North America Feed Additives Market Market Size, Share, Trends & Growth Forecast Report, Segmented By Type, Livestock and Country (The U.S., Canada and Rest of North America), Industry Analysis from 2025 to 2033

North America Feed Additives Market Size

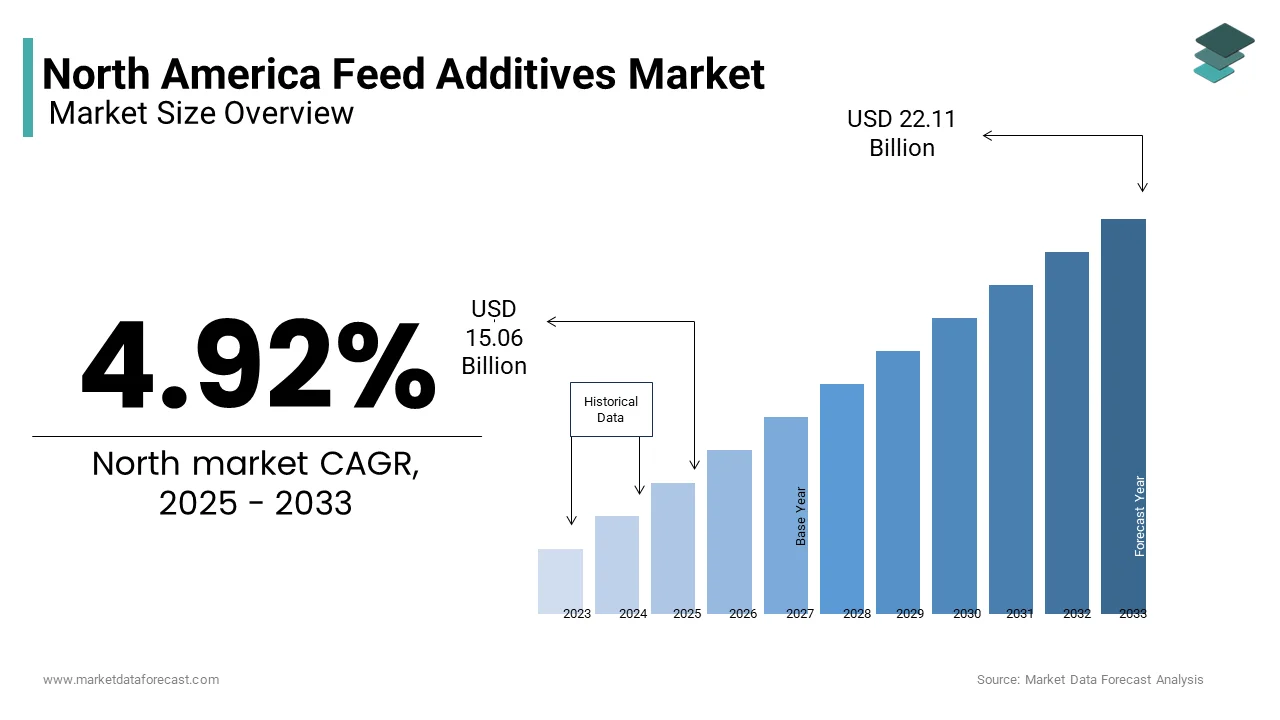

The North American feed additives market was valued at USD 14.35 billion in 2024 and is expected to reach USD 15.06 billion in 2025 from USD 22.11 billion by 2033, growing at a CAGR of 4.92% during the forecast period from 2025 to 2033.

Feed additives are used to enhance animal nutrition, health, and productivity. Feed additives encompass a wide range of substances, including vitamins, amino acids, enzymes, probiotics, antioxidants, and growth promoters, which are incorporated into animal diets to improve feed efficiency, support growth rates, and ensure overall livestock well-being. As per the United States Department of Agriculture (USDA), the region's livestock sector is one of the largest globally, with poultry production alone exceeding 45 billion pounds annually, underscoring the importance of feed quality in maintaining such output levels. The market is driven by the growing demand for high-quality meat, dairy, and eggs, coupled with heightened consumer awareness about food safety and sustainability.

