Global Surgical Staplers Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Disposable Stapler and Reusable Stapler), Product (Manual and Powered), End Users (Pelvis, Abdominal, Thoracic, Cardiac, Hemorrhoids, Paediatric, Cosmetic and General Surgery), Application (Hospitals, Ambulatory Surgical Centers and Clinics) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Surgical Staplers Market Size (2024 to 2032)

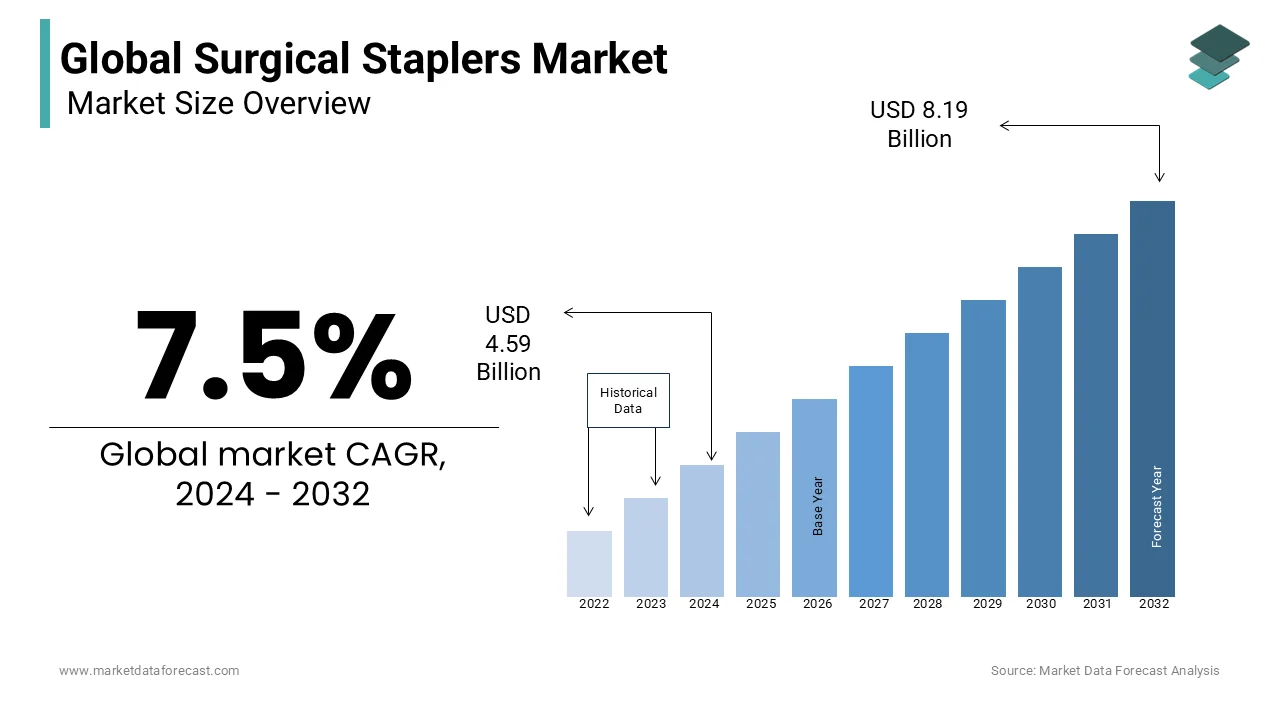

In 2023, the global surgical staplers market was valued at USD 4.27 billion and it is expected to reach USD 8.19 billion by 2032 from USD 4.59 billion in 2024, growing at a CAGR of 7.5% during the forecast period.

MARKET DRIVERS

Y-O-Y growth in the aging population is resulting in the increasing patient population of various diseases and fuelling the demand for surgical staplers and propelling the global market growth.

The aging population is growing at an aggressive rate across the world. As a result, they are much more likely to diagnose several diseases, primarily accelerating the global surgical staplers market growth. Technological advancements, growing disposable income, highly developed healthcare infrastructure in developed and developing countries, and the rising demand for power surgical instruments in improving economies further drive the surgical staplers market. Delivery of technologically innovative surgical staplers with maximum efficiency and safety will increase the adoption rate and product demand. Furthermore, rising global demand for surgical staplers over surgical sutures and increasing the number of surgical procedures worldwide make the surgical staplers market grow further.

Some other driving factors contributing to the growth of the global surgical staplers market are the rise of the need for wound and tissue management devices and advanced technology. Increment of demand for minimally invasive and robotic surgeries, obesity, and awareness among people about bariatric surgeries. Moreover, the increment of incidence cases and rate of increment of cancer cases.

