North America Medical Gloves Market Size, Share, Trends & Growth Forecast Report By Product (Latex Gloves, Nitrile Gloves, Vinyl Gloves, Neoprene Gloves, Other Product Types), Form (Powder-free Gloves, Powdered Gloves), Application (Examination, Surgical, Dental, Food Processing, Cleanroom, Other Applications), Usage (Disposable Gloves, Reusable Gloves), Sterility, Distribution Channel, End-use, and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Medical Gloves Market Size

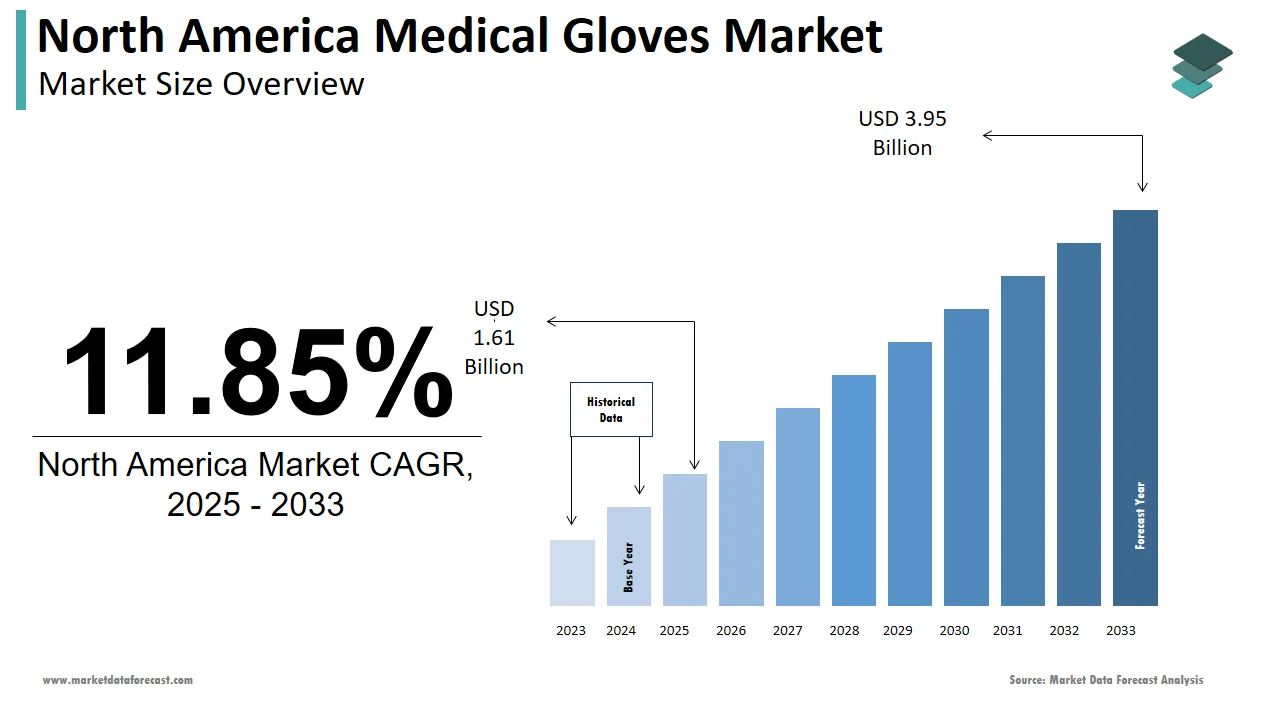

The size of the medical gloves market in North America was valued at USD 1.44 billion in 2024. This market is expected to grow at a CAGR of 11.85% from 2025 to 2033 and be worth USD 3.95 billion by 2033 from USD 1.61 billion in 2025.

The North America medical gloves market is a cornerstone of infection control and safety protocols in healthcare settings, witnessing unprecedented growth driven by heightened awareness of hygiene standards. The Centers for Disease Control and Prevention (CDC) estimates that over 1.7 million healthcare-associated infections (HAIs) occur annually in the U.S. emphasizing the critical need for protective gloves. Canada with its publicly funded healthcare system has also seen steady adoption, supported by government initiatives to enhance infection prevention measures. As per Deloitte, the demand for nitrile gloves surged by 40% post-pandemic due to latex allergies and superior durability. Moreover, advancements in glove manufacturing technologies have expanded their applications beyond healthcare into sectors like food processing and cleanroom environments. A report by McKinsey shows that the global emphasis on sustainability is driving innovation in biodegradable gloves, further shaping the market landscape.

