North America Plywood Market Size, Share, Trends & Growth Forecast Report By Type (Hardwood, Softwood), Application (Construction, Industrial), Use Type (New Construction, Rehabilitation), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Plywood Market Size

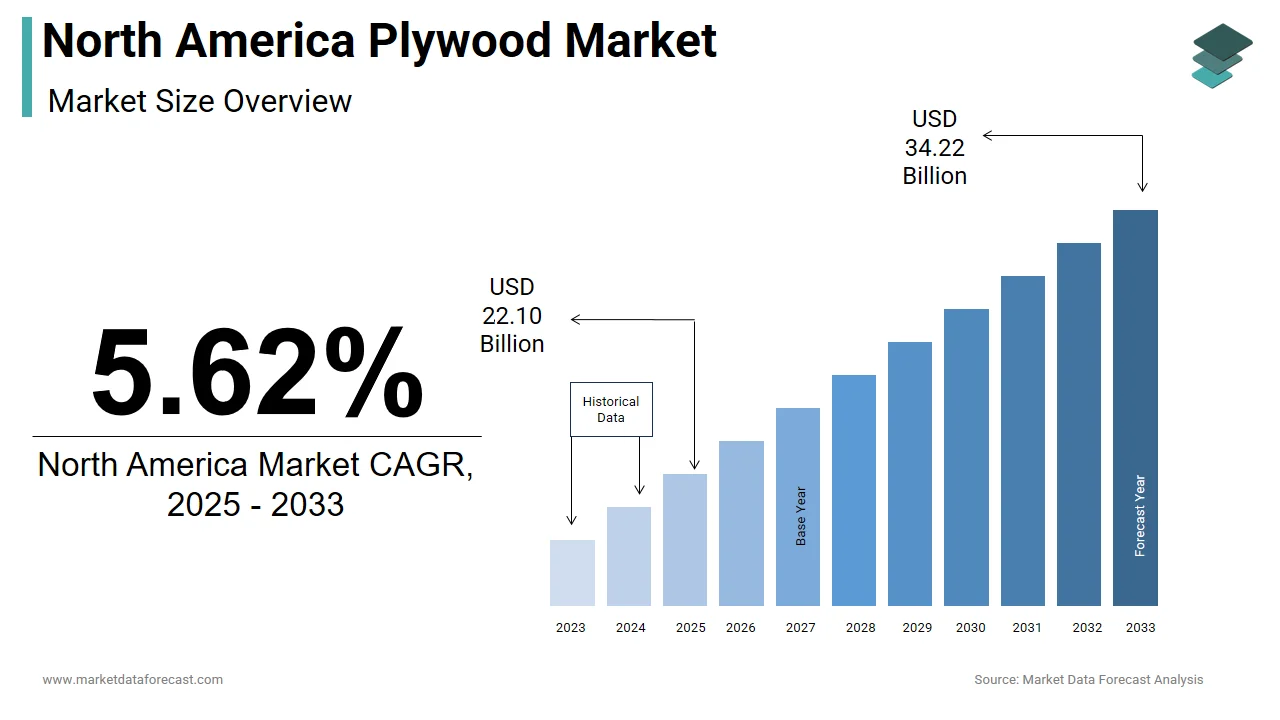

The size of the North America plywood market was worth USD 20.92 billion in 2024. The North America market is anticipated to grow at a CAGR of 5.62% from 2025 to 2033 and be worth USD 34.22 billion by 2033 from USD 22.10 billion in 2025.

The North America plywood market encompasses the production, distribution, and consumption of engineered wood panels composed of thin layers or "plies" of wood veneer bonded together with adhesives. This construction method enhances strength, durability, and resistance to warping, making plywood a preferred material across construction, furniture manufacturing, and industrial applications. In recent years, the market has experienced fluctuating dynamics due to shifting housing demand, environmental regulations, and supply chain disruptions.

Plywood usage is closely tied to residential construction activity. Besides, growing interest in sustainable building materials has positioned plywood favorably against alternatives like oriented strand board (OSB), particularly among eco-conscious developers. However, the industry continues to face logistical and regulatory pressures that shape its trajectory across the continent.

