North America Mobile Wallet Market Size, Share, Trends & Growth Forecast Report By Technology (Proximity Technology, Remote Technology), Application and Country (The United States, Canada and Rest of North America), Industry Analysis From 2025 to 2033

North America Mobile Wallet Market Size

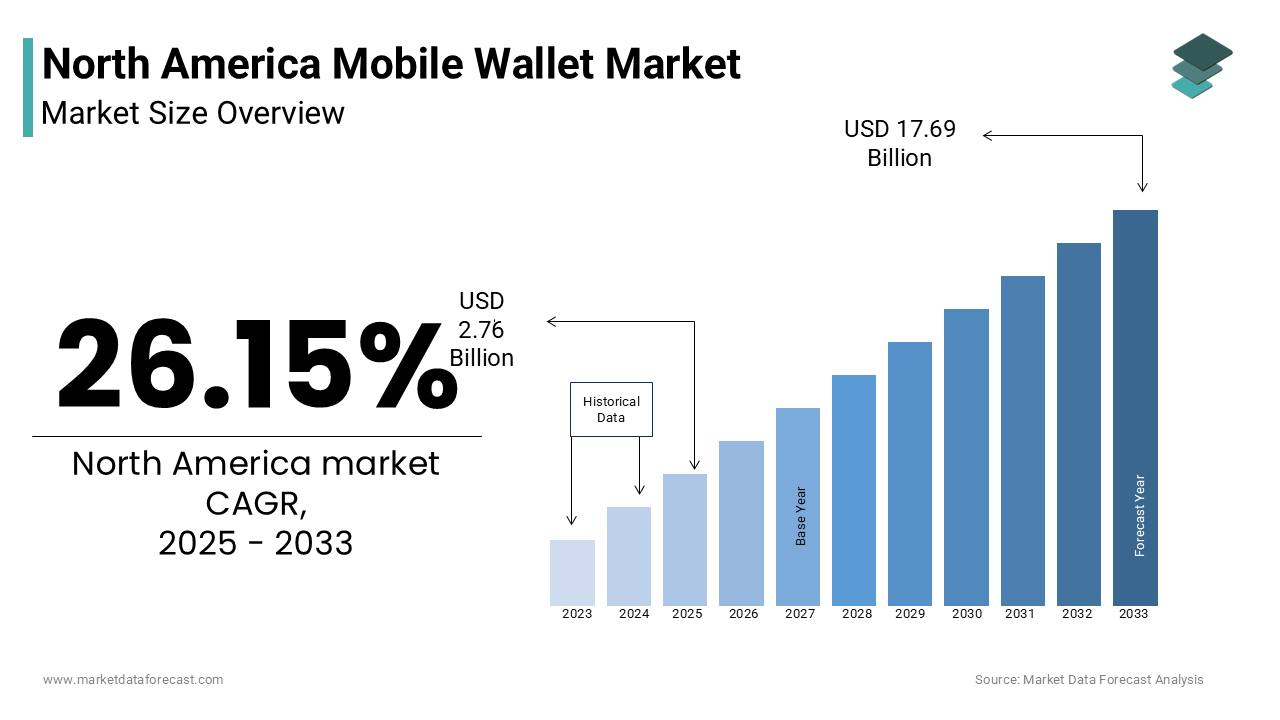

The North America Mobile Wallet Market was worth USD 2.19 billion in 2024. The North American market is expected to reach USD 17.69 billion by 2033 from USD 2.76 billion in 2025, rising at a CAGR of 26.15% from 2025 to 2033.

The North America mobile wallet market refers to the digital ecosystem that enables users to store payment credentials, loyalty cards, coupons, and identification documents on their smartphones or wearable devices for seamless transactions. Also, this market has evolved into a critical component of the region's financial infrastructure, driven by advancements in Near Field Communication (NFC), QR code technology, and secure element-based authentication systems.

