Global Fintech Market Size, Share, Trends & Growth Forecast Report By Technology, Service (Payment, Fund transfer, Personal Finance, Loans, Insurance and Wealth Management), Application (Banking, Insurance and Securities), Deployment Mode (Cloud and On-premises) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis (2024 to 2033)

Global Fintech Market Size

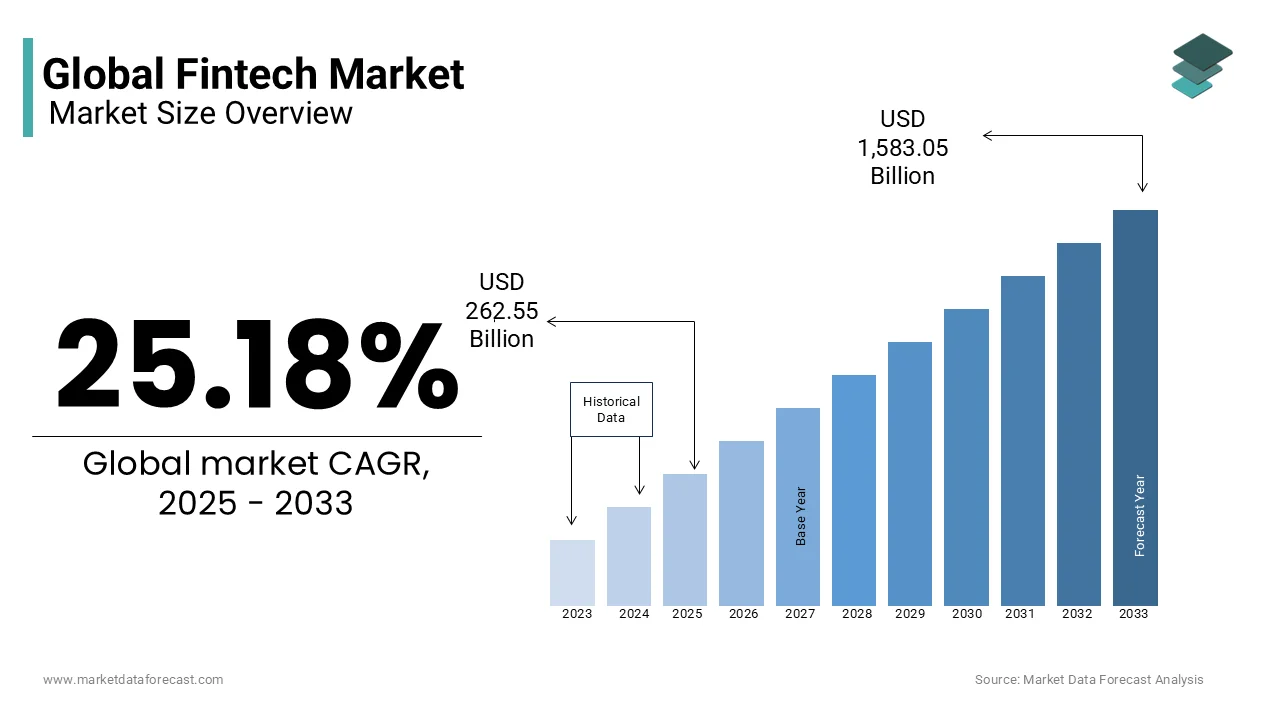

The global fintech market is expected to reach USD 1583.05 billion by 2033 from USD 209.74 billion in 2024, growing at a CAGR of 25.18% during the forecast period.

FINTECH MARKET OVERVIEW

Fintech represents a transformative force in the financial services industry, leveraging technology to streamline, enhance, and innovate banking, payments, lending, insurance, wealth management, and other financial services. Fintech, short for financial technology, encompasses a range of solutions such as blockchain, artificial intelligence (AI), and cloud computing, revolutionizing customer experiences and operational efficiencies. The fintech market has seen exponential growth due to rising digital adoption, increased smartphone penetration, and growing demand for contactless payments. Notably, the COVID-19 pandemic served as a catalyst, accelerating the adoption of digital payment platforms, e-wallets, and online lending services. According to a recent Deloitte report, global investment in fintech reached unprecedented levels, signaling confidence in the sector's potential. Furthermore, McKinsey highlights that nearly 90% of global consumers now engage in some form of digital financial services, underscoring fintech's integral role in reshaping modern finance.