MARKET DRIVERS

Growth in Residential Construction Activity

The sustained growth in residential construction, particularly in the United States, is one of the primary drivers of the North America plywood market. Plywood is extensively used in framing, flooring, roofing, and sheathing applications, making it indispensable in homebuilding.

Furthermore, the preference for higher-quality building materials in premium housing developments has led to a shift toward plywood over alternatives such as OSB, especially in regions prone to moisture exposure. States like Texas, Florida, and California, which are experiencing population growth and urban expansion, have seen a surge in housing permits, directly fueling plywood demand.

This upward trend in construction is supported by long-term demographic shifts, low unemployment rates, and government incentives aimed at affordable housing. Consequently, the residential sector remains a robust pillar underpinning the North America plywood market.

Rising Demand for Sustainable and Eco-Friendly Building Materials

The increasing preference for sustainable and environmentally friendly building materials is also a key driver shaping the North America plywood market. Consumers and developers alike are prioritizing green construction practices, which has elevated the demand for plywood, an inherently renewable resource when sourced responsibly.

According to the U.S. Green Building Council, a substantial portion of new non-residential buildings constructed in 2023 were LEED-certified, emphasizing the use of sustainable materials like certified plywood.

Plywood manufacturers are responding to this trend by adopting Forest Stewardship Council (FSC) certification and other sustainability standards.

As reported by the Hardwood Plywood & Veneer Association (HPVA), more than 60% of plywood produced in the U.S. now comes from FSC-certified forests, ensuring responsible forest management and traceability throughout the supply chain.

Moreover, advancements in adhesive technology have enabled the production of formaldehyde-free and low-emission plywood variants, aligning with stringent indoor air quality regulations. For instance, the California Air Resources Board (CARB) mandates ultra-low emissions for composite wood products, a standard many plywood producers have already met, expanding their market reach.

In addition, the U.S. Department of Agriculture’s (USDA) BioPreferred Program has further incentivized the use of biobased construction materials, with plywood being a key beneficiary.

MARKET RESTRAINTS

Volatility in Raw Material Supply and Pricing

One of the most pressing restraints facing the North America plywood market is the volatility in raw material supply and pricing, primarily driven by fluctuations in lumber availability and costs. Plywood production relies heavily on softwood logs, especially species like Douglas fir, spruce, and pine, which are subject to seasonal harvesting cycles, forest management policies, and trade dynamics.

Supply chain bottlenecks have further exacerbated cost instability. Labor shortages in forestry operations, along with transportation delays and increased fuel costs, have added pressure on manufacturers. The U.S. Lumber Coalition reported that domestic lumber imports from Canada, historically a stable source, were disrupted due to renegotiations under the Softwood Lumber Agreement, causing temporary spikes in input costs.

These price swings make it difficult for plywood producers to maintain consistent pricing strategies, impacting both large-scale distributors and small contractors. Moreover, high material costs can push builders to substitute plywood with alternatives such as OSB or metal framing, reducing overall demand.

This ongoing unpredictability in raw material availability and cost presents a persistent challenge to the financial stability and scalability of the North America plywood industry.

Regulatory Constraints and Environmental Opposition

Environmental regulations and opposition from conservation groups represent a major restraint on the North America plywood market. While plywood is generally considered a renewable and sustainable product, sourcing raw materials often involves logging activities that are subject to increasing scrutiny from regulators and environmental organizations.

In the United States, federal agencies such as the U.S. Forest Service and the Bureau of Land Management have implemented stricter guidelines for public land logging, limiting access to traditional timber sources.

According to the Sierra Club, over 30% of proposed logging projects on federal lands were delayed or canceled in 2023 due to legal challenges or environmental concerns. Similarly, in Canada, the Canadian Sustainable Forestry Certification Coalition reported that new restrictions imposed in British Columbia to protect old-growth forests resulted in a notable reduction in available harvestable areas. These constraints have led to tighter supply conditions and increased competition for raw materials, pushing up procurement costs for plywood manufacturers.

Also, environmental advocacy groups have intensified campaigns against deforestation, influencing public perception and potentially deterring buyers who prioritize carbon neutrality and biodiversity preservation.

While many plywood producers have adopted sustainable forestry certifications such as FSC and SFI (Sustainable Forestry Initiative), compliance with these programs adds operational complexity and cost.