In addition, as per data from the Food and Agriculture Organization (FAO), North America accounts for approximately 12% of global livestock production, with significant emphasis on optimizing feed-to-meat conversion ratios. This has propelled the adoption of advanced feed additives that cater to specific nutritional needs while addressing environmental concerns. The regional focus on sustainable farming practices further amplifies the role of feed additives, as they help reduce waste and minimize the ecological footprint of livestock operations. With evolving regulations and technological advancements shaping the industry, the North America Feed Additives Market continues to demonstrate resilience and innovation.

MARKET DRIVERS

Rising Demand for High-Quality Protein Sources

The increasing consumption of animal-based protein in North America is one of the key factors driving the growth of the North American feed additives market. According to the National Chicken Council, per capita chicken consumption in the United States reached over 98 pounds in recent years, reflecting a steady rise in demand for meat products. This surge is paralleled by similar trends in dairy and egg consumption, creating a pressing need for efficient livestock production systems. Feed additives play an indispensable role in meeting this demand by improving feed conversion ratios (FCR) and ensuring optimal nutrient absorption. For instance, amino acids like lysine and methionine are widely used to enhance protein synthesis in animals, thereby supporting faster growth and higher yields.

Moreover, as per the United Nations’ projections, global meat consumption is expected to increase by 14% by 2030, with North America remaining a key contributor. To sustain this growth trajectory, producers rely heavily on feed additives to maintain consistent product quality while minimizing production costs. Enzymes, such as phytases, are particularly effective in breaking down anti-nutritional factors in feed, leading to better digestibility and reduced reliance on costly raw materials. These innovations not only address economic considerations but also align with consumer expectations for affordable yet high-quality animal products, further fueling the expansion of the feed additives market.

Stringent Regulations Promoting Sustainable Practices

Environmental and regulatory pressures have emerged as another major driver for the North America Feed Additives Market. The Environmental Protection Agency (EPA) estimates that agriculture contributes nearly 10% of total greenhouse gas emissions in the United States, prompting stricter measures to mitigate the industry’s ecological impact. Feed additives offer a viable solution by reducing methane emissions from ruminants and minimizing nitrogen excretion through improved feed formulations. Probiotics and prebiotics, for example, are increasingly adopted to enhance gut health in livestock, subsequently lowering enteric fermentation, which is a primary source of methane.

Additionally, as per the World Resources Institute, adopting sustainable agricultural practices could reduce land use by up to 8% globally. Feed additives contribute significantly to this goal by enabling more efficient resource utilization. Antioxidants, such as vitamin E and selenium, extend the shelf life of feed ingredients, reducing spoilage and waste. Similarly, enzyme-based additives help break down indigestible components, allowing farmers to utilize alternative feed sources without compromising animal performance. These benefits align closely with government initiatives promoting eco-friendly farming methods, making feed additives a strategic choice for compliance and long-term sustainability.

MARKET RESTRAINTS

High Costs Associated with Advanced Feed Additives

The elevated cost associated with advanced formulations is primarily hampering the growth of the North American feed additives market. According to a report published by the American Feed Industry Association, certain specialized additives, such as encapsulated vitamins or bioengineered enzymes, can account for up to 30% of the total feed cost. This financial burden disproportionately affects small-scale farmers who operate on tight margins and lack the resources to invest in premium solutions. Furthermore, fluctuations in raw material prices are driven by supply chain disruptions or geopolitical tensions that exacerbate affordability issues. For instance, the price volatility of soybean meal, a common protein source, has surged by 25% in recent years, as per the USDA Economic Research Service.

Such challenges create barriers to widespread adoption, particularly among smaller livestock operations where profit margins are already constrained. While larger enterprises may absorb these costs more easily, they too face pressure to balance input expenses against market pricing dynamics. Additionally, the complexity of integrating new additives into existing feeding regimes often requires additional training and infrastructure investments, further inflating operational costs. These combined factors limit accessibility to cutting-edge feed additive technologies, impeding their overall market penetration across diverse segments of the livestock industry.