TECHNOLOGIES TRANSFORMED THE FINTECH MARKET

Blockchain Technology in Fintech

Blockchain technology has transformed the global fintech market by enabling secure, transparent, and decentralized financial transactions. Its adoption is rapidly expanding in areas such as cryptocurrency, smart contracts, and cross-border payments. According to the World Bank, blockchain-based remittance platforms have reduced transaction fees by up to 50%, benefiting developing economies. The Financial Stability Board highlights that decentralized finance (DeFi) platforms, which leverage blockchain, grew by over 40% in 2022, with a total value locked exceeding $50 billion. This technology’s ability to minimize fraud and streamline processes has made it a cornerstone for innovation, driving fintech market growth globally.

Artificial Intelligence (AI) in Fintech

AI is revolutionizing fintech through personalized banking, fraud detection, and risk management solutions. Its integration has enhanced customer experiences and operational efficiencies, enabling financial institutions to process large datasets rapidly. The International Telecommunication Union (ITU) reports that AI-powered fraud detection systems reduce financial fraud by over 90%, while the World Economic Forum highlights AI’s potential to save financial firms up to $1 trillion annually by 2030. Predictive analytics and AI-driven chatbots further increase customer engagement and satisfaction, bolstering fintech adoption. This transformative technology continues to accelerate market growth by enabling smarter, faster, and more scalable financial solutions.

Cloud Computing in Fintech

Cloud computing plays a pivotal role in modernizing the fintech industry by offering scalable, cost-effective, and secure infrastructure for digital financial services. By 2022, the United Nations Economic Commission for Europe (UNECE) estimated that nearly 60% of fintech firms utilized cloud solutions for data storage and analytics. Cloud platforms reduce operational costs by eliminating the need for on-premise systems, allowing startups to scale rapidly. Additionally, the Bank for International Settlements (BIS) notes that cloud computing improves cybersecurity by centralizing data protection measures. This technology has driven innovation in digital payments, mobile banking, and open banking, ensuring continued growth in the global fintech market.

Internet of Things (IoT) in Fintech

The Internet of Things (IoT) is creating new opportunities in fintech by enabling connected devices to streamline financial transactions and risk management. IoT applications, such as smart point-of-sale terminals and insurance telematics, enhance customer convenience and data-driven decision-making. The International Monetary Fund (IMF) highlights that IoT-enabled payment systems could handle over 20 billion devices by 2030, significantly boosting transaction volumes. Furthermore, IoT-driven solutions in risk assessment and underwriting have increased accuracy, particularly in insurance. By integrating IoT with financial services, fintech companies can enhance personalization and operational efficiency, contributing to substantial market expansion.

FINTECH MARKET TRENDS

Rising Adoption of Blockchain Technology

Blockchain technology is a transformative trend within the global fintech market and is reshaping traditional financial operations with enhanced transparency, security, and efficiency. Blockchain is increasingly utilized in payment processing, smart contracts, and digital identity verification. According to the International Monetary Fund (IMF), blockchain-based financial services can reduce transaction costs by up to 20%, boosting global trade and economic efficiency. Furthermore, the World Bank highlights that blockchain-enabled remittances have facilitated faster, lower-cost cross-border payments, particularly benefiting emerging economies. The growth of decentralized finance (DeFi) platforms powered by blockchain has further amplified its adoption, with DeFi assets reaching a total value locked (TVL) of over $50 billion, as reported by the Financial Stability Board, marking a robust upward trajectory in the fintech ecosystem.

