North America Flax Seed Market Size, Share, Growth, Trends, And Forecasts Report, Segmented By Type, Application, And By Region (The USA, Canada, Mexico And Rest of North America), Industry Analysis, From (2025 to 2033)

North America Flax Seed Market Size

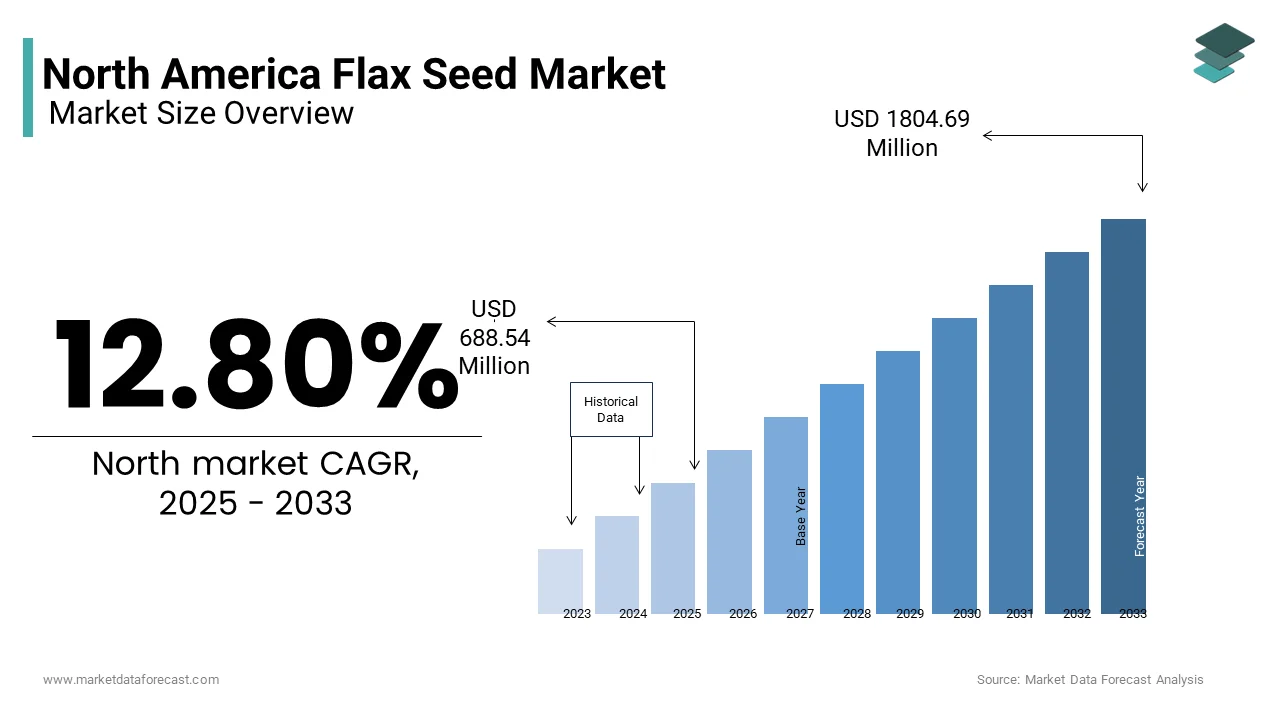

The North American flaxseed market was valued at USD 610.41 million in 2024 and is anticipated to reach USD 688.54 million in 2025 from USD 1804.69 million by 2033, growing at a CAGR of 12.80%, during the forecast period from 2025 to 2033.

MARKET DRIVERS

Rising Demand for Plant-Based Diets

The increasing adoption of plant-based diets is a key driver of the North American flaxseed market. Consumers are prioritizing plant-based foods due to their perceived health benefits and environmental sustainability. According to the Plant Based Foods Association, sales of plant-based products in the U.S. reached $8 billion in 2022. Flaxseed, being rich in omega-3 fatty acids, fiber, and protein, has become a staple ingredient in plant-based diets. Additionally, certification programs like USDA Organic and Non-GMO Project Verified have bolstered consumer trust, further propelling flaxseed adoption. Like, a significant portion of health-conscious consumers incorporate flaxseed into their daily diets, showcasing its pivotal role in driving market growth.