MARKET DRIVERS

Surge in Healthcare-Associated Infections (HAIs)

The rising incidence of healthcare-associated infections (HAIs) is a primary driver propelling the North America medical gloves market forward. According to the CDC, HAIs affect nearly 4% of hospitalized patients annually leading to prolonged hospital stays and increased healthcare costs. This alarming statistic underscores the critical role of medical gloves in preventing cross-contamination and ensuring patient safety. Furthermore, as per a study by the World Health Organization (WHO), proper use of gloves reduces the risk of HAIs by up to 30% is making them indispensable in clinical settings. The aging population, projected to reach 22% of the U.S. population by 2030, exacerbates this demand, as older adults are more susceptible to infections. Additionally, a report by BCG notes that the growing number of outpatient surgeries, which require stringent infection control measures, has amplified glove usage. These factors collectively shows the growing reliance on medical gloves, fueling market expansion.

Stringent Regulatory Standards

Stringent regulatory standards governing healthcare safety protocols represent another significant driver shaping the North America medical gloves market. The Occupational Safety and Health Administration (OSHA) mandates the use of gloves in all high-risk environments to prevent exposure to bloodborne pathogens is driving widespread adoption across healthcare facilities. Based on a study by PwC, over 90% of hospitals in the U.S. comply with these regulations creating a strong demand for high-quality gloves. These regulations not only enhance product quality but also increase consumer trust, particularly in non-healthcare sectors such as food processing and cleanroom environments. The shift towards value-based care models further amplifies the need for reliable gloves that align with patient safety goals, driving sustained market growth.

MARKET RESTRAINTS

Supply Chain Disruptions

Supply chain disruptions have emerged as a significant restraint impacting the North America medical gloves market, particularly during periods of heightened demand. A report by McKinsey reveals that over 60% of medical gloves are manufactured in Southeast Asia is making the supply chain vulnerable to geopolitical tensions and logistical bottlenecks. The COVID-19 pandemic spotlighted these vulnerabilities, with manufacturers experiencing delays of up to six months in securing raw materials. Besides these, as per a study by Deloitte, fluctuations in raw material prices such as nitrile and latex have increased production costs by 25% which is impacting profitability. These disruptions not only hinder timely delivery of gloves but also limit the ability to scale production during crises. Strengthening domestic manufacturing capabilities and diversifying supplier networks are essential to mitigate these risks. However, achieving these goals requires significant investment and collaboration across the industry.

Environmental Concerns

Environmental concerns associated with the disposal of medical gloves pose another major restraint to market growth. According to a study by the Environmental Protection Agency (EPA), over 300 million pounds of medical waste including disposable gloves are generated annually in the U.S. alone. The majority of these gloves are made from non-biodegradable materials, contributing to landfill accumulation and environmental degradation. Also, as per a report by Greenpeace, public awareness of plastic pollution has led to increased scrutiny of single-use products involving gloves. This trend is compounded by regulatory pressures, with states like California introducing bans on non-recyclable medical products. While manufacturers are exploring alternatives such as biodegradable gloves, these innovations often come at a higher cost limiting widespread adoption. Addressing these environmental challenges requires a balanced approach that prioritizes sustainability without compromising affordability.

MARKET OPPORTUNITIES

Expansion into Non-Medical Sectors

The growing demand for medical gloves in non-medical sectors presents a transformative opportunity for the North America market. The U.S. Department of Agriculture (USDA) mandates the use of gloves in food handling to prevent contamination, driving adoption in this sector. These industries require specialized gloves with low particle generation and chemical resistance, creating a niche market for manufacturers. By diversifying their product portfolios to cater to these sectors, glove manufacturers can unlock substantial growth potential and reduce dependency on traditional healthcare markets.

Innovation in Sustainable Materials

The development of sustainable materials for medical gloves offers a lucrative opportunity for the North America market. According to a study by Accenture, over 70% of consumers prefer eco-friendly products signaling a shift towards sustainable healthcare solutions. Manufacturers are responding by investing in biodegradable and recyclable materials e.g. plant-based latex and synthetic polymers. A report by PwC shows that gloves made from these materials can reduce environmental impact by up to 50% appealing to environmentally conscious buyers. Apart from these, as per a study by BCG, regulatory incentives for sustainable products such as tax breaks and subsidies, further encourage innovation. The growing emphasis on corporate social responsibility (CSR) has also prompted healthcare providers to adopt green procurement practices, creating a strong demand for sustainable gloves. By leveraging these trends, manufacturers can position themselves as leaders in eco-friendly healthcare solutions.