MARKET RESTRAINTS

The factors hindering the growth of the surgical staplers market are the rising demand for new wound closure materials like fibrin sealants and glues. In addition, the side effects, such as adverse or allergic reactions associated with products such as steel or titanium, are slowly restraining the market's demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Analysed |

By Type, Product, End-User, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Analysed |

North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

|

Key Market Players |

Becton Dickinson, Ethicon Inc. (U.S.), Medtronic plc (Ireland), CONMED Corporation (U.S.), Smith & Nephew (U.K.), Purple Surgical Inc. (U.K.), Intuitive Surgical Inc. (U.S.), Welfare Medical Ltd. (U.K.), Reach surgical Inc. (China), Merril Life Science Pvt. Ltd. (India), Grena Ltd. (U.K.), B. Braun Melsungen AG (Germany), Dextera Surgical Inc. (U.S.) and Frankenman International (China). |

SEGMENTAL ANALYSIS

Global Surgical Staplers Market Analysis By Type

The disposable segment is expected to hold a significant share of the global surgical staplers market during the forecast period. A disposal stapler is a one-time-use device mostly made of plastic. The disposal staplers are ideal as they reduce the chances of infections during surgery, eventually improving the technical quality. Furthermore, the transmission of infectious diseases from patients to medical personnel can be prevented by disposing of surgical staplers. Disposal surgical staplers are also cheaper when compared to reusable staplers. Avoiding transmission of infections through contaminated equipment is vital for healthcare organizations, which is considered the primary issue associated with reusable devices. Also, the disinfection of the reusable devices' multifaceted procedure requires proper care and maintenance.

Global Surgical Staplers Market Analysis By Application

The abdominal and pelvic segments are expected to lead the market and account for the major share of the worldwide market during the forecast period. Increasing incidents of obesity and rising health consciousness worldwide are propelling the segmental expansion. Increasing buying capacity and weight loss & bariatric surgeries across the globe are anticipated to fuel the growth rate of the segment.

Global Surgical Staplers Market Analysis By End-User

The hospital segment was identified as the largest end-use segment in the last few years. The ambulatory center segment is anticipated to display the highest CAGR over the forecast period. The ambulatory center segment's stable growth can be credited to shortages of hospital beds and scarce economic resources, particularly in underdeveloped and developing economies. The hospital segment is expected to dominate the global market over the forecast period due to bariatric surgery reimbursement scenarios.

REGIONAL ANALYSIS

North America holds the largest market share globally due to the region's early acceptance and adoption of staples and the demand for minimally invasive procedures.

The Asia Pacific is likely to show higher growth during the forecast period due to a large patient pool in economies such as China, India, and Japan. The surgical staplers remained categorized under "drugs" and were controlled under India’s Drugs and Cosmetics Act because of growing use and demand. The application of this act reduced strict regulations for making and supply of surgical staplers. In the Asia Pacific, the number of surgical procedures is increasing, and coupled with an increase in healthcare expenditure; the market is expected to witness lucrative growth.

KEY PLAYERS IN THE GLOBAL SURGICAL SUTURES MARKET

A list of crucial participants leading the global surgical sutures market profiled in this report are Becton Dickinson, Ethicon Inc. (U.S.), Medtronic plc (Ireland), CONMED Corporation (U.S.), Smith & Nephew (U.K.), Purple Surgical Inc. (U.K.), Intuitive Surgical Inc. (U.S.), Welfare Medical Ltd. (U.K.), Reach surgical Inc. (China), Merril Life Science Pvt. Ltd. (India), Grena Ltd. (U.K.), B. Braun Melsungen AG (Germany), Dextera Surgical Inc. (U.S.) and Frankenman International (China).

RECENT HAPPENINGS IN THIS MARKET

- In February 2020, a new generation of peri strips dry with veritas collagen matrix product (PSDV) was launched by Baxter International. PSDV has a secure grip for reliable staple line reinforcement in surgical procedures.

- In December 2020, an EEA circular stapler with Tri-staple technology was launched by Medtronic India. The Tri-staple technology comprises a sloped cartridge face that delivers less stress on the Tissue. The EEA circular stapler with Tri-staple technology stipulated for colorectal procedures requires safer anastomosis to avoid leaks. This product launch is to escalate the product portfolio of the company.

- Baxter International, a global leader in advanced surgical innovations, announced 510k clearance Food and Drug Administration in the U.S. for a new generation of its Peri-strips dry with veritas collagen matrix. The new generation of PSDV is twice as fast as the earlier version and another staple line reinforcement product. Unfortunately, modern stapling technology used in bariatric procedures results in high morbidity, and mortality persists. Staple line Bleeding and leaks are the most prevalent complications while performing stapling.

DETAILED SEGMENTATION OF THE GLOBAL SURGICAL SUTURES MARKET INCLUDED IN THIS REPORT

This research report on the global surgical staplers market has been segmented and sub-segmented based on type, product, application, end-user and region.

By Type

- Disposable Staplers

- Reusable Staplers

By Product

- Manual

- Powered

By Application

- Pelvis

- Abdominal

- Thoracic

- Cardiac

- Hemorrhoids

- Pediatric

- Cosmetic

- General Surgery

By End User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the projected market value of surgical staplers market market by 2032?

As per our research report, the global surgical staplers market size is estimated to be worth USD 8.19 billion by 2032.

Which region is growing the fastest in the global surgical staplers market?

Geographically, the North American surgical staplers market accounted for the largest share of the global market in 2023.

At What CAGR, the global surgical staplers market is expected to grow from 2023 to 2032?

The global surgical staplers market is estimated to grow at a CAGR of 7.5% from 2023 to 2032

Which are the significant players operating in the surgical staplers market?

Welfare Medical Ltd. (U.K.), Reach surgical Inc. (China), Merril Life Science Pvt. Ltd. (India), Grena Ltd. (U.K.), B. Braun Melsungen AG (Germany), Dextera Surgical Inc. (U.S.) and Frankenman International (China) are some of the significant players operating surgical staplers market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]