North America Thermoplastic Elastomers Market Size, Share, Trends & Growth Forecast Report By Application (Automotive, Electrical & Electronics, Industrial, Medical, Consumer Goods, Others), Material (Poly Styrenes, Poly Olefins, Poly Ether Imides, Poly Urethanes, Poly Esters, Poly Amides), and Country (United States, Canada, Mexico, Rest of North America) – Industry Analysis From 2025 to 2033.

North America Thermoplastic Elastomers Market Size

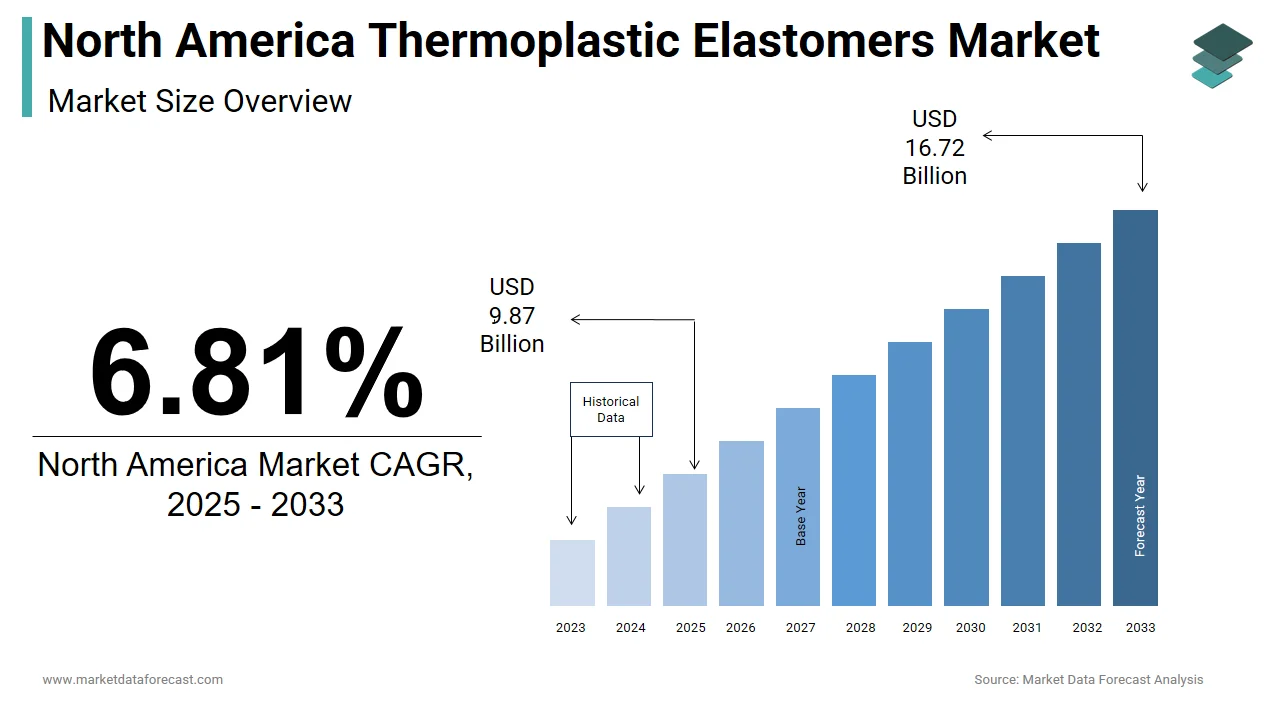

The size of the North America thermoplastic elastomers market was worth USD 9.24 billion in 2024. The North America market is anticipated to grow at a CAGR of 6.81% from 2025 to 2033 and be worth USD 16.72 billion by 2033 from USD 9.87 billion in 2025.

