North America Fintech Market Size, Share, Trends & Growth Forecast Report By Technology, Service, Application, Deployment Mode and Country (The United States, Canada and Rest of North America), Industry Analysis From 2024 to 2033

North American Fintech Market Size

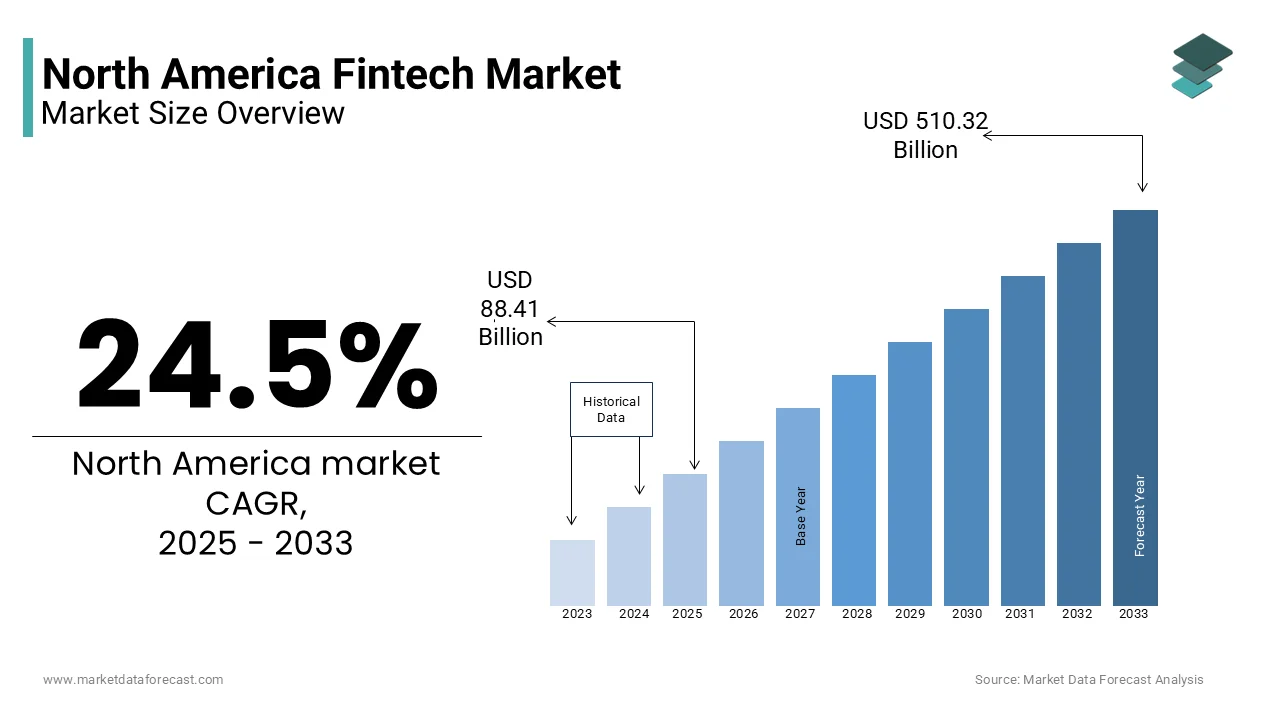

The fintech market size in North America was valued at USD 71.01 billion in 2024 and is predicted to be worth USD 510.32 billion by 2033 from USD 88.41 billion in 2025 and grow at a CAGR of 24.5% from 2025 to 2033.

Fintech, a term combining "financial" and "technology," encompasses a broad range of services, including digital payments, lending, wealth management, insurance, and blockchain-based solutions. The United States and Canada are the key contributors to the growth of the North American market. The robust startup ecosystem, the availability of venture capital funding and high digital adoption rates are bolstering the fintech market growth in North America. According to a 2022 report by the Federal Reserve, over 75% of U.S. adults used at least one fintech service, reflecting the widespread penetration of the sector. Furthermore, as per the data of Statista, the digital payments segment alone reached revenues of over $1.8 trillion in North America in 2022, which demonstrates the strong foothold of the fintech sector in North America. Regulatory frameworks in North America are evolving to balance innovation with security, particularly in areas like blockchain, cryptocurrency, and data privacy. The COVID-19 pandemic further accelerated the adoption of fintech solutions, with digital banking and contactless payment services experiencing unprecedented growth.

MARKET DRIVERS

High Digital Adoption and Internet Penetration in North America

The North American fintech market is driven by high digital adoption and widespread internet penetration. According to the U.S. Census Bureau, nearly 92% of households in the United States had internet access in 2022, fostering a favorable environment for digital financial solutions. Similarly, the Canadian Radio-television and Telecommunications Commission reports that 91% of Canadians regularly use the Internet, with a significant portion engaging in online banking and payment services. This high connectivity rate enables fintech companies to reach a broad audience, offering services like digital wallets, peer-to-peer payments, and mobile banking. The seamless integration of fintech into everyday life highlights its potential for sustained growth across North America.

