North America Surgical Staplers Market Research Report – Segmented By Type (Linear staplers, circular staplers) Technology , Usability, Application & Country (the United States, Canada & Rest of North America) - Industry Analysis on Size, Share, Trends & Growth Forecast (2025 to 2033)

North America Surgical Staplers Market Size

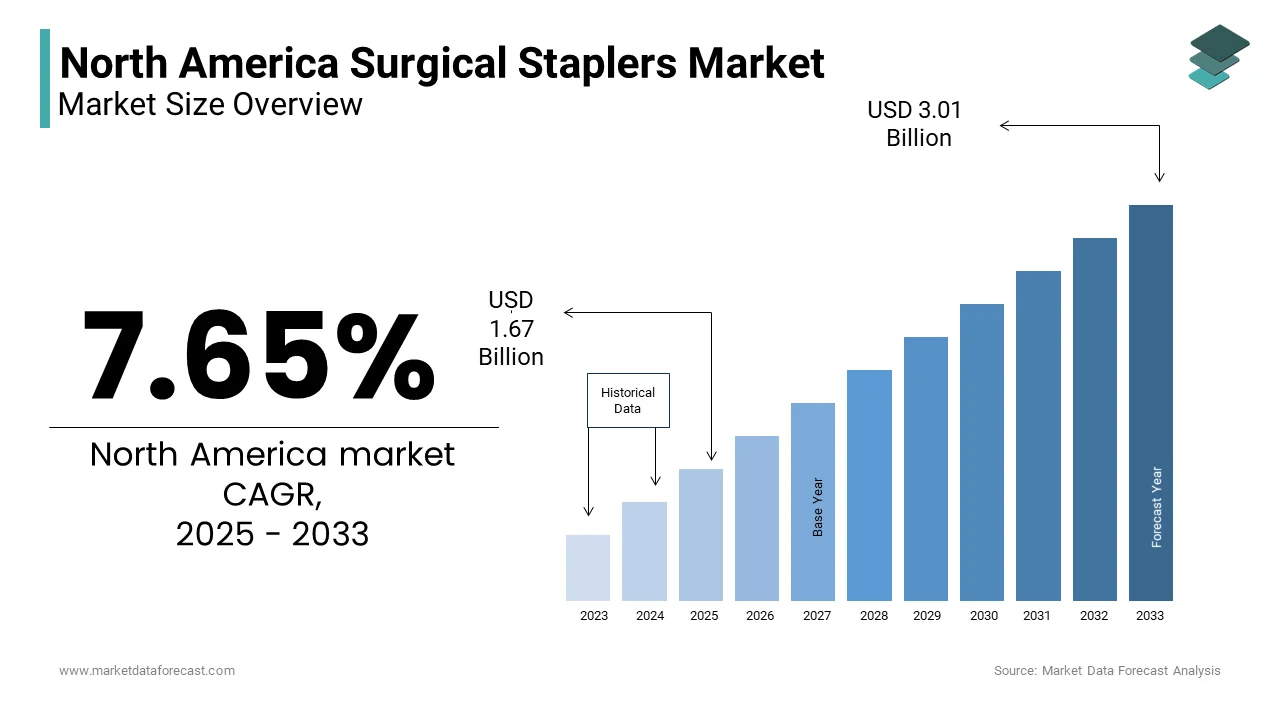

The North America Surgical Staplers Market was valued at USD 1.55 billion in 2024. The North America Surgical Staplers Market is expected to have 7.65 % CAGR from 2024 to 2033 and be worth USD 3.01 billion by 2033 from USD 1.67 billion in 2025.

The North America surgical staplers market is a robust segment within the broader healthcare industry, driven by advancements in minimally invasive surgeries and increasing demand for efficient wound closure techniques. As per a study conducted by Grand View Research, the region accounted for over 40% of the global surgical staplers market in 2022, reflecting its prominence. The United States dominates this regional market, primarily due to the presence of advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and a growing prevalence of chronic diseases requiring surgical interventions.

A key factor shaping the market's growth trajectory is the rising incidence of obesity-related conditions such as gastrointestinal disorders, which necessitate bariatric surgeries. According to the Centers for Disease Control and Prevention (CDC), approximately 42% of adults in the U.S. were obese in 2021, creating substantial demand for abdominal surgeries where surgical staplers are indispensable. Additionally, the aging population further fuels demand, with projections indicating that by 2030, nearly one-fifth of Americans will be aged 65 or older, as stated by the U.S. Census Bureau. This demographic shift is expected to escalate the need for orthopedic and general surgeries, propelling the market forward.Despite favorable conditions, regulatory scrutiny and pricing pressures remain challenges. However, ongoing innovations in product design and functionality continue to bolster the market’s resilience and expansion potential.