Thermoplastic elastomers (TPEs) are a class of polymers that exhibit both thermoplastic and elastomeric properties, allowing them to be processed like conventional plastics while offering the flexibility and resilience of rubbers. These materials find extensive application across industries such as automotive, consumer goods, medical devices, construction, and electronics due to their versatility, recyclability, and ability to withstand varying temperatures and mechanical stress. In North America, the demand for TPEs has been driven by a growing preference for lightweight, durable, and environmentally friendly alternatives to traditional rubber and PVC-based materials. The market is characterized by a wide range of product types, including styrenic block copolymers (SBC), thermoplastic polyurethanes (TPU), thermoplastic vulcanizates (TPV), and others.

MARKET DRIVERS

Expansion of the Automotive Industry

One of the primary drivers of the North America thermoplastic elastomers (TPEs) market is the sustained expansion of the automotive industry, which accounts for a significant share of TPE consumption. As per data from the Original Equipment Suppliers Association (OESA), the North American automotive supply chain produced over 14 million vehicles in 2023, with a strong emphasis on lightweight and fuel-efficient designs. TPEs are extensively used in automotive components such as seals, gaskets, interior trims, weather stripping, and under-the-hood applications due to their durability, flexibility, and resistance to extreme temperatures. According to the U.S. Department of Energy (DOE), reducing vehicle weight by 10% can improve fuel efficiency by up to 8%, making lightweight materials like TPEs increasingly valuable. Additionally, the shift toward electric vehicles (EVs) has further boosted demand, as TPEs offer superior sealing and insulation properties essential for battery enclosures and charging systems. Moreover, automotive manufacturers are adopting TPEs over traditional thermoset rubbers due to their recyclability and ease of processing, aligning with corporate sustainability commitments.

Growth in Consumer Goods and Medical Device Manufacturing

Another key driver of the North America thermoplastic elastomers (TPEs) market is the rapid expansion of the consumer goods and medical device manufacturing sectors, both of which rely heavily on high-performance, safe, and flexible materials. Their soft-touch, non-slip, and ergonomic properties make them ideal for enhancing user experience in handheld devices and personal care products. In the medical sector, TPEs are increasingly replacing latex and silicone in disposable gloves, tubing, syringes, and drug delivery systems due to their biocompatibility, sterilization resistance, and absence of plasticizers. Further, the rise in home healthcare and wearable medical devices has amplified the need for flexible, hypoallergenic materials.

MARKET RESTRAINTS

Volatility in Raw Material Prices

A major restraint affecting the North America thermoplastic elastomers (TPEs) market is the persistent volatility in raw material prices, particularly those derived from petroleum-based feedstocks such as butadiene, styrene, and polypropylene. These variations directly impact the cost structure of TPE manufacturers, who rely heavily on petrochemical inputs. According to the American Chemistry Council (ACC), the average price of ethylene, a key precursor in polymer production, increased by 14% in 2023 compared to the previous year. Similarly, styrene monomer prices surged by over 18% during the same period, driven by supply constraints and increased demand from downstream industries. These cost escalations have compressed profit margins for TPE producers and led to higher end-product pricing, dampening demand elasticity. Also, geopolitical tensions and trade restrictions have contributed to supply instability. The U.S. International Trade Commission (USITC) observed a 12% increase in import duties on certain chemical intermediates in early 2023, further straining procurement strategies.

Regulatory Pressures and Environmental Compliance Requirements

Stringent regulatory frameworks and evolving environmental compliance mandates present another major challenge for the North America thermoplastic elastomers (TPEs) market. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada (ECCC) have imposed increasingly rigorous standards on chemical emissions, recyclability, and lifecycle sustainability of polymer products. A notable example is the EPA’s Toxic Substances Control Act (TSCA), which requires comprehensive risk assessments for new and existing chemical substances used in TPE formulations. According to the National Institute of Environmental Health Sciences (NIEHS), concerns regarding microplastic pollution and endocrine-disrupting additives have prompted stricter scrutiny of polymer additives such as phthalates and bisphenols, even though many TPEs are free from such compounds. Nevertheless, manufacturers must invest heavily in reformulation and certification processes to meet evolving regulatory expectations. Furthermore, state-level regulations in California, New York, and Washington have introduced extended producer responsibility (EPR) laws, mandating greater accountability for post-consumer plastic waste. While these regulations aim to promote sustainability, they also create barriers to market entry and slow down product innovation cycles. Companies must navigate a complex landscape of federal, state, and international directives, leading to delays in commercialization and increased R&D expenditures.