Growing Awareness of Health Benefits

Growing awareness of the health benefits of flaxseed has significantly contributed to the market's growth. Flaxseed is widely recognized for its ability to reduce cholesterol levels, improve heart health, and support digestive wellness. Similarly, incorporating flaxseed into diets can reduce the risk of cardiovascular diseases. This awareness has led to increased usage in food products such as bread, cereals, and smoothies. Also, flaxseed consumption grew notably in recent years, driven by endorsements from health organizations and influencers. These measures have created a favorable environment for flaxseed manufacturers, positioning them as key players in the health food industry.

MARKET RESTRAINTS

Price Volatility and Supply Chain Issues

Price volatility and supply chain disruptions pose significant restraints to the North American flaxseed market. Fluctuations in raw material costs, driven by unpredictable weather patterns and geopolitical tensions, create uncertainty for farmers and processors. Also, the average price of flaxseed increased in 2023 due to droughts in key growing regions like Saskatchewan. This price instability makes it challenging for manufacturers to maintain consistent profit margins. Besides, logistical bottlenecks, such as port congestion and transportation delays, further exacerbate the issue. Also, a notable share of flaxseed shipments faced delays in 2023, deterring buyers and slowing market growth. These financial barriers hinder accessibility and restrict market expansion.

Limited Consumer Awareness

Limited consumer awareness about the nutritional benefits and culinary uses of flaxseed presents another major restraint for the market. Many consumers, particularly in rural areas, remain unfamiliar with how to incorporate flaxseed into their diets. Like, a considerable percentage of Americans reported insufficient knowledge about flaxseed’s health benefits. This lack of awareness is compounded by inadequate marketing efforts and educational campaigns by manufacturers. Also, only a small number of grocery stores provide information on flaxseed usage, limiting its visibility. These gaps in education and communication impede the adoption of flaxseed, slowing market expansion and innovation.

MARKET OPPORTUNITIES

Expansion in Functional Food Products

The growing popularity of functional food products offers significant opportunities for the flaxseed market. Functional foods, which provide additional health benefits beyond basic nutrition, are increasingly sought after by health-conscious consumers. Manufacturers are incorporating flaxseed into a variety of products, including energy bars, beverages, and supplements. Additionally, partnerships with health organizations have enhanced consumer trust, further boosting demand. These developments exhibit the expanding role of flaxseed in supporting the functional food industry.

Adoption of Vegan and Gluten-Free Products

The rising demand for vegan and gluten-free products presents another transformative opportunity for the flaxseed market. Flaxseed serves as an excellent egg substitute in vegan baking and is naturally gluten-free, making it ideal for specialized diets. Similarly, the gluten-free product sales increased notably in recent years, with flaxseed being a preferred ingredient. Also, flaxseed improves texture and nutritional value in gluten-free baked goods, enhancing their appeal. These trends position flaxseed as a key component in catering to the dietary needs of niche consumer segments.

MARKET CHALLENGES

Competition from Alternative Ingredients

One of the primary challenges impacting the North American flaxseed market is intense competition from alternative ingredients like chia seeds, hemp seeds, and quinoa. These substitutes offer similar nutritional benefits and are often marketed as premium superfoods, posing a threat to flaxseed’s market share. Apart from these, the lack of standardized pricing strategies among flaxseed producers creates confusion among buyers, further intensifying competition. In addition, a significant portion of consumers switch between superfood options based on price and availability.

Regulatory Hurdles for Labeling and Claims

Regulatory hurdles for labeling and health claims present another critical challenge for the flaxseed market. While governments promote healthy eating, the process of obtaining approvals for health-related claims on flaxseed packaging remains stringent and time-consuming. This issue is exacerbated by inconsistent labeling standards across states, creating confusion among manufacturers and consumers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.80% |

|

Segments Covered |

By Product, Application, and Country |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country's Covered |

The United States, Canada, and the Rest of North America |

|

Market Leaders Profiled |

Simosis International, Richardson International Ltd, Sunnyville Farms Ltd, AgMotion Specialty Grains, S.S. Johnson Seeds, Cargill Inc., CanMar Grain Products Ltd, Stokke Seeds, TA Foods Ltd, and Archer Daniels Midland Company |

SEGMENTAL ANALYSIS

By Product Insights

The ground flaxseed segment dominated the North American flaxseed market by holding 65.5% of the total share in 2024. This prominence is driven by its superior digestibility and ease of incorporation into various food products. One key factor is the growing demand for functional foods. Ground flaxseed is preferred in a substantial number of health food formulations due to its enhanced nutrient absorption compared to whole flaxseed. Besides, consumer awareness about the importance of omega-3 fatty acids has bolstered their adoption. Similarly, ground flaxseed improves heart health greatly, making it a staple ingredient in cereals, smoothies, and baked goods.