MARKET DRIVERS

Rising Adoption of Minimally Invasive Surgeries

Minimally invasive surgeries (MIS) have become a cornerstone of modern healthcare, significantly influencing the demand for surgical staplers. These devices play a pivotal role in MIS procedures by enabling precise tissue approximation and reducing recovery times. According to the American Hospital Association (AHA), over 90% of hospitals in the U.S. now offer minimally invasive options, underscoring their widespread adoption. Data from the Agency for Healthcare Research and Quality reveals that laparoscopic procedures alone accounted for more than 5 million surgeries annually in the U.S., driving significant demand for surgical staplers.

The precision and reliability of surgical staplers make them indispensable tools in complex surgeries like colorectal and thoracic operations. For instance, during bariatric surgeries, circular staplers are extensively used to create anastomoses, ensuring secure and leak-proof connections. The growing preference for MIS can also be attributed to patient-centric benefits such as reduced postoperative pain and shorter hospital stays. A report published by the National Institutes of Health estimates that MIS reduces recovery time by up to 60%, making it a preferred choice among both surgeons and patients.

Increasing Prevalence of Chronic Diseases

Chronic diseases, including cardiovascular disorders and cancer, are escalating the demand for surgical interventions, thereby fueling the growth of the surgical staplers market. The American Heart Association states that cardiovascular diseases affect over 120 million Americans, often requiring surgical treatments. Similarly, the American Cancer Society reported that there were approximately 1.9 million new cancer cases diagnosed in 2022, many of which necessitate tumor resection surgeries.

The surgical staplers are critical in oncological procedures, providing rapid and consistent hemostasis while minimizing damage to surrounding tissues. For example, linear staplers are frequently employed in lung cancer surgeries to achieve optimal sealing of airways. Furthermore, the prevalence of diabetes, estimated at 11.3% of the U.S. population by the CDC, correlates with complications like diabetic foot ulcers, which may require amputations using skin staplers. These statistics highlight how chronic disease prevalence acts as a catalyst for the burgeoning use of surgical staplers, reinforcing their status as essential medical devices in contemporary healthcare settings.

MARKET RESTRAINTS

High Costs and Budget Constraints

One of the most significant barriers to the growth of the North America surgical staplers market is the high cost associated with these devices. Advanced surgical staplers often come with steep price tags due to their sophisticated engineering and specialized functionalities. According to a report by the Healthcare Supply Chain Association, hospitals spend billions annually on medical devices, with surgical staplers being one of the costliest categories. Such expenditures strain hospital budgets, particularly in smaller facilities or rural areas where financial resources are limited.

Additionally, reimbursement policies for surgeries involving staplers vary widely, and in some cases, they fail to cover the full cost of the procedure. A study referenced by the American Medical Association highlights that inconsistent insurance coverage discourages healthcare providers from adopting premium-priced staplers. For instance, Medicare reimbursement rates for certain surgeries using disposable staplers are often insufficient to offset procurement costs, leading to reluctance among providers to invest in newer models. These economic factors hinder the widespread adoption of advanced staplers despite their clinical advantages is creating a restraint on market growth.

Stringent Regulatory Standards

Stringent regulatory requirements imposed by agencies like the U.S. Food and Drug Administration (FDA) pose another challenge to the surgical staplers market. Manufacturers must comply with rigorous testing protocols and obtain premarket approvals before launching new products. The FDA reports that approval timelines for Class II medical devices, including surgical staplers, can extend up to two years is delaying market entry and increasing development costs. Furthermore, recent recalls of defective staplers have heightened scrutiny. For example, in 2021, the FDA issued warnings about malfunctions in certain powered staplers is citing instances of misfires and tissue damage. Such incidents not only tarnish brand reputations but also intensify regulatory oversight, compelling manufacturers to allocate additional resources toward compliance. These stringent measures act as a deterrent to innovation and slow down the introduction of next-generation staplers is impeding overall market progress.

MARKET OPPORTUNITIES

Technological Innovations Enhancing Efficiency

Technological advancements are opening new avenues for growth in the North America surgical staplers market. Manufacturers are increasingly focusing on integrating smart features into staplers, such as real-time feedback systems and automated adjustments, to improve surgical outcomes. According to a publication by the Journal of Medical Devices, next-generation powered staplers equipped with sensors can monitor tissue thickness and adjust staple height accordingly is reducing complications like leaks or tears.