MARKET OPPORTUNITIES

Expansion of Prefabricated and Modular Construction

A potential opportunity emerging for the North America plywood market lies in the rapid expansion of prefabricated and modular construction methods. This construction approach involves assembling building components off-site in controlled environments before transporting them to the final location, offering faster project timelines, reduced labor costs, and improved material efficiency.

Plywood plays a crucial role in modular construction due to its dimensional stability, ease of fabrication, and compatibility with advanced manufacturing processes. Also, this construction type demands standardized and lightweight materials that can be precision-cut and pre-assembled, qualities that plywood delivers effectively.

In addition, governments and private developers are increasingly endorsing off-site construction as a solution to housing shortages and labor constraints.

The U.S. launched several initiatives in 2023 to promote factory-built housing, recognizing its potential to address affordability and speed-to-market. This policy backing is expected to drive sustained demand for plywood in prefabricated wall panels, flooring systems, and interior partitions.

Innovation in High-Performance Plywood Variants

The development and adoption of high-performance plywood variants tailored for specialized applications are another compelling opportunity for the North America plywood market. Manufacturers are increasingly investing in advanced treatments and composite technologies to enhance plywood’s durability, fire resistance, moisture protection, and acoustic properties, catering to niche sectors such as healthcare, education, and commercial infrastructure. For example, fire-rated plywood has gained traction in institutional buildings due to updated fire safety codes.

According to the National Fire Protection Association (NFPA), fire-resistant wood products are now specified in a significant share of new school constructions across the U.S., a segment that previously relied heavily on concrete and steel. Companies like LP Corporation and Georgia-Pacific have introduced proprietary fire-treated plywood lines that meet ASTM E84 Class A flame spread requirements without compromising structural integrity.

Similarly, marine-grade and exterior-rated plywood variants are witnessing strong demand in coastal and humid regions where conventional materials degrade quickly. The Southern Group of State Foresters reported that in 2023, sales of treated plywood increased by 9% in hurricane-prone states like Florida and Louisiana, driven by resilience-focused rebuilding efforts.

Moreover, acoustic plywood panels designed to improve sound insulation are gaining popularity in office spaces, theaters, and multi-family residential buildings.

These innovations are positioning plywood as a versatile and performance-driven alternative to traditional materials, opening new revenue streams and reinforcing its relevance in modern construction.

MARKET CHALLENGES

Intensifying Competition from Substitute Materials

A significant challenge confronting the North America plywood market is the intensifying competition from substitute materials such as oriented strand board (OSB), fiber cement, and engineered composites. While plywood has traditionally been favored for its superior strength and moisture resistance, OSB has gained widespread acceptance due to its lower production cost and similar structural properties.

According to the APA – The Engineered Wood Association, OSB captured over 65% of the U.S. structural panel market in 2023, surpassing plywood in volume for the eighth consecutive year. This shift is particularly evident in residential construction, where cost-sensitive builders opt for OSB in roof sheathing, wall panels, and subflooring applications. The National Association of Home Builders (NAHB) noted that in 2023, a high percentage of new single-family homes used OSB for at least one major component, largely driven by price considerations.

Beyond OSB, fiber cement boards are gaining traction in exterior cladding and siding applications due to their fire resistance and durability in harsh climates. James Hardie Industries, a leading fiber cement manufacturer, reported a notable increase in North American sales in 2023, indicating a gradual substitution effect in certain segments.

In addition, the rise of plastic composites and metal panels in industrial and commercial settings further limits plywood's market penetration.

Labor Shortages and Rising Manufacturing Costs

Labor shortages and escalating manufacturing costs present a formidable challenge to the North America plywood industry. The woodworking and lumber sectors have been grappling with a shrinking workforce, attributed to aging demographics, declining vocational training enrollment, and a general reluctance among younger workers to pursue careers in manufacturing.

The Hardwood Plywood & Veneer Association (HPVA) reported that in response, wages in the sector increased by 6.5% year-over-year, placing upward pressure on operating expenses.

Simultaneously, energy costs have surged due to inflationary trends and supply chain disruptions. Electricity costs also climbed, particularly in energy-intensive regions such as the Pacific Northwest.