Regulatory Hurdles and Approval Delays

Stringent regulatory frameworks governing the approval and commercialization of novel additives are further impeding the feed additives market in North America. The Food and Drug Administration (FDA) mandates rigorous testing protocols to ensure safety and efficacy before any new product enters the market. However, as per information shared by the Biotechnology Innovation Organization, the average time required to secure FDA approval for innovative feed additives can exceed five years, accompanied by substantial R&D expenditures. This prolonged timeline poses significant challenges for manufacturers aiming to introduce groundbreaking solutions tailored to emerging industry needs. Moreover, discrepancies between federal and state-level regulations often lead to fragmented compliance requirements, complicating distribution efforts. For example, California’s Proposition 12 imposes strict welfare standards that necessitate reformulation of feed additives to meet its criteria, creating additional hurdles for companies operating nationwide. Such inconsistencies deter investment in research and development, stifling innovation and delaying the availability of next-generation products capable of addressing pressing issues like antimicrobial resistance and environmental sustainability.

MARKET OPPORTUNITIES

Growing Adoption of Precision Nutrition Technologies

The advent of precision nutrition technologies is a promising opportunity for the North America feed additives market. As per insights from the National Institute of Animal Agriculture, precision livestock farming (PLF) is gaining traction, with the market projected to grow at a compound annual growth rate (CAGR) of 7.6% over the next decade. This paradigm shift involves leveraging data analytics, sensors, and AI-driven tools to customize feed formulations based on individual animal requirements, thereby maximizing productivity and minimizing waste. Feed additives play a central role in this evolution by enabling targeted interventions tailored to specific physiological stages or health conditions.

For instance, omega-3 fatty acid supplements are increasingly being used to enhance reproductive efficiency in dairy cattle, resulting in improved fertility rates and milk quality. Similarly, probiotic blends designed to combat pathogenic bacteria in poultry demonstrate promising outcomes in reducing antibiotic usage, aligning with consumer preferences for drug-free meat products. According to the American Veterinary Medical Association, farms implementing precision nutrition strategies have reported productivity gains of up to 15%. By capitalizing on these advancements, stakeholders can unlock untapped potential within niche markets, fostering greater profitability and differentiation in an increasingly competitive landscape.

Expansion into Alternative Protein Sectors

The expansion of the application of feed additives to alternative protein sectors, such as aquaculture and insect farming is a lucrative opportunity in the global market. As per the National Oceanic and Atmospheric Administration (NOAA), aquaculture production in North America has grown steadily, with salmon farming alone generating revenues exceeding $1 billion annually. Feed additives formulated specifically for aquatic species, such as carotenoids and marine-derived proteins, are essential for achieving optimal growth rates and vibrant coloration in farmed fish. Simultaneously, the emergence of insect-based feeds offers a novel avenue for innovation. Insects like black soldier flies are rich in essential nutrients and serve as sustainable alternatives to conventional protein sources. According to a study conducted by the University of California, Davis, incorporating enzyme-treated insect meals into livestock diets can improve weight gain by up to 20% while reducing environmental impact. By diversifying into these emerging sectors, feed additive manufacturers can tap into rapidly expanding markets driven by sustainability goals and shifting dietary patterns, positioning themselves at the forefront of future-oriented agricultural practices.

MARKET CHALLENGES

Resistance to Change Among Traditional Farmers

The resistance to change exhibited by traditional farmers entrenched in conventional practices is one of the significant challenges to the North American feed additives market. As per surveys conducted by the Farm Foundation, nearly 40% of livestock producers remain hesitant to adopt modern feed technologies due to skepticism about their effectiveness or unfamiliarity with implementation processes. This reluctance is particularly pronounced among older generations who prioritize tried-and-tested methods over experimental approaches. Consequently, educational outreach programs aimed at demonstrating tangible benefits often fall short, leaving many unaware of the long-term advantages offered by advanced additives. Furthermore, cultural and regional disparities exacerbate this issue. For example, Southern states tend to have lower adoption rates compared to technologically progressive regions like the Midwest, where large-scale operations dominate. According to Purdue University’s Agricultural Economics Department, addressing these gaps necessitates tailored communication strategies that resonate with local contexts and priorities. Without overcoming this barrier, the full potential of feed additives cannot be realized, limiting their contribution to enhanced productivity and sustainability across the agricultural value chain.