MARKET CHALLENGES

Price Volatility of Raw Materials

Price volatility of raw materials, such as latex and nitrile, poses a significant challenge to the North America medical gloves market. As indicated in a study by KPMG, fluctuations in global rubber prices have increased production costs by 30% over the past two years impacting profit margins. This volatility is exacerbated by geopolitical tensions and natural disasters, which disrupt supply chains and drive up prices. On top of that, as per a report by Deloitte, manufacturers face difficulties in passing these costs onto consumers, particularly in price-sensitive markets like food processing and cleanroom environments. Smaller companies, with limited financial resources, are disproportionately affected, often struggling to maintain competitive pricing. Addressing this challenge requires strategic investments in alternative materials and long-term supplier contracts to stabilize costs. Without mitigating these risks the market risks losing competitiveness and stifling innovation.

Resistance to Biodegradable Alternatives

Resistance to biodegradable alternatives represents another major challenge for the North America medical gloves market. Despite growing environmental awareness, many healthcare providers remain hesitant to adopt biodegradable gloves due to concerns about performance and durability. In line with a study by the American Medical Association (AMA), over 60% of healthcare professionals cite inferior quality as a barrier to switching from traditional gloves. These factors are compounded by regulatory uncertainties, as existing standards do not adequately address the unique properties of biodegradable materials. Overcoming these barriers requires targeted educational campaigns and partnerships between manufacturers and healthcare institutions to demonstrate the efficacy and cost-effectiveness of sustainable alternatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Form, Application, Usage, Sterility, Distribution Channel, End-use, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico and Rest of North America. |

|

Market Leaders Profiled |

Akzenta International S.A., Ansell Limited, Berner International GmbH, Cardinal Health, Inc., Erenler Medikal, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd., Leboo Healthcare Products Limited, Medline Industries, Inc., Robinson Healthcare, Rubberex Corp M Berhad, Semperit AG Holding, SHIELD Scientific, Sun Healthcare Sdn Bhd (Adventa Berhad), Supermax Corporation Berhad, Top Glove Corporation Berhad, and others. |

SEGMENTAL ANALYSIS

By Product Insights

The nitrile gloves segment dominated the North America medical gloves market by capturing 50.7% of the total market share in 2024. This influence in the market is credited to their superior durability and resistance to chemicals, making them ideal for high-risk environments. According to the FDA, nitrile gloves are less likely to cause allergic reactions compared to latex, further enhancing their appeal. The surge in demand for nitrile gloves was particularly evident during the pandemic, with sales increasing by 40%, as per a study by Deloitte. As well as, advancements in manufacturing technologies have reduced production costs are making nitrile gloves more affordable. These factors reinforce the prominence of nitrile gloves as the largest segment in the market.

The neoprene gloves segment is the fastest-growing segment, with a projected CAGR of 12.7% from 2025 to 2033. This growth is fueled by their unique properties, such as flexibility and resistance to oils and solvents making them ideal for specialized applications. To add to this, as per a report by PwC, the growing emphasis on ergonomic design has enhanced user comfort, driving adoption. These dynamics position neoprene gloves as the fastest-growing segment in the market.

By Form Insights

The powder-free gloves category represented the biggest segment in the North America medical gloves market by accounting for huge portion of the total market share in 2024. This dominance is due to their hypoallergenic properties and compliance with regulatory standards. The FDA via its examination suggested that powdered gloves were banned in 2016 due to health risks, driving widespread adoption of powder-free alternatives. Furthermore, as per a study by BCG, advancements in surface treatment technologies have improved grip and durability, enhancing their appeal. Hospitals and clinics are increasingly investing in these systems to ensure patient safety and operational efficiency reinforcing their position as the largest segment.

The powder-free gloves are also the rapidly advancing segment, with a calculted CAGR of 10.8% in the coming years. This progress is caused by the increasing emphasis on hygiene and safety in non-medical sectors, such as food processing. A study by PwC notes that powder-free gloves reduce contamination risks by 25%, attracting widespread adoption. These dynamics position powder-free gloves as the fastest-growing segment in the market.