Expansion of Digital Payments and E-Wallets

Digital payments and e-wallets are experiencing unprecedented growth, driven by evolving consumer preferences and supportive government policies. The United Nations Conference on Trade and Development (UNCTAD) reports that global digital payment transactions grew by 22% year-over-year in 2022, fueled by increasing smartphone penetration and enhanced internet accessibility. Additionally, government-backed initiatives like India’s Unified Payments Interface (UPI) and Europe’s PSD2 directive have accelerated the adoption of cashless transactions. According to the Bank for International Settlements (BIS), the use of e-wallets now accounts for over 40% of global retail transactions. The rapid proliferation of real-time payment systems and growing acceptance of QR code technology in developing markets further underscore the pivotal role of digital payments in the evolution of the fintech sector.

FINTECH MARKET DRIVERS

Surge in Smartphone Penetration and Internet Connectivity

The widespread adoption of smartphones and enhanced internet accessibility has been a pivotal driver of the global fintech market. The International Telecommunication Union (ITU) reports that over 5.3 billion people globally used the internet in 2022, marking a significant growth in digital inclusivity. This connectivity has fueled the adoption of mobile-based financial services, such as mobile banking apps and digital wallets. The World Bank emphasizes that smartphone penetration, particularly in emerging economies, has enabled access to previously underserved populations, with mobile money services reaching 1.6 billion accounts worldwide. This trend continues to drive the fintech market’s expansion by bridging gaps in traditional banking systems and promoting digital financial inclusion on a global scale.

Supportive Regulatory Frameworks and Government Initiatives

Governments worldwide are implementing supportive policies to foster fintech growth, driving innovation and adoption across financial systems. The Financial Stability Board highlights that over 60 countries have introduced regulatory sandboxes to encourage fintech innovation while ensuring compliance and consumer protection. Additionally, the International Monetary Fund (IMF) underscores initiatives such as India’s Pradhan Mantri Jan Dhan Yojana, which brought over 460 million unbanked individuals into the formal financial system, and the European Union’s PSD2 directive, which promotes open banking. Such frameworks reduce barriers to entry for fintech companies, stimulate competition, and enhance trust among consumers, creating a conducive environment for market expansion while addressing critical challenges in global financial systems.

FINTECH MARKET RESTRAINTS

Cybersecurity and Data Privacy Concerns

Cybersecurity challenges and data privacy risks pose significant restraints to the global fintech market. The World Economic Forum states that the financial sector experiences 300 times more cyberattacks than other industries, exposing vulnerabilities in fintech platforms. As fintech companies handle vast amounts of sensitive financial data, breaches can lead to severe consumer mistrust and regulatory scrutiny. The International Telecommunication Union (ITU) reports that only 59% of countries have adopted comprehensive data protection laws, creating inconsistencies in privacy safeguards. High-profile cyberattacks on fintech firms have further highlighted the pressing need for robust security measures, which can inflate operational costs and deter adoption in markets where consumer trust in digital platforms remains fragile.

Lack of Financial and Digital Literacy

Limited financial and digital literacy acts as a critical barrier to fintech adoption, particularly in emerging markets. According to the World Bank, approximately 1.4 billion adults globally remain unbanked, with a significant portion lacking the necessary understanding of digital financial tools. Similarly, the United Nations Educational, Scientific and Cultural Organization (UNESCO) emphasizes that in 2022, around 770 million adults faced basic literacy challenges, restricting their ability to access and effectively use fintech solutions. This gap in knowledge limits consumer trust and adoption, particularly in regions where digital education and awareness campaigns are scarce. Addressing this restraint requires concerted efforts from governments and private stakeholders to promote inclusive education and digital awareness.

FINTECH MARKET OPPORTUNITIES

Expansion of Financial Inclusion in Emerging Markets

Emerging markets present significant growth opportunities for the fintech sector by addressing the unmet needs of unbanked and underbanked populations. The World Bank reports that over 1.4 billion adults globally remain unbanked, with a large concentration in Sub-Saharan Africa, South Asia, and Latin America. Mobile money platforms and digital payment solutions are rapidly bridging this gap, enabling access to savings, credit, and insurance products. For instance, the International Finance Corporation (IFC) highlights that mobile money transactions in Sub-Saharan Africa surpassed $800 billion in 2022. By leveraging technology to deliver affordable financial services, fintech companies can unlock vast market potential while fostering economic empowerment and financial inclusion in underserved regions.