Increased Venture Capital Investment

The surge in venture capital (VC) funding is another significant driver of the North American fintech market. According to the National Venture Capital Association, U.S. fintech startups received over $45 billion in VC funding in 2022, marking a substantial investment in innovation and scalability. This influx of capital supports the development of cutting-edge solutions in blockchain, artificial intelligence, and open banking. In Canada, the Canadian Venture Capital & Private Equity Association notes that fintech accounted for a significant share of VC investments, particularly in digital payments and lending platforms. The robust financial backing fuels growth, enabling fintech companies to enhance product offerings and expand their market presence.

MARKET RESTRAINTS

Stringent Regulatory Frameworks

The North American fintech market faces significant restraint due to stringent regulatory requirements. Fintech companies must comply with complex laws related to data protection, anti-money laundering (AML), and financial fraud prevention. In the United States, regulations such as the Dodd-Frank Act and the Bank Secrecy Act impose strict compliance obligations, increasing operational costs. Similarly, Canada’s Anti-Money Laundering and Terrorist Financing Regime, overseen by FINTRAC (Financial Transactions and Reports Analysis Centre), requires fintech firms to implement extensive monitoring systems. According to a report by the U.S. Department of the Treasury, non-compliance fines in the financial sector exceeded $4 billion in 2022, underscoring the cost of navigating the regulatory landscape and its impact on fintech growth.

Cybersecurity Risks and Consumer Trust Issues

Cybersecurity risks are a persistent challenge for the North American fintech market, potentially undermining consumer trust. The Federal Bureau of Investigation (FBI) reported a 20% increase in cybercrime complaints in 2022, with financial fraud being a major contributor. High-profile data breaches and ransomware attacks on fintech platforms amplify concerns about the security of digital transactions and personal information. In Canada, the Office of the Privacy Commissioner noted that 29% of consumers remain skeptical about sharing financial data with digital platforms due to privacy concerns. These risks compel fintech companies to invest heavily in cybersecurity measures, which raises operational costs and creates barriers to market entry, especially for smaller players.

MARKET OPPORTUNITIES

Expansion of Blockchain and Cryptocurrency Adoption

The increasing acceptance of blockchain technology and cryptocurrencies presents a significant growth opportunity for the North American fintech market. Blockchain's decentralized nature offers enhanced security, transparency, and efficiency in financial transactions. The U.S. Department of Commerce highlights that blockchain-based fintech applications are being rapidly integrated into banking and payment systems, with the cryptocurrency market growing by 68% between 2021 and 2022. Canada has also seen an uptick in cryptocurrency ownership, with Statistics Canada reporting that 13% of Canadians held digital currencies in 2022. This growing adoption creates avenues for fintech firms to develop innovative solutions, such as crypto wallets, trading platforms, and decentralized finance (DeFi) services, to meet evolving consumer and institutional demands.

Growth in Digital Banking and Financial Inclusion

The rising demand for digital banking services and efforts to enhance financial inclusion offer immense potential for fintech in North America. The Federal Deposit Insurance Corporation (FDIC) reported that in 2022, approximately 4.5% of U.S. households were unbanked, down from previous years due to the expansion of digital banking platforms. Fintech companies are bridging this gap by providing low-cost, accessible financial services to underserved populations. Similarly, Canada’s Financial Consumer Agency has emphasized the role of digital-only banks in reaching remote communities, offering flexible banking solutions without traditional infrastructure. These advancements enable fintech firms to tap into untapped markets, driving growth while fostering inclusivity in the financial ecosystem.

MARKET OPPORTUNITIES

Competition from Traditional Financial Institutions

One of the significant challenges for the North American fintech market is competition from well-established traditional financial institutions. Banks and credit unions have responded to fintech’s disruption by investing heavily in their digital transformation strategies. According to the U.S. Federal Reserve, over 65% of banks in the United States introduced mobile banking apps and online financial management tools in 2022. Similarly, Canada’s Big Five banks have launched digital-only banking subsidiaries, offering competitive rates and services. These developments limit FinTech’s ability to differentiate itself, forcing companies to continually innovate to maintain market share while contending with institutions that already have established customer bases and resources.

