Global Algorithmic Trading Market Size, Share, Trends, & Growth Forecast Report By Trading Type (FOREX, Stock Markets, ETF, Bonds and Cryptocurrencies), Component (Solutions and Services), Deployment Mode (Cloud and On-Premises), Application (Investment Banking, Funds, Personal Investors, Others) & Region - Industry Forecast From 2025 to 2033

Global Algorithmic Trading Market Size

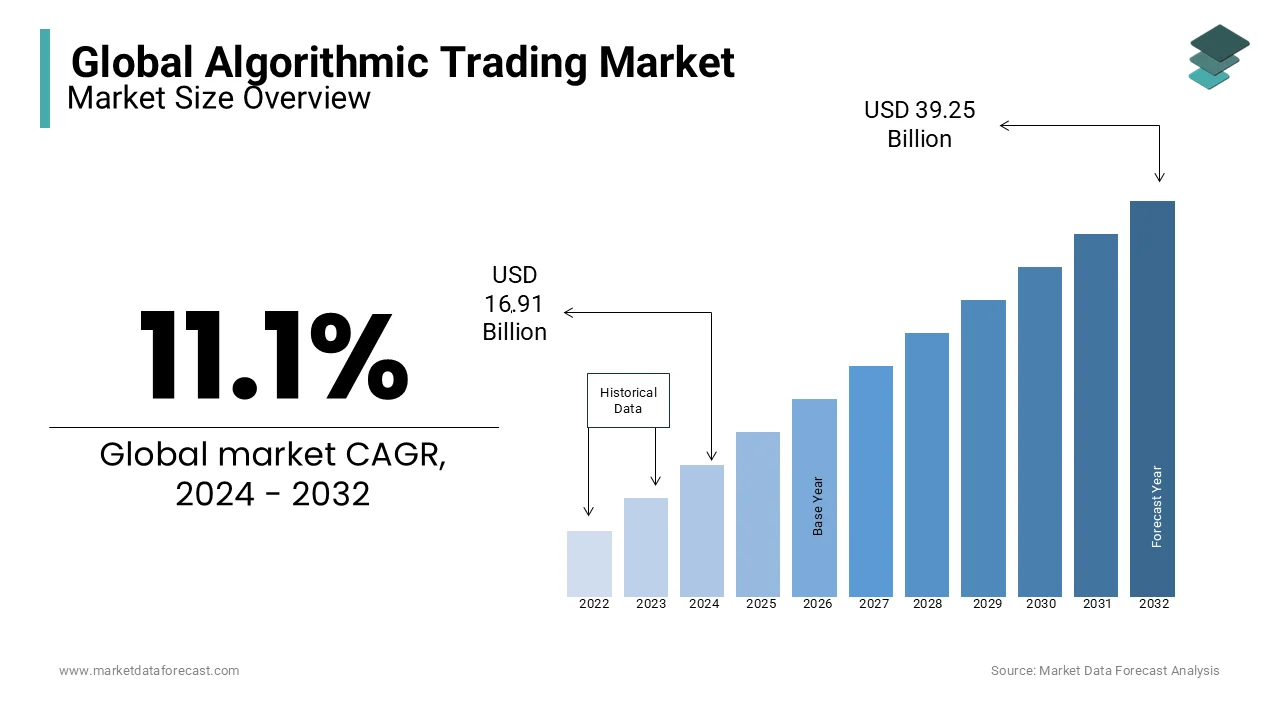

The global algorithmic trading market was worth USD 16.91 billion in 2024. The global market is anticipated to grow at a CAGR of 11.1% from 2025 to 2033, and the global market size is anticipated to be worth USD 43.61 billion by 2033 from USD 18.79 billion in 2025.

Algorithmic trading, automated trading, or black box trading is a technological advancement in the stock market. It is a programmed process that runs on a computer that follows a specific set of instructions to complete a trade to generate profits at a speed and frequency that human traders cannot. Traditionally, traders keep track of their trading activity and investment portfolio with the help of market surveillance. Applications like algorithmic trading offer the intelligence to seek out opportunities that exist in the market based on performance and other user-defined criteria. Factors such as favorable government regulations, growing demand for fast, reliable, and efficient order execution, increasing demand for market surveillance, and reduced transaction costs are expected to spearhead the market's need for algorithmic trading.

MARKET DRIVERS

The growing usage of algorithmic trading by the institutional investors is driving the global market growth.

Institutional investors mainly comprise banks, credit unions, insurance companies, hedge funds, investment advisers, and mutual fund companies, who pool their money to buy securities, real estate, or any other type of investment asset. Institutional investors use multiple computer-controlled algorithmic strategies daily in volatile trading markets, succumbing to commercial influence and market makers. These techniques allow traders to reduce transaction costs and improve profitability. These investors must perform high-frequency numbers, which is only sometimes possible. This helps them divide the total amount into smaller pieces and keep working at time intervals or according to specific strategies. For example, instead of placing 1,00,000 shares at once, an e-commerce technique can push 1,000 shares every 15 seconds and gradually place small amounts on the market over the period or all day. Since HF traders perform a large number of trades per day, automated trades are required using software and artificial intelligence, primarily to speed up trade execution. Therefore, only institutional investors can implement this technology, which encompasses an unfair advantage to profit from the value based on millisecond arbitrage. Following trends is among the most used techniques by traders based on algorithms. The approach identifies specific patterns that affect the purchase and sale of assets.