Integration of Artificial Intelligence in Financial Services

Artificial intelligence (AI) is revolutionizing the fintech industry, offering opportunities to enhance customer experience, optimize processes, and improve risk management. According to the United Nations Economic and Social Council (ECOSOC), AI-driven solutions can reduce loan processing times by up to 70% and improve fraud detection rates by over 90%. Financial institutions increasingly use AI for personalized banking, predictive analytics, and automated customer support, driving efficiency and scalability. Additionally, a study by the Organization for Economic Co-operation and Development (OECD) predicts that AI in financial services could contribute significantly to global economic output by 2030. The integration of AI allows fintech companies to deliver innovative and tailored solutions, ensuring sustained growth in a competitive marketplace.

FINTECH MARKET CHALLENGES

Regulatory Complexity and Compliance Challenges

Navigating diverse regulatory environments remains a critical challenge for the global fintech market. Financial regulators worldwide are introducing stringent frameworks to mitigate risks associated with data breaches, fraud, and money laundering. According to the Financial Stability Board, over 70 jurisdictions have implemented regulations for digital assets, often differing significantly in their scope and application. This lack of harmonization complicates cross-border operations, requiring fintech companies to invest heavily in compliance and legal expertise. Additionally, the International Monetary Fund (IMF) emphasizes that inconsistent regulatory approaches can stifle innovation and slow market entry, particularly for smaller fintech startups. Adapting to these complex legal landscapes is essential for sustained growth but represents a significant operational hurdle.

Limited Infrastructure in Developing Regions

Inadequate infrastructure in developing markets is a significant barrier to fintech adoption and expansion. The International Telecommunication Union (ITU) reports that nearly 2.7 billion people globally still lack internet access, with most residing in low-income countries. This digital divide restricts the reach of fintech services, particularly mobile payments and online banking, which depend on robust internet connectivity. Furthermore, the World Bank highlights that unreliable power supplies and underdeveloped mobile network coverage exacerbate the issue in rural areas. Addressing these infrastructural challenges requires substantial investments in digital infrastructure, which may be constrained by limited public and private funding in many emerging economies. Without these upgrades, the full potential of fintech remains untapped in these high-growth regions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

25.18% |

|

Segments Covered |

Technology, Service, Application, Deployment |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ZhongAn, Oscar, Qufeng, Avant, Lufax, Atom Bank, Kreditech, Kabbage, JD Finance, SoFi, Nubank, Klarna, Square and Funding Circle and other market players |

|

Fastest Growing Region |

Asia Pacific |

|

Largest Market |

North America |

SEGMENTAL ANALYSIS

By Technology Insights

The artificial intelligence (AI) segment dominated the fintech market by accounting for 36.8% of the global market share in 2023. According to the International Telecommunication Union (ITU), AI plays a vital role in the fintech market due to its widespread adoption in personalized banking, fraud detection, and process automation. Its leadership stems from the technology’s ability to reduce operational costs and enhance customer experiences. The World Economic Forum highlights that AI-powered fraud prevention tools have cut financial fraud by over 90%. Moreover, its applications in predictive analytics and robotic process automation are essential for scaling operations, making AI the cornerstone of modern fintech innovation.

On the other hand, Blockchain and distributed computing segments are growing rapidly and are expected to witness the fastest CAGR during the forecast period. This rapid growth is attributed to blockchain’s transformative role in enabling secure, transparent, and decentralized financial transactions. The World Bank reports that blockchain-powered remittance services have cut transaction costs by up to 50%, particularly benefiting emerging economies. Additionally, decentralized finance (DeFi) platforms saw a 40% increase in assets under management in 2022, reaching over $50 billion. Blockchain’s importance lies in its ability to minimize fraud, enhance cross-border payments, and support digital asset development, making it a key driver for fintech’s evolution.