These combined factors have led to increased production costs for plywood manufacturers, squeezing profit margins and complicating pricing strategies. Smaller mills, in particular, struggle to absorb these rising costs, with some opting to reduce production hours or consolidate operations.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, Use Type, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

Boise Cascade Company (US), Weyerhaeuser Company Ltd (US), Upm-Kymmene Oyj (Finland), Sveza Forest Ltd (Russia), Austral Plywoods Pty Ltd (Australia), Potlatchdeltic Corporation (US), Greenply Industries (India), Metsä Wood (Metsäliitto Cooperative) (Finland), Centuryply (India), Austin Plywood (India), and others. |

SEGMENTAL ANALYSIS

By Type Insights

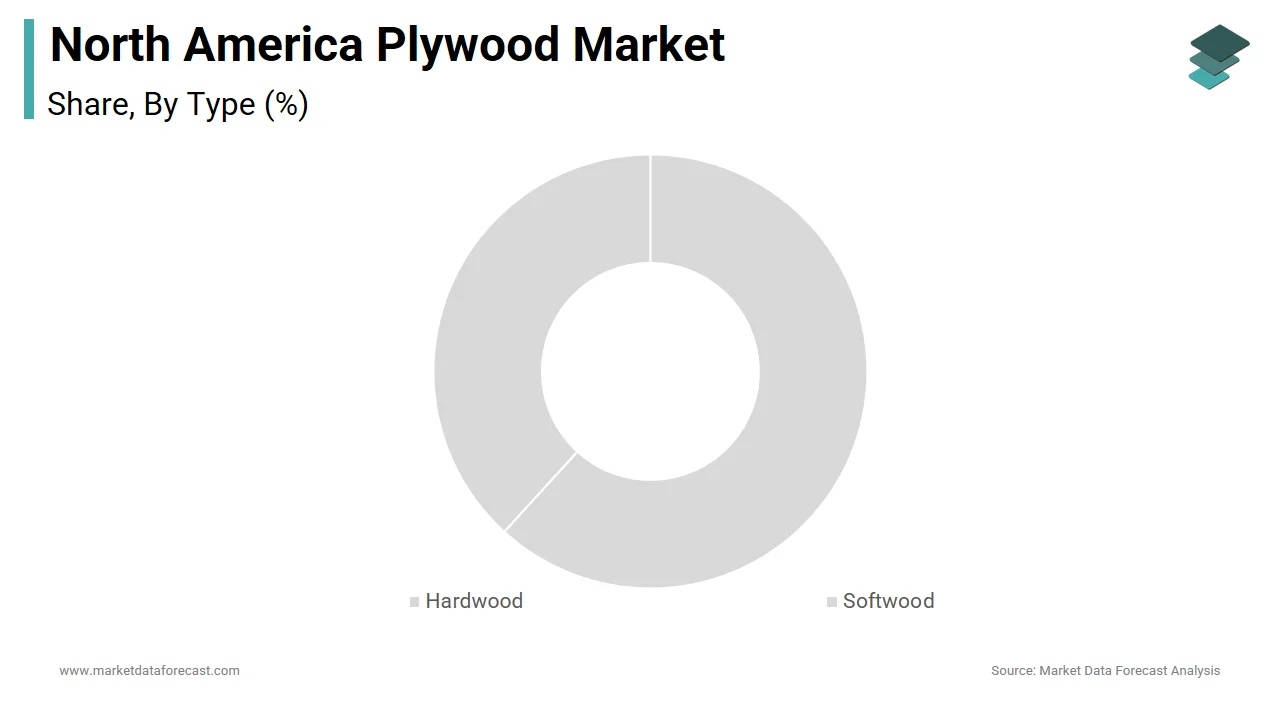

Softwood plywood remained the strongest segment in the North America plywood market, accounting for 68.3% of total consumption as of 2024. This dominance is primarily attributed to its extensive use in structural applications such as roofing, flooring, and wall sheathing within the construction industry.

The preference for softwood plywood stems from its superior strength-to-weight ratio, dimensional stability, and compatibility with building codes across major U.S. markets. States like Texas, Florida, and California have been key contributors to this demand, as reported by the U.S. Census Bureau.

Also, the material’s adaptability to engineered treatments, such as fire resistance and moisture protection, has further enhanced its appeal in commercial and institutional construction.

The availability of raw materials, particularly Douglas fir and southern yellow pine, also supports sustained production levels.