By Application Insights

The examination gloves segment led the North America medical gloves market, accounting for 60.8% share in 2024. This authority over the market is attributed to their widespread use in routine medical procedures such as patient examinations and vaccinations. In line with the CDC, examination gloves are mandatory in all healthcare settings to prevent cross-contamination emphasizing their importance. In support of this, as per a study by Deloitte, advancements in glove design such as textured surfaces and improved fit have enhanced user experience, driving adoption. These factors reinforce the prominence of examination gloves as the largest segment in the market.

The surgical gloves segment is rising quickly in this market, with an estimated CAGR of 11.7% from 2025 to 2033. This development is associated with the increasing number of surgeries, particularly outpatient procedures, which require stringent infection control measures. Beyond this, as per a report by PwC, innovations in sterility assurance and tactile sensitivity have enhanced their appeal, driving demand. These dynamics position surgical gloves as the fastest-growing segment in the market.

By Usage Insights

The disposable gloves segment secure the maximum portion in the North America medical gloves market by contributing a substantial portion in the total market share in 2024. This pre-eminence is linked to their widespread use in healthcare and non-healthcare settings, where hygiene and safety are paramount. According to the Environmental Protection Agency (EPA), disposable gloves are preferred due to their single-use nature by reducing the risk of cross-contamination. As an additional point, as per a study by BCG, advancements in material science have improved durability and comfort enhancing their appeal. Hospitals and clinics are increasingly investing in these systems to ensure compliance with regulatory standards strengthening their position as the largest segment.

The swiftest advancing segment in the market is reusable gloves with a projected CAGR of 9.5% over the forecast period owing to the growing emphasis on sustainability and cost-effectiveness, particularly in industrial applications. A study by PwC states that reusable gloves reduce waste by 50% attracting widespread adoption. These dynamics position reusable gloves as the fastest-growing segment in the market.

COUNTRY LEVEL ANALYSIS

The U.S. remains the undisputed leader in the North American medical gloves market by accounting for 79.4% share of the region’s total consumption in 2024. This control over the market is supported by its advanced healthcare infrastructure and stringent regulatory frameworks governing infection control. Furthermore, as per Deloitte, the post-pandemic surge in glove usage has solidified the U.S. as a key driver of innovation, with manufacturers investing heavily in nitrile and biodegradable alternatives. The aging population, projected to reach 22% by 2030 enhances even more this demand as older adults require more frequent medical interventions. Additionally, as per McKinsey, the expansion of outpatient surgeries and non-medical applications like food processing has diversified the market landscape, ensuring sustained growth.

Canada is experiencing steady growth in the North America medical gloves market. While its publicly funded healthcare system presents unique challenges including slower adoption rates government initiatives have spurred steady growth. The Statistics Canada states that healthcare spending increased by 5% in 2022 signaling growing interest in advanced gloves. In addition, regulatory bodies like Health Canada have introduced stricter guidelines for glove manufacturing ensuring compliance with safety standards. The country’s focus on preventive care and infection control has also fueled adoption, particularly in hospitals and clinics. These factors collectively position Canada as a steadily growing contributor to the regional market.

Mexico stands out as the fastest-growing market in North America medical gloves market. The country’s healthcare system is undergoing significant reforms, with private providers increasingly adopting gloves to enhance patient safety. According to INEGI, healthcare expenditure grew by 6% in 2022, reflecting rising demand for protective equipment. The Mexican government’s push for universal healthcare coverage has further accelerated adoption, particularly in rural areas. These developments underscore Mexico’s emerging role in the regional market.

KEY MARKET PLAYERS

A few of the notable companies operating in the North America medical gloves market profiled in this report are Akzenta International S.A., Ansell Limited, Berner International GmbH, Cardinal Health, Inc., Erenler Medikal, Hartalega Holdings Berhad, Kossan Rubber Industries Bhd., Leboo Healthcare Products Limited, Medline Industries, Inc., Robinson Healthcare, Rubberex Corp M Berhad, Semperit AG Holding, SHIELD Scientific, Sun Healthcare Sdn Bhd (Adventa Berhad), Supermax Corporation Berhad, Top Glove Corporation Berhad, and others.

TOP LEADING PLAYERS IN THE MARKET

Ansell Limited

Ansell Limited is a prominent player in the North America medical gloves market, renowned for its innovative and reliable products tailored to diverse applications. The company’s strengths lie in its ability to deliver high-performance gloves, such as nitrile and neoprene variants, which cater to both healthcare and industrial sectors. Ansell’s commitment to sustainability is evident in its development of biodegradable gloves, aligning with global environmental trends. Its extensive distribution network and strategic partnerships with healthcare institutions further strengthen its leading position. Ansell’s focus on ergonomic design and antimicrobial coatings has enhanced user comfort and safety, making it a trusted brand worldwide.