Apple Pay and Google Pay dominate the platform landscape, with combined usage surpassing 70% among active mobile wallet users. Additionally, the integration of biometric security features such as fingerprint scanning and facial recognition has significantly enhanced user trust in mobile payment systems. These developments underline the growing sophistication and reliability of mobile wallet solutions across North America, positioning them as central tools in the shift toward a cashless economy.

MARKET DRIVERS

Rising Adoption of Contactless Payment Technologies

One of the primary drivers fueling the North America mobile wallet market is the widespread acceptance and use of contactless payment technologies. Consumers increasingly prefer quick, secure, and hygienic transaction methods, especially in the wake of the global health crisis. This trend is further supported by the expansion of NFC-enabled point-of-sale (POS) terminals across major retailers and small businesses alike.

This infrastructure development has enabled greater compatibility between mobile wallets and merchant systems, encouraging wider consumer participation. Additionally, companies like Starbucks and McDonald's have integrated mobile wallet functionality directly into their apps, enhancing convenience and driving daily usage. So, the adoption of contactless mobile wallet solutions is expected to grow steadily in the coming years.

Expansion of Digital Banking and Financial Inclusion Initiatives

The next key driver shaping the North America mobile wallet market is the rapid expansion of digital banking services and financial inclusion efforts aimed at unbanked and underbanked populations. Traditional banks and fintech startups alike are integrating mobile wallet functionalities into their platforms to offer accessible, low-cost financial services.

Chime, Revolut, and PayPal have emerged as dominant players offering mobile-first financial tools, including virtual debit cards, instant money transfers, and budgeting features. According to Cornerstone Advisors, nearly 20 million Americans opened a digital-only bank account in 2023, with most relying on integrated mobile wallets for daily transactions. In Canada, as reported by Payments Canada, mobile wallet-linked accounts grew by 18% in 2023, particularly among younger demographics and rural communities. Furthermore, government-backed initiatives such as the Canadian Digital ID Strategy aim to enhance digital identity verification, enabling broader access to mobile wallet services without the need for physical documentation.

MARKET RESTRAINTS

Persistent Consumer Concerns Over Data Security and Privacy

Despite the rapid growth of the North America mobile wallet market, one significant restraint remains persistent consumer skepticism regarding data security and privacy. A 2023 survey found that 34% of American consumers are hesitant to adopt mobile wallets due to fears of data breaches and identity theft. Given the rise in cyberattacks targeting financial institutions and digital platforms, users remain wary about storing sensitive financial information on their smartphones.

This concern is further compounded by regulatory scrutiny surrounding data handling practices. For instance, California’s Consumer Privacy Act (CCPA) and similar legislation in other states have imposed stringent requirements on how companies collect, store, and share personal data. While these laws are designed to protect users, they also create compliance challenges for mobile wallet providers, slowing down innovation and service rollouts. As per IBM’s Cost of a Data Breach Report 2023, the average cost of a data breach in the financial services sector reached $5.90 million in North America, reinforcing the economic risks associated with digital payment platforms. Besides, high-profile incidents such as the 2022 breach affecting over 80,000 Apple Wallet users have heightened public awareness of potential vulnerabilities.

Fragmentation in Payment Infrastructure and Compatibility Issues

A major challenge impeding the seamless growth of the North America mobile wallet market is the fragmentation of payment infrastructure and lack of universal compatibility across different platforms and merchants. Despite the proliferation of mobile wallet services such as Apple Pay, Google Pay, Samsung Pay, and various proprietary apps from financial institutions, interoperability remains limited.

Moreover, regional disparities in payment processing standards contribute to this fragmentation. While NFC-based payments are widely accepted in urban centers like New York, Toronto, and San Francisco, smaller towns and independent retailers often rely on older magnetic stripe readers or chip-based systems incompatible with mobile wallets. Additionally, varying tokenization protocols and backend banking integrations make it difficult for consumers to switch seamlessly between different mobile wallet providers. This lack of uniformity discourages widespread adoption, particularly among older consumers and small business owners who perceive mobile wallets as complex or unreliable.