Hardwood plywood is emerging as the fastest-growing segment in the North America plywood market, projected to expand at a CAGR of 4.7% between 2025 and 2033. This growth trajectory is driven by rising demand from niche applications such as furniture manufacturing, cabinetry, and high-end architectural finishes.

A key factor behind this upsurge is the growing consumer preference for aesthetically pleasing and durable wood products in both residential interiors and luxury commercial developments.

Moreover, the rise of custom furniture and millwork industries has significantly boosted demand.

In addition, sustainability trends are favoring hardwood plywood, as it is often sourced from FSC-certified forests and requires less chemical treatment compared to alternative materials. The U.S. Green Building Council reports that LEED-certified projects increasingly specify hardwood plywood for interior design elements, contributing to its accelerated adoption in green-building initiatives.

This convergence of aesthetic appeal, functional performance, and environmental considerations positions hardwood plywood as a rapidly expanding segment within the broader North American plywood landscape.

By Application Insights

The construction application segment prevailed in the North America plywood market, capturing 72.2% of total usage in 2024. This superiority is underpinned by the integral role plywood plays in residential and non-residential building activities across the region.

Beyond homes, non-residential construction, including schools, hospitals, and office buildings, also contributes significantly. Furthermore, the durability and load-bearing capacity of plywood make it ideal for concrete formwork in infrastructure projects.

Plywood’s adaptability to weather-resistant and fire-treated variants also enhances its utility in diverse construction settings. With ongoing urbanization and infrastructure modernization efforts, the construction segment is expected to maintain its dominant position in the regional plywood market.

The industrial application segment is the quickest advancing within the North America plywood market, predicted to rise at a CAGR of 5.2% through 2033. This expansion is fueled by increasing utilization of plywood in specialized sectors such as packaging, machinery enclosures, transportation equipment, and temporary structures.

The rise of e-commerce has particularly amplified demand for wooden pallets and crates, many of which are fabricated using industrial-grade plywood due to its strength and dimensional consistency.

Moreover, the automotive and aerospace industries have adopted lightweight plywood composites for interior mockups and prototyping, as noted by the Society of Manufacturing Engineers.

Another growth driver is the increasing deployment of plywood in trade show exhibits and modular event structures. The Center for Exhibition Industry Research (CEIR) indicated that the U.S. exhibition and event industry rebounded strongly in 2023, generating over $11 billion in direct spending, much of which involved reusable plywood-based installations.

By Use Type Insights

New construction represented the largest use-type segment in the North America plywood market, commanding 67.3% of overall demand in 2024. This dominance is directly tied to the robust pace of housing and infrastructure development across the region.

Beyond residential projects, public and private infrastructure investments have also bolstered demand. These applications benefit from plywood’s ability to withstand repeated use while maintaining dimensional integrity.

In Canada, Natural Resources Canada observed that new construction accounted for nearly 60% of all wood product consumption in 2023, with British Columbia and Ontario leading in multi-family housing starts. The Canadian Mortgage and Housing Corporation (CMHC) noted that urban centers like Toronto and Vancouver saw an increase in new residential permits, reinforcing the continued reliance on plywood for foundational and framing applications.

Rehabilitation is the fastest-growing use-type segment in the North America plywood market, anticipated to grow at a CAGR of 5.4%. This upward trend is largely driven by the aging housing stock, increasing renovation activity, and government incentives aimed at improving energy efficiency and structural integrity.

According to the Joint Center for Housing Studies at Harvard University, U.S. homeowners spent $440 billion on home improvements in 2023, representing a substantial annual increase. Much of this expenditure was directed toward exterior upgrades, kitchen remodeling, and basement finishing, applications where plywood is commonly used for wall sheathing, flooring, and cabinetry.

As noted by the National Association of Home Builders (NAHB), these initiatives have spurred increased demand for high-performance plywood variants suited for retrofitting and insulation applications.

In Canada, Statistics Canada reported that residential renovation spending reached CAD $72 billion in 2023, with older homes in Quebec and Ontario undergoing significant rehabilitation. Many of these projects involve replacing outdated OSB or drywall with higher-quality plywood alternatives for improved durability and moisture resistance.

COUNTRY-WISE ANALYSIS

The United States dominated the North America plywood market, accounting for over 85% of total regional production and consumption in 2024. As the largest economy in the region, the U.S. maintains a strong construction and manufacturing base that drives consistent demand for plywood products.