MARKET OPPORTUNITIES

Surge in Demand for Sustainable and Bio-Based TPEs

A compelling opportunity for the North America thermoplastic elastomers (TPEs) market lies in the rising demand for sustainable and bio-based alternatives. Consumers and regulators alike are pushing for greener materials that reduce dependency on fossil fuels and minimize environmental impact. Several leading manufacturers have responded by introducing plant-derived TPEs made from renewable feedstocks such as castor oil, polylactic acid (PLA), and starch-based polymers. For instance, companies like BASF and Covestro have launched commercially viable bio-based TPE variants that match the performance of conventional petroleum-derived counterparts. The Biodegradable Products Institute (BPI) has certified multiple TPE formulations for compostability, opening doors to use in packaging, textiles, and consumer electronics. Additionally, automakers and footwear brands are incorporating bio-based TPEs into product lines to meet environmental targets. As reported by the Sustainable Packaging Coalition (SPC), over 60 North American companies pledged to adopt 100% reusable or recyclable materials by 2025, with TPEs playing a strategic role. The Ellen MacArthur Foundation further emphasizes that circular economy principles are gaining traction, encouraging TPE recyclability and reuse.

Increasing Use in Industrial and Construction Applications

The industrial and construction sectors represent a growing opportunity for the North America thermoplastic elastomers (TPEs) market, driven by the need for durable, flexible, and corrosion-resistant materials. According to the U.S. Census Bureau, total construction spending in the U.S. reached an all-time high of $1.7 trillion in 2023, with commercial and infrastructure projects accounting for a large portion. TPEs are increasingly being utilized in building materials such as sealants, roofing membranes, window profiles, and insulation tapes due to their excellent weather resistance, flexibility, and longevity. In industrial settings, TPEs are replacing conventional rubber and PVC in conveyor belts, hoses, gaskets, and protective coatings, especially in environments exposed to oils, chemicals, and abrasion. The National Association of Home Builders (NAHB) notes that modern construction techniques now emphasize energy efficiency and moisture control, areas where TPE-based products offer superior performance. Furthermore, green building certifications such as LEED and BREEAM are promoting the use of recyclable and low-emission materials, favoring TPE adoption. Additionally, the oil and gas sector is expanding its use of TPEs in pipeline linings, valve seals, and hydraulic equipment, owing to their resistance to hydrocarbons and extreme temperatures.

MARKET CHALLENGES

Intense Competition from Substitute Materials

One of the principal challenges facing the North America thermoplastic elastomers (TPEs) market is the intense competition from substitute materials such as silicone, rubber, polyvinyl chloride (PVC), and thermoplastic olefins (TPOs). Despite the unique advantages of TPEs—such as recyclability, processability, and flexibility—they face stiff competition from legacy materials that have well-established applications and cost structures. In addition, silicone remains a dominant choice in high-temperature applications, particularly in medical devices and cookware, where thermal stability is critical. Meanwhile, natural and synthetic rubbers continue to be widely used in industrial seals, tires, and vibration-damping components, where long-term durability is prioritized over recyclability. The Rubber Manufacturers Association (RMA) notes that a key share of automotive OEMs still specify rubber-based parts in under-the-hood applications due to their proven performance under extreme conditions. Additionally, PVC remains a cost-effective alternative in construction, wire and cable insulation, and consumer goods, despite growing environmental concerns. To counter this challenge, TPE manufacturers must focus on performance differentiation, sustainability positioning, and value-added engineering to justify premium pricing.

