied (U.S.), Black Box Corporation (U.S.), Nortek Air Solutions, LLC (U.S.), 3M (U.S.), Coolcentric (U.S.)., and others. |

SEGMENT ANALYSIS

By Type Insights

The enterprise data centers segment dominated the North America data center cooling market by holding 60.3% of the total share in 2024 owing to their widespread adoption across industries like finance, healthcare, and retail, which require robust on-premise infrastructure for mission-critical operations. According to the Environmental Protection Agency, enterprise facilities consume nearly 2% of total U.S. electricity by driving demand for efficient cooling solutions. Their importance lies in ensuring high uptime and security, which are non-negotiable for large organizations. The enterprise data centers remain pivotal in shaping the cooling market landscape with stringent regulatory compliance and the need for scalable thermal management,.

The edge data centers segment is likely to exhibit a CAGR of 25.6% during the forecast period. This rapid growth is fueled by the proliferation of IoT devices and 5G networks, which require low-latency processing closer to end-users. The Federal Communications Commission reports that over 80% of U.S. households now have access to advanced broadband services, accelerating edge deployments. According to the National Renewable Energy Laboratory, edge facilities are critical for supporting real-time applications like autonomous vehicles and smart cities. The edge data centers demand innovative cooling solutions due to space constraints and high-density workloads by making them a focal point for technological advancements in the cooling market.

By Solutions Insights

The air conditioning systems segment was the largest by occupying 35.5% of the share in 2024. This dominance is attributed to their widespread adoption in traditional data centers due to reliability and ease of deployment. According to the Environmental Protection Agency, air-based systems remain cost-effective for facilities with lower-density server racks, which still constitute a significant portion of existing infrastructure. Their importance lies in providing consistent temperature and humidity control with the rising need for preventing equipment from overheating. Additionally, advancements such as variable speed fans and smart controls have improved their efficiency by making them a preferred choice for many operators despite emerging alternatives.

The liquid cooling system segment is attributed to register a prominent CAGR of 28.4% from 2025 to 2033. This growth is driven by the increasing deployment of high-density servers and AI-driven workloads, which generate substantial heat that traditional air-based systems struggle to manage. According to the National Renewable Energy Laboratory, liquid cooling can reduce energy consumption by up to 40% compared to conventional methods by making it a sustainable choice. As per the U.S. Department of Commerce, hyperscale data centers are rapidly adopting liquid cooling to meet performance demands while achieving energy efficiency targets. The need for compact yet powerful cooling solutions further propels the adoption of liquid cooling systems.

By Service Insights

The maintenance and support services segment dominated the North America data center cooling market with 45.4% of share in 2024. This segment's dominance is driven by the critical need to ensure uninterrupted operations and optimal cooling system performance in data centers. According to the Environmental Protection Agency, cooling systems are responsible for nearly 40% of a data center’s energy consumption by making regular maintenance vital for efficiency and cost savings. The increasing complexity of cooling technologies, such as liquid immersion and hybrid systems are skilled support services. The preventive maintenance also reduces downtime risks, which can cost businesses up to $9,000 per minute, according to the Uptime Institute.

The installation and deployment services segment is projected to witness a CAGR of 18.4% from 2025 to 2033. This growth is fueled by the rapid expansion of hyperscale and edge data centers, which require precise installation of advanced cooling systems. According to the Federal Energy Regulatory Commission, over 70% of new data center projects prioritize energy-efficient cooling solutions by necessitating expert deployment services. According to the General Services Administration, growing adoption of prefabricated modular data centers, which rely heavily on streamlined installation processes. The demand for specialized installation expertise is surging due to this segment pivotal for overcoming technical challenges and ensuring scalability in the evolving data center landscape.

By Cooling Type Insights

The room-based cooling segment was the largest by occupying a significant share of 55% in 2024. Its dominance is attributed to its cost-effectiveness and suitability for traditional enterprise data centers with lower-density server environments. According to the Environmental Protection Agency, room-based systems consume nearly 35% of a data center's total energy by making them integral to achieving energy efficiency goals. These systems are widely adopted due to their scalability and ease of installation in large facilities. Their importance lies in providing uniform cooling across entire server rooms by ensuring operational reliability.

The row-based cooling segment is likely to experience a CAGR of 18.2% from 2025 to 2033. This growth is driven by the increasing adoption of high-density server racks and modular data center designs, which require targeted cooling solutions. According to the National Institute of Standards and Technology, row-based systems improve cooling efficiency by up to 30% compared to traditional methods by reducing energy consumption significantly. These systems address the need for precise thermal management in confined spaces with the rise of edge computing and hyperscale facilities. As per the U.S. Department of Commerce, modular data centers, which often utilize row-based cooling are expected to grow by over 20% annually.