In addition to housing, non-residential construction, including educational, healthcare, and commercial developments, contributed significantly to demand.

Sustainability initiatives are also influencing purchasing decisions. With a mature regulatory framework, strong domestic production capacity, and a vast distribution network, the U.S. continues to serve as the cornerstone of the North America plywood market.

Canada maintains a robust plywood industry, particularly in western provinces such as British Columbia and Alberta.

The British Columbia province benefits from abundant forest resources, especially species like Douglas fir and western larch, which are highly valued for their strength and durability in structural applications.

Domestic demand is primarily driven by residential construction and renovations. Additionally, Canada’s commitment to sustainable forestry practices has positioned its plywood exports competitively in global markets. Despite challenges related to environmental regulations and logging restrictions, Canada’s plywood industry remains resilient, benefiting from cross-border trade linkages and growing interest in eco-friendly building materials.

The Rest of North America is niche but emerging market. Although relatively small, this segment is gaining traction due to evolving construction practices, rising urbanization, and increased foreign investment in infrastructure.

Mexico has emerged as a focal point for plywood imports, especially from the United States. This growth is attributed to expanding industrial parks, low-cost housing programs, and increased demand from the automotive and aerospace sectors for specialized wood packaging.

Urban development projects in cities like Monterrey, Guadalajara, and Mexico City have also contributed to rising plywood consumption.

Moreover, the U.S.-Mexico-Canada Agreement (USMCA) has facilitated smoother trade flows, reducing tariffs and encouraging cross-border cooperation in wood product manufacturing. While still a minor contributor compared to the U.S. and Canada, the Rest of North America presents a promising avenue for future plywood market growth, particularly as construction techniques evolve and local manufacturing capabilities develop.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America plywood market profiled in this report are Boise Cascade Company (US), Weyerhaeuser Company Ltd (US), Upm-Kymmene Oyj (Finland), Sveza Forest Ltd (Russia), Austral Plywoods Pty Ltd (Australia), Potlatchdeltic Corporation (US), Greenply Industries (India), Metsä Wood (Metsäliitto Cooperative) (Finland), Centuryply (India), Austin Plywood (India), and others.

TOP LEADING PLAYERS IN THE MARKET

Georgia-Pacific LLC

Georgia-Pacific is a leading player in the North America plywood market, known for its diverse portfolio of wood-based building materials. The company has consistently invested in sustainable forestry and advanced manufacturing technologies to meet evolving consumer demands. With a strong supply chain network and emphasis on product innovation, Georgia-Pacific serves both residential and commercial construction sectors. Its commitment to environmental stewardship and high-quality engineered wood solutions positions it as a key contributor not only in North America but also influences global trends in sustainable plywood usage.

Weyerhaeuser Company

Weyerhaeuser is a major force in the forest products industry, with a significant presence in the plywood segment across North America. The company leverages its vast timberland holdings and vertically integrated operations to ensure raw material availability and cost efficiency. Weyerhaeuser focuses on delivering durable and high-performance plywood products tailored for structural applications. Through strategic investments in production capabilities and green certifications, the company plays a pivotal role in shaping global standards for sustainable forestry and wood product manufacturing.

Louisiana-Pacific Corporation (LP Building Solutions)

LP Building Solutions is renowned for its innovative approach to wood composite and plywood products. The company emphasizes technology-driven solutions that enhance product performance and sustainability. LP has expanded its market reach through continuous R&D efforts and customer-centric product development. In North America, LP’s contributions include introducing fire-treated and moisture-resistant plywood variants that cater to niche construction needs. Globally, the company’s influence extends through its export capabilities and partnerships, reinforcing its reputation as a forward-thinking leader in engineered wood solutions.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by key players in the North America plywood market is product innovation and differentiation. Companies are investing heavily in developing specialized plywood variants such as fire-rated, moisture-resistant, and formaldehyde-free panels to meet evolving regulatory standards and consumer preferences. These innovations allow manufacturers to target premium market segments and justify higher pricing while addressing sustainability concerns.

