North America Doors Market Size, Share, Trends & Growth Forecast Report By Material (Metal, Wood, Plastic, Glass, Composite), Mechanism (Swinging, Sliding, Folding, Overhead), Product Type (Interior, Exterior), Mode of Application (New Construction, Aftermarket), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Doors Market Size

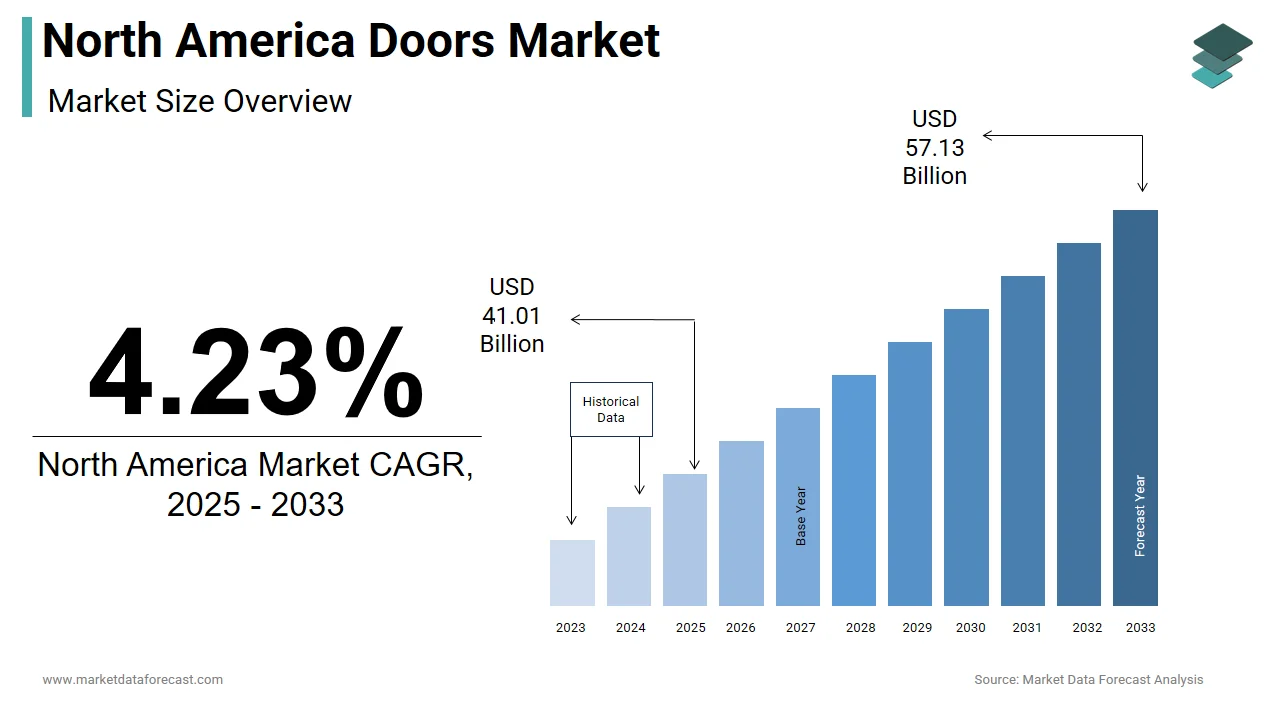

The size of the North America doors market was worth USD 39.35 billion in 2024. The North America market is anticipated to grow at a CAGR of 4.23% from 2025 to 2033 and be worth USD 57.13 billion by 2033 from USD 41.01 billion in 2025.

The North America doors market covers a wide range of products, including interior and exterior doors, designed for residential, commercial, and industrial applications. These doors are manufactured using materials such as wood, steel, aluminum, fiberglass, and composite materials, each offering distinct advantages in terms of durability, insulation, aesthetics, and security. The market is influenced by trends in architectural design, building codes, energy efficiency standards, and consumer preferences for smart and sustainable home solutions.

According to the U.S. Census Bureau, in 2023, housing completions in the United States reached approximately 1.47 million units, contributing significantly to the demand for both entry and interior doors. Moreover, renovation activities have surged, particularly in urban areas where homeowners are upgrading existing properties with modern, energy-efficient door systems.