Concerns Over Consumer Perception and Labeling Requirements

Consumer perception is further challenging the expansion of the North America Feed Additives Market, especially concerning labeling transparency and ingredient disclosure. As per findings from the International Food Information Council, over 60% of consumers express concerns about artificial additives in animal feed, fearing potential residues in end products. This apprehension extends to genetically modified organisms (GMOs) and synthetic compounds, which some view as incompatible with natural or organic claims. Such sentiments place immense pressure on manufacturers to reformulate products while adhering to complex labeling regulations. For example, the Non-GMO Project Verified label requires rigorous documentation and traceability throughout the supply chain, adding layers of complexity to production workflows. Additionally, misinformation spread via social media platforms amplifies public distrust, creating reputational risks for brands associated with controversial additives. To navigate these challenges effectively, industry players must invest in transparent marketing campaigns and engage directly with consumers to build trust and dispel misconceptions surrounding feed additive safety and functionality.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.92% |

|

Segments Covered |

By Type, Livestock, Form, Source and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

United States, Canada, Mexico |

|

Market Leaders Profiled |

DowDuPont (US), ADM (US), Evonik (Germany), BASF (Germany), DSM (Netherlands), Solvay (Belgium), Ajinomoto (Japan), Novozymes (Denmark), Cargill (US), InVivo (France), Nutreco (Netherlands), Kemin (US), Adisseo (France), Chr. Hansen (Denmark) and Alltech (US). |

SEGMENTAL ANALYSIS

By Type Insights

Largest Segment: Vitamins

The vitamins segment led the North America feed additives market by accounting for 31.3% of the global market share in 2024. The dominating position of vitamins segment in the North American market is driven by their critical role in enhancing animal health, boosting immunity, and improving feed efficiency. For instance, vitamin E is widely used to prevent oxidative stress in poultry, which is crucial for maintaining egg quality. For instance, the demand for enriched eggs with higher omega-3 fatty acids has grown by 15% annually, further propelling the use of vitamins in feed formulations. The versatility of vitamins across livestock categories is further boosting the expansion of the vitamins segment in the global market. As per the National Chicken Council, poultry producers rely heavily on vitamins like B-complex and D3 to optimize growth rates and bone health, especially given that U.S. per capita chicken consumption exceeds 98 pounds annually. Additionally, the rise in antibiotic-free meat production has increased reliance on vitamins to support natural immune functions, reducing dependency on synthetic drugs. The growing awareness among consumers about food safety is also contributing to the expansion of the vitamins segment in the global market. A study by the International Food Information Council highlights that over 60% of consumers prefer meat products from animals raised on nutrient-rich diets, underscoring the importance of vitamins in meeting these expectations.

The phytogenics segment is anticipated to witness the fastest CAGR of 9.12% over the forecast period. Factors such as the increasing demand for sustainable and eco-friendly solutions in livestock farming is propelling the growth of the phytogenics segment in the global market. According to the World Resources Institute, phytogenic additives reduce methane emissions by up to 20%, aligning with stringent environmental regulations imposed by agencies like the EPA. The shift toward antibiotic-free livestock production is further propelling the expansion of the phytogenics segment in the global market. For instance, over 70% of poultry farms in North America have adopted phytogenics to replace antibiotics, ensuring compliance with consumer preferences for drug-free meat. Furthermore, advancements in extraction technologies have made phytogenics more cost-effective and accessible. The University of California, Davis reports that bioactive compounds derived from plants such as oregano and thyme enhance gut health and improve feed conversion ratios by 10%. These benefits position phytogenics as a transformative solution for modern agriculture, accelerating their adoption across diverse livestock sectors.

By Livestock Insights

The poultry segment dominated the market by holding 41.4% of the global market share in 2024. The promising position of poultry segment in the global market is attributed to the region's high per capita chicken consumption, which exceeds 98 pounds annually. For instance, the U.S. alone produces over 45 billion pounds of poultry meat each year, creating substantial demand for specialized feed additives to ensure consistent quality and productivity. The rising focus on optimizing feed-to-meat conversion ratios is also aiding the expansion of poultry segment in the North American market. Enzymes and amino acids are extensively used in poultry feed to break down anti-nutritional factors and enhance protein synthesis. For instance, these additives can improve weight gain by up to 15%, directly impacting profitability. Additionally, the growing trend toward antibiotic-free poultry farming has spurred the adoption of probiotics and prebiotics, which support gut health and reduce disease incidence. Such innovations not only meet regulatory requirements but also cater to consumer demand for healthier and safer meat products, contributing to the growth of the poultry segment in the global market.