The adoption of IoT-enabled staplers is also gaining traction, allowing surgeons to track device performance during procedures. A report by McKinsey & Company suggests that connected medical devices could enhance operational efficiency by up to 30%, driving demand for technologically advanced staplers. Additionally, innovations in biocompatible materials are expanding usability, with bioabsorbable staples offering improved healing properties. These advancements align with the growing emphasis on precision medicine is presenting lucrative opportunities for companies willing to invest in R&D.

Expanding Applications in Emerging Therapies

The expanding scope of surgical staplers beyond traditional applications presents another promising opportunity. With the rise of organ transplantation and reconstructive surgeries, staplers are being adapted for novel uses. The United Network for Organ Sharing (UNOS) reports that over 40,000 organ transplants were performed in the U.S. in 2022 with the need for reliable tools like circular staplers to ensure vascular anastomosis. Moreover, the growing field of robotic-assisted surgery offers untapped potential. As per data from the International Federation of Robotics, the number of robotic surgical systems installed in North America grew by 25% between 2020 and 2022. Surgical staplers compatible with robotic platforms enable greater precision and control, fostering collaboration between device manufacturers and robotics firms. These emerging therapies and technological synergies expand the vast untapped potential within the market.

MARKET CHALLENGES

Intense Market Competition and Price Wars

The North America surgical staplers market faces stiff competition among key players, leading to aggressive pricing strategies that impact profitability. Major companies like Medtronic, Johnson & Johnson, and Ethicon dominate the landscape, but smaller firms are increasingly entering the fray, intensifying rivalry. According to a competitive analysis by Deloitte, price wars have become commonplace, with discounts ranging from 10% to 20% offered to secure contracts with large hospital networks.

This environment creates challenges for manufacturers striving to balance affordability with innovation. Smaller players often struggle to compete with established brands, limiting their ability to scale operations. Furthermore, consolidation among healthcare providers has resulted in bulk purchasing agreements favoring low-cost suppliers is squeezing profit margins. These dynamics hinder long-term investments in research and development by posing a challenge to sustained market growth.

Resistance to Change Among Practitioners

Another obstacle is the resistance to adopting new technologies among some healthcare practitioners. Despite the availability of advanced staplers, many surgeons prefer traditional suturing methods due to familiarity and perceived reliability. A survey conducted by the American College of Surgeons found that nearly 30% of respondents expressed hesitation in switching to newer stapler models without extensive training.

Training programs for innovative devices are often inadequate or underfunded, exacerbating this issue. Moreover, concerns about device malfunctions persist, as highlighted by the FDA's recall database, which documents user-reported errors. Overcoming practitioner skepticism requires targeted educational initiatives and robust post-market support, which remains a persistent challenge for market players aiming to drive adoption of cutting-edge solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.65 % |

|

Segments Covered |

By Type,Technology ,Usability,Application and Country. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Country Covered |

The U.S., Canada and Rest of North America |

|

Market Leader Profiled |

Ethicon Inc., Medtronic plc, CONMED Corporation, Smith & Nephew, Purple Surgical Inc. |

SEGMENTAL ANALYSIS

By Type Insights

Linear staplers segment was the largest by accounting for 45.9% of the North America surgical staplers market share in 2024. The segment’s growth is due to the versatility across various surgical disciplines, including gastrointestinal and thoracic procedures. Linear staplers are particularly favored for their ability to provide precise cuts and simultaneous sealing by reducing intraoperative blood loss and improving patient outcomes. The rising incidence of colorectal cancers, which require anastomoses achievable through linear staplers is also to boost the growth of the market. The American Cancer Society estimates over 150,000 new cases of colorectal cancer annually, underscoring the need for these devices. Additionally, advancements in ergonomic designs and reloadable cartridges enhance usability, encouraging wider adoption.

The circular staplers segment is likely to exhibit the highest CAGR of 8.5% from 2025 to 2033. This rapid expansion is fueled by their critical role in bariatric and colorectal surgeries, where they create secure anastomoses. The surge in obesity-related surgeries is projected to grow by 7% annually by the CDC that directly boosts demand for circular staplers.

Innovations such as adjustable diameters and enhanced visualization features contribute to their accelerated adoption. Moreover, partnerships between manufacturers and training institutions are equipping surgeons with skills to utilize circular staplers effectively will further propel the market penetration.