A key factor influencing this growth is the increasing emphasis on building safety and accessibility, driven by updated fire and seismic regulations. Moreover, the adoption of smart door technologies—such as automated entry systems, biometric locks, and integrated home automation features—has gained traction, especially among high-end residential and corporate developments.

MARKET DRIVERS

Growth in Residential Construction and Home Renovation Activities

A primary driver fueling the North America doors market is the robust growth in residential construction and remodeling activities. Each new home typically requires multiple interior and exterior doors, directly contributing to market demand.

Homeowners are increasingly investing in premium door solutions that enhance curb appeal, improve thermal efficiency, and provide better security. Similarly, the trend toward smart homes has led to rising demand for technologically advanced entry doors equipped with digital locks, remote access control, and integration with home automation systems.

In Canada, the Canadian Wood Council noted that engineered wood and solid hardwood doors accounted for over 18% of all door installations in new builds during 2023, reflecting a preference for natural materials. With growing disposable incomes and favorable mortgage conditions, residential construction and renovation will continue to be pivotal drivers of the doors market in North America.

Increasing Demand for Energy-Efficient and Sustainable Door Solutions

Another significant driver of the North America doors market is the rising demand for energy-efficient and sustainable door products. As awareness of environmental issues grows and regulatory frameworks tighten, consumers and builders alike are shifting toward doors that minimize heat loss, reduce carbon footprints, and meet green certification standards.

Manufacturers have responded by introducing insulated core doors, weather-stripped frames, and high-performance glazing options. For instance, JELD-WEN, one of the leading door producers, launched a line of ENERGY STAR-certified fiberglass doors in 2023, which saw a key increase in sales volume compared to traditional models.

In parallel, government initiatives promoting sustainable building practices are influencing material choices. Environment and Climate Change Canada reported that federal green building incentives led to a key rise in the use of certified sustainable wood doors in public infrastructure projects during 2023.

This shift underscores the importance of sustainability as a key growth driver in the North America doors market.

MARKET RESTRAINTS

Supply Chain Disruptions and Raw Material Price Volatility

One of the most pressing restraints affecting the North America doors market is the ongoing volatility in raw material prices and supply chain disruptions. Door manufacturing relies heavily on inputs such as wood, steel, aluminum, PVC, and glass, all of which have experienced significant cost fluctuations due to global economic uncertainties and geopolitical tensions.

According to the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) for lumber rose between January and December 2023, impacting the affordability of wooden door production. These cost surges have constrained profit margins for manufacturers and led to higher retail prices, potentially deterring budget-conscious consumers.

Supply chain bottlenecks have further exacerbated the situation. The Institute for Supply Management noted in 2023 that 72% of door manufacturing firms experienced delays in receiving raw materials, particularly from international suppliers affected by labor shortages and transportation backlogs. These disruptions have slowed production timelines and limited inventory availability, particularly for custom-designed or specialty doors.

Moreover, freight costs have remained elevated due to ongoing logistical challenges. Unless stabilized, these factors could hinder market expansion and dampen consumer confidence in the near term.

Labor Shortages and Installation Cost Constraints

Labor shortages in the construction and installation sectors have emerged as a major restraint for the North America doors market. Skilled professionals such as carpenters, installers, and finishers are in short supply, delaying project timelines and increasing labor costs for both residential and commercial clients.

According to the Associated General Contractors of America, in 2023, 89% of U.S. construction firms struggled to hire qualified door installers, citing a lack of vocational training and an aging workforce.

This labor crunch is particularly acute in specialized door installations, such as those involving custom millwork, automated entry systems, or commercial-grade security doors.

Moreover, training gaps and reduced interest in trade careers among younger generations continue to limit workforce replenishment. As per the Canadian Apprenticeship Forum, only 11% of apprentices in 2023 were under the age of 25, indicating a structural challenge in sustaining skilled labor availability. Until addressed through policy reforms and industry-led training programs, labor constraints will remain a persistent barrier to market growth.

MARKET OPPORTUNITIES

Expansion of Smart and Connected Door Technologies

An emerging opportunity in the North America doors market is the rapid adoption of smart and connected door technologies. These innovations include motorized entry systems, biometric locks, real-time monitoring via mobile apps, and integration with home automation platforms such as Amazon Alexa and Google Home.