The aquatic animals segment is a promising segment and is predicted to register a CAGR of 9.12% over the forecast period due to the booming aquaculture industry in North America. Feed additives tailored for aquatic species, such as carotenoids and marine-derived proteins, play a vital role in achieving vibrant coloration and optimal growth rates in farmed fish. The rising demand for sustainable seafood is further propelling the growth of the aquatic animals segment in the global market. For instance, over 80% of U.S. consumers prioritize eco-friendly seafood options. Feed additives help reduce the ecological footprint of aquaculture by minimizing waste and improving nutrient absorption. For instance, enzyme-treated feeds can enhance digestibility by 20%. These advancements not only address environmental concerns but also align with consumer preferences for responsibly sourced seafood, positioning aquatic animals as the fastest-growing segment in the feed additives market.

By Form Insights

The dry feed additives segment occupied the largest share of 66.3% of the global market in 2024. The dominance of dry feed additives segment in the North American market is attributed to their superior shelf life, ease of storage, and compatibility with automated feeding systems. According to the USDA Economic Research Service, dry formulations account for over 70% of total feed additive usage in large-scale livestock operations, highlighting their widespread adoption. The cost-effectiveness of dry feed additives is further boosting the expansion of the segment in the North American market. Dry additives require minimal processing compared to liquid alternatives, reducing production costs significantly. Moreover, they are less prone to spoilage, ensuring consistent quality over extended periods. As per the National Institute of Animal Agriculture, dry probiotics and enzymes are particularly popular in poultry and swine farming due to their ability to withstand varying environmental conditions. These advantages make dry additives a preferred choice for farmers seeking reliable and economical solutions to enhance livestock performance.

The liquid feed additives segment is experiencing rapid growth and is likely to register a CAGR of 8.18% over the forecast period owing to the advancements in formulation technologies and their suitability for precision nutrition applications. According to the Farm Foundation, liquid additives offer superior bioavailability, enabling faster nutrient absorption and improved animal health outcomes. This characteristic is especially valuable in aquaculture, where precise dosing is critical for maintaining water quality. The rising adoption of automated feeding systems in modern livestock operations is further fuelling the expansion of liquid feed additives segment in the North American market. For instance, more than 60% of large-scale dairy farms in North America have integrated liquid additive dispensers into their workflows, allowing for real-time adjustments based on individual animal needs. Additionally, liquid antioxidants and preservatives are gaining traction due to their ability to extend the shelf life of perishable feed ingredients. These innovations position liquid additives as a dynamic solution for addressing evolving industry challenges, fueling their rapid expansion.

By Source Insights

The synthetic feed additives segment led the market by accounting for 61.6% of the global market share in 2024. The leading position of synthetic feed additives segment in the global market is driven by their affordability and scalability, making them accessible to a wide range of livestock producers. For instance, synthetic amino acids like lysine and methionine account for over 80% of the global market, underscoring their widespread use in North America. The consistent performance under diverse conditions of synthetic feed additives is propelling the growth of the segment in the North America. Unlike natural alternatives, synthetic additives are engineered to deliver precise nutrient profiles, ensuring uniform results across different livestock categories. As per the National Institute of Animal Agriculture, synthetic vitamins are particularly favored in poultry farming due to their ability to withstand high temperatures during pelleting processes. Furthermore, their cost-effectiveness makes them an attractive option for small-scale farmers operating on tight budgets, reinforcing their position as the largest segment in the market.

The natural feed additives segment is anticipated to register a promising CAGR of 7.78% over the forecast period owing to the rising consumer demand for organic and sustainably produced animal products. For instance, sales of organic meat and dairy products in North America have surged by 12% annually, which is driving the need for additive solutions that align with organic certification standards. The growing scrutiny of synthetic additives by regulatory bodies is also boosting the expansion of the natural feed additives segment in the global market. As per the Environmental Protection Agency, stricter guidelines on chemical residues in animal products have prompted manufacturers to explore plant-based alternatives. For instance, demonstrate that natural antioxidants like rosemary extract can extend feed shelf life while reducing oxidative stress in livestock. These benefits, coupled with growing awareness about animal welfare, position natural additives as a pivotal force in reshaping the future of the feed additives market.