Complexity in Recycling and Waste Management

A growing challenge for the North America thermoplastic elastomers (TPEs) market is the complexity associated with recycling and waste management. Although TPEs are technically recyclable unlike thermoset rubbers, their heterogeneous composition—often blended with other polymers or additives—poses difficulties in separation and reprocessing. Unlike commodity plastics such as PET or HDPE, which have well-defined recycling infrastructures, TPEs often fall into niche categories that lack dedicated collection and processing systems. The Association of Plastic Recyclers (APR) notes that contamination from multi-material assemblies complicates mechanical recycling, reducing the economic viability of reclaiming TPE content from end-of-life products. Moreover, while some TPEs are compatible with chemical recycling, the technology remains in the early stages of commercial deployment in North America. As governments push for extended producer responsibility (EPR) and single-use plastic bans, TPE manufacturers must address recyclability concerns to maintain market relevance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Application, Material, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Countries Covered |

United States, Canada, Mexico, Rest of North America |

|

Market Leaders Profiled |

BASF SE, Arkema, DuPont, Covestro AG, China Petrochemical Corporation, Dynasol Elastomers, EMS-CHEMIE HOLDING AG, Evonik Industries, LG Chem, LCY Chemical Corporation, Lubrizol Corporation, LyondellBasell Industries, Tosoh Corporation, Avient Corporation, Teknor APEX Company, The Dow Chemical Company, and TSRC Corporation. |