By Technology Insights

The manual staplers segment was the largest and held 55.4% of the North America surgical staplers market share in 2024. The growth of the segment is attributed to affordability and ease of use, especially in resource-constrained settings. Manual staplers are widely utilized in general surgeries, where cost-effectiveness remains a priority.Their simplicity ensures minimal learning curves, appealing to practitioners who value reliability over automation.

The powered staplers segment is projected to grow at a CAGR of 9.2% throughout the forecast period. Their superior precision and consistency make them ideal for complex surgeries. The integration of artificial intelligence and motorized controls enhances accuracy is addressing concerns related to human error. Increasing investments in robotic surgery platforms are amplifying demand for powered staplers, as they seamlessly integrate with these systems.

By Usability Insights

The Disposable staplers dominated the market by holding a significant share of the North America surgical staplers market share in 2024. Their single-use nature eliminates risks of cross-contamination, aligning with stringent infection control standards. Hospitals prioritize disposables for their convenience and compliance with hygiene protocols.

Advancements in lightweight materials and ergonomic designs further bolster their appeal. Additionally, the growing volume of outpatient surgeries favors disposables due to their ease of deployment and disposal.

The reusable staplers segment is projected to register a CAGR of 7.8% during the forecast period. Cost-efficiency and sustainability initiatives drive their adoption in budget-conscious facilities. Enhanced durability and recyclability make them attractive alternatives to disposables. Manufacturers are investing in antimicrobial coatings and modular designs to extend lifespans by accelerating market penetration.

By Application Insights

The abdominal and pelvic surgeries segment dominated the North America surgical staplers market with prominent share in 2024. This dominance is driven by the high prevalence of gastrointestinal disorders, requiring frequent use of staplers for anastomoses and resections. The rising incidence of colorectal cancers and bariatric surgeries further amplifies demand, supported by advancements in stapler technology tailored for these procedures.

The orthopedic surgeries segment is likely to grow with a CAGR of 8.9% in the next coming years. The aging population and increased focus on joint replacements propel demand. Innovations in staplers designed for bone fixation and soft tissue repair enhance their utility in orthopedics is fostering rapid adoption.

COUNTRY LEVEL ANALYSIS

The United States was the largest contributor in the North America surgical staplers market by capturing 80.9% of the share in 2024. The market growth in this country is driven by its advanced healthcare infrastructure and high adoption rates of minimally invasive surgeries. Surgical staplers are extensively used in procedures like colorectal and bariatric surgeries, driven by the rising prevalence of obesity and gastrointestinal disorders. According to the Centers for Disease Control and Prevention, over 42% of American adults are obese is creating a surge in demand for abdominal surgeries where staplers play a critical role.

The U.S. also benefits from favorable reimbursement policies for surgical procedures by encouraging hospitals to invest in premium devices. Additionally, the presence of leading manufacturers like Medtronic and Ethicon fosters innovation and availability of cutting-edge products. According to a study by the National Institutes of Health, laparoscopic surgeries, which heavily rely on staplers, reduce recovery times by up to 60%, further boosting adoption. These factors collectively position the U.S. as a global leader in the surgical staplers market.

Canada is esteemed to have a significant CAGR of 12.6% in the foreseen years. The country's robust public healthcare system and growing emphasis on patient safety drive demand for advanced medical devices. Surgical staplers are widely adopted in orthopedic and general surgeries, supported by an aging population projected to reach 25% of the total population by 2030, as stated by Statistics Canada.

Government initiatives promoting minimally invasive techniques have bolstered adoption. For instance, Health Canada’s push for safer surgical practices aligns with the increasing use of disposable staplers to minimize infection risks. Furthermore, partnerships between Canadian hospitals and international manufacturers ensure access to innovative products, enhancing market growth.

Top Players in the Market

Medtronic

Medtronic stands as a global pioneer in the surgical staplers market, renowned for its innovative product portfolio tailored to meet diverse clinical needs. The company’s powered staplers, integrated with advanced sensors and feedback mechanisms, set industry benchmarks for precision and reliability. Medtronic’s strong distribution network ensures widespread accessibility across North America, catering to both urban hospitals and rural clinics.

Ethicon (Johnson & Johnson)

Ethicon, a subsidiary of Johnson & Johnson, commands a formidable presence in the surgical staplers market through its focus on quality and usability. The company specializes in circular and linear staplers designed for complex procedures like colorectal surgeries. Ethicon’s commitment to sustainability is evident in its biocompatible materials, which enhance patient outcomes. Collaborations with academic institutions for training programs have strengthened surgeon confidence in adopting their products.