COUNTRY ANALYSIS

The United States held the major share of 70.4% of the North America feed additives market share in 2024. The dominance of the U.S. in the North American region is attributed to the country's robust livestock sector, which includes some of the world's largest poultry, dairy, and beef operations. According to the USDA, the U.S. produces over 45 billion pounds of poultry meat annually, creating immense demand for specialized feed additives to maintain high productivity levels. The presence of advanced agricultural infrastructure is further propelling the growth of the United States feed additives market. For instance, more than 80% of U.S. livestock farms utilize automated feeding systems, enabling precise integration of feed additives like enzymes and probiotics. Additionally, stringent food safety regulations enforced by the FDA have accelerated the adoption of natural and eco-friendly additives, ensuring compliance with consumer expectations. These factors, combined with the country's technological prowess, cement the U.S.'s position as the undisputed leader in the regional market.

Canada is a prominent market for feed additives in North America. The strong emphasis of Canada on sustainable farming practices has positioned it as a hub for innovative additive solutions. For instance, more than 60% of livestock producers have adopted feed additives that reduce greenhouse gas emissions, aligning with national environmental goals. The thriving aquaculture industry of Canada is also aiding the expansion of the Canadian feed additives market. For instance, the Department of Fisheries and Oceans reports that Atlantic salmon farming generates over $1 billion annually, creating significant demand for marine-derived additives. Additionally, government incentives for adopting organic farming methods have spurred the use of natural additives, further bolstering the market's growth. These initiatives highlight Canada's commitment to balancing economic development with ecological responsibility.

Top Players in the Market

Cargill Incorporated

Cargill Incorporated is a global leader in the feed additives market, renowned for its innovative and sustainable solutions tailored to meet the evolving needs of livestock producers. The company’s extensive portfolio includes amino acids, enzymes, and probiotics, which are designed to enhance animal health and productivity while addressing environmental concerns. Cargill’s commitment to research and development has positioned it as a pioneer in precision nutrition technologies, enabling farmers to optimize feed formulations based on specific nutritional requirements. By fostering partnerships with agricultural stakeholders, Cargill continues to drive advancements in sustainable farming practices, reinforcing its leadership in the North America feed additives market.

BASF SE

BASF SE is a key player in the North America feed additives market, leveraging its expertise in chemical innovation to deliver high-performance solutions. The company specializes in vitamins, carotenoids, and antioxidants, which are integral to improving feed quality and livestock health. BASF’s emphasis on sustainability is evident in its development of eco-friendly additives that reduce the ecological footprint of livestock operations. Through strategic collaborations and investments in cutting-edge technologies, BASF has established itself as a trusted partner for farmers seeking to enhance productivity while adhering to stringent regulatory standards. Its focus on customer-centric solutions further strengthens its market position.

Archer Daniels Midland Company (ADM)

Archer Daniels Midland Company (ADM) is a prominent contributor to the North America Feed Additives Market, offering a diverse range of products such as amino acids, enzymes, and phytogenics. ADM’s innovative approach to animal nutrition is driven by its commitment to sustainability and food safety. The company invests heavily in R&D to develop additive solutions that address emerging challenges in livestock farming, including antibiotic resistance and environmental impact. By aligning its offerings with consumer preferences for natural and organic products, ADM has successfully expanded its footprint in the regional market, solidifying its reputation as a leader in the industry.

Top Strategies Used by The Key Market

Strategic Acquisitions and Partnerships

Key players in the North America feed additives market have prioritized strategic acquisitions and partnerships to expand their product portfolios and strengthen their market presence. By acquiring smaller firms specializing in niche additives or forming alliances with research institutions, these companies gain access to cutting-edge technologies and innovative solutions. Such collaborations enable them to address unmet needs in the livestock sector while enhancing their competitive edge. This strategy also facilitates entry into underserved markets, allowing companies to capitalize on untapped opportunities and diversify their revenue streams.

Investment in Sustainable Solutions

Sustainability has emerged as a cornerstone of competitive strategy in the feed additives market. Leading companies are investing heavily in the development of eco-friendly additives that align with regulatory requirements and consumer expectations. By focusing on reducing greenhouse gas emissions, minimizing waste, and promoting antibiotic-free farming, these players position themselves as champions of sustainable agriculture. Their commitment to environmental stewardship not only enhances brand loyalty but also ensures compliance with evolving industry standards, reinforcing their leadership in the market.