The proliferation of smart home ecosystems and heightened concerns about security have driven widespread consumer interest in intelligent door solutions.

In the residential sector, companies such as Schlage, Kwikset, and August have introduced smart deadbolts and Wi-Fi-enabled entry systems that allow homeowners to remotely lock or unlock doors, receive occupancy alerts, and integrate with surveillance cameras.

Commercial applications are also expanding rapidly, particularly in office complexes, hotels, and multifamily housing developments. With continued advancements in IoT and artificial intelligence, smart door technology is expected to become more accessible and feature-rich, offering a strong avenue for future market expansion.

Growth in E-Commerce and Direct-to-Consumer Sales Channels

The digital transformation of the door industry presents a significant opportunity for market players through the expansion of e-commerce and direct-to-consumer (DTC) sales channels. Online platforms now allow consumers to browse, compare, and purchase doors from the comfort of their homes, supported by virtual visualization tools and augmented reality (AR) integrations.

According to Digital Commerce 360, online furniture and home goods sales in the U.S. reached $204 billion in 2023, with doors and windows experiencing a 14% year-over-year growth. Major brands such as Masonite, Therma-Tru, and Simpson Door have expanded their digital presence, offering free samples, virtual consultations, and detailed installation guides to enhance the online buying experience.

A key driver behind this shift is changing consumer behavior, particularly among millennials and Gen Z buyers who prefer seamless, transparent purchasing journeys.

Moreover, logistics improvements have made it easier to ship large items like pre-hung doors without compromising condition or delivery speed. With sustained investment in digital marketing, customer engagement, and omnichannel strategies, the DTC model is poised to reshape how doors are sold and distributed across North America, offering a lucrative growth path for forward-thinking manufacturers.

MARKET CHALLENGES

Intense Competition and Price Sensitivity Among Consumers

The North America doors market faces intense competition among a diverse array of domestic and international players, resulting in aggressive pricing strategies and margin pressures. This saturation has intensified rivalry, compelling firms to frequently discount products to retain market share, especially in price-sensitive segments.

Price sensitivity among consumers remains a critical challenge. A 2023 survey by J.D. Power found that 68% of U.S. homeowners considered price as the top factor when selecting doors, surpassing brand reputation and sustainability credentials. This preference has driven demand for cost-effective alternatives like basic fiberglass and entry-level steel doors, squeezing profits for premium door manufacturers.

Moreover, imported door products, particularly from China and Mexico, have flooded the North American market due to lower production costs. The U.S. International Trade Commission reported that imports of composite and engineered doors into the U.S. increased by 12.6% in volume terms in 2023, intensifying competition for domestic producers.

While this offers consumers more choice, it puts pressure on local manufacturers to either reduce costs or differentiate their offerings through innovation, branding, or service enhancements.

Regulatory Compliance and Environmental Standards

Regulatory scrutiny around emissions, indoor air quality, and sustainable sourcing poses a significant challenge for door manufacturers operating in North America. Both the U.S. and Canada have implemented stringent environmental and health-related regulations that require door products to meet specific performance and chemical emission standards.

According to the California Air Resources Board, formaldehyde emissions from composite wood products—including engineered wood doors—are strictly regulated under the Airborne Toxic Control Measure (ATCM), requiring manufacturers to invest in compliant materials and testing procedures.

Smaller manufacturers, in particular, face difficulties in adapting to evolving regulations without compromising profitability. As environmental policies continue to tighten, ensuring regulatory alignment while maintaining competitive pricing remains a pressing challenge for the North America doors market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Material, Mechanism, Product Type, Mode of Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Assa Abloy, Dormakaba, Masonite, Andersen Corporation, Simpson Door Company, Jeld-Wen, Inc., PGT, Fancy Doors & Mouldings, Cornerstone Building Brands, ARCAT, Lacantina Doors, Boon Edam, Pella Corporation, The Lyon & Billard Lumber Co., Atrium, Fenesta, Corinthian Doors, Hormann, MI Windows and Doors, LLC, Novoferm GmbH, Marvin, Viwintech Window & Door Inc., Therma-Tru Corp., OCM Industrial Doors., and others. |

SEGMENTAL ANALYSIS

By Material Insights

The wood doors segment was the largest in the North America doors market, capturing 35.4% of total market share as of 2024. This dominance is attributed to the enduring popularity of wood as a preferred material for both interior and exterior applications due to its natural aesthetics, durability, and customization options.