The whole flaxseed segment is projected to grow at the highest CAGR of 7.8%. This rapid growth is fueled by its increasing use in pet food and animal feed applications. One significant driver is the rising trend of premium pet nutrition. Also, a significant portion of pet owners in North America now prioritize natural ingredients like whole flaxseed, which provide essential nutrients for pets. Another factor is the growing emphasis on sustainability. Also, whole flaxseed reduces feed waste notably, aligning with eco-friendly practices. These trends position whole flaxseed as a rapidly expanding segment within the market.

By Application Insights

The food application segment led the North American flaxseed market by accounting for a substantial share of the total revenue in 2024. This is attributed to the widespread use of flaxseed in health-conscious diets and functional food products. One key factor is the growing demand for plant-based proteins. Also, sales of plant-based foods grew significantly in 2022, creating steady demand for flaxseed as a versatile ingredient. Apart from these, endorsements from health organizations have bolstered consumer trust. The American Heart Association reports that flaxseed consumption reduces cholesterol levels considerably, driving its integration into bread, cereals, and snacks.

The pet food application segment is poised to be the swiftest-expanding, with a calculated CAGR of 9.2% from 2025 to 2033. This growth is driven by the increasing demand for premium and natural pet nutrition solutions. One significant factor is the rising disposable income of pet owners. Further, pet-related spending surged greatly in 2023, with flaxseed being a preferred ingredient in premium pet food formulations. Another driver is the growing awareness of pet health benefits. Like, flaxseed improves coat quality and joint health in pets, enhancing its appeal among manufacturers. These developments position pet food as a key growth driver in the flaxseed market.

COUNTRY LEVEL ANALYSIS

The United States commanded the largest share of the North American flaxseed market by contributing 45.5% of the region’s total revenue in 2024. The country’s dominance is due to its robust health food industry and strong consumer base for plant-based diets. One key factor is the increasing adoption of flaxseed in functional foods. Like, a significant share of health-conscious consumers in the U.S. incorporate flaxseed into their diets, driving steady demand. Another driver is federal funding for sustainable agriculture. Additionally, advancements in processing technologies have positioned U.S.-based companies as global leaders.

Canada is contributing majorly to the region’s total revenue in 2024. The nation’s market growth is propelled by its status as the world’s largest flaxseed producer, with Saskatchewan alone accounting for a substantial share of production. One significant factor is the growing export demand. Another driver is the government’s commitment to reducing carbon emissions. Like, flaxseed farming reduces greenhouse gas emissions considerably, aligning with sustainability goals. These initiatives position Canada as a key contributor to the market.

The Rest of North America is contributing to the regional market. The segment’s growth is fueled by the increasing adoption of flaxseed in small-scale farming and urban health food stores. One key factor is Mexico’s investment in rural farming projects, where flaxseed is used to improve soil fertility. Another driver is the region’s focus on combating malnutrition, prompting the use of flaxseed in fortified food products.

KEY MARKET PLAYERS

Simosis International, Richardson International Ltd, Sunnyville Farms Ltd, AgMotion Speciality Grains, S.S.S Johnson Seeds, Cargill Inc., CanMarAr Grain Products Ltd, Stokke Seeds, TA Foods Ltd, and Archer Daniels Midland Company. They are the market leaders that are dominating the North American flaxseed market.

Top Players In The Market

Archer Daniels Midland Company (ADM)

Archer Daniels Midland Company (ADM) is a leading player in the North American flaxseed market, renowned for its vertically integrated supply chain and innovative processing technologies. The company focuses on producing high-quality ground flaxseed for food applications, catering to health-conscious consumers. Additionally, the company expanded its partnerships with farmers in Saskatchewan to ensure sustainable sourcing practices.