Emphasis on Research and Development

R&D is a critical driver of innovation in the North America feed additives market. Key players are channeling significant resources into exploring novel formulations and advanced delivery systems that improve feed efficiency and animal health. By staying at the forefront of technological advancements, these companies can introduce groundbreaking solutions tailored to specific livestock categories. This focus on innovation enables them to differentiate their offerings, meet the demands of modern farming practices, and maintain a strong foothold in an increasingly competitive landscape.

COMPETITION OVERVIEW

The North America feed additives market is characterized by intense competition, driven by the presence of established multinational corporations and emerging niche players. Companies strive to differentiate themselves through innovation, sustainability, and customer-centric strategies, creating a dynamic and rapidly evolving landscape. Leaders like Cargill, BASF, and ADM dominate the market by leveraging their extensive R&D capabilities and global reach to deliver high-performance solutions. At the same time, smaller firms focus on specialized products that cater to specific livestock segments or address unique challenges such as antibiotic resistance. Regulatory pressures and shifting consumer preferences further intensify competition, compelling companies to adopt sustainable practices and transparent labeling. Collaborations, mergers, and acquisitions are common strategies used to consolidate market share and expand product portfolios. This competitive environment fosters continuous innovation, ensuring that the market remains responsive to the needs of both producers and consumers.

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Cargill Incorporated launched a new line of enzyme-based feed additives designed to enhance nutrient absorption in poultry. This move aims to address growing demand for efficient feed solutions in the North American market.

- In June 2023, BASF SE partnered with a leading agricultural research institute to develop sustainable phytogenic additives. This collaboration underscores BASF’s commitment to eco-friendly innovations in animal nutrition.

- In January 2023, Archer Daniels Midland Company (ADM) acquired a startup specializing in precision nutrition technologies. This acquisition strengthens ADM’s ability to offer tailored feed formulations for livestock producers.

- In September 2022, DSM Nutritional Products introduced a range of natural antioxidants aimed at extending the shelf life of feed ingredients. This initiative aligns with consumer preferences for organic and sustainable products.

-

In November 2022, Evonik Industries expanded its production facility in the U.S. to increase the supply of amino acids and other essential additives. This expansion supports the company’s goal of meeting rising demand in the North American feed additives market.

MARKET SEGMENTATION

This research report on the North American feed additives market has been segmented and sub-segmented into the following categories.

By Type

-

Vitamins

-

Acidifiers

-

Amino acids

-

Phosphates

-

Carotenoids

-

Enzymes

-

Mycotoxin detoxifiers

-

Flavors & sweeteners

-

Antibiotics

-

Minerals

-

Antioxidants

-

Non-protein nitrogen

-

Phytogenics

-

Preservatives

-

Probiotics

By Livestock

-

Ruminants

-

Dairy

-

Beef

-

Calf

-

Goats

-

Sheep

-

-

Poultry

-

Broilers

-

Layers

-

Breeders

-

-

Swine

-

Aquatic animal

-

Others such as equine and pets

By Form

-

Dry

-

Liquid

By Source

-

Natural

-

Synthetic

By Country

-

The U.S.

-

Canada

-

Rest of North America

Frequently Asked Questions

What are feed additives and how are they used in North American livestock farming?

Feed additives are supplements included in animal feed to improve health, digestion, growth performance, and product quality. In North America, they’re widely used in poultry, swine, dairy, and aquaculture sectors to boost efficiency and meet regulatory standards.

What factors are driving the growth of the North America feed additives market?

The market is growing due to rising meat and dairy consumption, increased focus on animal welfare, demand for antibiotic alternatives, and a shift toward precision nutrition to enhance feed conversion rates.

What are the most common types of feed additives used in the region?

Popular categories include amino acids, vitamins & minerals, enzymes, probiotics, prebiotics, and acidifiers, with increasing demand for natural and functional additives that support immunity and gut health.

What challenges are impacting the feed additives industry in North America?

Key challenges include regulatory pressure on antibiotic usage, fluctuating raw material prices, consumer demand for "clean label" animal products, and the need for consistent additive performance across different feed formulations.

What future trends will shape the North American feed additives market?

The future will be shaped by innovations in gut microbiome research, customized additive blends, sustainable sourcing, and AI-driven feed optimization for better traceability and environmental compliance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com