One key driver behind this segment’s leadership is the strong preference for traditional and high-end architectural styles in residential construction. Also, hardwood doors are known for their superior insulation properties, contributing to energy efficiency in colder regions like Canada and the northern United States.

Another major factor is the growing trend toward home renovations that emphasize craftsmanship and sustainability. Moreover, the demand from luxury housing developments has reinforced the position of wood doors. These combined factors continue to sustain the dominance of the wood doors segment across North America.

The composite doors segment is currently the fastest-growing within the North America doors market, expanding at a CAGR of 9.7%. This rapid growth is primarily driven by the increasing demand for doors that combine strength, thermal efficiency, and low maintenance, particularly in urban and suburban residential settings.

A major contributing factor is the rising adoption of composite doors in multi-family housing and townhouse developments, where security and durability are critical considerations. As per the U.S. Census Bureau, in 2023, new multifamily housing starts increased, creating significant opportunities for composite door manufacturers who cater to developers seeking cost-effective yet high-performance solutions.

Also, composite doors offer superior resistance to warping, moisture, and extreme weather conditions compared to traditional materials like wood or PVC. In parallel, government initiatives promoting sustainable building practices have further fueled interest in composite doors made from recycled content.

With continuous advancements in manufacturing techniques and material composition, the composite doors segment is well-positioned for sustained growth, offering a compelling balance between functionality, aesthetics, and environmental responsibility.

By Mechanism Insights

The swinging doors segment holds the largest share in the North America doors market, accounting for 48.2% of total revenue in 2024. Swinging doors remain the most commonly used mechanism type in both residential and commercial applications due to their simplicity, ease of installation, and compatibility with standard door frames.

One of the primary drivers behind this segment’s dominance is its widespread use in single-family homes and apartment complexes. According to the U.S. Census Bureau, in 2023, over 1.4 million housing units were completed in the United States, nearly all of which featured swinging entry and interior doors as part of standard construction practices. Their intuitive design and accessibility make them ideal for everyday use, especially in private residences.

In addition, swinging doors are extensively used in institutional and office environments, including schools, hospitals, and government buildings.

Furthermore, advancements in hardware technology have enhanced the functionality of swinging doors without compromising aesthetics. Companies such as Stanley Hardware and Baldwin Hardware introduced smart hinges and magnetic closers in 2023, improving energy efficiency and safety compliance. These factors collectively reinforce the swinging doors segment as the dominant force in the North America doors market.

The folding doors segment is emerging as the fastest-growing within the North America doors market, expanding at a CAGR of 11.2%. This growth is largely attributed to the increasing popularity of open-space living concepts and the demand for flexible interior layouts that maximize space utilization.

A key driver of this trend is the rise in luxury home construction and high-end renovation projects, particularly in urban centers. These designs allow for seamless transitions between spaces while enhancing natural lighting and ventilation.

Additionally, architects and interior designers are increasingly specifying folding doors for commercial applications such as restaurants, retail stores, and event venues. Manufacturers such as NanaWall and Marvin Windows introduced lightweight aluminum-framed folding door systems with improved insulation and acoustic performance, making them suitable for year-round use. With continued innovation and shifting consumer preferences toward versatile and aesthetically appealing architectural elements, the folding doors segment is poised for strong expansion in the coming years.

By Product Type Insights

The interior doors segment holds the largest share in the North America doors market, capturing 54.1% of total revenue in 2024. Interior doors are integral to every residential and commercial structure, serving functional, aesthetic, and spatial organization purposes, making them a consistent driver of market demand.

One of the primary reasons for this segment’s dominance is the sheer volume of interior doors required in each new construction project. In multifamily developments, this number increases significantly, further amplifying demand across the sector.

Home renovation activity has also been a major contributorHollow core and molded composite doors remained popular choices due to their affordability and ease of installation.