MARKET OPPORTUNITIES

Integration with Embedded Finance and Super App Ecosystems

A most promising opportunity for the North America mobile wallet market lies in its integration with embedded finance and the emergence of super app ecosystems. Embedded finance allows non-financial platforms—such as ride-hailing services, food delivery apps, and social media networks to offer financial services directly within their interfaces.

Super apps, which consolidate multiple services into a single platform, are gaining traction in North America despite being more prevalent in Asia. Companies like Uber, Shopify, and even TikTok are exploring ways to embed mobile wallet functions for payments, peer-to-peer transfers, and microloans. Additionally, partnerships between fintech firms and tech giants are accelerating this trend. For example, Shopify’s collaboration with Affirm enables users to make BNPL (Buy Now, Pay Later) purchases through its integrated mobile wallet system. These developments highlight how embedded finance and super app models are unlocking new revenue streams and user engagement avenues for mobile wallet providers across North America.

Expansion of Loyalty Programs and Personalized Offers via Mobile Wallets

A compelling opportunity for the North America mobile wallet market is the growing integration of loyalty programs, personalized offers, and digital coupons within mobile wallet applications. Retailers and brands are leveraging mobile wallets as a centralized hub for customer engagement, moving beyond simple transactional utility to become comprehensive marketing tools. According to McKinsey & Company, a significant share of North American consumers are more likely to return to a brand if it provides personalized digital offers through a mobile wallet or app.

Major retailers such as Walmart, Target, and CVS have expanded their digital loyalty ecosystems to include mobile wallet integration, allowing users to automatically apply discounts at checkout. This shift not only enhances customer retention but also drives incremental spending. For instance, Starbucks’ mobile wallet platform, which combines payments with its loyalty program, accounted for over 25% of the company’s total U.S. transactions in 2023, according to its annual investor report. Similarly, Apple Wallet and Google Pay have introduced features that allow users to store and redeem branded offers in real time.

MARKET CHALLENGES

Regulatory Complexity Across Jurisdictions

A foremost challenge for the North America mobile wallet market is the complexity of navigating a multi-layered regulatory environment spanning federal, state, and provincial jurisdictions. Unlike countries with centralized financial oversight, the U.S. and Canada operate under fragmented legal frameworks that impose varying compliance obligations on mobile wallet providers. For instance, in the U.S., financial technology companies must contend with regulations from the Consumer Financial Protection Bureau (CFPB), Office of the Comptroller of the Currency (OCC), and state-level money transmitter laws, each with differing licensing and reporting requirements.

In Canada, while federal bodies such as the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) oversee anti-money laundering (AML) compliance, provinces like British Columbia and Quebec maintain additional regulatory nuances. In line with the Payments Canada, compliance-related expenses for mobile wallet providers increased in 2023 due to evolving Know Your Customer (KYC) and data localization mandates. Furthermore, cross-border operations between the U.S. and Canada require adherence to distinct tax and remittance rules, complicating the scalability of mobile wallet services.

Competition from Alternative Payment Methods and Cryptocurrencies

An escalating challenge for the North America mobile wallet market is the growing competition from alternative payment methods and decentralized finance (DeFi) solutions such as cryptocurrencies and stablecoins. As digital payment ecosystems diversify, consumers are increasingly adopting options like Buy Now, Pay Later (BNPL), direct bank transfers, and crypto-based transactions that bypass traditional mobile wallet infrastructures. According to PYMNTS Intelligence, 28% of U.S. consumers used cryptocurrency for at least one online purchase in 2023, marking a 12% increase from the prior year.