The growing demand for AI-based services in the financial industry is driving the growth of the global algorithmic trading market.

In algorithmic trading, AI helps to adopt market conditions, learn from experiences, and make trading decisions accordingly. Trading houses like Blackrock, Renaissance Technologies, and Two Sigma, among others, use AI to select stocks. Therefore, the increasing adoption of AI in the financial industry is expected to drive the growth of the algorithmic trading market during the forecast period. Additionally, the increasing adoption of stockless trading algorithms by institutional asset managers is another growth driver in the global algorithmic trading market.

MARKET RESTRAINTS

Regulatory constraints and compliance challenges are primarily hampering the growth of the global algorithmic trading market. Systemic risk concerns in financial markets, technology infrastructure limitations and high costs of implementing algorithmic trading systems are hindering the global algorithmic trading market growth. Lack of transparency and accountability, cybersecurity threats, and data breaches are further inhibiting the growth rate of the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.1% |

|

Segments Covered |

By Trading Type, Component, Deployment Mode, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AlgoTrader GmbH, Trading Technologies International, Inc., Tethys Technology, Inc., Tower Research Capital LLC, Lime Brokerage LLC, InfoReach, Inc., FlexTrade Systems, Inc., Hudson River Trading LLC, Citadel LLC, Virtu Financial, and others |

SEGMENTAL ANALYSIS

By Trading Type Insights

REGIONAL ANALYSIS

The algorithmic trading market in North America contributed the largest share in 2024 due to technological advancements and the increasing application of algorithmic trading among various end-users, such as banks and financial institutions in the North American region. North America is supposed to hold its dominant size in the global algorithmic trading market through the adoption and expansion of algorithmic trading. Increasing investments in trading technologies like blockchain, the growing presence of algorithmic trading providers, and growing government support for global trade are the main factors contributing to the growth of the market during the outlook period. Furthermore, significant technological advances and the considerable application of trading algorithms in various applications, such as banks and financial institutions in the locale, are expected to drive market growth.

KEY MARKET PLAYERS

Some of the major players operating in the global algorithmic trading market include AlgoTrader GmbH, Trading Technologies International, Inc., Tethys Technology, Inc., Tower Research Capital LLC, Lime Brokerage LLC, InfoReach, Inc., FlexTrade Systems, Inc., Hudson River Trading LLC, Citadel LLC, and Virtu Financial.

RECENT MARKET HAPPENINGS

-

In February 2020, German publicly traded FinTech company NAGA announced that it had improved its overall trading experience with the recent deployment of the MetaTrader 5 platform. The company expanded its multi-asset offering to provide its solutions to Growing clients with direct access to the stock market listed on nine global stock exchanges.

-

In March 2020, Algo Trader published the release of its AlgoTrader 6.0, which includes crypto exchange adapters like Deribit, Huobi, Kraken, and Bithumb. It delivers full support for Level II order book information for all data adapters on the market. The new Order Book widget in the AlgoTrader UI shows the user all of the BUY and SELL orders.

MARKET SEGMENTATION

This global algorithmic trading market research report has been segmented and sub-segmented based on trading type, component, deployment mode, application, and region.

By Trading Type

-

FOREX

-

Stock Markets

-

ETF

-

Bonds

-

Cryptocurrencies

By Component

-

Solutions

-

Services

By Deployment Mode

-

Cloud

-

On-Premises

By Application

-

Investment Banking

-

Funds

-

Personal Investors

-

Others

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

What are the main advantages of algorithmic trading?

The main advantages of algorithmic trading include increased trading speed, reduced transaction costs, minimized human error, and the ability to backtest strategies on historical data. It also allows for more sophisticated and complex trading strategies that can adapt to changing market conditions in real time.

What are the key regulatory considerations for algorithmic trading globally?

Key regulatory considerations include ensuring market stability, preventing market manipulation, and maintaining fair trading practices. Regulatory bodies like the SEC (U.S.), ESMA (Europe), and SEBI (India) have implemented specific rules for algorithmic trading to address these concerns, including requirements for algorithm testing, risk controls, and transparency.

What are the risks associated with algorithmic trading?

Risks include technical failures, algorithm errors, and increased market volatility due to high-frequency trading. There is also the risk of market manipulation if algorithms are not properly monitored. Regulatory scrutiny and compliance requirements can also pose challenges for market participants.

What is the future outlook for the algorithmic trading market?

The future outlook for the algorithmic trading market is positive, with continued growth expected due to advances in technology, increasing market complexity, and the ongoing need for efficiency in trading operations. Innovations in artificial intelligence, machine learning, and big data analytics are likely to further enhance algorithmic trading capabilities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com