SEGMENTAL ANALYSIS

By Application Insights

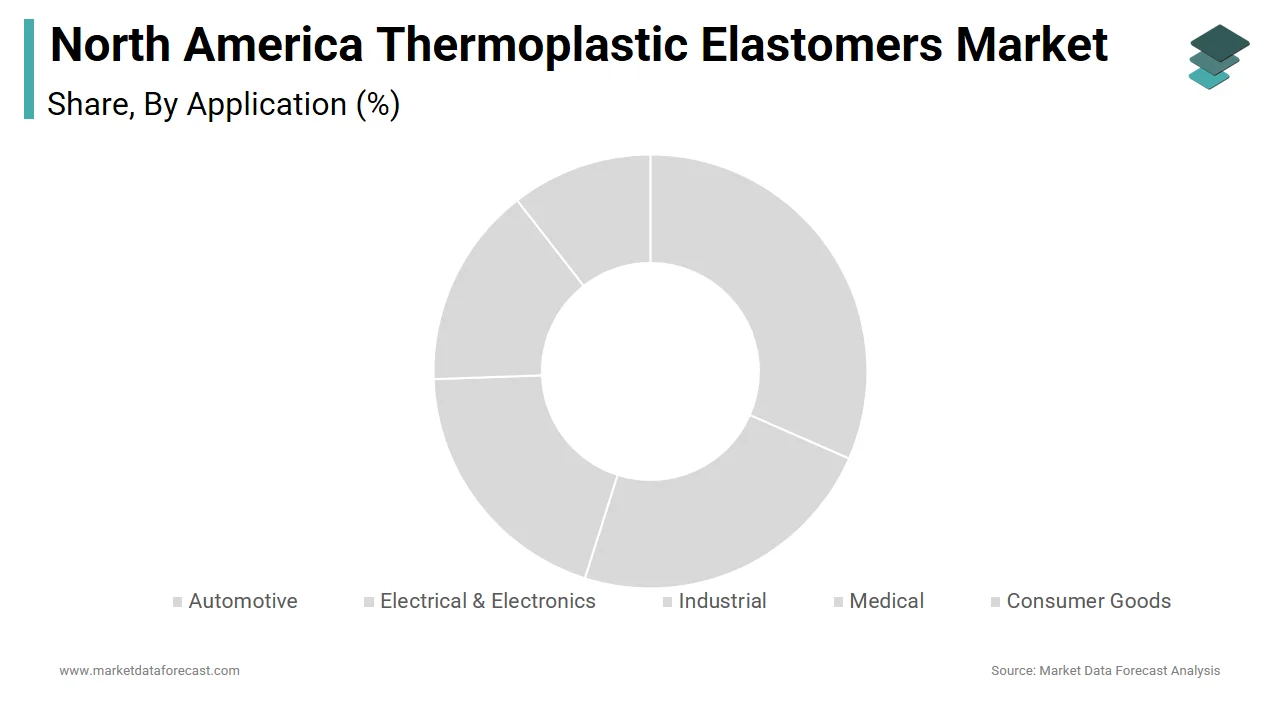

The automotive sector held the biggest share of the North America thermoplastic elastomers (TPEs) market by accounting for a 45.3% in 2024. This dominance is primarily attributed to the widespread use of TPEs in vehicle manufacturing, including interior components, exterior seals, under-the-hood applications, and flexible hoses. Moreover, the shift toward electric vehicles (EVs) has further boosted TPE demand. TPEs are extensively used in battery enclosures, charging cables, and insulation components due to their flexibility, thermal resistance, and electrical insulation properties. Also, automotive manufacturers prefer TPEs over traditional thermoset rubbers due to their recyclability and ease of processing.

The medical application segment is the fastest-growing in the North America thermoplastic elastomers (TPEs) market, projected to expand at a CAGR of 7.8%. This rapid growth is driven by increasing demand for disposable medical devices, biocompatible materials, and advanced healthcare infrastructure development. Further, the rise in home healthcare and wearable medical devices has amplified the need for flexible, hypoallergenic materials. Moreover, TPEs offer advantages over silicone and PVC in terms of recyclability and cost-effectiveness.

By Material Insights

Polystyrenes, particularly styrenic block copolymers (SBCs), represent the largest material segment in the North America thermoplastic elastomers (TPEs) market by holding 38% of total market share in 2024. Their widespread adoption stems from their versatility, ease of processing, and ability to be tailored for various end-use applications. In the automotive industry, these materials are employed in dashboard components, grip handles, and weather stripping, contributing significantly to market growth. Furthermore, the packaging industry remains a major consumer of poly styrene-based TPEs. Additionally, government initiatives promoting sustainable alternatives to PVC have encouraged the adoption of SBC-based compounds.

Polyolefin-based thermoplastic vulcanizates (TPVs) are emerging as the swiftest growing material segment in the North America thermoplastic elastomers (TPEs) market, anticipated to grow at a CAGR of 8.2%. This is caused by their superior durability, heat resistance, and suitability for automotive and industrial applications. In addition, TPVs are gaining traction in industrial sectors such as construction, energy, and agriculture. Moreover, the push for recyclable materials has favored TPVs over thermoset rubbers, which cannot be reprocessed once cured. With strong support from both automotive and industrial sectors, poly olefins are set to outpace other TPE materials in growth trajectory.

COUNTRY LEVEL ANALYSIS

The United States accounted for 78.4% of the North America thermoplastic elastomers (TPEs) market in 2024, maintaining its position as the dominant regional player due to its well-established automotive, healthcare, and consumer goods industries. Automakers are increasingly using TPEs in interior trims, seals, and under-the-hood components to reduce weight and improve fuel efficiency. In the medical sector, the U.S. continues to lead in innovation and production. Regulatory approvals from the FDA have also accelerated the adoption of biocompatible TPEs. Beyond these sectors, the consumer goods and packaging industries remain strong contributors. These diverse applications solidify the U.S. as the central hub of the North America TPE market.

Canada is experiencing steady growth supported by expanding industrial manufacturing, construction activities, and healthcare advancements. TPEs are increasingly being used in building materials such as sealants, roofing membranes, and insulation tapes due to their durability and environmental resistance. Additionally, the automotive industry in Canada remains a key consumer of TPEs. The shift toward electric vehicles (EVs) is also influencing material selection, with OEMs focusing on lightweight and recyclable options. In the healthcare domain, the Public Health Agency of Canada (PHAC) notes that medical supply demand remained elevated in 2023, particularly for disposable gloves and protective equipment, where TPEs serve as a preferred alternative to latex. These combined factors ensure continued growth in Canada’s TPE market.

The Rest of North America, comprising Mexico and select Central American territories, adds a notable share of the regional thermoplastic elastomers (TPEs) market but shows promising potential for future expansion. While currently smaller in scale, this sub-region is witnessing growing industrialization, automotive production, and investment in consumer goods manufacturing. Additionally, the Mexican government’s focus on medical device exports has spurred TPE adoption in healthcare products, especially gloves and disposable equipment. Central American nations such as Costa Rica and Guatemala are also developing niche manufacturing bases, particularly in electronics and textiles.

