Global Real Time Payments Market Size, Share, Trends, & Growth Forecast Report – Segmented By Component (Solutions, Services), Payment Type (Person-to-Person, Business-to-Person, Person-to-Business), Deployment Mode (On-Premises, Cloud), Industry Vertical (BFSI, IT & Telecommunication, Retail & E-commerce, Government, Energy and Utilities, Others), & Region - Industry Forecast From 2024 to 2032

Global Real-Time Payments Market Size (2024 to 2032)

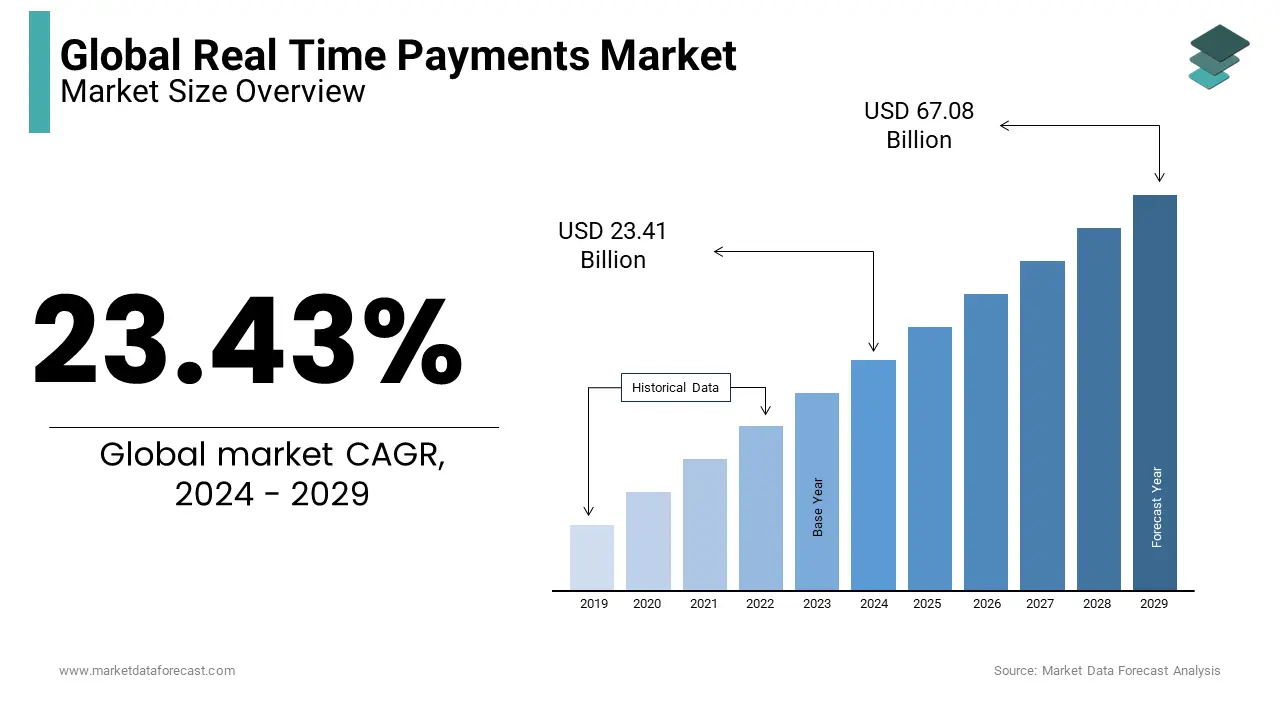

The global real-time payments market was valued at USD 18.97 billion in 2023. The global market is predicted to reach USD 23.41 billion in 2024 and USD 126.12 billion by 2032, growing at a CAGR of 23.43% during the forecast period.

Real-time payments are enabled through the digital architecture, which is also called payment rail. The real-time amount is accessible all time for cost transfer. The main reason for the wide use of real-time payment is its efficiency, convenience, and safety. The current industry trend is Platform to Business has the highest global revenue share in the Real-Time payments market. The open API-based real-time payment is gaining popularity. Fintech companies currently in this domain are not just focusing on transactions but also offering investment services like mutual funds. Big Data is the trending technology in this industry. Banks and other financial institutions use it to provide personalized experiences and generate consumer insights. Banking as a Service is projected to increase by 25% over the next three years, delivering consumers with embedded services such as real-time payments and retail banking, and 86% of market players plan to utilize open APIs.

MARKET DRIVERS

Technological innovation is one of the major drivers in the Real-Time payments market. When it comes to developed countries, smartphone adoption has reached 70% and is continuously rising in emerging countries too.

This has led to more adoption of cashless payments, thus driving the growth of Real-Time prices. Many startups in the financial domain are bringing competitive services and products at costs that offer ease of usage and security. Consumer expectation is growing, they expect everything to be available in real-time, and the Real-Time amount is catering to this expectation which has led to an increased usage of these payment options. The regulations across the globe are also driving its adoption. Rules led by Federal Reserve Bank & NACHA incentivize the use of Real-Time payments. Along with all the industry drivers, Globalization is also one of the significant drivers of Real-Time prices. Now, the need for a smooth and straightforward payment interface is rising, and Real-Time payment offers a simple interface with lower glitches and instant and secure payment transfers.