Bunge Limited

Bunge Limited specializes in flaxseed processing and distribution, offering products tailored for both human consumption and animal feed. Known for its commitment to quality, Bunge has introduced advanced milling technologies to enhance the digestibility of ground flaxseed. The company also invested in research to improve crop yields and reduce environmental impact. These efforts have solidified Bunge’s reputation as a reliable provider in the flaxseed industry.

Richardson International

Richardson International is a key innovator in the flaxseed market, focusing on exports and value-added products. Its flaxseed offerings are widely used in functional foods and bakery products due to their superior nutritional profile. The company also collaborated with Canadian universities to conduct field trials on drought-resistant flaxseed varieties, ensuring product reliability.

Top Strategies Used By Key Market Participants

Key players in the North American flaxseed market employ strategies such as vertical integration, innovation, and sustainability to strengthen their positions. Companies like ADM and Bunge focus on developing advanced processing technologies to enhance product quality and meet consumer demands for organic and non-GMO products. Strategic alliances with farmers and universities help expand their reach across diverse applications. Richardson emphasizes consumer education, targeting urban markets through awareness campaigns. Another common strategy is investing in R&D to improve crop resilience and yield. These approaches collectively drive growth and competitiveness in the flaxseed market.

Competition Overview

The North American flaxseed market is highly competitive, driven by innovation, regulatory compliance, and diverse applications across industries. Leading players like ADM, Bunge, and Richardson International dominate the landscape, each targeting specific niches such as functional foods, pet nutrition, and sustainable farming. The competitive environment is further intensified by the entry of new startups and the adoption of disruptive technologies like precision agriculture. Regulatory frameworks also play a pivotal role, with companies striving to comply with organic certification standards while innovating within constraints. Collaborations with research institutions and government bodies provide a competitive edge, fostering innovation. Additionally, price differentiation and feature customization are common tactics to capture market share.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, ADM launched a line of USDA Organic-certified flaxseed products, targeting premium health food markets and enhancing its brand visibility.

- In June 2023, Bunge partnered with pet food manufacturers to incorporate flaxseed into premium pet nutrition products, broadening its application base.

- In August 2023, Richardson International conducted field trials in collaboration with Canadian universities to develop drought-resistant flaxseed varieties, ensuring product reliability.

- In October 2023, ADM expanded its partnerships with Saskatchewan farmers to promote sustainable sourcing practices, reinforcing its supply chain capabilities.

- In December 2023, Richardson launched a marketing campaign to educate urban consumers about the health benefits of flaxseed, improving adoption rates and brand loyalty.

MARKET SEGMENTATION

This research report on the North American flax seed market is segmented and sub-segmented into the following categories.

By Product

- Milled (Ground) Flaxseed

- Whole Flaxseed

- and Flaxseed Oil

By Application

- Food

- Bakery Products & Cereals

- Energy Bars

- Flaxseed Meal Powders

- Supplements, Flour

- Animal Food

- Others

By Country

- The USA

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

What is flax seed and why is it in demand in North America?

Flax seed is a nutrient-dense superfood known for its high omega-3 fatty acid, fiber, and lignan content. Its demand is rising in North America due to increased consumer focus on plant-based, heart-healthy, and functional foods.

Which sectors are driving flax seed consumption in North America?

Key demand comes from the food & beverage industry (in bakery, cereals, smoothies), followed by nutraceuticals, personal care, and even pet food—reflecting flax seed's versatility and health positioning.

What are the main challenges facing the flax seed market in North America?

Major hurdles include fluctuations in crop yields due to climate variability, limited consumer awareness beyond niche health markets, and competition from other seeds like chia and hemp.

How are sustainability and organic trends impacting the flax seed industry?

The organic flax segment is growing rapidly, driven by clean-label demand, environmentally-conscious farming, and interest in non-GMO and chemical-free nutrition options.

What’s the outlook for the flax seed market in North America over the next 5 years?

The market is set to expand steadily with increased product innovation (like flax milk and protein powder), growth in vegan nutrition, and stronger integration into mainstream grocery and wellness channels.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com