MARKET KEY PLAYERS

Companies playing a dominant role in the North America thermoplastic elastomers market profiled in this report are BASF SE, Arkema, DuPont, Covestro AG, China Petrochemical Corporation, Dynasol Elastomers, EMS-CHEMIE HOLDING AG, Evonik Industries, LG Chem, LCY Chemical Corporation, Lubrizol Corporation, LyondellBasell Industries, Tosoh Corporation, Avient Corporation, Teknor APEX Company, The Dow Chemical Company, and TSRC Corporation.

TOP LEADING PLAYERS IN THE MARKET

BASF SE

BASF is a leading global chemical company with a strong presence in the North America thermoplastic elastomers (TPEs) market. The company offers a broad portfolio of TPE solutions, including polyurethanes, styrenic block copolymers, and engineering plastics tailored for automotive, consumer goods, and industrial applications. BASF’s innovation-driven approach has enabled the development of sustainable and high-performance TPE variants that align with evolving industry demands.

The company actively collaborates with automotive OEMs and medical device manufacturers to enhance material performance while supporting sustainability goals. Its commitment to research and development ensures continuous improvement in product functionality, recyclability, and processing efficiency, making it a key influencer in shaping the future of the TPE landscape in North America.

Covestro AG

Covestro is a major contributor to the North America thermoplastic elastomers market, particularly in the fields of thermoplastic polyurethanes (TPUs) and polycarbonate-based blends. The company's TPE offerings are widely used in footwear, electronics, automotive interiors, and protective equipment due to their flexibility, durability, and thermal resistance.

Covestro emphasizes sustainability by developing bio-based and low-emission TPE alternatives that cater to environmentally conscious industries. It also invests heavily in digitalization and circular economy initiatives, aiming to improve material lifecycle management. Through strategic partnerships and localized production facilities, Covestro strengthens its position as a reliable supplier of high-performance TPE solutions across North America.

Kraton Corporation

Kraton Corporation specializes in styrenic block copolymers (SBCs), a key segment within the thermoplastic elastomers market. The company serves diverse sectors such as adhesives, sealants, personal care, and asphalt modification, offering customizable formulations that enhance product performance and processability.

Kraton focuses on delivering innovative, renewable-content-based TPEs that meet the growing demand for sustainable materials. Its technical expertise and customer-centric approach have made it a preferred partner for formulators and manufacturers seeking high-value polymer solutions. By expanding its product range and investing in green chemistry, Kraton continues to solidify its influence in the North American TPE market.

TOP STRATEGIES USED BY KEY MARKET PARTICIPANTS

One of the primary strategies employed by key players in the North America thermoplastic elastomers (TPEs) market is product innovation and formulation customization. Companies are continuously developing new grades of TPEs with enhanced properties such as higher heat resistance, improved recyclability, and reduced environmental impact to meet specific application requirements.

Another crucial strategy is strategic collaborations and joint ventures with downstream manufacturers, especially in the automotive and healthcare sectors. These partnerships allow TPE producers to align their R&D efforts with end-user needs, ensuring that their materials integrate seamlessly into final products while meeting regulatory and performance standards.

Lastly, companies are increasingly focusing on expanding regional production capabilities and strengthening supply chain resilience. This includes establishing localized manufacturing units, acquiring niche material firms, and investing in advanced compounding technologies to ensure consistent product availability and faster response to market demands in North America.

COMPETITION OVERVIEW

The North America thermoplastic elastomers (TPEs) market is highly competitive, characterized by the presence of established global players and a growing number of regional manufacturers striving to capture market share through innovation, sustainability, and operational excellence. The competition is shaped by factors such as technological advancements, shifting consumer preferences toward eco-friendly materials, and increasing demand from high-growth industries like automotive, healthcare, and consumer goods.