Companies like PayPal and Square have introduced crypto wallets, allowing users to convert digital assets into fiat currency for everyday transactions, thereby reducing reliance on conventional mobile wallets. Moreover, the rise of decentralized applications (dApps) built on blockchain platforms such as Ethereum and Solana enables peer-to-peer transactions without intermediaries, posing a disruptive threat to centralized mobile wallet providers. Moreover, emerging payment rails like FedNow in the U.S. and Real-Time Rail (RTR) in Canada offer instant fund transfers directly between banks, diminishing the perceived necessity of mobile wallet intermediation.

SEGMENTAL ANALYSIS

By Technology Insights

The proximity technology remained the dominant segment in the North America mobile wallet market by accounting for 65.2% of total revenue share in 2024. This dominance is primarily driven by the widespread adoption of Near Field Communication (NFC) and QR code-based payment systems across retail, hospitality, and transit sectors.

One key driver of this segment’s growth is the rapid deployment of NFC-enabled point-of-sale infrastructure. Like, over 70% of U.S. merchants in 2023 now support NFC payments, up from just 35% in 2019. Additionally, major retailers like Target, Walmart, and Starbucks have integrated mobile wallet features into their apps, enabling seamless tap-to-pay experiences. In Canada, as reported by Payments Canada, proximity-based mobile wallet usage grew by 24% in 2023 , particularly in urban centers where transit systems such as Toronto’s Presto and New York’s OMNY have incorporated mobile wallet integration for fare payments.

Remote technology is emerging as the fastest-growing segment within the North America mobile wallet market, projected to expand at a CAGR of 16.8% from 2025 to 2033, outpacing proximity-based solutions. This segment includes mobile wallets used for online transactions via mobile browsers or apps without requiring physical device interaction at the point of sale.

A major factor driving this segment is the surge in online shopping and digital content consumption. According to Adobe Analytics, U.S. e-commerce spending hit an all-time high of $950 billion in 2023, with mobile devices contributing to nearly 45% of all transactions. Apple Pay and Google Pay have significantly expanded their remote capabilities, allowing users to make secure online purchases without re-entering card details. Furthermore, the integration of mobile wallets into BNPL platforms like Affirm and Klarna has accelerated remote transaction volumes.

By Application Insights

The retail and e-commerce continue to outperform other application areas, capturing over 58% of total transaction volume in 2024, underscoring the sector’s pivotal role in shaping digital wallet monetization models. This dominance is largely attributed to the increasing shift toward digital shopping habits and the integration of mobile wallets into leading e-commerce platforms such as Amazon, Shopify, and eBay. As per Digital Commerce 360, U.S. e-commerce sales surpassed $1 trillion in 2023, with mobile-driven transactions accounting for more than half of that total, many of which were facilitated through mobile wallet integrations.

Major retail chains are enhancing customer convenience by embedding mobile wallet functionality directly into their loyalty programs and checkout processes. Additionally, mobile wallet providers like Apple Pay and PayPal have introduced one-click checkout options, reducing cart abandonment rates significantly, as noted by Baymard Institute. In Canada, Shopify’s partnership with mobile wallet providers enabled over 1.2 million small businesses to accept mobile wallet payments online, further expanding the reach of this segment.

Hospitality and transportation are emerging as the fastest-growing application segments in the North America mobile wallet market, projected to grow at a CAGR of 18.4% in the forecast period. This growth is primarily fueled by the increasing digitization of travel and hospitality services, including mobile check-ins, ticketless boarding, and contactless hotel payments.

Airline giants like Delta, United, and Air Canada have rolled out mobile wallet-compatible boarding passes and loyalty program integrations, improving user experience and operational efficiency. As per Airlines for America, over 85% of U.S. airline passengers used digital boarding passes in 2023, many stored directly in their mobile wallets. Similarly, ride-sharing companies like Uber and Lyft allow users to store payment methods and redeem promotional credits seamlessly via mobile wallets. As mobility services become increasingly mobile-first, mobile wallet adoption in hospitality and transportation is set to accelerate rapidly.