MARKET RESTRAINTS

The main challenge in Real-Time payment is that one design cannot be implemented across all geographies. Generally, the software is made for localized usage, which further works as a restraint in its wide adoption. The absence of synergy between different segments and fragmentation creates difficulty in its operation throughout the globe. Fraud and security are other restraints. Even if high-level security is built, there are still chances of fraud attacks. Since the payment software has a lot of critical data saved in it, it requires adequate fraud protection and security management. Also, the evolving technology is one of the challenges because it requires continuous evolvement and updating from the Real-Time Payment application. Customer-side adoption is also one of the challenges. Although the adoption is growing at a more excellent pace in developed countries, in some parts of the world, technology and internet penetration is slower, so it will take some time to adopt these digital payment options.

MARKET OPPORTUNITIES

The rise of eCommerce and other online platforms has created an opportunity for Real-Time online payment over traditional payment options because of safety and convenience reasons. Rapid digitalization and transaction security concerns also create opportunities for the Real-Time payment industry. Increased internet penetration, technology adoption, and mobile usage create opportunities for Real-Time Payments.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

23.43% |

|

Segments Covered |

By Component, Deployment, Payment Type, Industry Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

FinServ Inc., Mastercard Inc., PayPal Holdings Inc., Visa Inc., Temenos AG, and others. |

SEGMENTAL ANALYSIS

Global Real-Time Payments Market Analysis By Component

Based on Segmentation by Component, the demand for services and solutions is increasing. The reason is the rise of E-commerce companies that adopt the payment gateway to provide online transaction services to customers.

Global Real-Time Payments Market Analysis By Deployment

To improve the integration platform, many companies are adopting the Cloud-based platform. Also, due to the increase in the usage of mobile applications for payment, Cloud platforms have become more reliable because of their low cost and better functioning.

Global Real-Time Payments Market Analysis By Payment Type

In recent years and for the forecasted period between 2022-27, the Person-to-Person is expected to increase, and usage of Real-Time Payment will be more for this mode of transaction. The reason for the growth is fueled by COVID-19 and also digitalization of payment modes.

Global Real-Time Payments Market Analysis By Industry Vertical

In all the segments mentioned above, the CAGR for Retail & E-commerce is expected to be the highest. Because of the high volume of daily transactions and also the customers increasing adoption of Real-Time transactions, it's more convenient, easily accessible, and can be done for any amount of payment and at any time.

REGIONAL ANALYSIS

Asia Pacific is forecasted to have the highest growth for this market as its an emerging economy. With the economy and technology rising in these counties, the demand for Real-Time Payment is also increasing. The drivers are E-commerce development, application usage by the young generation, and government regulation.

KEY PLAYERS IN THE GLOBAL REAL-TIME PAYMENTS MARKET

- FinServ Inc.

- Mastercard Inc.

- PayPal Holdings Inc.

- Visa Inc.

- Temenos AG, and others.

RECENT HAPPENINGS IN THE GLOBAL REAL-TIME PAYMENTS MARKET

-

In 2022, ACI Worldwide announced ACI Smart Engage, a mobile engagement platform that lets merchants sell their goods and services directly to customers' smartphones using location, voice, and image recognition technology.

-

In 2022, Fintech firm FIS, in partnership with Treasury Prime, launched a finance tool that will enable banking and payment capabilities for organizations of all sizes.

-

In 2022, DFC and Mastercard partnered to deepen the partnership to create economic opportunity for individual and small businesses.

DETAILED SEGMENTATION OF THE GLOBAL REAL-TIME PAYMENTS MARKET INCLUDED IN THIS REPORT

This research report on the global real-time payments market has been segmented and sub-segmented based on the component, deployment, payment type, industry vertical, and region.

By Component

-

Solutions

-

Services

By Deployment

-

On-Premises

-

Cloud

By Payment Type

-

Person-to-Person

-

Business-to-Person

-

Person-to-Business

By Industry Vertical

-

BFSI

-

IT & Telecommunication

-

Energy and Utilities

-

Retail & E-commerce

-

Government

-

Others

By Region

-

Europe

-

North America

-

Asia Pacific

-

Latin America

-

Middle East & Africa

Frequently Asked Questions

What are the benefits of real-time payments for businesses?

For businesses, real-time payments offer several advantages, including improved cash flow management, reduced payment processing times, lower transaction costs, and enhanced customer satisfaction. They also facilitate more efficient supply chain operations and can support new business models that rely on immediate payment capabilities.

What are the challenges in implementing real-time payment systems globally?

Implementing RTP systems globally faces several challenges, including infrastructure disparities, regulatory differences, cybersecurity concerns, and the need for interoperability between different national systems. Additionally, countries must invest in updating legacy systems and ensuring widespread adoption among financial institutions and consumers.

What are some security measures associated with real-time payments?

Security measures for RTP systems include advanced encryption, multi-factor authentication, real-time fraud detection and monitoring, and compliance with international security standards such as PCI DSS. Financial institutions also implement robust risk management frameworks to safeguard against potential cyber threats and fraud.

How is the adoption of real-time payments expected to evolve in the future?

The adoption of real-time payments is expected to grow rapidly, driven by increasing demand for instant financial transactions, technological advancements, and regulatory support. As more countries develop and enhance their RTP systems, global interoperability is likely to improve, leading to a more connected and efficient global payments landscape. Additionally, innovations such as blockchain and digital currencies could further transform the RTP market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com