Technological Integration Barriers for Small Businesses

Small businesses, a key target for fintech solutions like digital payments and lending platforms, often face barriers to technological integration, hindering market growth. The U.S. Small Business Administration (SBA) notes that over 40% of small enterprises lack the infrastructure to adopt advanced digital solutions due to cost and limited expertise. In Canada, Innovation, Science, and Economic Development (ISED) Canada highlights that small businesses are slower to implement fintech technologies, citing challenges in understanding and integrating these solutions into their operations. This digital divide prevents fintech companies from fully accessing this market segment, reducing their growth potential in addressing a substantial portion of North America’s economy.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.39% |

|

Segments Covered |

By Technology, Service, Application, deployment mode, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

The United States, Canada, Mexico, and Rest of North America |

|

Market Leaders Profiled |

Oscar, Square, ZhongAn, Qufeng, Lufax, Avant, Atom Bank, Kabbage, Kreditech, JD Finance, Nubank, SoFi, Klarna and Funding Circle. |

SEGMENTAL INSIGHTS

By Technology Insights

Based on technology, AI and blockchain segments accounted for the majority of the North American market share in 2024. The blockchain segment held 36.1% of the North American market share in 2024 and is estimated to register a healthy CAGR during the forecast period. Blockchain technology is revolutionizing financial transactions by offering transparency, security, and efficiency. The growing demand for decentralized finance (DeFi), regulatory clarity and rapid adoption of blockchain technology by various enterprises are driving the growth of the blockchain segment in the global market. On the other hand, the AI segment is predicted to register a promising CAGR during the forecast period.

By Service Insights

The payments segment in the North American market is multiplying with the increasing consumer transactions and payments for products and services over the Internet, as well as mobile payments from point-of-sale terminals through smartphone applications. The division is predicted to experience a record growth rate over the forecast period.

By Application Insights

Based on the application, the banking segment holds a prominent share of the regional market and is likely to continue its dominion in the coming years. The increasing need for secured digital transactions and the advent of several Fintech start-up companies have boosted the adoption of these services in the banking industry.

By Deployment Mode Insights

The cloud segment is predicted to hold the major share of the North American fintech market during the forecast period, owing primarily to the scalability and cost-effectiveness of the cloud solutions.

REGIONAL ANALYSIS

The United States accounted for the largest share of the North American fintech market and is estimated to continue to hold the dominating position in the North American market throughout the forecast period due to its advanced digital infrastructure, high consumer adoption, and robust venture capital ecosystem. According to the reports of the Federal Reserve, more than 75% of U.S. adults used at least one fintech service in 2022. The U.S. also houses the largest number of fintech startups globally and is supported by $45 billion in venture capital funding in 2022, according to the National Venture Capital Association. With major hubs like Silicon Valley and New York, the U.S. spearheads innovation in digital payments, lending, and blockchain.

Canada also ranks as a key player in the North American fintech market. The growth of the Canadian fintech market is majorly driven by its strong banking infrastructure and increasing digital adoption. According to Statistics Canada, 91% of Canadians actively use the Internet, with a significant portion engaging in digital banking and payment services. Canadian fintech firms are gaining traction in areas like wealth management and insurtech, while partnerships between startups and traditional banks are fostering growth. The Financial Consumer Agency of Canada notes that digital-only banks and fintech platforms are enhancing financial accessibility, particularly in remote regions, making Canada a vital contributor to regional market expansion.

KEY MARKET PLAYERS

Companies playing a leading role in the North American fintech market include Oscar, Square, ZhongAn, Qufeng, Lufax, Avant, Atom Bank, Kabbage, Kreditech, JD Finance, Nubank, SoFi, Klarna and Funding Circle. The leader in the financial technology market was Ant Financial of the Alibaba Group, which observed ten times more Wallet subscriptions and 13 times more average (daily) transactions in 2017 than in 2015.

RECENT HAPPENINGS IN THE MARKET

- In March 2019, Cognizant announced that it would acquire the Dublin-based Meritsoft financial software company.

- In March 2019, WorldFirst acquired the Australian company CurrencyVue to build a global trading platform. As demand for fintech increases, the market is ready to see more acquisitions and acquisitions in 2019.

- In 2017, hackers violated the software platform of Equifax Inc., one of the leading financial technology companies, and gained access to confidential personal information from 145 million Equifax customers in the United States and Canada.

MARKET SEGMENTATION

This research report on the North American fintech market has been segmented and sub-segmented based on the following categories.

By Technology

- API

- Artificial Intelligence

- Blockchain

- Distributed Computing

By Service

- Payment

- Fund Transfer

- Personal Finance

- Loans

- Insurance

- Wealth Management

By Application

- Banking

- Insurance

- Securities

By Deployment Mode

- Cloud

- On-premises

By Country

- The United States

- Canada

- Rest of North America

Frequently Asked Questions

Which countries in North America contribute significantly to the fintech market share?

The United States and Canada are the primary contributors to the fintech market in North America, with a substantial share of fintech activities concentrated in major financial hubs.

How does the regulatory environment in the United States impact the growth of the fintech sector?

The regulatory environment in the United States plays a crucial role in shaping the fintech sector. Regulatory frameworks, such as those governing digital payments and online lending, influence market dynamics and innovation.

What are the key trends driving fintech growth in Canada?

In Canada, key trends driving fintech growth include the adoption of digital wallets, blockchain technology applications, and the integration of artificial intelligence in financial services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]