By Organization Size Insights

The large-sized organizations segment was accounted in holding a dominant share of the North America data center cooling market in 2024. This dominance is driven by their extensive reliance on enterprise-grade data centers to support complex operations, including cloud computing, big data analytics, and AI workloads. According to the Environmental Protection Agency, large organizations consume nearly 90% of total data center energy in the U.S. by necessitating advanced cooling solutions to manage heat loads efficiently. The dominance is driven by significant investments in scalable infrastructure and compliance with stringent energy efficiency regulations. These organizations prioritize high-performance cooling systems to ensure reliability and reduce operational costs by making them a cornerstone of the cooling market.

The small and medium organizations segment is projected to grow at a CAGR of 18.5% in the coming years. This growth is fueled by the increasing adoption of digital tools and cloud services, enabling these organizations to compete with larger enterprises. According to the U.S. Small Business Administration, small businesses account for 99.9% of all U.S. businesses due to their vast potential to drive demand for cost-effective and modular cooling solutions. According to the General Services Administration, government incentives for SMEs to adopt sustainable practices further accelerate this trend. They increasingly deploy edge computing and colocation facilities, which require innovative, space-efficient cooling technologies.

COUNTRY LEVEL ANALYSIS

The United States dominated the North America data center cooling market with a share of 65.6% in 2024 due to its vast network of hyperscale data centers in tech hubs like Northern Virginia and Silicon Valley. According to the Environmental Protection Agency, U.S. data centers consume about 2% of the nation's electricity by driving demand for advanced cooling solutions. With cloud adoption and AI growth accelerating, the U.S. remains pivotal in shaping cooling innovations. Its importance lies in supporting industries like finance, healthcare, and e-commerce by ensuring reliability and sustainability in an increasingly digital economy.

Canada data center cooling market is projected to register a CAGR of 16.4% from 2025 to 2033. This growth is fueled by favorable climatic conditions by enabling free cooling techniques that reduce energy costs by up to 40%, as per Natural Resources Canada. Additionally, Canada’s commitment to renewable energy, with over 60% of its electricity sourced from hydroelectric power that makes it an attractive location for sustainable data centers. The Canadian government emphasizes green initiatives that further propels the investments in efficient cooling technologies.

KEY MARKET PLAYERS

A few notable companies operating in the North America data center cooling market profiled in this report are Vertiv Group Corp. (U.S.), Eaton (U.S.), Daikin Applied (U.S.), Black Box Corporation (U.S.), Nortek Air Solutions, LLC (U.S.), 3M (U.S.), Coolcentric (U.S.)., and others.

TOP LEADING PLAYERS IN THE MARKET

Vertiv Group Corp.

Vertiv Group Corp. is a prominent leader in the North America data center cooling market, offering a wide range of thermal management solutions tailored to meet the demands of modern data centers. The company is highly regarded for its innovative Liebert cooling systems, which are widely adopted in hyperscale and enterprise facilities. Vertiv’s commitment to sustainability and energy efficiency has positioned it as a key contributor to the global market. Its advanced cooling technologies not only enhance operational reliability but also support the growing need for scalable infrastructure. By focusing on smart and eco-friendly solutions, Vertiv continues to play a pivotal role in advancing data center cooling practices worldwide.

Stulz GmbH

Stulz GmbH is a major player in the North America data center cooling market, known for its precision air conditioning and modular cooling systems. The company’s CyberAir and Micro DC solutions are celebrated for their adaptability and efficiency in high-density environments. Stulz’s emphasis on sustainability is evident in its use of indirect free cooling and adiabatic systems, which reduce energy consumption while maintaining optimal performance. With a strong global presence, Stulz has established itself as a trusted provider of innovative cooling technologies. Its ability to address the unique challenges of modern data centers reinforces its prominence in both regional and international markets.

Schneider Electric SE

Schneider Electric SE is a dominant force in the North America data center cooling market, offering integrated solutions like EcoStruxure for Data Centers. This platform combines cooling, power, and IT management to optimize data center operations. Schneider’s InRow and chiller-based systems are designed to meet the needs of edge computing, colocation, and hyperscale facilities. The company’s focus on sustainability and energy efficiency is reflected in its cutting-edge technologies, which minimize environmental impact while ensuring reliable thermal performance. Schneider Electric’s commitment to innovation and intelligent solutions has solidified its position as a global leader in the data center cooling market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic acquisitions and collaborations:

Companies like Vertiv Group Corp. and Schneider Electric SE have actively pursued acquisitions to expand their product portfolios and geographic reach. For instance, Vertiv has acquired firms specializing in liquid cooling technologies to bolster its offerings for high-density data centers. Similarly, Schneider Electric has formed partnerships with technology providers to integrate IoT and AI-driven analytics into its cooling systems, enabling predictive maintenance and optimized energy usage. Such moves allow these companies to stay ahead in a competitive market by delivering integrated and intelligent solutions.

Product innovation and customization:

Stulz GmbH and Rittal GmbH & Co. KG have invested heavily in developing advanced cooling systems tailored to specific customer needs. For example, Stulz has introduced modular and scalable cooling solutions that cater to edge computing environments, while Rittal focuses on compact, energy-efficient designs for small-scale data centers. By offering innovative and adaptable products, these companies address the unique challenges posed by evolving data center architectures, such as high-density server racks and space constraints.