By Service Insights

The payment services segment was the largest segment in the global fintech market in 2023 and captured 28.7% of the global market share in 2023. This dominance is driven by the growing adoption of digital wallets, real-time payment systems, and contactless payment methods. The United Nations Conference on Trade and Development (UNCTAD) highlights that global digital payment transactions grew by 22% year-over-year in 2022. Payment solutions are vital for enhancing convenience, promoting financial inclusion, and supporting e-commerce growth. Initiatives like India’s Unified Payments Interface (UPI) and Europe’s PSD2 directive have further cemented this segment’s importance in streamlining financial transactions across diverse markets.

The loan segment is predicted to be the fastest growing segment in the global market over the forecast period. Digital lending platforms are gaining traction due to their ability to provide instant credit access, even in underserved regions. The World Bank states that digital loan disbursements increased by over 30% in 2022, driven by simplified online applications and credit scoring using artificial intelligence. This segment’s rapid growth stems from rising demand for peer-to-peer (P2P) lending and small business loans. By leveraging technology, fintech lenders offer quicker, more transparent, and more accessible borrowing options, making loans a critical component of the fintech ecosystem’s expansion.

The fund transfer segment is likely to have a CAGR of 12.8% during the forecast period. The increasing volume of international trade and money transfers is attributed to prompting the growth rate of the market. The fintech services made international transactions highly compatible and safe, which is attributed to elevating the segment’s growth rate to an extent.

The personal finance segment is deemed to have significant growth opportunities in the coming years. The growing interest in financial literacy and personalized financial management tools is specifically to fuel the growth rate of the segment in the coming years. Also, the increasing preference for real-time analysis and tailored financial advice that helps investors make perfect decisions is greatly influencing the growth rate of the market.

By Application Insights

The banking segment led the market and accounted for 42.9% of the global fintech market share in 2023. Its dominance is driven by the integration of digital banking services, mobile applications, and online platforms that have transformed traditional banking operations. The International Monetary Fund (IMF) highlights that digital banking adoption surged by 35% globally in 2022, driven by rising demand for real-time account management and financial transactions. The banking segment’s significance lies in its role as the backbone of the financial ecosystem, providing essential services such as payments, credit, and savings through innovative, technology-driven solutions.

The insurance segment is the fastest-growing application in the fintech market and is anticipated to exhibit a CAGR of 22% over the forecast period. The rise of insurtech solutions, leveraging artificial intelligence, blockchain, and IoT, has revolutionized the insurance industry by enabling personalized offerings and faster claims processing. According to the United Nations Economic and Social Council (ECOSOC), digital insurance adoption grew by 28% in 2022, driven by advancements in automated underwriting and telematics-based policies. This growth reflects a shift toward customer-centric solutions, with insurtech platforms enhancing accessibility and affordability, making the insurance sector a dynamic force in the fintech market.

By Deployment Mode Insights

The cloud deployment segment accounted for 60.6% of the global market share in 2023 and emerged as the most dominating segment. The widespread adoption of cloud technology stems from its scalability, cost-effectiveness, and enhanced data security features. Financial institutions increasingly rely on cloud-based solutions for real-time data analytics, seamless customer experiences, and compliance with evolving regulatory requirements. The Bank for International Settlements (BIS) highlights that nearly 70% of fintech firms transitioned to cloud infrastructure in 2022 to optimize operational efficiency and reduce costs. Cloud deployment’s importance lies in its ability to support innovation, allowing fintech providers to deliver flexible and secure financial services globally.

The on-premises segment remains significant, especially for financial institutions prioritizing control and security. However, challenges related to scalability and costs may limit its growth compared to cloud-based alternatives. The on-premises segment is likely to have a prominent growth rate during the forecast period. In earlier days, the demand for this segment was a huge priority, but the rising number of disadvantages like scalability and costs is slightly degrading its growth rate when compared with the cloud-based deployment.