Becton, Dickinson and Company (BD)

Becton, Dickinson and Company excels in offering cost-effective yet high-performing surgical staplers, making it a preferred choice for budget-conscious facilities. BD’s emphasis on ergonomic design and modular reloadable cartridges enhances operational efficiency during surgeries. The company’s strategic acquisitions have expanded its product line, enabling it to cater to niche applications such as thoracic surgeries. BD continues to reinforce its competitive edge in the market with a robust pipeline of innovations.

Top strategies used by the key market participants

Key players in the North America surgical staples market employ a mix of organic and inorganic strategies to maintain their dominance positions. These include product innovation, strategic partnerships, and mergers and acquisitions. For instance, Medtronic focuses heavily on R&D, launching technologically advanced staplers equipped with IoT capabilities to enhance precision. Ethicon leverages collaborations with training institutions to promote awareness about its products among surgeons. Meanwhile, BD prioritizes cost optimization by streamlining manufacturing processes while maintaining high-quality standards.

Penetration pricing strategies are another common tactic, particularly in emerging markets within North America, ensuring affordability without compromising performance. Joint ventures with robotics firms also enable companies to integrate staplers into automated surgical systems is fostering synergies across technologies.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

A few of the noteworthy companies operating in the North America surgical staplers market profiled in the report are Ethicon Inc., Medtronic plc, CONMED Corporation, Smith & Nephew, Purple Surgical Inc., Intuitive Surgical Inc., Welfare Medical Ltd., Reach surgical Inc., Merril Life Science Pvt. Ltd., Grena Ltd., B. Braun Melsungen AG, Dextera Surgical Inc., Frankenman International, and Becton & Dickinson.

The North America surgical staplers market is characterized by intense competition among established players striving to innovate and capture greater market share. Leading firms like Medtronic, Ethicon, and BD continuously invest in R&D to introduce cutting-edge products that address unmet clinical needs. This competitive landscape is further shaped by collaborations between manufacturers and healthcare providers to develop customized solutions.

Technological advancements, such as AI-enabled staplers and compatibility with robotic platforms, serve as key differentiators. Smaller players also contribute to market dynamism by targeting underserved segments with affordable alternatives. Regulatory compliance and stringent quality controls add layers of complexity, compelling companies to prioritize safety alongside innovation. Overall, the market reflects a balance of consolidation and fragmentation, with ample opportunities for growth amid evolving healthcare demands.

RECENT HAPPENINGS IN THE MARKET

- In April 2023, Medtronic launched Signia™ Powered Stapling System, featuring adaptive firing technology to improve tissue compression accuracy is strengthening its dominance in powered staplers.

- In June 2023, Ethicon introduced Echelon™ Circular Stapler with Gripping Surface Technology, enhancing hemostasis during colorectal surgeries by reinforcing its expertise in complex procedures.

- In September 2023, BD acquired Staple Innovations Inc., expanding its portfolio of reusable staplers and addressing sustainability trends in healthcare.

- In November 2023, Medtronic partnered with Intuitive Surgical to integrate its staplers with da Vinci robotic systems, boosting compatibility and market reach.

- In February 2024, Ethicon collaborated with Mayo Clinic to conduct training workshops on advanced stapling techniques is increasing surgeon confidence and adoption rates.

MARKET SEGMENTATION

This research report on the north america surgical staplers market has been segmented and sub-segmented into the following.

By Type

- Linear staplers

- circular staplers

By Technology

- manual staplers

- powered staplers

By Usability

- Disposable staplers

- reusable staplers

By Application

- abdominal and pelvic surgeries

- orthopedic surgeries segment

By Country

- The U.S.

- Canada

- Rest of North America.

Frequently Asked Questions

What are the major types of surgical staplers available in north america surgical staplers market?

The market primarily includes manual and powered surgical staplers. They can further be classified into disposable and reusable staplers.

What are the latest technological advancements in surgical staplers market in north america ?

Recent innovations include robotic-assisted staplers, smart staplers with real-time feedback, bioabsorbable staplers, and advanced ergonomic designs for better precision.

What is the market outlook for the North America Surgical Staplers Market?

The market is expected to grow steadily, driven by technological advancements, increasing surgical volumes, and the adoption of minimally invasive procedures.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com