Sustainability and energy efficiency initiatives:

Asetek A/S, known for its liquid cooling solutions, emphasizes eco-friendly technologies that reduce carbon footprints and water usage. Similarly, Schneider Electric has positioned itself as a leader in green data center solutions by promoting renewable energy integration and energy-efficient cooling systems. These efforts align with regulatory standards and consumer expectations, enhancing brand reputation and market share.

COMPETITIVE LANDSCAPE

The North America data center cooling market is characterized by intense competition, driven by the rapid expansion of digital infrastructure and the growing emphasis on energy efficiency and sustainability. The market comprises a mix of established global players, regional leaders, and niche innovators, each striving to capture a larger share of this dynamic industry. Prominent companies such as Vertiv Group Corp., Schneider Electric SE, and Stulz GmbH dominate the landscape, leveraging their extensive product portfolios, technological expertise, and strong distribution networks to maintain its dominant position. These firms focus on delivering innovative solutions like liquid cooling, AI-driven thermal management, and modular systems to cater to the diverse needs of hyperscale, enterprise, and edge data centers.

Competition is further intensified by the entry of smaller, specialized players like Asetek A/S, which concentrate on cutting-edge liquid cooling technologies for high-density environments. These companies often differentiate themselves through superior energy efficiency and customization capabilities, appealing to environmentally conscious customers. Additionally, partnerships and collaborations with technology providers and cloud service operators have become a key competitive strategy, enabling firms to integrate advanced analytics and IoT into their offerings.

The market also witnesses fierce competition in terms of pricing, performance, and sustainability. As regulatory pressures mount and organizations prioritize green initiatives, companies are increasingly investing in eco-friendly cooling solutions. This focus on innovation, coupled with the rising demand for scalable and efficient thermal management, ensures that competition remains robust, fostering continuous advancements in the North America data center cooling market.

RECENT MARKET DEVELOPMENTS

- In December 2023, Vertiv Group Corp. acquired CoolTera Ltd, a provider of liquid cooling infrastructure solutions. This acquisition is expected to enhance Vertiv’s thermal management portfolio to meet high-density computing demands.

- In March 2024, Vertiv Group Corp. joined the NVIDIA Partner Network as a Solution Advisor: Consultant partner. This collaboration aligns with NVIDIA to address advanced data center cooling needs driven by AI workloads.

- In October 2024, Schneider Electric SE acquired a 75% stake in Motivair Corp, a U.S.-based liquid cooling company, for $850 million. This acquisition is expected to bolster Schneider Electric’s data center cooling capabilities.

- In November 2024, Schneider Electric SE replaced its CEO to accelerate strategy execution. This domiannce change indicates a commitment to strengthening its position in the data center cooling market.

- In November 2024, Vertiv Group Corp. reported strong Q3 earnings, driven by high demand for AI data center solutions. This performance reflects Vertiv’s strengthened market position.

- In December 2024, Vertiv Group Corp.’s stock rose sharply after presenting a strong long-term outlook at an investor event. This event showcased its latest technology and reaffirmed its growth targets.

- In May 2023, Vertiv Group Corp. was selected by NVIDIA after securing a $5 million grant from ARPA-E's COOLERCHIPS program. This initiative integrates direct liquid cooling and immersion cooling into a single system to address high-density compute challenges.

- In December 2023, Vertiv Group Corp. collaborated with Intel to provide pumped two-phase (P2P) liquid cooling infrastructure for the Gaudi3 AI accelerator platform. This partnership enhances Vertiv’s liquid cooling solutions for data centers.

- In November 2021, Vertiv Group Corp. completed the acquisition of E+I Engineering, a global provider of electrical switchgear and power distribution systems. This acquisition expands Vertiv’s data center infrastructure offerings.

MARKET SEGMENTATION

This research report on the North America data center cooling market is segmented and sub-segmented based on categories.

By Type

-

Enterprise Data Center

-

Edge Data Center

By Solutions

-

Air Conditioning

-

Chilling Units

-

Cooling Towers

-

Economizer System

-

Liquid Cooling System

-

Computer Room Air Conditioning (CRAC) and Computer Room Air Handler (CRAH)

-

Control Units

-

Others

By Service

-

Consulting and Training

-

Installation and Deployment

-

Maintenance and Support

By Cooling Type

-

Room-Based Cooling

-

Rack-Based Cooling

-

Row-Based Cooling

By Organization Size

-

Large Organization Size

-

Small and Medium Organization

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What challenges does the data center cooling market face in North America?

Challenges include high energy consumption, the rising cost of cooling solutions, the complexity of managing large-scale cooling infrastructure, and the environmental impact of cooling technologies.

What is the market outlook for data center cooling in North America?

The market is expected to grow due to the increasing demand for data processing power, the rise of edge computing, and the push for more energy-efficient and sustainable cooling solutions.

What is the future of data center cooling in North America?

The future of data center cooling in North America looks promising, with an emphasis on advanced cooling technologies such as liquid cooling, AI-based optimization, and energy-efficient solutions aimed at reducing operational costs and environmental impact.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com