REGIONAL ANALYSIS

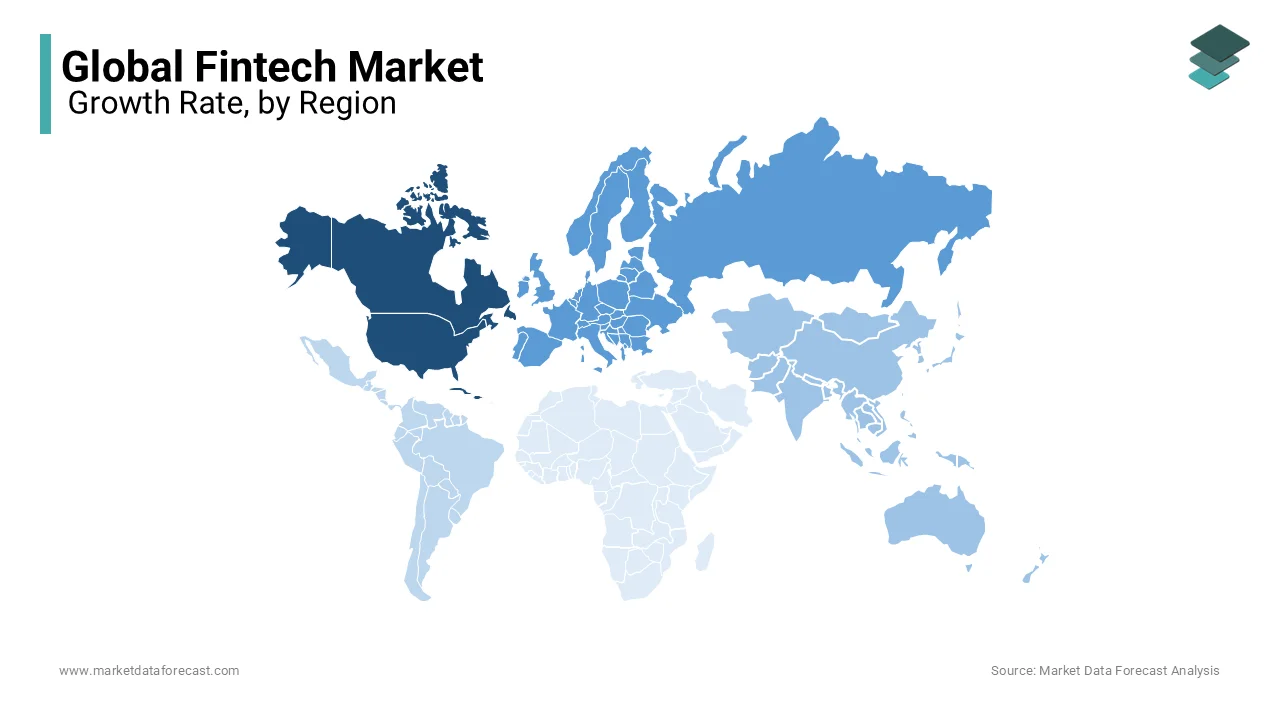

North America accounted for 34.3% of the market share in 2023. The region’s dominance is fueled by a highly developed financial ecosystem, advanced technological infrastructure, and significant venture capital investments. The Financial Stability Board highlights that the United States and Canada are home to over 8,000 fintech startups, with prominent contributions from digital payments, wealth management, and insurtech platforms. Additionally, widespread adoption of contactless payment methods and government initiatives supporting innovation position North America as a global leader. The region’s importance lies in its role as a hub for innovation and investment in the fintech sector.

Asia Pacific is attributed to grow at a projected CAGR of 27.45% during the forecast period owing to the rapid digital transformation, high smartphone penetration, and government-backed financial inclusion initiatives. For instance, India’s Unified Payments Interface (UPI) processed over 74 billion transactions in 2022, reflecting a 90% year-over-year growth. Meanwhile, China’s mobile payment market reached $68 trillion in transactions, according to the United Nations Conference on Trade and Development (UNCTAD). The region's fintech expansion is also supported by rising consumer demand for e-wallets, peer-to-peer lending, and blockchain solutions, making Asia-Pacific a dynamic growth hub.