Apart from these, changing interior design trends have spurred interest in premium interior door products. These designs offered both functionality and modern appeal, influencing purchasing decisions.

Manufacturers such as Masonite and Simpson Door Company expanded their interior door offerings in 2023, introducing customizable finishes and sustainable materials to align with evolving consumer preferences. With ongoing construction and remodeling activity, the interior doors segment remains a cornerstone of the North America doors market.

The exterior doors segment is the fastest-growing within the North America doors market, projected to expand at a CAGR of 8.9%. This growth is primarily driven by heightened focus on home security, energy efficiency, and curb appeal, particularly among homeowners investing in new constructions and upscale renovations.

A key factor behind this surge is the increasing adoption of insulated fiberglass and steel entry doors that provide superior thermal performance and durability.

In addition, advancements in smart door technology have boosted demand for technologically advanced entry systems. Companies such as Schlage, Kwikset, and August launched Wi-Fi-enabled deadbolts and biometric locks that integrate with home automation platforms. Commercial applications have also contributed to growth. Similarly, office complexes and educational institutions prioritized secure, automated entry solutions, further driving demand.

By Mode of Application Insights

The new construction segment holds the largest share in the North America doors market, accounting for 61.4% of total revenue in 2024. This dominance is primarily driven by robust residential and commercial building activity across the United States and Canada, ensuring steady demand for both interior and exterior doors.

One of the key contributors to this segment’s leadership is the rebound in housing starts following post-pandemic economic recovery. Each new home typically requires multiple doors, including front entry, patio, bathroom, bedroom, and closet doors, generating substantial demand across the supply chain.

In Canada, Statistics Canada reported that new residential construction permits increased by 4.7% in 2023, supporting the expansion of single-family and multi-unit dwellings. Commercial construction also saw momentum, with the American Institute of Architects noting a 6.2% growth in non-residential building starts, further bolstering door demand for office complexes, schools, and healthcare facilities.

Additionally, the adoption of standardized door sizes and pre-hung door systems in mass production homebuilding has streamlined procurement processes for developers. With favorable mortgage conditions and ongoing urbanization, the new construction segment remains a central pillar of the North America doors market.

The aftermarket segment is the fastest-growing within the North America doors market, expanding at a CAGR of 9.4%. This growth is primarily driven by the rising volume of home improvement and retrofitting activities, as aging housing stock and evolving consumer preferences prompt homeowners to replace outdated or inefficient doors.

A key factor fueling this expansion is the surge in DIY and professional renovation projects. Many homeowners are opting for energy-efficient models to reduce utility bills and enhance comfort, particularly in older homes with poor insulation.

Also, there has been growing awareness around security and aesthetics, leading to increased demand for modern entry doors equipped with smart locks and durable finishes. Retailers such as Lowe’s and The Home Depot have expanded their door replacement services, offering online consultations, free samples, and professional installation support. With continued investment in digital marketing, customer engagement, and omnichannel strategies, the aftermarket segment is expected to maintain its upward trajectory, offering a lucrative avenue for industry players.

COUNTRY LEVEL ANALYSIS

United States Doors Market Insights

The United States accounted for the largest share of the North America doors market, representing a 78.4% of regional revenue in 2024. As the global leader in residential and commercial construction, the U.S. drives massive demand for interior and exterior doors across new builds, renovations, and infrastructure projects.

A key driver of the market in the U.S. is the scale of residential construction activity. Each new home typically requires between six to ten doors, ensuring consistent demand across manufacturers and distributors.

Simultaneously, the renovation sector has seen strong growth. Door replacements formed a significant portion of these expenditures, particularly for energy-efficient and smart entry systems.

Canada Doors Market Insights

The Canadian doors industry benefits from stable economic growth, increasing urbanization, and a growing emphasis on sustainable building practices.

Residential construction plays a pivotal role in sustaining demand. The Canadian Wood Council reported that engineered wood and solid hardwood doors accounted for over 18% of all door installations in new builds during 2023, reflecting a preference for natural materials.

In addition to residential demand, commercial construction has seen a resurgence, particularly in institutional and healthcare sectors. Moreover, the Canadian Green Building Council reported that LEED-certified buildings grew, many incorporating thermally efficient and eco-friendly door systems.