REGIONAL ANALYSIS

The United States holds the largest share of the North America mobile wallet market, accounting for approximately 82% of total transaction value in 2024. This position is underpinned by a mature digital payment ecosystem, high smartphone penetration, and strong consumer trust in mobile financial services.

A key growth driver is the expansion of contactless payment infrastructure. Retailers like McDonald's, Starbucks, and CVS have also embedded mobile wallet functionality into their branded apps, enhancing daily usage frequency. In addition, the rise of fintech firms such as Chime, Revolut, and Affirm has spurred innovation in mobile wallet-linked financial services. These factors collectively reinforce the U.S.’s dominant position in the regional mobile wallet market.

Canada exhibits strong growth momentum, supported by proactive government initiatives, high digital literacy, and robust banking infrastructure.

A major catalyst for this growth is the national push toward digital identity and secure financial transactions. The Canadian Digital ID Strategy, launched in 2022, aims to streamline access to mobile wallet services by standardizing digital verification protocols across provinces. Major banks like RBC, TD, and Scotiabank have also embedded mobile wallet features into their digital banking apps, enabling real-time fund transfers and bill payments. These developments position Canada as a rapidly maturing market with significant long-term growth potential.

The Rest of North America, comprising Mexico and select Caribbean economies, holds a relatively modest but growing share of the regional mobile wallet market, contributing to the total transaction value in 2024. While still in the early stages of adoption compared to the U.S. and Canada, these markets present substantial opportunities due to rising smartphone penetration, increasing internet connectivity, and growing interest in digital financial services.

In Mexico, mobile wallet adoption is being driven by government-backed financial inclusion programs and the expansion of fintech startups. According to Banco de México, digital payment transactions in the country grew by 34% in 2023, with mobile wallets playing an increasingly prominent role. Companies like Clip, Konfio, and OXXO Pay have introduced mobile-first payment solutions tailored to small businesses and unbanked populations. Also, international players such as PayPal and Mercado Pago have localized their mobile wallet offerings to cater to Mexican consumers. As per GSMA Intelligence, Mexico’s smartphone adoption rate reached 76% in 2023, providing a solid foundation for further mobile wallet growth. In the Caribbean, countries like Jamaica and the Bahamas are piloting mobile wallet integration with national digital currency initiatives, such as the Sand Dollar project. These developments indicate that while currently a minor contributor, the Rest of North America represents a promising frontier for future mobile wallet expansion.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Apple Pay, Google Pay, PayPal, Venmo, Cash App, Samsung Pay, Zelle, Amazon Pay, Green Dot Corporation, and Boku, Inc. are some of the key market players in the North America mobile wallet market.

The competition in the North America mobile wallet market is highly dynamic, characterized by a mix of established tech giants, fintech disruptors, and traditional financial institutions vying for dominance. With mobile payments becoming increasingly embedded in everyday transactions, companies are continuously innovating to differentiate their offerings and capture user attention. The market is largely shaped by ecosystem-driven strategies, where platform integration plays a crucial role in user retention. Apple and Google maintain strong footholds due to their device ecosystems, while digital payment pioneers like PayPal and Square leverage their extensive merchant networks. Emerging fintech firms and banking apps are also gaining traction by offering niche services such as instant money transfers, loyalty rewards, and BNPL options. As consumer expectations evolve, the competitive landscape remains fluid, prompting continuous enhancements in usability, security, and functional versatility to maintain relevance in an increasingly crowded space.

Top Players in the North America Mobile Wallet Market

Apple Inc.

Apple has played a transformative role in shaping the North America mobile wallet landscape through Apple Pay, its secure and user-friendly digital wallet solution. By integrating NFC technology with biometric authentication, Apple has set a high standard for mobile payments. The company’s ecosystem of devices and services ensures seamless integration, fostering widespread adoption among iPhone users. Apple Pay’s partnerships with major banks and retailers have reinforced its position as a dominant player, influencing consumer behavior toward contactless payments.