Top Glove Corporation Berhad

Top Glove Corporation Berhad is a key contributor to the North America medical gloves market, offering a comprehensive range of products that meet stringent quality standards. The company’s strengths include its scalable production capabilities and robust customer support services. Top Glove’s focus on innovation has enabled the development of gloves with superior chemical resistance and durability, appealing to high-risk environments. Its strategic investments in automation and sustainable manufacturing practices have positioned it as a leader in cost-effective and eco-friendly solutions. Top Glove’s global presence and reputation for reliability make it a preferred partner for healthcare providers.

Hartalega Holdings Berhad

Hartalega Holdings Berhad is a leading player in the North America medical gloves market, known for its cutting-edge technologies and user-centric designs. The company’s strengths lie in its ability to deliver customizable solutions that cater to the unique needs of healthcare providers. Hartalega’s emphasis on sustainability has resulted in the development of gloves made from renewable materials, appealing to environmentally conscious buyers. Its strategic collaborations with research institutions have expanded its reach, enabling it to address the growing demand for advanced gloves. Hartalega’s commitment to innovation and quality ensures its prominence in the global market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

Key players in the North America medical gloves market employ several strategies to maintain their competitive edge. Strategic acquisitions are a common approach, allowing companies to expand their product portfolios and enter new markets. Partnerships with technology firms, particularly those specializing in sustainable materials, are also prevalent, enabling the development of eco-friendly gloves. Additionally, investments in research and development drive innovation, ensuring compliance with evolving regulatory standards. Companies also focus on enhancing customer engagement through training programs and support services.

COMPETITION OVERVIEW

The North America medical gloves market features fierce competition, with many players competing for share. Established companies leverage their extensive networks and technological expertise to maintain dominance, while emerging players focus on niche markets to differentiate themselves. The market is witnessing a wave of consolidation, with mergers and acquisitions becoming increasingly common. Additionally, the growing emphasis on sustainability has intensified competition, as companies strive to offer innovative solutions that meet the evolving needs of healthcare providers. This dynamic landscape underscores the importance of strategic differentiation and continuous innovation.

TOP 5 MAJOR ACTIONS TAKEN BY COMPANIES

- In April 2024, Ansell Limited launched a new line of biodegradable gloves, enhancing its sustainability portfolio and appealing to environmentally conscious buyers.

- In June 2023, Top Glove Corporation Berhad partnered with a research institution to develop gloves with antimicrobial coatings, improving user safety and compliance.

- In January 2024, Hartalega Holdings Berhad introduced a range of ergonomic gloves designed for cleanroom environments, addressing the growing demand for precision and contamination control.

- In September 2023, Medline Industries acquired a startup specializing in sustainable glove materials, strengthening its position in the eco-friendly healthcare segment.

- In November 2023, Cardinal Health collaborated with a technology firm to integrate smart sensors into gloves, enabling real-time monitoring of contamination risks.

MARKET SEGMENTATION

This research report on the North America medical gloves market is segmented and sub-segmented into the following categories.

By Product

- Latex gloves

- Nitrile gloves

- Vinyl gloves

- Neoprene gloves

- Others

By Form

- Powder-free gloves

- Powdered gloves

By Application

- Examination

- Surgical

- Dental

- Food processing

- Cleanroom

- Others

By Usage

- Disposable gloves

- Reusable gloves

By Sterility

- Sterile gloves

- Non-sterile gloves

By Distribution Channel

- Brick and mortar

- E-commerce

By End-use

- Hospitals

- Clinics

- Ambulatory surgical centers

- Diagnostic centers

- Others

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What is the projected growth of the North America medical gloves market from 2025 to 2033?

The North America medical gloves market is expected to grow at a compound annual growth rate (CAGR) of 11.85% from 2025 to 2033, reaching USD 3.95 billion by 2033 from USD 1.61 billion in 2025.

2. What are the primary factors driving the growth of the medical gloves market in North America?

The rising incidence of healthcare-associated infections (HAIs) and stringent regulatory standards governing healthcare safety protocols are key drivers propelling the North America medical gloves market forward.

3. Which segment dominate the North America medical gloves market?

The nitrile gloves segment dominated the market in 2024, capturing 50.7% of the total market share.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]