Major manufacturers such as Norandex and Plastpro have expanded their presence through localized production and distribution networks. With increasing disposable incomes and regulatory support for energy-efficient construction, Canada’s doors market continues to evolve, positioning itself as a key player in the broader North American landscape.

Mexico Doors Market Insights

Mexico represented the third-largest contributor to the North America doors market. While smaller in scale compared to the U.S. and Canada, Mexico's door industry is gradually expanding due to industrialization, urban development, and rising disposable incomes.

A key driver of market growth is the expansion of the residential construction sector. This uptick has spurred demand for cost-effective door solutions, particularly in lower-income segments where molded composite and PVC doors dominate.

Additionally, foreign investment in manufacturing and logistics facilities has contributed to commercial door demand. Domestic producers such as Puertas y Ventanas del Norte and Grupo Maderas have capitalized on this trend by expanding their product lines to include locally manufactured composite and wooden doors. Despite economic volatility and supply chain constraints, Mexico's doors market continues to evolve, supported by infrastructure modernization programs and rising middle-class purchasing power.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America doors market profiled in this report are Assa Abloy, Dormakaba, Masonite, Andersen Corporation, Simpson Door Company, Jeld-Wen, Inc., PGT, Fancy Doors & Mouldings, Cornerstone Building Brands, ARCAT, Lacantina Doors, Boon Edam, Pella Corporation, The Lyon & Billard Lumber Co., Atrium, Fenesta, Corinthian Doors, Hormann, MI Windows and Doors, LLC, Novoferm GmbH, Marvin, Viwintech Window & Door Inc., Therma-Tru Corp., OCM Industrial Doors., and others.

TOP LEADING PLAYERS IN THE MARKET

Masonite International Corporation

Masonite is a leading global manufacturer of interior and exterior doors, with a strong presence across North America. The company is known for its innovative product designs, including molded composite doors, fiberglass entry systems, and sustainable wood alternatives. Masonite’s commitment to research and development has resulted in energy-efficient, durable, and aesthetically appealing door solutions tailored for residential and commercial applications. With an extensive distribution network and strategic partnerships, Masonite plays a crucial role in shaping industry standards and influencing market trends.

JELD-WEN Holding, Inc.

JELD-WEN is one of the largest door and window manufacturers in the world, serving both residential and commercial markets across North America. The company offers a comprehensive portfolio that includes wood, steel, vinyl, and composite doors designed for performance, security, and design flexibility. JELD-WEN emphasizes sustainability by incorporating recycled materials and low-emission finishes into its products. Its vertically integrated supply chain and investment in automation have enhanced efficiency, allowing it to deliver high-quality products at competitive prices while maintaining a dominant regional footprint.

Therma-Tru Doors

Therma-Tru specializes in fiberglass entry and patio doors and is widely recognized for setting benchmarks in energy efficiency, durability, and aesthetics. The brand is particularly favored by homeowners and architects for its ability to combine traditional looks with modern performance features. Therma-Tru invests heavily in product innovation, focusing on advanced insulation technologies and smart home integration. As a subsidiary of Fortune Brands Home & Security, Therma-Tru benefits from strong brand recognition and extensive retail partnerships, reinforcing its leadership position in the North American doors market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Product Innovation and Customization

Leading players prioritize continuous innovation to meet evolving consumer preferences. Companies are expanding their portfolios with smart, sustainable, and high-performance door options. This includes introducing bio-based materials, customizable finishes, and integrated home automation features that cater to both residential and commercial applications.

Vertical Integration and Supply Chain Optimization

To enhance efficiency and reduce dependency on external suppliers, major companies are integrating upstream into raw material sourcing and downstream into retail channels. This strategy helps control costs, improve product quality, and ensure faster time-to-market.

Digital Transformation and E-Commerce Expansion

With shifting consumer behavior toward online purchasing, key players are investing heavily in digital platforms. Virtual visualization tools, direct-to-consumer sales models, and omnichannel strategies are being leveraged to strengthen customer engagement and streamline the buying process.