Europe accounted for 23.7% of the global fintech market share in 2023. Europe holds a significant share of the global fintech market, driven by regulatory initiatives like the Revised Payment Services Directive (PSD2), which promotes open banking. The European Central Bank highlights that digital payment transactions in the EU grew by 22% in 2022. Fintech hubs such as the UK, Germany, and Sweden are leaders in blockchain and digital banking solutions, contributing to robust market growth.

Latin America’s fintech sector is growing rapidly, fueled by rising demand for digital payment solutions and financial inclusion. The World Bank reports that 70% of adults in the region remain unbanked, creating opportunities for fintech startups. Brazil and Mexico account for over 70% of the region's fintech ecosystem, according to the International Finance Corporation (IFC).

The fintech market in the Middle East and Africa is experiencing steady growth, driven by mobile payment platforms and blockchain adoption. The International Monetary Fund (IMF) notes that mobile money accounts in Sub-Saharan Africa surpassed 1 billion in 2022, making it a critical area for fintech adoption. Government initiatives in the UAE and South Africa further support innovation in digital banking and payments.

KEY MARKET PLAYERS

Companies that play a notable role in the global fintech market include Stripe, Square, PayPal, Robinhood, Coinbase, Ant Group, Adyen, Revolut, Transferwise and Sofifa.

Top 3 Players in The Global Fintech Market

PayPal Holdings, Inc.

PayPal is a leading global player in digital payments, facilitating secure online transactions for individuals and businesses. The company's platform supports over 430 million active accounts worldwide, according to PayPal's 2022 annual report. It plays a critical role in the global fintech market by enabling seamless cross-border transactions in over 200 markets. PayPal's services, including Venmo and Xoom, cater to peer-to-peer payments and remittances, driving financial inclusion. Its strategic acquisitions, such as Honey and iZettle, have diversified its offerings, cementing its position as a key innovator in the industry.

Ant Group Co., Ltd.

Ant Group, the operator of Alipay, is a fintech giant based in China and one of the most influential players in the Asia-Pacific region. Alipay serves over 1.3 billion users globally, as noted by the United Nations Conference on Trade and Development (UNCTAD). The platform dominates mobile payments and financial services, with innovative features such as QR code-based payments and digital wealth management tools. Ant Group's focus on artificial intelligence and blockchain technology further enhances its market leadership. Its contributions extend beyond payments, as its Yu’e Bao platform revolutionized money market fund investments, attracting trillions of yuan in assets.

Square, Inc. (Now Block, Inc.)

Square rebranded as Block, Inc., is a prominent US-based fintech firm known for its contributions to small business solutions and consumer financial services. The company’s point-of-sale systems, Cash App, and Square Capital have democratized access to payments, banking, and lending. According to the World Bank, Block has significantly impacted financial inclusion in underserved markets by enabling micro and small businesses to accept digital payments. Its focus on cryptocurrency, particularly through the Bitcoin-focused Spiral division, underscores its innovative approach to fintech growth. Block’s ecosystem integrates hardware, software, and financial services, making it a major contributor to the global fintech market's expansion.

Major Strategies Used by Key Players in the Fintech Market

Strategic Partnerships and Collaborations

Key players in the fintech market frequently form partnerships with financial institutions, technology firms, and governments to expand their service offerings and geographic reach. For instance, PayPal Holdings partnered with Visa and Mastercard to enhance cross-border payment capabilities and reduce transaction fees. Similarly, Ant Group collaborates with local financial institutions to integrate Alipay into various markets, ensuring compliance with local regulations while increasing its global footprint. These collaborations enable companies to leverage shared resources and expertise, fostering growth and innovation.

Diversification of Services

Fintech firms diversify their offerings to attract a broader customer base and create multiple revenue streams. PayPal’s acquisitions of Honey (a discount and rewards platform) and Venmo (a peer-to-peer payment app) showcase its strategy to enhance user engagement and expand into e-commerce. Block, Inc. (formerly Square) diversified with its Cash App for peer-to-peer payments and cryptocurrency trading, appealing to tech-savvy consumers. Diversification allows these firms to address evolving customer needs while reducing reliance on a single product line.