Google LLC (Alphabet Inc.)

Google contributes significantly to the North America mobile wallet market through Google Wallet (formerly Google Pay). Its open-platform approach allows broad compatibility across Android devices, making it accessible to a wide demographic. Google's emphasis on digital identity, smart transit integrations, and seamless online payment experiences has strengthened its presence. The company continues to innovate by expanding wallet functionalities beyond payments, including event tickets, loyalty cards, and digital IDs.

PayPal Holdings, Inc.

PayPal remains a key player in the North America mobile wallet market due to its early entry into digital payments and strong brand recognition. Through its mobile app, PayPal offers a versatile wallet that supports peer-to-peer transfers, online shopping, and in-store QR-based payments. The company’s ability to integrate with e-commerce platforms and partner with financial institutions has solidified its relevance in both consumer and merchant ecosystems, ensuring sustained influence in the evolving digital wallet space.

Top Strategies Used by Key Market Participants

Strategic Partnerships and Ecosystem Integration

Leading players focus on forming alliances with financial institutions, retailers, and technology providers to enhance wallet functionality and expand reach. These collaborations help integrate mobile wallets into broader digital ecosystems, improving user retention and transaction frequency.

Innovation in Security and Biometric Authentication

To build consumer trust, companies invest heavily in advanced security features such as tokenization, encryption, and biometric verification. Strengthening fraud prevention mechanisms ensures safer transactions and encourages wider adoption across demographics.

Expansion into New Use Cases Beyond Payments

Market leaders are diversifying mobile wallet applications to include digital IDs, loyalty programs, transit passes, and health records. This multi-functional approach increases daily usage and positions mobile wallets as essential tools in consumers’ digital lives.

RECENT MARKET DEVELOPMENTS

- In February 2024, Apple expanded Apple Wallet’s capabilities by introducing support for digital driver’s licenses and state-issued IDs across select U.S. states. This enhancement reinforced Apple’s strategy of transforming the mobile wallet into a comprehensive digital identity and payment hub.

- In May 2024, Google rebranded Google Pay as Google Wallet and introduced enhanced personal finance management tools, aiming to increase daily engagement by offering users a more integrated financial experience beyond just payments.

- In July 2024, PayPal launched a new feature allowing users to link multiple bank accounts directly to their PayPal mobile wallet, streamlining fund transfers and improving accessibility for underbanked populations in North America.

- In September 2024, Meta announced deeper integration of its digital wallet within WhatsApp and Messenger platforms in North America, enabling users to send and receive money seamlessly within chat interfaces, thereby expanding its mobile wallet reach.

- In November 2024, Samsung Pay partnered with major U.S. transit agencies to enable mobile wallet-based ticketing for public transportation systems in cities like Los Angeles and Chicago, reinforcing its utility beyond retail payments.

MARKET SEGMENTATION

This research report on the North America mobile wallet market is segmented and sub-segmented into the following categories.

By Technology

- Proximity Technology

- Remote Technology

By Application

- Retail & E-Commerce

- Hospitality & Transportation

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

What are the emerging trends shaping the future of the North America mobile wallet market?

Emerging trends include integration of biometric authentication (like facial recognition and fingerprint scanning), AI-powered personalized financial services, blockchain for enhanced security, and increased adoption of contactless payments driven by IoT devices and 5G technology.

How is the rise of cryptocurrencies impacting the North America mobile wallet market?

Cryptocurrency integration in mobile wallets is growing, enabling users to store, send, and receive digital currencies alongside traditional money, paving the way for hybrid wallets that support both fiat and crypto assets.

What is the outlook for mobile wallet adoption in physical retail versus e-commerce in North America?

Mobile wallet usage will continue growing rapidly in both sectors, with contactless payments becoming standard in physical retail and mobile wallets becoming integral to streamlined checkout experiences in e-commerce.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com