Market leaders leverage their extensive R&D capabilities, brand recognition, and diversified product portfolios to maintain dominance. At the same time, emerging players are gaining traction by introducing cost-effective, specialty-grade TPEs tailored for niche applications. Strategic moves such as mergers, acquisitions, and partnerships are becoming common as companies aim to expand their geographic reach and strengthen their foothold in key end-use sectors.

Additionally, the rising emphasis on circular economy principles and regulatory support for recyclable polymers are pushing vendors to innovate beyond traditional offerings. As a result, differentiation through product performance, sustainability credentials, and value-added services has become essential for maintaining a competitive edge in this dynamic and evolving market landscape.

RECENT MARKET DEVELOPMENTS

- In March 2024, BASF announced the launch of a new line of bio-based thermoplastic elastomers designed for use in flexible packaging and footwear applications, aiming to reduce reliance on fossil-fuel-derived feedstocks and enhance sustainability.

- In June 2024, Covestro partnered with a leading North American automotive manufacturer to develop lightweight TPE components for electric vehicles, focusing on improving battery insulation and structural integrity without compromising performance.

- In August 2024, Kraton Corporation opened a dedicated innovation center in Texas to accelerate the development of high-performance styrenic block copolymer-based TPEs tailored for adhesive and sealant applications across various industries.

- In October 2024, Lubrizol Advanced Materials acquired a specialty polymer compounding facility in Canada to expand its local production capacity and better serve medical device manufacturers requiring high-purity TPE compounds.

- In December 2024, Teknor Apex introduced an upgraded series of PVC-free thermoplastic elastomers specifically formulated for use in food packaging and household appliances, enhancing safety, durability, and recyclability.

MARKET SEGMENTATION

This research report on the North America thermoplastic elastomers market is segmented and sub-segmented into the following categories.

By Application

- Automotive

- Electrical & Electronics

- Industrial

- Medical

- Consumer Goods

- Others

By Material

- Poly Styrenes

- Poly Olefins

- Poly Ether Imides

- Poly Urethanes

- Poly Esters

- Poly Amides

By Country

- United States

- Canada

- Mexico

- Rest of North America

Frequently Asked Questions

1. What are the main end-use industries for thermoplastic elastomers in North America?

Major sectors are automotive, construction, electrical and electronics, medical, footwear, consumer goods, and adhesives and sealants

2. How is the automotive industry influencing the North America Thermoplastic Elastomers Market?

The automotive sector drives demand for TPEs due to lightweighting, fuel efficiency, design flexibility, and the shift to electric vehicles

3. How are technological advancements shaping the North America Thermoplastic Elastomers Market?

Innovations in polymer chemistry, recycling, and sustainable sourcing are expanding TPE applications and performance

4. Who are the leading companies in the North America Thermoplastic Elastomers Market?

Notable players include DuPont, BASF SE, Covestro AG, Kraton Corporation, Advanced Elastomer Systems LP, and The Dow Chemical Company

5. What are the primary drivers of growth in the North America Thermoplastic Elastomers Market?

Growth is fueled by demand in automotive, electronics, construction, and consumer goods, plus a focus on sustainability and lightweight materials

6, What are the main challenges facing the North America Thermoplastic Elastomers Market?

Key challenges include high production costs, regulatory pressures, environmental concerns, and intense competition among suppliers

7. How is sustainability impacting the North America Thermoplastic Elastomers Market?

There is a growing emphasis on recyclable and bio-based TPEs, eco-friendly manufacturing, and compliance with environmental regulations

8. What trends are shaping the future of the North America Thermoplastic Elastomers Market?

Trends include increased use in electric vehicles, medical devices, smart electronics, and the adoption of advanced manufacturing techniques

9. What is the significance of R&D in the North America Thermoplastic Elastomers Market?

Ongoing R&D enables the development of high-performance, specialty TPEs for demanding applications in automotive, healthcare, and electronics

10. What opportunities exist for new entrants in the North America Thermoplastic Elastomers Market?

Opportunities lie in specialty TPEs for electric vehicles, medical devices, sustainable materials, and customized solutions for emerging industries

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com