Investments in Emerging Technologies

Fintech leaders heavily invest in technologies such as artificial intelligence (AI), blockchain, and big data to improve their service efficiency and scalability. For example, Ant Group incorporates blockchain into its supply chain finance solutions to enhance transparency and efficiency. Similarly, Block's focus on Bitcoin technology and decentralized finance (DeFi) positions it as a leader in cryptocurrency innovation. These technological advancements enable players to maintain a competitive edge and meet the growing demand for secure and efficient financial solutions.

Global Expansion

Expanding into new geographic markets is a key strategy to tap into underserved populations and high-growth regions. Ant Group’s aggressive expansion in Southeast Asia and Africa demonstrates its commitment to financial inclusion. PayPal, too, has expanded into emerging markets by localizing its platform and partnering with regional financial entities. Global expansion allows fintech firms to capture untapped opportunities and establish themselves as dominant players in the industry.

Focus on Customer Experience

Enhancing customer experience remains a priority, with key players leveraging data analytics and AI to deliver personalized financial solutions. PayPal and Block use predictive analytics to offer tailored recommendations for users, while Ant Group’s Alipay provides a seamless payment experience with features like real-time transaction tracking. This customer-centric approach fosters brand loyalty and long-term engagement.

RECENT MARKET DEVELOPMENTS

- In September 2024, JP Morgan announced its integrity by investing about USD 250 million in MercadoLibre, a leading e-commerce company in Latin America. The credit profile of MercadiLibre’s fintech subsidiary is aimed to highlight these investments. Companies are particularly interested in tracking the financial and technological capabilities within Latin America.

- In May 2024, fintech companies operating within the Dubai International Financial Centre (DIFC) secured a total of USD 3.3 billion in the Middle East and Africa. The company is all set to underscore the region’s commitment to fostering innovation and entrepreneurship in the fintech space.

- In May 2024, the New Jersey Fintech Accelerator was launched by the New Jersey Economic Development Authority at Stevens Institute of Technology (NJ FAST). The major aim of this launch is to provide mentorship, resources, and networking opportunities for startup companies that are attributed to nurture great innovative services for fintech companies.

- In May 2024, Wipro and Microsoft collaborated together to drive digital transformation in the fintech industry. Wipro already has expertise in using artificial intelligence, whereas Microsoft has prominent cloud computing capabilities; the collaboration of these is certainly to create tailored solutions that are required for the fintech companies.

- In October 2023, the Monetary Authority of Singapore gave a license for Coinbase to expand its range of financial services in Singapore. The company shall establish a dominant mark in Singapore with its strategic moves in the coming years.

- For instance, in 2019, Cognizant acquired Mertisoft, a Dublin-based financial software company, and WorldFirst acquired Australian firm CurrencyVue, which changed the global trading platform. The acquisitions promoted integrated advanced technologies that expanded their service offerings, reflecting strategic efforts.

MARKET SEGMENTATION

This research report on the global fintech market is segmented and sub-segmented based on technology, service, application, deployment mode, and region.

By Technology

- API

- Artificial Intelligence (AI)

- Blockchain

- Distributed Computing

By Service

- Payment

- Fund Transfer

- Personal Finance

- Loans

- Insurance

- Wealth Management

By Application

- Banking

- Insurance

- Securities

- Others

By Deployment Mode

- Cloud

- On-Premises

By Region

- North America

- Europe

- South America

- Asia-Pacific

- Middle East and Africa

Frequently Asked Questions

How much is the global fintech market expected to grow in the next eight years?

The global market is estimated to grow at a CAGR of 25.18% from 2025 to 2033.

How big the fintech market?

The global market is expected to reach USD 209.7 billion in 2024.

Which region is growing the fastest in the worldwide fintech market?

North America is the most dominating region in the global market.

Who are the key players in the global fintech market?

Companies playing a major role in the global market are Stripe, Square, PayPal, Robinhood, Coinbase, Ant Group, Adyen, Revolut, TransferWise, SoFi, Affirm, Klarna, Chime, Plaid, Ripple, Wealthfront, Betterment and OnDec.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com