COMPETITION OVERVIEW

The competition in the North America doors market is intense and marked by the presence of several large-scale manufacturers, regional players, and emerging brands. Market leaders such as Masonite, JELD-WEN, and Therma-Tru dominate due to their extensive product offerings, established distribution networks, and strong brand recognition. These companies continuously innovate to differentiate themselves and capture larger market shares. However, mid-sized and local firms are gaining traction by focusing on niche segments, cost-effective solutions, and localized marketing strategies.

Sustainability and digitalization have become critical battlegrounds, with companies vying to offer eco-friendly products and enhanced online shopping experiences. Additionally, supply chain disruptions and fluctuating raw material prices further intensify the pressure on profit margins, compelling firms to optimize operations and adopt lean manufacturing practices. As consumer expectations evolve, companies must balance affordability, durability, and aesthetic appeal to remain competitive. Unless addressed through policy reforms and industry-led training programs, labor constraints will remain a persistent barrier to market growth. Overall, the competitive landscape remains dynamic, driven by technological advancements, changing end-use demands, and aggressive expansion strategies.

RECENT MARKET DEVELOPMENTS

- In February 2024, Masonite launched a new line of customizable fiberglass entry doors featuring embedded smart lock technology, aiming to enhance security and convenience for homeowners while strengthening its position in the premium residential segment.

- In March 2024, JELD-WEN announced a strategic partnership with a leading home automation platform to integrate voice-controlled access systems into its exterior door lineup, enhancing compatibility with smart home ecosystems and improving user experience.

- In May 2024, Therma-Tru introduced an AI-powered door selection tool on its website, allowing users to visualize different door styles based on architectural preferences, lighting conditions, and home color schemes, significantly improving the online buying journey.

- In July 2024, Masonite expanded its U.S.-based manufacturing capabilities by opening a new production facility in Texas, aimed at reducing lead times and meeting rising demand for custom and energy-efficient door solutions.

- In September 2024, JELD-WEN acquired a regional door distributor in the Midwest, strengthening its logistics infrastructure and enabling faster delivery times to both retail and professional builder customers across the central United States.

MARKET SEGMENTATION

This research report on the North America doors market is segmented and sub-segmented into the following categories.

By Material

- Metal

- Wood

- Plastic

- Glass

- Composite

By Mechanism

- Swinging

- Sliding

- Folding

- Overhead

By Product Type

- Interior

- Exterior

By Mode of Application

- New Construction

- Aftermarket

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. Which door types dominate the North America Doors Market?

Panel doors lead in interior applications, while sliding and automatic doors are popular in commercial and healthcare settings for their space-saving and touchless features

2. Which materials are most popular in the North America Doors Market?

Wood, metal, glass, plastic, composite, and fiberglass are widely used, each offering unique benefits in durability, aesthetics, and energy efficiency

3. What are the key trends shaping the North America Doors Market in 2025 and beyond?

Trends include energy-efficient doors, smart locking systems, touchless entry, eco-friendly materials, and increased customization for aesthetics and function

4. How is e-commerce impacting the North America Doors Market?

E-commerce growth is making door selection more convenient, supporting digital visualization, and expanding market accessibility for manufacturers and consumers

5. What is driving demand for automatic and sensor-based doors in North America?

Increased focus on hygiene, operational efficiency, and security in public and commercial spaces is boosting demand for automatic, touchless, and sensor-based doors

6. How important is energy efficiency in the North America Doors Market?

Energy efficiency is crucial, with consumers and builders seeking doors that improve insulation, reduce energy costs, and support green building certifications

7. Which end-user segments are driving growth in the North America Doors Market?

Both residential and non-residential sectors are growing, with new construction and remodeling fueling demand for modern, durable, and secure doors

8. How are smart technologies influencing the North America Doors Market?

Smart doors with IoT-enabled locks, remote access, and integrated security are becoming standard in new homes and commercial buildings

9. Who are the leading manufacturers in the North America Doors Market?

Major players include Andersen Windows and Doors, Cornerstone Building Brands, JELD-WEN, Pella, and other regional and niche manufacturers

10. What are the main challenges facing the North America Doors Market?

Challenges include rising material costs, regulatory compliance, supply chain disruptions, and the need for ongoing innovation and sustainability

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com