Another crucial strategy is expanding production capacity and optimizing supply chains. Major plywood producers are modernizing manufacturing facilities, integrating automation, and enhancing logistics networks to improve efficiency and reduce lead times. By securing long-term timber supply agreements and streamlining distribution channels, companies aim to maintain stable operations despite raw material volatility and labor shortages.

Lastly, strategic acquisitions and partnerships have become a favored approach to consolidate market position. Leading firms are acquiring smaller mills or forming alliances with complementary businesses to increase geographic reach, diversify product offerings, and strengthen their foothold in competitive markets. These moves help companies adapt swiftly to changing demand patterns and reinforce their leadership in the regional plywood industry.

COMPETITION OVERVIEW

The competition within the North America plywood market is characterized by a mix of established industry leaders and regional players vying for market share amid fluctuating demand and supply-side challenges. While a few dominant companies control a substantial portion of the market, numerous independent manufacturers continue to operate, particularly in niche and specialty plywood segments. This creates a fragmented yet dynamic landscape where product differentiation, sustainability credentials, and operational resilience play critical roles in determining competitive advantage. Manufacturers are increasingly focused on enhancing product performance, improving environmental compliance, and leveraging digital tools for supply chain visibility. At the same time, external pressures such as rising input costs, trade regulations, and shifting construction trends necessitate agile business models. As demand for eco-friendly and high-performance materials grows, companies are intensifying their innovation efforts to capture new opportunities and maintain relevance in an evolving marketplace.

RECENT MARKET DEVELOPMENTS

- In February 2024, Georgia-Pacific announced the expansion of its sustainable sourcing initiative by partnering with local forest cooperatives to enhance traceability and responsible harvesting practices across its supply chain.

- In May 2024, Weyerhaeuser launched a new line of high-performance structural plywood designed specifically for use in modular and prefabricated construction, aligning with the growing trend in off-site building methods.

- In July 2024, Louisiana-Pacific introduced a proprietary adhesive formulation for its plywood products aimed at reducing emissions and improving indoor air quality, catering to stricter environmental standards in residential construction.

- In September 2024, Roseburg Forest Products upgraded one of its Oregon-based plywood manufacturing facilities with automated cutting and sorting systems to improve production efficiency and reduce waste.

- In November 2024, Boise Cascade expanded its distribution footprint by opening a new regional warehouse in Texas to better serve the booming housing markets in the southern United States.

MARKET SEGMENTATION

This research report on the North America plywood market is segmented and sub-segmented into the following categories.

By Type

- Hardwood

- Softwood

By Application

- Construction

- Industrial

By Use Type

- New Construction

- Rehabilitation

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main drivers fueling growth in the North America Plywood Market?

Growth is driven by government investment in wood products, booming construction and renovation activities, technological innovation, and rising demand for sustainable building materials

2. How is the construction industry influencing the North America Plywood Market?

The expanding residential and commercial construction sectors are major plywood consumers, using it for roofing, flooring, wall sheathing, and concrete formwork

3. Which product types are most popular in the North America Plywood Market?

Softwood plywood is widely used in construction, while hardwood and decorative plywood are favored for furniture and interior design; tropical and specialty plywood serve niche applications

4. How is sustainability shaping the North America Plywood Market?

The market is increasingly adopting certified wood sources, eco-friendly production, and green building practices to reduce environmental impact and meet consumer demand for sustainable materials

5. How have technological advancements impacted the North America Plywood Market?

Automation, precision cutting, and new manufacturing processes have improved efficiency, reduced costs, and enabled the production of high-performance plywood with enhanced features

6. What are the main challenges facing the North America Plywood Market?

Challenges include fluctuating raw material prices, competition from substitute materials, and import price volatility

7. What is the outlook for renovation and remodeling in the North America Plywood Market?

Increased renovation and remodeling activities in residential and commercial spaces are boosting plywood demand for new and replacement applications

8. How are government policies and incentives affecting the North America Plywood Market?

Subsidies, tax relief, and infrastructure investments support plywood manufacturing, while regulations favoring green materials further stimulate market growth

9. Who are the leading players in the North America Plywood Market?

The market includes numerous manufacturers and suppliers, with the U.S. holding a significant share due to its robust construction and manufacturing sectors

10. How is the North America Plywood Market segmented by application and product type?

Segmentation includes softwood, hardwood, tropical, and decorative plywood by type, and construction, furniture, packaging, and flooring by application

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com